Jul 2018

16

Renewal of Tax Credits Deadline 31st July

The deadline of 31st July is fast approaching for employees renewing tax credits. Payments will be stopped if tax credits are not renewed by this deadline. HMRC are asking employers to encourage their employees to renew their claim for tax credits as soon as possible and to use the online method.

An employee can renew their tax credits online using their mobile device, tablet or computer. They can also renew on HMRC’s App. Renewing online is easy and is less time consuming, an employee can do this once they have received their renewal pack.

Employees need to report any changes in their circumstances that they have not previously reported to HMRC, for example, changes to working hours, income etc. HMRC has a specialist support team through the tax credits helpline that employees can contact if they cannot renew online.

Employers can help encourage their employees to renew their tax credits by:

- Asking their employees to check their renewal packs and ensure all data is correct and up to date and renewing online

- Ensuring all the employees payment details and personal details through payroll have been reported to HMRC by Real Time Information

- Employers could include a note on the employees' payslips from April to July mentioning renewing tax credits and the deadline date

- If there is a business/company newsletter, it could include a section on renewing tax credits and the deadline date.

Jan 2018

12

2018-19 Rates and Thresholds for Employers

For 2018-19 the new personal allowance for an employee is £11,850.

The 20% PAYE tax threshold is for annual earnings up to £34,500.

The UK higher tax rate of 40% is on annual earnings from £34,501 to £150,000.

The UK additional tax rate is 45% on annual earnings over £150,001.

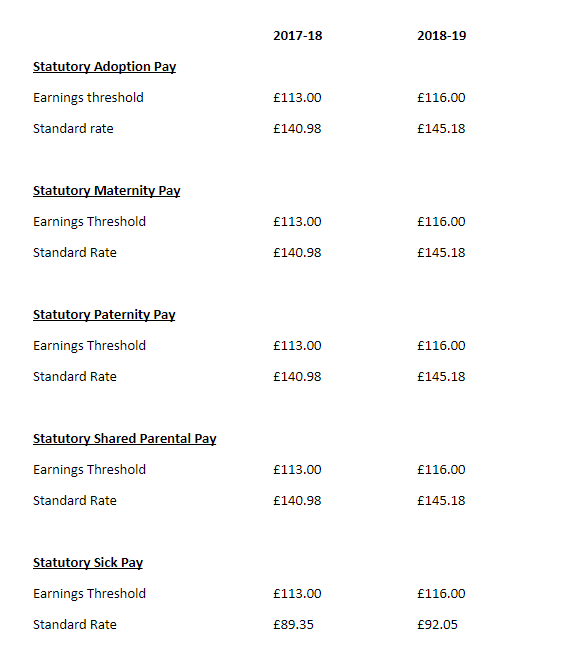

For the new tax year 2018-19, the Department for Work and Pensions have published the statutory payment rates for benefits and pensions.

Click here to see the full list published.

Please see some rates details below:

Dec 2017

20

Employer NICs to be paid on Termination Payments from 6th April 2019

In the Spring Budget 2017, it was announced by the Chancellor of the Exchequer, Philip Hammond, that termination payments over £30,000 which are currently subject to income tax, would be subject to Employer National Insurance Contributions from April 2018. The government, however, has announced on 2nd November that the introduction of the National Insurance Contributions bill has been delayed.

From 6th April 2019 rather than 6th April 2018 Class 1A employer National Insurance contributions will be payable on termination payments over £30,000.

At the moment, generally the first £30,000 of a termination payment is free of tax and no National Insurance contributions will be due on any part of the payment to the extent that it would have qualified for tax exemption. In the Finance Bill 2017, the tax treatment of termination payments will be clarified and this will include all contractual and non-contractual payments in lieu of notice taxable as earnings and requiring employers to tax the equivalent of an employee’s basic pay if notice is not worked. The changes, including to Foreign Service Relief, will take effect from 6 April 2018.

For further information select here.

Related Articles

- Payroll for Bureaus: From loss leader to profit centre

- Autumn Budget 2017 - Employer Focus

- The Benefits of BrightPay Connect for Employers

Dec 2017

18

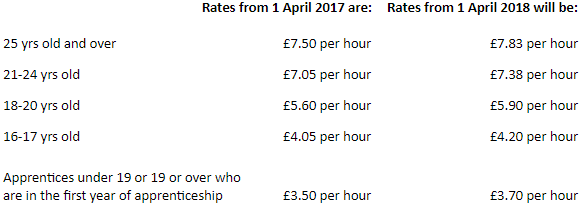

Minimum Wage Increase on 1st April 2018

The Low Pay Commission’s Autumn 2017 report has been published and on the 1st April 2018, the minimum wage will increase again.

The National Minimum Wage (NMW) is the minimum pay per hour most employees are entitled to by law. An employee's age and if they are an apprentice will determine the rate they will receive.

Dec 2017

6

Autumn Budget 2017 - Employer Focus

The main points to be noted by employers from Autumn Budget 2017, as announced by Chancellor of the Exchequer, Philip Hammond are:

- The personal tax allowance will increase by £350 from £11,500 to £11,850 from 6th April 2018. This is in line with the government's goal to have the personal tax allowance at £12,500 by 2020.

- The higher rate tax threshold will increase to £46,350 from £45,000.

- As previously announced, there has been a delay by one year on the series of changes for NICs to be implemented. These changes will now take effect from April 2019. They include the reforms to the NIC treatment of termination payments, abolition of Class 2 NICs and changes to NICs treatment of sporting testimonials.

- The planned increase in Class 4 NICs from 9% to 10% in April 2018 and to 11% in April 2019 by the government will no longer be happening.

- There is an increase in the Company Car Tax (CCT) diesel supplement to 4% from 3%. The supplement will apply to diesel cars registered on or after 1st January 1998 that are not certified to the Real Driving Emissions 2 standard. It will not apply to diesel hybrids or other vehicles except cars.

- From 6th April 2018 there will be no Benefit in Kind charge on electricity that employers provide to charge employees’ electric vehicles.

- The Government has announced its intention to consult on the extension to the private sector of the IR35 reforms, introduced in the public sector earlier this year.

- There is an increase of the lifetime allowance for pension savings, rising to £1,030,000 for 2018-19.

- The National Minimum Wage details for 1st April 2018 were published.

- HMRC's compliance team are monitoring employers that are claiming the Employment Allowance, as it has been reported that some employers are using avoidance schemes to avoid paying National Insurance amounts due.

Related Articles

Nov 2017

16

Changes to Making Payments to HMRC

A few changes have been made on methods of making payments to HMRC:

- The option of using Transcash service at the Post Office to pay HMRC will be withdrawn from December 2017

- From 13th January 2018, payments to HMRC with a personal credit card will no longer be accepted

HMRC would encourage all their customers to use the following methods to make payments:

- By direct debit

- By business debit card online or by telephone

- By online or telephone banking

These methods are more secure and can save the customer time and the expense of going to the Post Office or Bank.

Related Articles

Oct 2017

25

Further Changes to Student Loans from 6th April 2018

The Government has announced a change to the Plan 2 repayment threshold for Student Loan borrowers. The threshold that will come into effect from 6th April 2018 will be £25,000, a £4,000 increase from the current threshold of £21,000.

It has previously been confirmed by the Student Loans Company that the student loan repayment threshold will rise to £18,330 for Student Loan Plan 1, taking effect from 6th April 2018. Student Loan Plan 1 is for pre-2012 loans.

The Plan 2 repayment threshold of £21,000 was to be fixed until the year 2021, but this has been changed following an announcement made by the Prime Minister about changes to the student finance system.

Summary of the Student Plan thresholds:

- Plan 1 loans will increase by £555 from the current threshold of £17,775 to £18,330 in 2018-19.

- Plan 2 loans will increase by £4,000 from the current threshold of £21,000 to £25,000 in 2018-19

This figure will apply to all current and future borrowers for whom employers make Student Loan deductions. In BrightPay 2018-19, the new student loan repayment thresholds for both plans will automatically be calculated and the appropriate student loan deduction applied.

Sep 2017

18

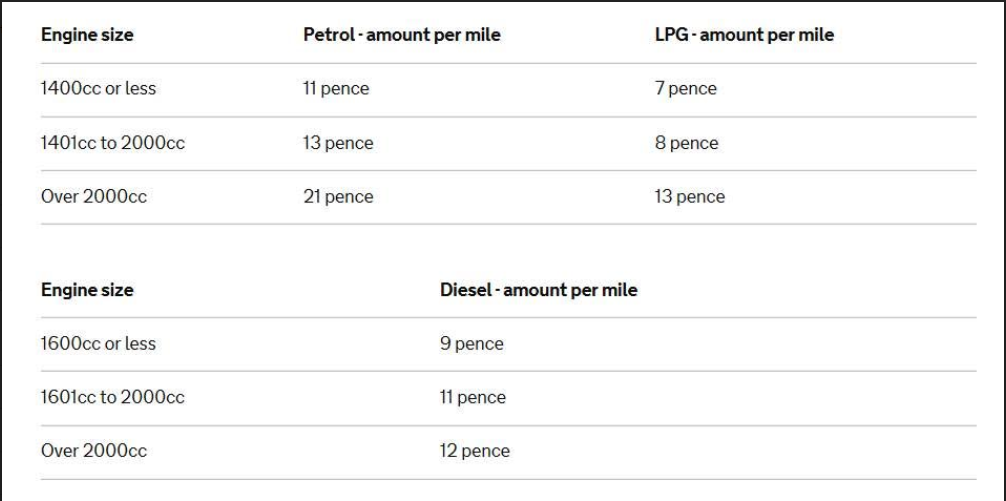

Latest Advisory Fuel Rates for Company Cars

For company cars, HMRC has released details regarding the latest Advisory Fuel Rates. From the date of change, employers may use the old rates or new rates for one month. Employers are under no obligation to make supplementary payments to reflect the new rates but can do so if they wish. Hybrid cars are treated as either petrol or diesel cars for this purpose for the fuel rates.

The changes are to engine size from 1401cc to 2000cc and to LPG engine over 2000cc. To view the latest rates click here.

The rates are as below:

Sep 2017

11

New Student Loan Plan 1 Thresholds for 2018-19

It has been confirmed that the student loan repayment threshold will rise to £18,330 for Student Loan Plan 1 for the new tax year 2018-19 by the Student Loans Company. This will come into effect from 6th April 2018. Student Loan Plan 1 is for pre-2012 loans and the current 2017-18 threshold is £17,775. This new threshold will apply to all borrowers who have a Plan 1 loan for whom employers make student loan deductions.

For Student Loan Plan 2, which is for post 2012 loans, there will be no change to the current threshold of £21,000 in the new tax year. There is no change to the student loan repayment threshold for postgraduate loans, which is also £21,000.

In BrightPay 2018-19, the new student loan repayment thresholds for Plan 1 will automatically be calculated and the appropriate student loan deduction applied.

Aug 2017

14

Voluntary Overtime must now be included in Holiday Pay Calculations

The Employment Appeal Tribunal (EAT) has dismissed an appeal by Dudley Metropolitan Borough Council, ruling that voluntary overtime should be taken into account when calculating holiday pay. This landmark legal victory now means that employers must now incorporate regular voluntary overtime when calculating holiday pay. Unite Union are now advising employers to urgently address this issue and ensure they are compliant.

This ruling will affect a large number of employees throughout the UK who get paid for regular voluntary overtime but do not receive any annual leave entitlement payment for working it. This legal victory sets a legal binding precedent that employment tribunals throughout the UK are obliged to adhere to.

This landmark case involved an appeal that was brought by Dudley Metropolitan Borough Council and this is the first case that the Employment Appeal Tribunal decided to confirm that payments to employees for voluntary duties only should be included in the calculation of employees’ annual leave entitlement pay. In the EAT findings, under the European Union’s Working Time Directive, there is no distinction between contractually required work and tasks that are performed voluntarily under other special or separate arrangements, because levels of normal remuneration have to be maintained when calculating holiday pay in relation to the guaranteed four weeks of annual leave provided under EU law.

The EAT also upheld that where voluntary shifts, standby and call-out payments form part of normal pay, they should be included in holiday pay calculations so that no employee would be deterred from taking annual leave at no financial disadvantage.

The findings in the case of Dudley Metropolitan Borough Council v Mr G. Willetts and others builds on previous findings in the case Unite legal services took in 2014. This appeal resulted in a ruling covering holiday pay for employees that were contractually obliged to perform overtime.

56 employees of Dudley Metropolitan Borough Council, who were Unite members, took the case against Dudley Metropolitan Borough Council. These employees are employed by the Council as tradesmen who worked on maintaining the council’s stock of houses. They worked regular overtime on a voluntary basis only, which included working overtime on Saturdays. In order to deal with emergency call-outs and repairs, the employees decided to organise and a standby rota every four weeks.

For some employees, this additional voluntary overtime equated to approximately £6,000 per annum along with their basic salary. The Council paid the employees the amount due for the voluntary overtime worked, but the voluntary overtime was not included in their holiday pay calculations. The omission of this additional holiday pay was costing the employees between £350 and £1,500 per year, depending on the amount of voluntary overtime undertaken.

Howard Beckett, Unite’s Assistant General Secretary for legal services said:

“The ruling means unscrupulous employers no longer have carte blanche to fix artificially low levels of ‘basic’ hours and then contend the rest of time as ‘voluntary’ overtime that did not have to be paid in respect of annual leave.

Unite will be liaising with Dudley Metropolitan Borough Council and its legal team over reaching a satisfactory settlement for our members. In the meantime we would urge other employers who have been fleecing workers of their holiday pay to get their house in order or face legal action…”.