Oct 2022

5

Bright new beginnings: Our latest acquisition and new branding

It’s an exciting day here at Bright, as today we are launching our new Bright branding, as well as announcing our latest acquisition. We’re thrilled to let all our customers know that BTCSoftware are now part of the Bright family. BTCSoftware offer multi-award-winning tax software solutions which help accountants to streamline and simplify tax and compliance work.

The addition of BTCSoftware to Bright makes sense to us as leading providers of software solutions to accountants and businesses. We believe that BTCSoftware’s product offering slots in nicely with our current payroll, HR, bookkeeping, accounts production and practice management software solutions.

This development is the next big step in Bright’s mission to streamline business processes for accountants and businesses, by delivering excellent products that enable automation and integration of core business sectors and functions. This mission is underpinned by offering world class support, a common philosophy which unifies all of Bright’s software solutions. This focus on serving customers above everything else, makes BTCSoftware a perfect addition to Bright, as they pride themselves on their highly rated, responsive customer support.

Same great products, Bright new brand

What’s different?

We now have a shiny new website which can be found at www.brightsg.com. The Bright website will be home to all of our products going forward, and each of our products will have their own pages within the website. Moving all our content and resources to the new website will be a gradual process, and so, the existing BrightPay website is not going anywhere just yet.

Our product logos have also changed from their varying colours to white or navy versions, ensuring all our logos have a uniform look and feel.

Why have we rebranded?

Since forming in 2021, Bright has brought a wide range of products together, and in doing so has integrated teams from across the UK and Ireland. Bright’s software solutions, including BrightPay Payroll Software, Thesaurus Payroll Manager, Surf Accounts Production, AccountancyManager, and now BTCSoftware give us the ability to offer accountants a fully comprehensive solution to their needs. While this range of products, expertise and support, allows us to combine the strengths of each brand, it also requires us to create a more unified voice.

With the launch of Bright, our new logo, and our new website, customers can find all our products under the one name and location. Customers will still see familiar product logos but should in time become used to seeing Bright appear more often, reflecting our future plans.

We hope that our new cohesive branding will help communicate who we are, what we offer, and reinforce our position as a one stop provider of software solutions for accountants and businesses.

Check out Bright’s new podcast

In other exciting news, Bright is introducing its first podcast series, Lightbulb Moments, which features disruptors and thought leaders from the accounting industry, revealing the bright ideas that gave them the power to switch things up for their business, practice and clients.

Sep 2022

28

Mini budget reveals big changes for payroll

On the 18th of October 2022, there was an announced reversal of some of the measures previously outlined in September's mini-budget.

The new chancellor, Jeremy Hunt, has made changes to the mini-budget, ahead of the medium-term fiscal plan at the end of October. Hunt will be reversing almost all of the tax cuts, that the previous chancellor, Kwasi Kwarteng, announced in September. Hunt stated that stability is the objective and that this new approach will cost taxpayers much less than originally planned.

Whether you’re an accountant, payroll bureau, business owner or payroll professional, you’re probably wondering what effect this will have on how you run payroll.

Below, we’ve listed the changes which will most affect payroll processors and what steps, if any, you need to take to implement these changes.

1. Income tax stays the same

The reduction of the basic rate of income tax by 1% will be scrapped ‘indefinitely’, and so will remain at 20%.

What do I need to do?

No action from payroll processors is required.

2. Health & Social Care Levy scrapped

- The planned abolishment of the Health and Social Care Levy will go ahead as planned. From 6th November 2022, the temporary increase to National Insurance (NI) contributions will end and the rates which were applicable in the 2021/22 tax year will apply once again.

- The 1.25% Health and Social Care Levy will no longer come into force next year.

- Those who pay National Insurance on an annual basis will pay a blended rate of NI for the 2022/23 tax year to take into accountant the changes in NI rates throughout the year.

The blended rates are as follows:

| National Insurance Class | Main rate | Additional rate |

| Directors | 12.73% | 2.73% |

| Class 1A and 1B | 14.53% | N/A |

| Class 4 | 9.73% | 2.73% |

What do I need to do?

The new rates will mean that payroll software providers will need to update their software from November 6th to account for these changes.

3. IR35 rules to remain the same

It was previously announced that rules regarding off-payroll working would return to what they were pre-2017, however this is now no longer the case. The reform, which would have cost £2bn a year, has now been cancelled and IR35 rules will remain the same.

What do I need to do?

No action from payroll processors is required.

4. Retained EU Law (Revocation and Reform) Bill

The Retained EU Law (Revocation and Reform) Bill is a new bill which will end all EU retained laws by 31st December 2023 to make way for new regulations, tailor-made for the UK.

What do I need to do?

This bill could potentially have massive implications for UK employment law, so it is one to watch in the coming year.

Further changes to the mini-budget

Hunt introduced other changes to the mini-budget, which included:

- The universal help on energy prices will only apply for six months, until April 2023 (instead of the two years that it was originally intended for)

- There will be no rise in corporation tax

- The basic rate of income tax will remain at 20%

- No cuts on dividend tax rates

- New VAT-free shopping for overseas visitors will no longer be going ahead

- There will be no freeze on alcohol duty rates

Related articles:

Aug 2022

31

Our 2022 customer survey results: BrightPay in the cloud

It's that time of the year again, the BrightPay customer satisfaction survey results are in. This was our first customer survey since becoming part of Bright which, as well as being the provider of BrightPay payroll software, is a provider of accounts production, bookkeeping and practice management software.

The aim of our annual customer surveys has been to discover what we are doing right and what we can improve on. However, this year especially, one of the main objectives of our survey was to learn more about our customers' expectations, hopes and ambitions as a business, and see how we, as software providers, can best support these aspirations.

Over 1000 BrightPay users took part in this year’s survey, including accountants and payroll bureaus who process payroll for their clients, and businesses who take care of their payroll in-house.

BrightPay’s 2022 customer survey: The results

One of the first questions we ask our customers each year is “How satisfied are you with BrightPay?,” and we’re happy to announce that BrightPay have achieved a 99.1% customer satisfaction rating for 2022. This means that our customer satisfaction rate has now been 99% or higher for 9 years in a row.

Another important question for us has always been “How happy are you with our customer support?”. This year, BrightPay received an impressive customer support rating of 98.9%.

An important metric for us is our Net Promoter Score (NPS) which is used to determine how likely users are to recommend our software to a friend or colleague. BrightPay’s NPS for 2022 was 71.4, putting us well above the industry average of 40 for B2B software and SaaS.

BrightPay in the cloud

In this year's customer survey, there was a lot of focus on BrightPay’s fully cloud version*, which will become available as a Beta version later this year. We asked why you’re likely or unlikely to switch to the online version of BrightPay, and what worries or apprehensions you may have about switching to the cloud payroll software.

Reasons why users said they were interested in moving to the online version of BrightPay included:

- The ability to access the software from anywhere, at any time

- The multi-user capabilities that come with having full online access to the software

- The fact that hosting and data security is transferred to Bright

- Having the ability to scale your payroll service offering

- Having an edge over competitors

- The possibility of increasing profitability

- The ability to track user updates

- Automatic software updates

- To reduce the need for an in-house server

Reasons why users were unlikely or unsure about making the switch, were a lot less varied than those that said they were likely to switch. The majority gave the reason that they were happy with the functionality of BrightPay’s desktop version and felt no reason to move.

A number of users said that they had limited internet access or were living in areas with a slow internet connection, and so felt that an online software wasn’t an option for them. However, we are aware that a proportion of our customers may face this issue, which is why the Windows version of BrightPay will remain available.

The main theme we noticed amongst respondents who said they were unlikely to make the move were concerns of the learning curve that may be associated. Others expressed a lack of knowledge surrounding cloud technology, with comments such as “I’m not sure I understand cloud technology,” “As a small business, I’m unsure if I need it” and “I need to learn more about the cloud software’s features.” However, as you can see from the list above of why users will most likely make the switch, cloud software has many benefits, with the main ones encompassing flexibility, scalability, and security.

At BrightPay, we aim to make the migration process as automated and as seamless as possible for our users to switch from the desktop to cloud payroll solution. The online payroll software’s screen layouts and user design will be almost identical to BrightPay’s desktop version and so there will be almost no learning curve. Our aim is to ensure that the software continues to be user-friendly.

How the online version of BrightPay will look

We understand there is always apprehension when switching to a new system, but users can rest assured that the cloud software will be just as easy to use as the BrightPay you’re used to, with the added benefits.

To celebrate National Payroll week, which is from 5th - 9th September and organised by the CIPP to demonstrate the impact the payroll industry has in the UK through the collection of income tax and National Insurance, BrightPay will be holding a free online webinar. The webinar is on the evolution of payroll, from its beginnings to what we can expect in the future. Register now to confirm your place. Check out our dedicated National Payroll Week webpage for more payroll news and updates.

The development of our fully cloud version of BrightPay is progressing as expected. At the moment, we are on track for a target beta release towards the end of 2022. Fill in this form if you wish to be notified when the beta version is available to use. If you want to learn more about BrightPay and our current cloud payroll extension, BrightPay Connect, book a free online demo today.

*While you will be able to process payroll using BrightPay’s online version, features of the cloud software won’t include the same functionality as the desktop version upon initial release. However, we will be working hard to get the online software in line with the desktop version.

Aug 2022

18

Organised labour fraud: Warning to employers from HMRC

HMRC’s August employer bulletin was released last week and included in it were warnings to employers on organised labour fraud. Organised labour fraud is the umbrella term HMRC gives to three main types of fraud which all share similar features.

The three types of fraud are:

- Payroll company fraud

- Labour fraud in construction

- Mini-umbrella company fraud

These types of fraud are orchestrated by organised crime groups and involve a genuine supply of labour. Crime groups may grow their operations to include other types of fraud where the supply of labour is central to how the fraud operates.

Organised labour fraud affects HMRC, businesses, employees, and the general public. These frauds steal vital revenue that funds the UK’s public services, can hurt the finances and reputations of businesses, and for employees, it can affect their employment rights and may impact their ability to claim benefits in the future.

Payroll company fraud

This type of fraud takes place when a business outsources its payroll responsibilities to a fraudulent third party who claim to be a payroll provider. The fraudulent ‘payroll provider’ will process the payroll of their victims’ employees. While they will pay the employees their wages, they will fail to pay income tax, National Insurance and VAT to HMRC. This is how they get away with the scam for some time, as the employer may take a while to notice what has been happening. With this type of fraud, there is a risk that the employer could still be deemed liable for the tax, NI and VAT payments that were never received by HMRC.

Labour fraud in construction

This is another type of fraud which targets employers. HMRC defines it as “the fraudulent use of contrived labour supply chains in the construction industry.” This fraud involves the abuse of the Construction Industry Scheme to move labour-related VAT and Income Tax liabilities into “shell corporations.” Shell corporations are companies which have no business operations or significant assets. These companies are sometimes used in organised crime. The shell companies will then go default and will owe a debt to HMRC.

Mini-umbrella company fraud

The third fraud is one that can affect businesses which use temporary labour. It works by criminals creating multiple limited companies, with each one employing a small number of temporary employees. Each of these micro companies may fraudulently claim Employment Allowance and abuse the VAT Flat Rate Scheme which are government incentives aimed at helping small businesses.

Common traits of organised labour fraud

In their 2022, August bulletin, HMRC have listed a number of red flags or common traits to watch out for in fraudulent businesses, including:

- Businesses with a short life span — sometimes as little as 12 months. These businesses will then be abandoned or become insolvent, and another entity will take their place

- Hijacked VAT registration, Construction Industry Scheme registration and, or PAYE scheme numbers

- Unusually long supply chains which often make no commercial sense

- Turnover rises at an exponential rate and debt accrues quickly

- The director’s business history suggests they lack the experience to run a company of that type and size

- Directors may have a history of ‘phoenixing’ companies which is when a business is conducted through a succession of companies. Each in turn becomes insolvent and transfers the business onto the next company.

What can you do to avoid being a victim of organised labour fraud

HMRC recommends that businesses have a system in place whenever they receive a supply of labour. Every business should:

- Check the legal, financial, tax and social obligations of suppliers

- conduct robust due diligence on suppliers and act to mitigate or remove risks

- Continuously monitor and review your due diligence

HMRC also recommends that individuals register for their Personal Tax Account as regular checking ensures that the information shown there is accurate.

You should contact HMRC as soon as possible if you have information or concerns regarding a supplier.

Related articles:

May 2022

20

2022/23 student loan plans and repayment thresholds

There was an increase to the thresholds for student loan repayments for the 2022/23 tax year. When an employee’s annual income is above the repayment threshold, they will have to repay their student loan. An employee’s repayment threshold will depend on when and where they went to university and from which country they received their loan.

The amount an employee can earn before they will need to start paying a percentage of their income towards their student loan will depend on which loan plan they fall under. Loan plans include plans 1, 2, 4 and postgraduate.

To work out which plan an employee should be on, please reference our charts below:

English Students

| Where the course was attended | When the course was started | Undergraduate/Postgraduate | Loan plan |

| Anywhere in the UK | Before 1st September 2012 | Undergraduate | 1 |

| Anywhere in the UK | On or after 1st September 2012 | Undergraduate | 2 |

Welsh Students

| Where the course was attended | When the course was started | Undergraduate/Postgraduate | Loan plan |

| Anywhere in the UK | Before 1st September 2012 | Undergraduate | 1 |

| Anywhere in the UK | On or after 1st September 2012 | Undergraduate | 2 |

Scottish Students

| Where the course was attended | When the course was stared | Undergraduate/Postgraduate | Loan plan |

| Anywhere in the UK | On or after 1st September 1998 | Undergraduate or postgraduate | 4 |

Northern Ireland Students

| Where the course was attended | When the course was stared | Undergraduate/Postgraduate | Loan plan |

| Anywhere in the UK | On or after 1st September 1998 | Undergraduate or postgraduate | 1 |

EU Students

| Where the course was attended | When the course was stared | Undergraduate/Postgraduate | Loan plan |

| England or Wales | On or after 1st September 1998, but before 1st September 2012 | Undergraduate | 4 |

| England or Wales | On or after 1st September 2012 | Undergraduate | 2 |

| Scotland | On or after 1st September 1998 | Undergraduate or postgraduate | 4 |

| Northern Ireland | On or after 1st September 1998 | Undergraduate or postgraduate | 1 |

Postgraduate Loan

For English or Welsh students, they are on a Postgraduate Loan repayment plan if they:

- Took out a Postgraduate Master’s Loan on or after 1st August 2016

Or

- Took out a Postgraduate Doctoral Loan on or after 1st August 2018.

For EU students, they are on a Postgraduate Loan repayment plan if they started a postgraduate course on or after 1st August 2016.

Student loan repayment threshold increases from April 2022

| Loan Plan | 2021/22 | 2022/23 |

| Loan plan 1 | £19,895 | £20,195 |

| Loan plan 2 | £27,295 | £27,295 |

| Loan plan 4 | £25,000 | £25,375 |

| Postgraduate loans | £21,000 | £21,000 |

Figures from Gov.uk.

Related articles:

Apr 2022

11

The 22/23 tax year: Key dates for employers

The 2022/23 UK tax year begins on 6th of April, 2022. For employers, there are a range of need-to-know dates and important deadlines you must be remember each year to ensure you stay compliant, and avoid any penalties from HMRC.

To make things easy for you, below, we have compiled a list of payroll and self-assessment tax return deadlines for employers and the self-employed.

Payroll dates and deadlines

6th April

As the new tax year begins, with it brings a number of changes. Follow the links to read about important changes for the 2022/23 tax year such as the new National Insurance Levy and new NLM and NMW rates.

19th April

You have until the 19th of April to submit your Employer Payment Summary (EPS) for the previous tax year to inform HMRC that you have completed your final submission for the year.

31st May

You must give any employees who were on your payroll on the last day of the previous tax year (5th April) a copy of their P60 by the 31st of May.

6th July

For each employee you provided with expenses and benefits for the previous tax year, you must submit your P11D forms online to HMRC and give your employees a copy of the information on your forms, by the 6th of July. By this date you must also submit a P11D(b) form to HMRC to declare the total amount of Class 1A NICs you owe on expenses and benefits provided for the year.

19th July

If paying by cheque, any Class 1A National Insurance owed on expenses or benefits for the previous tax year must reach HMRC by the 19th of July.

22nd July

If paying electronically, any Class 1A National Insurance owed on expenses or benefits for the previous tax year must reach HMRC by the 22nd of July.

19th October

If you have a PAYE Settlement Agreement, you must pay all tax and Class 1B National Insurance owed by the 19th of October, if paying by cheque.

22nd October

If you have a PAYE Settlement Agreement, you must pay all tax and Class 1B National Insurance owed by the 19th of October, if paying electronically.

5th April 2023

The last day of the tax year is the 5th of April and your final Full Payment Submission (FPS) should be made on or before the final pay day of the tax year.

If you choose to payroll your employees’ benefits for the 2023/24 tax year, you must register online on or before 5th April 2023.

Self Assessment tax return deadlines

31st July

Your second payment on account for the current tax year must be paid by the 31st of July.

5th October

If you’re self-employed or a sole trader, not self-employed, or registering a partner or partnership you must register for Self Assessment by the 5th of October.

31st October

Paper Self-Assessment Tax Returns must be received by HMRC by the 31st of October.

30th December

Deadline for Online Self Assessment Tax Return if you are eligible and want it collected through next year’s PAYE tax code.

31 January 2023

Online Self-Assessment Tax Returns must be received by HMRC by the 31st of January.

Pay any tax you owe for the previous tax year and your first payment on account towards your bill for the next tax year.

To switch to BrightPay before the new tax year, book a free consultation with one of our migration specialists today. Or, to see the software in action, book a free online demo today.

Related articles:

- Construction Industry Scheme: Full functionality at no added cost

- What to include on a payslip and how they should be shared with employees

- 5 Reasons why BrightPay receives a 99% Customer Satisfaction Rating

Apr 2022

6

6 payroll mistakes (and how to avoid them)

Payroll is an essential aspect of any business and one which is important to get right. Whether you are running payroll for the first time as a new business or if you have decided to begin to run your payroll in-house, having previously outsourced to a payroll bureau; here are six mistakes to watch out for when processing payroll.

1. Not complying with HMRC

When you run payroll, you need to report payroll information to HMRC. You may be charged penalties if you do not report the correct information to HMRC or if you do not submit the information on time. It is necessary that you use a HMRC recognised software that can report PAYE information online and in real time, known as RTI. Using a HMRC recognised software is needed for:

- Recording your employees’ details.

- Working out your employees’ pay and deductions.

- Working out any statutory pay your employees’ may be entitled to.

- Working out how much you owe to HMRC.

2. Not complying with GDPR

When processing payroll, you are dealing with a lot of personal information. Using a GDPR compliant payroll software means you and your employees can rest assured that all personal data is stored and managed in a safe and secure manner.

3. Not complying with automatic enrolment

It is a legal requirement for employers to enrol eligible employees into a workplace pension scheme which both the employer and the employee will contribute to. There are certain auto enrolment duties that employers must carry out in order to be fully compliant. Some of these duties are once off actions and others are ongoing duties which involves monitoring changes in your employees age and earnings. Every three years, employers must carry out the re-enrolment of any staff who may have left the scheme.

4. Not backing up payroll data

When running payroll, it is highly recommended that you always keep a backup of all payroll data. It is also advised that this back up is saved somewhere other than on the hard drive of the computer you use to process payroll. Using a cloud platform or an external device to back up data is the safest option to ensure you never lose valuable information, should something happen to your computer.

5. Having inexperienced or untrained staff run payroll

While using the right software has made processing payroll easier than ever before, it is still not something that should be assumed is easy and straightforward to do. When staff running payroll are inexperienced or untrained, you are leaving your business open to problems like employees being paid the wrong amounts, penalties for non-compliance, time wasted correcting errors and overall damaging your reputation as a business. It is also important staff keep up to date and informed with any changing HMRC legislation or employee entitlements.

6. Inefficiency and human error

Your efficiency when running payroll will depend greatly on the level of automation used. Automation cuts down on the repetition of uncomplicated tasks. Automation not only saves your business time and money by allowing you to process payroll quicker, it also does so by reducing the possibility of human error. A payroll software must be used to automate payroll processes.

Solution:

You have two options when it comes to ensuring none of these mistakes are made by your business when processing payroll.

Option One: Outsource your payroll to a professional.

Option Two: Choose a payroll software that ensures all these mistakes are easily avoided.

While outsourcing your payroll duties to a professional might seem like the simplest option, it may not be the most cost effective one. You can save money while having the same peace of mind that your payroll is correct by running your payroll in-house with the right payroll software.

BrightPay is a multi-award-winning payroll software that automates payroll processing. The software is constantly performing tasks in the background, which helps streamline your payroll workflows. BrightPay’s integration with HMRC, accounting packages and pension providers automates payroll tasks while also ensuring that you can easily stay compliant.

BrightPay will automatically assess new employees for auto enrolment each pay period and inform you of which employees need to be enrolled. Our software will then continue to monitor staff and inform you of any changes in eligibility, giving you peace of mind that all your auto enrolment duties are taken care of. BrightPay even automatically prepares customised letters which employees must receive, informing them of their auto enrolment rights.

.png)

When it comes to the General Data Protection Regulation(GDPR), BrightPay Connect, our cloud extension, helps you stay compliant by offering a secure online portal for employers to share payslips with their employees as well as other HR documents. Our newest feature, two-factor authentication, adds a second layer of security for employers logging into BrightPay Connect. A security code will be sent to the user via email or text which needs to be entered to log in to the employer dashboard, lowering the risk of data breaches.

While there will be a learning curve with any new software, BrightPay’s user friendly interface and intuitive design makes that learning curve a lot less steep. BrightPay’s website has a comprehensive library of support documentation that takes you step by step through payroll processes. If you cannot find the answer you are looking for, BrightPay’s support team can be reached by phone or email; offering BrightPay customers free help and guidance when they need it.

Other useful resources that can be found on our website are our guides and ebooks, video tutorials, blogs and webinars. Previous webinars can be watched on demand from our website. We also host weekly live webinars which anyone can join for free.

Why not book a free demo today and discover how BrightPay can help you avoid payroll mistakes and make processing payroll a breeze.

Mar 2022

28

BrightPay and AccountancyManager join forces

It has been an exciting six months since BrightPay merged with Relate Software to become Bright Software Group or “Bright”, as we are now known. Things haven’t slowed down since and we are delighted to announce that Bright has now acquired AccountancyManager, the UK’s leading onboarding and practice management software. The cloud-based software slots in nicely with Bright’s payroll, HR, bookkeeping and post-accounting software products. This is an exciting opportunity for the individual brands to exploit our operational synergies and develop the best products to serve payroll bureaus, accountancy firms and SMEs across the UK and Ireland.

Click here to find out more about Bright.

Who are AccountancyManager?

AccountancyManager (AM) is an award-winning practice management software that shares the same ultimate goal as Bright; to improve accountants’ day-to-day activities by automating time-consuming tasks, helping them to achieve a better work/life balance and grow their businesses. Founded in 2017 by James Byrne and Alex Hawke, AccountancyManager quickly grew and today is used by thousands of accountants and bookkeepers across the UK and Ireland.

A Bright future for AccountancyManager

James Byrne, co-founder of AM will continue as a shareholder in the combined group and will remain involved with the business as an advisor to the combined board. Kevin McCallum, CEO of AM, will become Chief Operating Officer of the new, combined group as well as continuing to manage AM, working closely with Bright CEO, Paul Byrne.

Here’s what Kevin McCallum, incoming COO of Bright, has to say about the merger: “AccountancyManager joining Bright makes so much sense for many reasons, but for me, the shared values and customer-centric approach are the most compelling. I’m excited to be joining Paul and the wider Bright team in building out the scope and scale of our business and supporting more and more accountants and their clients.”

By partnering with AccountancyManager and combining products and strengths from both businesses, Bright can provide a greater offering to our customers, with scope and backing for further innovation and development. This is an exciting moment in Bright’s journey to delivering a one-stop solution for businesses and accountancy firms. Together we will aim to provide a best-in-class software suite with a clear value proposition to drive efficiency and reduce errors, all with increased flexibility from working with a cloud offering.

Related articles:

Mar 2022

23

The payroll and HR connection (and how to use it to your advantage)

In a Censuswide survey of 251 HR and payroll managers, 76% of businesses admitted to failing to pay their employees correctly or on time on one or more occasion. In the 2019 survey it was also revealed that, on average, employees had been paid incorrectly or late four times in the previous twelve months. This failure can sour employee relations and employees may feel they are unable to trust their employers.

Successful businesses are built on relationships and when there is a breakdown of trust, relationships are damaged, and your business may suffer consequently. When a concern arises for an employee, it is often the HR department that they first turn to – including questions and issues to do with pay. Whether or not you think that payroll should be the responsibility of HR personnel, businesses can benefit from integrating the two functions.

BrightPay Connect is a cloud add on to BrightPay’s payroll software that streamlines payroll and HR processes: meaning less work for employers and more peace of mind that your employees pay will be accurate. BrightPay Connect can also help improve communication between you and your employees. Effective communication within organisations has become more important than ever since the COVID-19 outbreak has forced many of us to work remotely.

BrightPay Connect gives you access to an online employer portal from which you can manage employees in many ways. An unlimited number of users can be added, meaning the portal can be accessed safely and securely by any colleagues you wish to allow access. Listed below are eight features of BrightPay Connect and how these features can benefit employers, HR departments and payroll processers.

1. Payroll records

Instantly access your employee’s payslips and payroll documents, run your own payroll reports, and view amounts due to HMRC anywhere, anytime through your secure online portal.

2. Employee self-service

Invite your employees to an online self-service portal and employee app where they can access their payslip library, request annual leave, access HR documents and update personal contact details. Find out more. Employees can download the employee app on their smartphone or tablet giving them instant access to their payroll information on the go. The employee app is available to download for free on any Android or iOS device.

3. Employee records

Employers and managers can keep track of their employee’s basic personal details, which can be updated by employees. This ensures that you have the most accurate and current details on file for your employees.

4. Employee calendar

The real-time employee calendar allows you and your colleagues to see, at a glance, who is on leave, when, and whether they are on annual leave, unpaid leave, parenting leave or sick leave.

5. Leave management

Employees can submit holiday requests with a few simple clicks. Managers will be notified of the request and can view the holiday calendar online before approving, ensuring that you always have sufficient cover.

6. Secure Cloud Storage

When it comes to payroll, data security is extremely important. Payroll information is stored on Microsoft Azure, which is one of the safest ways to store personal data securely.

7. Company messaging

Whether it is an important memo, the company newsletter, or details of a staff party, the notification system will transform internal communications. All employees can be kept up to date on what is happening in the workplace, regardless of where they are located.

8. HR Documents & Resources

You can share documents and resources with individuals, teams or the whole company at the touch of a button. Track who has viewed circulated documents and who has not.

Book a BrightPay Connect demo today to learn more about these features and how they can benefit your business. Related articles:

Feb 2022

16

What to include on a payslip and how they should be shared with employees

By law, employers must provide all employees with a payslip for each pay period. As well as giving employees a rundown of their earnings and any deductions there might be to their pay, payslips may be required as proof of income when applying for a mortgage or other loans. Payslips should be provided to employees either before or on the day they receive payment and are usually generated within the payroll software. According to ACAS, payslips must include:

- Total pay before deductions

- Total pay after deductions

- Amounts of any variable or fixed deductions

- A breakdown of how the wages will be paid if more than one payment method is used

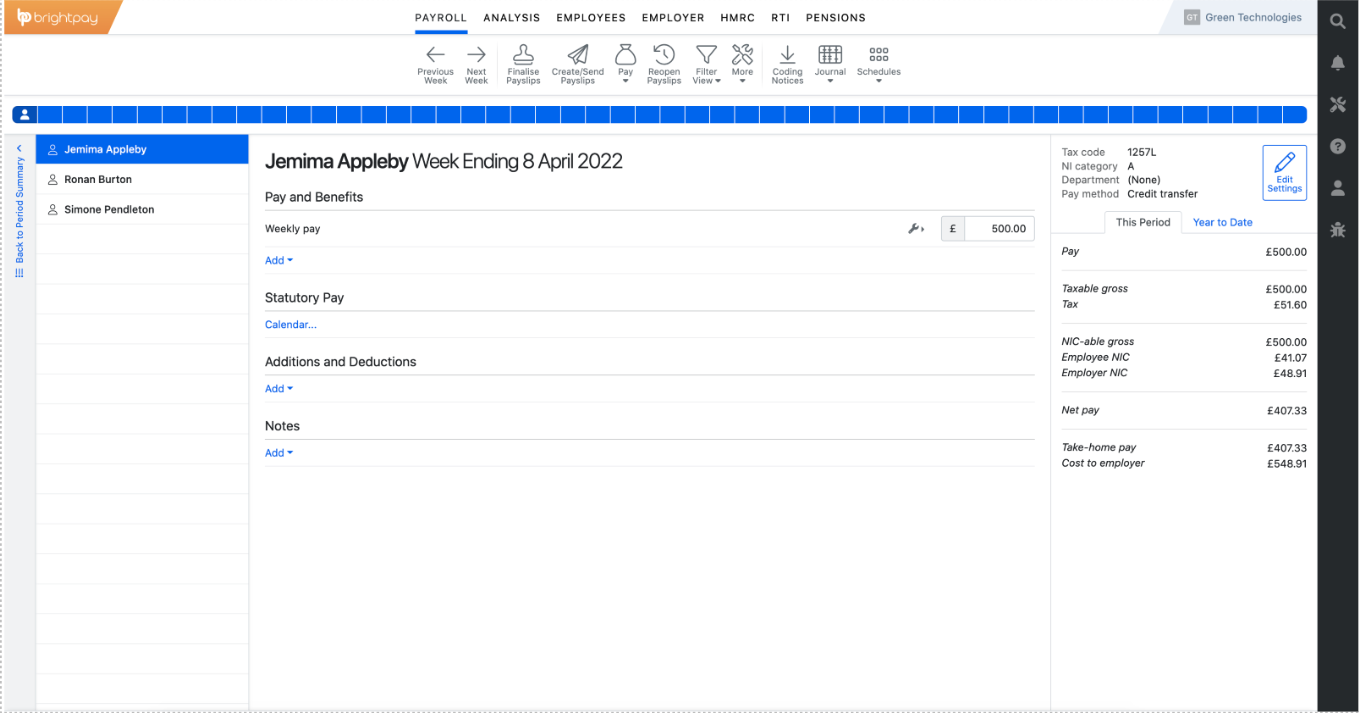

Below is an example of information you may find on a payslip:

How should payslips be shared with employees?

Employees’ payslips should be provided to them as at least one of the following:

- A hard copy

- Attached in an email

- An online copy

Giving employees a printed copy of their payslip is becoming less common. As well as the fact many businesses are digitising their paper processes, a payslip contains a lot of sensitive employee information, and a printed payslip could easily fall into the wrong hands. When emailing payslips, it is important that the payslip is password protected. More and more businesses are choosing to opt for sharing payslips with employees online. Not only do they save on paper on ink, but they are also more secure and can be easily retrieved when needed.

How can I provide employees with online payslips?

Some payroll software providers include an option to share employees' payslips through an online portal. BrightPay payroll software has a cloud add-on, BrightPay Connect, which includes an employee self-service mobile app where employees can view and download all new and historic payslips. Once a payslip becomes available, the employee will receive a push notification on their phone. If they do not have access to the app, they can also access their employee portal online from any device.

Sharing employees' payslips through an online portal such as BrightPay Connect is the best way to avoid payslip data breaches and insure you are in compliance with UK data protection laws. It also means that employees will always have access to all their past payslips and won’t need to come to their employer to request them.

Can you produce payslips using Basic PAYE tools?

You can use Basic PAYE tools (BPT) to produce payslips for your employees. However, the payslips produced will not include all the details which you are required to provide by law. By using a payroll software such as BrightPay, the payslips produced will contain all the information required by law, while also being customizable with the option of including additional information.

To find out more about how you can share payslips with employees online, book a free online demo of BrightPay Connect today. If you’re not yet using BrightPay Payroll Software, book a free migration consultation to speak to a dedicated migration specialist to help you through the set-up process.

Related articles:

-1.png)