Mar 2020

10

Covid-19 - are you ready?

In light of the recent Coronavirus outbreak, many employers are starting to prepare for the possibility of employees needing to work from home.

Have you Internet?

Whether you are a single employer or a bureau, you will need an internet connection for transmitting files to HMRC.

Are you using a computer other than your work computer?

Where you are using a different computer, BrightPay will need to be installed on that computer. This is a quick download from our website. Then, simply enter the activation key that was included on your invoice. If you can’t find this key, we can resend it to you.

Okay, you have an internet connection and a computer with BrightPay installed on it, what about the payroll file(s)?

Are you a single employer?

- Using your work computer - you already have the file and need read no further.

- Using Dropbox or Google Drive as your file save location - the files will automatically be available to you on any other machine which is also signed in to the shared drive.

- Using Connect - you can simply restore your payroll data into your BrightPay software by signing into your Connect account at home through the software.

Alternatively, before leaving the office, simply copy the payroll file to a USB key or email it to yourself.

There are some useful help links at the bottom of this article to help with any of these options.

Are you a payroll bureau?

- Using Connect – An Administrator can set relevant payroll staff members up as a user and give them access to the companies that they need to work on. Users can then simply restore the required payroll data into their BrightPay software from their Connect account and also synchronise completed payroll back up to Connect. Users will be able to log in to their Connect account at home through the software and restore in the latest cloud backup. Care however must be taken that synchronisation is up to date and that other users are not working on the same data file at the same time. When restoring in from a cloud backup, you will see the time and date of the most recent backup that was done. Setting up a user in Connect and Restoring from Connect are covered in the help articles below.

- Using remote desktop – log in to your remote desktop as normal. No further action is required.

- Using a shared drive (e.g. Dropbox) – Once your PC is logged in to the shared drive and BrightPay’s file save location was set as this drive, then all payroll files should be available within your home environment. You may need to browse to the shared file location when opening an employer.

Alternatively, before leaving the office, staff members may wish to save their payroll file(s) to an external drive, then follow the help below on Transferring BrightPay from one PC to another.

Help articles

Feb 2020

19

BrightPay 2020/21 is now available to pre-order

BrightPay 2020/21 is scheduled for release the week ending 27th March. We will send you another email once it is released and ready to download. This further email will also be accompanied by a full list of the new 2020/21 features and legislative updates.

New BrightPay Connect Subscription Pricing Model

From April 2020, BrightPay Connect customers will be billed on a usage subscription model based on the number of employees in the billing month. This monthly subscription pricing model means that you only pay for what you use. For the vast majority of customers, this new billing model will result in a reduced annual cost.

Invoicing will be monthly in arrears e.g. usage in April 2020 will be billed and payable in May 2020.

You will need to enter some basic information on our new online billing system, which will be available shortly. We will notify all Connect customers once it is available.

Note: Your payroll software desktop licence will continue to be charged on a per tax year basis.

What do you need to do now?

Nothing. Your BrightPay payroll software 2019/20 licence will continue to work as normal until the end of the tax year. Pre-order BrightPay 2020/21 today and we will email you when it is available to download. Our BrightPay Connect billing system will be available shortly and we will notify all Connect customers when it is up and running.

Jan 2019

31

Important Pricing Update for BrightPay 2019/20

We introduced the initial version of BrightPay over seven years ago. Since then, we’ve added hundreds of powerful features and enhancements, with many more planned for the future.

We have invested a considerable amount on technology and people and we intend to continue our program of development into the future.

To keep pace with the value that BrightPay provides, we’re increasing our pricing from 2019/20 onwards. This will ensure that we can continue to develop and support the best payroll software in the UK.

Details of the new BrightPay pricing can be viewed on our website. We believe our pricing remains excellent value and continues to be very competitive when compared to the options from other providers. We will continue to offer full support at no extra cost.

For customers with three or less employees (who have been using our ‘Free’ version to date), BrightPay will cost just £49 per year from April 2019, and will include full unrestricted functionality as well as free phone and email support. Your BrightPay 2018/19 free licence will continue to work until the end of the tax year without any cost.

We’d like to thank you for being a customer and for your continued support.

Jul 2017

10

The story behind BrightPay Connect ….. in 60 seconds.

We started out with the idea of automating the payroll backup to a secure location and, while that backup was being stored remotely, to optionally allow employee access to their current and historic payslips.

Then we were asked if we could provide a way for employees to change their personal details and this was followed by a suggestion that maybe the employees could request leave and that the employer, in deciding whether to approve these requests, would be able to view a company wide calendar to see who else was off on the requested dates. BrightPay Connect, an optional cloud add on was born.

More recently, we added the ability to upload documents, for example employment contracts, to the employee portal, so that all such documents would be easily accessible and the employer would also know if and when they had been opened by the employees.

Although it was not our intention starting out, it now appears that we have ended up with a fairly complete HR system suitable for most small businesses and, no doubt, the list of HR features will continue to grow.

As an employer, you can also provide access to your accountant or anyone else you might want to share with. You can also specify different access levels so that, for example, the person approving holiday requests doesn’t get to see how much your employees are paid.

The 2 things that customers really rave about are (1) you are up and running in seconds, as this is all the time it takes to sync all of your employees and (2) you can access your employees’ details from anywhere, from any device.

Book a BrightPay Connect Demo today to see how you and your employees can benefit.

BrightPay - Payroll and Auto Enrolment Software

Bright Contracts - Employment Contracts and Handbooks

Jul 2017

5

Auto enrolment and the new client

All bureau payroll providers will, by now, be very familiar with how to deal with clients who have had a staging date allocated to them by the Pensions Regulator.

However, this staging process is nearing an end and new employers, who take on staff after 1st October 2017, will have immediate automatic enrolment duties. They will no longer be allocated a staging date by the regulator.

These employers will still be able to postpone for up to three months to allow them the time to choose and set up a pension scheme.

Heretofore, it was essential that any postponement communication was sent to postponed employees within 6 weeks of the staging date. Under the new regime, the staging date will now be referred to as the duties start date. This duties start date will be the date that the first employee started. Any postponement communication will now need to be sent within 6 weeks of the duties start date.

If the first employee is a director, then the company will have no AE duties until such time as a second employee commences. In this case it is the start date of this second employee that becomes the duties start date.

Example

ABC Limited commences trading on 1st December 2017 and has one employee, being a director. On 1st March 2018, ABC Limited takes on a new employee.

The duties start date for ABC Limited is 1st March 2018 and ABC Limited has no AE duties until this date. If ABC Limited decides to postpone, a communication will need to issue on or before 12th April 2018. Assuming that ABC Limited is paying monthly, on 31st March, when it is processing its payroll, it may choose to postpone (for up to 3 months) and issue the communication at the time of doing the March payroll.

If the postponement is for 3 months then, when processing the payroll at 30th June 2018, being completion of the postponement period, all employees must be assessed and enrolled if necessary. The same ongoing duties still apply and, each pay period, all non-enrolled staff should be assessed for age and earnings to see if they need to be enrolled or given the option to enrol.

There are transitional rules for employers taking on their first employer between 2nd April 2017 and 30th September 2017.

BrightPay payroll software will guide the user through the process for new employers. Find out how to enter a new employer's duties start date in BrightPay.

May 2017

15

BrightPay at the Excel in London

Last week, BrightPay attended Accountex, the UK's largest exhibition and conference dedicated to Accountancy Professionals.

It was great to meet so many existing and prospective customers.

Mar 2017

21

Off-payroll working in the public sector

Current HMRC guidance can be found here.

The guidance concerns both the provider of the services (the personal services company) and the payer for the services (the public sector client)

Assume an invoice of £6,000 for services (excluding VAT) issued by Joe Bloggs of ABC Ltd and that the payment falls within the new rules.

If you are the personal services company

Using the example deductions in HMRC's article, as the public sector client has already deducted tax (£1,458) and NIC (£413), you receive £4,129 (excluding VAT).

If you are paying yourself this £4,129 from your company, you will have no further PAYE or NIC liability on it, so, in your payroll system, you should mark the gross payment (£4,129) as not being liable to tax or NIC.

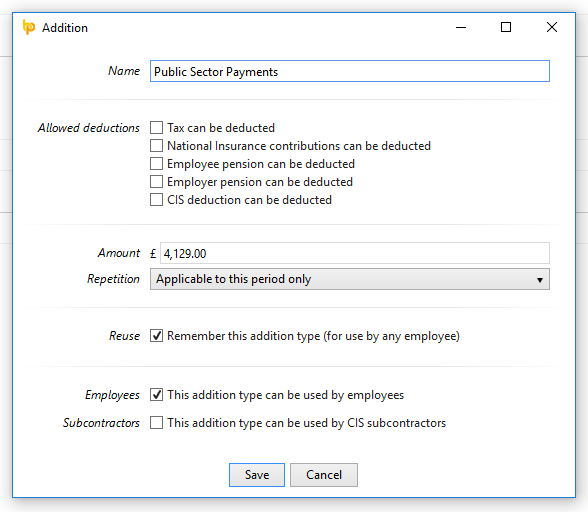

In BrightPay, simply set up a new addition type as per the following screen. Ensure that tax, NIC etc. are all unticked.

When the payroll is finalised, the non taxable pay will appear on the FPS.

![]()

If you are the public sector client

Pay Joe Bloggs through your payroll as if he were a normal employee.

When entering Joe Bloggs to your payroll, use starter declaration C - secondary employment. This will put him on basic rate tax. You should also tick that the employee is on an irregular payment pattern.

The payment frequency that you select for Joe Bloggs should match their contract as closely as possible e.g. if he is being paid for a month's work and you put him through the weekly payroll run, this will adversely impact on your NIC figures.

It may be useful to set up a department named “Personal Services Company” and assign Joe Bloggs to that department. This will enable specific reports for this category of employee.

When the contract ends, P45 Joe Bloggs as you would a normal employee.

Auto enrolment

The public sector client should treat Joe Bloggs as if he were a normal employee for AE purposes, if he falls within the definition of a personal services worker as per TPR's guidance (HMRC's guidance on this is contradictory - they state that Joe Bloggs should not be considered for auto enrolment in all cases). If the contract is a one off, then postponement would be appropriate. If Joe Bloggs is genuinely self employed and does not come within the scope of a personal services worker, then simply mark as exempt when BrightPay flags him for enrolment.

In the payroll of ABC Ltd, if Joe Bloggs is not deemed as a worker in the public sector company, he should be enrolled by ABC. However, in the majority of cases ABC Ltd will be a single director company, so is not deemed an employer for AE purposes.

Other:

This article does not cover the treatment of VAT.

Please note that the definition of public sector client, for the purposes of these rules, is quite broad and includes those bodies listed in the Freedom of Information Act 2000. Click here for list. e.g. a GP surgery may fall under the new rules although it is difficult to imagine Joe Bloggs in the above example not being genuinely self employed in this case (unless, for example, Joe Bloggs was a self employed locum who only provides his services to the one GP surgery).

It is also worth noting that the cost for the public sector client will have increased as a result of the employer NIC liability. This may lead to the re-negotiation of contracts in the majority of cases.

Dec 2015

14

10 key reasons to move from HMRC Basic PAYE Tools to BrightPay

1. BrightPay is HMRC recognised

2. RTI is fully automated

3. BrightPay will automatically import your HMRC Basic PAYE Tools data

4. BrightPay will handle all auto enrolment tasks (at no extra cost)

5. BrightPay includes the NEST API, meaning the upload of auto enrolment data is automated

6. BrightPay will perform a pre staging assessment of your workforce to establish how much auto enrolment is going to cost and to determine if you need to register with a pension scheme

7. Payslips can be emailed to employees and will contain details of any pension deductions

8. You can use postponement, giving you more time to get a pension scheme in place

9. BrightPay is free for up to 3 employee records or £89 plus VAT per annum for a single employer with unlimited employees

10. Support is included in this price

This list is not exhaustive and only covers the key points.

Dec 2015

9

Auto enrolment - Autumn statement changes affecting minimum contribution schemes

The Government has announced plans to adjust, by about 6 months, the date on which the minimum pension contribution levels increase.

Phase 2 (when the minimum contributions increase to 3% employee and 2% employer) was scheduled for 1st October 2017 and phase 3 (when they increase to 5% employee and 3% employer) was scheduled for 1st October 2018.

Phase 2 will now start on 6 April 2018† and phase 3 will start on 6 April 2019† (†subject to parliamentary approval). This is not a delay to the roll out of automatic enrolment, but a measure to give all employers, and smaller employers in particular, more time to prepare for the increases and to reduce the administrative burden by aligning the changes with the start of each tax year.

This change will also make it considerably easier for payroll software to deal with the uplifts as they are now aligned to payroll years.

Aug 2015

14

HMRC Basic PAYE Tools users to get Automatic Enrolment tool from TPR

The tool to be provided by the Pensions Regulator for HMRC Basic PAYE Tools (BPT) users will only handle qualifying earnings schemes. It will not do communications nor will it prepare files for the pension companies. It will be an Excel spreadsheet which will need to be populated each pay period so that assessments and calculations can be performed. The results will then need to be input back into BPT. Then the BPT user will need to log in to the pension scheme's web portal and manually input the figures. There will be extra time required in this process and there will be potential for error.

This combined with the fact that HMRC Basic PAYE Tools does not prepare payslips means that the proposition for commercially available fully integrated payroll and auto enrolment software is much stronger.

BrightPay costs £89 (plus VAT) per annum* and will automatically import the file from HMRC Basic PAYE Tools meaning there is no time involved in setting up.

In addition, BrightPay will include the NEST API before January 2016 meaning NEST registered employers will not even need to log in to the NEST portal when submitting the contribution file each pay period.

* Single employer, unlimited employees. BrightPay is free for employers with 3 or less employees.