Mar 2020

10

Don’t let Covid-19 stop you from running payroll

As of 10 March, the number of confirmed cases of coronavirus increased to 373 in the UK, with cases across Europe also surging. With the number of cases bound to escalate, it has been predicted that if the coronavirus outbreak worsens, up to a fifth of UK workers could be off sick.

With panic over coronavirus soaring, many workers are being asked to stay away from the office and do day-to-day tasks from the comfort of their home. Not going into the office is an effective way of preventing the spread of coronavirus, because it minimises the risk of you coming into contact with someone carrying the disease.

Flexible working is becoming a growing trend

The reality is, working from home is already very popular, potential pandemic or not. Flexible working is a trend that has emerged in the last decade as more people seek that ideal work-life balance instead of work-life burnout.

Nearly a quarter of Britain’s workforce now work flexibly, that is, they work part of the week in an office and part at home, highlighting how quickly this trend is growing. Flexible working brings many work-life balance benefits as employees have more time to see their family, exercise and dedicate time to themselves. Seven in 10 of those who work flexibly say they are less stressed as a result of their working arrangement.

As well as the health benefits, it often results in happier employees. They then potentially work harder and are more productive. For employers, flexible working also helps to attract and retain talented employees. Additionally, it can result in increased loyalty and reduced office space cost.

Businesses need to carefully consider which processes and tools will make flexible work as productive and positive as possible for their employees. You need to make sure that they have essentials such as laptops, a reliable internet connection and being able to connect to systems remotely. This would have been difficult a few years ago, but thanks to the cloud, you can have everything you need at all times.

Flexible working with BrightPay Payroll

Although the payroll itself cannot be processed online with BrightPay Connect, the payroll software is still very flexible. Each BrightPay licence can be installed on up to 10 PCs where users have the option to process the payroll from 10 separate locations meaning you don’t need cloud payroll to operate and process your payroll. In addition, you can log into your BrightPay Connect account to view your payroll information at any time. You no longer need to be seated at your desk in the office to access the system - all the data you need to do your job is available on any of the 10 PC’s that the BrightPay application is installed on.

If you are not using the BrightPay Connect add-on, you can still access the payroll data file through a cloud environment to process the payroll. Again, the software itself can be installed to the local C drive of up to 10 PCs, be it a home computer or a laptop. The payroll files can be stored on a secure server or cloud environment, such as Dropbox or Google Drive, where the payroll information can be accessed from multiple computers.

With BrightPay Connect’s automatic cloud backup, payroll information is stored online and can be accessed by employers anywhere, anytime. Employers can also use BrightPay Connect to remotely manage employee’s leave, upload employee documents and send communications to employees that are working remotely.

Will coronavirus lead to long-term changes?

Will 2020 be the year in which office employees working more from home becomes the norm? Although many employers have implemented a mandatory ‘work from home’ policy as a precaution against coronavirus, it could also be the turning point for many businesses to recognise just how beneficial flexible working can be.

Book a demo today to discover how you can process payroll remotely with BrightPay.

Jan 2020

30

Customer Update: January 2020

Welcome to BrightPay's January update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

Easily integrate BrightPay with your accounting software

-

BrightPay Connect monthly subscription pricing - How will it work?

-

What the Tory victory means for IR35 and off-payroll working

Free Webinar: Last chance to register!

Payroll transformed: How cloud platforms supercharge the payroll process for employers

Join BrightPay for a free webinar where we look at cloud innovation and how it is positively impacting the payroll process for employers. Not in the distant or even medium-term future: this is happening right now. Register now to see how next-generation cloud features can revolutionise your business.

Easily integrate BrightPay with your accounting software

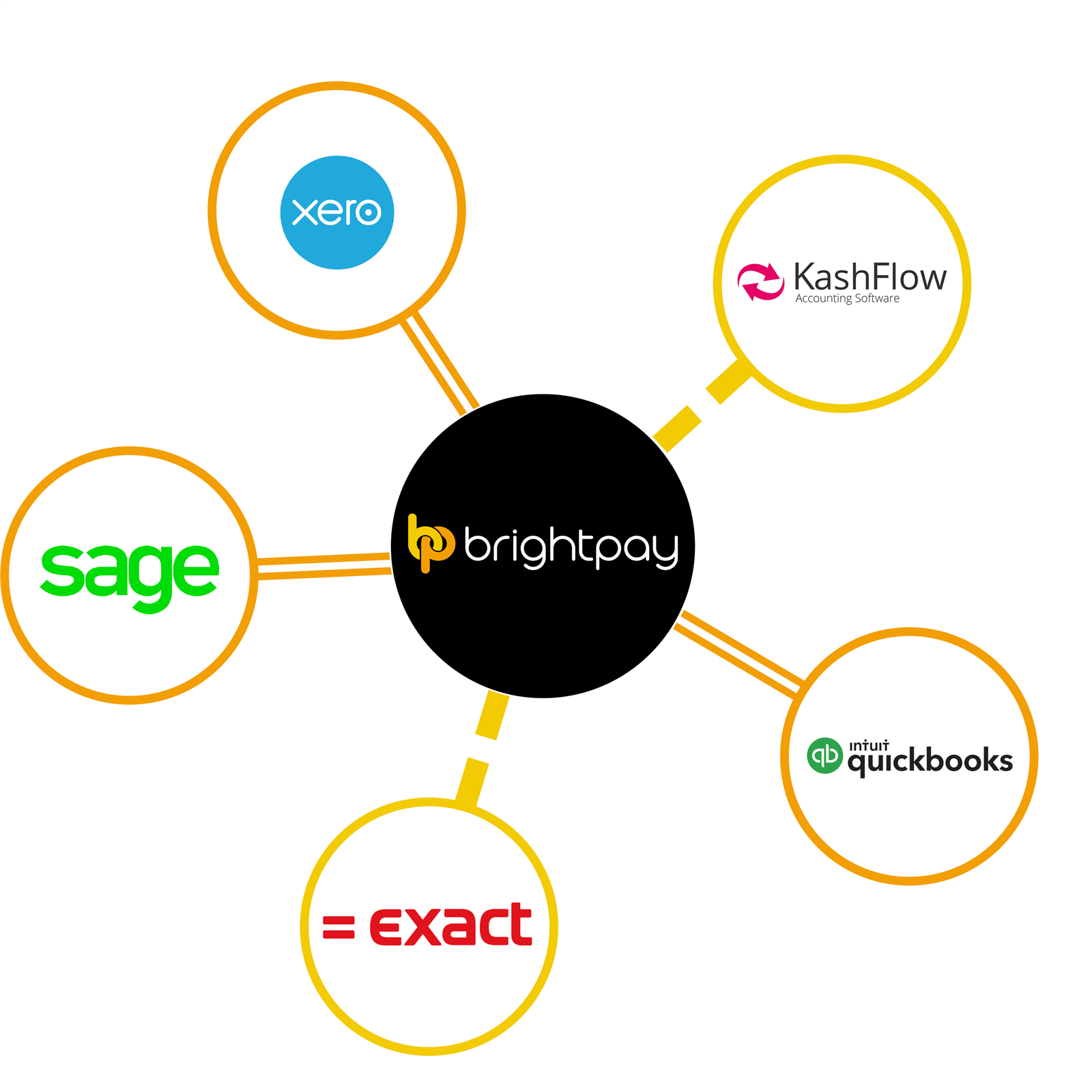

BrightPay’s payroll journal feature allows users to create wage journals from finalised pay periods so that they can be added into various accounting packages. With this direct integration, users will be able to send the payroll journal to the accounting package directly from within BrightPay. BrightPay includes direct API integration with Sage One, Quickbooks Online and Xero, and coming soon is integration with FreeAgent, AccountsIQ, Kashflow and Twinfield.

Employer obligations: Simple ways to comply using BrightPay Connect

There's been a lot of talk recently about online client platforms. They can bring many benefits to both employers and employees alike - from online payslip access to annual leave management to a HR document hub. But can cloud payroll portals really help with employer obligations? Here we look at how BrightPay Connect can help with record keeping requirements, employment law obligations and GDPR compliance.

Annual Leave Management: Say Goodbye to Paper Trails and Excel Spreadsheets

Minimum Wage Rates Increase from 1st April 2020

It has been announced that on the 1st April 2020 the minimum wage will increase by amounts ranging from 4.6% to 6.5%. An employee's age and if they are an apprentice will determine the rate they will receive. BrightPay can track employee hourly rates against the National Minimum/Living Wage (including apprentices), UK Living Wage, London Living Wage, or they can be marked as not eligible.

Jan 2020

28

Employer obligations: Simple ways to comply using online payroll portals

There's been a lot of talk recently about online client platforms. They can bring many benefits to both employers and employees alike - from online payslip access to annual leave management to a HR document hub.

But can cloud payroll portals really help with employer obligations? Here we look at how BrightPay Connect can help with record-keeping requirements, employment law obligations and GDPR compliance.

Record-Keeping Requirements

By law, employers must retain certain documentation relating to their employees for specific minimum periods. Good cloud systems will record this information for you, meaning everything is stored securely online.

Not only is BrightPay Connect useful for keeping a record of payroll information, but employers can also use it to hold various employment and leave records. Sometimes record-keeping can be something that we let slip or are perhaps not as diligent as we might be with say, payroll files, where we tend to be very diligent.

If you have an inspection, the inspector will want to see all of the employee records, whether it’s pay records, annual leave, sick leave, maternity leave, and they’ll expect the records to be readily accessible. With BrightPay Connect, you can access the calendar and reporting features to see at a glance who has taken leave, and when, so should an inspector arrive, you can simply log into Connect to access the records, rather than getting into a panic about what is saved where.

Employment Legislation

For employers, there’s also compliance with employment legislation. This will be even more important over the coming months, as three new pieces of employment legislation come into force on 6th April 2020.

One of the changes being introduced is the introduction of a day-one right to receive a written statement of terms and conditions (more commonly known as a contract of employment). At the moment, this needs to be given to new employees, no later than two months after the beginning of their employment, so this new day-one timeframe requirement from this April of providing an employee with their contract on their first day of employment will be a big change for many employers. For employers who use Bright Contracts to create contracts of employment, the software will soon be updated in line with the new legislation.

Free Webinar: Employment Law Update - Register now

If you are on leave or not based at the same location as the new employee, meeting that day-one deadline could be challenging, and that’s where the online employer and employee portals can help. Being able to upload employment contracts and other employee documentation onto the cloud from any location, and share it with the employee, could be a lifesaver. With BrightPay Connect, the documents and resources hub also offers an activity log, which gives the date and time stamps in relation to when an employee accessed the document.

GDPR Compliance

In the new world of GDPR, non-compliance will be a continuous threat to all businesses. BrightPay Connect offers significant benefits to help your business or practice comply with GDPR legislation.

GDPR Remote Access for Employees

The GDPR legislation includes a best practice recommendation, whereby organisations should provide individuals with remote access to a secure system, which would give them direct access to their personal information. An online employee portal, such as BrightPay Connect, will store employee’s information online, giving the employee access to personal data that employer has on file for them. The employee can update their contact information easily, with changes instantly and seamlessly updated in the payroll software.

Data Security

Your data accuracy and compliance improve even further when you add in the ability to automatically backup payroll data in the cloud. If you only keep your payroll data on your desktop, you are at risk of losing the information. How prepared are you for a disaster recovery situation? Would employees still get paid if the information was lost? Without cloud backup, the consequences would be dire. But now, these problems can be solved quickly, and that’s because of cloud innovation.

Cloud integration introduces the ability to automatically and securely backup the payroll data to the cloud. BrightPay Connect maintains a chronological history of all your backups, and these backups can be restored at any time if required. It’s simply an added layer of data protection to safeguard your payroll data.

Book a demo today to discover more ways that BrightPay Connect can help you comply with your employer obligations.

Nov 2019

29

BrightPay wins ‘Payroll Software of the Year 2019'

BrightPay was announced as the WINNER of ‘Payroll Software of the Year 2019’ at the ICB Luca Awards.

The annual LUCA Awards recognise outstanding achievement in the bookkeeping world, where ICB members and students vote in an online ballot to decide the winners of the awards. This year, BrightPay was awarded Payroll Software of the Year, over shortlisted contenders Moneysoft, Sage and Xero.

The awards took place earlier this week, during the annual two-day Bookkeepers Summit, where the BrightPay team had great feedback from the ICB members who are using BrightPay.

Payroll Software you can trust…

The award comes just one year after BrightPay was announced as the winner of ‘Payroll Software of the Year’ 2018 at the AccountingWEB Software Excellence Awards.

With over 25 years of payroll experience, our products are used to process the payroll for over 320,000 businesses across the UK and Ireland. BrightPay also has an impressive 99% customer satisfaction rate and a 5-star rating on Software Advice.

BrightPay for Bookkeepers

BrightPay includes a number of features that are very beneficial for bookkeepers.

- With BrightPay, you can batch process the payroll. You can finalise payslips, check for coding notices, and send outstanding RTI & CIS submissions to HMRC for multiple employers at the same time.

- BrightPay includes direct integration with accounting packages, where you can send your payroll journal directly from BrightPay to Sage One, Quickbooks Online and Xero at the click of a button.

- With the BrightPay Connect add-on, there is the ability to invite your clients to an online employer dashboard. The client can enter their employee’s hours and payment information for the pay period, and once reviewed, this information can be synchronised to the payroll software on the bureaus PC.

These are just a few of the many features we have in BrightPay that can help bookkeepers, but there’s so much more on offer. Don’t miss out - book a demo today to see these features in action and to discover more ways that BrightPay’s award-winning software can improve efficiency and save you time.

We would like to say a massive thank you to all of the ICB members and students who voted for us this year and to all of our customers. Go team BrightPay!!

Oct 2019

3

The life-changing magic of payroll cloud platforms: Free up time, work smarter and make more profits

The payroll landscape has changed significantly in recent years, not just because of RTI and auto enrolment, but also because of online client platforms. The relationship between the client and the payroll professional is no longer one-directional. Payroll services can - and should - be a team effort.

Join BrightPay’s Rachel Hynes and Ian Jenkinson as they take you through how cloud innovation can streamline, automate and delegate day-to-day tasks such as payslip distribution, entering the client's payroll data and backing up your payroll. That’s more time to focus on the essentials and provide better service.

Webinar Agenda

- Part 1: In this webinar, Rachel will examine six exciting ways that client cloud platforms have transformed payroll services. Not in the distant or even medium-term future: this is happening right now.

- Part 2: Ian will demonstrate how BrightPay Connect’s next-generation features can benefit your practice. Your payroll and HR processes can be more integrated into the cloud and streamlined with your payroll software than ever before.

Be ready to offer a new level of payroll and HR-related services by embracing automation and cloud flexibility for you, your clients and their employees. Register for this free CPD accredited webinar now to see how you can become more efficient by implementing new cloud technologies.

Can’t make it? Register for the webinar anyway and we will send you the on-demand recording when it’s ready.

More upcoming webinars

Join BrightPay for our series of free CPD accredited webinars where we look at how cloud innovation is transforming the future of payroll services. More upcoming webinars include:

Sep 2019

26

Are employees receiving the National Minimum Wage?

According to Office for National Statistics figures, wage growth has risen to 3.6% in the year to May 2019, outpacing inflation since March 2018. While unfortunately we don’t have a crystal ball to predict how long this will last, we know something for certain: the National Minimum Wage (NMW) and National Living Wage (NLW) will continue to change every year.

Tracking employee hourly rates depending on their circumstances might seem complicated, but it doesn’t have to be. Here at BrightPay, we are constantly working to provide you with a platform that makes payroll and amendments easy. In this short guide, we have summarised all the key information and steps to make changes to the NMW and NLW on BrightPay.

Hourly rates

The hourly rate for the minimum wage depends on an employee's age and whether they are an apprentice:

- The apprentice rate is applicable to apprentices aged under 19 and those aged 19 or over when they are in the first year of their apprenticeship

- Employees under 24 years old are entitled to the National Minimum Wage

- Employees aged 25 or over are entitled to the National Living Wage

The rates for the National Living Wage and the National Minimum Wage change every April and are currently:

| Category of worker | Hourly rate |

| Aged 25 and over (National Living Wage rate) | £8.21 |

| Aged 21 to 24 inclusive | £7.70 |

| Aged 18 to 20 inclusive | £6.15 |

| Aged under 18 (but above compulsory school leaving age) | £4.35 |

| Apprentices aged under 19 | £3.90 |

| Apprentices aged 19 and over, but in the first year of their apprenticeship | £3.90 |

BrightPay can track all employee hourly rates depending on their circumstances. That is including all the cases above, as well as the London Living Wage, and they can also be marked as not eligible.

Checking if an employee is receiving the NMW

You can use BrightPay to determine if an employee is receiving the National Minimum Wage, which is automatically calculated for hourly paid employees.

Once the number of hours worked for a pay period is entered, the payroll software will use the rest of data available about the employee, such as their age, hours worked in period and minimum wage profile to calculate how the hourly rate used compares to the minimum hourly rate, and alert the user if it falls below the relevant minimum wage.

Non-hourly employees

The process is simple for most employees, but you might be wondering about non-hourly employees. The good news is that on BrightPay you will also find a Minimum Wage Report feature that allows you to enter/confirm the number of hours worked for each employee and generate a report that confirms who is above or below the minimum wage. Easy, isn’t it?

If an employee's wage is below the National Minimum/Living Wage, BrightPay will flag it with a yellow status bar within 'Payroll' – or you can choose to hide this notification if you prefer.

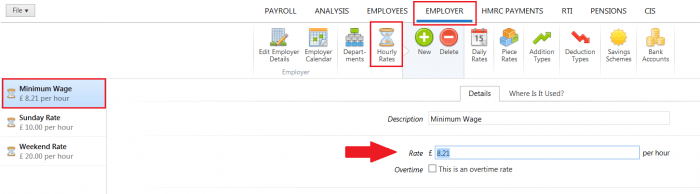

Amending a global hourly rate

When the Minimum Wage changes, you can amend the global hourly rates automatically. Hourly rates can also be set up at the employer level in BrightPay from the 'Employer' tab, selecting 'Hourly Rates'. Once the hourly rate has been determined, the changes will automatically be applied to all employees assigned to that hourly rate.

Aug 2019

15

Payroll transformed: How client cloud platforms supercharge your bureau

Accounting and payroll processing is best left to the experts. That’s always been true - and it remains true. The steady hand of a seasoned accountant or payroll professional is a powerful commodity that can’t be replaced by software.

But as much as things have stayed the same, other things have changed, too. The relationship between client and professional is no longer one-directional. What software has created is a new collaborative framework in which the payroll professional can thrive.

Payroll services can - and should - be a team effort. Gone are the days of payroll bureaus continuously slogging through manual processes, and the frustration of clients who need to approach their payroll services provider with every minor tweak.

In its place is software with cloud integration that envelops the day-to-day tasks like annual leave management, payslip distribution and backing up your payroll. That’s more time to focus on the essentials and provide better service.

Software can never replace the core professionalism of a payroll professional, but it can supplement it in many ingenious ways. Through self-service, through apps, through cloud backup: payroll software is about making your life easier.

You do the hard work, you get the credit, while your software hums along quietly in the background, automating and simplifying the repetitive aspects of the job and keeping you compliant.

Download our free guide where we discuss six exciting ways client cloud platforms have transformed payroll services. Not in the distant or even medium-term future: now. Here’s how cloud integration can help you today.

Jul 2019

8

BrightPay - Award-winning payroll software you can trust

After winning ‘Payroll Software of the Year’ at last years’ Accounting Excellence Awards, the BrightPay team are delighted to be shortlisted in the payroll software category again this year. The winner is decided by a public vote held by AccountingWEB, whereby members are asked to rate the software systems that they use to determine the best products on the market.

In recent months, BrightPay carried out a customer survey and we were happy to discover that we have maintained our 99% customer satisfaction rate. Recent comments from some of our happy customers include:

- “Using BrightPay has revolutionised the way we manage payroll as a practice. The staff are always extremely friendly and helpful, and especially attentive to suggestions.” - Carol Webb, Casktrak Ltd

- “After using other payroll packages for several years, I was highly delighted when I discovered BrightPay. The time I save per payroll is great and it’s the easiest, fastest and operator-friendly software I have ever used.” - Irene Hopkinson, Westmill Accountancy

- “Having tried various payroll software, BrightPay is far superior to anything else on the market and their customer support is superb.” - Helen Bower, Adder Bookkeeping Ltd

- “BrightPay is the first payroll software we have used which is truly fit for purpose. The functionality and straightforward approach of the software is second to none, and when paired with the fantastic customer support and value for money makes BrightPay the payroll software provider of choice.” - David Atyeo, Donovan Atyeo

- “This is our first year using BrightPay Connect and we are so pleased with it as it has enabled us to automate more in the way reports and how payslips are delivered to our clients. Really love the approval feature. Well done!” - Bharat Hathi, BDH Chartered Certified Accountants

Over the past year, our team of developers have been working hard to make BrightPay better than ever. We have added many new features to help our customers manage their payroll processing more efficiently.

- This year we introduced payroll journal API integration with a number of accounting packages. This allows users to send the payroll journal directly to their accounts software from within BrightPay. BrightPay currently has direct integration with Sage One, Quickbooks Online and Xero with many more currently in development.

- Another new feature this year is batch payroll processing, whereby users have the ability to finalise payslips, check for coding notices and send outstanding RTI & CIS submissions for multiple employers at the same time, which has significantly reduced the payroll processing time for payroll bureaus and accountants.

- With BrightPay Connect, we have also launched the client payroll entry and payroll approval feature, which is a game-changer for payroll bureaus and accountants. Clients can enter their payroll information into an online employer dashboard. Once reviewed by the bureau, the information is seamlessly synchronised back to the payroll software, eliminating the manual input and putting the onus on the client to make sure that the payroll information is 100% accurate.

Book an online demo today to find out more about our new features. You can also have a look at our Accounting Web Product Showcase where Ann Tighe from BrightPay shows AccountingWEB’s head of insight John Stokdyk some of the features that enable accountants to save time and boost efficiency.

Best of luck to all of the software providers who have been shortlisted for an Accounting Excellence Award.

Jun 2019

4

Customer Update: June 2019

The hidden benefits of an employee self-service system

The ability for employees to view and edit their own data is one of the most important advancements of HR in recent years. Providing employees with remote access to view personal information is also a best practice recommendation of the GDPR. It's obviously true that employees have a lot to gain from a self-service system, but what about HR personnel, managers and everyone else involved in the payroll and HR process? They benefit too!

Payroll Implications of Brexit

Britain is currently like a cat that waits at the door crying to be let out but once the door is open, decides it doesn’t want to leave anymore. But never mind all these bigwigs in Westminster saying how this will affect that and so on; today I want to talk about what Brexit means for the unsung heroes of HR, in particular, payroll. How will leaving the EU affect their everyday work life? We have put together four key areas to note.

DIY payroll: Empowering clients with self-service remote access

There’s a lot of talk these days about ‘customer-centricity’, in particular integrating your clients into the processes that serve them. The internet makes it easy for clients to help themselves because they can access specific functionality that isn’t confined to a single location or computer. Download our free guide where we discuss DIY payroll and more ways that innovation is improving payroll as a service.

BrightPay back with a bang at Accountex 2019

The BrightPay team were back at Accountex again this year for our fifth year in a row. It was great to meet with so many existing customers and new customers and get to speak with them face-to-face. Don’t miss out - if you didn’t attend, make sure to book a demo and download our brochure today to find out about our newest features.

Download brochure | Book a demo

Three quick things that will really help accountants

18 months ago, the book “What’s next for accountants” stayed at Number 1 on Amazon for three weeks, and was hailed by accountants and gurus across the world as a “must read”. We have persuaded the author (Shane Lukas) to celebrate the 20th anniversary of his business by giving you three ground-breaking gifts.

New User Management Interface for Connect

Our new User Management feature for BrightPay Connect makes it more seamless and quicker for users to be set up or amended. It offers the option to select permissions for multiple employers at one time for a standard user. There is also a new permission to allow standard users to connect and synchronise employers from BrightPay to Connect and a new feature to mark an employer as confidential.

Happy Birthday GDPR!

Yes, that’s right folks, on May 25th of this year our beloved GDPR turns 1 year old! *dries eyes* - they grow up so fast. We all know that GDPR has been a resounding success but we also know that, like all 1 year olds, there's been some teething problems. So let’s take a look back through our photo album of the past year and see how our little trooper has fared over its first year.

Digital trends that every employer should know

It’s predicted that by 2020, the global workforce would be dominated by millennials and generation X. That means by next year, over 70% of the global workforce will be under the age of 40. A younger workforce presents knock-on effects for the entire business. As an employer, you need to adapt to meet the expectations of this new generation of employees; they’re very different from the workforce that preceded them.

From the support desk: Can BrightPay be accessed from multiple users on different machines?

BrightPay employer data files can be stored on a shared network drive or cloud drive to be accessed by multiple PCs or Macs. The BrightPay software application must be installed on each individual PC or Mac you wish to use to access the shared location. A single BrightPay licence allows for up to ten installations.

More FAQs | Online Documentation | Video Tutorials

Key issues facing your payroll department in 2019

The CIPP unveiled their latest “Future of Payroll Report” (2019) for the second year running and surprisingly, it’s not a total snoozefest! The report acknowledges that whilst payroll software and technology make things easier, the number of enquiries does not decrease and payroll departments need to be on the ball to be in a position to answer these queries effectively.

May 2019

28

Digital trends that every employer should know

It’s predicted that by 2020, the global workforce would be dominated by millennials (35%) and generation X (35%). That means by next year, over 70% of the global workforce will be under the age of 40. A younger workforce presents knock-on effects for the entire business. As an employer, you need to adapt to meet the expectations of this new generation of employees; they’re very different from the workforce that preceded them. Having grown up using the internet as second nature, these young employees are true digital natives and have never known a world without it.

Take, for instance, payroll. With payment technologies evolving, millennials have become some of the fastest adopters of mobile and digital payments. Their influence on mobile payroll adoption cannot be ignored. The simple fact is these new generation employees don’t do paper forms. They are increasingly looking for digital options to access payslips and apply for annual leave.

In recent years, employees are using holiday time differently than previous generations, with the average leave duration reduced to just 2.34 days. This alone creates new challenges for payroll and HR managers. Shorter, more frequent bursts of annual leave tend to be requested last minute rather than planned in advance. It is important for employers and HR personnel to be able to quickly review and approve leave requests.

Mobile payroll solutions, such as BrightPay Connect, are an ideal way to improve the efficiency of your business, especially as new generation workers continue to integrate smartphones into every aspect of business operations.

BrightPay Connect benefits include:

- Request annual leave - An employee opens up their phone or tablet, logs in to the employee self-service app and applies for leave online. The HR manager or employer will be alerted of the leave request and can approve the leave instantly, with the leave automatically flowing back to the payroll software. On the self-service portal, both the employee and the employer can view their number of leave days taken and remaining, along with an employee leave calendar displaying all past and future leave.

- View payslips and payroll documents - The employee can login to their self-service account to view and download all current and historic payslips and payroll documents such as P60s. For the payroll processor, there is no more printing or emailing payslips. Payslips are automatically added to the employee’s online portal each pay period eliminating employee requests for copies of past payslips.

- Access everything in one central location - Keep everything in one central place. For employees, there is just one login to view employee documents and a company noticeboard. Employers can upload documents such as employment contracts, staff handbooks, privacy policies, training manuals. The employer can decide whether the employee should have access to view the document or not, using it as a central location for everything to do with each individual employee.

As an employer, adopting these few features favoured by younger workers, along with the additional employer benefits (such as an automatic cloud backup of payroll data and instant access to payroll reports), you are guaranteed to improve the efficiency of your business and payroll processing.

Book a demo today to find out how you can benefit from BrightPay Connect.