Jan 2018

12

2018-19 Rates and Thresholds for Employers

For 2018-19 the new personal allowance for an employee is £11,850.

The 20% PAYE tax threshold is for annual earnings up to £34,500.

The UK higher tax rate of 40% is on annual earnings from £34,501 to £150,000.

The UK additional tax rate is 45% on annual earnings over £150,001.

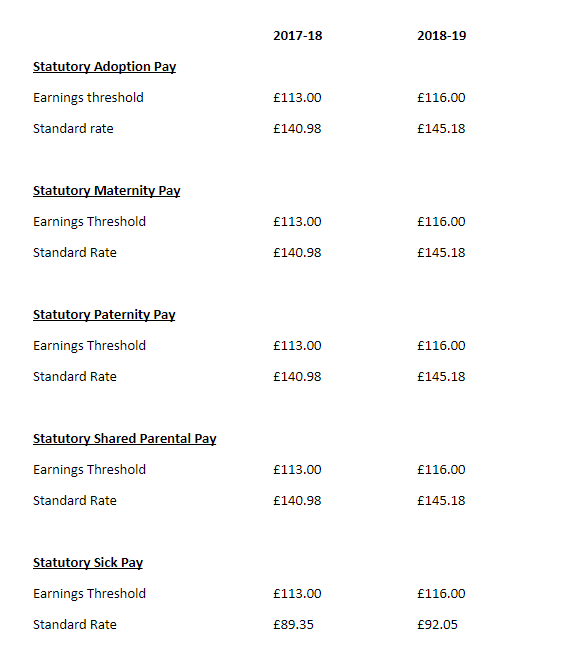

For the new tax year 2018-19, the Department for Work and Pensions have published the statutory payment rates for benefits and pensions.

Click here to see the full list published.

Please see some rates details below: