Mar 2015

23

BrightPay 2015/16 is Now Available. What's New?

BrightPay 15/16 is now available to download. Here’s a quick overview of what’s new:

2015/16 Tax Year Updates

- 2015/16 rates, thresholds and calculations for PAYE, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, and Statutory Shared Parental Pay.

- The emergency tax code has changed from 1000L to 1060L.

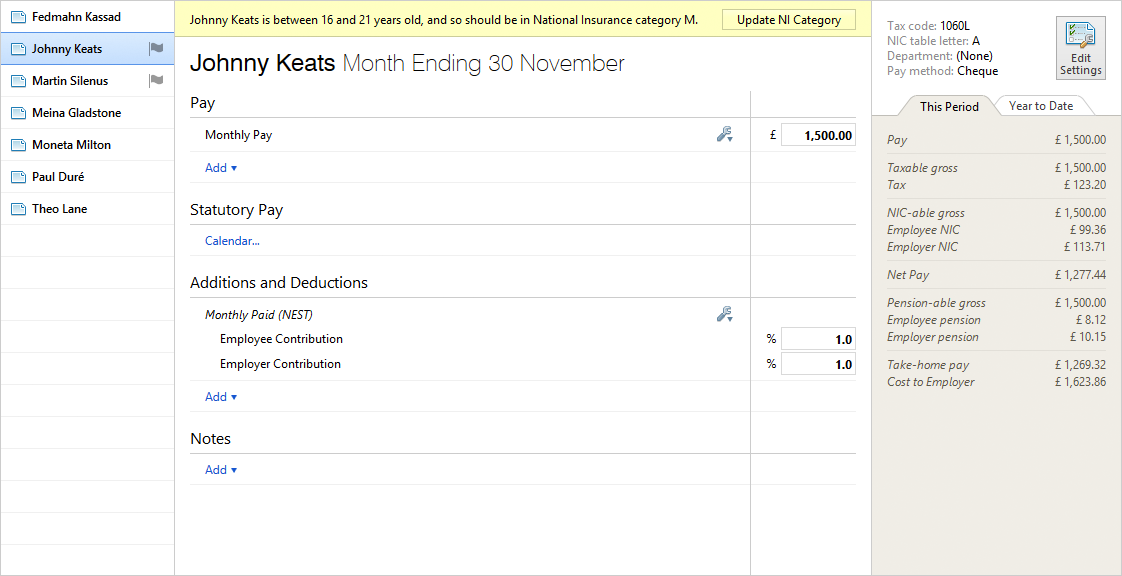

- Support for the newly introduced National Insurance category letters for employees under 21 years old:

- M – Standard rate contributions

- Z – Deferred rate contributions

- I – Contracted-out Salary Related standard rate contributions

- K – Contracted-out Salary Related deferred rate contributions

- Eligible employers can continue to claim the £2000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30 and P32 forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all RTI submission types.

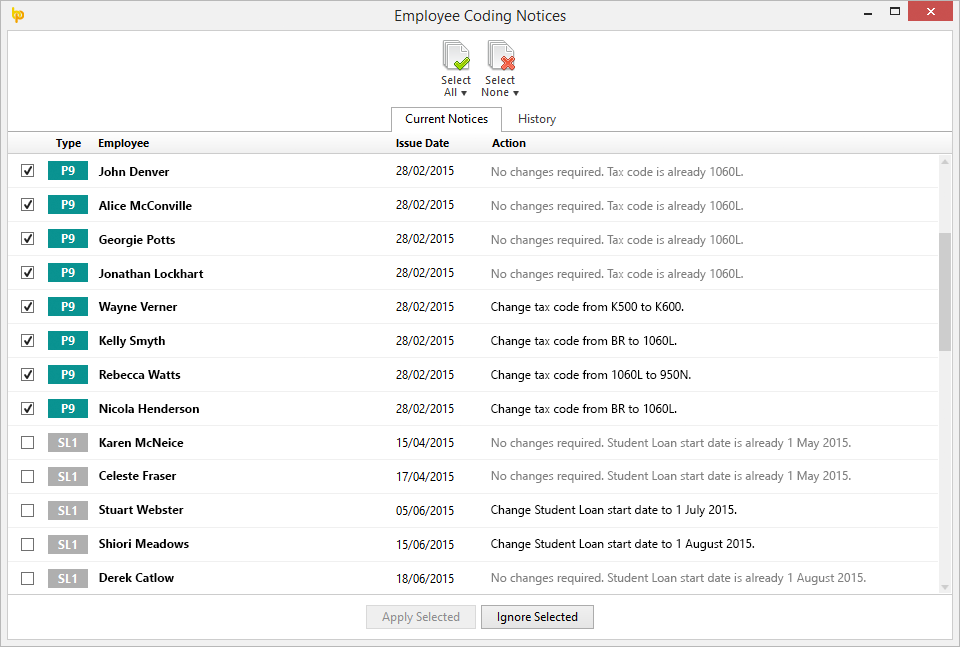

PAYE Coding Notices

BrightPay 2015/16 includes the ability to retrieve and process employee PAYE coding notices directly from HMRC (P9, PB, P6B, SL1, SL2).

To use this feature, ensure the notice options in your HMRC PAYE dashboard are all set to Yes. Only new coding notices issued after this instruction will be available for download.

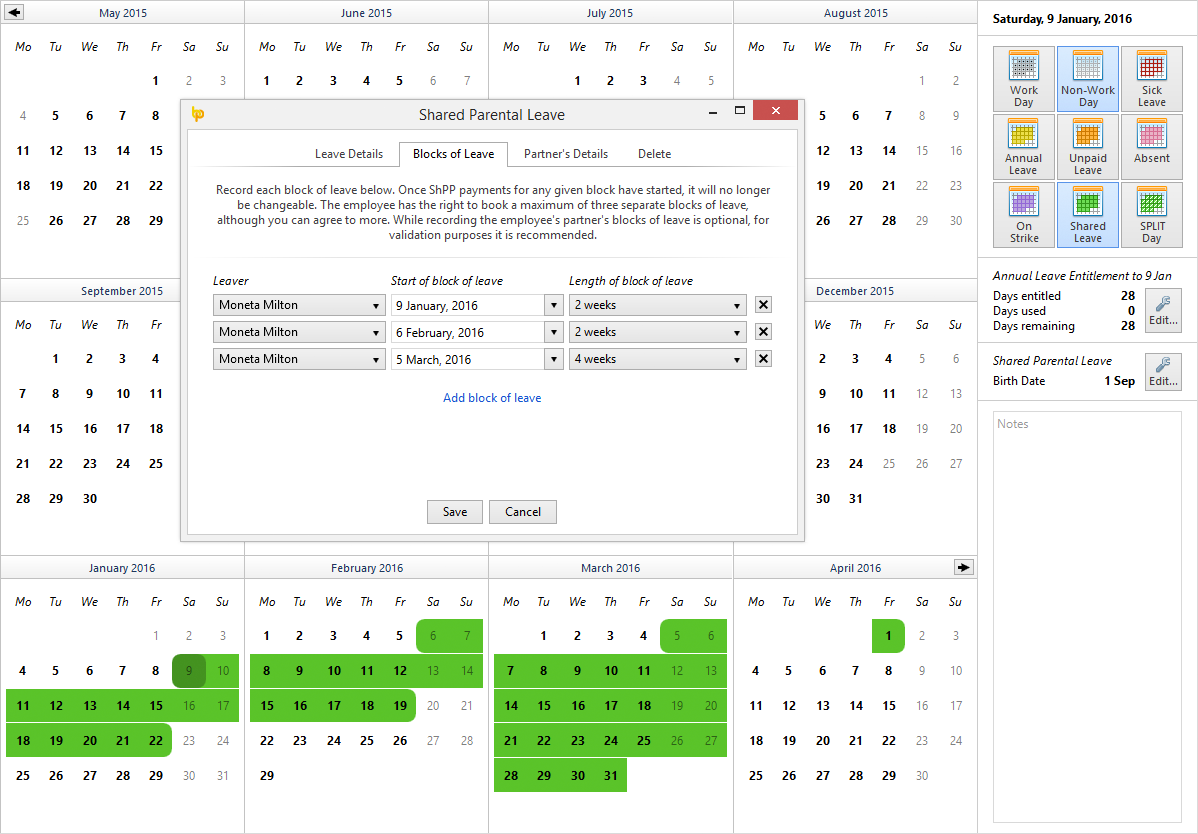

Shared Parental Leave

Shared Parental Leave (SPL) is a new legal entitlement for eligible parents of babies due (or children placed for adoption) on or after 5 April 2015. SPL lets parents choose either to have one parent take the main child caring role, or to share the child caring responsibilities evenly, depending on their preferences and circumstances. Unlike maternity/adoption leave, eligible employees can stop and start their SPL and return to work between periods of leave.

BrightPay 2015/16 has full support for Shared Parental Leave and Statutory Shared Parental Pay (ShPP).

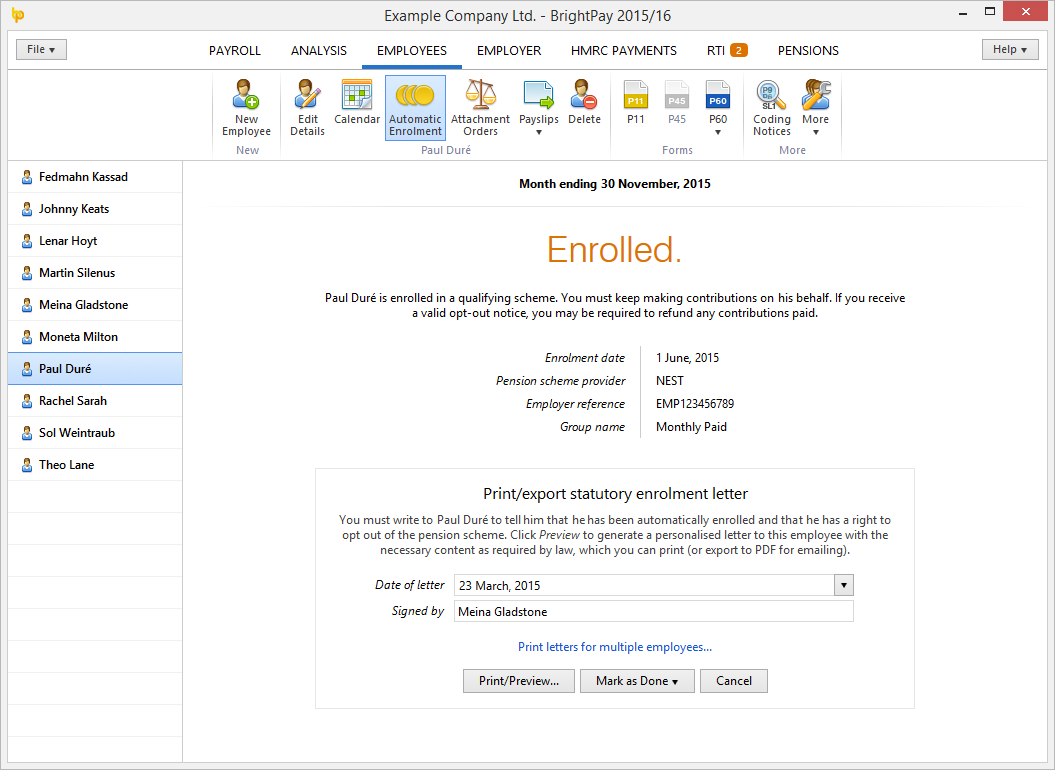

Pensions and Automatic Enrolment

With the first wave of small employers (i.e. those with less than 50 employees) set to stage for Automatic Enrolment in January 2016, this tax year will be busy.

We first introduced support for Automatic Enrolment in BrightPay 2014/15, providing the ability to set up qualifying pensions schemes, assessment, postponement, enrolment, opt-ins, opt-outs, employee communications, and more. We have dedicated support for NEST, NOW: Pensions, The People's Pension and Scottish Widows.

In BrightPay 2015/16 we have improved Automatic Enrolment support and added several new features:

- There is now a dedicated PENSIONS tab for setting up Automatic Enrolment in BrightPay, adding/editing pensions schemes, and exporting enrolment and contribution files.

- Batch processing – multiple employees can now be postponed or enrolled (and as well as other actions) together in a single click. Multiple communications can be printed together.

- Ability to override BrightPay's assessment of an entitled worker or non-eligible jobholder (e.g. if the employee's pay would normally put them in a different category).

- Ability to continue enrolment from a previous tax year or continue enrolment from other payroll software.

We'll be continuing to update Automatic Enrolment during the 2015/16 tax year and provide dedicated support for more pension scheme providers.

Improved Reminders

For years, BrightPay has given reminders of important actions and detected potential data errors as you process your payroll. In 2015/16, we've improved the system to handle even more reminders and give much improved visual feedback.

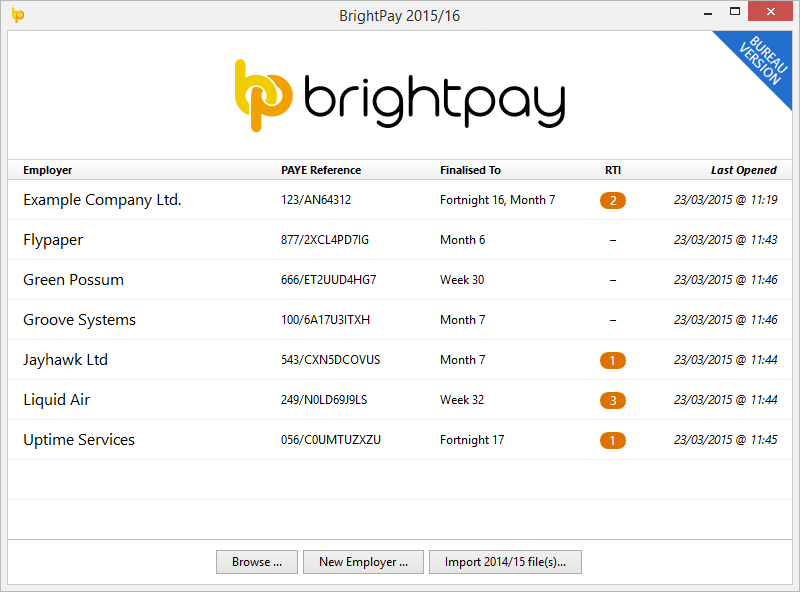

New Start-up Window

Standard and Bureau users alike will benefit from the extra employer information included in the new BrightPay start up window:

Other 2015/16 Changes in BrightPay

- Ability to batch print, email or export one or multiple payslips for a single employee.

- Automatic prompt to create an EPS when recoverable amounts are detected in an HMRC payment.

- A new summary of calendar events in the current period for the currently selected employee appears in the bottom right of main payroll screen.

- Support for Direct Earnings Attachment orders.

- New ability to set up an addition or deduction to repeat to a date beyond the current tax year.

- Improved Statutory pay descriptions.

- New ability to hide 'zero' payments, additions and deductions on printer (or emailed/exported) payslips.

- Employer's HMRC Sender password is now securely masked in the BrightPay user interface.

- Lots and lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

BrightPay 15/16 is the same price as BrightPay 14/15 (including FREE for small employers with up to three employees). Support will continue to be free of charge for all users.