Mar 2020

30

Carry Over of Annual leave – Government Relaxes Rules

The rules in relation to the carry over of annual leave have been temporarily relaxed to deal with the coronavirus disruption.

The Government has announced that employees and workers who are unable to take their annual leave due to coronavirus may carry over up to four weeks’ paid holiday into the next two leave years.

The Working Time (Coronavirus) (Amendment) Regulations 2020 will amend the Working Time Regulations 1998 to create an exemption relating specifically to the coronavirus outbreak.

Employees may be unable to take their annual leave for a number of reasons, including:

- they are working in key sectors and due to work demands cannot take annual leave,

- they are self-isolating or are too sick to take holidays before the end of their leave year,

- they have been temporarily sent home, placed on layoff or furlough leave.

If an individual leaves their job, either by resigning or due to dismissal during the two-year period, any untaken paid holiday must be added to their final pay. The government has stressed that employers should ensure in so far as possible that workers have adequate opportunity to take their holidays. An individual should not be paid in lieu for holidays unless they are leaving.

The change will apply to most workers including agency workers and those on zero-hours workers.

The temporary change relates only to 4 weeks leave. Employers who do not currently have a policy on the carry over of leave, may decide whether they will allow for extra holidays to be carried over. Extra holidays may include;

- the remaining 1.6 weeks of statutory leave,

- any contractual holiday entitlement above the legal minimum.

Mar 2020

23

Coronavirus Job Retention Scheme & Furlough Leave

The below are some of the key points in relation to the Coronavirus Job Retention Scheme, we will update as more information becomes available.

What is it?

The Coronavirus Job Retention Scheme allows all UK employers to access financial support to continue paying part of their employees salary that would otherwise have been laid off due to Covid-19. It prevents against layoffs and redundancies.

What organisations are eligible?

All UK companies are eligible: limited companies, sole traders who employee people, LLPs, partnerships, charities.

Which employees are eligible?

Furlough leave is available to all employees on a contract, including;

- full-time employees

- part-time employees

- employees on agency contracts

- employees on flexible or zero hour contracts

How does it work?

- The employer must designate affected employees as furloughed workers.

- They should notify the employee that they have been marked as Furlough. Agreement from the employee may be required.

- HMRC must be notified of the employee designated as furloughed workers as well as details of their earnings. This is done through an online portal (not currently set up).

- HMRC will reimburse 80% of furloughed workers wage costs, based on the February earnings of salaried workers, up to a cap of £2,500 per month.

- Wages for those on variable hours, can be calculated based on the higher of either:

- the same month's earning from the previous year

- average monthly earnings from the 2019-20 tax year

If the employee has been employed for less than a year, employers can claim for an average of their monthly earnings since they started work.

- Employees remain employed, their continuity of service is not impacted.

- Employer may choose to top-up the other 20% of salary. If they don’t top-up the 20% it will be a deduction in wages.

- Wages paid through the Scheme are subject to the usual income tax and other deductions.

What are the employment issues?

Changing the status of employees to a furloughed worker remains subject to existing employment law. Generally, where an employee’s contract contains a layoff or short term clause employers should be able to place employees on furlough leave. Where there is no such clause, it is best advised to get agreement from the employee.

Additionally, a 20% reduction in salary will be a change in terms and conditions of employment. Where employers are not topping up the government payment, they should also seek agreement from the employee.

Given the current situation and the alternatives for those employees should they not agree, one can expect that most employees will agree. That said, prudent employers will seek to get their employees agreement as part of their furlough leave process.

Please see a sample letter to notify your employee that they have designated as a furlough worker here.

Mar 2020

20

Changes to the Employment Allowance for 2020-21

From 6th April 2020 the eligibility rules for an employer claiming the Employment Allowance will change. Employers will have to check if they meet the correct criteria in order to check if they are eligible to claim the allowance. Some of the eligibility rules are as follows:

- An employer can only claim the Employment Allowance for the tax year if their total (secondary) Class 1 National Insurance contributions is below the threshold of £100,000 in the previous tax year.

- An employer cannot claim the allowance for deemed payments of employment income, as they are not included in the total cost of up to £100,000 for employers’ (secondary) Class 1 National Insurance contributions.

- In the tax year before you claim if there is more than one payroll or connected companies the employer will need to add the total liabilities for employers’ (secondary) Class 1 National Insurance contributions for all payrolls or companies and only if the total liability is under £100,000 can one payroll or company claim the Employment Allowance.

- An employer will have to check they will not exceed the de minimis state aid threshold, if applicable, as the Employment Allowance will be included as this type of aid. De minimis state aid rules apply to an employer if their business engages in providing goods or services to the market.

In Budget 2020 it was announced that the Employment Allowance will increase from £3,000 to £4,000 from 6th April 2020 thus helping to reduce the employers’ (secondary) Class 1 National Insurance contributions liabilities.

In the tax years before 2020-21 the Employment Allowance claim auto-renewed, as in the employer did not have to make separate claims every tax year. But this is changing from 6th April 2020 onwards. The method of claiming through the Employer Payment Summary remains the same but the employer will have to make a new claim for the Employment Allowance to HMRC each tax year.

Mar 2020

19

BrightPay 2020/21 is Now Available. What's New?

BrightPay 2020/21 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2020/21 Tax Year Updates

- There are no changes to tax bands, rates or the emergency tax code in 2020/21. BrightPay continues full support for Welsh Rate of Income Tax (WRIT) and Scottish Rate of Income Tax (SRIT).

- 2020/21 employee and employer National Insurance contribution rates, thresholds and calculations.

- 2020/21 Student Loan and Postgraduate Loan thresholds.

- 2020/21 rate of Statutory Sick Pay, including support for COVID-19 related periods of sick leave (in which SSP is paid from day one).

- 2020/21 rates for Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, and Statutory Shared Parental Pay.

- Support for new Parental Bereavement Leave and Statutory Parental Bereavement Pay.

- 2020/21 rates for company cars, vans and fuel. BrightPay now allows input of 'zero emission miles' for cars with a C02 rating of less than or equal to 50g/km (which is now used in the calculation of cash equivalent).

- Support for real-time PAYE tax and Employer Class 1A NICs due on year-to-date termination awards over the £30K annual threshold and on year-to-date sporting testimonial payments over the £100K annual threshold.

- Ability to process 2020/21 HMRC coding notices.

- April 2020 National Living Wage rates.

- Eligible employers can continue to claim Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC. For 2020/21, the maximum Employment Allowance claim has been increased to £4,000.

- Updated P11, P45, P60, P30, P32, P11D and PBIK forms.

- Updated RTI submissions in line with the latest HMRC specifications, including the new De Minimis State Aid declaration on the EPS. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EXB, CIS300, CISREQ).

- Support for off-payroll workers subject to April 2020 rules. Off-payroll working rules have been postponed until April 2021.

Automatic Enrolment Updates

- 2020/21 qualifying earnings thresholds.

- For 2020/21, the minimum required pension contribution level continues to be 8%, at least 3% of which must be contributed by the employer.

- Various enrolment/contributions API submission and CSV formats have been updated to the latest versions to ensure continued compatibility with all pension scheme providers.

- Additional one-off contributions can now be optionally persisted to following pay periods.

- Makes it more clear on the Automatic Enrolment journey report when an assessment is part of automatic re-enrolment.

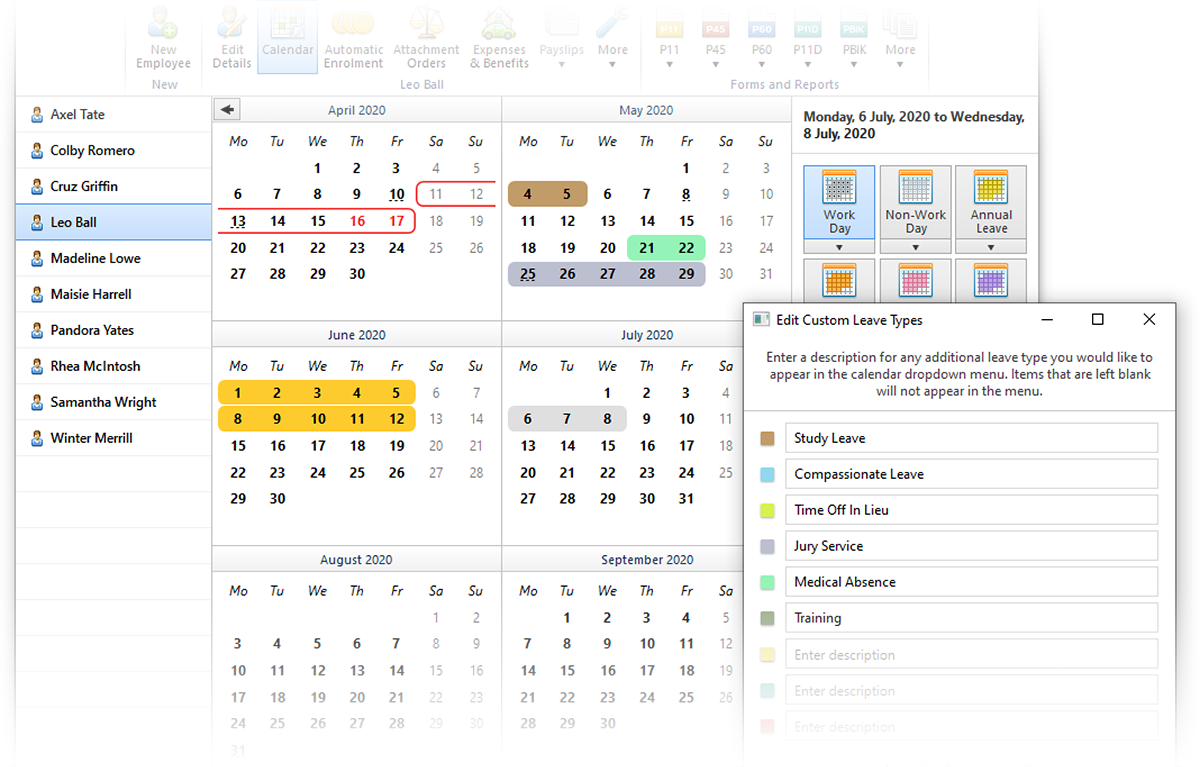

Define and Set Custom Leave Types on Employee Calendar

- You can now define up to nine additional custom types of employee leave. Six of the custom types are set up with default descriptions, which you can edit, add to, or remove as need be.

- Custom leave types act like the existing built-in kinds of leave, in that they are mutually exclusive and can only be applied to working days. They can be set on a per-employee basis, or batch set for multiple employees at once.

- Custom leave types also appear on the employer calendar. Mouse-hover tooltips have been added to the various views of the employer calendar to help determine what each colour indicates where it's not clear.

- A new Calendar Report (which replaces the previous Print Calendar functionality) gives you the power and flexibility to create and/or share a customised report of employee leave that can be filtered by type of leave, and presented individually for each employee, or as a summary containing multiple employees.

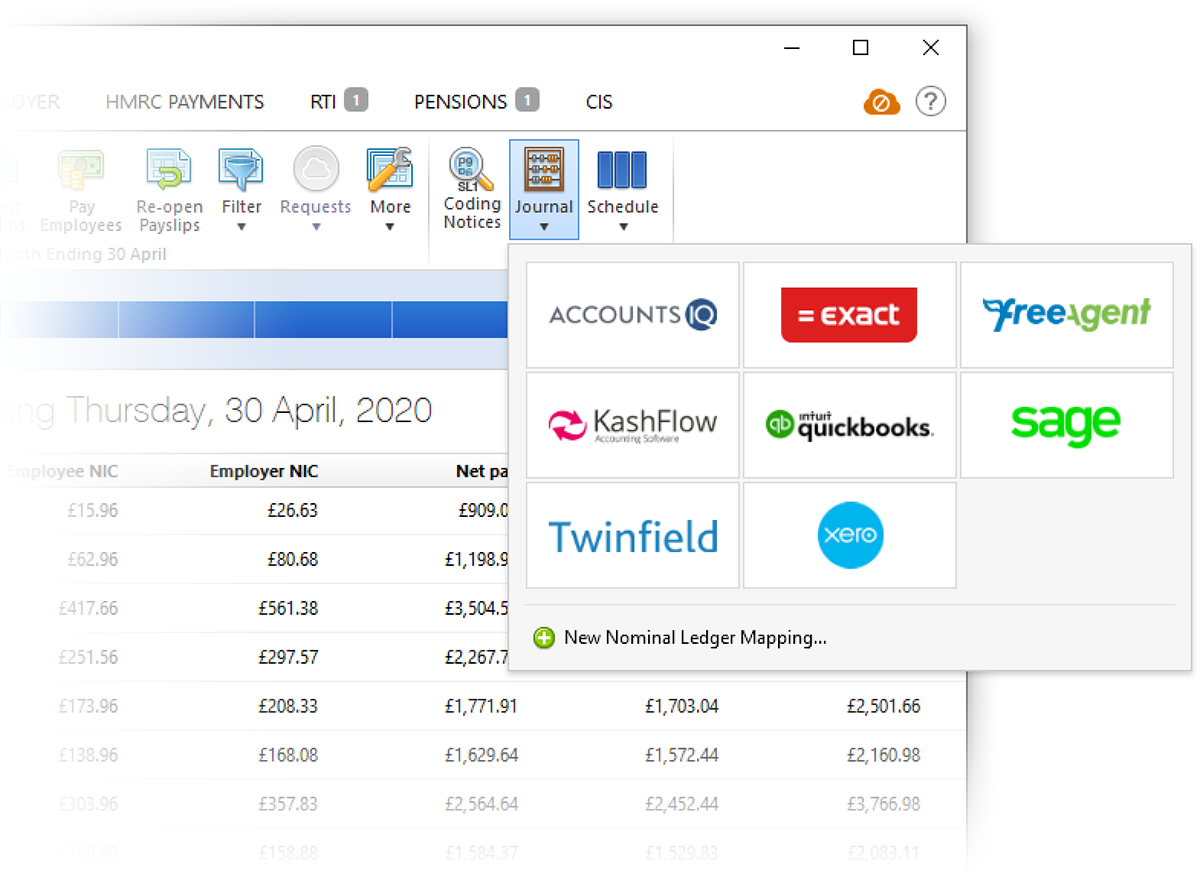

More Journal API Support

Along with the API support added for Sage, Quickbooks and Xero in 2019/20, BrightPay 2020/21 now supports posting journals directly via API to FreeAgent, Kashflow, Twinfield and AccountsIQ. The option to create a CSV journal is also still available where supported.

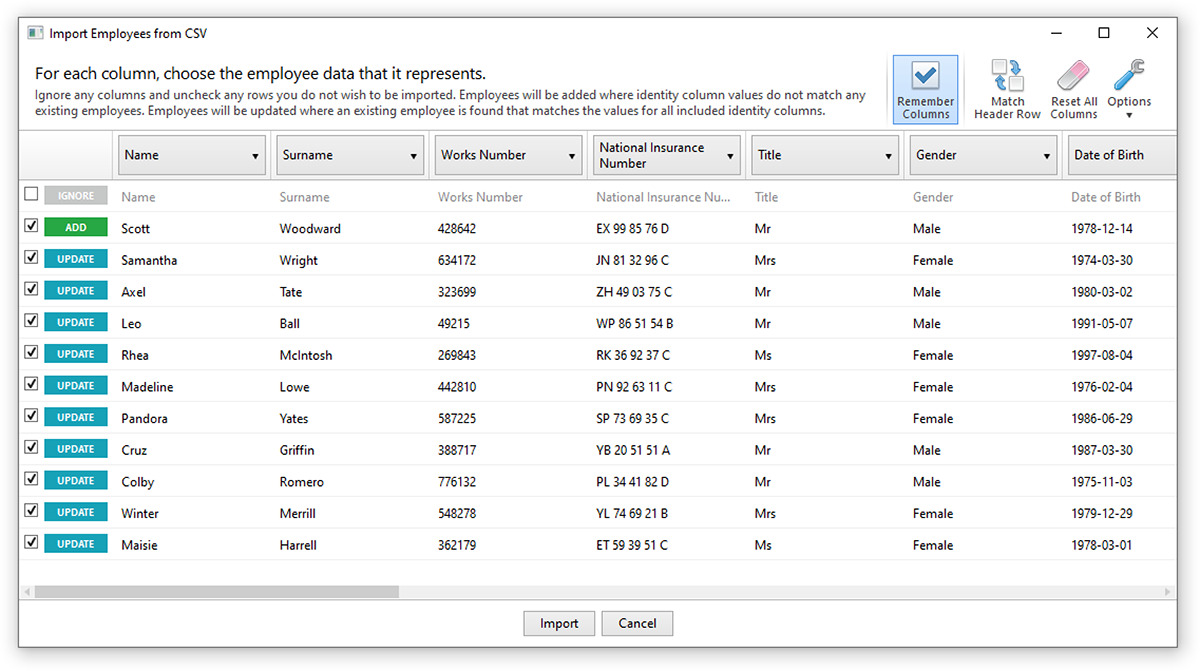

Update Employees from CSV File

BrightPay has traditionally only allowed new employees to be added from a CSV file. Now, you can both add new employees and update existing employees from a CSV file. (The same has been done for subcontractors).

BrightPay Connect

- The Connect tab on the start-up window now directly shows your sign-in status.

- The list of employers (in the Open/Create Employer tab of start-up window) now shows cloud icons for employers that are linked to the signed-in BrightPay account.

- Ability to download and import a 2019/20 Connect backup into BrightPay 2020/21 (only applies for employers which have not yet been linked and synchronised for 2020/21).

- When an employer is opened in BrightPay 2020/21 that is not linked to Connect, but it is known that the 2019/20 version of that file was linked to Connect, BrightPay will now automatically prompt you to link the 2020/21 file to Connect.

Other 2020/21 Updates in BrightPay

- Annual leave entitlement calculations now include 'upcoming booked annual leave days', which can optionally be included on reports and payslips.

- When zero-ising payslips (or subcontractor payments), new options to set amount to zero, or remove items altogether.

- Ability to create an SSP1 document in BrightPay.

- When importing payments from CSV, any lines which failed to import (e.g. due to not matching an employee pay record, or due to the matching pay record being already finalised) are now clearly indicated in the response dialog (instead of the previously unhelpful 'X of Y succeeded' message).

- Public holidays on employee calendar are now shown with a dotted text underline (rather than appearing as if they were non-working days by default).

- In analysis, if the column ordering settings of a report is manually changed from the 'default' settings (which are derived from employee UI display preferences), and then that report is saved, the custom ordering is now maintained, and this report will no longer receive 'default' column ordering settings when it is re-opened.

- Ability to import saved reports from another BrightPay data file into the currently open file.

- Allows one of the added emergency contacts for an employee to be set as the 'primary' contact. New analysis columns (and a new report) for emergency contact details have been added.

- New 'notes' input for parenting leave and attachment orders.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

Includes all updates made to BrightPay during the 2019/20 tax year

While we have traditionally focused our announcements of new features and updates in each new tax year version of BrightPay, it doesn't mean we're not busy during the rest of the year. In 2019/20, we released many updates and enhancements throughout the tax year, all of which are of course included in BrightPay 2020/21. See our release notes for full details. Here's a quick reminder of some of the main areas of improvement:

- Supports the latest UK and London Living Wage rates, announced in November 2019.

- New flexibility and control over when an employee's P60 and P11D are to be made available in Self Service in Connect.

- Ability to batch print, email and export P45 for multiple employees.

- Ability to print, export or email currently open payslips (i.e. those which have not yet been finalised). Such payslips are decorated with a 'DRAFT' watermark.

- Bureau features

- New 'Bureau Statistics Report' which shows various totals for each employer for informational or billing purposes. Accessed via the BrightPay startup window employer menu, it can be viewed/printed or exported to CSV.

- Ability to batch check for coding notices for multiple employers.

- Ability to sort employers by label colour on the BrightPay startup window.

- Improved interface and workflow for viewing/entering the 'average weekly earnings' for statutory parenting pay, including new warnings where BrightPay detects that there are more or fewer historic payment records than expected.

- Several new payroll period summary column options for amounts "in previous period" (allowing you to compare current and previous period amounts on the period summary view). Also new column options for tax code, NI number, department, payment method and directorship.

- Improves rounding of calculated weighted departmental amounts (which prevents penny differences both in analysis and when posting a departmental journal).

- Ability to ignore BrightPay's "Auto enrolment scheme contributions are below minimum level" warning for any given membership (e.g. where employee has opted down).

- Coding notices – where an employee is unable to be matched, the NINO or works number that HMRC have on file is now clearly shown to help determine why.

- 'Contracted hours per week' and 'Is payment to a non-individual' fields are now available as column options in Analysis.

- When using the ’Select By’ button in lists of employees, the ’Name Initial’ and ’Surname Initial’ options now show grouped selection choices (e.g. A–F, G–L, etc., depending on total number of selectable employees).

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Mar 2020

18

Customer Update: March 2020

Welcome to BrightPay's March update. Our most important news this month include:

-

Covid-19 - Are you Ready?

-

The Challenge of the Coronavirus & Remote Working with BrightPay

-

Statutory Sick Pay (SSP) & Covid 19

BrightPay 2020/21 is now available to pre-order

BrightPay 2020/21 is scheduled for release the week ending 27th March. We will send you another email once it is released and ready to download. This further email will also be accompanied by a full list of the new 2020/21 features and legislative updates.

The Challenge of the Coronavirus & How BrightPay can Facilitate Remote Working

Businesses are understandably concerned about the steps they should be taking to manage the risk of COVID-19. We would like to provide reassurance to our customers that BrightPay is well prepared. Many businesses are now putting precautionary measures in place to combat the spread of the virus and to protect their employees. BrightPay can facilitate the option to work from home, which is one of the primary ways businesses are changing the way they operate.

How BrightPay Connect pricing is calculated

BrightPay Connect customers will be billed on a usage subscription model based on the number of employees in the billing month. This monthly subscription pricing model means that you only pay for what you use. For the vast majority of customers, this new billing model will result in a reduced annual cost.

BrightPay Connect is priced based on the number of active employees in a particular month. This means that you won't be charged for employees who left before the start of the month, or who are on the payroll but not due to start until after the month-end. The cost per month is scalable, depending on the number of active employees. The cost per employee reduces as you add more employees.

How to Handle SSP & Covid 19

HMRC have advised that if you need to take time off work to self-isolate due to Covid 19, the first 3 waiting days that normally apply for SSP will be disregarded and you will be entitled to receive SSP from the first day.

As this is a unique case and BrightPay is programmed to take into account the usual 3 waiting days, an override should be performed in BrightPay by simply marking the previous 3 days on the employee's calendar as sick leave. The SSP to be applied will then be from their first actual day of self-isolation/sick leave. The government will work with stakeholders over the coming months to set up a repayment mechanism as soon as possible.

Mar 2020

16

New Redundancy Changes from 6th April 2020

The new legislation of The Employment Rights (Increase of Limits) Order 2020 was laid to Parliament on 3rd March 2020 and the changes will come into force on 6th April 2020.

In this legislation the maximum amount weekly pay for redundancy payment calculations will increase by £13 from £525 to £538 from 6th April. This law applies to England, Scotland and Wales.

Currently, where an ex gratia payment is made on termination of employment (on top of notice pay), the first £30,000 can be paid free of income tax and any amount above this is taxable. However, the entire payment is currently exempt from national insurance contributions. From 6 April 2020, the first £30,000 of any ex gratia termination payment (including any redundancy payment) will still be free of income tax and national insurance but any amount above this will be subject to Class 1A employer national insurance contributions.

Employees that are employed by their employer for two years or more are normally entitled to statutory redundancy payments. The age of the person can determine the monetary amount they received based on the following:

- An employee under 22 years of age receives 50% of a week’s pay for each full year of employment

- An employee aged under 41 and above 21 will receive 1 week’s pay for each full year of employment

- An employee that is 41 and older will receive 1.5 week’s pay for each full year of employment

In England, Scotland and Wales the maximum an employee can be awarded for statutory redundancy is £15,750 and £16,410 in Northern Ireland. Statutory redundancy payments are capped at 20 years length of services.

In England, Scotland and Wales the maximum an employee can be awarded for compensation for unfair dismissal has increased by £2,075 to £88,519 from 6th April onwards.

An increase of £1 for the employment protection daily rate amount will apply to England, Scotland and Wales from the start of 2020-21. The new daily rate is £30.

At present there are no details of changes to the statutory maximum weekly amount or the employment protection daily rate amount for Northern Ireland. The maximum rate operating in 2019-20 was £547 per week and £29 respectively.

Mar 2020

13

Budget 2020 – An Employer Focus

Chancellor of the Exchequer Rishi Sunak presented Budget 2020 to Parliament on 11th March 2020. The main points to be noted by employers are:

- The personal tax allowance will remain the same at £12,500 for the new tax year 2020-21.

- There are no changes to the PAYE tax thresholds from 6th April 2020.

- The National Insurance threshold will increase by £868, from £8,632 to £9,500 for 2020-21.

- The Employment Allowance has increased to £4,000 from £3,000 for eligible employers.

- From April 2020 the government will restrict the Employment Allowance to employers with an employer National Insurance contributions (NICs) bill below £100,000 in the previous tax year.

- Employees aged 25 and over will receive the National Living Wage of £8.72 an hour and it was announced that it is planned that the National Living Wage (NLW) will increase by two thirds by 2024 that will equate to £10.50 per hour.

- In relation to the Coronavirus, as previously announced by the Prime Minister Statutory Sick Pay (SSP) will be paid from the first day of sick leave rather than day four and the government will refund Statutory Sick Pay for 14 days to employers with less than 250 employees.

- A temporary Coronavirus Business Interruption Loan Scheme will be available for businesses from the government to help pay employees’ wages and business costs.

Mar 2020

10

Covid-19 - are you ready?

In light of the recent Coronavirus outbreak, many employers are starting to prepare for the possibility of employees needing to work from home.

Have you Internet?

Whether you are a single employer or a bureau, you will need an internet connection for transmitting files to HMRC.

Are you using a computer other than your work computer?

Where you are using a different computer, BrightPay will need to be installed on that computer. This is a quick download from our website. Then, simply enter the activation key that was included on your invoice. If you can’t find this key, we can resend it to you.

Okay, you have an internet connection and a computer with BrightPay installed on it, what about the payroll file(s)?

Are you a single employer?

- Using your work computer - you already have the file and need read no further.

- Using Dropbox or Google Drive as your file save location - the files will automatically be available to you on any other machine which is also signed in to the shared drive.

- Using Connect - you can simply restore your payroll data into your BrightPay software by signing into your Connect account at home through the software.

Alternatively, before leaving the office, simply copy the payroll file to a USB key or email it to yourself.

There are some useful help links at the bottom of this article to help with any of these options.

Are you a payroll bureau?

- Using Connect – An Administrator can set relevant payroll staff members up as a user and give them access to the companies that they need to work on. Users can then simply restore the required payroll data into their BrightPay software from their Connect account and also synchronise completed payroll back up to Connect. Users will be able to log in to their Connect account at home through the software and restore in the latest cloud backup. Care however must be taken that synchronisation is up to date and that other users are not working on the same data file at the same time. When restoring in from a cloud backup, you will see the time and date of the most recent backup that was done. Setting up a user in Connect and Restoring from Connect are covered in the help articles below.

- Using remote desktop – log in to your remote desktop as normal. No further action is required.

- Using a shared drive (e.g. Dropbox) – Once your PC is logged in to the shared drive and BrightPay’s file save location was set as this drive, then all payroll files should be available within your home environment. You may need to browse to the shared file location when opening an employer.

Alternatively, before leaving the office, staff members may wish to save their payroll file(s) to an external drive, then follow the help below on Transferring BrightPay from one PC to another.

Help articles

Mar 2020

10

Don’t let Covid-19 stop you from running payroll

As of 10 March, the number of confirmed cases of coronavirus increased to 373 in the UK, with cases across Europe also surging. With the number of cases bound to escalate, it has been predicted that if the coronavirus outbreak worsens, up to a fifth of UK workers could be off sick.

With panic over coronavirus soaring, many workers are being asked to stay away from the office and do day-to-day tasks from the comfort of their home. Not going into the office is an effective way of preventing the spread of coronavirus, because it minimises the risk of you coming into contact with someone carrying the disease.

Flexible working is becoming a growing trend

The reality is, working from home is already very popular, potential pandemic or not. Flexible working is a trend that has emerged in the last decade as more people seek that ideal work-life balance instead of work-life burnout.

Nearly a quarter of Britain’s workforce now work flexibly, that is, they work part of the week in an office and part at home, highlighting how quickly this trend is growing. Flexible working brings many work-life balance benefits as employees have more time to see their family, exercise and dedicate time to themselves. Seven in 10 of those who work flexibly say they are less stressed as a result of their working arrangement.

As well as the health benefits, it often results in happier employees. They then potentially work harder and are more productive. For employers, flexible working also helps to attract and retain talented employees. Additionally, it can result in increased loyalty and reduced office space cost.

Businesses need to carefully consider which processes and tools will make flexible work as productive and positive as possible for their employees. You need to make sure that they have essentials such as laptops, a reliable internet connection and being able to connect to systems remotely. This would have been difficult a few years ago, but thanks to the cloud, you can have everything you need at all times.

Flexible working with BrightPay Payroll

Although the payroll itself cannot be processed online with BrightPay Connect, the payroll software is still very flexible. Each BrightPay licence can be installed on up to 10 PCs where users have the option to process the payroll from 10 separate locations meaning you don’t need cloud payroll to operate and process your payroll. In addition, you can log into your BrightPay Connect account to view your payroll information at any time. You no longer need to be seated at your desk in the office to access the system - all the data you need to do your job is available on any of the 10 PC’s that the BrightPay application is installed on.

If you are not using the BrightPay Connect add-on, you can still access the payroll data file through a cloud environment to process the payroll. Again, the software itself can be installed to the local C drive of up to 10 PCs, be it a home computer or a laptop. The payroll files can be stored on a secure server or cloud environment, such as Dropbox or Google Drive, where the payroll information can be accessed from multiple computers.

With BrightPay Connect’s automatic cloud backup, payroll information is stored online and can be accessed by employers anywhere, anytime. Employers can also use BrightPay Connect to remotely manage employee’s leave, upload employee documents and send communications to employees that are working remotely.

Will coronavirus lead to long-term changes?

Will 2020 be the year in which office employees working more from home becomes the norm? Although many employers have implemented a mandatory ‘work from home’ policy as a precaution against coronavirus, it could also be the turning point for many businesses to recognise just how beneficial flexible working can be.

Book a demo today to discover how you can process payroll remotely with BrightPay.