May 2019

31

New User Management Interface for Connect

Our new User Management feature for BrightPay Connect makes it more seamless and quicker for users to be set up or amended. It offers the option to select permissions for multiple employers at one time for a standard user. There is also a new permission to allow standard users to connect and synchronise employers from BrightPay to Connect and a new feature to mark an employer as confidential.

Types of Users for Connect

- An administrator has full control over a BrightPay Connect account, with the ability to edit account settings, add other users, redeem purchase codes, connect employers and manage all employer and employee information and processes.

- A standard user typically has access to just one employer in your BrightPay Connect account, although they can be granted access to multiple employers if required. A standard user can view employer (and associated employees) information with various levels of restrictions and permissions.

User Permissions & Confidential Employers

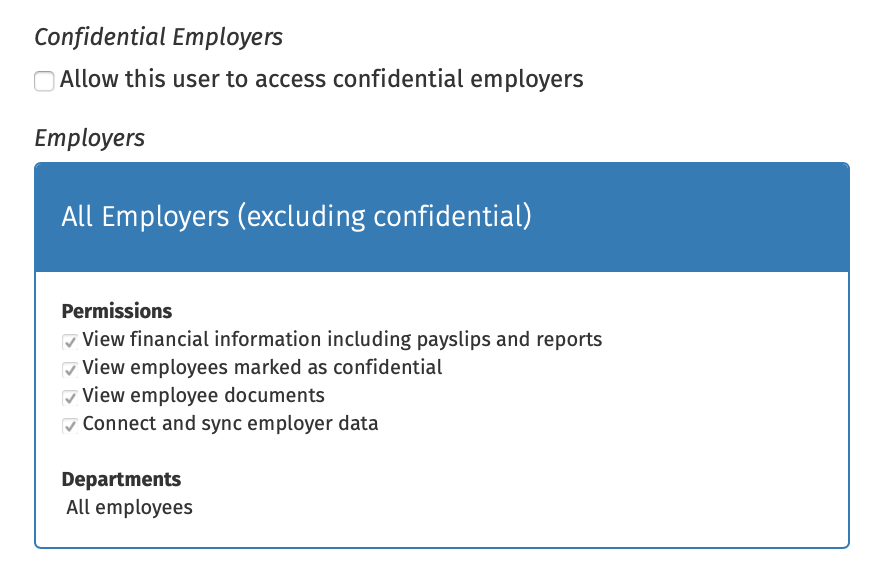

As before, standard users can be set up so that they are restricted by department, so that they can only see information pertaining to employees that are associated with a particular department. They can also be restricted from accessing certain information, such as the ability to:

- View financial information including payslips and reports

- View employees marked as confidential

- View employee documents

- NEW: Connect and synchronise employer data

- Approve employee self-service requests

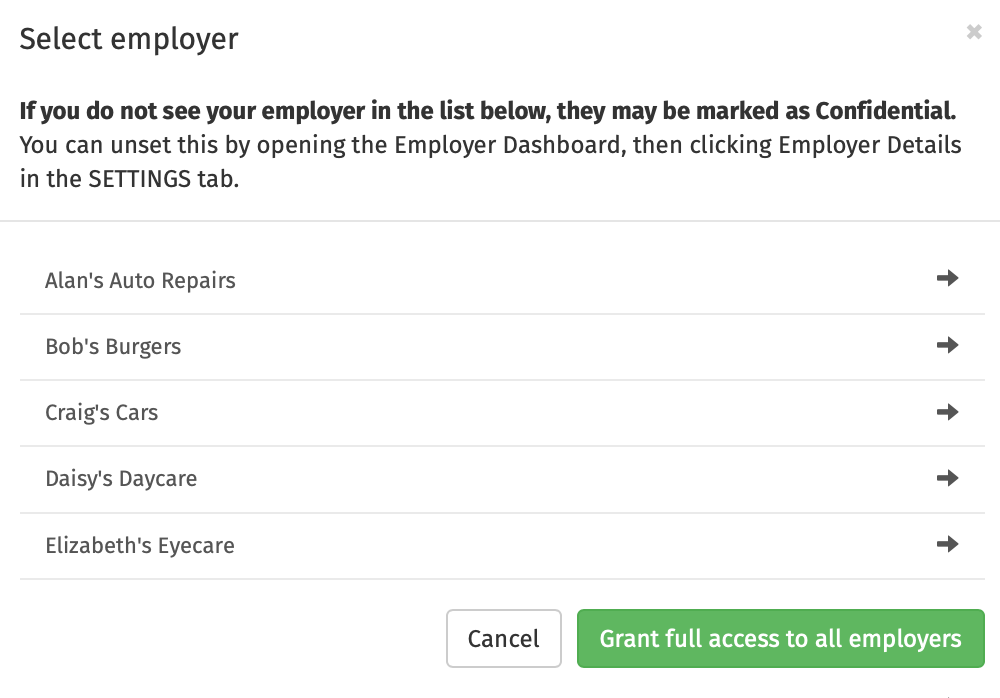

You now also have the option to grant a standard user access to all current employers, along with any new employers linked to the Connect account. Simply select ‘Grant Full Access to all Employers’ and select the permissions you wish to be applied to the user, including the new permission to Connect and Sync employer data.

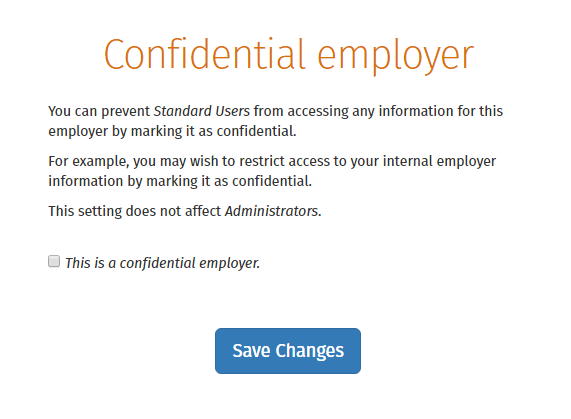

If required, an employer in Connect can be marked as confidential under the settings tab on the employer’s dashboard and only administrators on the Connect account will be able to view this employer. Standard users can only access confidential employers if they are given permission to do so.

Inviting your client as a user

If the employer details are entered in the ‘Client Details’ tab in the employer section in BrightPay, the employer can be added as a standard user by the bureau very quickly and easily. On the employer’s dashboard in Connect, you will see the option to ‘Invite your Client’. Selecting this populates the client’s information for a new standard user and you can then choose the permissions for the client.

May 2019

28

Digital trends that every employer should know

It’s predicted that by 2020, the global workforce would be dominated by millennials (35%) and generation X (35%). That means by next year, over 70% of the global workforce will be under the age of 40. A younger workforce presents knock-on effects for the entire business. As an employer, you need to adapt to meet the expectations of this new generation of employees; they’re very different from the workforce that preceded them. Having grown up using the internet as second nature, these young employees are true digital natives and have never known a world without it.

Take, for instance, payroll. With payment technologies evolving, millennials have become some of the fastest adopters of mobile and digital payments. Their influence on mobile payroll adoption cannot be ignored. The simple fact is these new generation employees don’t do paper forms. They are increasingly looking for digital options to access payslips and apply for annual leave.

In recent years, employees are using holiday time differently than previous generations, with the average leave duration reduced to just 2.34 days. This alone creates new challenges for payroll and HR managers. Shorter, more frequent bursts of annual leave tend to be requested last minute rather than planned in advance. It is important for employers and HR personnel to be able to quickly review and approve leave requests.

Mobile payroll solutions, such as BrightPay Connect, are an ideal way to improve the efficiency of your business, especially as new generation workers continue to integrate smartphones into every aspect of business operations.

BrightPay Connect benefits include:

- Request annual leave - An employee opens up their phone or tablet, logs in to the employee self-service app and applies for leave online. The HR manager or employer will be alerted of the leave request and can approve the leave instantly, with the leave automatically flowing back to the payroll software. On the self-service portal, both the employee and the employer can view their number of leave days taken and remaining, along with an employee leave calendar displaying all past and future leave.

- View payslips and payroll documents - The employee can login to their self-service account to view and download all current and historic payslips and payroll documents such as P60s. For the payroll processor, there is no more printing or emailing payslips. Payslips are automatically added to the employee’s online portal each pay period eliminating employee requests for copies of past payslips.

- Access everything in one central location - Keep everything in one central place. For employees, there is just one login to view employee documents and a company noticeboard. Employers can upload documents such as employment contracts, staff handbooks, privacy policies, training manuals. The employer can decide whether the employee should have access to view the document or not, using it as a central location for everything to do with each individual employee.

As an employer, adopting these few features favoured by younger workers, along with the additional employer benefits (such as an automatic cloud backup of payroll data and instant access to payroll reports), you are guaranteed to improve the efficiency of your business and payroll processing.

Book a demo today to find out how you can benefit from BrightPay Connect.

May 2019

24

Happy Birthday GDPR!

Guys, if you’re anything like me then you’ve been counting down the days, been kept awake with excitement thinking of what to wear and how hard you’ll party for what seems like forever. Yes, that’s right folks, on May 25th of this year our beloved GDPR turns 1 year old! *dries eyes* - they grow up so fast.

We all know that GDPR has been a resounding success but we also know that, like all 1 year olds, there's been some teething problems. So let’s take a look back through our photo album of the past year and see how our little trooper has fared over its first year.

Let’s start with the reason GDPR is in our lives - data breaches. How’s it been doing with those? Well, this is probably the most successful part of GDPR’s short life. Prior to GDPR, there was no single breach notification regulation for the EU. Instead, it was compiled of lots of different interpretations of the 1995 Data Protection Directive (which GDPR replaced) meaning it was a kind of Wild West of data and sensitive information. Then GDPR came sauntering in to bring law and order to a lawless wasteland and created a unified framework for all breach notifications.

A data breach is when personal data for which a company is responsible is accidentally or unlawfully disclosed. If this happens, under GDPR, companies are obliged to report the data breach to their national DPA within 72 hours. The number of these reported in the last year is a whopping 41,502. Crikey! Looks like GDPR is really whipping people into shape!

To add to that, there has been an eye-watering 95,180 complaints made since the introduction of GDPR - a complaint being from those who believe that their rights under GDPR had been violated. The most common types of complaints (no surprises) were concerning telemarketing and promotional emails.

So what’s been happening as a result of these complaints and breaches then? Well, this is where our golden child’s report card slips from an “A+” to a “B - could be better, gets distracted easily” because although the number of breaches reported has been incredible, the total penalties imposed under the statute added up to €55,955,871. Which sounds really impressive until you remember that a single €50 million fine levied against Google in January accounts for nearly 90% of that sum. The vast majority of companies are still not being penalised at all for data breaches or are being fined so insignificantly that frankly, my dear, they don't give a damn.

So as we dry our eyes and close the photo album of the first year of GDPR’s existence, we can let out a big sigh and know that GDPR is the little regulation that is doing its best and making us all proud as punch. Now let’s all join together in singing a big ol’ Happy Birthday - and don’t worry, I received consent from all present, purchased the rights to the song and accepted cookies on all our behalves so no chance of the feds swooping in mid-song.