Jul 2020

27

Connect – Calendar Updates

The calendar functionality in BrightPay Connect has been updated and improved, making it more user friendly and graphically appealing for both employers and employees. Improvements such as calendar and leave view, custom leave types and requesting leave are part of the new enhancements.

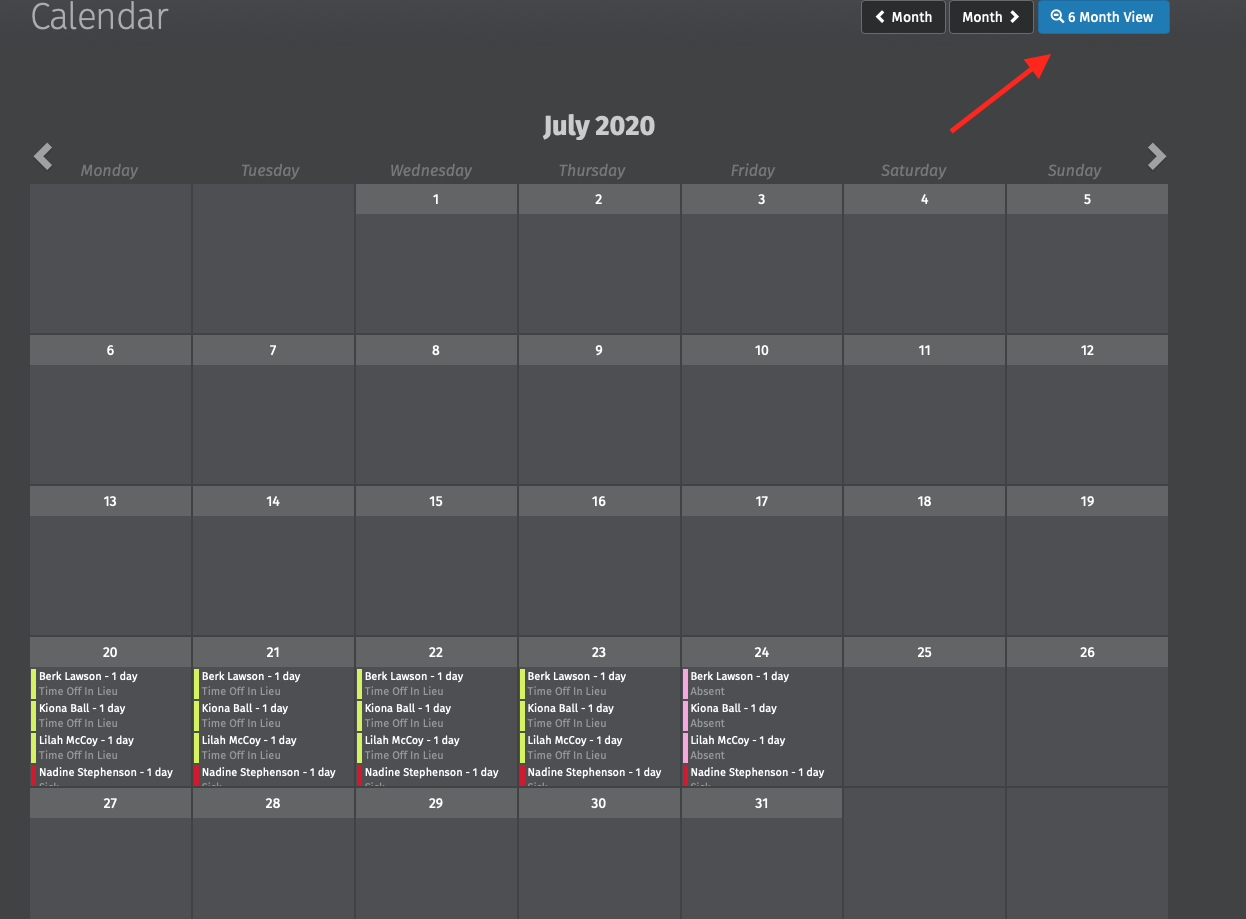

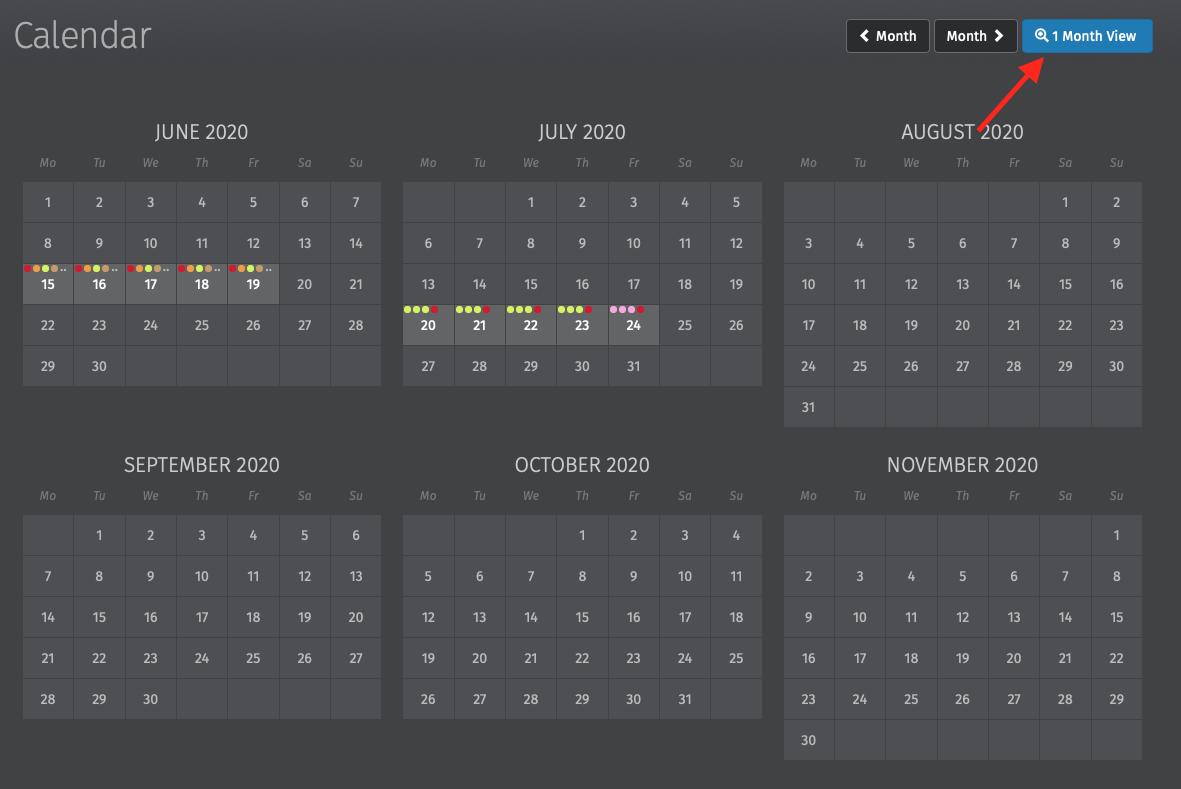

Calendar Display

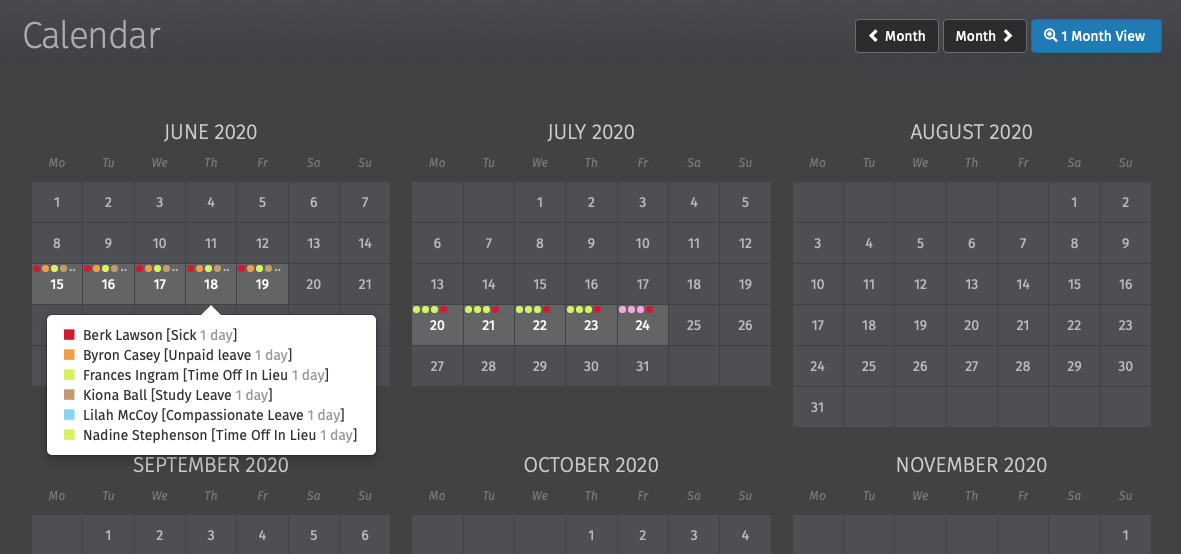

The number of months displayed on the calendar for both employers and employees can be selected, the options available are 3 months, 6 months, 9 months and 12 months. This can be selected under the Settings tab in the Employer portal, further details can be found here.

On the Employer or Employee Calendar in Connect the calendar can be displayed for one month or multiple months. One month view can be seen by selecting the '1 Month View' option. The view can be returned to the default number of months view by selecting ‘3 / 6 / 9 / 12 Month View’. On the ‘1 Month View’ there are new widgets for scrolling up and down through the number of leave entries on a particular date.

Dates with multiple types of events are dotted with the relevant colours. To see the breakdown, simply hover your mouse over the date. By selecting a date on the calendar a dialog box will open to show all the entries on that date without having to scroll.

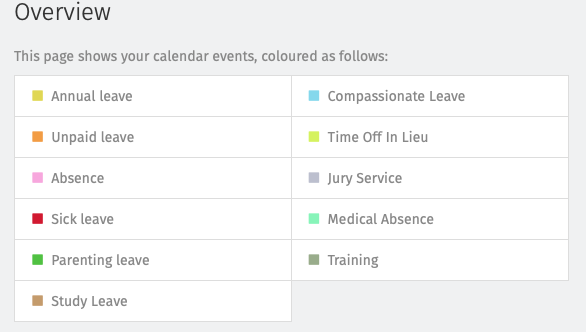

Custom Leave Types

Custom leave types are now available in BrightPay Connect. In BrightPay 2020/21 you can define nine additional custom leave types for employees. Six of the custom leave types are set up with default descriptions such as time in lieu and study leave. Instructions on how to add, edit or remove these custom leave types can be found here.

When a custom leave type is entered on the employee’s calendar in BrightPay and synchronised to Connect the leave type will be displayed on the calendar for both the employer and the employee to view on their online portal or mobile app. Custom leave can only be entered on an employee’s calendar by a user in Connect or on the employee’s calendar in the BrightPay employer file. Employees cannot request any custom leave types.

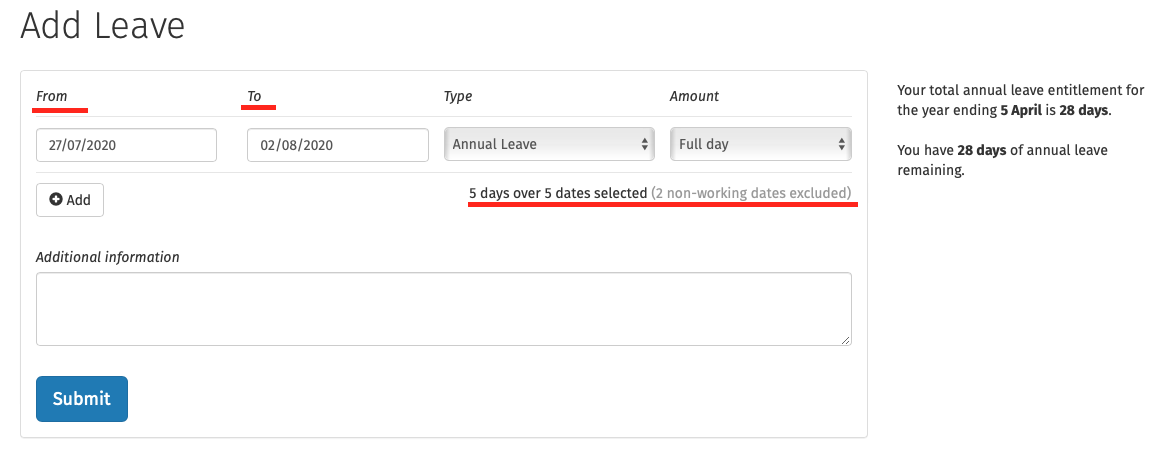

Adding/Requesting Leave

When employers are adding leave on an employee’s calendar in Connect or an employee is requesting leave, they are now entered as date ranges simplifying leave dates being selected. If the employer or an employee enter in an invalid date range (e.g. including non-working days in the date range) it will automatically correct this and only working days will be included in the request.

Interested in finding out more about how BrightPay Connect can streamline your leave management processes? Book an online demo of BrightPay Connect today.

Jul 2020

24

Coronavirus Job Retention Scheme (CJRS) Updates

Employers need to submit claims on HMRC’s CJRS online portal for any furlough payments under the CJRS that relate to periods ending on or before 30th June by 31st July 2020. You will no longer be able to submit a claim for the period up to 30th June after 31st July.

The CJRS was originally introduced by the government from 1st March in response to the coronavirus pandemic in order to give financial support to businesses and employees. Under this scheme all employers, regardless of size or business sector, could claim from HMRC a payment for 80% of the wage costs for employees that were furloughed up to a maximum of £2,500 per month per employee.

From 1st July 2020 employees that were previously furloughed can be brought back to work on a part time basis by their employers once an agreement is reached between the employer and the employee. Employers will still be able to claim under the CJRS for hours that are not worked by the employee. The new grant claim will be based on hours not worked by the employee and the normal hours an employee would usually work.

HMRC has also updated their guidance to confirm employers can claim amounts paid to an employee who is serving their statutory or contractual notice period up to the claim limit of 80% of their pay up to a maximum of £2,500 per month. However, grants cannot be used to substitute redundancy payments.

HMRC plan on introducing a method through the tax system to recover grant amounts overclaimed by employers under the CJRS. Repaying overclaimed grant amounts back will reduce or prevent any potential tax liability under that legislation. Tax liabilities may be due on any overclaim amounts. Further details will follow.

Interested in finding out more? Join BrightPay for a free webinar where we explore the key changes in relation to flexible furlough, phasing out of the Coronavirus Job Retention Scheme and changes to making a claim. Places are limited - click here to book your place now.

Jul 2020

21

The End of Earlier Year Updates

From the end of this tax year, an Earlier Year Update (EYU) will no longer be accepted by HMRC as a valid RTI submission to report changes to employees’ pay details for tax year ending 5th April 2021. HMRC had originally planned to abolish the Earlier Year Update for tax year 2019-20 and onwards.

An Additional Full Payment Submission must be submitted instead to report the correct year to date figures for an employee to HMRC.

For tax years up to and including 2017-18, any amendments must be reported to HMRC via an EYU submission only. For 2018-19 and 2019-20, a correction submission can be made using either an Earlier Year Update or an Additional Full Payment Submission to report changes to HMRC.

For tax years 2018-19 and 2019-20, in order to avoid any issues with employers trying to use both options, BrightPay decided to only cater for amendments using the Additional Full Payment Submission option. An Additional Full Payment Submission will report the correct year to date details for employees to HMRC, rather than amendments that the Earlier Year Update would report.

To make corrections in BrightPay, you need to re-open the payslips for the employee in BrightPay, make the necessary changes and finalise the payslips to the last pay period again.

To subsequently create an Additional Full Payment Submission for submission to HMRC, follow our simple instructions here.

Jul 2020

14

Make Payroll Entry And Approval Simple With BrightPay Connect

We speak to payroll bureaus all of the time, always keen to hear what their biggest challenges are and how we can help make their job easier, and one of the most common issues we hear is that requesting payroll information from clients can be an inefficient, time-consuming and often, frustrating process. And we understand why.

For any payroll bureau, getting payroll approved by clients can be a tiresome process. Despite meticulous attention to detail, finding mistakes in the payroll is common. Even the most detail-oriented clients are prone to forgetting to let you know that James had to take a week off with the flu, or that Michelle’s maternity leave started early. As a result, it isn’t until you hand over the so-called finalised payroll to the client that these changes are brought to your attention and you’ve got to go back and make the (often, many) appropriate changes. Sound familiar?

The good news is that BrightPay Connect makes this process so much simpler and reduces the chances of such omitted information (and the time it takes to get that final payroll approval) significantly. As such, it has become a must-have tool for bureaus big and small who want to streamline their payroll entry and approval process and increase efficiency with their clients.

What Is BrightPay Connect?

Not to be confused with the payroll software, BrightPay Connect is an add-on feature which is purchased separately and works alongside BrightPay payroll software. As such, it offers a range of features not made available through the payroll software alone. These include an employee app, an employer dashboard, a secure online portal and much more. While BrightPay’s payroll software looks after the day to day tasks involved in payroll management, BrightPay Connect offers extra benefits, not least of which is it’s payroll entry and approval feature.

How BrightPay Connect Can Help With Payroll Entry And Approval

Getting payroll information from clients has never been as easy thanks to Connect. From your bureau dashboard you can send a payroll entry request to one client at a time, or in batch form to dozens/hundreds of clients in the same amount of clicks. You simply select the clients from a drop-down menu and send your requests, instantly.

A real-time dashboard also lets you see what requests you’ve sent out and breaks them down into requests that have been responded to by the client, and requests for which you’re still waiting for a response.

On the client’s end, they will receive a notification on their online employer dashboard that lets them know they need to enter or upload their employee’s pay information for the pay period. The client can add new employees here too, and there’s a user-friendly comment section where they can leave any notes that they’d like to share with you, cutting out the need for endless back and forth emails.

Once you’ve received the payroll entry from your clients, complete with their employee’s pay information, the bureau can review the information that has been entered by the client and apply this information in BrightPay Payroll Software at the click of a button. All communications between the payroll bureau and the client are automatically tracked in the online audit trail on BrightPay Connect.

From this point you can finalise the payslips or if you wish to get the payroll signed off by the client, you can send them a payroll approval request. This allows you to securely send a payroll summary to the client for them to review before you send the payslips to the employees.

Similar to the payroll entry request, the client will receive their payroll approval request on their online client dashboard instantly and can choose to either approve or reject the payroll. Either way, your dashboard will update automatically to let you know and the audit trail keeps a complete time-stamped record of all requests, protecting both your bureau and your client.

Want to learn more about BrightPay Connect and how it’s sophisticated payroll entry and approval functionality can transform your payroll processes? Book a free online demo here for a detailed walkthrough of everything the portal can offer you and your clients.

Jul 2020

13

How To Process COVID-19 Related SSP in BrightPay 20/21

HMRC have advised that if an employee needs to take time off sick or to self-isolate due to COVID-19, the first 3 waiting days that normally apply for SSP will be disregarded and the employee will be entitled to receive SSP from the first day.

We have programmed BrightPay 20/21 so that there is a new option for ‘COVID-19 Related Sick Leave’ and, by choosing this option, the software will automatically apply any SSP due to the employee from day one. Whereas, if you were to choose the normal SSP, the software will take into account the usual 3 waiting days.

With the Coronavirus Statutory Sick Pay Rebate Scheme, the employer can claim for up to 2 weeks sick leave for an employee that cannot work due to COVID-19, and also those who are self-isolating or shielding, subject to eligibility criteria.

An SSP Claim Report is available in BrightPay to assist users in ascertaining the amounts needed for input into HMRC's Coronavirus SSP Rebate Scheme online service.

A Step By Step Guide To Processing In BrightPay

Processing COVID-19 related Statutory Sick Pay is easy in BrightPay. Here’s a detailed step-by-step guide to help you do it.

Processing COVID-19 Related Sick Leave in BrightPay

- First, you need to select the employee’s name on the left. Under ‘Statutory Pay’, click ‘Calendar’, and on the calendar, select the date range that the employee is out on sick leave.

- Click ‘Sick Leave’ from the options on the right of the screen and choose 'COVID-19 Related Sick Leave'. The number of ‘Qualifying Days’ & ‘SSP Days’ will be displayed on the screen, bypassing the usual 3 waiting days.

- When you close out of the calendar, BrightPay will automatically apply any SSP due to the employee.

It is important to note that if existing payment records have not been recorded in BrightPay or if there is insufficient historical payroll data to determine the employee's average weekly earnings, the automatic calculation may be inaccurate or not possible. In this instance, you can manually override the employee’s average weekly earnings.

BrightPay’s Coronavirus SSP Rebate Scheme Claim Report

As mentioned, BrightPay also has a claim report to assist users in determining the amounts that you can reclaim through the Coronavirus SSP Rebate Scheme. This report can be found within the ‘Employees’ tab in BrightPay.

- First enter the start and end date of the claim period you are claiming for.

- On the next screen, select the employees you wish to include in your claim.

- If your chosen claim period covers some of the 19/20 tax year, enter COVID-19 related SSP amounts that you wish to claim for the previous tax year.

- On the final screen, a summary of your claim will be displayed. Enter any of the additional information that HMRC require when making a claim. If you wish, you can view the full report, and this can be printed, exported or emailed for your records.

Each claim report generated in the software is stand-alone and no data is saved each time a claim report is run. Therefore, it is your responsibility to ensure that you have exported the report, so that you don’t lose the information.

SSP & Furloughed Employees

Furloughed employees retain their statutory rights, including their right to Statutory Sick Pay, and so furloughed employees who become ill must be paid at least the rate of SSP, subject to them meeting the eligibility criteria. You can claim back from both the Coronavirus Job Retention Scheme and the SSP rebate scheme for the same employee but not for the same period of time.

If an employee becomes sick while furloughed, it is up to the employers to decide whether to move these employees onto Statutory Sick Pay or to keep them on furlough, at their furloughed rate. If the employee is moved onto SSP, employers can no longer claim for the furloughed salary. Whereas, if the employee is kept on the furloughed rate, they remain eligible for the employer to claim for these costs through the furlough scheme.

Free COVID-19 Webinars For Employers

Want to keep up-to-date with the latest updates regarding COVID-19 and businesses? We’re holding regular webinars to share with you all news relating to HMRC updates, what employers need to know and how you can make sure you’re complying with best practices at all times.

Click here to watch our previous webinars on-demand, where we cover everything from important COVID-19 payroll updates to return to work government policies and more.

To receive email notifications letting you know when we’re holding our next webinar, sign-up to our mailing list and ensure you don’t miss out on the latest updates for your business.

Jul 2020

9

Chancellor announces furlough bonus scheme and more in Summer Statement

“Stand by workers and we’ll stand by you”

Whilst working from home, my daily TV schedule consists of tons of Judge Judy, border patrol programmes and Can’t Pay Take It Away (great show). But yesterday, like many others, I was glued to the live stream from the House of Commons as Chancellor Rishi Sunak unveiled a plethora of announcements that are aimed at stimulating the festering sore that is the UK economy after a global pandemic and nationwide lockdown.

And let me tell you, it’s a lot. Rishi has clearly been listening and a lot of his rhetoric and policy announced in the Summer Statement addressed those whose jobs and futures have been affected the most, in particular young people (16-24) and the hospitality sector. Unemployment rates and redundancies are on the rise with the tapering off of the Coronavirus Job Retention Scheme and these measures are to try and help employees stay in work and help employers to enable them to do so, with the Chancellor stating: “stand by workers and we’ll stand by you”.

So what’s been announced? While there was an abundance of big news, such as the temporary writing off of stamp duty under £500,000 and a £2bn “green homes grants” to make more homes energy efficient, in this blog I will focus mainly on the points that apply to employees and employers.

- The first major announcement, following on from the Job Retention Scheme which was a lifeline for millions of people in the UK, the next phase is the Job Retention Bonus Scheme. This bonus of £1,000 will be given to an employer for each member of staff they bring back from furlough. To stop people taking the mick and chancing their arm, the employee must be employed from once they’re taken back to at least January 2021 of next year. The employee must also be earning at least £535 per month for this period.

- A kickstart scheme was then unveiled with the aim to, you guessed it, kickstart job creation for young people as under 25s are 2.5 times more likely to suffer job loss as a result of Covid-19. The government has pledged £2bn to fund hundreds of thousands of jobs for 16-25 year olds whereby they will pay the wages of new, young employees for 6 months. There is no cap on the number of young people that can be hired under this scheme.

- To boost apprenticeships, which have a 91% successful retention rate, businesses who create positions for new apprentices will be given a bonus of £2,000 for each apprentice under the age of 25 and £1,500 for those over 25. The bonus scheme is available for employees who apply between August 2020 and January 2021.

- Work coach numbers positions in Job Centres will be doubled and guidance counsellor positions will be boosted also with the aim of helping people find jobs.

- To help the hospitality sector, a temporary cut to VAT on food, accommodation and attractions has been announced that cuts VAT from 20% to 5%.

- The Chancellor also announced the introduction of “eat out to help out” vouchers that give diners 50% off their meals out from Mondays to Wednesday with a maximum discount of £10 per person for the month of August only.

So there you have it. While these measures are most welcome and certainly very creative (Rishi gets an A for effort) there are still major concerns not being addressed and it feels a little like putting a plaster on an arrow wound as the economy slowly bleeds out. We need this sort of energy not just now, but for the next couple of years as we come to terms with all of this.

So personally, I will take my butt to a half-price meal and enjoy every bite whilst I silently reserve judgement on it all and wait to see what happens.

Jul 2020

7

5 Principles To Help Protect Your Employees During COVID-19

More and more businesses are reopening at last. This is very good news for the economy as a whole, but also for business owners and their staff that depend on them. However, the shift brings with it some concern surrounding the responsibilities employers now face in regard to how they protect their employees during a public health pandemic. This unchartered territory raises a lot of questions about what employers need to be doing differently, and how they can do it effectively.

Luckily enough, the Government has produced a series of guidance documents which provide information on the appropriate steps that employers should be taking to protect employees from COVID-19.

There are currently 12 separate guidance documents, each one focused on specific industries or other categories. They are:

- Close contact services

- Construction and other outdoor work

- Factories, plants and warehouses

- Heritage locations

- Hotels and other guest accommodation

- Labs and research facilities

- Offices and contact centres

- Other people’s homes

- Restaurants, pubs, bars and takeaway services

- Shops and branches

- Vehicles

- The visitor economy

Many businesses will find that at least two of these categories are applicable to their business. For example, an employer may operate an office and a factory or warehouse. This will mean that some employers may need to work from more than one of the guides.

5 Principles of Protecting Employees

Regardless of what industry you are in, there are 5 principles that employers should be following to protect employees as they come back to work.

1. Risk Assessment

You must carry out a COVID-19 Risk Assessment. In completing your risk assessment you will be looking to identify what work activities might cause transmission of the virus, the likelihood of such a transmission, who is likely to be at risk and formulate a plan to minimise this risk. Once completed, it will be important that you share the results of your risk assessment with staff and staff representatives and make it easily available to them anytime. The BrightPay Connect employee app is perfectly suited to this.

2. Working From Home

Employers need to take all reasonable steps to continue to allow employees to work from home. As an employer, you should allow someone to work from home even if you wouldn't in normal circumstances have agreed to a request for remote working. If it is at all possible for the work to be done in an effective way, even if it's not ideal, even if there are some tasks that can't be done, employers should be doing everything they can to facilitate remote working for the foreseeable future.

3. Workplace Hygiene

Where it is not possible for employees to work from home and they are coming into the workplace, employers will need to put in place appropriate cleaning, handwashing and hygiene procedures. Suggestions put forward in the guidance include:

- Providing hand sanitizers in the workplace

- Frequently cleaning and disinfecting regularly touched surfaces

- Encourage people to follow the guidance on hand washing and hygiene

4. Social Distancing

You will also need to ensure that social distancing of 2 metres is in place wherever possible. This will require lots of signage and established one-way systems. Consider placing tape on floors to mark out 2 meter boundaries, make sure that rest areas are appropriately cordoned off so that people aren't encouraged to sit too close together, and limit the number of employees allowed in common areas, such as a staff kitchen, at a time.

5. Personal Protective Equipment

Of course there are going to be some jobs where social distancing can’t be achieved. In these situations, additional steps should be taken to manage the transmission risk via the use of personal protective equipment. These steps may include the use of gloves, face masks, perspex guards and staggering start/break times.

Internal Communications

As mentioned earlier, once you have completed your risk assessment and you have decided on the preventative measures you are taking, it will be important that you communicate these changes effectively with your employees and your employee representatives or union representatives.

- It is advisable that you put in place COVID-19 Safe Working Policy. This will clearly communicate to workers what steps you have taken to help prevent the spread of infection and it will also set out any responsibilities workers have.

- You should also consider holding a Return to The Workplace Induction in which you go through this new policy in detail and in person to ensure that everyone fully understands the changes being made.

- Sending out a Returning to The Workplace Staff Survey before your employees return will help you to identify any concerns they feel about coming back to work and potential gaps in your policy that need to be addressed.

Make Sure Your Business Is Compliant With Our Free Webinar

The BrightPay team are holding regular webinars to share with you all news relating to HMRC updates, what employers need to know and how you can make sure you’re complying with best practices at all times. Click here to watch our previous COVID-19 webinars on-demand, where we cover everything from important COVID-19 payroll updates to return to work government policies and more.

Jul 2020

3

Flexible Furlough - Employees Returning to Work Part-Time

The Coronavirus Job Retention Scheme is changing to support businesses as the economy is carefully reopened. Before July, employees that were placed on furlough could not undertake work for you. Originally, the scheme was only for employees who were not working, and while on furlough, an employee could not undertake work for or on behalf of the organisation.

From 1st July, businesses have the flexibility to bring furloughed employees back to work for any amount of time and any shift pattern, while still being able to claim under the CJRS for hours not worked. This new flexibility will help businesses with reopening and help boost the economy.

The government will continue to pay 80% of furloughed employees wages for any normal hours they do not work, up until the end of August, but the employer will have to pay employees for the hours they do work. For example, if a furloughed worker returns to work for two days per week, they would need to be paid as normal by their employer for these two days, while the government would cover the other three days.

Employers will decide the hours and shift patterns their employees will work on their return, and so employees can work as much or as little as the business needs, with no minimum time that they can furlough staff for.

Any working hours arrangement agreed between a business and their employee must cover at least one week and be confirmed to the employee in writing. You must keep a written record of the agreement for five years and keep records of how many hours your employees work and the number of hours they are furloughed (i.e. not working).

If employees are unable to return to work, or employers do not have work for them to do, they can remain fully furloughed and the employer can continue to claim the grant for their full hours under the existing rules.

From 1st July, employers will only be able to claim for employees who have previously been furloughed for at least 3 consecutive weeks any time between 1st March 2020 and 30th June 2020. An exception to this is where an employee is returning from statutory parental leave after 10th June and meets the qualifying criteria to be furloughed for the first time.

Where an employee is flexibly furloughed, employers will be required to submit data on the usual hours an employee would be expected to work in a claim period, the employee’s actual hours worked, and the number of furloughed hours for each claim period.

If you claim in advance and your employee works for more hours than you agreed, then you’ll have to pay some of the grant back to HMRC. This means that you should not claim until you have certainty about the number of hours your employees are working during the claim period.

Interested in finding out more about the new changes to the Coronavirus Job Retention Scheme? Watch our webinar on-demand where we discuss flexible furlough, the wind-down of the scheme and changes to making a CJRS claim.

Jul 2020

2

Customer Update: July 2020

Welcome to BrightPay's July update. Our most important news this month include:

-

Timeline - Furlough scheme to wind-down gradually

-

Flexible Furlough - Employees Returning to Work Part-Time

-

Chancellor to grant “draconian” powers to reclaim millions in Covid-19 support payments

-

Calculating a flexibly furloughed employee's 'usual hours'

Changes to the CJRS & Furloughing Employees

The Coronavirus Job Retention Scheme has been hugely popular and will continue to support jobs until the end of October. However, from 1st July, there will be many changes to the scheme. Here we've put together a summary of some of the key points in relation to flexible furlough, phasing out of the scheme and changes to making a claim.

Employees returning from statutory leave after 10 June 2020

From 1st July 2020, employers will only be able to claim for employees who have previously been furloughed for at least 3 consecutive weeks any time between 1st March 2020 and 30th June 2020. An exception to this is where an employee is returning from statutory parental leave after 10th June 2020 and meets the qualifying criteria to be furloughed for the first time.

CJRS calculations have changed in BrightPay from version 20.5 onwards

For many of our customers, this calculation change will not make a difference. But those who pay in lieu (e.g. a July pay date for June payroll), or those for whom an already submitted claim period ending 30 June did not actually cover all of June's earnings, will need to check and ensure that all reclaimable amounts are accounted for and submitted to HMRC prior to making July claims.

COVID-19 Webinar - Did you miss it? Watch on-demand now

During our most recent webinar, we looked at upcoming changes to the Coronavirus Job Retention Scheme. We also examined five principles that employers should be following to protect employees as they come back to work. Don't miss out - watch it back anytime.

Jul 2020

1

CJRS calculations have changed in BrightPay from version 20.5 onwards

When guidance for the Coronavirus Job Retention Scheme (CJRS) was first published in April 2020, HMRC did not provide comprehensive instructions on how to calculate the amounts for every scenario. Like other software providers, we were left to make certain assumptions with very little time for development.

One such scenario for which no official guidance was initially provided by HMRC was the handling of pay reference periods that are only partly encapsulated by a CJRS claim period (e.g. the week ending 3 May in a claim for 1–31 May).

BrightPay's initial handling of this scenario was to ignore the pay reference period start and end dates, and work solely from the pay date, i.e. if a pay date was encapsulated by a claim period, then BrightPay would include the full amount in the claim, regardless of whether the pay reference period start and end dates were fully or partially within the claim period. This reasoning is consistent with other payroll calculations (e.g. that for average weekly earnings for statutory pay), and was deemed adequate by HMRC in our communications with them.

Later, HMRC published new guidance on how to handle part pay reference periods that involved apportioning the pay by the number of encapsulated days in a claim period. For example, if an employee was paid £500 for the week ending 3 May, then the new guidance stated that only £500 ÷ 7 × 3 (£214.29) should be accounted for in a claim for 1–31 May (with the other 4 days in a previous claim).

At first, there was no urgency to update BrightPay, as claim period dates were flexible anyway, and as long as claim period dates were selected that aligned with the pay reference period dates (including the pay date), everything worked out.

But from July 2020, things are changing again.

From July 2020 onwards, to support flexible furlough, HMRC require that claim dates are strictly within a single calendar month. And so to meet this new obligation, we have had no choice but to change the CJRS calculation in BrightPay 20.5 to work the updated way, splitting pay reference periods where required and apportioning them by the number of days, regardless of pay date. (BrightPay 20.5 also supports flexible furlough, as well as the updated rules and rates for August, September and October.)

For many of our customers, this calculation change will not make a difference. But those who pay in lieu (e.g. a July pay date for June payroll), or those for whom an already submitted claim period ending 30 June did not actually cover all of June's earnings, will need to check and ensure that all reclaimable amounts are accounted for and submitted to HMRC prior to making July claims. Going forward, depending on the pay schedule and CJRS claim dates, it may also be necessary to finalise pay periods further in advance of when they would normally be finalised, to ensure that amounts from the beginning of such periods are picked up in a CJRS claim.