Aug 2022

31

Our 2022 customer survey results: BrightPay in the cloud

It's that time of the year again, the BrightPay customer satisfaction survey results are in. This was our first customer survey since becoming part of Bright which, as well as being the provider of BrightPay payroll software, is a provider of accounts production, bookkeeping and practice management software.

The aim of our annual customer surveys has been to discover what we are doing right and what we can improve on. However, this year especially, one of the main objectives of our survey was to learn more about our customers' expectations, hopes and ambitions as a business, and see how we, as software providers, can best support these aspirations.

Over 1000 BrightPay users took part in this year’s survey, including accountants and payroll bureaus who process payroll for their clients, and businesses who take care of their payroll in-house.

BrightPay’s 2022 customer survey: The results

One of the first questions we ask our customers each year is “How satisfied are you with BrightPay?,” and we’re happy to announce that BrightPay have achieved a 99.1% customer satisfaction rating for 2022. This means that our customer satisfaction rate has now been 99% or higher for 9 years in a row.

Another important question for us has always been “How happy are you with our customer support?”. This year, BrightPay received an impressive customer support rating of 98.9%.

An important metric for us is our Net Promoter Score (NPS) which is used to determine how likely users are to recommend our software to a friend or colleague. BrightPay’s NPS for 2022 was 71.4, putting us well above the industry average of 40 for B2B software and SaaS.

BrightPay in the cloud

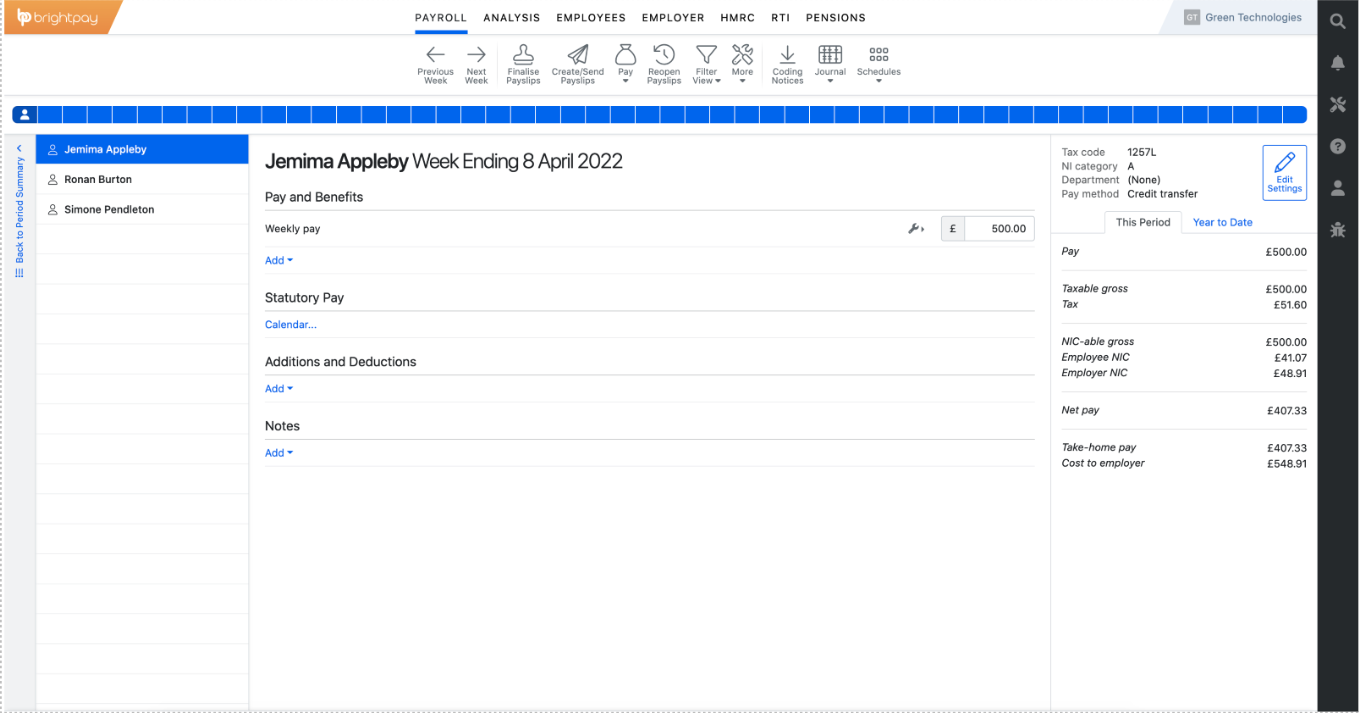

In this year's customer survey, there was a lot of focus on BrightPay’s fully cloud version*, which will become available as a Beta version later this year. We asked why you’re likely or unlikely to switch to the online version of BrightPay, and what worries or apprehensions you may have about switching to the cloud payroll software.

Reasons why users said they were interested in moving to the online version of BrightPay included:

- The ability to access the software from anywhere, at any time

- The multi-user capabilities that come with having full online access to the software

- The fact that hosting and data security is transferred to Bright

- Having the ability to scale your payroll service offering

- Having an edge over competitors

- The possibility of increasing profitability

- The ability to track user updates

- Automatic software updates

- To reduce the need for an in-house server

Reasons why users were unlikely or unsure about making the switch, were a lot less varied than those that said they were likely to switch. The majority gave the reason that they were happy with the functionality of BrightPay’s desktop version and felt no reason to move.

A number of users said that they had limited internet access or were living in areas with a slow internet connection, and so felt that an online software wasn’t an option for them. However, we are aware that a proportion of our customers may face this issue, which is why the Windows version of BrightPay will remain available.

The main theme we noticed amongst respondents who said they were unlikely to make the move were concerns of the learning curve that may be associated. Others expressed a lack of knowledge surrounding cloud technology, with comments such as “I’m not sure I understand cloud technology,” “As a small business, I’m unsure if I need it” and “I need to learn more about the cloud software’s features.” However, as you can see from the list above of why users will most likely make the switch, cloud software has many benefits, with the main ones encompassing flexibility, scalability, and security.

At BrightPay, we aim to make the migration process as automated and as seamless as possible for our users to switch from the desktop to cloud payroll solution. The online payroll software’s screen layouts and user design will be almost identical to BrightPay’s desktop version and so there will be almost no learning curve. Our aim is to ensure that the software continues to be user-friendly.

How the online version of BrightPay will look

We understand there is always apprehension when switching to a new system, but users can rest assured that the cloud software will be just as easy to use as the BrightPay you’re used to, with the added benefits.

To celebrate National Payroll week, which is from 5th - 9th September and organised by the CIPP to demonstrate the impact the payroll industry has in the UK through the collection of income tax and National Insurance, BrightPay will be holding a free online webinar. The webinar is on the evolution of payroll, from its beginnings to what we can expect in the future. Register now to confirm your place. Check out our dedicated National Payroll Week webpage for more payroll news and updates.

The development of our fully cloud version of BrightPay is progressing as expected. At the moment, we are on track for a target beta release towards the end of 2022. Fill in this form if you wish to be notified when the beta version is available to use. If you want to learn more about BrightPay and our current cloud payroll extension, BrightPay Connect, book a free online demo today.

*While you will be able to process payroll using BrightPay’s online version, features of the cloud software won’t include the same functionality as the desktop version upon initial release. However, we will be working hard to get the online software in line with the desktop version.

Aug 2022

29

Customer Update: September 2022

Welcome to BrightPay's September update. Our most important news this month include:

-

Organised labour fraud: Warning to employers from HMRC

-

Identifying payroll client pain points and how to address them

-

Weather alert: How to handle last-minute annual leave requests

National Payroll Week Special

National Payroll week is next week and we have a whole range of fun events lined up to celebrate and give payroll the recognition it deserves. From live webinars to quizzes – register now to avoid disappointment, as places are limited.

Customer Survey 2022 Results

Our customer survey results are in and we’re happy to announce that BrightPay have achieved a 99.1% customer satisfaction rating and a 98.9% customer support rating for 2022. Our Net Promoter Score was 71.4, putting us well above the industry average of 40 for B2B software and SaaS.

Security alert! Top 5 payroll security tips

There are a surprising number of bureaus that aren’t aware of the cyber-security threats we face today. Almost everything online is accessible at our fingertips, so just how safe is your clients’ data? In our latest guide, discover 5 top payroll security tips you can start offering your clients today.

6 exciting ways to boost the speed of your payroll

Tasks such as annual leave management, distributing payslips and backing up your payroll data can often be quite tedious and time-consuming. In this free guide, we’ll zoom in on 6 exciting ways cloud technology can help boost your payroll processes today.

How payroll and practice management work together

In our upcoming webinar on 22nd of September, see how your payroll and practice management software can work together to give your practice a more organised, streamlined and structured workflow. From automating your admin to speeding up your onboarding process – the opportunities are endless!

Warning from HMRC: Organised labour fraud

HMRC’s recent employer bulletin included warnings to employers on organised labour fraud. Organised labour fraud affects HMRC, businesses, employees, and the general public. Learn about the 3 types of fraud, and how to avoid it, in our latest blog post.

Save your practice over £20,000 a year

In this webinar, we will look at what’s most important to accountants and bureaus when choosing a payroll software - exactly how much value can it bring to your practice? We will also share results of our customer research to highlight how much time and money you can save by using BrightPay and BrightPay Connect.

5 ways to boost the efficiency of your payroll process

Join our most popular webinar for employers on the 7th of September, where our payroll experts will discuss 5 ways you can boost the efficiency of your payroll and HR processes by using next-generation cloud technology.

Aug 2022

18

Organised labour fraud: Warning to employers from HMRC

HMRC’s August employer bulletin was released last week and included in it were warnings to employers on organised labour fraud. Organised labour fraud is the umbrella term HMRC gives to three main types of fraud which all share similar features.

The three types of fraud are:

- Payroll company fraud

- Labour fraud in construction

- Mini-umbrella company fraud

These types of fraud are orchestrated by organised crime groups and involve a genuine supply of labour. Crime groups may grow their operations to include other types of fraud where the supply of labour is central to how the fraud operates.

Organised labour fraud affects HMRC, businesses, employees, and the general public. These frauds steal vital revenue that funds the UK’s public services, can hurt the finances and reputations of businesses, and for employees, it can affect their employment rights and may impact their ability to claim benefits in the future.

Payroll company fraud

This type of fraud takes place when a business outsources its payroll responsibilities to a fraudulent third party who claim to be a payroll provider. The fraudulent ‘payroll provider’ will process the payroll of their victims’ employees. While they will pay the employees their wages, they will fail to pay income tax, National Insurance and VAT to HMRC. This is how they get away with the scam for some time, as the employer may take a while to notice what has been happening. With this type of fraud, there is a risk that the employer could still be deemed liable for the tax, NI and VAT payments that were never received by HMRC.

Labour fraud in construction

This is another type of fraud which targets employers. HMRC defines it as “the fraudulent use of contrived labour supply chains in the construction industry.” This fraud involves the abuse of the Construction Industry Scheme to move labour-related VAT and Income Tax liabilities into “shell corporations.” Shell corporations are companies which have no business operations or significant assets. These companies are sometimes used in organised crime. The shell companies will then go default and will owe a debt to HMRC.

Mini-umbrella company fraud

The third fraud is one that can affect businesses which use temporary labour. It works by criminals creating multiple limited companies, with each one employing a small number of temporary employees. Each of these micro companies may fraudulently claim Employment Allowance and abuse the VAT Flat Rate Scheme which are government incentives aimed at helping small businesses.

Common traits of organised labour fraud

In their 2022, August bulletin, HMRC have listed a number of red flags or common traits to watch out for in fraudulent businesses, including:

- Businesses with a short life span — sometimes as little as 12 months. These businesses will then be abandoned or become insolvent, and another entity will take their place

- Hijacked VAT registration, Construction Industry Scheme registration and, or PAYE scheme numbers

- Unusually long supply chains which often make no commercial sense

- Turnover rises at an exponential rate and debt accrues quickly

- The director’s business history suggests they lack the experience to run a company of that type and size

- Directors may have a history of ‘phoenixing’ companies which is when a business is conducted through a succession of companies. Each in turn becomes insolvent and transfers the business onto the next company.

What can you do to avoid being a victim of organised labour fraud

HMRC recommends that businesses have a system in place whenever they receive a supply of labour. Every business should:

- Check the legal, financial, tax and social obligations of suppliers

- conduct robust due diligence on suppliers and act to mitigate or remove risks

- Continuously monitor and review your due diligence

HMRC also recommends that individuals register for their Personal Tax Account as regular checking ensures that the information shown there is accurate.

You should contact HMRC as soon as possible if you have information or concerns regarding a supplier.

Related articles:

Aug 2022

16

Give clients more responsibility over their payroll

You’ve finalised this month’s payroll, payslips have been sent and payments have been scheduled, finally, you can attend to other tasks in your practice. The phone rings – it’s John, one of your clients. He forgot to mention that Mary worked overtime this month and that James was on sick leave. This is the second month in a row that this has happened. It’s now your job to rectify the payroll, which can take up a lot of time and possibly even delay other clients’ tasks in the process.

It can be hard to manage client communications, especially when both you and your clients are busy attending to other matters. John may have sent you an email about this a few weeks ago or left a message with reception, but emails tend to get lost and phone messages can be easily missed.

If only there was a system in place that allowed clients to view a payroll summary before it's been finalised. A system that gives the client more control and lets them have the final say before their employees’ payslips get distributed. Not only would this save you time, it would also give your clients more control and accountability towards their employees’ pay, improving communication and trust between you and your clients.

We have the solution

BrightPay Connect’s Client Payroll Approval feature allows you to send a payroll summary to your clients via their client self-service dashboard. From here, clients can access the dashboard from their computer and review their employees’ payroll and approve it. Once they’re happy with it, you will be notified on your own bureau dashboard that it's been approved. This information automatically flows to the payroll software, eliminating tedious back and forth communication.

This saves your bureau precious time and reduces data errors across the board. The feature also gives your clients more control of their payroll, making them accountable for the payments that land in their employees’ bank accounts. This means that should an employee have an issue regarding their payslip, the client themselves is more likely to have an answer for any mistakes and issues that need resolving.

This seamless flow of information between you and your clients can really set you apart from other practices. Not only does it increase client satisfaction, but it also improves the competency of your practice by allowing you to broaden the services you offer.

Our cloud-extension also comes with a Client Payroll Entry feature. This allows your clients to send updated payroll information from their own client dashboard. From here, clients can then enter any changes to employees’ hours and any additions and deductions for that pay period.

However, these are only a few features of our cloud-extension, BrightPay Connect. It also comes with a wide range of other payroll solutions for accountants than can increase your profits and broaden the scope of your practice.

Learn more about BrightPay Connect by booking a free 15-minute demo, so you can prepare any questions you want to ask us in person, at the event. Here is a quick peak at some of the benefits our cloud extension, BrightPay Connect, can offer your practice:

- Automatic cloud backups of your payroll data that ensure your clients’ data is safe and secure at all times. This also aligns with GDPR best practices.?

- Remote working support by notifying you when someone else has worked on an employer’s file from a different computer, and if they are still working on that file.??

- Bureau branding giving clients a more personal touch to your services, enhancing work relationships.?

Interested in staying up to date on all the latest payroll trends and legislative changes? Sign up to our newsletter below for weekly emails so you can stay in the loop.?

Aug 2022

2

Weather alert: How to handle last-minute annual leave requests

Phew, what a summer we’ve been having! From barbeques to beach days, it’s no wonder staff have been booking days off last-minute to soak up the sun. However, this can lead to businesses becoming short-staffed, which can put a strain on your usual workflow. With more staff taking annual leave, it can also often lead to you spending more time on payroll. You’re a business owner, not a juggler, so how does one handle last-minute holiday requests, every time the sun comes out? Here are our top 3 tips and tools from the payroll industry.

1. Take your annual leave management online

Rather than receiving annual leave requests via letters, phone calls or emails, why not get a software that manages the whole process for you? For example, employee apps are becoming increasingly popular, and with good reason. With an employee app, you can let employees book annual leave themselves, from a few simple taps on their phone. This means your employees can submit annual leave requests from anywhere, at any time.

You, as the employer, will then be notified of this request and can sign into your employer portal from a browser, where you can accept or reject the requests, at the click of a button. This can be done whether you’re on your desktop in the office, or your tablet at the beach – perfect for those last-minute leave requests!

This not only streamlines and automates your annual leave management process, it also makes your business much more tech savvy, improves employee job satisfaction, and aligns more with hybrid and remote working models.

2. Automatically sync employee annual leave to your payroll software

Adjusting payroll files last-minute can be exhausting, especially during busy holiday periods. However, using a payroll software that can automatically sync your employees’ annual leave data back to the payroll software, can save you a significant amount of time, each pay period.

For example, our cloud extension, Bright Pay Connect, syncs all of the data from our annual leave management tool, directly back to the payroll software. This means that all of your employees’ leave data will be up-to-date in the payroll software while you’re using it. This reduces the likelihood of errors on payslips, saving you time rectifying any errors that can crop up from mismanaged annual leave.

3. Get an online company calendar

Having an online companywide calendar lets you view your entire company’s leave (annual leave, maternity leave, sick leave, etc.) from your browser, on any device. This means that when you’re deciding whether to accept or reject a last-minute annual leave request, you can quickly pop onto your online company calendar to see who else might be booked off on those selected dates.

Having an online company calendar also allows you recognise patterns in staff’s annual leave bookings. For example, John might have taken annual leave the past four Mondays in a row, Frank could be unknowingly taking every second Friday off, while Mary doesn’t seem to have taken any leave in the past 10 months. This lets you keep a closer eye on your staff’s time off, and lets you make more strategic and well-rounded decisions for your business.

Summer isn’t over, and neither are last-minute leave requests

As you can see, annual leave management really has never been easier. All of the features mentioned above are available in our cloud extension, BrightPay Connect. If you’re interested in learning more about BrightPay Connect, why not book a free 15-minute demo, where we can show you even more ways our cloud extension can benefit your business.

New to BrightPay? BrightPay is one of the UK’s leading payroll software providers for small businesses, and is award-winning payroll software. Download our completely free of charge 60-day trial, with full functionality.

Want to stay in the loop of all things payroll? Keep up-to-date on all the latest payroll trends, news and legislative updates in our weekly newsletter.