Sep 2019

26

Are employees receiving the National Minimum Wage?

According to Office for National Statistics figures, wage growth has risen to 3.6% in the year to May 2019, outpacing inflation since March 2018. While unfortunately we don’t have a crystal ball to predict how long this will last, we know something for certain: the National Minimum Wage (NMW) and National Living Wage (NLW) will continue to change every year.

Tracking employee hourly rates depending on their circumstances might seem complicated, but it doesn’t have to be. Here at BrightPay, we are constantly working to provide you with a platform that makes payroll and amendments easy. In this short guide, we have summarised all the key information and steps to make changes to the NMW and NLW on BrightPay.

Hourly rates

The hourly rate for the minimum wage depends on an employee's age and whether they are an apprentice:

- The apprentice rate is applicable to apprentices aged under 19 and those aged 19 or over when they are in the first year of their apprenticeship

- Employees under 24 years old are entitled to the National Minimum Wage

- Employees aged 25 or over are entitled to the National Living Wage

The rates for the National Living Wage and the National Minimum Wage change every April and are currently:

| Category of worker | Hourly rate |

| Aged 25 and over (National Living Wage rate) | £8.21 |

| Aged 21 to 24 inclusive | £7.70 |

| Aged 18 to 20 inclusive | £6.15 |

| Aged under 18 (but above compulsory school leaving age) | £4.35 |

| Apprentices aged under 19 | £3.90 |

| Apprentices aged 19 and over, but in the first year of their apprenticeship | £3.90 |

BrightPay can track all employee hourly rates depending on their circumstances. That is including all the cases above, as well as the London Living Wage, and they can also be marked as not eligible.

Checking if an employee is receiving the NMW

You can use BrightPay to determine if an employee is receiving the National Minimum Wage, which is automatically calculated for hourly paid employees.

Once the number of hours worked for a pay period is entered, the payroll software will use the rest of data available about the employee, such as their age, hours worked in period and minimum wage profile to calculate how the hourly rate used compares to the minimum hourly rate, and alert the user if it falls below the relevant minimum wage.

Non-hourly employees

The process is simple for most employees, but you might be wondering about non-hourly employees. The good news is that on BrightPay you will also find a Minimum Wage Report feature that allows you to enter/confirm the number of hours worked for each employee and generate a report that confirms who is above or below the minimum wage. Easy, isn’t it?

If an employee's wage is below the National Minimum/Living Wage, BrightPay will flag it with a yellow status bar within 'Payroll' – or you can choose to hide this notification if you prefer.

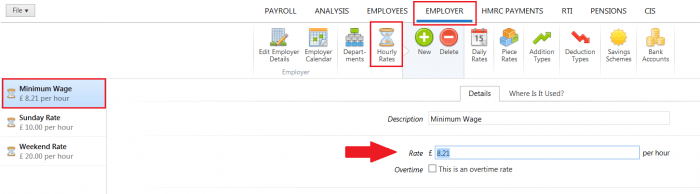

Amending a global hourly rate

When the Minimum Wage changes, you can amend the global hourly rates automatically. Hourly rates can also be set up at the employer level in BrightPay from the 'Employer' tab, selecting 'Hourly Rates'. Once the hourly rate has been determined, the changes will automatically be applied to all employees assigned to that hourly rate.