Sep 2013

23

What's New in BrightPay 13.5?

BrightPay 13.5 is a free upgrade to our 2013/14 payroll software. It adds many new features to BrightPay, including some popular customer requests.

Ability to Report on Specific Employer Items in Analysis

Until now, BrightPay's analysis feature was limited to reporting on the common payroll data that could apply to any employee's payslip in any period (e.g. gross pay, tax, NICs, etc.).

Until now, BrightPay's analysis feature was limited to reporting on the common payroll data that could apply to any employee's payslip in any period (e.g. gross pay, tax, NICs, etc.).

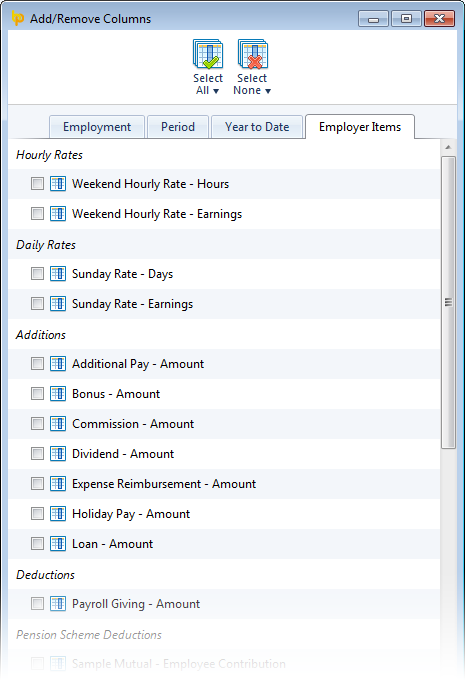

A popular request from customers was the ability to report on the employer specific data that is editable under the main Employer tab of BrightPay, including:

- Specific addition and deduction types

- Specific hourly and daily rates

- Specific pension scheme deductions

- Specific savings scheme transactions

This feature is now available in BrightPay 13.5. As you add/edit the above items and use them in payslips, their amounts become available for reporting in Analysis.

Also, to make it easier to build your reports, the Add/Remove Columns feature in BrightPay has now been organised into tabs.

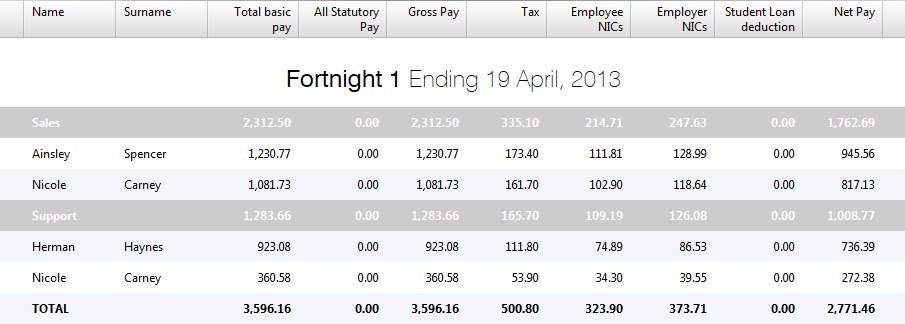

Improved Departmental Reporting

When reporting by department, BrightPay now groups the departmental records in a more logical, useful way. An employee in multiple departments can now have his/her payroll values split out into each department within the results for a single period.

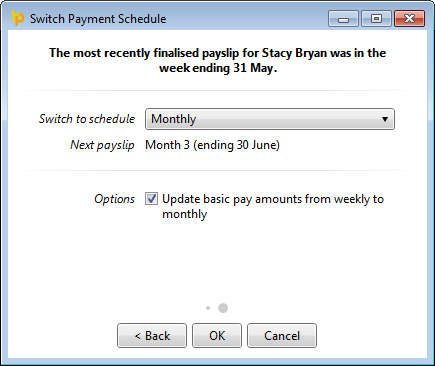

Ability to Switch Employees to a New Payment Schedule Mid Tax Year

Do you have employees who are switching from being paid weekly to being paid monthly? Or the other way around? Perhaps some need to switch to or from a fortnightly or 4-weekly pay schedule?

This feature is now available in BrightPay 13.5. In any period, you can now switch one, multiple or all employees to a new payment schedule. This can be done as many times as is required throughout the tax year.

Here's how it works (for example, when switching from weekly-paid to monthly-paid):

Here's how it works (for example, when switching from weekly-paid to monthly-paid):

- Finalise an employee's payslips up until the final week that she should receive a weekly payment.

- Her next payslip will be set up in the following week. You want her next payslip to be in the following month instead, so choose this week in BrightPay and go to More > Switch Employee(s) Payment Schedule...

- More than one employee can be switched if need be. Select the relevant employees and click Continue.

- Select 'Monthly' as the new payment schedule.

- BrightPay will automatically determine the next available month to switch to, or, if no monthly schedule has been set up, allow you to do so.

- To prevent doubling up on payroll amounts, employees can only be switched to a later month that does not overlap with any already finalised weeks.

- If there are one or more weeks which could be finalised before switching to a monthly schedule, BrightPay will warn you.

- You can optionally choose to have the employee's basic pay automatically adjusted from weekly to monthly.

- Click OK. BrightPay will remove the weekly payslip that is no longer relevant, and create the employee's first monthly payslip.

Other New Features and Fixes

- Ability to ignore 'zero pay' payslips in analysis.

- Fixes a bug in which an EPS (or NVR) cannot be created for mid-year-start employers.

- Fixes a bug in which BrightPay will not accept an employee start date for mid-year-start employers.

- Other minor fixes and performance improvements.

Upgrading

When you next launch BrightPay, the upgrade should be automatically detected – simply follow the instructions on-screen. If you have any problems upgrading, please contact us.

Sep 2013

18

Childcare Vouchers - a win-win situation for all involved!

Childcare vouchers play a vital role for employers as they endeavor to hold onto their skilled and experienced workforce and also cut costs. By introducing childcare voucher schemes employers can reap financial benefits.

Employers who provide childcare vouchers for employees can save up to 12.8% on National Insurance Contributions (on the value of the vouchers up to £55 per week). The more employees with nursery/crèche costs are encouraged to claim childcare vouchers; the greater the saving for your business.

Childcare vouchers allow working parents to save on registered childcare costs through their employer. By taking part of their salary in vouchers, rather than paying the child-minder or registered crèche directly from their net pay, a working parents' tax burden is reduced and their employers also save money - so it is a “win-win” situation for all involved.

Childcare vouchers are a flexible, legal method for working parents to pay for all forms of registered childcare including day nurseries, registered child-minders, crèches and playgroups, after-school and breakfast clubs, holiday schemes and workplace nurseries.

So How Do Childcare Vouchers Work?

The first £55 per week (£243 per month) of childcare vouchers that an employee receives through their payroll is exempt from income tax and national insurance contributions. This means that a parent paying basic rate tax could save up to £77 per month on registered childcare.

Couples who work for companies each offering the childcare voucher scheme are both entitled to claim up to £243 each per month of their salary as childcare vouchers. These joint tax exemptions could mean a family saving of as much as £154 per month on registered childcare costs.

Childcare voucher schemes are very easy to set up and put into practice. Due to the tax incentives involved childcare vouchers are a business investment, not an expense.

To find out more about childcare vouchers visit http://www.employersforchildcare.org

To find out how to set up Childcare Vouchers in BrightPay see http://www.brightpay.co.uk/docs/13-14/processing-payroll/childcare-vouchers/

Sep 2013

11

Missed RTI Deadline? – Expect a Letter from HMRC

167,000 employers have missed one or more deadlines for the new RTI reporting system for PAYE income tax. These employers will now receive a letter from HMRC.

HMRC previously sent a chasing letter to companies that missed a deadline in June, and instructions on how to use RTI were sent in October 2012 and again in February 2013.

Although a few companies may not report because their PAYE scheme is unused or no longer operating, but in these cases employers are still required to let HMRC know by contacting the Employer Helpline.

Certain employers are also required to operate a PAYE scheme for employee expenses and benefits, in this case they should either submit a nil EPS every month, or contact HMRC to change their scheme to annual reporting. The Tax Office will not contact employers who have already registered their PAYE scheme as an annual scheme.

Over 85 percent of employers - 1.6 million employers and 40 million individuals - are now using RTI, with HMRC recently contacting employers via an on-line survey to estimate how companies are coping.

A temporary relaxation for small businesses was recently extended to April 2014 due to manageability concerns as The Institute of Chartered Accountants in England and Wales warned it would be "impossible" for many businesses to comply.