Sep 2021

29

BrightPay Connect - The New Norm In HR Management

Human resources is a dynamic field that is constantly changing. HR managers are required to keep up with the times as industries and employment law evolve. Whether that means updating a company policy to reflect legislative developments, finding ways to engage employees in order to create a vibrant work culture, or using innovative new technologies to affect positive change in the workplace, HR managers have a lot on their plate.

If you’re a HR manager, you’re probably nodding your head in enthusiastic agreement right now. But did you know that BrightPay Connect has been designed with you in mind? Not only can it streamline the payroll process, but it can have significant benefits for the HR department too.

BrightPay Connect provides much needed solutions to the challenges that HR managers face everyday. These vary from data storage and protection to internal communication and leave management, in other words - all of the things that take up your time and prevent you from working on the tasks that really need your attention. That’s why Connect is quickly becoming the new norm for forward-thinking HR professionals across Ireland and the United Kingdom.

What Is BrightPay Connect?

Connect is a cloud-based add-on to BrightPay’s payroll software. It offers a vast range of powerful new features, including an employee self-service smartphone and tablet app, automated cloud back-up, online employer dashboards and so much more. Connect combines payroll and HR functionality to create a holistic product that benefits bureaus, employers, HR and payroll administrators and employees alike.

Although BrightPay’s payroll software can only be accessed on a PC, BrightPay Connect can be used on any device, anywhere. The payroll is still processed on the desktop version of BrightPay, but the payroll information is stored online on a secure cloud server. This makes it particularly useful for the rapidly growing number of businesses who are offering remote working options to their employees. Remote working presents many challenges to HR managers, many of which are addressed by Connect.

However, this doesn’t mean that only businesses with remote working employees will benefit from BrightPay Connect. Keep reading to find out how Connect can transform your HR department.

Employee apps are a growing trend in human resource management. Self-service apps can allow employees to take control of their personal data, communicate with employers, and track their annual leave. Click the link to read more: https://t.co/FHMBkHCWEi pic.twitter.com/qvPhVr1Git

— BrightPay UK (@BrightPayUK) September 22, 2021

BrightPay Connect For HR Professionals

Although BrightPay Connect has many features that can have positive impacts on HR management, there are three in particular that HR managers love.

Annual Leave Management

Managing annual leave can be time-consuming and complicated, especially if your business has a large number of employees. However, it doesn’t have to be. BrightPay Connect includes an annual leave management feature that makes the process more straightforward for both employees and HR managers.

On their self-service app, employees can request annual or unpaid leave via the employee calendar. As soon as the request has been sent it will appear on their HR manager’s BrightPay Connect online dashboard. From here, the HR manager can check the company calendar to see if anyone else will be on leave on those dates, and either approve or deny the request accordingly.

Furthermore, a time-stamped record is kept of all requests, approvals and denials, along with which manager dealt with them. This is very useful if there are multiple managers managing leave requests from their own departments.

Document Sharing and Storage

BrightPay Connect makes document sharing more efficient and effective than ever before. From their employer dashboard, employers can upload documents to Connect. These documents are then available via employee dashboards or the employee self-service app.

This feature is fully customizable, meaning that the employer can choose which employees get access to the documents uploaded. They may choose to make them available to the entire company, to a specific team or department, or to just one individual employee. Similarly, they can choose to keep them private if they need to. For example, they may upload an employee file for a new employee. By uploading it, it’s automatically stored in the cloud but nobody who shouldn’t see it will have access to it.

Employee Personal Data

Finally, BrightPay Connect makes it easier for HR managers to comply with their data protection obligations under the GDPR. One such obligation relates to giving employees access to any personal data on them that you store.

In the employee app, employees can view this information and request to make edits. One example of this in practice would be if an employee moves house and needs to update their postal address, or changes phone number and needs to replace their old number with their new one.

Every HR manager knows how important it is to comply with GDPR so the fact that BrightPay Connect helps with this is a major advantage to the cloud-based add-on.

Book Your Free BrightPay Connect Demo

To find out more about how BrightPay Connect can help you to streamline your HR process and evolve with the times, book a free demo with our Connect team today. They’ll walk you through the benefits of our industry leading add-on and show you why BrightPay Connect is fast becoming the new norm in HR management.

Sep 2021

28

BrightPay & Relate Software join forces to create an accounting & payroll software champion

We are delighted to announce that BrightPay has joined forces with Relate Software, a leader in post-accounting, practice management, and bookkeeping software. The partnership will aim to create a software champion serving payroll and accounting bureau and SMEs across Ireland and the UK.

BrightPay is a modern payroll and HR software which takes care of every aspect of running your payroll, from entering employee and payment details to creating payslips and sending real-time payroll submissions. The software has been designed from the ground up to be clear and simple, and yet no compromise has been made on its payroll features.

Likewise, Relate is dedicated to building innovative and focused products designed specifically for the accounting profession. Its offering includes Surf products, a cloud native product suite of bookkeeping, post-accounting, and practice management software. Relate is an industry-leader in Ireland and has been building software for over 25 years.

By partnering with Relate and combining products and strengths from both businesses, we can provide a greater offering to our customers, with scope and backing for further innovation and development. This is an exciting moment in BrightPay’s journey to delivering a one stop solution for businesses and accountancy firms. Together we will aim to provide a best-in-class software suite with a clear value proposition to drive efficiency and reduce errors, all with increased flexibility from working with a cloud offering.

For more information, please see the press release and customer FAQs.

Sep 2021

24

Harness the power of phone notifications for employee communications

Push notifications are 7 times more likely to be opened than an email. This high ‘open rate’ has meant marketers have been utilising them as an important communication tool for a number of years. Now, employers and HR departments are examining how this marketing trend can be used to engage employees.

What are push notifications?

Recent research carried out in the UK has shown that 25% of smartphone users have between 11 and 20 apps on their phone, and 24% have 31 or more. With potentially dozens of apps on a user’s smartphone, it has become increasingly difficult to engage them.

Push notifications are short messages or alerts sent by an app or website to a user’s phone or desktop in real-time. They ‘pop-up’ on the screen, prompting the user to take some action. The messages can be personalised and can contain images, GIFs or video. They don’t deliver the primary message, but rather give an instruction to the user. The notifications are very effective; they engage users and encourage action.

How can employers use them?

Employers and HR departments can use push notifications to send important information to employees, anytime and anywhere. For example, BrightPay Connect customers commonly use the push notifications feature to notify employees of their latest payslip, Health & Safety updates, changes to the employee handbook, and even to direct them to the latest company newsletter.

How does BrightPay Connect harness the power of push notifications?

BrightPay Connect is an optional cloud add-on that works with BrightPay’s desktop payroll software. It is primarily focused on improving payroll workflows by automating tasks to save a business significant time, but its functionality also offers employers a ready-to-go, easy-to-use HR software solution.

With BrightPay Connect, employers and employees have their own self-service app which can be accessed by a web browser or by the app. Using the calendar feature on the app, employees can easily manage their annual leave, view how much they’ve already taken, how much is left, and can make leave requests, which are sent to their manager. The push notification then alerts employees of whether or not their request for leave has been approved.

Notifying employees of important changes:

The push notification is used to alert individuals, teams, or the whole company that a new document has been shared to their self-service portal. The HR team can share with an employee their contract of employment, their performance review, training records and other confidential information. To the wider company, they can share the company handbook and return-to-work procedures including the company’s social distancing and COVID-19 policies.

Additionally, the app’s activity log allows managers and HR to keep track of who has viewed documents and who has not. This can be significantly helpful to employers who are legally required to provide employees with certain documents.

Push notifications can be used to help ensure important messages are not missed. With overflowing inboxes, employees are more likely to click on these alerts and remain updated on any company news.

To learn more about BrightPay Connect and how it can help your business, book a demo to speak to a member of our team.

Related Articles:

Sep 2021

22

What to include on a hybrid working policy

Post lockdown, as restrictions lifted across the UK, many of us returned to the office for the first time in over a year. And while it was great to have the option of returning to the office, it didn't necessarily mean that everyone wanted to, not on a full-time basis at least. Experiencing the longer lie-ins, no commute, and an overall better work-life balance, employers and employees alike have enjoyed the benefits of remote working. However, each employee is different and working from home may not be as suitable for some as it is for others. A 2021 survey by Forbes found that 97% of employees surveyed would prefer flexibility between working remotely and working in the office. Because of this, many businesses have adopted a hybrid working model.

What is hybrid working and how can an employee request it?

In the UK, hybrid working falls under flexible working and is when an employee works part of their time in the workplace provided by their employer and part of their time from home or anywhere else other than the normal place of work. Employees have the right to request that they work this way once they have worked continuously for the same employer for at least the last 26 weeks. Employees can do so by making a statutory application to their employer. The employer must then make a decision on the matter within three months, or longer if this is agreed to by the employee.

If the employer agrees to allow one or more employees to work a hybrid working model, a Hybrid Working Policy document should be created so that all staff are aware of how the new arrangement will operate. Because many employers now have experience with employees working from home, they should already be aware of the challenges and advantages it can bring. This will be an advantage for employers and HR managers as they put together their Hybrid Working Policy.

What information should be included in a Hybrid Working Policy?

The rules and limitations surrounding the company’s hybrid working policy should be clearly outlined in the Hybrid Working Policy, including:

- Are there any roles within the company which may not be suitable for remote working

- Will employees need to follow a hybrid working schedule

- Are there certain tasks which you, as an employer, would prefer to be taken care of in the office rather than at home (or vice versa)

- While working remotely, is the employee allowed to work anywhere or are there limitations. Examples of this may be that the employee must stay in the country or cannot work in public settings due to cybersecurity concerns

- What hours should an employee be working. Are there set working hours, when should they take breaks and what is the maximum number of hours they should be working each day

The policy should include details of how staff will be managed and supported as they work from separate locations, including:

- How should employees communicate with managers and colleagues and what should be done to ensure effective and fair communication

- How should new staff be onboarded

- How will employees’ performance will be managed

- How will employees’ health, safety and wellbeing be maintained

Guidelines for remote working should be clearly defined, including:

- What equipment is suitable for remote working and how will the equipment be provided

- What are the insurance requirements for the employer and the employee

- Details of a home risk assessment

- How cyber security will be maintained

How should a Hybrid Working Policy be shared with employees?

Once you have put together a Hybrid Working Policy, what is the best way to share it with employees? When sharing the policy with employees, you may want to share it with all or multiple employees at the same time. As employees may be working from different locations, it’s likely not possible to physically hand out the document to each employee.

You could email the policy to employees. However, emails are not always an effective way of getting your employees' attention. In a 2019 survey, 34% of respondents said that they sometimes ignore HR emails from their employer, while 5.7% even said that they always ignore HR emails. The reason for this may be that employees are simply overwhelmed by the number of emails they receive at work.

A better way of getting employees to read your new Hybrid Working Policy is by sharing it with them through an app on their smartphones. BrightPay Connect is a cloud add-on to BrightPay payroll software which includes an employee app which can be used to take care of a number of HR tasks. With BrightPay Connect, employers will have access to their own employer dashboard from where they can upload employee documents to be shared with employees through the employee app. Employers can share documents with individual employees, multiple employees or all employees if they wish to do so. This means employees can easily access all their documents in one place, be it their individual contract of employment or company-wide documents. Since the documents are available on the employees' phones, it also means they can be accessed anytime, anywhere.

When a document is shared with employees this way, each employee will receive a push notification on their mobile to notify them that the document has become available for them to view. With push notifications, because users can instantly read the alert on their device, they are less likely to ignore it like they may do with an email. Furthermore, employers can track who has and who has not read each document and so you can give them a nudge if needs be.

Reviewing and updating your Hybrid Working Policy

As hybrid working is still a relatively new concept for many employers, the policy should be reviewed regularly. Employers may want to make changes to the policy as the needs of the business and employees change. The updated policy can be quickly reshared on BrightPay Connect and employees, are once again alerted to it by push notification.

As well as sharing documents, you can also easily share payslips with employees using BrightPay Connect. Other HR functions of BrightPay Connect which are done using the employee app are annual leave management and updating employee information. To learn more about the many benefits of BrightPay Connect and how they can improve your business and ease the transition to hybrid working, book a free online demo today.

Related articles:

Sep 2021

16

Coronavirus Statutory Sick Pay Rebate Scheme to end on 30th September 2021

The Coronavirus Statutory Sick Pay Rebate scheme was introduced to repay employers the current amount of Statutory Sick Pay paid to current or former employees on or after 13th March 2020 for periods of sickness related to Coronavirus. An employer can claim up to 2 weeks of COVID-related statutory sick pay for an employee that was paid, however this will end on 30th September 2021.

Employers will have up to the deadline on 31st December 2021 to reclaim back Coronavirus Statutory Sick Pay on this scheme for periods before and up to the end of September 2021. HMRC’s main guidance for claims under this scheme can be accessed here.

The employer must keep records for the statutory sick payments they wish to claim from HMRC such as:

- National insurance number for each employee being claimed for

- Start and end dates for the period of sick leave the employee could not work

- The reason why the employee could not work

- Details of the qualifying dates in the period the employee could not work

Hybrid working ????? is now seen as a permanent way of working by employers and employees alike. Key to its success is ensuring you have the right tools and know-how to deliver your services as usual. Download our guide to find out more: https://t.co/VkSUkbh8sT pic.twitter.com/MOGYT6BTr6

— BrightPay UK (@BrightPayUK) September 8, 2021

Related articles:

Sep 2021

14

BrightPay’s 2021 Customer Survey Results

Earlier this year, BrightPay conducted our annual Customer Satisfaction Survey. At BrightPay we are constantly trying to improve our products as well as our customer service. Our Customer Satisfaction Survey helps us identify in which areas we should make improvements. As it is an annual survey, it allows us to monitor customer satisfaction over time and evaluate the success of the changes we have made and the efforts we have put in throughout the year.

A total of 1169 customers took part in our survey. Just over half of those surveyed were employers on a standard BrightPay licence while the remaining were accountants or payroll bureaus who run payroll for multiple clients.

Below are some of the key stats from the survey:

For 2021 BrightPay received a 99.5% customer satisfaction rate. This means that our customer satisfaction rate has remained over 99% for the 7th year in a row.

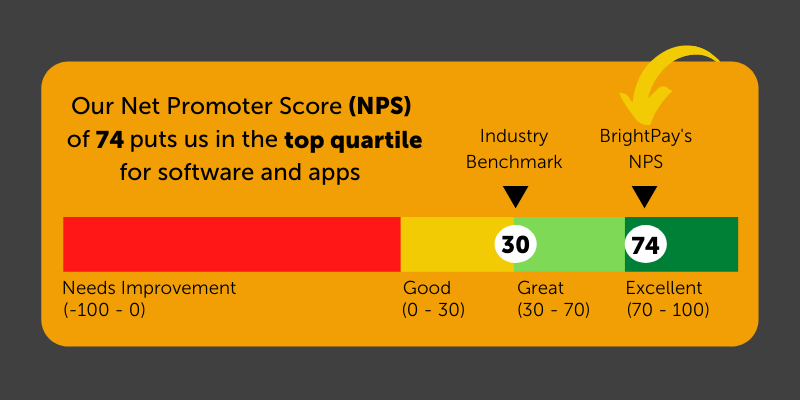

BrightPay’s 2021 Net Promoter Score (NPS) is 74. An NPS represents how likely customers are to recommend your product or service to others. With the industry average NPS score being 30, a score of 74 puts us in the top quartile for software and apps.

Of the 1169 customers surveyed, 166 had started using BrightPay within the last 12 months. 98.8% of our new users said that the software was easy to use. This score is thanks to our functionality and our user-friendly interface.

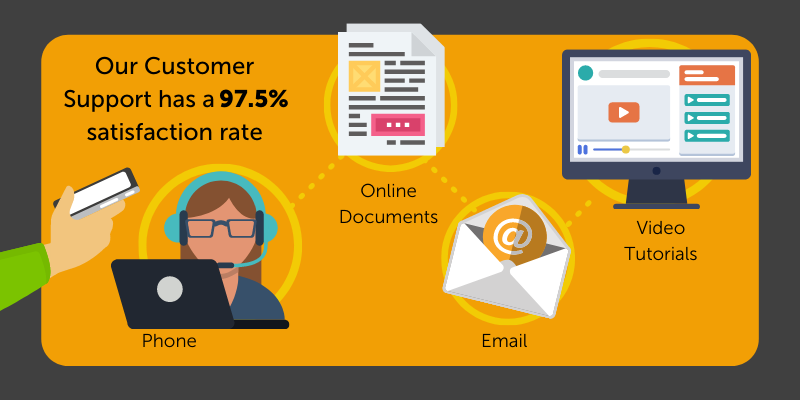

At BrightPay, unlike other payroll software providers, we do not charge for customer support. Because we do not profit from your need for help, this motivates us to make our software as user-friendly as possible. BrightPay customers can speak to one of our payroll experts by phone or email. If you need help switching from your old payroll software provider to BrightPay, we have a team of payroll migration experts on hand to help. As well as this, to help our customers, we hold free weekly webinars where we discuss current payroll topics and answer your payroll queries. We also have helpful videos, documents, guides and eBooks available on our website. It is because of this that our customer support has achieved a 97.5% satisfaction rate.

98.7% of customers surveyed said that they save both time and money by using BrightPay. This is through using our integrations with accounting packages, pension providers and a payments platform that allows you to pay employees, subcontractors, and HMRC, all in real-time.

Payroll bureaus and accountants can also save time by using our batch payroll processing feature which allows you to perform payroll tasks for multiple clients at the same time.

Another way you can save time and money is by using our optional cloud add-on BrightPay Connect, which 42% of BrightPay users surveyed said they also use. BrightPay Connect includes an employer dashboard which gives you a complete overview of the payroll information including managing employee leave, sharing payslips and other documents with employees. It also automatically backups the payroll data to the cloud every 15 minutes.

BrightPay Connect includes an employee self-service app which 99.1% of our customers surveyed said they love. From the app, employees can view current and historic payslips, request annual leave, view personal employment documents such as their contract of employment or companywide documents such as a monthly newsletter.

The 2020/2021 financial year was one like no other for BrightPay and for our customers. We all had to change the way we worked in order to adapt to the new world we found ourselves in. During the COVID-19 crisis, keeping up to date with the ever-changing furlough scheme and other wage support measures put in place by the UK government took centre stage for payroll processers. 99% of customers surveyed said they were satisfied with our handling of COVID-19 thanks to our software upgrades, free online webinars, online support documents and our phone and email support.

BrightPay would like to thank all those who took the time to take part in our Customer Satisfaction Survey. We believe that by listening to our customers' needs we can continue to grow and improve as a company. The full Customer Satisfaction Survey infographic can be viewed here. If you would like to find out more about BrightPay and BrightPay Connect, book a free online demo today.

Sep 2021

13

A start-ups guide to auto enrolment

If you’ve just started a new business, firstly – congratulations! Secondly, are you planning on hiring employees? If so, under the Pensions Act 2008, every employer in the UK must enrol their eligible staff into a workplace pension and pay into it. If you are not a new business but are considering hiring your first employee, you will have automatic enrolment duties that you must comply with straight away. Your new auto enrolment responsibilities apply from the new employee’s first day of employment. This will be known as your duties start date.

Getting started

The Pensions Regulator (TPR) have an online tool that employers can use to find out what you’ll need to do for automatic enrolment. What you need to do will depend on whether your employees are being enrolled into a pension scheme or not. Either way, all employers have duties to carry out including an online declaration of compliance that needs to be submitted to The Pensions Regulator.

Ongoing duties

Each time you pay your staff (including new starters), you must monitor their age and earnings to see if they need to be enrolled into a pension scheme and how much you as the employer, need to pay in. BrightPay payroll software will automatically assess all employees once the duties start date is reached. It will continuously monitor any changes to an employee's work status each pay period and flag an employee if they become eligible to notify you that auto enrolment duties need to be performed.

BrightPay is compatible with 18 different workplace pension schemes and includes direct API integration with NEST, The People's Pension, Smart Pension, and Aviva. The API integration allows BrightPay users to send their pension data to the pension provider with one click.

Automatic re-enrolment

Every three years (from your duties start date) you must carry out re-enrolment to put back in any staff who have left your scheme. Re-enrolment is a legal duty whereby if you don’t act, you could be fined.

In BrightPay, if employees meet the criteria for re-enrolment, on-screen flags and alerts will appear to notify you that you now have re-enrolment duties to perform. This feature is included in BrightPay and will be activated by entering your chosen re-enrolment date into the software.

Costs involved

According to The Pensions Regulator, 61% of employers with 1 to 4 staff had no overall set up costs. All payroll software providers should be making it easy for employers to comply with their duties and not charge extra for the functionality. All BrightPay licences include full auto enrolment functionality at no extra cost, including personalised auto enrolment letters to employees.

Find out more about processing payroll and automatic enrolment by booking a free 15-minute online demo.

Related Articles:

Sep 2021

10

How is payroll impacted by the new national insurance levy?

On Tuesday, the Prime Minister announced a 1.25% health and social care levy on earned income, which will come into effect in April 2022. Speaking to the House of Commons, Boris Johnson declared that this additional levy was required in order to raise funds for health and social care across the UK.

Speaking about the National Health Service, the Prime Minster said “Covid has put enormous pressure on the NHS” and in order to not only “tackle Covid backlogs” but to also reform an already struggling service, a record investment would be required. The additional levy is expected to raise £36 billion over three years.

How will the new health and social care levy be introduced?

In April 2022, the 1.25% levy will be raised via a temporary increase to the National Insurance Contributions (NICs). This will impact Class 1 (employee and employer), Class 1A, Class 1B, and Class 4 (self-employed). In April 2023, the NI will revert back to its current rates and the health and social care levy will be separated out on its own.

Who will be affected by the 1.25% levy?

The new levy will then be paid by all working adults and will also include those above the state pension age who are still working. The exception is those earning less than £9,564 a year or £797 a month, who don't pay National Insurance and won't have to pay the new levy.

How has dividend tax been affected?

The Prime Minister also announced on Tuesday that dividend tax would rise from 2022 by 1.25% to help cover the costs of the social care package. This will not affect shares held in tax-exempt savings accounts, known as ISAs. The £2,000 tax-free allowance for dividend income will also remain unaffected.

What does this mean for payroll?

As typical with any changes to legislation, BrightPay payroll software will be updated to apply the new rates to your employees' earnings. This will first be reflected on an employee’s payslip with an increase to their NIC deduction, and then in April 2023 the new levy will be introduced as a separate deduction on the payslip.

Discover more:

To keep up to date on deadlines, industry insights, and news, subscribe to BrightPay’s newsletter. BrightPay is an industry-leading payroll software with over 320,000 customers in the UK and Ireland. BrightPay publishes blogs, guides and hosts frequent webinars, free-of-charge, to support the accounting and bookkeeping community. Check out the full list of our upcoming webinars here.

Sep 2021

8

A spotlight on employee-led sustainability projects

Early this year at BrightPay we moved into our new energy-efficient offices in Meath, Ireland. BrightPay’s employees have formed the 'Green Team', a company-wide committee tasked with identifying and implementing opportunities that can improve the sustainability of our company.

From the start the Green Team have demonstrated their enthusiasm for environmental sustainability and passion for sharing their knowledge. This is highlighted below in a number of projects they’ve undertaken:

Making the Garden Bloom:

While the initial focus was on the new purpose-built offices, the Green Team soon turned their attention to the green spaces outside. Inspired by their Earth Week guest, Dr Emma Reeves, a Senior Ecologist at the Forest, Environmental Research, & Services (FERS), the group was particularly keen to plant native, bee-friendly plants and trees that would help pollinators and further benefit biodiversity. The first planting phase has been completed with the group planning the layout of the garden and planting shrubs, flowers, and trees. In September, the second phase will begin, with the team planting Spring bulbs including hyacinths, tulips, and daffodils.

Single-Use Plastics Awareness Campaign:

On the 3rd of July, the Single-Use Plastics Directive came into effect for all EU member states. In Ireland, this means that certain single-use plastics such as straws and coffee cups have been banned from the Irish market. Supporting this initiative, the Green Team created an awareness campaign highlighting the use of plastic in the beauty industry and introduced a single-use plastics ban in the office. With 10 of the most commonly found single-use plastic items representing 70% of all marine litter, this is an important and useful step all employees can take.

Future projects:

The Green Team’s future plans are focused on tackling pollution and engaging with more employees at Thesaurus Software. In September, the company will take part in a clean-up at a local beach and will also develop a new project highlighting the unsustainable nature of fast fashion and what options are available to address it.

If you’re interested in keeping up to date with BrightPay’s journey, sign up to our sustainability newsletter for future updates.

Sep 2021

1

Customer Update: September 2021

Welcome to BrightPay's September update. Our most important news this month include:

-

How BrightPay Connect can help with your back to work strategy

-

Payslips explained: Top tips to help your employees

-

Employee Apps - The Next Big Thing In Employee Self-Service

5 ways to boost the efficiency of your payroll process (webinar for employers)

Join our upcoming webinar on 16th September where we discuss practical ways you can streamline payroll and HR processes within your business using cloud technology.

6 tips for payroll success while making a profit (webinar for bureaus)

Join our upcoming webinar on 29th September where we discuss practical ways you can streamline payroll and HR processes in your practice using cloud technology while making a profit.

Free eBook: Hybrid working and payroll

Discover how you can use the move to hybrid working as an opportunity to grow and diversify your practice while also improving how you communicate with clients.

Furlough scheme ends 30 September

We are now in the last remaining weeks of the furlough scheme as the Coronavirus Job Retention Scheme (CJRS) will end on 30th September 2021. Unless there is a sudden and surprising change of policy, the government support for organisations affected by COVID-19 will end.

How do I choose a re-enrolment date?

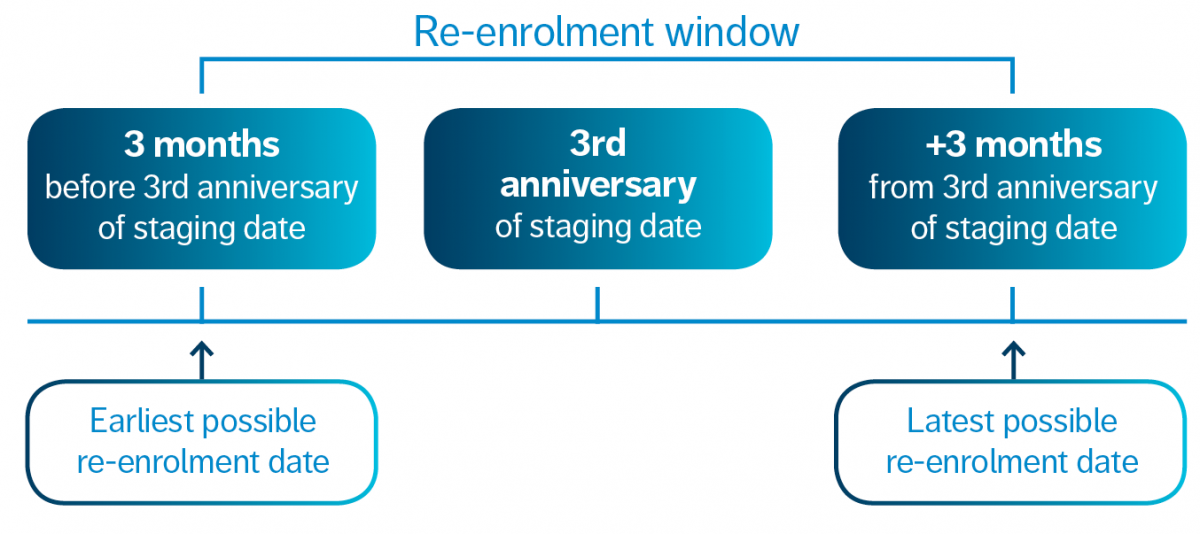

Re-enrolment occurs every 3 years from your staging date. Your re-enrolment date is chosen by you, and you have a 6-month window to choose from. The 6-month window rule means that you can choose a date three months before your staging date and up until three months after it.

It’s time to go paperless: how an employee app can help?

BrightPay Connect is a cloud add-on to our payroll software that can help you to digitalise payroll and HR processes, allowing you to cut down on your use of paper and even stop using it altogether.