Dec 2019

20

All I want for Christmas is the perfect cloud platform

What springs to mind when you hear the word ‘cloud’ will vary from person to person. Some will think of the weather as they look, grumbling, out their front window. But others will be thinking about all that extra storage on their iPhone. See, the meaning of the word has changed in recent times and most of us will now think the latter. But what about those who haven’t a notion what you’re on about? What is the cloud?

The cloud is a general term for any computing service that involves hosting over the internet to deliver computing services in lieu of a hard drive. Services such as storage, payroll and HR information. The other key feature is that you can access these services or information anytime, anywhere from any device that is connected to the internet. In fact, you’re already using cloud services if you use social media, Google Drive and Dropbox to name but a few. And now the cloud has become a must-have for any business who wishes to keep up with the times.

I can hear some of you now: “it sounds great but my employees would never use something like that”. Well, that’s where you’re wrong. A recent survey found that 48% of people believe technological advances will change the face of the workplace and a whopping 87% of those said they would be happy to adapt to technological changes if the right tools were given to them. Wow! So how do I know which cloud platform to choose for my business?

I’m glad you asked! Our experts got together for a brainstorming session and found that there are four key things to look out for when choosing the right cloud platform for your business - cost, compliance, simplicity and connection.

- Cost - Your upfront costs should be minimised - it shouldn’t be an expensive luxury reserved for big corporations. Make sure it provides the option of having multiple users so you can delegate and give access to various people to manage payroll tasks and HR requests on your behalf.

- Compliance - Make sure it takes into account your obligations as an employer with regards to things like the GDPR legislation, record keeping requirements and automatic enrolment duties. A good platform will have compliance built-in as standard and will manage it seamlessly.

- Simplicity - The most important thing to increase uptake of a cloud platform is to make sure it is user-friendly and reduces the chance of human error. Look out for simplistic interfaces and whether or not training and support is available. The best of the best will offer this for free. You should also be able to get set up and ready to go with minimal disruption to your business.

- Connection - Make sure it offers features that are attractive to employees such as a downloadable app, a self-service portal and company-wide messaging features. Because at the end of the day, your employees won’t give a damn about how excited you might be about it unless it works for them too. These features tie in with our ever-increasing digitally-minded workforce and will make them feel more in control and engaged.

So there you have it… off you go now! Good luck scouring through the internet trying to find the perfect cloud platform. But….., well, ...it is Christmas after all and I’m feeling generous. Ah what the heck, I’ll just let you in on a secret which is the best cloud platform for businesses out there: our very own BrightPay Connect.

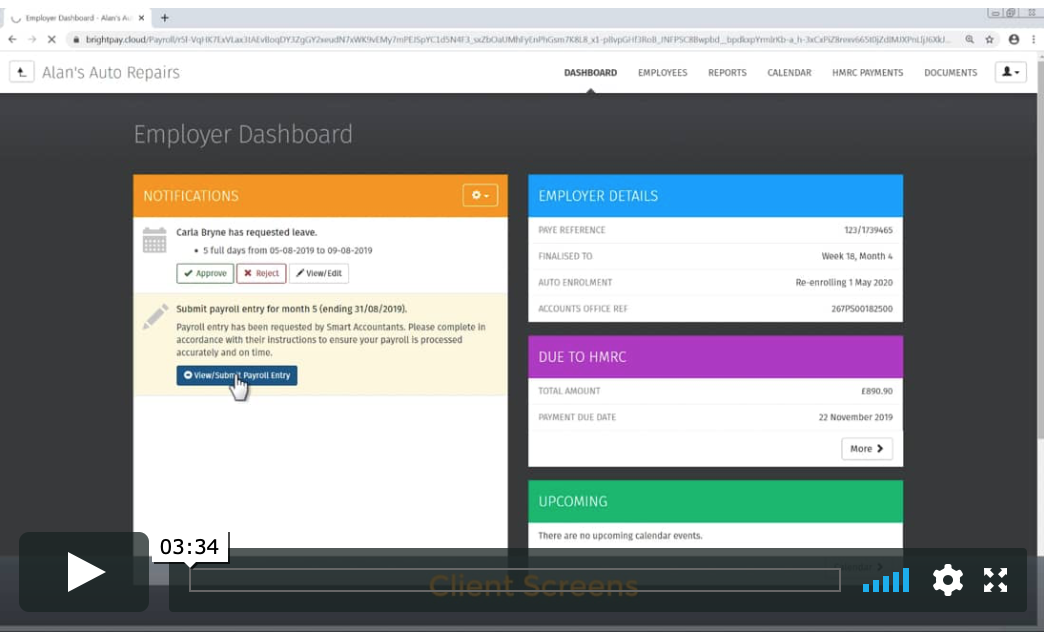

BrightPay Connect is an add-on to BrightPay’s award-winning payroll software and ticks literally every single box I just mentioned over the course of this post. I’ve done enough talking so instead let me show you. Book a demo today to find out if BrightPay Connect is the perfect fit for your business.

Merry Christmas everyone! Don’t say I didn’t get you anything!

Dec 2019

11

New Living Wage Rates Announced

The Living Wage Week ran from 11th to 17th November 2019 and as part of this week, the new Living Wage rate details were revealed on Monday 11th November 2019. The Mayor of London announced the London rate for the Living Wage whereas the UK rate is announced countrywide at the same time.

The UK Living Wage rate has increased by 30p per hour to £9.30, an increase of 3.3%.

The new London Living Wage, announced by the Mayor of London, Sadiq Khan, has increased by 20p from £10.55 to £10.75 per hour. This is a 1.9% increase and this rate is £2.54 higher than the legal minimum wage set by the Government. This helps reflect the higher cost of living facing families in the city.

There are now 1,700 London Living Wage accredited employers in London such as London City Airport and Crystal Palace Football Club. With this increase, London full time employees who receive the Living Wage will be almost £5,000 better off than other employees in London on the minimum wage.

According to the Trust for London, almost 20% of employees in London are paid less than the Living Wage which include 60% of jobs in the hotel and restaurant sector and 40% in the retail sector.

For information about the Living Wage Foundation and Living Wage Week visit the Living Wage Foundation website.

Dec 2019

6

Advisory Fuel Rates updated from 1st December 2019

HMRC has issued details regarding the latest Advisory Fuel Rates for company cars.

From the 1st December 2019 employers may use the old rates or new rates for one month. Employers are under no obligation to make supplementary payments to reflect the new rates but can do so if they wish. Hybrid cars are treated as either petrol or diesel cars for this purpose for the fuel rates.

The rates are as below:

| Engine Size | Petrol- amount per mile | LPG - amount per mile |

| 1400cc or less | 12 pence | 8 pence |

| 1401cc to 2000cc | 14 pence | 9 pence |

| Over 2000cc | 21 pence | 14 pence |

| Engine Size | Diesel - amount per mile |

| 1600cc | 9 pence |

| 1601cc | 11 pence |

| 2000cc | 14 pence |

For fully electric cars the Advisory Electricity Rate is 4 pence per mile. But electricity is not a fuel for car fuel benefit purposes. Please click here to see all details as per HMRC.

Dec 2019

5

Customer Update: December 2019

Welcome to BrightPay's December update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

How to choose the right Cloud HR platform for your business

-

Batch processing in BrightPay - so hot right now

-

Flexible working in the world of accountancy

The interactive digital payslip has arrived - Free for BrightPay Customers

You can now do so much more than simply manage the payslip process. BrightPay Connect offers an online self-service platform and an employee app. Employees have 24/7 easy access to view the payslips anytime, anywhere, using your smartphone, tablet or desktop computer. Historic payslips and P60s are available to access and download. BrightPay Connect offers employees:

- Ability to request annual leave on the go

- Current and historic payslip library

- Access to uploaded HR documents, such as contracts of employment and company handbooks

- View leave taken and leave remaining

- Holiday leave yearly calendar

- Access to edit and update personal contact details

Client Payroll Approval. This is what you must be offering as a service (and why clients will LOVE it)

BrightPay Connect’s Payroll Approval Request allows bureau users to securely send their clients a payroll summary before the payroll is finalised. Clients can then review and authorise the payroll details for the pay period through their online employer dashboard. Ultimately, your client will be accountable for ensuring the payroll information is 100% correct before the payroll is finalised. Additionally, there is an audit trail of the requests being approved by the client.

New AccountingWEB Live Conference for Accountants - Will you attend?

The popular AccountingWEB online platform has announced a new conference for accountants. AccountingWEB Live is a unique blend of technology showcase, educational workshop and inspiring content. As well as a full content programme, AccountingWEB Live will feature showcases from the UK’s leading technology brands, demonstrating the latest products, updates and solutions. We are delighted that BrightPay will exhibit at AccountingWEB Live next year to showcase our latest features.

New BrightPay Connect Subscription Pricing Model

From April 2020, customers will be billed on a usage subscription model based on the number of active employees in the billing month. Once signed up for a BrightPay Connect account, you will be invoiced monthly in arrears through our new online billing system. There are no contracts or ties. Should you decide to stop using Connect, no notice is required. Payroll Bureaus on a bureau package will be charged based on the total number of active employees in respect of clients that are synchronised to BrightPay Connect (not on a client-by-client basis).

Why employee apps are the future of payroll

The advancement of employee mobile apps offers many different advantages for employers, employees, and the business as a whole. Payroll apps will streamline payroll processing while reducing the number of payroll queries from employees. The BrightPay Connect self-service app provides a digital payslip platform where employees benefit from secure access anytime, anywhere, using their smartphone or tablet. Through these app features, you can provide your employees with access to GDPR compliant self-service tools, a payslip library and a user-friendly holiday leave management facility.