May 2021

18

The importance of automated backups

Gather round the fire young payroll processors and let me tell you a tale of terror. The year is 2021, you’ve been in lockdown and working from home for the past year. All of your important work is stored on your trusty laptop. Not only that, but you’ve been processing payroll for a client who employs 20 people...and it’s payday. All of a sudden BAM! Your coffee cup knocks over and spills all over your laptop and the screen goes blank. It won’t switch back on. All your data has been lost. Did I mention its payday?!! Come back, stop screaming! It’s only a story!

But here’s the thing, it’s not a story. These accidents happen literally all the time and all the more so since we’ve been working from home with pets, children and other halves who have no respect for personal boundaries. In my case, my cat was trying to catch a fly and knocked my coffee cup over (yes really) but I’m sure everyone has their own story of misfortune to tell.

But accidents aren’t the only way in which your data can be permanently lost. Pretty soon we’ll returning to our offices again and with that comes the perils of the workplace such as:

- Your office could be physically broken into and your equipment stolen.

- You could lose your laptop by accidentally leaving it on, say, the tube.

- There’s a fire or property damage and your computers are beyond repair.

- You are a victim of cybercrime where your computer is infected with ransomware or other harmful viruses.

Luckily there is a simple way to avoid the terror of losing all of your precious work and payroll data and it’s - yup you’ve guessed it - backing up your data.

Now, some of you may be manually backing up your data and that’s great. But there is a much easier way. BrightPay Payroll Software offers an add-on called BrightPay Connect that automatically, yes automatically, does this for you every time you run your payroll or make any changes to it. Any work you do gets automatically synchronised to the cloud.

Let’s talk about the cloud. It gets a bad rap sometimes and people seem to be a little tentative about it. But in actual fact it is an absolute ideal information storage space. It’s also easily accessible, remotely accessible and quickly accessible no matter where in the world you are (dependent on WiFi). So if you have any problems or lose any of your payroll data you can literally pluck it out of the sky and restore it to your computer.

Not only that, but BrightPay Connect maintains a chronological history of your backups so you can restore or download any of the backups at any time, whether it’s to a PC or a Mac. You can also backup onto your existing computer or simply download a backup to a brand new computer that hasn’t been destroyed by coffee, enabling you to get up and running right where you left off, no matter where you are.

So basically a secure, encrypted software that automatically stores your data in the cloud, making it easily and remotely accessible? Yes please - you’d be mad not to! And you don’t have to get rid of your cat either. For more information about BrightPay Connect, book a 20-minute demo that goes over all of the additional functionalities.

Related Articles:

May 2021

14

Free webinar: Leaving lockdown

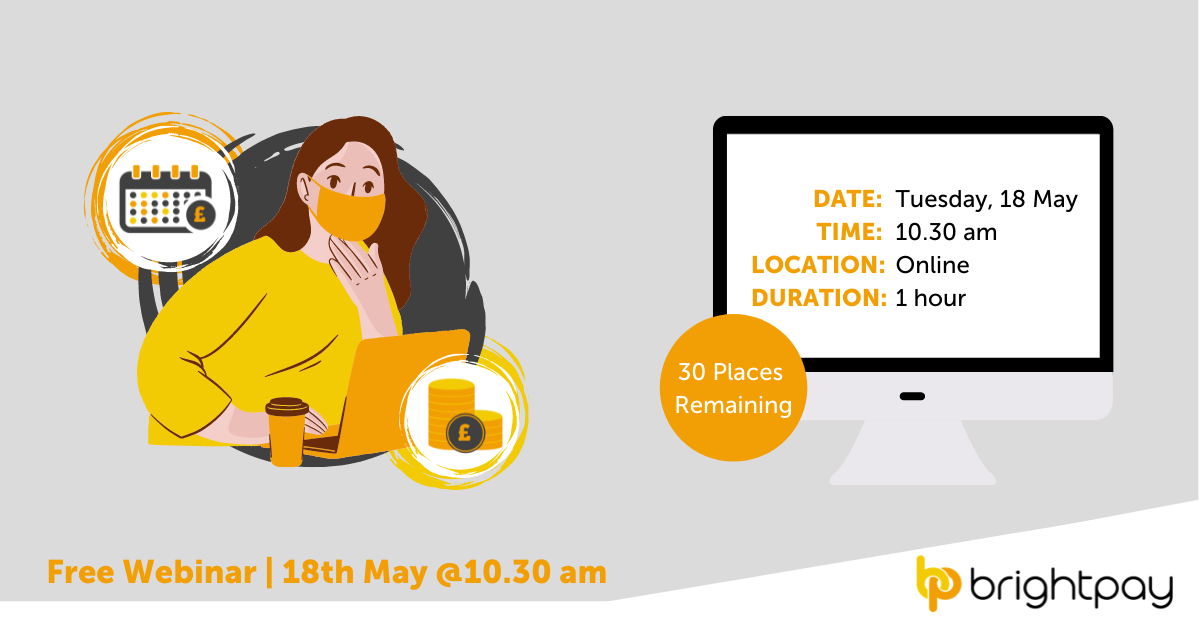

Finally, the country is beginning to reopen and there is an end of COVID-19 in sight! BrightPay are hosting a free online webinar where our team of experts discuss the recent changes to the furlough scheme including the extension of the scheme until 30th September 2021.

Join our upcoming webinar on 18th May at 10.30 am BST and learn:

- Changes to scheme eligibility

- The wind-down of subsidy rates

- The challenge of reference periods

- The dos and don’ts of furlough agreements

- How BrightPay caters for furlough pay

- COVID-19 & Redundancies

- Vaccine Policy – Do You Need One?

- Managing the annual leave backlog

Don’t miss out – book your free seat here

Free eBook

Download a free copy of our latest eBook: Top tips for managing employees as lockdown ends (and what you should avoid). We discuss the need for a Vaccine Policy and other challenges that employers and HR managers will face over the coming months as the country re-opens and employees start requesting annual leave.

Related articles:

May 2021

14

The payroll mistake that could cost you (and how to avoid a fine)

At the beginning of the pandemic, we saw a sudden rise in the number of employers who were not complying with their auto enrolment duties. The number of warnings issued to employers who failed to comply with their auto enrolment duties increased by almost 200% for the months of July, August and September 2020, compared to the previous quarter. The Pension Regulator (TPR) introduced more flexibility at the beginning of the pandemic for employers who may be struggling, allowing them more time to ensure their pension contributions were up to date.

This rise in non-compliance at the start of the pandemic coincided with a dip in both employee and employer pension contributions. Although auto enrolment responsibilities remained in place throughout the pandemic, including for employees who had been furloughed, some employees chose to opt out or reduce their contribution levels. As the country begins to reopen, pension contributions have now returned to pre-coronavirus levels. Now more than ever, employees are realising how important it is to save for their futures.

As levels of enforcement are also now back to normal, it is important that employers are staying on top of their auto enrolment duties.

What happens if you do not comply with your auto-enrolment duties?

1. You will receive a warning letter informing you that you must take care of your duties by a certain deadline.

2. If you do not meet the deadline, you will receive a statutory notice telling you to comply with your duties and/or pay any contributions you have missed or are late in paying. You may also be asked to pay any of your staff’s unpaid contributions and interest on missed contributions.

3. If you fail to comply with a statutory notice, you will be issued a penalty notice or you may be sent a fixed penalty notice. The fine is fixed at £400 and must be paid within the period set out in the penalty notice.

4. If you still do not comply with the statutory notice you may be sent an escalating penalty notice. This gives you a new deadline to comply, after which you will be fined at a daily rate of £50 to £10,000, depending on the number of staff you have.

In the year ending March 2020, TPR issued a total of £23.1m worth of fines to employers who didn’t comply with their auto enrolment duties, with one employer fined £350,000 for failing to re-enrol staff into its workplace pension scheme.

Of course, sometimes employers can make genuine mistakes when trying to keep up with auto enrolment and re-enrolment duties, however, these mistakes can be easily avoided when you use a payroll software that caters for auto enrolment and re-enrolment.

Use a payroll software that makes auto enrolment easy

If you are notified that you have eligible jobholders who must be enrolled into a scheme, you can have them all enrolled in just a few simple clicks as BrightPay allows you to enrol multiple employees at once. When enrolled, BrightPay will automatically generate letters, informing employees that they have been enrolled. The letters can be sent by email, printed, or shared via our online portal, BrightPay Connect, in a matter of seconds. Sharing employees’ letters through an online portal is not only convenient, but it also helps the environment by cutting down on paper. Read here about BrightPay’s sustainably efforts.

Auto enrolment is an ongoing responsibility, and your duties don’t end once you have enrolled your staff and sent them their letters. As employees get older or their qualifying earnings change, there may be new duties you need to perform. Luckily, BrightPay will closely monitor any changes and notify you of any new duties.

On the three-year anniversary of when your auto enrolment duties first began, you will need to re-enrol staff. Failure to re-enrol can result in a fixed penalty from TPR. BrightPay will notify you of when employees are due to be re-enrolled into a pension scheme, meaning you don’t need to try and remember this date yourself.

To find out more about how BrightPay can help you stay on top of your auto enrolment duties, check out our videos on auto enrolment or book a free online demo of our software to see it for yourself.

May 2021

11

Leaving lockdown: How to manage the annual leave backlog

Employers are well used to staff wanting to take holidays at the same time. It is inevitable that certain times of year like Easter or Christmas will be more popular than others. As we remain in lockdown, most employees will want to save their time off for when restrictions are lifted. Last year, key workers who did not get to take all their statutory annual leave entitlement due to COVID-19 were allowed carry over up to four weeks of unused holidays into the next two years. While this flexibility was necessary to protect workers' rights, it has caused an annual leave backlog that could become a real nightmare for employers to manage.

While we know that “nothing can be guaranteed”, we cannot help but feel optimistic about Boris Johnson’s tentative plan to ease all lockdown restrictions on June 21st, 2021. There is even an online petition asking the government to make June 21st, 2021 a one-off Bank Holiday, to be known as Merriweather Day, as an opportunity for families and friends to come together. Once this date was announced there was a huge scramble in workplaces for employees to get their requests in to have the week of June 21st off. While it might not be possible to please everyone and give them this time off, it is important that you deal with annual leave requests in a way which is transparent and fair.

Some employers are choosing to force staff to take holidays at a time that better suits the business. While some employees may be perfectly happy with these tactics being enforced, many others will feel hard done by that they do not have any control over the dates that they take off. Offering to buy back employees’ holiday days that are in excess of the statutory minimum is another method that is being used, however, this could end up being expensive and hard to manage for employers. So, what is the best option for all parties involved?

An employee app that manages staff holidays

BrightPay Connect, an optional add-on to BrightPay’s payroll software, is the simplest way to manage your staff's annual leave – headache free. BrightPay Connect streamlines leave requests and leave approval. This is how it works:

- The employee requests leave from the calendar in their BrightPay Connect mobile app or from their PC or tablet. This means employees can request leave anytime, anywhere.

- The employer (or the person who has been assigned to oversee the management of that employee’s annual leave) is notified of the request on the dashboard of their own BrightPay Connect account.

- The employer/manager can then either approve or deny the request at the click of a button.

- The employee will receive a notification on their device informing them of whether their request has been approved or denied.

The most popular policy of granting annual leave is on a first come, first served basis. While this policy is the most fair; depending on the system in place, it can still be difficult to keep track of which employee requested the leave first. With BrightPay Connect, you don’t have that problem as you will be able to see the order in which requests come in. Employees also have the ability to request half days or request to cancel leave that has already been granted.

In the employer’s dashboard, from the calendar tab, the employer can view a real time, company-wide calendar. At a glance, employers see which employees are on leave and the type of leave. This is especially handy nowadays when staff may be working from home and it is hard to keep track of who is off and who is not. Cloud integration means any approved leave requests will flow directly back to your BrightPay payroll software on your PC or Mac.

Using BrightPay Connect to manage employee’s leave means less conflict in the workplace and less stress all round. Book a free demo today to find out the many other ways BrightPay Connect can improve employer/employee relationships.

Register for our upcoming free webinar where we will discuss preparing for the safe return to the workplace, the furlough wind-down, redundancies and vaccine policies.

Download our free whitepaper on tips for managing employees as lockdown ends. The guide includes: important HR tips and best practices as we approach the return to workplaces. Plus, our team of employment law experts reveal what you should avoid: https://t.co/Fwm24GNpob #payroll pic.twitter.com/obedP7QG1l

— BrightPay UK (@BrightPayUK) April 27, 2021

Related articles:

May 2021

4

Customer Update: May 2021

Welcome to BrightPay's May update. Our most important news this month include:

-

BrightPay celebrates Earth Day 2021

-

The Coronavirus Job Retention Scheme: Past, Present & Future

-

Can employees be furloughed more than once?

Don’t miss the P60 deadline

You need to provide a P60 for each employee on the payroll who was working for you on the last day of the tax year (5 April). All employers are legally obliged to issue P60s to employees by 31 May. You could face hefty fines from HMRC if you miss the deadline.

How to manage employees as lockdown ends

As the UK draws closer to the end of lockdown and employees return to the workplace from furlough, employers and HR managers have a busy few months ahead. In this guide, we highlight important HR tips and best practices to remember as we approach the return to the workplace (and mistakes to avoid).

Connecting payroll & payments

Eliminate the need to create bank files and forget the manual workload associated with making payments to employees and subcontractors. Join our free upcoming webinar to find out more about BrightPay’s new Direct Payments functionality. Click here to find out more.

Leaving Lockdown: Furlough, Redundancies & Vaccines in the Workplace

This webinar will discuss the furlough wind-down, redundancies and how to implement a vaccine policy in the workplace. Discover how the furlough rules are changing in May and how the government subsidy will gradually decline from July onwards.

Never lose your payroll data again

With our add-on product, BrightPay Connect, you don't need to worry about manually backing up your payroll data. BrightPay Connect maintains a chronological history of your backups. You can restore or download any of the backups to your PC or Mac at any time.

Upcoming webinar – How to choose the right payroll software for your business

There are so many payroll software providers on the market and each offer different packages and add-on products that choosing the right one for your business can become overwhelming. Join our free online webinar where we can help you make the right decision.

Apr 2021

29

Don’t miss the P60 deadline

All employers are legally obliged to issue P60s to employees by 31 May. This is a deadline, so aim to send them before this date. You can use your payroll software, such as BrightPay, to produce them. They can be issued to employees in paper form or electronically. Employees need their P60 to claim back overpaid tax, to apply for tax credits, or as proof of income if applying for a loan or a mortgage.

Does this include all employees?

You need to provide a P60 for each employee on the payroll who was working for you on the last day of the tax year (5 April). Therefore, you’re not required to issue P60s to employees who have left your business during the tax year.

How do I issue P60s in BrightPay?

- The P60 option is located within the Employees menu

- Select an employee who is in active employment as of 5th April from the left-hand listing

- Click P60 on the menu bar and simply select the P60 option you require

![]()

Go paperless. We encourage employers to supply P60s digitally to employees. There are many digital options available to you in BrightPay such as email or through the secure online portal, BrightPay Connect. If you do decide to print P60s, there is no need to buy special print paper, as P60 layouts produced by BrightPay have been approved by HMRC for printing on to plain paper.

Read about BrightPay’s sustainability journey.

What happens if I miss the deadline?

If you miss the 31 May deadline to issue P60s to employees, you could face hefty fines from HMRC. The initial penalty for missing the deadline is £300, followed by an additional fine of £60 per day after that. So, if you miss the deadline, make sure to give your employees their P60s as soon as possible or the fine will keep increasing. However, if you miss the P60 deadline due to a genuine error and you take steps to issue the P60 as soon as possible, a fine is less likely.

To assist employers in completing the 2020/21 tax year and transitioning to tax year 2021/22, BrightPay have compiled a list of frequently asked questions, answered by payroll experts.

Related Articles:

Apr 2021

28

How BrightPay celebrated Earth Day 2021

As you may know, at BrightPay we recently moved into our new offices which are purpose built to be energy efficient, affording us the opportunity to record and monitor our carbon emissions. It's a new start for the team and inspired by our energy efficient offices we would like to encourage employees to live a more sustainable lifestyle overall.

To help raise awareness amongst our employees, we have established the BrightPay Green Team which is made up of 12 team members, across multiple departments. The Green Team have been working on coming up with creative ways to make the company's operations more environmentally friendly. They also aim to encourage change amongst colleagues on an individual level, at home, at work and in the community.

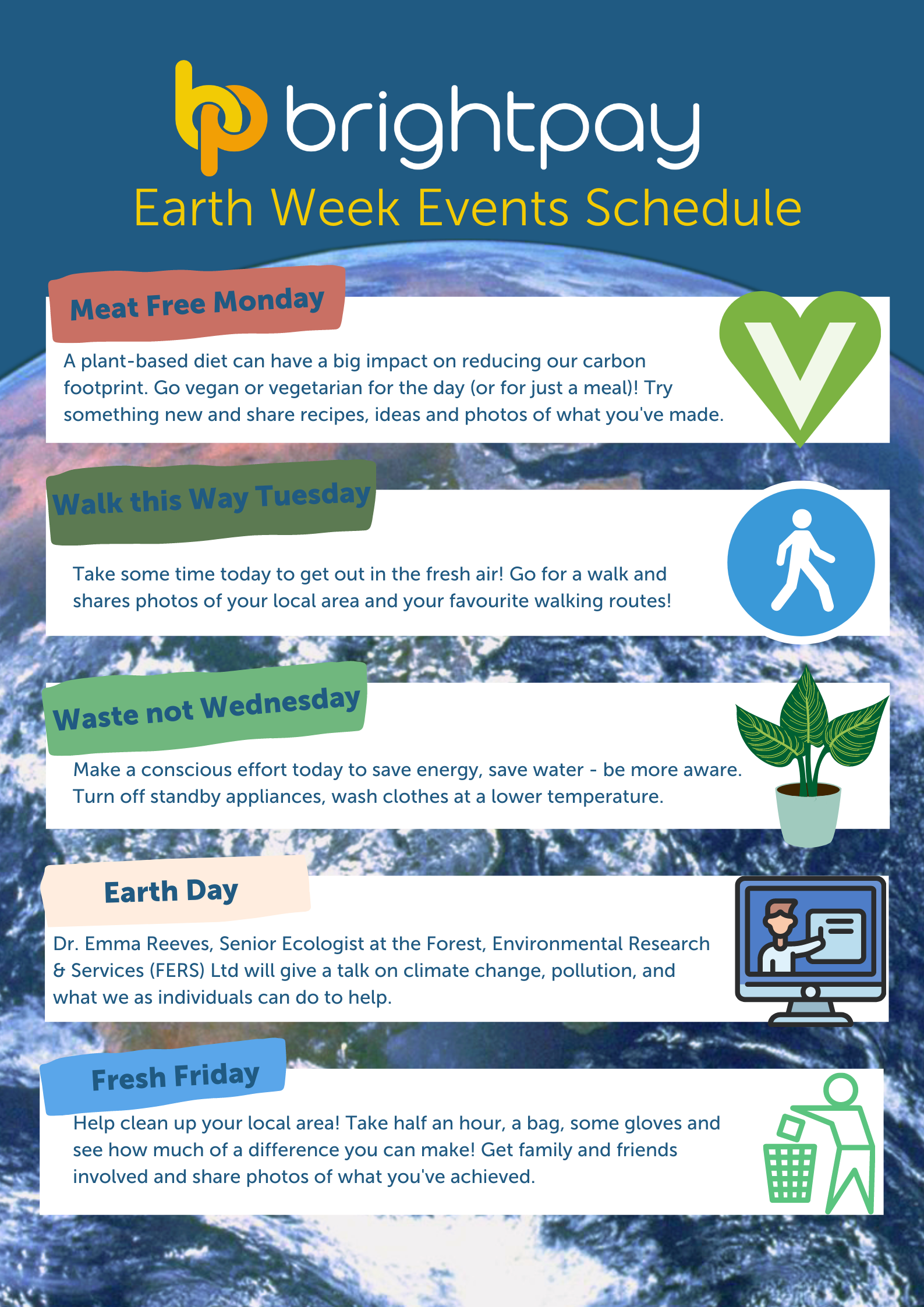

In our first campaign to raise awareness, the Green Team celebrated Earth Day 2021 (April, 22nd) with a number of activities planned throughout the week.

As we continue to work remotely, we encouraged everyone to get involved and share photos of their activities online.

The BrightPay Team getting involved in Earth Day celebrations.

We started off our ‘Earth Week’ with ‘Meat Free Monday’. The production of meat and dairy products account for around 14.5% of global greenhouse gas emissions each year and so we encouraged employees to eat vegetarian or vegan meals for the day. On Tuesday we encouraged employees to take a walk in their local area. On Wednesday we asked employees to unplug devices, cut down on emails and have a ‘digital clean-up' to save C02 emissions. Thursday, April 22nd, was Earth Day and to celebrate we had a live online talk from Dr Emma Reeves, Senior Ecologist at the Forest, Environmental Research & Services (FERS) Ltd who discussed reducing our waste, the benefits of living a more eco-friendly lifestyle and the small changes we as individuals can make to help the planet. Friday was ‘Fresh Friday’ where we encouraged employees to go litter picking in their local areas.

Earth week was a success and we accomplished what we set out to do, which was to raise environmental awareness amongst our colleagues and encourage involvement in the company's sustainability efforts.

We will continue our dedication to creating a greener future. Subscribe to BrightPay’s sustainability newsletter to follow our journey.

Related articles:

Apr 2021

23

Working from Home Tax Relief 2021/22

Working from home became normality for many people since the beginning of the COVID-19 pandemic in March 2020, and still is one year later. A recent survey estimates that 60% of us are still working from the confines of our own homes.

Some good news is that if your employer requires you to work from home, you can benefit from the working-from-home allowance. Employers can pay you £6 a week extra tax-free. And if your employer doesn’t add this allowance to your payslip, you can claim it yourself.

Employees can claim tax relief for additional household costs if you have to work from home on a regular basis, either for all or part of the week. This includes if you have to work from home due to COVID-19. However, you cannot claim tax relief if you choose to work from home. You can apply through the government's dedicated site where you can also check if you are eligible to claim. To claim, you'll need a Government Gateway User ID and password.

Additional household costs include things like extra heating & electricity expenses, work-related calls, internet connection and metered water bills. They don’t include costs that would stay the same whether you were working at home or in an office, for example, rent.

You’ll get tax relief based on the rate at which you pay tax. For example, if you pay the 20% basic rate of tax and claim tax relief on £6 a week you would get £1.20 per week in tax relief (20% of £6). You do not receive this money by cheque as it is done by altering your tax code that indicates to your employer how much tax to take off your payslip. Less tax will be taken off your payslip, meaning you’ll take home more.

You may also be able to claim tax relief on equipment you’ve bought for work, such as a laptop, office chair or mobile phone.

You can now claim for the 2021/22 tax year.

Related Articles:

Apr 2021

21

The true cost of payroll processing and 3 ways to reduce the hidden impact on payroll

With little automaton and integration, calculating payroll and settling payments can be a complicated end-to-end process. The complexity of traditional payment flows makes reconciliation difficult, and this is further compounded by an outdated banking infrastructure, with its reliance on manual process and file uploads.

As complexity increases, so too does cost. In the current economic climate, there may be a clear temptation to delay the technological upgrades required to streamline this process. But, as recent research has shown, by not shedding legacy technology and shoring up operational efficiency, companies are adopting an increasingly risky strategy – especially when it comes to the payment processes that sit at the very heart of a business – payroll.

Payment processes incur both hard and hidden inefficiencies

What is clear from the research is that payment processes incur both hard and hidden inefficiencies. The biggest hard cost, as reported by 39% of businesses surveyed, is the hours spent on manual processes.

Depending on the payroll software used, the current payroll process can be error-prone and time-consuming - a fragmented process relying on manual entry, including:

- Manual entry of payee details, tax codes and reference numbers

- Archaic file upload system

- Time taken to check, and often double check the figures, to fix the file errors and incorrect value inputs, to deal with payment rejections and to action the emergency pay procedures, should deadlines be missed, or payments be redirected.

The Bacs system has a 3-day cycle to payment completion so even once files are uploaded and payments are processed, there is still a wait for those payments to clear.

The hidden costs pack a bigger punch

But, it’s the hidden costs that can pack a bigger punch, with 65% of employment services companies agreeing that these actually outweigh the hard costs.

Take, for example, the manual process of payroll - the hard cost is the salary paid against the quantifiable hours spent on the process, while the hidden cost is where those hours could have been better spent and the impact that it could have had on customer experience and satisfaction, competitor differentiation, brand reputation, business agility and team morale.

3 ways to reduce the hidden impact on payroll

1. Be responsive to the needs of the Instant Economy

The Instant Economy – an economy of instant experiences, instant information and instant services in both consumer and business lives. But digital, real-time, and responsive business services are required to power the Instant Economy, and a fast digital payments solution must be at the heart of the services infrastructure.

The Instant Economy is increasingly becoming the benchmark for customer experience. When applying Instant Economy thinking to payments, it is not about making them happen quickly. That is just the start. It’s about building innovative products on top of a real-time and responsive, digital payments infrastructure.

Accountants and payroll bureaus need to innovate and evolve to meet the expectations of a market that is accustomed to the benefits of faster, more instant payments. And luckily this is now easier than they think, thanks to companies like BrightPay.

2. Use payment integrated payroll

Leveraging Modulr’s direct access to the critical payments infrastructure, BrightPay can now offer its customers an alternative to the legacy system and a more agile and reliable method of running payroll. This new functionality will integrate payroll and payment processes and remove the reliance on file upload to provide a better end-to-end solution for both accountants and payroll bureaus, and their clients.

The Modulr platform allows BrightPay to remove many of the manual processes currently used for payments processing and replace them with automation. This in turn reduces both the financial impact of the hours spent on payroll and the number of manual errors made when processing payments, which becomes particularly critical for payroll bureaus dealing with multiple clients.

3. Automate to Innovate

Using end-to-end automation in this way is key to driving efficiency and reducing costs, both hard and hidden - replacing the legacy payroll system with a real-time and responsive, digital one, and reducing a two-hour process down to 30 seconds.

Payments can be triggered automatically, from one platform, incurring no more manual processing or checking that funds have cleared. There’s no need to extract files to upload to banking systems or wait for Bacs payments to clear and errors to surface; last minute changes can be processed at the last minute. Payments can be paid in seconds, even outside of banking hours and with full visibility for faster and easier reconciliation.

Delay, and there’ll be a price to pay

So, accountants and payroll companies tempted to put off the technological upgrades required to streamline what is traditionally a complicated, error-prone and time-consuming payroll process should take heed – delay and there’s a high price to pay. And, not just in terms of the hard cost of the process itself, but also the hidden costs which are now shown to be more far-reaching.

But there are alternatives. Digital technologies are revolutionising many of the traditional ways of doing things, including payroll, resulting in better end-to-end journeys. Automation and systems integration are the key to realising digital transformation ambitions, while reducing costs, both hard and hidden. And by harnessing Modulr technology, BrightPay can now offer its customers both.

BrightPay and Modulr are together transforming the way accountants and payroll bureaus do business, by streamlining and automating their payments and payroll processes. Book a demo of BrightPay today or watch this short video to see the BrightPay & Modulr integration in action. On 22 April, join the BrightPay and Modulr teams for a free webinar, as we explore what you need to know about this Direct Payments functionality. Plus, we will demonstrate how quick and seamless the process is in both BrightPay and Modulr.

Related Articles:

Apr 2021

19

BrightPay celebrates Earth Day 2021

The first Earth Day launched fifty-one years ago in response to an emerging environmental consciousness, catalysed by a number of environmental disasters in the ‘60s. Although the stakes only grow as the years go by, we can appreciate that there has been a profound cultural shift since it began.

At BrightPay we are committed to a cleaner, greener future for all. This commitment will see us developing our business towards ecological sustainability at both a company and an individual level. Our new offices (opening soon!) are purpose built to be energy efficient, affording us the opportunity to record and monitor our carbon emissions. In addition to this, we have established the Green Team, an internal company initiative, to educate, promote and inspire sustainability among our colleagues and our loyal customers.

The Green Team members are brimming with ideas to identify and support the implementation of solutions to help BrightPay operate in a more environmentally sustainable way. Our plans, including those for Earth Day, are grounded in the belief that small actions at the individual level can build to create a larger change. We will leverage our individual power to influence, as an employee, a consumer, a voter, and as a member of our community.

In our first campaign to raise awareness, the Green Team will be celebrating Earth Day 2021 with a number of activities planned throughout the week. Take a look below at what we have planned. On Earth Day, we will be inviting Dr Emma Reeves, Senior Ecologist at the Forest, Environmental Research & Services (FERS) Ltd to discuss climate change, pollution, and what we as individuals can do to help.

Our dedication to the environment won’t stop at the end of the week. Subscribe to BrightPay’s sustainability newsletter to follow our journey.