Apr 2021

14

The Coronavirus Job Retention Scheme: Past, Present & Future

With the Coronavirus Job Retention Scheme (CJRS) to remain in place until September 30th, 2021 in the hope of aiding economic recovery, we are going to look at some of the key milestones of the scheme so far and how the scheme will change between now and September.

March 2020 – June 2020

The government paid 80% of furloughed employees wages up to a cap of £2,500, as well as employer National Insurance contributions and pension contributions. The rules at this time meant that employees had to be fully furloughed for a minimum of 21 days, and they were not allowed to work while they were on furlough.

July 2020 – October 2020

CJRS entered its second phase on 1 July 2020, and during these few months, the CJRS was only available to employers that have used CJRS 1 and only for employees they have previously furloughed. The government contribution to employees’ wages reduced month-on-month as the scheme was winding down. There were also some benefits to this part of the scheme, as flexible furlough was introduced, allowing furloughed employees to return to work part time, with no minimum furlough period.

October 2020 – April 2021

CJRS was once again due to end, but after mounting pressure, the scheme was extended at the eleventh hour, initially until March and then April of this year. The extended months of the furlough scheme were nicknamed CJRS 3 as it brought with it a new set of scheme rules, including the 80% government subsidy being reinstated.

April 2021 – September 2021

During the Budget, the chancellor announced that the furlough scheme would be extended yet again, and this time, it has been extended until the end of September 2021. With this extension, apart from eligibility changes in May, the rules will continue as they are currently until the end of June. However, the levels of subsidy support will change again from 1st July, where employers will be asked to contribute a percentage of their employees' wage from July onwards as the scheme winds down.

The past year has been very frustrating for payroll processors. Not only had you the added workload of processing furlough pay and making subsidy claims, but you also had to learn about the various changes to the Coronavirus Job Retention Scheme.

There was a lot of time involved in learning, and keeping up to date with changes, which were being announced very frequently. At the beginning, there were times when changes were even being made every week, and it was difficult to keep up to date with the latest guidance.

At BrightPay, we kept the payroll software up to date to cater for the relevant scheme changes. We tried to automate as much as possible in the payroll software to make your life easier. BrightPay has a furlough pay calculator, including support for flexible furlough, which is something many other payroll software providers did not cater for. We also have a CJRS claim report, to make it easier for users when calculating amounts for furlough claims.

In a recent survey, BrightPay achieved a 98.6% rating for our overall handling of COVID-19 including customer support, payroll upgrades, COVID-19 webinars and online support. We also won a COVID-19 Hero Award, and this is because of our response to COVID-19 and how we have helped our customers throughout the past year. The judges recognised that we went above and beyond to support payroll professionals at a time when they were under pressure with government schemes and trying to interpret guidance.

Join our free webinar where we will discuss CJRS rule changes, furlough extensions and other HMRC quirks.

To learn more about BrightPay’s features and how they can benefit your business, book a free demo today.

Related articles:

Apr 2021

12

CJRS: Recent Changes to Furlough Reference Period Rules

The Coronavirus Job Retention Scheme (CJRS) has been in place for over a whole year now. With this milestone comes changes to how an employee's furlough pay should be calculated. If you’re in a position where employees are fully furloughed, you do not need to work out the employee’s usual hours and furloughed hours. However, if an employee is flexibly furloughed, you will be required to work out the employee’s usual hours, their actual hours worked and their furloughed hours for each claim period.

How to calculate hours for workers who were eligible for furlough under the original scheme

Regardless of whether these workers were actually placed on furlough, the following three rules should be followed when working out furlough pay.

- For employees with fixed hours, the usual hours calculation is based on their normal contractual hours at the end of the last pay period ending on or before 19th March 2020. If an employee with fixed hours was on annual leave, off work sick, or on family-related statutory leave at any time during the last reference period, the usual hours should be calculated as if the employee had not taken that leave.

- Where the employee’s pay varies, their ‘usual hours’ will be the higher of the average number of hours worked in the 2019/20 tax year or the hours worked in the corresponding calendar period in the year before the furlough claim period.

- As we have passed the one-year anniversary of the furlough scheme, where the furlough claim period is March 2021 onwards, the corresponding calendar period 2019 should be used, as opposed to 2020. This is to prevent the issue where an employee may have been furloughed in the same month last year, and so would only have received 80% of 80% of pay. If your employee did not work for you in the lookback period for the month you’re claiming for, you can only use the averaging method to calculate 80% of their wages.

How to calculate usual hours for workers who were not eligible for furlough under the original scheme

For workers who were not eligible for furlough under the original scheme, for example, new joiners after the previous cut-off date of 19th March 2020, a different pay reference period exists.

Where these employees are contracted to work a fixed number of hours, the calculation is based on the wages payable in the last pay period ending on or before 30th October 2020.

Where neither 19th March 2020 nor 30th October 2020 reference dates apply, the employee is not eligible for periods starting before 1st May 2021. If you made a payment of earnings to the employee which was reported to HMRC on an RTI submission between 31st October 2020 and 2nd March 2021, they may be eligible for periods starting on or after 1st May 2021 and their reference date will be 2 March 2021.

For other employees, you’ll calculate ‘usual hours’ based on the average number of hours worked in the 20/21 tax year up to the day before the employee’s first day spent on furlough on or after either:

- 1 November 2020 (for those with a reference date of 30 October 2020)

- 1 May 2021 (for those with a reference date of 2 March 2021)

If you would like further information on how the furlough scheme rules are going to change between now and September 2021, join us for our upcoming free webinar where we will examine these changes and what they mean for your business.

Related articles:

Apr 2021

7

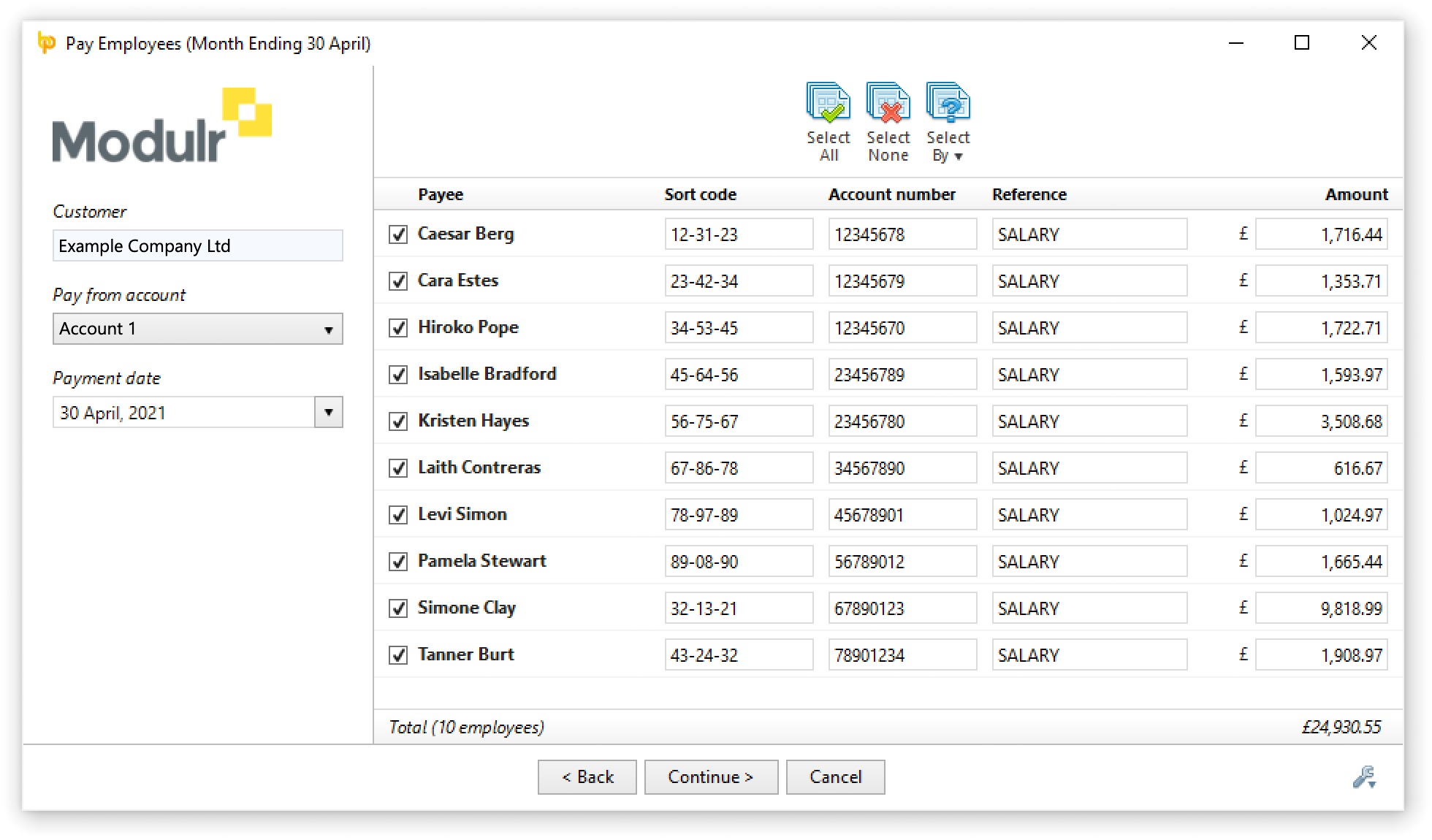

Pay Employees Directly through BrightPay

Collaboration is at the centre of BrightPay’s plan of continuously addressing the challenges our customers face by ensuring we can offer new and innovative solutions. Our partnership with Modulr, the UK payments platform, achieves exactly this. The API integration will significantly simplify the task of managing payroll payments for thousands of our customers across the UK. Through Modulr, BrightPay’s customers can eliminate the need to create bank files and the manual work associated with making payments to employees.

What does this integration mean for BrightPay customers and their clients?

The Modulr BrightPay integration enables accountants to provide their clients with a new service, the option of a seamless payroll workflow. Using Modulr, accountants and bureaus can offer accounts to individual clients, which allows payroll payments to be initiated within BrightPay payroll software without the need for payment files. Its functionality provides numerous benefits for accountants and their clients.

- Save time: With Modulr, you have access to the Faster Payments Service (FPS) scheme, which does not require you to upload any bank files. This eliminates the many frustrating steps traditionally associated with making Bacs payroll payments.

- Pay employees faster: Faster Payments Service, launched in 2008, is a payment scheme that is far faster than the traditional Bacs method. Instead of taking three days to process payments, FPS settles payments in 90 seconds. Conveniently, you can also make payments 24/7, 365 days a year, with the flexibility of instant emergency payments.

- Minimise error: An integrated payments solution can help cut down on costly data entry errors. By using an automated system, no manual input is required, which improves accuracy and reduces error. Moreover, payments must first be approved by clients on their individual Modulr dashboard before being sent.

- Increase security: Payments are made using a highly secure and compliant network. Modulr’s infrastructure is designed to ensure the highest level of data and system confidentiality and is compliant with the highest industry standards and regulations.??

Who is Modulr?

Modulr is the tech behind the tech. It’s likely you’ve been using their payments infrastructure without even knowing it. They are the award-winning payments partner behind Revolut, Sage, Iwoca and over 10,000 businesses (and millions of customers). The fintech company has established itself as a leading alternative to wholesale and commercial payments. It is FCA approved, has direct access to Faster Payments and is a partner of Visa, granting it direct access to the industry-leading global payments network.?

Pricing Structure

We want our customers to have the best experience possible and this collaboration with Modulr is an important step in this. We are confident that this partnership will improve the payroll workflow. We maintain that having a seamless payroll service should be available at an affordable price point and as our BrightPay customers know, we don’t believe in complicated pricing structures, opaque amounts or unfair selling tactics. That’s why BrightPay will not be receiving any referral fees for this service. This allows our customers who register with Modulr to avail of it at a highly competitive rate.

Schedule a personal demo:

Interested in learning more? Click here to learn more about BrightPay’s integration with Modulr and talk to a member of our team today to discover how BrightPay can improve your payroll processes.

Free webinar:

On Thursday, 22 April, join the BrightPay and Modulr teams for a free webinar, as we explore what you need to know about this Direct Payments functionality. Plus, we will demonstrate how quick and seamless the process is in both BrightPay and Modulr.

Related articles:

Apr 2021

1

Customer Update: April 2021

Welcome to BrightPay's April update. Our most important news this month include:

-

BrightPay 2021/22 is Now Available – What’s new?

-

Ensure a smooth switch into the New Tax Year

-

The Impact the National Minimum Wage Increase has on Furloughed Employees

Furlough Extension: How the Rules are Changing

The furlough scheme has once again been extended, this time until the end of September 2021. The rules in relation to scheme eligibility, the levels of subsidy support, and the reference period used for newly eligible employees are all due to change between now and September.

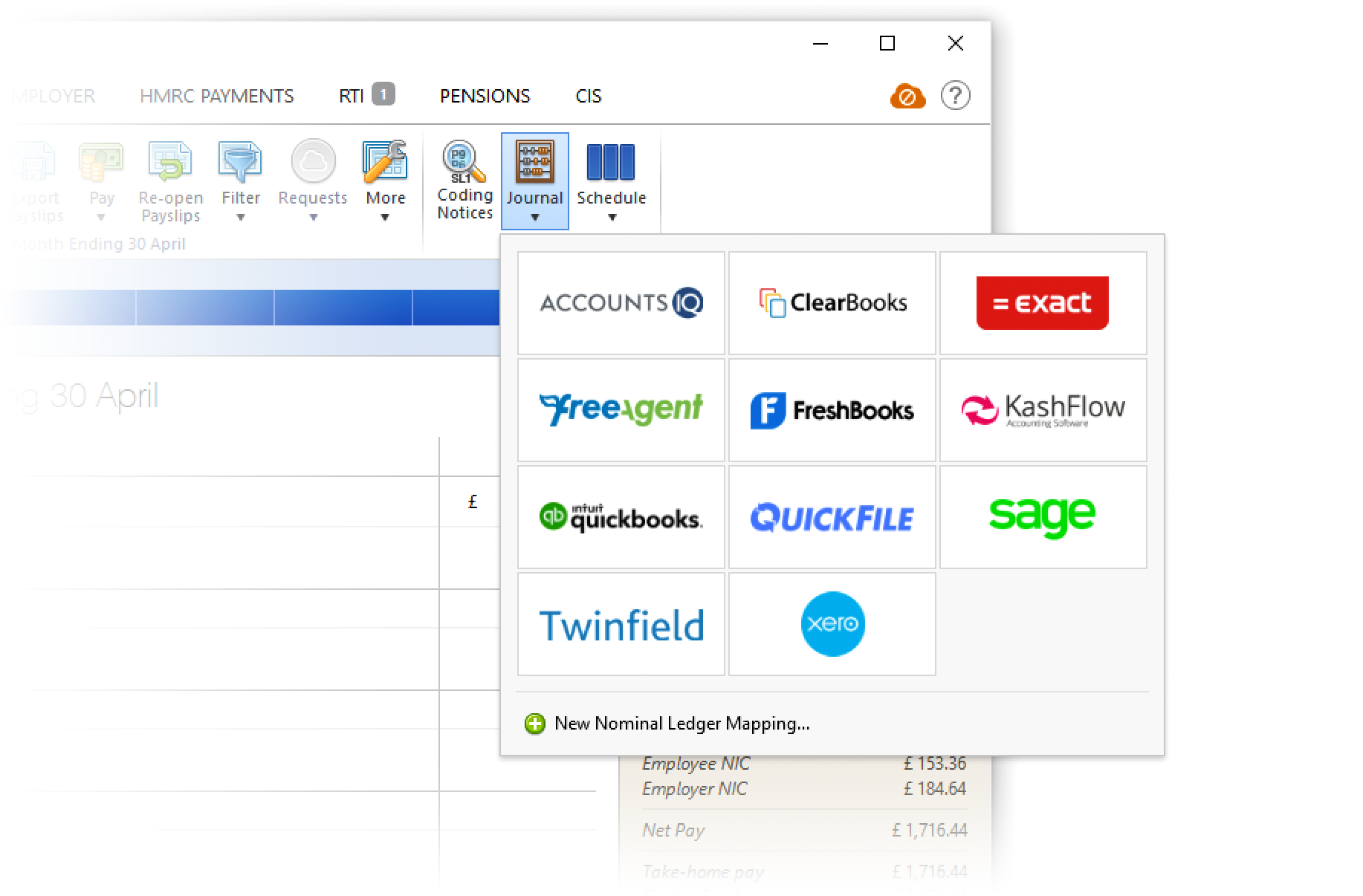

Introducing BrightPay’s New Integration with Clear Books, FreshBooks, QuickFile and Zoho

We are delighted to announce our new API integration with even more accounting software solutions including Clear Books, FreshBooks, QuickFile and Zoho. This joins our growing list of Integration options created by us to ensure our customers save time and reduce the risk of errors.

Coming Soon: Pay Employees Directly through BrightPay

BrightPay’s new integration with Modulr will give you a fast, secure and easy way to pay employees through BrightPay. Processing payroll and paying employees shouldn’t be separate tasks and we have a solution! Coming next week.

IR35 - Are you Ready?

IR35 rules take effect 6th April. It is fast-approaching and recent studies found that 30% of businesses are unprepared despite organisations having had an additional year to prepare for the extension. Take action now with just under 1 week to go.

Greener Supply Chain with BrightPay

Here at BrightPay we take environmental responsibility very seriously and are committed to developing our business towards ecological sustainability at both a company and an individual level. Our new carbon efficient offices will open in 2021. We have also recently established a passionate Green Team to educate, promote and inspire sustainability to our employees and our loyal customers. Subscribe to BrightPay’s sustainability newsletter to follow our journey.

Mar 2021

31

Furlough extension: How the rules are changing

The furlough scheme has once again been extended, this time until the end of September 2021. The rules in relation to scheme eligibility, the levels of subsidy support, and the reference period used for newly eligible employees are all due to change between now and September.

Levels of Subsidy Support

1st November 2020 to 30th June 2021

Under the existing scheme rules, employers can claim grants covering 80% of wages up to a cap of £2,500 for the hours an employee is not working. Where the employee is not working, the employer does not have to contribute towards wages for unworked hours, but they are responsible for paying employer NICs and pension contributions. Where an employee is on flexible furlough, or also known as partial furlough, employers have to pay full pay for any hours worked.

The Government subsidy will continue at this level until 30th June 2021, but from 1st July, employers will be asked to contribute a percentage of their employees' wages as the scheme winds down.

1st July 2021 to 30th September 2021

For the month of July, the Government will contribute 70% of wages up to a maximum of £2,187.50 per month for unworked hours. The employer will also have to contribute 10% of wages so that the employee receives 80% of their usual wages for any hours not worked, (up to the cap of £2,500).

For August and September, the Government subsidy will drop to 60% up to a cap of £1,875 per month, with the employer having to top up the additional 20% so that the employee receives 80% of their wages (again, up to the cap of £2,500).

Employers must continue to pay the employer NICs and pension contributions on the Government subsidy for the hours not worked. Employers can also continue to choose to top up their employees’ wages above the 80% total and £2,500 cap for the hours not worked at their own expense.

Scheme Eligibility

On or before 30th April 2021

For periods ending on or before 30th April 2021, you can claim for employees who were employed on 30th October 2020, as long as you have made an RTI submission to HMRC between 20th March 2020 and 30th October 2020, notifying HMRC of a payment made to that employee.

Employees made redundant, or who stopped working for you, after 23rd September 2020 can be rehired and placed on furlough under the scheme up until 30th April 2021. This is allowed as long as the employee was employed as of 23rd September 2020 and included in an RTI submission between 20th March 2020 and 30th October 2020.

On or after 1st May 2021

For periods starting on or after 1st May 2021, you can claim for employees who were employed on 2nd March 2021, as long as they were notified to HMRC on an RTI submission between 20th March 2020 and 2nd March 2021. You do not need to have previously claimed for an employee before the 2nd March 2021 to claim for periods starting on or after 1st May 2021.

The Government has not yet produced guidance for calculating hours for workers who were first on the payroll after 30th October 2020 but will do so shortly. This will only be relevant for workers furloughed for the first time from 1st May 2021 onwards.

Free Furlough Webinar

Join the BrightPay team for a free webinar where they explore the upcoming changes to the furlough scheme, how BrightPay payroll software caters for CJRS and furlough, and answer any questions that you may have.

Related Articles:

Mar 2021

29

Informally Payrolling of Benefits Changes for 2021-22

From 2021-22 onwards the option will no longer be available for employers to informally payroll benefits by making an agreement with HMRC. Informally payrolling benefits meant the employer did not have to register for payrolling of benefits before the start of the tax year and made an agreement with HMRC. All employers that now wish to payroll benefits in the tax year 2021-22, even if they had this previous arrangement with HMRC, must register with HMRC using the online Payrolling Benefits in Kind (PBIK) service before 6th April 2021 (if you had not already registered last year).

Employers can register with HMRC using the PBIKs service. Registering with HMRC allows you to payroll tax on benefits and expenses without the need to submit a form P11D after the end of the tax year. P11D(b) returns will still have to be submitted and must include the total values of all payrolled and all non-payrolled benefits.

Using the online service, you can:

- Choose which benefits and expenses you want to include in the payroll for the following tax year.

- Add or remove benefits and expenses.

- Exclude employees who receive benefits or expenses but don’t want them payrolled. For these employees you must continue to report the benefit or expense on a P11D (you can exclude an employee at any time in a tax year but once you’ve done this you can’t reverse the decision, in year).

The benefits you wont be able to payroll are:

- Employer provided living accommodation

- Interest free and low interest (beneficial) loans

Tax is collected on benefits and expenses by adding the benefit or expense to the employee’s taxable pay in payroll. Tax is then deducted or repaid as usual as per the employee’s tax code and the details reported on the Full Payment Submission to HMRC. Payrolling of benefits and expenses can be processed for employees in BrightPay 2021-22 and a PBIK form can be produced for employees.

Related articles:

Mar 2021

24

Payroll in the Connected Era: How integration has transformed the world of payroll

Application programming interface (API) integration makes our lives easier by simplifying processes. Put simply, API integration facilitates connectivity between two or more applications. APIs are everywhere and many of us use them on a daily basis. An example of an API is using your Facebook login credentials to sign into a third-party website or when you use your PayPal account to pay on an e-commerce site.

How can API integration help simplify your payroll processing?

BrightPay’s integration with HMRC, accounting software packages, pension providers and an employee self-service portal can help you improve your business and make life easier for you when processing payroll. Communication between BrightPay and other platforms means you can halve the amount of time that needs to be spent entering payroll data.

Some of the benefits of API integration when processing payroll include:

- Increased efficiency

- Increased productivity

- Time savings

- Reduced errors

- Data accuracy

- Simple processing

Coming soon: Pay employees directly through BrightPay

Coming soon to BrightPay – our latest API integration with payment platform Modulr will allow you to pay your employees quickly and securely, directly through BrightPay. Saving you time, maximising efficiency, and eliminating costly payroll errors. Learn more about BrightPay's integration with Modulr here.

Upcoming Webinar

On Tuesday, March 30th at 11am, join us for a live webinar where we will discuss the benefits of integration between your payroll software and your accounting software. We will discuss how BrightPay’s integration with Accounts IQ, Clear Books, FreeAgent, FreshBooks, Kashflow, Quickbooks, (Online), QuickFile, Sage One, Twinfield, Xero and Zoho can streamline payroll processes. There will also be a live demonstration of how this integration works within the software.

Webinar Agenda:

- The importance of automation

- What is payroll journal integration?

- How BrightPay’s journal integration can help your business

- The benefits of integrated payroll & accounting systems

- Other API integrations in BrightPay

Book your place now to join the live webinar on Tuesday, March 30th at 11am.

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Related articles:

- Payroll Software: Why integration with accounting packages is a must

- BrightPay announces API integration with AccountsIQ

- What’s not to LOVE about BrightPay’s integration with FreeAgent

Mar 2021

22

BrightPay 2021/22 is Now Available. What's New?

BrightPay 2021/22 is now available (for new customers and existing customers).

2020 was challenging. Many of our development plans for the year had to be changed or postponed due to the need to cater for the Coronavirus Job Retention Scheme (CJRS) and the Coronavirus Statutory Sick Pay Rebate Scheme (CSSPRS) in BrightPay (not to mention the withdrawn-at-the-last-minute Job Support Scheme (JSS), which we invested many development hours on to no avail). We also have an Irish version of BrightPay, which likewise required additional time and attention on the equivalent schemes in the Republic of Ireland. And of course all of this had to be done in suboptimal conditions, with staff working remotely from home, often with young children. Demanding as it was, our team really stepped up, and as a company we were awarded with the COVID Hero Supplier Award at the Accounting Software Excellence Awards 2020.

At the same time, we have been working hard to bring a version of BrightPay to the cloud. While we have nothing to announce just yet, I can confirm it's going well, but it is still very much in development. We have a beta version planned, but cannot yet commit to a timeframe.

And so, given the time spent on COVID-19 features, along with that on cloud development, there hasn't been as much time as in previous years to spend on new features for BrightPay 2021/22. But we do have some new features, and we hope you'll find them useful. Rest assured that time-constraints have not caused any sacrifices to be made on quality – our goal to make the best payroll software continues as usual.

Here’s a quick overview of what’s new in 2021/22:

2021/22 Tax Year Updates

- 2021/22 tax bands. The emergency tax code has changed from 1250L to 1257L. When importing from the previous tax year, L codes are uplifted by 7, M codes are uplifted by 8 and N codes by 6.

- 2021/22 employee and employer National Insurance contribution rates, thresholds and calculations.

- 2021/22 Student Loan and Postgraduate Loan thresholds. Support for the new Student Loan Plan 4.

- 2021/22 rate of Statutory Sick Pay, including continued support for COVID-19 related periods of sick leave (in which SSP is paid from day one).

- 2021/22 rates and average weekly earnings thresholds for Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay and Statutory Parental Bereavement Pay.

- 2021/22 rates and calculations for company cars, vans and fuel.

- Support for off-payroll workers.

- Ability to process 2021/22 HMRC coding notices.

- April 2021 National Minimum/Living Wage rates. The top minimum wage age threshold has been reduced from 25 to 23.

- Eligible employers can continue to claim Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30, P32, P11D and PBIK forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EXB, CIS300, CISREQ).

- Continued support for the Coronavirus Job Retention Scheme (CJRS) and the Coronavirus Statutory Sick Pay Rebate Scheme (CSSPRS).

Automatic Enrolment Updates

- 2021/22 qualifying earnings thresholds.

- For 2021/22, the minimum required pension contribution level continues to be 8%, at least 3% of which must be contributed by the employer.

- Various enrolment/contributions API submission and CSV formats have been updated to the latest versions to ensure continued compatibility with all pension scheme providers.

Pay Using Modulr

You can now create and send payment requests to Modulr directly from BrightPay, provided you have an active Modulr account that is set up for making payments. Payee information and amounts are automatically populated using the data from your payroll, making it a simple, fast and efficient way to pay your employees (or subcontractors).

More Journal API Support

BrightPay 2021/22 now supports posting journals directly via API to FreshBooks, QuickFile and ClearBooks.

Other New Features and Updates in 2021/22

- The way of setting up a pay schedule for the tax year has been changed in response to customer feedback, making it easier and more flexible.

- Ability to auto-zeroise individual basic payments, additions and deductions for each pay period (i.e. repeat them into the next pay period as usual, but with a zero amount)

- Ability to auto-generate works numbers.

- BrightPay now shows the total "number of employees" in many more on-screen summaries and report documents.

- CIS – New custom P&D Statement template design that is able to contain much more information than the standard HMRC template (e.g. breakdown of hourly payments, addition subcontractor information, etc.)

- CIS – BrightPay is now smarter about automatically ticking/unticking and including/excluding subcontractors from various lists or reports by default depending on whether they received any pay in a tax period.

- More employee fields are importable from CSV, and a few column options have been added to Analysis.

- Several additional minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

Includes all updates made to BrightPay during the 2020/21 tax year

Although 2020/21 updates were primarily focused on the CJRS, we did add a few other enhancements, all of which are of course included in BrightPay 2021/22. See our release notes for full details. Here's a quick reminder of some of the main areas of improvement:

- Supports the latest UK and London Living Wage rates, announced in November 2020.

- New message in HMRC Payments that lets you know when the equivalent annualised NIC-able pay would put you in excess of the Apprenticeship Levy threshold.

- New "Amount due to HMRC" column is available to be displayed on the BrightPay startup window.

- BrightPay now uses the Microsoft Edge WebView2 Runtime to display web-based content, ensuring technical compatibility with the requirements of modern web services.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Mar 2021

19

The Key to Keeping in Touch with Employees while Working from Home

One of the biggest frustrations for many employees who now work from home is not having access to the physical paper-based files they had in the office. Many organisations still rely on a HR cabinet which stores sensitive employee data such as contracts of employment, annual leave requests and appraisal documents. Due to COVID-19, the new remote working culture has created many new challenges, data security being a significant one. How secure is your filing cabinet, particularly when you aren’t in the office?

Without the added challenge of a pandemic, HR productivity and managing HR workflows are everyday issues. Common tasks such as the managing of annual leave requests/cancelling requests or dealing with employee queries such as, ‘‘Can I have a copy of my last 3 payslips?’’ can take up unnecessary amounts of time.

BrightPay Connect can help. BrightPay Connect is an optional cloud add-on to BrightPay's payroll desktop application that offers employers flexibility and online benefits, making the payroll process easier.

Along with many other features, BrightPay Connect offers a HR Document Upload feature which allows managers to share documents with individuals, teams or the whole company at the touch of a button. Distribute the company handbook to all employees or upload an individual’s contract of employment, performance reviews or training material. The document upload feature ensures company documents are organised and that employees can securely access HR information anytime, anywhere using their smartphone or tablet device.

Regular communication is an essential way to help your teams adjust to home working. Without it your employees can feel disconnected, morale can dip, and priorities can become confused.

BrightPay Connect’s HR Document Upload tool can be used to distribute COVID-19 mandatory documents such as a COVID-19 Safe Working Policy, the company newsletter or details of the Return-to-Work Policy. The notification system will stand out and draw employees to read the communications via an employee app, avoiding it becoming lost in their email inbox.

Sending this important information directly to the employee’s phone is so much more powerful than simply sending a company-wide email. The click rate of a push notification is 7 times higher than that of email, and so it’s a great way of communicating with employees when it comes to important updates.

Things can – and should – be much simpler in your HR department. And with BrightPay Connect, that’s the new reality. Book a demo of BrightPay Connect today and see how you can eliminate time-consuming HR tasks.

Related articles:

Mar 2021

10

1 Year On: BrightPay & Covid-19

It’s been exactly one year since BrightPay sent all employees to work from home for 2 weeks as a mysterious flu-like disease called COVID-19 began spreading across Ireland and the UK. Those 2 weeks have turned in 52 weeks... and counting.

On March 10th 2020, employees were given access to all the tools and resources needed to work from home well in advance of the lockdown panic that came towards the end of March 2020. BrightPay worked with employees to try and strike a balance between ensuring employees could be productive and focused when not in the office, whilst also juggling often hectic home lives as we all adjusted to lockdown. Keeping in-touch and keeping moral up was a key priority.

The company was in a fortunate position to be able to continue employing all members of staff during such a scary and uncertain time. BrightPay’s COVID-19 response plan involved additional staffing and increased hours to assist customers. With payroll being an essential service and part of every business, the show had to go on!

BrightPay has been at the forefront for employers and accountants when it comes to the Coronavirus Job Retention Scheme (CJRS) and were one of the first payroll software providers to release software upgrades to cater for the furlough scheme as changes were announced. BrightPay's overall response to COVID-19 was rated 98.6% in a recent customer survey, and this included payroll upgrades, webinars, online guidance and customer support.

BrightPay won the COVID-19 Hero Award (supplier) at the Accounting Excellence Awards that took place recently. There were a number of criteria that were considered by the panel for this award. Judging took into account the speed, time and relevance of businesses’ COVID-19 response and how many customers accessed it.

Despite all the COVID-19 scheme changes, upgrades and webinars, the developers have been kept busy constantly improving the software and introducing new features. BrightPay’s optional add-on product, BrightPay Connect now supports two-factor authentication sign in. This means you can add an extra layer of security to the employer login on your BrightPay Connect account in case your password is stolen.

As remote and flexible working are now the new normal, BrightPay in tandem with BrightPay Connect will soon allow for a completely seamless "working from home" experience where there are multiple individuals who work on or require access to the same employer files. BrightPay Connect can help you prevent conflicting copies of the payroll, including an ‘other user check’ and a ‘version check’ when opening the payroll.

Let’s hope we all return to a somewhat normal life within the next year, and that I won’t be writing ‘working from home 104 weeks later’ this time next year. BrightPay wishes you the very best as we enter Year 2 of living with COVID-19.

If you are looking to change payroll software provider or looking to bring your payroll in-house, please don’t hesitate to get in touch. Book a free 15-minute online demo to see how BrightPay can change your world of payroll.