Feb 2021

8

Two Factor Authentication Explained

As security is a large concern for many businesses nowadays as data breaches are a threat to all entities, Two Factor Authentication can now be enabled as a feature for users of BrightPay Connect. Two Factor Authentication is a second layer of protection to re-confirm the identity for users logging into Connect through an internet browser or through BrightPay. This improves security, protects against fraud and lowers the risk of data breaches as users can access sensitive employer and employee data in Connect with the increased security layer.

BrightPay Connect is an optional cloud add-on feature that works with BrightPay. BrightPay Connect provides a secure, automated and user-friendly way to backup and a self-service dashboard to both accountants and employers so they can access payslips, payroll reports, amounts due to HMRC, annual leave requests and employee contact details.

How it works

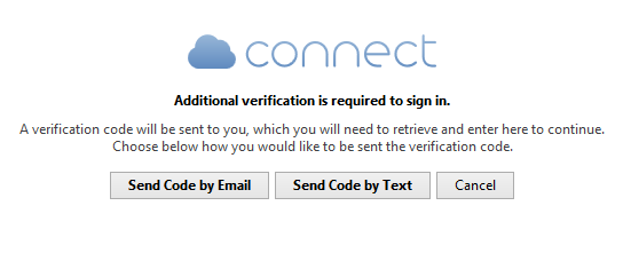

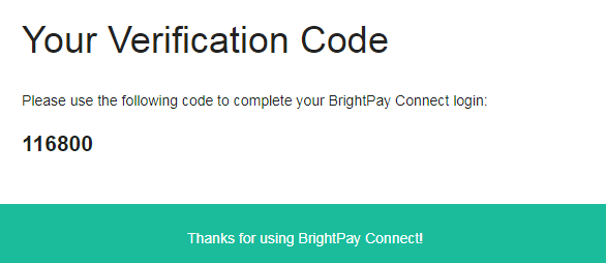

If Two Factor Authentication is enabled for a Connect account, when any user on the Connect account tries to sign into Connect via their internet browser here or through BrightPay, they will be asked to enter in a security code that needs to be sent to them. The user can select to have the security code to be sent by email or by text to the user.

Once the user receives the security code the user enters this in the 'verify code' field and selects 'Verify Code'. The user will only be able to access the security code if they have access to the email account or mobile device. The random generated 6 digit security code will expire after fifteen minutes so a new code will have to be sent if the code is not used in the time limit.

This Two Factor Authentication uses a second security measure of identification ensuring the user is the correct user when logging into Connect. It adds an additional layer of security to an already secure hosted platform and gives the user more reassurance that their payroll data is safer and more secure.

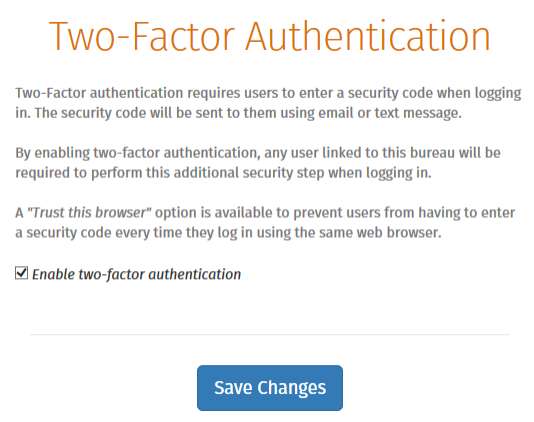

To Enable this option in Connect when you are logged in > Go to 'Settings' > Go to 'Two Factor Authentication' > Tick the box > 'Save Changes'.

Related Articles:

- GDPR: Frequently Asked Questions

- GDPR and BrightPay

- Five Challenges Businesses Face When Switching Payroll Software

Feb 2021

4

Five Challenges Businesses Face When Switching Payroll Software

Switching software for any business can be a confusing, challenging, and disagreeable process. When it comes to payroll software, this challenge can be even greater. If you are in the process of switching to a new payroll software you may have spent weeks, months even, searching for the best available solution. This likely involved speaking to various customer service and sales teams, watching online product demos, and comparing all the different options available to you. By now, you may have narrowed down your choices. Chances are, this will include BrightPay Payroll Software!

From your research, you fully understand all the additional features and advantages that this new software will bring, from automating tedious tasks to saving you money in the long run. Yet, many businesses who have spent months and months of their time analysing their options, who are fully aware that they are losing money and opportunities by staying with their current provider, are still hesitant to make the move. They feel that the challenges are greater than the benefits.

Let’s take a look at some of these very real challenges and examine how they can be minimised.

1. Business as usual:

Implementing any new software has teething problems. It’s not simply a matter of installing the software; it also means migrating the data over to a new system and ensuring that your team is properly trained to use and make the most of it. Accomplishing this while ensuring that it doesn’t interfere with your day-to-day operations can be quite challenging. You cannot afford to process your own or your client’s payroll incorrectly.

With BrightPay, we recommend that you initially run your new payroll software alongside your previous software. This is a good way to determine that everything has been set up correctly in BrightPay and there are no inaccuracies. It also provides the comfort of knowing you have a fail-safe. We offer a 60-day free trial, an ideal way to test out the software to see if it’s the right fit for your business.

2. Migrating data:

How much time will you have to spend entering data to get the new payroll system up and running? Arguably, migrating data from an old system to a new one, is the most time-consuming part of the job. Certainly, it’s the most tedious. However, it is an important part of the process and requires careful attention to reduce errors and minimise potential issues. Early preparation is key.

To speed up this process, BrightPay facilitates the importing of employee information. If your current payroll software allows it, you can export your data in a CSV file format (or to Excel, which can subsequently be converted to CSV format) and import it into BrightPay. If there is no option to export a CSV file, you also have the option to import the employee information using a FPS file. We also have a dedicated migration team that can assist you through this process.

3. Support for your Software:

Customer support is something that every business needs when switching to a different payroll software. Even if migration runs smoothly, chances are you’ll have a question or a tricky issue down the line that you will need help with. When considering your options, check whether the payroll software provider you choose has a dedicated customer support team, how you can get in touch with them, and if there are any additional costs to avail of support. What other forms of support do they offer? Are there webinars, online product documentation, step-by-step guides and video tutorials easily available?

A lack of support beyond the implementation phase is not acceptable and neither is a whole load of added costs. BrightPay support is completely free and has been for nearly 30 years! This includes payroll experts available via phone or email, free webinars, video tutorials, eBooks, and comprehensive online support documentation. All BrightPay licences include software updates in response to any changes to payroll legislation and government schemes.

We believe providing free support is what’s best for our customers and it motivates us to create easy to use, problem-free software. Don’t just take our word for it though. View our customer testimonials page and see for yourself!

4. Integrating with Internal Processes:

A different challenge but one that can be equally frustrating to buyers is ensuring that the new software they’re looking at will work with internal workplace policies. You may be convinced the software is right for you and your team, but it’s equally important the software meets your IT and Legal team’s requirements. Data protection and compliance with GDPR should be a priority for any company. Speak to the software provider about their privacy policy and how they handle your data or your client’s data. If you’re still unsure, ask your company’s Data Protection Officer to join in on the conversation.

Data Protection has always been a concern for BrightPay and we’ve always aimed to act with complete integrity in this regard. Like all companies, in preparation for GDPR we have had to complete a total review on how we gather, maintain and use data. Find out about BrightPay’s security measures.

5. Timing Differences

Knowing when to make the move can be difficult. On one hand, waiting for the new tax year may look appealing but on the other hand, staying with your current provider may have a negative impact on your business. We would recommend moving at a time that is most convenient to you. If this means waiting for the new tax year, then you will only have to import employee details into BrightPay. If you want to move mid-year, then both employee information and their mid-year pay information will need to be imported.

Book a demo to avail of a free migration consultation with the BrightPay team. You will be assigned a dedicated account manager to help you through your decision making and setup process, ensuring a smooth transition to BrightPay.

Related Articles:

Feb 2021

2

Customer Update: February 2021

Welcome to BrightPay's February update. Our most important news this month include:

-

New Proposed Statutory Payment Rates Announced for 2021-22

-

Self Assessment late filing penalty deadline extended to 28th February

-

Free webinar: A recap of recent furlough changes

-

Changes to the Kickstart Scheme

How to spend less time on payroll & furlough

In the past year, the role of the payroll processor has been made even more complex than ever before with furlough calculations and working from home. It’s now more important than ever before to automate payroll tasks. In this free webinar, we look at how integrated payroll and accounting systems can help reduce time wasted on manual work. Places are limited.

Are you ready for the changes to IR35?

From April 2021, the rules in relation to off-payroll workers are due to change for contractors working with medium to large sized clients in the private sector. BrightPay will be able to cater for workers who are inside IR35.

Coming in February: BrightPay Connect supports two-factor authentication sign in

With two-factor authentication, you can add an extra layer of security to the employer login on your BrightPay Connect account in case your password is stolen. Instead of only entering a password to log in, you’ll also enter a code or use a security key.

10 Benefits of using a Cloud Payroll Portal to Manage Employees Annual Leave

COVID-19 has created many new challenges for organisations processing their employees’ annual leave entitlements. As more people are now working remotely, it is likely that organisations’ annual leave request methods are no longer adequate. Discover ten benefits of using BrightPay Connect to manage your staff’s annual leave.

Switching to BrightPay: Free Migration Consultation

Book a demo today to avail of a free migration consultation with the BrightPay team. You will be assigned a dedicated account manager to help you through the setup process, ensuring a smooth transition to BrightPay. Don't delay - migration appointments are filling up fast!

COVID-19 & the big shift to bringing payroll in-house to safeguard jobs

The impact of COVID-19 has seen a growing shift towards businesses bringing their payroll in-house to save money and reduce the risk of employee redundancies. Register for our free webinar to discover the benefits that businesses can gain by making the switch to bringing their payroll in-house.

Feb 2021

1

Changes to the Kickstart Scheme

The Kickstart Scheme was introduced by the Department for Work and Pensions for employers in September 2020. This new scheme has created over 120,000 jobs since September 2020 for employees aged between 16 and 24 years old. It is helping young people start their careers as they have been some of the people hardest hit due to economic conditions from the global pandemic.

This scheme allows an employer or group of employers to create new placements for young people and apply for funding from the scheme. The 6 month placements are open to those currently claiming Universal Credit and in danger of long term unemployment. The job placements will allow the participants to gain experience and skills that will assist them in finding employment when they have completed the scheme.

There was a condition previously that an employer had to have a minimum of 30 job placements in order to qualify under this scheme but from 3rd February this threshold will be removed and employers will be able to apply to the Kickstart Scheme without this condition. The closing date for new applicants under this scheme was 28th January, but for employers who want to partake in this scheme they can contact one of the 600 gateway organisations that have been set up such as a Local Authority or Chamber of Commerce. The Department for Work and Pensions welcomes existing gateways continuing to apply to add more employers and job placements. There is £2 billion available under this scheme and the scheme will run until December 2021.

Under the Kickstart Scheme funding for 25 hours per week for 100% of the relevant National Minimum Wage category in addition to employer National Insurance contributions and employer minimum automatic enrolment pension contributions is available per participant. Funding of £1,500 for setup, support and training costs per placement is also paid. This scheme is available to employers in England, Scotland and Wales.

The job placements must:

- Be a minimum of 25 hours per week, for 6 months

- Pay at least the National Minimum Wage or National Living Wage for the person’s age category

- Only require basic training

Every application ought to include how the employer will aid the participants grow their skills and experience.

Development options could include:

- Providing support to the participants to seek long-term work, including career advice and setting goals

- Support with CV and interview preparations

- Developing their skills in the workplace such as timekeeping, attendance and teamwork

Related Articles:

Jan 2021

29

10 Benefits of using a Cloud Payroll Portal to Manage Employees Annual Leave

For employers, managers and HR departments, the task of handling your employees’ time-off requests can often feel more complicated than it needs to be. When requests are submitted manually or when the protocol on how requests should be made is unclear, it can often lead to problems. Delays in processing, lost requests or conflict over which employee is more entitled when there are overlapping requests are just some of the headaches that employers may have to endure.

COVID-19 has created many new challenges for organisations processing their employees’ annual leave entitlements. As more people are now working remotely, it is likely that organisations’ annual leave request conventions are no longer adequate.

Although we know that it is not always possible to keep everyone happy, having a leave request system in place that is transparent, fair and convenient can make life a lot easier for employers and management, while at the same time boosting employee morale.

An online solution that synchronizes with your payroll software

BrightPay Connect is an online, self-service solution that allows employees to request leave wherever or whenever suits them; be it from their desk or even in their own time through the BrightPay Connect mobile or tablet app. BrightPay Connect is an optional cloud add-on that works alongside BrightPay Payroll. Once a request for leave has been made, the relevant manager will receive a notification on their own BrightPay Connect dashboard. From the dashboard, employers can either approve or deny the leave request. Below, we’ve listed ten benefits of using BrightPay Connect to manage your staff’s annual leave.

- Through your dashboard, you can view a real time, company-wide calendar. Here, at a glance, you can see which employees are on leave, when they are on leave (employees can choose full days, half-days or even by the hour, if set up to do so) and the type of leave (e.g., sick, paid, unpaid, parental).

- The relevant manager will receive a push notification when a new leave request has been made. From the notification box they can then either accept or deny the request, making request approvals quick and easy.

- Cloud integration means any approved leave requests will flow directly back to your BrightPay payroll software on your PC or Mac. This saves you time and cuts down on errors when entering employees leave for payroll processing.

- Through the app, employees can view how much leave they have remaining which reduces the back and forth between employees and management/HR regarding how many days leave they have left.

- You have the ability to grant access to your accountant, bookkeeper or selected colleagues. This means that in your absence you can rest assured any annual leave requests are being taken care of. There is also a full audit trail of leave that has been requested and who has dealt with that request.

- The calendar on your employer dashboard draws attention to employees whose absenteeism might otherwise go unnoticed. Likewise, the employee dashboard draws attention to the employee’s own absenteeism. Having past sick days visible to employees has been shown to reduce the employee’s overall sick days taken.

- The employer has the ability to mark off any mandatory leave days for employees so there is transparency around which days must be taken as holidays.

- If your leave approval works on a first come, first serve basis, by using BrightPay Connect you cut out any confusion over who requested the leave first.

- Employees also reap the benefits of using a cloud payroll portal. Giving the employees the ability to request leave wherever and whenever they want gives them a sense of control and in turn feel more organised and less stressed. Researchers at the University of Birmingham found that when employees have more autonomy in the workplace this can increase employee motivation, job satisfaction and overall well-being.

- Nowadays, many people either do not have or rarely use a desktop computer at home. Therefore, being able to access the BrightPay Connect app through your smartphone or tablet makes a significant difference for employees. The employee payroll and HR smartphone app is available for free on any Android or iOS device.

Book an online demo today to discover more about BrightPay Connect and the many other ways it can benefit your business.

Related articles:

Jan 2021

26

New Proposed Statutory Payment Rates Announced for 2021-22

As there was no Autumn Statement or Budget from Chancellor Rishi Sunak, the financial secretary to the Treasury, Jesse Norman announced a written ministerial statement in the House of Commons with details of the increase of the National Insurance thresholds. The 2020 Autumn Spending Review confirmed that the personal tax allowance and tax basic rate threshold would increase by 0.5%. This is based on the consumer price index.

This would mean that the personal tax allowance for 2021-22 would increase by £70 from £12,500 to £12,570 and the tax basic rate threshold for 2021-22 would increase to £37,700 from £37,500.

The annual National Insurance threshold for Small Employer’ Relief remains at £45,000.

Please see some rates details below:

Statutory Adoption Pay |

2020-21 | 2021-22 |

| Earnings threshold | £120.00 | £120.00 |

| Standard rate | £151.20 | £151.97 |

Statutory Maternity Pay |

2020-21 | 2021-22 |

| Earnings Threshold | £120.00 | £120.00 |

| Standard Rate | £151.20 | £151.97 |

Statutory Paternity Pay |

2020-21 | 2021-22 |

| Earnings Threshold | £120.00 | £120.00 |

| Standard Rate | £151.20 | £151.97 |

Statutory Shared Parental Pay |

2020-21 | 2021-22 |

| Earnings Threshold | £120.00 | £120.00 |

| Standard Rate | £151.20 | £151.97 |

Statutory Sick Pay |

2020-21 | 2021-22 |

| Earnings Threshold | £120.00 | £120.00 |

| Standard Rate | £95.85 | £96.35 |

Jan 2021

12

Customer Update: January 2021

Welcome to BrightPay's January update. Our most important news this month include:

-

3 simple ways to automate your payroll

-

BrightPay: The heroes that were needed for payroll professionals

-

How to manage COVID-19 related statutory sick pay

-

From the support desk: Annual leave entitlement methods in BrightPay

Free Webinar: Optimising your payroll offering to improve profitability

Many accountants would say that offering payroll as a service is not necessarily cost-effective and that it can be a very time-consuming process. But this doesn’t need to be the case. In this webinar, we explore various ways that accountants can automate payroll processes, and ultimately, become more profitable.

Payroll in the Connected Era: How integration has transformed the world of payroll

During this webinar, BrightPay will discuss the benefits of integrating your payroll and accounting software. We will also demonstrate how you can streamline the entire process from start to finish. Discover how you can free up time for you to spend on other tasks that really need your attention.

Why employees love self-service apps (And you should too!)

Today’s employees are accustomed to having information readily available. An employee portal can help fulfil that expectation with the added benefit of creating workflow efficiencies. The employee self-service app eliminates the burden of sending payslips, updating personal information, approving annual leave requests and answering leave balance enquiries for the payroll department.

HMRC announce more furlough changes for 2021

HMRC have set out the detail of how the CJRS will operate from 1st February onwards, including a further extension to 30th April 2021. Join us on 2nd February as we recap upcoming changes to the furlough scheme and what these changes mean for your business. Plus, we will share some of the key lessons learned from processing payroll in a pandemic, and how it prepares us for payroll in the ‘next normal’.

Key payroll changes to keep an eye on in 2021

If 2020 has taught us anything it’s that you never know what’s around the corner. All the plans and predictions we made for this year fell through our fingers with the pandemic and global recession. Here we look at three things that are likely to happen in 2021 which those working in payroll need to keep an eye on. It’s always good to be prepared!

Jan 2021

6

New financial support announced for businesses to survive lockdown

I don’t know about you, but I feel like I’m Bill Murray in Groundhog Day - stuck in an endless purgatory of the same day repeating itself over and over again with no escape. Yes it’s another day, another lockdown and it feels never-ending. Unless you’ve been hiding under a rock (in which case, is there room for one more?) you’ll know that England is now in a strict national lockdown until mid-February. That means that all non-essential business, schools and universities need to close and we all have to stay at home.

What does this mean for businesses and employees now who are once again affected by this absolute fiasco? Well, it seems it’s business as usual if you will pardon the pun, as not much has changed. However, Rishi Sunk did unveil “more financial support” for businesses affected by the lockdown measures yesterday morning (note my use of inverted commas). Retail, hospitality and leisure businesses will now be able to apply for one-off grants of up to £9,000 per property.

On top of these one-off £9k grants, a further £594m discretionary fund will be made available via local authorities and devolved administrations to support other businesses outside of these sectors who have also been affected by the lockdown.

There are already existing support packages in place though. These include grants of up to £3,000 for closed businesses, 100% business rates relief for hospitality, leisure and retail, and of course, everyone’s good ol’ pal furlough. While Rishi has been very quiet on further furlough support, the current scheme is due to run until the end of April as it is so this seems the government are still optimistic that we will be out of the woods by then with the rollout of the mass vaccination programme. Remember, you can apply for furlough at any time, even if you have never claimed under the scheme before.

Along with furlough, other notable absentees from Rishi’s measures included extending the business rates holiday (which ends in April), VAT cut, or an increase in statutory sick pay, despite calls from business leaders for such moves. Even with the new £4.6bn support package, is it enough?

With Englands’s lockdown due to be reviewed on February 15th and Scotland’s at the end of January we now enter another period of stasis. We can only hope that this really is the last time we have to endure this and hope that all the hard work that has gone into keeping businesses afloat and employees on the payroll over the past 10 months has not been in vain. Stay tuned for more updates over the coming weeks. And with that, I’m off to bake my seventy-sixth loaf of banana bread and have a cry into the tea towel.

Dec 2020

21

BrightPay's Christmas Opening Hours

The management and staff at BrightPay would like to thank you for your valued custom in 2020 and to take this opportunity to wish you a Merry Christmas and a prosperous New Year.

Here are our opening hours for the Christmas period:

| Monday 21st | 09:00 - 13:00 | 14:00 - 17:00 |

| Tuesday 22nd | 09:30 - 13:00 | 14:00 - 17:00 |

| Wednesday 23rd | 09:00 - 13:00 | 14:00 - 17:00 |

| Thursday 24th | Closed |

| Friday 25th | Closed |

| Saturday 26th | Closed |

| Sunday 27th | Closed |

| Monday 28th | Closed |

| Tuesday 29th | 09:30 - 13:00 | 14:00 - 17:00 |

| Wednesday 30th | 09:00 - 13:00 | 14:00 - 17:00 |

| Thursday 31st | 09:00 - 13:00 | 14:00 - 17:00 |

| Friday 1st | Closed |

Call us on 0345 939 0019, email us at [email protected] or complete our online form.

Dec 2020

18

Add some sparkle to Christmas with the perfect cloud solution

What springs to mind when you hear the word ‘cloud’ will vary from person to person. Some will think of the weather as they look, grumbling, out their front window. But others will be thinking about all that extra storage on their iPhone. The meaning of the word has changed in recent times and most of us will now think the latter. But what about those who haven’t a notion what you’re on about? What is the cloud?

The cloud is a general term for any computing service that involves hosting over the internet to deliver computing services in lieu of a hard drive. Services such as storage, payroll and HR information. The other key feature is that you can access these services or information anytime, anywhere from any device that is connected to the internet. In fact, you’re already using cloud services if you use social media, Google Drive and Dropbox to name but a few. And now the cloud has become a must-have for any business who wishes to keep up with the times.

I can hear some of you now: “It sounds great, but my employees would never use something like that”. Well, that’s where you’re wrong. A recent survey found that 48% of people believe technological advances will change the face of the workplace and a massive 87% of those said they would be happy to adapt to technological changes if the right tools were given to them. Wow! So how do I know which cloud platform to choose for my business?

I’m glad you asked! Our experts got together for a brainstorming session and found that there are four key things to look out for when choosing the right cloud platform for your business - cost, compliance, simplicity and connection.

- Cost - Your upfront costs should be minimised – using the cloud shouldn’t be an expensive luxury reserved for big corporations. Make sure it provides the option of having multiple users so you can delegate and give access to various people to manage payroll tasks and HR requests on your behalf.

- Compliance - Make sure it takes into account your obligations as an employer with regards to things like the GDPR legislation, record keeping requirements and automatic enrolment duties. A good platform will have compliance built-in as standard and will manage it seamlessly.

- Simplicity - The most important thing to increase the uptake of a cloud platform is to make sure it is user-friendly and reduces the chance of human error. Look out for simplistic interfaces and whether or not training and support are available. The best of the best will offer this support for free. You should also be able to get set up and ready to go with minimal disruption to your business.

- Connection - Make sure it offers features that are attractive to employees such as a downloadable app, a self-service portal and company-wide communication features. Because at the end of the day, your employees won’t give a damn about how excited you might be about something unless it works for them too. These features tie in with our ever-increasing digitally-minded workforce and will make them feel more in control and engaged.

So, there you have it… off you go now! Good luck scouring through the internet trying to find the perfect cloud platform. But…., well, ....it is Christmas after all and I’m feeling generous. Ah, what the heck, I’ll just let you in on a secret which is the best cloud payroll platform for businesses out there: our very own BrightPay Connect.

BrightPay Connect is an add-on to BrightPay’s award-winning payroll software and ticks literally every single box I just mentioned over the course of this post. I’ve done enough talking so instead let me show you. Book a demo today to find out why BrightPay Connect is the perfect fit for your business.

Merry Christmas everyone! Don’t say I didn’t get you anything!