Sep 2020

1

Customer Update: September 2020

Welcome to BrightPay's September update. Our most important news this month include:

-

Furlough wind down timescales

-

Do SEISS grants need to be paid back?

-

Thresholds to rise for Student Loan repayment from 6th April 2021

Furlough Changes for September

The Coronavirus Job Retention Scheme is ending fully on 31st October 2020, but until then, the level of the grant will be reduced each month. For September, the government will pay 70% of wages up to a cap of £2,187.50 for the hours the employee does not work. Employers will need to pay employer National Insurance contributions and employer pension contributions plus 10% of wages to make up 80% of the total, up to a cap of £2,500.

Free Webinar: CJRS & Flexible Furlough - Changes you need to know

As the government’s furlough scheme winds down in upcoming months, employers will need to contribute to employees’ wages and the Coronavirus Job Retention Scheme will end fully at the end of October 2020. In this webinar, we look at what you need to know about reduced government contributions, flexible furlough and making a claim.

Benefits of employee apps that you never knew (and why employees love them)

BrightPay Connect offers a whole host of additional features, from automatic cloud backup to employee dashboards. However, the employee app is one of the most attractive of these additional features, and for good reason. It enables you to introduce more effective ways of communicating with employees and streamline everyday processes such as annual leave requests.

Easily integrate BrightPay with your accounting software

BrightPay’s payroll journal feature allows users to create wage journals from finalised pay periods so that they can be seamlessly transferred into various accounting packages. BrightPay includes direct API integration with a number of accounting packages. With this direct integration, users will be able to directly send the payroll journal to the accounting package from within BrightPay.

Aug 2020

21

Thresholds to rise for Student Loan repayment from 6th April 2021

The Department of Education have announced the new student loan thresholds that will apply from 6th April 2021.

The repayment threshold for Student Loan Plan 1 will increase by 3% and the repayment threshold for Student Loan Plan 2 will increase by 2.7%.

The repayment threshold for the Postgraduate loans will remain the same.

For any loans before 2012, Plan 1 Loans will apply and for loans after 2012 Plan 2 Loans will apply.

Earnings above the thresholds for both Plan 1 and Plan 2 for 2021/22 will be calculated as normal at 9%. The rate of the postgraduate loan type introduced in the 2019/20 tax year will continue to be calculated at 6%.

Summary of the Student Plan thresholds:

- Plan 1 loans will increase from the current threshold of £19,390 to £19,895 in 2021/22.

- Plan 2 loans will increase from the current threshold of £26,575 to £27,295 in 2021/22.

- Postgraduate loans will not change and remain at the current threshold of £21,000.

A Student Loan Type 4 will come into effect from 6th April 2021 for students who have taken a loan out in Scotland. The First Minister has committed to the student loan repayment threshold which will rise to £25,000 in Scotland from April 2021.

In BrightPay 2021/22, the new student loan repayment thresholds for both plans will automatically be calculated by the payroll software and the appropriate student loan deduction applied.

Aug 2020

18

Furlough wind down timescales

The Coronavirus Job Retention Scheme has been hugely popular and will continue to support jobs until the end of October, however, from 1st July, many changes were made to the scheme.

The government’s furlough scheme will wind down in upcoming months, employers will need to contribute to employees’ wages and the Coronavirus Job Retention Scheme will end fully at the end of October.

Before August, employers could claim 80% of a furloughed employee’s wage costs, to a monthly maximum of £2,500. The government also refunded employer NICs and auto-enrolment pension contributions on this sum.

Going forward, the level of grant will be reduced each month. Employers will have to start contributing to the wage costs of paying their furloughed staff, and this employer contribution will gradually increase in September and October.

- In August, the government will continue to pay 80% of wages up to a cap of £2,500, but employers are now required to pay employer National Insurance contributions and employer pension contributions. For the average claim, this represents 5% of the gross employment costs that they would have incurred if the employee had not been furloughed.

- For September, the government will pay 70% of wages up to a cap of £2,187.50 for the hours the employee does not work. Employers will need to pay employer NI contributions and employer pension contributions plus 10% of wages to make up 80% of the total, up to a cap of £2,500.

- In October, the government will pay 60% of wages up to a cap of £1,875 for the hours the employee does not work. Employers will need to pay employer NI contributions and employer pension contributions plus 20% of wages to make up 80% of the total, up to a cap of £2,500.

Employers will continue to be able to choose to top up employee wages above the 80% total and £2,500 cap for the hours not worked at their own expense if they wish. Employers will have to pay their employees for the hours worked.

After 31st October, the government contributions will finish and the scheme will come to an end.

When the scheme was extended until October, employers were promised that they would not face a ‘cliff-edge’ withdrawal of funding and that the scheme would be wound down gradually. The wind-down phase of the furlough scheme is more generous than many had expected, with most furloughed employee wage costs still being met by the government over the coming months. Depending on how the re-opening of businesses progresses, this approach may give some employers time to rebuild and save jobs that would otherwise have been lost.

Job Retention Bonus Scheme

During last month’s summer economic update, the chancellor announced that although the scheme will end at the end of October, all businesses can avail of a Job Retention Bonus Scheme for each employee they bring back from furlough. This is a one-off payment of £1,000 to employers that have used the Coronavirus Job Retention Scheme for each furloughed employee who remains continuously employed until 31 January 2021.

To be eligible, employees will need to earn at least an average of £520 per month for November, December and January, they must have been furloughed at any point and legitimately claimed for under the Coronavirus Job Retention Scheme, and they must have been continuously employed up until at least 31 January 2021.

Employers will be able to claim the bonus from February 2021 once accurate RTI data to 31 January has been received.

How BrightPay can help?

BrightPay software is being continually updated to ensure you can adapt your processes to all the upcoming changes regarding furlough.

If you’re not already using BrightPay, why not book a demo or download BrightPay’s free 60 day trial? One of our payroll experts will show you its clear and easy to use interface and talk you through its underlying comprehensive set of payroll functionality.

Aug 2020

11

3 Benefits of Employee Apps That You Never Knew

Employee apps have become a big trend in the digital communications infrastructure of businesses in every industry imaginable over the past few years. Initially, they served little or no real tangible purpose other than to help the business appear to be at the forefront of technology and employment trends. However, more recently, app designers have created apps that deliver real, measurable value for both employees and employers.

Introduced in 2017, the BrightPay employee app is available to all BrightPay Connect customers. Connect is an add-on to the payroll software which offers a whole host of additional features, from automatic cloud backup to employee dashboards. However, the employee app is one of the most attractive of these additional features, and for good reason.

This is because employers and human resource managers are constantly trying to find more effective ways of communicating with their employees, as well as methods to streamline everyday processes such as annual leave requests. Our employee app does all of this and more, and gives employees a crucial sense of engagement that’s invaluable to company culture and the productivity of staff.

But, if you’re an employer or human resources manager who’s considering using an employee app to update your internal comms abilities, you’re going to need to weigh up the benefits of the app and think about how they would apply to your organisation.

Benefits of Employee Apps

So, without further ado, let’s break down the benefits of employee apps so that you can make the best decision for your business.

Leave Requests and Approval

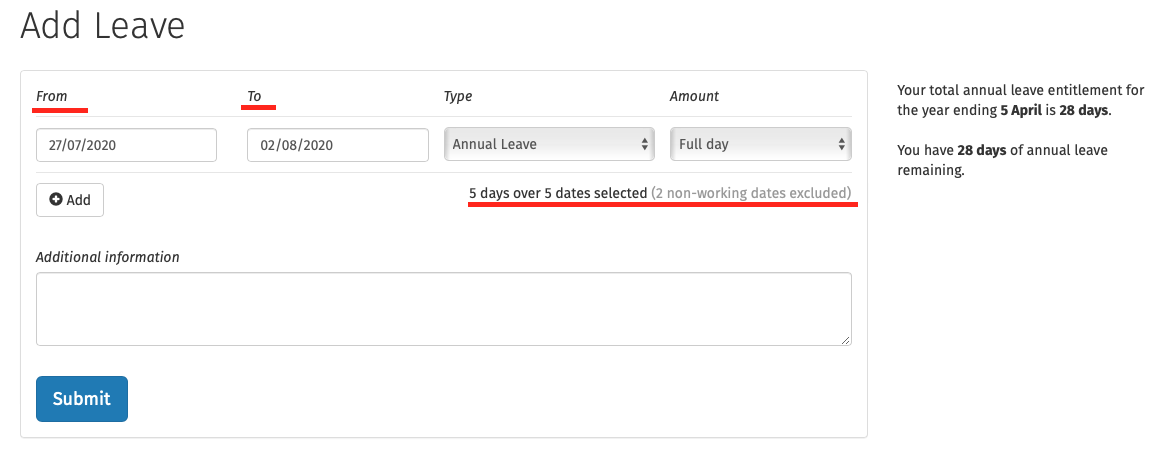

Few people expect that an employee app can help with leave requests, but they can. In the BrightPay Connect employee app, employees can apply for annual leave or unpaid leave directly from their tablet or smartphone. Once they've sent their request, the relevant manager will receive a notification on their BrightPay Connect dashboard.

From here, they can approve or reject the request. The calendar on their dashboard will show them all of the scheduled leave for the relevant dates, so they can see who else is on leave at that time. If they choose to approve it, the leave will automatically appear in the company calendar on both the online dashboard and the employee app.

This is particularly useful to companies with large numbers of employees whereby a significant amount of time is spent processing employee leave requests and manually updating the company calendar.

Internal Communications

Another major benefit of using a self-service employee app is the vast improvement in internal communications. Employers can upload any type of documents they want to be available on the employee app. These documents are then stored in the cloud, where employees can easily access them from anywhere in the world.

What makes this feature even more useful is that the employer can choose who has access to which documents. For example, you may upload three documents at once. One is an updated Health and Safety policy, another is a new budget document for the marketing team, and another is an employee file for a recent starter.

Our document sharing feature will allow you to make your Health and Safety policy available to everyone in the company, make the budget document available only to the marketing team, and make the new employee file only visible to yourself and your human resources manager. You can customize the access permissions for each document, and change that access at any time. And you can see who has opened and read the various documents via a time-stamped historical log.

This means that, not only can you use the document sharing facility to distribute important documents to your employees, but you can also use Connect as a secure online hub, where you store all employee data and documents safely.

Payslip Archive

One of the features of the BrightPay Connect employee app that your employees will really love is the handy payslip archive. Via the app, payslips are distributed directly to employee smartphones or tablets where they can be viewed, downloaded and printed in just a few clicks. But, in addition to this, the payslips are kept on the app in a historical archive that dates back to when you started using BrightPay Payroll - even if it’s before you introduced the app or started using BrightPay Connect.

This is great news for employees for two reasons. Firstly, because they cannot lose payslips in their email inbox or accidentally delete them and have to ask for them to be resent. And secondly, because it makes applying for mortgages or other personal finance banking options simpler as they can easily access and print as many payslips as their bank requires.

Find out more about the BrightPay Connect Employee App today

If you think that the BrightPay Connect employee app could benefit your business, why not book a free demo with our team of Connect experts? They will talk you through all of its many features, including the app and so much more.

Aug 2020

7

Customer Update: August 2020

Welcome to BrightPay's August update. Our most important news this month include:

-

Chancellor announces furlough bonus scheme and more in Summer Statement

-

CJRS Changes & Flexible Furlough - What you need to know

-

Flexible Furlough - Calculating Employee Hours

BrightPay Connect - What’s New?

This month saw a number of updates to BrightPay Connect, including a new option to download all payslips in a given period. The calendar functionality in BrightPay Connect has also been updated and improved, making it more user-friendly and graphically appealing for both employers and employees. Improvements such as calendar and leave view, custom leave types and requesting leave are part of the new enhancements.

Free COVID-19 & Payroll Webinar

Join BrightPay on 12th August for a free COVID-19 & Payroll webinar. In this webinar, we explore the key changes in relation to flexible furlough, phasing out of the scheme and changes to making a claim. This new flexibility will help businesses with reopening and help boost the economy. Places are limited. Click here to book your place now.

Processing Employee Hours Made Simple With BrightPay Connect

We’re always keen to hear what the biggest challenges are for payroll bureaus and how we can help make their job easier. One of the most common issues we understand is that requesting payroll information from clients can be an inefficient, time-consuming and often, frustrating process. The good news is that BrightPay Connect makes this process so much simpler. It has become a must-have tool for bureaus who want to streamline their payroll process and increase efficiency.

Automate Annual Leave Management with BrightPay Connect

After months of lockdown, many people are embracing the idea of staycations in a bid to save what’s left of the summer. For employers, however, managing employee leave can be far from relaxing if it is a manual process. BrightPay Connect’s online leave management tools eliminate cumbersome people management tasks. It’s more than just payroll software, it’s a ready-to-go, easy-to-use HR software solution. The staycation trend should be a reason to be excited, not an admin nightmare.

Jul 2020

27

Connect – Calendar Updates

The calendar functionality in BrightPay Connect has been updated and improved, making it more user friendly and graphically appealing for both employers and employees. Improvements such as calendar and leave view, custom leave types and requesting leave are part of the new enhancements.

Calendar Display

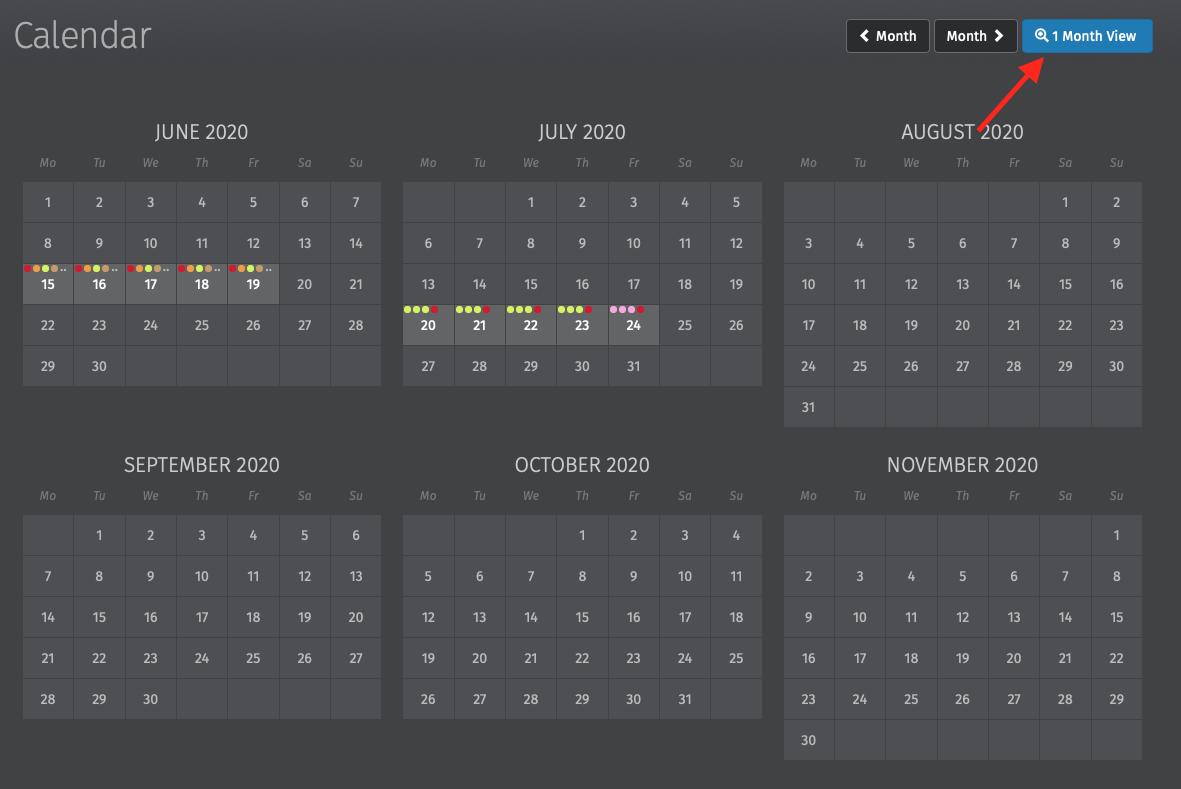

The number of months displayed on the calendar for both employers and employees can be selected, the options available are 3 months, 6 months, 9 months and 12 months. This can be selected under the Settings tab in the Employer portal, further details can be found here.

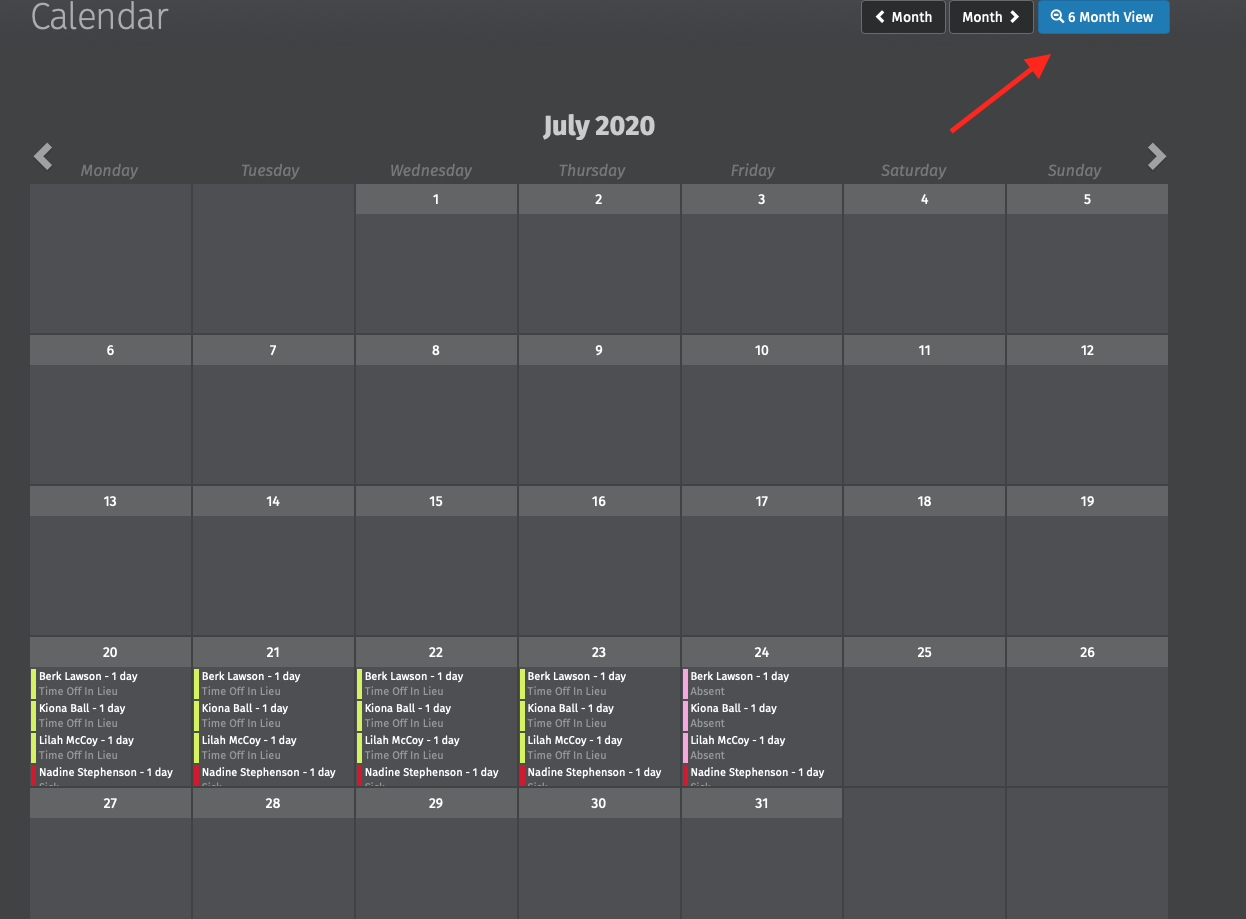

On the Employer or Employee Calendar in Connect the calendar can be displayed for one month or multiple months. One month view can be seen by selecting the '1 Month View' option. The view can be returned to the default number of months view by selecting ‘3 / 6 / 9 / 12 Month View’. On the ‘1 Month View’ there are new widgets for scrolling up and down through the number of leave entries on a particular date.

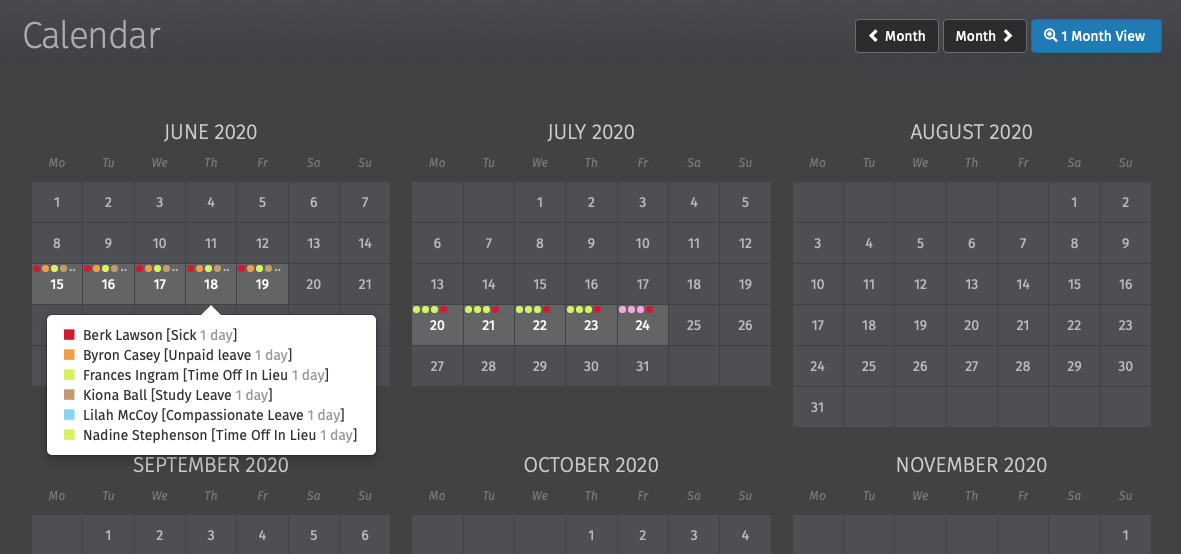

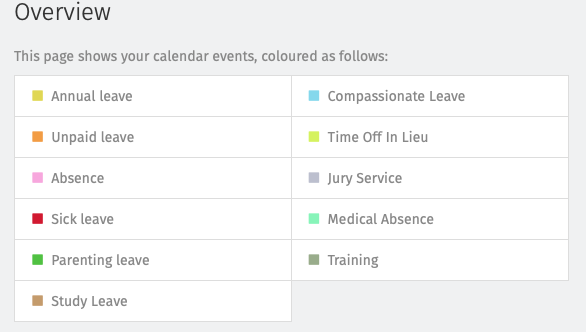

Dates with multiple types of events are dotted with the relevant colours. To see the breakdown, simply hover your mouse over the date. By selecting a date on the calendar a dialog box will open to show all the entries on that date without having to scroll.

Custom Leave Types

Custom leave types are now available in BrightPay Connect. In BrightPay 2020/21 you can define nine additional custom leave types for employees. Six of the custom leave types are set up with default descriptions such as time in lieu and study leave. Instructions on how to add, edit or remove these custom leave types can be found here.

When a custom leave type is entered on the employee’s calendar in BrightPay and synchronised to Connect the leave type will be displayed on the calendar for both the employer and the employee to view on their online portal or mobile app. Custom leave can only be entered on an employee’s calendar by a user in Connect or on the employee’s calendar in the BrightPay employer file. Employees cannot request any custom leave types.

Adding/Requesting Leave

When employers are adding leave on an employee’s calendar in Connect or an employee is requesting leave, they are now entered as date ranges simplifying leave dates being selected. If the employer or an employee enter in an invalid date range (e.g. including non-working days in the date range) it will automatically correct this and only working days will be included in the request.

Interested in finding out more about how BrightPay Connect can streamline your leave management processes? Book an online demo of BrightPay Connect today.

Jul 2020

24

Coronavirus Job Retention Scheme (CJRS) Updates

Employers need to submit claims on HMRC’s CJRS online portal for any furlough payments under the CJRS that relate to periods ending on or before 30th June by 31st July 2020. You will no longer be able to submit a claim for the period up to 30th June after 31st July.

The CJRS was originally introduced by the government from 1st March in response to the coronavirus pandemic in order to give financial support to businesses and employees. Under this scheme all employers, regardless of size or business sector, could claim from HMRC a payment for 80% of the wage costs for employees that were furloughed up to a maximum of £2,500 per month per employee.

From 1st July 2020 employees that were previously furloughed can be brought back to work on a part time basis by their employers once an agreement is reached between the employer and the employee. Employers will still be able to claim under the CJRS for hours that are not worked by the employee. The new grant claim will be based on hours not worked by the employee and the normal hours an employee would usually work.

HMRC has also updated their guidance to confirm employers can claim amounts paid to an employee who is serving their statutory or contractual notice period up to the claim limit of 80% of their pay up to a maximum of £2,500 per month. However, grants cannot be used to substitute redundancy payments.

HMRC plan on introducing a method through the tax system to recover grant amounts overclaimed by employers under the CJRS. Repaying overclaimed grant amounts back will reduce or prevent any potential tax liability under that legislation. Tax liabilities may be due on any overclaim amounts. Further details will follow.

Interested in finding out more? Join BrightPay for a free webinar where we explore the key changes in relation to flexible furlough, phasing out of the Coronavirus Job Retention Scheme and changes to making a claim. Places are limited - click here to book your place now.

Jul 2020

21

The End of Earlier Year Updates

From the end of this tax year, an Earlier Year Update (EYU) will no longer be accepted by HMRC as a valid RTI submission to report changes to employees’ pay details for tax year ending 5th April 2021. HMRC had originally planned to abolish the Earlier Year Update for tax year 2019-20 and onwards.

An Additional Full Payment Submission must be submitted instead to report the correct year to date figures for an employee to HMRC.

For tax years up to and including 2017-18, any amendments must be reported to HMRC via an EYU submission only. For 2018-19 and 2019-20, a correction submission can be made using either an Earlier Year Update or an Additional Full Payment Submission to report changes to HMRC.

For tax years 2018-19 and 2019-20, in order to avoid any issues with employers trying to use both options, BrightPay decided to only cater for amendments using the Additional Full Payment Submission option. An Additional Full Payment Submission will report the correct year to date details for employees to HMRC, rather than amendments that the Earlier Year Update would report.

To make corrections in BrightPay, you need to re-open the payslips for the employee in BrightPay, make the necessary changes and finalise the payslips to the last pay period again.

To subsequently create an Additional Full Payment Submission for submission to HMRC, follow our simple instructions here.

Jul 2020

14

Make Payroll Entry And Approval Simple With BrightPay Connect

We speak to payroll bureaus all of the time, always keen to hear what their biggest challenges are and how we can help make their job easier, and one of the most common issues we hear is that requesting payroll information from clients can be an inefficient, time-consuming and often, frustrating process. And we understand why.

For any payroll bureau, getting payroll approved by clients can be a tiresome process. Despite meticulous attention to detail, finding mistakes in the payroll is common. Even the most detail-oriented clients are prone to forgetting to let you know that James had to take a week off with the flu, or that Michelle’s maternity leave started early. As a result, it isn’t until you hand over the so-called finalised payroll to the client that these changes are brought to your attention and you’ve got to go back and make the (often, many) appropriate changes. Sound familiar?

The good news is that BrightPay Connect makes this process so much simpler and reduces the chances of such omitted information (and the time it takes to get that final payroll approval) significantly. As such, it has become a must-have tool for bureaus big and small who want to streamline their payroll entry and approval process and increase efficiency with their clients.

What Is BrightPay Connect?

Not to be confused with the payroll software, BrightPay Connect is an add-on feature which is purchased separately and works alongside BrightPay payroll software. As such, it offers a range of features not made available through the payroll software alone. These include an employee app, an employer dashboard, a secure online portal and much more. While BrightPay’s payroll software looks after the day to day tasks involved in payroll management, BrightPay Connect offers extra benefits, not least of which is it’s payroll entry and approval feature.

How BrightPay Connect Can Help With Payroll Entry And Approval

Getting payroll information from clients has never been as easy thanks to Connect. From your bureau dashboard you can send a payroll entry request to one client at a time, or in batch form to dozens/hundreds of clients in the same amount of clicks. You simply select the clients from a drop-down menu and send your requests, instantly.

A real-time dashboard also lets you see what requests you’ve sent out and breaks them down into requests that have been responded to by the client, and requests for which you’re still waiting for a response.

On the client’s end, they will receive a notification on their online employer dashboard that lets them know they need to enter or upload their employee’s pay information for the pay period. The client can add new employees here too, and there’s a user-friendly comment section where they can leave any notes that they’d like to share with you, cutting out the need for endless back and forth emails.

Once you’ve received the payroll entry from your clients, complete with their employee’s pay information, the bureau can review the information that has been entered by the client and apply this information in BrightPay Payroll Software at the click of a button. All communications between the payroll bureau and the client are automatically tracked in the online audit trail on BrightPay Connect.

From this point you can finalise the payslips or if you wish to get the payroll signed off by the client, you can send them a payroll approval request. This allows you to securely send a payroll summary to the client for them to review before you send the payslips to the employees.

Similar to the payroll entry request, the client will receive their payroll approval request on their online client dashboard instantly and can choose to either approve or reject the payroll. Either way, your dashboard will update automatically to let you know and the audit trail keeps a complete time-stamped record of all requests, protecting both your bureau and your client.

Want to learn more about BrightPay Connect and how it’s sophisticated payroll entry and approval functionality can transform your payroll processes? Book a free online demo here for a detailed walkthrough of everything the portal can offer you and your clients.

Jul 2020

13

How To Process COVID-19 Related SSP in BrightPay 20/21

HMRC have advised that if an employee needs to take time off sick or to self-isolate due to COVID-19, the first 3 waiting days that normally apply for SSP will be disregarded and the employee will be entitled to receive SSP from the first day.

We have programmed BrightPay 20/21 so that there is a new option for ‘COVID-19 Related Sick Leave’ and, by choosing this option, the software will automatically apply any SSP due to the employee from day one. Whereas, if you were to choose the normal SSP, the software will take into account the usual 3 waiting days.

With the Coronavirus Statutory Sick Pay Rebate Scheme, the employer can claim for up to 2 weeks sick leave for an employee that cannot work due to COVID-19, and also those who are self-isolating or shielding, subject to eligibility criteria.

An SSP Claim Report is available in BrightPay to assist users in ascertaining the amounts needed for input into HMRC's Coronavirus SSP Rebate Scheme online service.

A Step By Step Guide To Processing In BrightPay

Processing COVID-19 related Statutory Sick Pay is easy in BrightPay. Here’s a detailed step-by-step guide to help you do it.

Processing COVID-19 Related Sick Leave in BrightPay

- First, you need to select the employee’s name on the left. Under ‘Statutory Pay’, click ‘Calendar’, and on the calendar, select the date range that the employee is out on sick leave.

- Click ‘Sick Leave’ from the options on the right of the screen and choose 'COVID-19 Related Sick Leave'. The number of ‘Qualifying Days’ & ‘SSP Days’ will be displayed on the screen, bypassing the usual 3 waiting days.

- When you close out of the calendar, BrightPay will automatically apply any SSP due to the employee.

It is important to note that if existing payment records have not been recorded in BrightPay or if there is insufficient historical payroll data to determine the employee's average weekly earnings, the automatic calculation may be inaccurate or not possible. In this instance, you can manually override the employee’s average weekly earnings.

BrightPay’s Coronavirus SSP Rebate Scheme Claim Report

As mentioned, BrightPay also has a claim report to assist users in determining the amounts that you can reclaim through the Coronavirus SSP Rebate Scheme. This report can be found within the ‘Employees’ tab in BrightPay.

- First enter the start and end date of the claim period you are claiming for.

- On the next screen, select the employees you wish to include in your claim.

- If your chosen claim period covers some of the 19/20 tax year, enter COVID-19 related SSP amounts that you wish to claim for the previous tax year.

- On the final screen, a summary of your claim will be displayed. Enter any of the additional information that HMRC require when making a claim. If you wish, you can view the full report, and this can be printed, exported or emailed for your records.

Each claim report generated in the software is stand-alone and no data is saved each time a claim report is run. Therefore, it is your responsibility to ensure that you have exported the report, so that you don’t lose the information.

SSP & Furloughed Employees

Furloughed employees retain their statutory rights, including their right to Statutory Sick Pay, and so furloughed employees who become ill must be paid at least the rate of SSP, subject to them meeting the eligibility criteria. You can claim back from both the Coronavirus Job Retention Scheme and the SSP rebate scheme for the same employee but not for the same period of time.

If an employee becomes sick while furloughed, it is up to the employers to decide whether to move these employees onto Statutory Sick Pay or to keep them on furlough, at their furloughed rate. If the employee is moved onto SSP, employers can no longer claim for the furloughed salary. Whereas, if the employee is kept on the furloughed rate, they remain eligible for the employer to claim for these costs through the furlough scheme.

Free COVID-19 Webinars For Employers

Want to keep up-to-date with the latest updates regarding COVID-19 and businesses? We’re holding regular webinars to share with you all news relating to HMRC updates, what employers need to know and how you can make sure you’re complying with best practices at all times.

Click here to watch our previous webinars on-demand, where we cover everything from important COVID-19 payroll updates to return to work government policies and more.

To receive email notifications letting you know when we’re holding our next webinar, sign-up to our mailing list and ensure you don’t miss out on the latest updates for your business.