May 2021

18

The importance of automated backups

Gather round the fire young payroll processors and let me tell you a tale of terror. The year is 2021, you’ve been in lockdown and working from home for the past year. All of your important work is stored on your trusty laptop. Not only that, but you’ve been processing payroll for a client who employs 20 people...and it’s payday. All of a sudden BAM! Your coffee cup knocks over and spills all over your laptop and the screen goes blank. It won’t switch back on. All your data has been lost. Did I mention its payday?!! Come back, stop screaming! It’s only a story!

But here’s the thing, it’s not a story. These accidents happen literally all the time and all the more so since we’ve been working from home with pets, children and other halves who have no respect for personal boundaries. In my case, my cat was trying to catch a fly and knocked my coffee cup over (yes really) but I’m sure everyone has their own story of misfortune to tell.

But accidents aren’t the only way in which your data can be permanently lost. Pretty soon we’ll returning to our offices again and with that comes the perils of the workplace such as:

- Your office could be physically broken into and your equipment stolen.

- You could lose your laptop by accidentally leaving it on, say, the tube.

- There’s a fire or property damage and your computers are beyond repair.

- You are a victim of cybercrime where your computer is infected with ransomware or other harmful viruses.

Luckily there is a simple way to avoid the terror of losing all of your precious work and payroll data and it’s - yup you’ve guessed it - backing up your data.

Now, some of you may be manually backing up your data and that’s great. But there is a much easier way. BrightPay Payroll Software offers an add-on called BrightPay Connect that automatically, yes automatically, does this for you every time you run your payroll or make any changes to it. Any work you do gets automatically synchronised to the cloud.

Let’s talk about the cloud. It gets a bad rap sometimes and people seem to be a little tentative about it. But in actual fact it is an absolute ideal information storage space. It’s also easily accessible, remotely accessible and quickly accessible no matter where in the world you are (dependent on WiFi). So if you have any problems or lose any of your payroll data you can literally pluck it out of the sky and restore it to your computer.

Not only that, but BrightPay Connect maintains a chronological history of your backups so you can restore or download any of the backups at any time, whether it’s to a PC or a Mac. You can also backup onto your existing computer or simply download a backup to a brand new computer that hasn’t been destroyed by coffee, enabling you to get up and running right where you left off, no matter where you are.

So basically a secure, encrypted software that automatically stores your data in the cloud, making it easily and remotely accessible? Yes please - you’d be mad not to! And you don’t have to get rid of your cat either. For more information about BrightPay Connect, book a 20-minute demo that goes over all of the additional functionalities.

Related Articles:

Feb 2021

8

Two Factor Authentication Explained

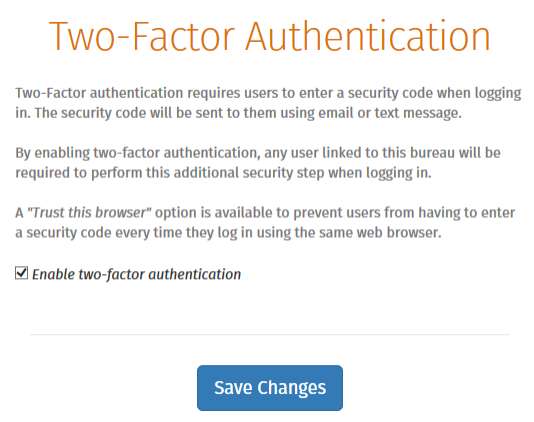

As security is a large concern for many businesses nowadays as data breaches are a threat to all entities, Two Factor Authentication can now be enabled as a feature for users of BrightPay Connect. Two Factor Authentication is a second layer of protection to re-confirm the identity for users logging into Connect through an internet browser or through BrightPay. This improves security, protects against fraud and lowers the risk of data breaches as users can access sensitive employer and employee data in Connect with the increased security layer.

BrightPay Connect is an optional cloud add-on feature that works with BrightPay. BrightPay Connect provides a secure, automated and user-friendly way to backup and a self-service dashboard to both accountants and employers so they can access payslips, payroll reports, amounts due to HMRC, annual leave requests and employee contact details.

How it works

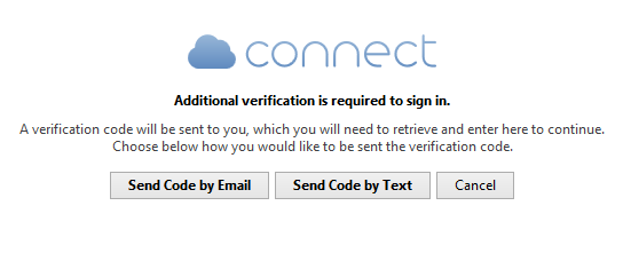

If Two Factor Authentication is enabled for a Connect account, when any user on the Connect account tries to sign into Connect via their internet browser here or through BrightPay, they will be asked to enter in a security code that needs to be sent to them. The user can select to have the security code to be sent by email or by text to the user.

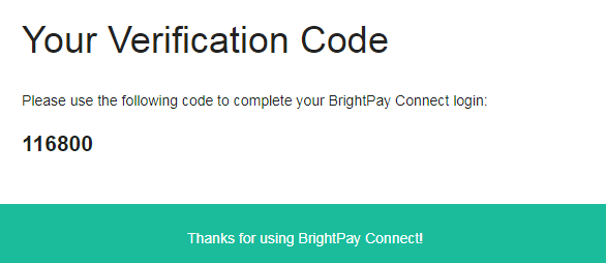

Once the user receives the security code the user enters this in the 'verify code' field and selects 'Verify Code'. The user will only be able to access the security code if they have access to the email account or mobile device. The random generated 6 digit security code will expire after fifteen minutes so a new code will have to be sent if the code is not used in the time limit.

This Two Factor Authentication uses a second security measure of identification ensuring the user is the correct user when logging into Connect. It adds an additional layer of security to an already secure hosted platform and gives the user more reassurance that their payroll data is safer and more secure.

To Enable this option in Connect when you are logged in > Go to 'Settings' > Go to 'Two Factor Authentication' > Tick the box > 'Save Changes'.

Related Articles:

- GDPR: Frequently Asked Questions

- GDPR and BrightPay

- Five Challenges Businesses Face When Switching Payroll Software

Jan 2021

29

10 Benefits of using a Cloud Payroll Portal to Manage Employees Annual Leave

For employers, managers and HR departments, the task of handling your employees’ time-off requests can often feel more complicated than it needs to be. When requests are submitted manually or when the protocol on how requests should be made is unclear, it can often lead to problems. Delays in processing, lost requests or conflict over which employee is more entitled when there are overlapping requests are just some of the headaches that employers may have to endure.

COVID-19 has created many new challenges for organisations processing their employees’ annual leave entitlements. As more people are now working remotely, it is likely that organisations’ annual leave request conventions are no longer adequate.

Although we know that it is not always possible to keep everyone happy, having a leave request system in place that is transparent, fair and convenient can make life a lot easier for employers and management, while at the same time boosting employee morale.

An online solution that synchronizes with your payroll software

BrightPay Connect is an online, self-service solution that allows employees to request leave wherever or whenever suits them; be it from their desk or even in their own time through the BrightPay Connect mobile or tablet app. BrightPay Connect is an optional cloud add-on that works alongside BrightPay Payroll. Once a request for leave has been made, the relevant manager will receive a notification on their own BrightPay Connect dashboard. From the dashboard, employers can either approve or deny the leave request. Below, we’ve listed ten benefits of using BrightPay Connect to manage your staff’s annual leave.

- Through your dashboard, you can view a real time, company-wide calendar. Here, at a glance, you can see which employees are on leave, when they are on leave (employees can choose full days, half-days or even by the hour, if set up to do so) and the type of leave (e.g., sick, paid, unpaid, parental).

- The relevant manager will receive a push notification when a new leave request has been made. From the notification box they can then either accept or deny the request, making request approvals quick and easy.

- Cloud integration means any approved leave requests will flow directly back to your BrightPay payroll software on your PC or Mac. This saves you time and cuts down on errors when entering employees leave for payroll processing.

- Through the app, employees can view how much leave they have remaining which reduces the back and forth between employees and management/HR regarding how many days leave they have left.

- You have the ability to grant access to your accountant, bookkeeper or selected colleagues. This means that in your absence you can rest assured any annual leave requests are being taken care of. There is also a full audit trail of leave that has been requested and who has dealt with that request.

- The calendar on your employer dashboard draws attention to employees whose absenteeism might otherwise go unnoticed. Likewise, the employee dashboard draws attention to the employee’s own absenteeism. Having past sick days visible to employees has been shown to reduce the employee’s overall sick days taken.

- The employer has the ability to mark off any mandatory leave days for employees so there is transparency around which days must be taken as holidays.

- If your leave approval works on a first come, first serve basis, by using BrightPay Connect you cut out any confusion over who requested the leave first.

- Employees also reap the benefits of using a cloud payroll portal. Giving the employees the ability to request leave wherever and whenever they want gives them a sense of control and in turn feel more organised and less stressed. Researchers at the University of Birmingham found that when employees have more autonomy in the workplace this can increase employee motivation, job satisfaction and overall well-being.

- Nowadays, many people either do not have or rarely use a desktop computer at home. Therefore, being able to access the BrightPay Connect app through your smartphone or tablet makes a significant difference for employees. The employee payroll and HR smartphone app is available for free on any Android or iOS device.

Book an online demo today to discover more about BrightPay Connect and the many other ways it can benefit your business.

Related articles:

Dec 2020

18

Add some sparkle to Christmas with the perfect cloud solution

What springs to mind when you hear the word ‘cloud’ will vary from person to person. Some will think of the weather as they look, grumbling, out their front window. But others will be thinking about all that extra storage on their iPhone. The meaning of the word has changed in recent times and most of us will now think the latter. But what about those who haven’t a notion what you’re on about? What is the cloud?

The cloud is a general term for any computing service that involves hosting over the internet to deliver computing services in lieu of a hard drive. Services such as storage, payroll and HR information. The other key feature is that you can access these services or information anytime, anywhere from any device that is connected to the internet. In fact, you’re already using cloud services if you use social media, Google Drive and Dropbox to name but a few. And now the cloud has become a must-have for any business who wishes to keep up with the times.

I can hear some of you now: “It sounds great, but my employees would never use something like that”. Well, that’s where you’re wrong. A recent survey found that 48% of people believe technological advances will change the face of the workplace and a massive 87% of those said they would be happy to adapt to technological changes if the right tools were given to them. Wow! So how do I know which cloud platform to choose for my business?

I’m glad you asked! Our experts got together for a brainstorming session and found that there are four key things to look out for when choosing the right cloud platform for your business - cost, compliance, simplicity and connection.

- Cost - Your upfront costs should be minimised – using the cloud shouldn’t be an expensive luxury reserved for big corporations. Make sure it provides the option of having multiple users so you can delegate and give access to various people to manage payroll tasks and HR requests on your behalf.

- Compliance - Make sure it takes into account your obligations as an employer with regards to things like the GDPR legislation, record keeping requirements and automatic enrolment duties. A good platform will have compliance built-in as standard and will manage it seamlessly.

- Simplicity - The most important thing to increase the uptake of a cloud platform is to make sure it is user-friendly and reduces the chance of human error. Look out for simplistic interfaces and whether or not training and support are available. The best of the best will offer this support for free. You should also be able to get set up and ready to go with minimal disruption to your business.

- Connection - Make sure it offers features that are attractive to employees such as a downloadable app, a self-service portal and company-wide communication features. Because at the end of the day, your employees won’t give a damn about how excited you might be about something unless it works for them too. These features tie in with our ever-increasing digitally-minded workforce and will make them feel more in control and engaged.

So, there you have it… off you go now! Good luck scouring through the internet trying to find the perfect cloud platform. But…., well, ....it is Christmas after all and I’m feeling generous. Ah, what the heck, I’ll just let you in on a secret which is the best cloud payroll platform for businesses out there: our very own BrightPay Connect.

BrightPay Connect is an add-on to BrightPay’s award-winning payroll software and ticks literally every single box I just mentioned over the course of this post. I’ve done enough talking so instead let me show you. Book a demo today to find out why BrightPay Connect is the perfect fit for your business.

Merry Christmas everyone! Don’t say I didn’t get you anything!

Sep 2020

22

Managing Annual Leave During COVID-19: 3 Tips Every HR Manager Needs To Know

COVID-19 has thrown many curveballs for businesses of every size and industry across the United Kingdom. Employers are finding themselves in situations that they could never have expected and faced with challenges that nobody saw coming. However, life must go on and business owners are forced to find creative solutions to overcome these challenges and ensure the continued growth of their businesses.

One of the most common challenges facing employers right now is related to annual leave. Of course, many employees across the country have been placed on furlough for some time in 2020 and many are still on furlough today. However, this doesn’t mean that they are not entitled to annual leave, or that their employee rights no longer apply.

So, employers who have had to place employees on furlough are now trying to figure out how to manage annual leave for those employees in a way which is fair to their staff without being detrimental to their business. Thankfully, help is at hand. In this blog post, we share top tips for employers who find themselves navigating these murky waters and help you to take a strategic approach that’s in everyone’s interest.

3 Tips For Managing Annual Leave During COVID-19

Thankfully, help is at hand. These top tips for employers who find themselves navigating these murky waters will help you to take a strategic approach that’s in everyone’s interest.

Review Existing Policy

The first thing you need to do when figuring out how you’re going to manage your employee annual leave is to review your existing annual leave policy. Most businesses will have standard annual leave policies that don’t vary all that much from business to business. However, there are some things in your policy that you may want to change temporarily.

For example, many businesses state in that policy that annual leave cannot be carried from one year to another. However, the rules in relation to the carry over of annual leave have been temporarily relaxed to deal with the coronavirus disruption. Many employees have not been able to take their annual leave and will likely not be able to do so in the months to come and so you should review and update this element of your policy in light of these relaxed rules.

Internal Communication

The second step in this process is to ensure that you communicate any and all changes to your existing annual leave policy with all employees. If you are making changes to the policy, it is essential that you share these changes with staff.

Simply sending a company-wide email may not be sufficient in this case, as it’s very likely that the email could get lost amongst many other emails in the employee’s inbox. A better option would be to distribute the updated policy via an online employee portal such as BrightPay Connect. With Connect’s self-service portal and app, employees can access important documents anywhere, anytime, and receive instant notifications on their smartphone or tablet when a new document has been made available to them.

If you think that employees will have a lot of questions regarding the changes to the existing policy, it would be in your best interest to hold a meeting either online or in person, where employees have the opportunity to ask questions and you can give detailed explanations so that everyone is on the same page.

Be As Flexible As Possible

Finally, human resources managers or line managers who are dealing with incoming annual leave requests should at all times strive to be as flexible and facilitating as possible. These are very unusual and utterly unprecedented circumstances that we find ourselves in. You may have employees with underlying conditions, with children but no access to childcare etc. whose ability to take holiday time is compromised through no fault of their own.

Therefore, it is in the best interest of your employees and your business to try where possible to accommodate the needs of your employees when it comes to annual leave until the public health status has improved.

Manage Annual Leave During COVID-19 With BrightPay Connect

BrightPay Connect is an optional cloud portal add-on to our multi-award winning payroll software. With Connect, employers can take advantage of the latest in cloud automation technologies and employee self-service. Connect boasts industry-leading features in both payroll and human resources to create a holistic cloud portal that actually works for your business.

With BrightPay Connect, managing annual leave is simple, and it’s even more beneficial during COVID-19 as employees are working from home more than ever before. Connect allows employees to request annual leave straight from an employee app on their smartphone or tablet. The request instantly appears in the Connect dashboard of the relevant manager.

The manager can then check if other employees are on leave during the requested dates via a company calendar, which is also accessible on their online dashboard. Then, they can approve or reject the request and the employee is instantly notified on their app. Furthermore, a time-stamped log of all requests, approvals and rejections is kept in the cloud for future reference. This is ideal when multiple users are managing annual leave remotely.

Book Your BrightPay Connect Demo Today

If your business is struggling with annual leave management because of COVID-19, then why not get in touch with us today? Book your free BrightPay Connect demo where a member of our BrightPay Connect team of experts will be happy to assist you. We will walk you through the various features of BrightPay Connect and explain in detail how these features can make annual leave management easier than ever before.

Sep 2020

10

Remote Working Is Becoming The New Normal - What Does This Means For Payroll?

2020 has been a transformative year for most businesses. Many employers have had to take a long hard look at how they manage their employees and make significant changes in the wake of COVID-19 in order to adapt to what is quickly becoming the new normal. For a large proportion of these businesses, allowing employees to work remotely is playing a central role in that change. And this throws up some challenges.

Remote working isn’t a new phenomenon. Cloud innovations have made it possible for people to work from home for many years. However, most businesses have been reluctant to embrace this practice up until now. This is because, when employees are spread out, even the most basic tasks such as distributing payslips, applying for annual leave and internal communication can be more difficult.

Today, however, employers are finding themselves in a position where they must allow employees to work remotely and find clever solutions to these challenges. And BrightPay Connect is one such solution that makes remote working easier for everyone.

How Does Remote Working Affect Payroll and HR?

You might not think that remote working has any impact on processing payroll, especially if you’re a small business with just one payroll administrator. But there are a number of ways that remote working can indirectly impact payroll. It also has numerous knock-on effects on human resources management which need to be addressed in order for a business to thrive.

Here are some examples of the payroll and HR challenges presented by remote working:

- Distributing payslips manually can be more time-consuming, costly and less secure when employees are not located in the workplace, and instead payslips must be posted to their home addresses.

- Making sure that the payroll and any employee leave during that particular pay period are aligned can be tricky, especially if a number of different line managers and/or HR staff are operating from different locations.

- Checking that the information for the current pay period is accurate can be challenging with employers and managers working from home with often unreliable internet connections.

BrightPay Connect Makes Remote Working Easier

BrightPay Connect is a cloud portal add-on to our payroll software. While the payroll software gives you everything you need to process your payroll, BrightPay Connect offers a range of additional features that streamline your human resource management.

The features of BrightPay Connect include:

- An employee self-service app that’s compatible with both iOS and Android. On the app employees can apply for leave, view and edit their personal data, access a secure payslip library and view HR documents, all from their smartphone or tablet.

- An online employer dashboard. Because payroll information is stored online with BrightPay Connect, employers can access their dashboard from their laptops at home. On this dashboard, employers can view a company calendar which displays all past and upcoming employee leave, upload and share documents with employees, and view any outstanding payments due to HMRC. The employer dashboard also shows notifications for any employee leave requests, or requests from the payroll processor.

- Automatic cloud backups. With BrightPay Connect, you don’t need to worry about safely storing your data. BrightPay Connect automatically backs up the payroll data to the cloud and keeps a chronological history of all backups so that you can restore previous versions if needed. This is a great step towards GDPR compliance for businesses who are trying to modernise their data protection practices. The cloud backup is also extremely useful for remote working because everything is stored and accessible via the cloud from any location.

- Clever employee leave management. Employees can request leave directly from their smartphone app. This is beneficial to remote employees because it eliminates the need for employees to visit their line manager or human resources manager in order to fill out leave request paperwork. The request instantly appears as a notification on their manager’s online dashboard. From here, the manager can use the company calendar to see who else is on leave for the dates requested, and either approve or deny the leave request. A time-stamped log of all leave requests is maintained which is particularly useful when a number of different people are managing employee leave as all of the relevant parties can easily see who approved or denied a request, and when.

- Requests for payroll data. Whether you are a payroll bureau processing payroll for a number of clients, or an in-house payroll administrator looking for payroll information from various departmental managers, BrightPay Connect’s payroll entry requests feature can be extremely beneficial when working remotely. You can send a request to your clients or to in-house managers requesting information regarding the employee’s hours and payment information for that particular pay period. Once the payroll information has been entered or uploaded, you will receive a notification on your employer dashboard and can synchronise the information directly to the payroll software. As well as eliminating the need for double entry of payroll information, it also frees up time spent chasing the various managers for the employee timesheets, especially if they are working remotely.

Book Your Free BrightPay Connect Demo Now

If your business is embracing remote working and trying to find ways to facilitate this new practice, then book your free BrightPay Connect demo today and let our team of experts show you just how much easier remote working can be.

Aug 2020

11

3 Benefits of Employee Apps That You Never Knew

Employee apps have become a big trend in the digital communications infrastructure of businesses in every industry imaginable over the past few years. Initially, they served little or no real tangible purpose other than to help the business appear to be at the forefront of technology and employment trends. However, more recently, app designers have created apps that deliver real, measurable value for both employees and employers.

Introduced in 2017, the BrightPay employee app is available to all BrightPay Connect customers. Connect is an add-on to the payroll software which offers a whole host of additional features, from automatic cloud backup to employee dashboards. However, the employee app is one of the most attractive of these additional features, and for good reason.

This is because employers and human resource managers are constantly trying to find more effective ways of communicating with their employees, as well as methods to streamline everyday processes such as annual leave requests. Our employee app does all of this and more, and gives employees a crucial sense of engagement that’s invaluable to company culture and the productivity of staff.

But, if you’re an employer or human resources manager who’s considering using an employee app to update your internal comms abilities, you’re going to need to weigh up the benefits of the app and think about how they would apply to your organisation.

Benefits of Employee Apps

So, without further ado, let’s break down the benefits of employee apps so that you can make the best decision for your business.

Leave Requests and Approval

Few people expect that an employee app can help with leave requests, but they can. In the BrightPay Connect employee app, employees can apply for annual leave or unpaid leave directly from their tablet or smartphone. Once they've sent their request, the relevant manager will receive a notification on their BrightPay Connect dashboard.

From here, they can approve or reject the request. The calendar on their dashboard will show them all of the scheduled leave for the relevant dates, so they can see who else is on leave at that time. If they choose to approve it, the leave will automatically appear in the company calendar on both the online dashboard and the employee app.

This is particularly useful to companies with large numbers of employees whereby a significant amount of time is spent processing employee leave requests and manually updating the company calendar.

Internal Communications

Another major benefit of using a self-service employee app is the vast improvement in internal communications. Employers can upload any type of documents they want to be available on the employee app. These documents are then stored in the cloud, where employees can easily access them from anywhere in the world.

What makes this feature even more useful is that the employer can choose who has access to which documents. For example, you may upload three documents at once. One is an updated Health and Safety policy, another is a new budget document for the marketing team, and another is an employee file for a recent starter.

Our document sharing feature will allow you to make your Health and Safety policy available to everyone in the company, make the budget document available only to the marketing team, and make the new employee file only visible to yourself and your human resources manager. You can customize the access permissions for each document, and change that access at any time. And you can see who has opened and read the various documents via a time-stamped historical log.

This means that, not only can you use the document sharing facility to distribute important documents to your employees, but you can also use Connect as a secure online hub, where you store all employee data and documents safely.

Payslip Archive

One of the features of the BrightPay Connect employee app that your employees will really love is the handy payslip archive. Via the app, payslips are distributed directly to employee smartphones or tablets where they can be viewed, downloaded and printed in just a few clicks. But, in addition to this, the payslips are kept on the app in a historical archive that dates back to when you started using BrightPay Payroll - even if it’s before you introduced the app or started using BrightPay Connect.

This is great news for employees for two reasons. Firstly, because they cannot lose payslips in their email inbox or accidentally delete them and have to ask for them to be resent. And secondly, because it makes applying for mortgages or other personal finance banking options simpler as they can easily access and print as many payslips as their bank requires.

Find out more about the BrightPay Connect Employee App today

If you think that the BrightPay Connect employee app could benefit your business, why not book a free demo with our team of Connect experts? They will talk you through all of its many features, including the app and so much more.

Jul 2020

27

Connect – Calendar Updates

The calendar functionality in BrightPay Connect has been updated and improved, making it more user friendly and graphically appealing for both employers and employees. Improvements such as calendar and leave view, custom leave types and requesting leave are part of the new enhancements.

Calendar Display

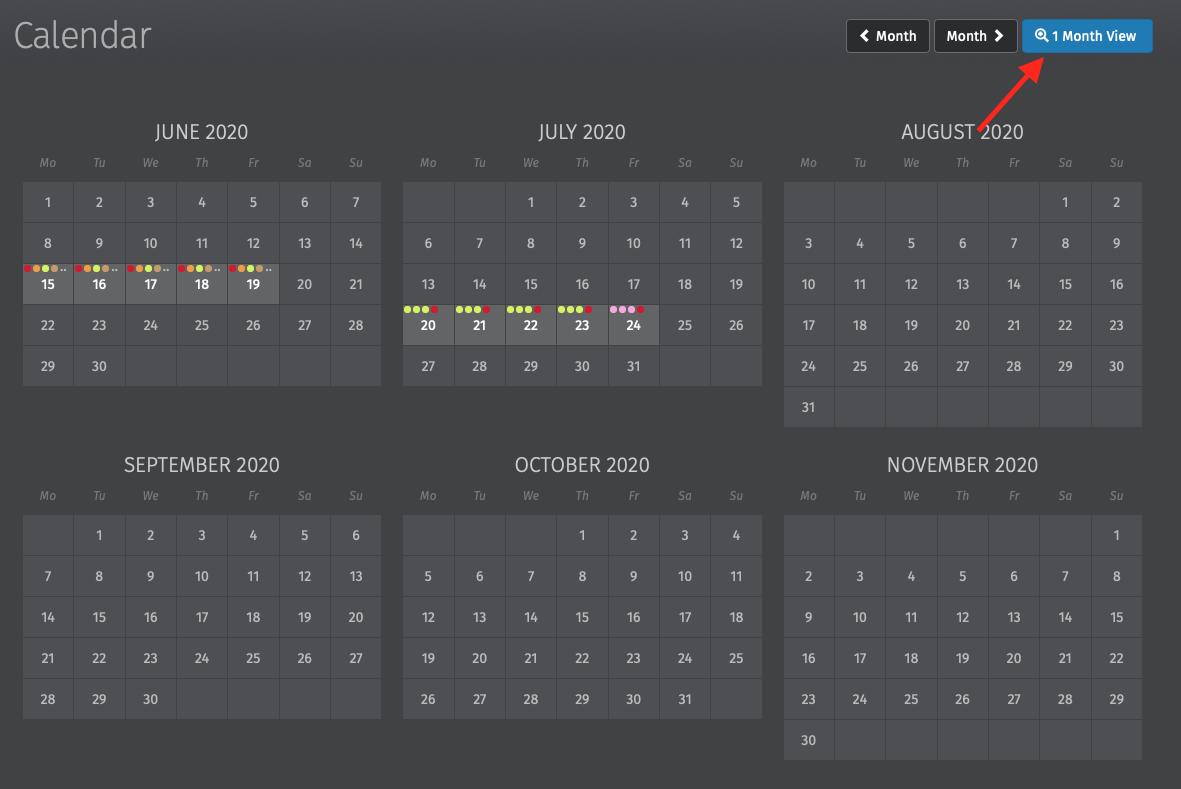

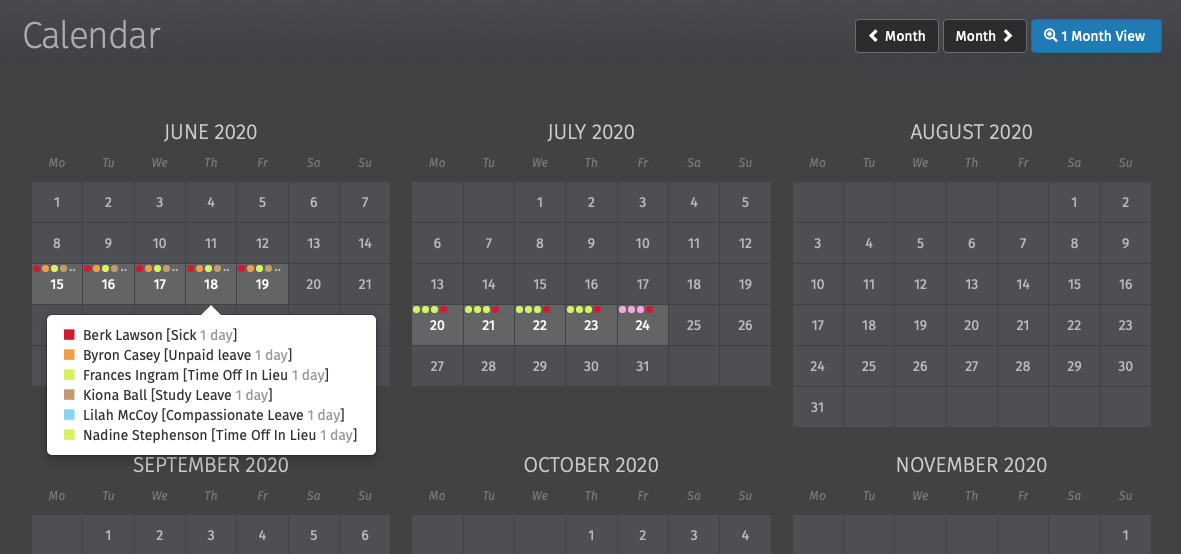

The number of months displayed on the calendar for both employers and employees can be selected, the options available are 3 months, 6 months, 9 months and 12 months. This can be selected under the Settings tab in the Employer portal, further details can be found here.

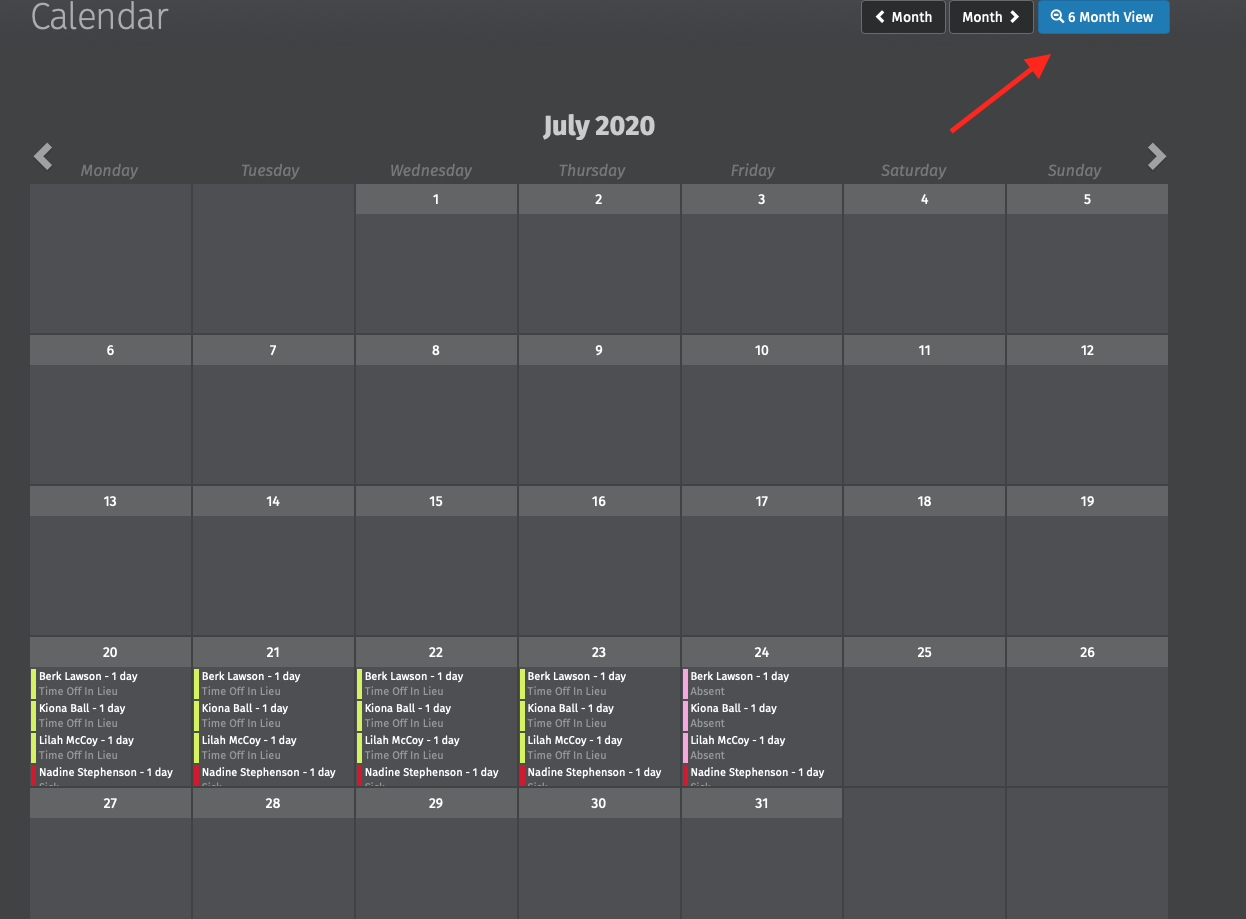

On the Employer or Employee Calendar in Connect the calendar can be displayed for one month or multiple months. One month view can be seen by selecting the '1 Month View' option. The view can be returned to the default number of months view by selecting ‘3 / 6 / 9 / 12 Month View’. On the ‘1 Month View’ there are new widgets for scrolling up and down through the number of leave entries on a particular date.

Dates with multiple types of events are dotted with the relevant colours. To see the breakdown, simply hover your mouse over the date. By selecting a date on the calendar a dialog box will open to show all the entries on that date without having to scroll.

Custom Leave Types

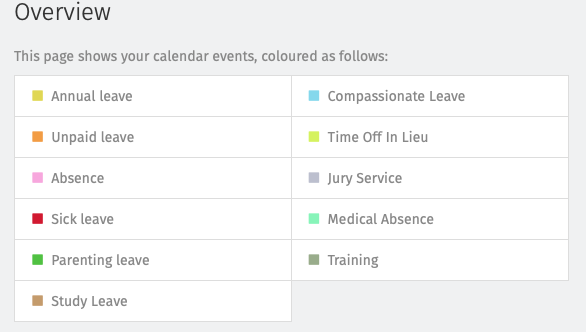

Custom leave types are now available in BrightPay Connect. In BrightPay 2020/21 you can define nine additional custom leave types for employees. Six of the custom leave types are set up with default descriptions such as time in lieu and study leave. Instructions on how to add, edit or remove these custom leave types can be found here.

When a custom leave type is entered on the employee’s calendar in BrightPay and synchronised to Connect the leave type will be displayed on the calendar for both the employer and the employee to view on their online portal or mobile app. Custom leave can only be entered on an employee’s calendar by a user in Connect or on the employee’s calendar in the BrightPay employer file. Employees cannot request any custom leave types.

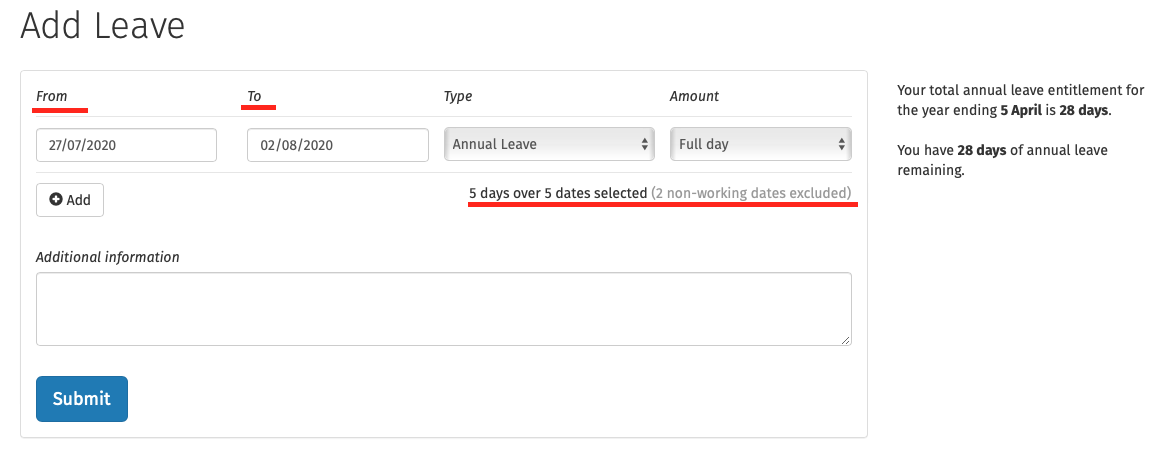

Adding/Requesting Leave

When employers are adding leave on an employee’s calendar in Connect or an employee is requesting leave, they are now entered as date ranges simplifying leave dates being selected. If the employer or an employee enter in an invalid date range (e.g. including non-working days in the date range) it will automatically correct this and only working days will be included in the request.

Interested in finding out more about how BrightPay Connect can streamline your leave management processes? Book an online demo of BrightPay Connect today.

Jul 2020

14

Make Payroll Entry And Approval Simple With BrightPay Connect

We speak to payroll bureaus all of the time, always keen to hear what their biggest challenges are and how we can help make their job easier, and one of the most common issues we hear is that requesting payroll information from clients can be an inefficient, time-consuming and often, frustrating process. And we understand why.

For any payroll bureau, getting payroll approved by clients can be a tiresome process. Despite meticulous attention to detail, finding mistakes in the payroll is common. Even the most detail-oriented clients are prone to forgetting to let you know that James had to take a week off with the flu, or that Michelle’s maternity leave started early. As a result, it isn’t until you hand over the so-called finalised payroll to the client that these changes are brought to your attention and you’ve got to go back and make the (often, many) appropriate changes. Sound familiar?

The good news is that BrightPay Connect makes this process so much simpler and reduces the chances of such omitted information (and the time it takes to get that final payroll approval) significantly. As such, it has become a must-have tool for bureaus big and small who want to streamline their payroll entry and approval process and increase efficiency with their clients.

What Is BrightPay Connect?

Not to be confused with the payroll software, BrightPay Connect is an add-on feature which is purchased separately and works alongside BrightPay payroll software. As such, it offers a range of features not made available through the payroll software alone. These include an employee app, an employer dashboard, a secure online portal and much more. While BrightPay’s payroll software looks after the day to day tasks involved in payroll management, BrightPay Connect offers extra benefits, not least of which is it’s payroll entry and approval feature.

How BrightPay Connect Can Help With Payroll Entry And Approval

Getting payroll information from clients has never been as easy thanks to Connect. From your bureau dashboard you can send a payroll entry request to one client at a time, or in batch form to dozens/hundreds of clients in the same amount of clicks. You simply select the clients from a drop-down menu and send your requests, instantly.

A real-time dashboard also lets you see what requests you’ve sent out and breaks them down into requests that have been responded to by the client, and requests for which you’re still waiting for a response.

On the client’s end, they will receive a notification on their online employer dashboard that lets them know they need to enter or upload their employee’s pay information for the pay period. The client can add new employees here too, and there’s a user-friendly comment section where they can leave any notes that they’d like to share with you, cutting out the need for endless back and forth emails.

Once you’ve received the payroll entry from your clients, complete with their employee’s pay information, the bureau can review the information that has been entered by the client and apply this information in BrightPay Payroll Software at the click of a button. All communications between the payroll bureau and the client are automatically tracked in the online audit trail on BrightPay Connect.

From this point you can finalise the payslips or if you wish to get the payroll signed off by the client, you can send them a payroll approval request. This allows you to securely send a payroll summary to the client for them to review before you send the payslips to the employees.

Similar to the payroll entry request, the client will receive their payroll approval request on their online client dashboard instantly and can choose to either approve or reject the payroll. Either way, your dashboard will update automatically to let you know and the audit trail keeps a complete time-stamped record of all requests, protecting both your bureau and your client.

Want to learn more about BrightPay Connect and how it’s sophisticated payroll entry and approval functionality can transform your payroll processes? Book a free online demo here for a detailed walkthrough of everything the portal can offer you and your clients.

May 2020

12

How to introduce BrightPay Connect to clients

Introducing a new service to your payroll clients isn’t always as simple as we’d like it to be. Yes, you know that it would be great for their business and maybe they do too, but it’s likely that they’ll still need some convincing to get them over the line and on board. So, here are 3 things to keep in mind when introducing BrightPay Connect as a new payroll process.

What Does Your Client Need

Before you make your case to your clients, you need to be sure that you’re offering them the best service for their business. Every client is different in one way or another, and this means that a one-size-fits-all approach to their payroll just isn’t going to work. It’s also not going to give them confidence in your ability if they think you don’t understand their business, so doing your homework here will really pay off.

In order to get your client on board with your new payroll offering, it’s useful to think about what challenges they’re facing right now regarding payroll, and whether BrightPay Connect is a right fit for them. BrightPay Connect offers a whole range of additional HR benefits, so think about how these extras can save your clients time. Begin your introduction by showing your clients that they’re in safe hands because you fully understand their payroll challenges and you’ve got just the product to help them make their payroll processes even easier than it’s ever been before.

How Can You Provide Added Value

So now that you’ve established how BrightPay Connect can modernise your client’s payroll process, it’s time to pitch the benefits to them. For most clients, this is a simple case of informing them about the HR features they may not have themselves including:

- Client payroll portal

- Payslip library

- Employee payroll app

- Annual leave management

- HR document upload feature

- Automated payroll reports

You can also present BrightPay Connect as a time saving opportunity by explaining to them that the cloud functionality frees them up to dedicate additional resources to other aspects of the business.

What’s The Bottom Line

Every client, whether big or small, is always trying to find new ways to cut costs, reduce administration and maximize profits (without cutting quality services). And in today’s climate, most businesses don’t have any choice in keeping their costs down as much as possible. So, one of the best ways you can sell your payroll services to your clients is by simply showing them just how cost effective it is.

BrightPay Connect offers highly competitive pricing options where users are billed based on usage. The usage subscription model is based on the number of active employees in the billing month. The more clients you have the lower your cost per employee, which means you can pass the savings along to them. You can also find ways to make it even more tempting to your clients, such as offering them a free trial period, or a special deal if they refer a new client to your bureau. This is totally up to you, but don’t be afraid to be creative with how you cost this service.

Book a demo of BrightPay Connect to see how you can help your clients with a new and improved payroll service offering.