Oct 2013

11

GOOD NEWS PROPOSED FOR COMMUTERS

The Mayor of London, Boris Johnson, has proposed that season tickets for commuters be considered as a salary sacrifice to give tax relief to those who have to travel to work. He has suggested that they be treated the same as the current Child Care Voucher or Cycle to Work Scheme. The employer would buy the season ticket and deduct the cost from the employee’s pay before tax is deducted. Therefore the employee would have the benefit of the ticket but pay tax on a lesser amount.

At the moment this is only a proposal and has been forwarded to the Chancellor for consultation.

Sep 2013

23

What's New in BrightPay 13.5?

BrightPay 13.5 is a free upgrade to our 2013/14 payroll software. It adds many new features to BrightPay, including some popular customer requests.

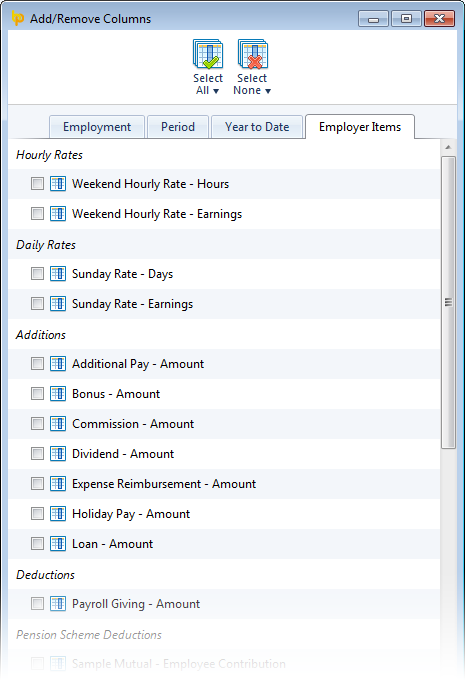

Ability to Report on Specific Employer Items in Analysis

Until now, BrightPay's analysis feature was limited to reporting on the common payroll data that could apply to any employee's payslip in any period (e.g. gross pay, tax, NICs, etc.).

Until now, BrightPay's analysis feature was limited to reporting on the common payroll data that could apply to any employee's payslip in any period (e.g. gross pay, tax, NICs, etc.).

A popular request from customers was the ability to report on the employer specific data that is editable under the main Employer tab of BrightPay, including:

- Specific addition and deduction types

- Specific hourly and daily rates

- Specific pension scheme deductions

- Specific savings scheme transactions

This feature is now available in BrightPay 13.5. As you add/edit the above items and use them in payslips, their amounts become available for reporting in Analysis.

Also, to make it easier to build your reports, the Add/Remove Columns feature in BrightPay has now been organised into tabs.

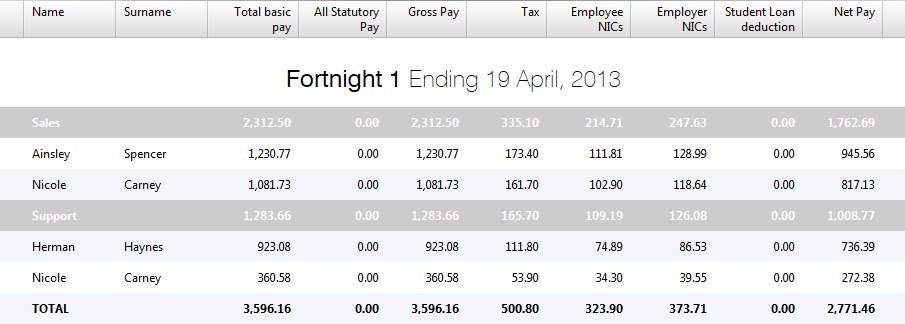

Improved Departmental Reporting

When reporting by department, BrightPay now groups the departmental records in a more logical, useful way. An employee in multiple departments can now have his/her payroll values split out into each department within the results for a single period.

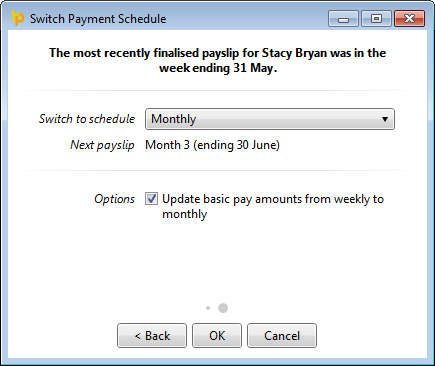

Ability to Switch Employees to a New Payment Schedule Mid Tax Year

Do you have employees who are switching from being paid weekly to being paid monthly? Or the other way around? Perhaps some need to switch to or from a fortnightly or 4-weekly pay schedule?

This feature is now available in BrightPay 13.5. In any period, you can now switch one, multiple or all employees to a new payment schedule. This can be done as many times as is required throughout the tax year.

Here's how it works (for example, when switching from weekly-paid to monthly-paid):

Here's how it works (for example, when switching from weekly-paid to monthly-paid):

- Finalise an employee's payslips up until the final week that she should receive a weekly payment.

- Her next payslip will be set up in the following week. You want her next payslip to be in the following month instead, so choose this week in BrightPay and go to More > Switch Employee(s) Payment Schedule...

- More than one employee can be switched if need be. Select the relevant employees and click Continue.

- Select 'Monthly' as the new payment schedule.

- BrightPay will automatically determine the next available month to switch to, or, if no monthly schedule has been set up, allow you to do so.

- To prevent doubling up on payroll amounts, employees can only be switched to a later month that does not overlap with any already finalised weeks.

- If there are one or more weeks which could be finalised before switching to a monthly schedule, BrightPay will warn you.

- You can optionally choose to have the employee's basic pay automatically adjusted from weekly to monthly.

- Click OK. BrightPay will remove the weekly payslip that is no longer relevant, and create the employee's first monthly payslip.

Other New Features and Fixes

- Ability to ignore 'zero pay' payslips in analysis.

- Fixes a bug in which an EPS (or NVR) cannot be created for mid-year-start employers.

- Fixes a bug in which BrightPay will not accept an employee start date for mid-year-start employers.

- Other minor fixes and performance improvements.

Upgrading

When you next launch BrightPay, the upgrade should be automatically detected – simply follow the instructions on-screen. If you have any problems upgrading, please contact us.

Sep 2013

18

Childcare Vouchers - a win-win situation for all involved!

Childcare vouchers play a vital role for employers as they endeavor to hold onto their skilled and experienced workforce and also cut costs. By introducing childcare voucher schemes employers can reap financial benefits.

Employers who provide childcare vouchers for employees can save up to 12.8% on National Insurance Contributions (on the value of the vouchers up to £55 per week). The more employees with nursery/crèche costs are encouraged to claim childcare vouchers; the greater the saving for your business.

Childcare vouchers allow working parents to save on registered childcare costs through their employer. By taking part of their salary in vouchers, rather than paying the child-minder or registered crèche directly from their net pay, a working parents' tax burden is reduced and their employers also save money - so it is a “win-win” situation for all involved.

Childcare vouchers are a flexible, legal method for working parents to pay for all forms of registered childcare including day nurseries, registered child-minders, crèches and playgroups, after-school and breakfast clubs, holiday schemes and workplace nurseries.

So How Do Childcare Vouchers Work?

The first £55 per week (£243 per month) of childcare vouchers that an employee receives through their payroll is exempt from income tax and national insurance contributions. This means that a parent paying basic rate tax could save up to £77 per month on registered childcare.

Couples who work for companies each offering the childcare voucher scheme are both entitled to claim up to £243 each per month of their salary as childcare vouchers. These joint tax exemptions could mean a family saving of as much as £154 per month on registered childcare costs.

Childcare voucher schemes are very easy to set up and put into practice. Due to the tax incentives involved childcare vouchers are a business investment, not an expense.

To find out more about childcare vouchers visit http://www.employersforchildcare.org

To find out how to set up Childcare Vouchers in BrightPay see http://www.brightpay.co.uk/docs/13-14/processing-payroll/childcare-vouchers/

Sep 2013

11

Missed RTI Deadline? – Expect a Letter from HMRC

167,000 employers have missed one or more deadlines for the new RTI reporting system for PAYE income tax. These employers will now receive a letter from HMRC.

HMRC previously sent a chasing letter to companies that missed a deadline in June, and instructions on how to use RTI were sent in October 2012 and again in February 2013.

Although a few companies may not report because their PAYE scheme is unused or no longer operating, but in these cases employers are still required to let HMRC know by contacting the Employer Helpline.

Certain employers are also required to operate a PAYE scheme for employee expenses and benefits, in this case they should either submit a nil EPS every month, or contact HMRC to change their scheme to annual reporting. The Tax Office will not contact employers who have already registered their PAYE scheme as an annual scheme.

Over 85 percent of employers - 1.6 million employers and 40 million individuals - are now using RTI, with HMRC recently contacting employers via an on-line survey to estimate how companies are coping.

A temporary relaxation for small businesses was recently extended to April 2014 due to manageability concerns as The Institute of Chartered Accountants in England and Wales warned it would be "impossible" for many businesses to comply.

Aug 2013

27

Payroll World Awards - Shortlist announcement

BrightPay has been shortlisted as a finalist in the 'payroll software product' category for the Payroll World Awards 2013! The full list of finalists will be publicised on the Payroll World Awards website, via email and in the magazine on the 30 August.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Aug 2013

22

Rate BrightPay and Win £1,000 in Amazon Vouchers

We'd greatly appreciate your time (a few minutes!) to share your feedback on BrightPay in the AccountingWEB Software Satisfaction Awards Survey.

As well as helping us to improve BrightPay, your feedback could also enable us to become one of the lucky few shortlisted for a prestigious AccountingWEB Software Satisfaction Award!

AccountingWEB are offering those that participate in the survey the chance to win a top prize of £1,000 in Amazon vouchers or one of five £100 Amazon vouchers.

Aug 2013

22

CIPP Payroll and Pensions Awards Shortlist Announced

Following a judging which took place on Friday 16 August 2013, we are delighted to announce that CIPP have short-listed BrightPay for the CIPP’s payroll and pensions excellence awards.

BrightPay has been shortlisted in the "Payroll product of the year" category.

The winner will be announced on 26th September 2013.

Aug 2013

14

Real Time Information - Reconciling PAYE Charges

HMRC has published a message on their website regarding RTI reconciliation issues.

"We have received feedback that some PAYE schemes have experienced difficulties in reconciling the difference between:

· the tax we say is due, and

· the tax they think is due

We have set up a dedicated team to identify the cause of these discrepancies.

The team is working with a number of PAYE schemes to work through their examples to examine what is causing these discrepancies, and then to resolve them.

This will also enable us to:· understand the issue in greater depth, and · take the steps necessary to prevent them arising in the first place."

Aug 2013

9

Something to watch out for if you run a four weekly payroll although it may not happen for another 20 years !

A “quirk” in the tax system that occurs once every 20 years has resulted in Asda staff owing more than £12m in outstanding tax to HMRC.

The supermarket’s 170,000 employees were affected by the payroll anomaly that occurs for companies with four-weekly payroll systems, where 14 payments are made in a tax year rather than the usual 13. Most of the employees were paid 14 times between 6th April 2012 and 5th April 2013 – the 2012/13 tax year – rather than the usual 13 times.

The payroll provider, said: “This is an anomaly within HMRC and there is no means of getting round it by payroll providers.”

Following the incident HMRC posted advice on its website on “dealing with ‘week 53’ payments”. When completing a Full Payment Submission it says: “Do not change the final tax code to week 1 if the only reason you have used week 1 is to calculate a payment on week 53."

Aug 2013

8

Get your CIS Repayment Claims right first time!

Please use the following points as a checklist to ensure that you have covered all aspects before sending in your company’s CIS repayment claim to HMRC. These are the top issues that are likely to affect how quickly we can process the claim.

Please send your claims to:

PAYE Employer Office

Room BP4009

Park View

NEWCASTLE

NE98 1ZZ

1. Ensure the company’s Agent is authorized specifically for PAYE to act on its behalf for CIS repayments. Form 64-8 is used for this purpose and can be downloaded from the HMRC website here. Please send it to:

HM Revenue & Customs Central Agent Authorisation Team Longbenton Newcastle upon Tyne NE98 1ZZ

Further information on authorization can be found here.

2. Double-check that the Unique Taxpayer Reference (UTR) and the company subcontractor’s name are correct on all documents.

3. Check that all the company’s Payment and Deduction Statements that HMRC have requested to process the claim are sent and that they are for the correct period (the tax year runs from 6 April in one year to 5 April the following year).

4. If the company was incorporated during the year, please ensure that its claim for repayment is only for deductions taken from the company’s payments and not any for periods before incorporation.

5. Check that the CIS deductions taken from the company’s subcontractors are correct and have been reported correctly on the monthly returns.

6. Check that the company has no outstanding returns (CIS300) in its capacity as a contractor within CIS.

7. Ensure that form P35 - or the final Employer Payment Summary (EPS) under Real Time Information (RTI), showing CIS deductions taken from the company’s payments, has already been submitted.

8. Submit any information requested within the timescale specified by HMRC, such as following receipt of a ‘CIS suffered letter’ and that you have included everything that HMRC has requested.

9. Where there are overpayments that do not relate to CIS, please verify how these have arisen by providing supporting documentary evidence to HMRC along with the company’s claim for repayment.

10. Where the company has ceased trading, please remember to send in all outstanding returns for the subcontractors.

Bright Contracts – Employment Contracts and Handbooks.

BrightPay – Payroll & Auto Enrolment Software.