Nov 2019

29

BrightPay wins ‘Payroll Software of the Year 2019'

BrightPay was announced as the WINNER of ‘Payroll Software of the Year 2019’ at the ICB Luca Awards.

The annual LUCA Awards recognise outstanding achievement in the bookkeeping world, where ICB members and students vote in an online ballot to decide the winners of the awards. This year, BrightPay was awarded Payroll Software of the Year, over shortlisted contenders Moneysoft, Sage and Xero.

The awards took place earlier this week, during the annual two-day Bookkeepers Summit, where the BrightPay team had great feedback from the ICB members who are using BrightPay.

Payroll Software you can trust…

The award comes just one year after BrightPay was announced as the winner of ‘Payroll Software of the Year’ 2018 at the AccountingWEB Software Excellence Awards.

With over 25 years of payroll experience, our products are used to process the payroll for over 320,000 businesses across the UK and Ireland. BrightPay also has an impressive 99% customer satisfaction rate and a 5-star rating on Software Advice.

BrightPay for Bookkeepers

BrightPay includes a number of features that are very beneficial for bookkeepers.

- With BrightPay, you can batch process the payroll. You can finalise payslips, check for coding notices, and send outstanding RTI & CIS submissions to HMRC for multiple employers at the same time.

- BrightPay includes direct integration with accounting packages, where you can send your payroll journal directly from BrightPay to Sage One, Quickbooks Online and Xero at the click of a button.

- With the BrightPay Connect add-on, there is the ability to invite your clients to an online employer dashboard. The client can enter their employee’s hours and payment information for the pay period, and once reviewed, this information can be synchronised to the payroll software on the bureaus PC.

These are just a few of the many features we have in BrightPay that can help bookkeepers, but there’s so much more on offer. Don’t miss out - book a demo today to see these features in action and to discover more ways that BrightPay’s award-winning software can improve efficiency and save you time.

We would like to say a massive thank you to all of the ICB members and students who voted for us this year and to all of our customers. Go team BrightPay!!

Nov 2019

27

How cloud payroll portals jack up your cybersecurity

Until the recent past, small businesses were unlikely targets for sophisticated cyber-attacks. But in the internet era, things have changed dramatically.

SMEs are doing more business online than ever and they are using cloud services that don’t use strong encryption technology. It’s turned your average SME into a likely, lucrative target. There’s a lot of sensitive data to be had, and if it’s behind a door with an easy lock to pick then all the better.

This new reality is on display in official statistics. Over four in ten businesses (43%) and two in ten charities (19%) experienced a cybersecurity breach or attack in 2018, according to the government’s cybersecurity breaches survey.

Three-quarters of businesses (74%) and over half of all charities (53%) surveyed also identified cybersecurity as a high priority for their organisation’s senior management. It’s likely GDPR and its stiffened sanctions for breaches and blunders has a lot to do with this heightened priority.

Payroll processing is a key innovation battleground in this new era of hacks and data regulation. Clients want the convenience of online access to their payroll information, but they also demand (and require) the very best in security.

For a bureau, offering best-in-class cybersecurity is a valuable way to add and demonstrate value, with very little actual effort on your part. A bureau using the most secure cloud payroll facility will offer data security as standard.

Meanwhile, the security itself is actually handled by the software supplier and the infrastructure they provide. All you need to do is make the right choice when it comes to picking a software partner.

When using BrightPay Connect in conjunction with your BrightPay desktop application, for instance, all communication between both systems is carried out on a safe channel with maximum security.

BrightPay utilises all manner of best practice to guard against nefarious tactics such as data injection, authentication hacking, cross-site scripting, exposure flaws, request forgery, and the many other types of vulnerabilities.

BrightPay Connect utilises the Microsoft Azure platform to give users reliability, scalability, data redundancy, geo-replication and timely security updates out of the box.

As a payroll bureau, cybersecurity is a critical commercial area. You must be able to promise security to both current and prospective clients. By investing in payroll software that offers cloud integration powered by the latest tech, that’s an easy promise to keep. Being at the bleeding edge of cybersecurity has never been simpler.

Book a demo today to discover more ways that BrightPay Connect can protect your business.

Nov 2019

19

How to use cloud technology to attract new staff

The Cloud is the current buzz-word in technology. Employers in the know are reaping the benefits from its capabilities, including helping them attract and retain new staff.

Why is this important? Becoming an employer of choice has never been more important, especially as we are at near full employment. A quick search of any of the main job boards will show an abundance of available jobs. It’s a jobseeker’s market. The challenge for employers therefore is to attract and retain the best candidates. One way to attract and retain employees is to offer them something new, something edgy… a strong, feature-rich, cloud employee self-service system could be it.

Today’s world has gone online, everyone has social media accounts, we are all familiar with buying many of our goods and services online. This is particularly true for millenials (generally defined as those born between 1984 and 1999) who are are fast becoming the largest sector of our workforce. Understanding how to tap into their fast-paced expectations is crucial for business success.

Businesses who do not compete in this space run risks of being overlooked by prospective employees, millennials in particular. This is where employers should consider a cloud, employee self-service system. Offering online access to their annual leave calendar, their personal details, their employers details, all their HR documents and all of their payslips on their smartphones via a dedicated employee app is the smartest, most cost effective way to show your employees you are in the same digital space that they are.

Book a demo today to find out how your business can benefit from cloud self-service systems.

Nov 2019

14

Customer Update: November 2019

Welcome to BrightPay's November update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

IR35 clampdown - Three BBC presenters are made pay back a total of £92,000

-

Expand your payroll services with online client platforms

-

3 GDPR myths you need to ignore

Online payslips offering enhanced GDPR security

Manually approving requests, keeping track of the employees’ annual leave and inputting new data into the payroll software takes a lot of time and can be a frustrating administrative burden for both payroll and HR staff. To make the process easier for all parties involved, the BrightPay Connect app provides a self-service platform that employees can access anytime, anywhere, using the smartphone app or online portal.

CPD Accredited Webinar: Expand your payroll services with online client platforms

Standing out in a crowd of other payroll bureau providers is no easy task, and it’s getting more difficult all the time. Difficult, but not impossible. As a payroll bureau, you need to find unique ways to differentiate your practice from all the others.

Cloud innovation and online client portals are making it easier than ever before for bureaus to offer value-added service. Savvy bureaus are implementing client online dashboards customised with their own bureau branding to effectively differentiate themselves, in order to stand out from their competitors.

Accountants rewarded who take a leap of faith into the cloud

All of us, in the hyper-connected internet era, have found ourselves at a loss when using some software, website or app. You just want to do one thing, or you want to set something up and... you just can’t. It might feel like specific software or apps are testing us in some way. Only those who can navigate through the narrow tunnels of this software are genuinely worthy, in some weird twist on the Arthurian legend of Excalibur.

Clients can now input their employee hours into BrightPay

BrightPay Connect allows bureau users to securely send payroll entry requests and payroll approval requests to their clients, changing the way payroll bureaus interact and communicate with clients. Clients can securely add their employee’s hours saving bureaus hours of administrative time each pay period. Ultimately, your client will be accountable for ensuring the payroll information is 100% correct before the payroll is finalised. Additionally, there is an audit trail of the requests being approved by the client.

Do you want more empowered employees?

Despite the political and social chaos of the moment, we do live in more enlightened times, and employees have more rights now than ever before. Part of that evolution involves empowerment, an integral aspect of BrightPay Connect’s appeal. Payroll bureaus can now offer their clients’ employees easier online access to manage their own payroll information, annual leave, personal contact data and payslips on the go.

Employees can browse and download their history of payslips and other payroll documents, view their payroll calendar, including annual leave, sick leave, and parenting leave, make changes and direct annual leave requests, fully informed.

Oct 2019

17

Customer Update: October 2019

Welcome to BrightPay's October update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

Are employees receiving the National Minimum Wage?

-

BrightPay Connect’s smartphone app

-

Online payslips offering enhanced GDPR security

Free webinar: Payroll transformed - How cloud platforms supercharge the payroll process for employers

The relationship between employees and the employer is no longer one-directional. What software has created is a new collaborative framework in which employers can easily engage with their employees while managing payroll and HR processes. Payroll software with cloud integration envelops the day-to-day tasks like annual leave management, payslip distribution and backing up your payroll. Register for this FREE webinar where we’ll zoom in on six exciting ways that employer cloud platforms have transformed the payroll process.

Changes to Student Loans from 6th April 2020

New rates for the tax year 2020/21 for Student Loan Plans 1 and 2 have been announced by the Department of Education. The new rates will apply to all current and future borrowers for whom employers make Student Loan deductions. In BrightPay 2020/21, the new student loan repayment thresholds for both plans will automatically be calculated and the appropriate student loan deduction applied.

New Feature Announcement: Batch Operations for Payroll Bureaus

BrightPay users have the ability to batch process multiple employers at the same time. This feature is very useful for bureau users, especially for those with a lot of single-director companies or payrolls that don’t change from week to week. The Batch Operation function enables users to process or perform a task on multiple employer files with a single click. Batch processing is available to finalise payslips, to check for coding notices and to send outstanding RTI & CIS submissions for multiple employers at the same time.

Have you heard of our smartphone app which is free for employees?

BrightPay’s employee self-service smartphone and tablet app is available with our cloud add-on BrightPay Connect. The user-friendly app streamlines the payroll processing while reducing the number of payroll queries from employees. The benefits for employees include:

- Instant access to current & historic payslips.

- Request leave on the go.

- View holiday leave remaining and leave taken.

- View HR documents such as employee contracts & handbooks.

- Edit personal contact information including address and phone number details.

Free webinar for payroll bureaus: Cloud platforms - the next generation payroll trend that every bureau should adopt

Online client platforms are transforming payroll services to increase the efficiency and effectiveness of payroll work. BrightPay is running a series of free webinars where we look at cloud innovation and how it’s positively impacting the way bureaus and accountants offer payroll services. Join us for our upcoming webinar as we take a look at what’s new with cloud technology and how it may affect your payroll processing.

Oct 2019

3

The life-changing magic of payroll cloud platforms: Free up time, work smarter and make more profits

The payroll landscape has changed significantly in recent years, not just because of RTI and auto enrolment, but also because of online client platforms. The relationship between the client and the payroll professional is no longer one-directional. Payroll services can - and should - be a team effort.

Join BrightPay’s Rachel Hynes and Ian Jenkinson as they take you through how cloud innovation can streamline, automate and delegate day-to-day tasks such as payslip distribution, entering the client's payroll data and backing up your payroll. That’s more time to focus on the essentials and provide better service.

Webinar Agenda

- Part 1: In this webinar, Rachel will examine six exciting ways that client cloud platforms have transformed payroll services. Not in the distant or even medium-term future: this is happening right now.

- Part 2: Ian will demonstrate how BrightPay Connect’s next-generation features can benefit your practice. Your payroll and HR processes can be more integrated into the cloud and streamlined with your payroll software than ever before.

Be ready to offer a new level of payroll and HR-related services by embracing automation and cloud flexibility for you, your clients and their employees. Register for this free CPD accredited webinar now to see how you can become more efficient by implementing new cloud technologies.

Can’t make it? Register for the webinar anyway and we will send you the on-demand recording when it’s ready.

More upcoming webinars

Join BrightPay for our series of free CPD accredited webinars where we look at how cloud innovation is transforming the future of payroll services. More upcoming webinars include:

Sep 2019

26

Good Work Plan

The Government’s Good Work Plan sets out their vision for the future of the UK labour market.

Whilst some of the initiatives are still at the planning and consultation stage, others have been giving legal effect.

On 6th April 2020 three new pieces of employment legislation will come into force.

- The Employment Rights (Employment Particulars and Paid Annual Leave) (Amendment) Regulations 2018

- The draft Employment Rights (Miscellaneous Amendments) Regulations 2019

- The draft Agency Workers (Amendment) Regulations 2018

Under the new legislation the following changes will be introduced:

- It will become a day one right to receive a written statement of terms and conditions (or contract of employment). The information to be included in the written statement has also been extended. This right will now include workers as well as employees.

- The holiday pay reference period will increase from 12 weeks to 52 weeks. This reform is intended to improve the holiday pay for seasonal workers, who tend to lose out over the way it is currently calculated.

- The Employment Rights (Miscellaneous Amendments) Regulations 2019 will increase the maximum fine an Employment Tribunal can impose on an employer from £5,000 to £20,000 where there has been an aggravated breach of workers’ rights.

- A loophole which allowed agency workers to be paid at a cheaper rate than permanent employees performing the same role will now be closed.

Sep 2019

26

Are employees receiving the National Minimum Wage?

According to Office for National Statistics figures, wage growth has risen to 3.6% in the year to May 2019, outpacing inflation since March 2018. While unfortunately we don’t have a crystal ball to predict how long this will last, we know something for certain: the National Minimum Wage (NMW) and National Living Wage (NLW) will continue to change every year.

Tracking employee hourly rates depending on their circumstances might seem complicated, but it doesn’t have to be. Here at BrightPay, we are constantly working to provide you with a platform that makes payroll and amendments easy. In this short guide, we have summarised all the key information and steps to make changes to the NMW and NLW on BrightPay.

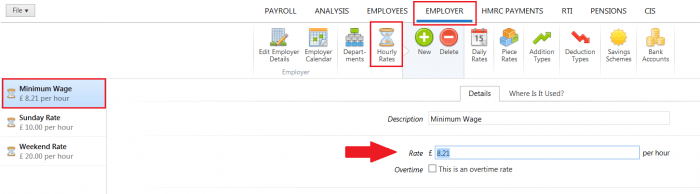

Hourly rates

The hourly rate for the minimum wage depends on an employee's age and whether they are an apprentice:

- The apprentice rate is applicable to apprentices aged under 19 and those aged 19 or over when they are in the first year of their apprenticeship

- Employees under 24 years old are entitled to the National Minimum Wage

- Employees aged 25 or over are entitled to the National Living Wage

The rates for the National Living Wage and the National Minimum Wage change every April and are currently:

| Category of worker | Hourly rate |

| Aged 25 and over (National Living Wage rate) | £8.21 |

| Aged 21 to 24 inclusive | £7.70 |

| Aged 18 to 20 inclusive | £6.15 |

| Aged under 18 (but above compulsory school leaving age) | £4.35 |

| Apprentices aged under 19 | £3.90 |

| Apprentices aged 19 and over, but in the first year of their apprenticeship | £3.90 |

BrightPay can track all employee hourly rates depending on their circumstances. That is including all the cases above, as well as the London Living Wage, and they can also be marked as not eligible.

Checking if an employee is receiving the NMW

You can use BrightPay to determine if an employee is receiving the National Minimum Wage, which is automatically calculated for hourly paid employees.

Once the number of hours worked for a pay period is entered, the payroll software will use the rest of data available about the employee, such as their age, hours worked in period and minimum wage profile to calculate how the hourly rate used compares to the minimum hourly rate, and alert the user if it falls below the relevant minimum wage.

Non-hourly employees

The process is simple for most employees, but you might be wondering about non-hourly employees. The good news is that on BrightPay you will also find a Minimum Wage Report feature that allows you to enter/confirm the number of hours worked for each employee and generate a report that confirms who is above or below the minimum wage. Easy, isn’t it?

If an employee's wage is below the National Minimum/Living Wage, BrightPay will flag it with a yellow status bar within 'Payroll' – or you can choose to hide this notification if you prefer.

Amending a global hourly rate

When the Minimum Wage changes, you can amend the global hourly rates automatically. Hourly rates can also be set up at the employer level in BrightPay from the 'Employer' tab, selecting 'Hourly Rates'. Once the hourly rate has been determined, the changes will automatically be applied to all employees assigned to that hourly rate.

Sep 2019

17

Payroll Software in a hyper-connected internet era

All of us, in the hyper-connected internet era, have found ourselves at a loss when using some software, website or app. You just want to do one thing, or you want to set something up and... you just can’t.

It might feel like specific software or apps are testing us in some way. Only those who can navigate through the narrow tunnels of this software are genuinely worthy, in some weird twist on the Arthurian legend of Excalibur.

But all of this struggle defeats the entire purpose of working digitally and efficiently, particularly for already busy professionals like accountants. All payroll software should be straightforward to use and set up. This is true for BrightPay’s payroll software, and even easier again is BrightPay Connect - the payroll add-on offering cloud integration and an online portal.

BrightPay Connect requires no downloads or manual data input. Everything is automatically available for your clients, where your clients can just login to their own password-protected portal anytime, anywhere. The online portal gives clients access to all employee payslips, employee leave and payroll reports that you would have previously emailed to clients each pay period.

And there are levels to this, too. Senior employees or managers can be given different levels of administration to approve leave, change employee details, view employee payslips, and access payroll reports.

We understand that you don’t offer one-size-fits-all service to your clients, and your payroll software functionality needs to match that. BrightPay is flexible, and your involvement in the payroll process can be ramped up or scaled back as required.

BrightPay’s employer self-service portal has built-in features giving your clients a ready-to-go and easy-to-use HR solution. HR documents can be uploaded including employee handbooks and contracts, disciplinary documents, company newsletters, training material and more.

Clients can also manage all leave for their employees. These features will automate and streamline many of the day-to-day HR functions that your clients deal with. The benefits of the payroll service you offer cascades down throughout the business.

BrightPay Connect gives accountants the ability to send requests to their clients where the clients can now enter payments, additions and deductions for their employees and can also add new starters through their online employer dashboard.

From there, BrightPay Connect goes one step further with the approval feature, allowing you to securely send clients a payroll summary for them to approve before the payroll is finalised. Ultimately, your client will be accountable for ensuring that the payroll information is 100% correct before the payroll is finalised.

Very quickly, your payroll bureau becomes an indispensable part of the business’s administration. By embracing cloud innovation, accountants can really streamline and automate much of the payroll process. And with BrightPay’s easy-to-use, automated software, it’s a low touch, easy-to-manage process. What more can you ask for?

Book a BrightPay Connect demo today to see just how much time cloud automation and integration can save you.

Sep 2019

5

Changes to Student Loans from 6th April 2020

New rates for the tax year 2020/21 for Student Loan Plans 1 and 2 have been announced by the Department of Education. The Student Loan Plan 1 rate will rise to £19,390 on 6th April 2020 from £18,935. The current Plan 2 rate of £25,725 will also rise to £26,575. Earnings above the thresholds for both Plan 1 and Plan 2 for 2020/21 will be calculated as normal at 9%.

The rate of the postgraduate loan type introduced in the 2019/20 tax year of £21,000 will remain the same in 2020/21 and will continue to be calculated at 6%.

Summary of the Student Plan thresholds:

- Plan 1 loans will increase by £455 from the current threshold of £18,935 to £19,390 in 2020/21.

- Plan 2 loans will increase by £850 from the current threshold of £25,725 to £26,575 in 2020/21.

This figure will apply to all current and future borrowers for whom employers make Student

Loan deductions. In BrightPay Payroll Software 2020/21, the new student loan repayment thresholds for both plans will automatically be calculated and the appropriate student loan deduction applied.