Jun 2019

25

Time on your side: How BrightPay Connect empowers employees

With Summer creeping in and school holidays fast approaching, employee holidays go from a trickle into a flood. For workers, it’s a well-deserved break - but for businesses, it can be a nightmare.

The process of annual leave management can still be a manual, spreadsheet, paper-based or, worse, email heavy exercise. BrightPay Connect’s online annual leave tools completely eliminate these cumbersome people management tasks.

It’s more than just payroll software, it’s a ready-to-go, easy-to-use HR software solution that offers an annual leave management facility. HR software shouldn’t be an expensive luxury reserved for big corporates. BrightPay Connect is affordable and designed with small businesses in mind.

The benefits of BrightPay Connect’s online annual leave tools come in three main prongs, enabling:

- Employers to effectively plan their company calendar and staff resources

- Employees to request leave on a portal or smartphone app

- Employees to access leave taken and leave remaining records

All the while, leave is automatically recorded on the payroll software and synced to the cloud. It’s easier for everyone: the employer and the employee. The annual holiday rush should be a reason to be excited, not an admin nightmare.

Employee self-service is about more than leave, though. With BrightPay Connect’s employee self-service portal, an employee can login to their self-service account to view and download all current and historic payslips and payroll documents such as P60s. No more printing or emailing payslips. Instead, payslips are automatically added to the employee’s online portal each pay period eliminating employee requests for copies of past payslips.

That’s easy access to everything in one central location. Employers can upload documents such as employment contracts, staff handbooks, privacy policies, training manuals. The employer can decide whether the employee should have access to view the document or not.

No more laborious, repetitive admin. Just one simple online portal that can save you hours every pay period while simultaneously reducing HR queries and payroll administrative tasks. That’s payroll that’s better for employers, employees, and the environment.

BrightPay, WINNER of Payroll Software of the Year 2018 is a payroll and AE software that makes managing payroll easy. Our cloud add-on, BrightPay Connect introduces powerful online features including an automated cloud backup, online annual leave management, client payroll entry and approval and an employee self-service portal. Book a BrightPay Connect demo today to see just how much time cloud automation and integration can save you.

Jun 2019

18

Payroll Implications of Brexit

If you have eyes and ears then you will have heard something about Brexit lately as the deadline looms ever closer. Britain is currently like a cat that waits at the door crying to be let out but once the door is open, decides it doesn’t want to leave anymore. But never mind all these bigwigs in Westminster saying how this will affect that and so on; today I want to talk about what Brexit means for the unsung heroes of HR, in particular, payroll. How will leaving the EU affect their everyday work life? Well, there are a few key areas to note:

Data Protection - I mean, obviously. This has been pretty much every payroll department’s waking nightmare for the past year since GDPR was introduced. If you have been a good little payroll bureau then you will have all your ducks in a row. But even still, once we leave the EU, it’s up to the European Commission (EC) whether it grants the UK an ‘Adequacy Decision’ to transfer data around the region as the country will no longer be an EU member. So all going to plan it should be ok. But we all know that nothing has gone to plan so far, so in the event we weren’t given an Adequacy Decision, transferring data could become administratively burdensome for employers, especially global ones who rely on data exchanges across borders.

Payment processing - Money’s great isn’t it? Especially when someone puts it conveniently into your bank account. Do you know who loves money? Payroll. It’s their whole world! And what makes it easy to move money to all its lovely employees is being a member of the Single Euro Payments Area or SEPA. This is a body made up of EU member states (and a few non-EU ones too) that streamlines the sending and receiving of payments across SEPA regions meaning that payments are processed in the same way as UK payments. Therefore, continued membership of SEPA is of paramount importance to payroll providers and something they’ll be keeping an eye on.

Employment law - Payroll is made up of tons of HR stuff like holiday pay and maternity pay etc. And where we get the rulebook on these processes is from EU directives on employment law. Although these laws have been great, freedom from EU Directives means that the British government could decide to revisit some laws and make some reforms where necessary. Or maybe not! Who knows. Britain may want to maintain their obsequious stance to the EU to make life easier but it is still an interesting point.

Anything else? How you deal with EU staff (which you can read more about here). Social security payments made in Member states could see a big shift. Along with this, payroll functions that operate across more than one country with, say, expatriate staff could be in for a wild ride. But the most startling obvious thing at the moment is that nothing is really clear at all and none of us can predict what will come out of the woodwork.

The best way to safeguard your payroll against all this uncertainty is to make sure all your HR processes are in place and your payroll software is up-to-date and ready for changes).

Jun 2019

4

Customer Update: June 2019

The hidden benefits of an employee self-service system

The ability for employees to view and edit their own data is one of the most important advancements of HR in recent years. Providing employees with remote access to view personal information is also a best practice recommendation of the GDPR. It's obviously true that employees have a lot to gain from a self-service system, but what about HR personnel, managers and everyone else involved in the payroll and HR process? They benefit too!

Payroll Implications of Brexit

Britain is currently like a cat that waits at the door crying to be let out but once the door is open, decides it doesn’t want to leave anymore. But never mind all these bigwigs in Westminster saying how this will affect that and so on; today I want to talk about what Brexit means for the unsung heroes of HR, in particular, payroll. How will leaving the EU affect their everyday work life? We have put together four key areas to note.

DIY payroll: Empowering clients with self-service remote access

There’s a lot of talk these days about ‘customer-centricity’, in particular integrating your clients into the processes that serve them. The internet makes it easy for clients to help themselves because they can access specific functionality that isn’t confined to a single location or computer. Download our free guide where we discuss DIY payroll and more ways that innovation is improving payroll as a service.

BrightPay back with a bang at Accountex 2019

The BrightPay team were back at Accountex again this year for our fifth year in a row. It was great to meet with so many existing customers and new customers and get to speak with them face-to-face. Don’t miss out - if you didn’t attend, make sure to book a demo and download our brochure today to find out about our newest features.

Download brochure | Book a demo

Three quick things that will really help accountants

18 months ago, the book “What’s next for accountants” stayed at Number 1 on Amazon for three weeks, and was hailed by accountants and gurus across the world as a “must read”. We have persuaded the author (Shane Lukas) to celebrate the 20th anniversary of his business by giving you three ground-breaking gifts.

New User Management Interface for Connect

Our new User Management feature for BrightPay Connect makes it more seamless and quicker for users to be set up or amended. It offers the option to select permissions for multiple employers at one time for a standard user. There is also a new permission to allow standard users to connect and synchronise employers from BrightPay to Connect and a new feature to mark an employer as confidential.

Happy Birthday GDPR!

Yes, that’s right folks, on May 25th of this year our beloved GDPR turns 1 year old! *dries eyes* - they grow up so fast. We all know that GDPR has been a resounding success but we also know that, like all 1 year olds, there's been some teething problems. So let’s take a look back through our photo album of the past year and see how our little trooper has fared over its first year.

Digital trends that every employer should know

It’s predicted that by 2020, the global workforce would be dominated by millennials and generation X. That means by next year, over 70% of the global workforce will be under the age of 40. A younger workforce presents knock-on effects for the entire business. As an employer, you need to adapt to meet the expectations of this new generation of employees; they’re very different from the workforce that preceded them.

From the support desk: Can BrightPay be accessed from multiple users on different machines?

BrightPay employer data files can be stored on a shared network drive or cloud drive to be accessed by multiple PCs or Macs. The BrightPay software application must be installed on each individual PC or Mac you wish to use to access the shared location. A single BrightPay licence allows for up to ten installations.

More FAQs | Online Documentation | Video Tutorials

Key issues facing your payroll department in 2019

The CIPP unveiled their latest “Future of Payroll Report” (2019) for the second year running and surprisingly, it’s not a total snoozefest! The report acknowledges that whilst payroll software and technology make things easier, the number of enquiries does not decrease and payroll departments need to be on the ball to be in a position to answer these queries effectively.

May 2019

31

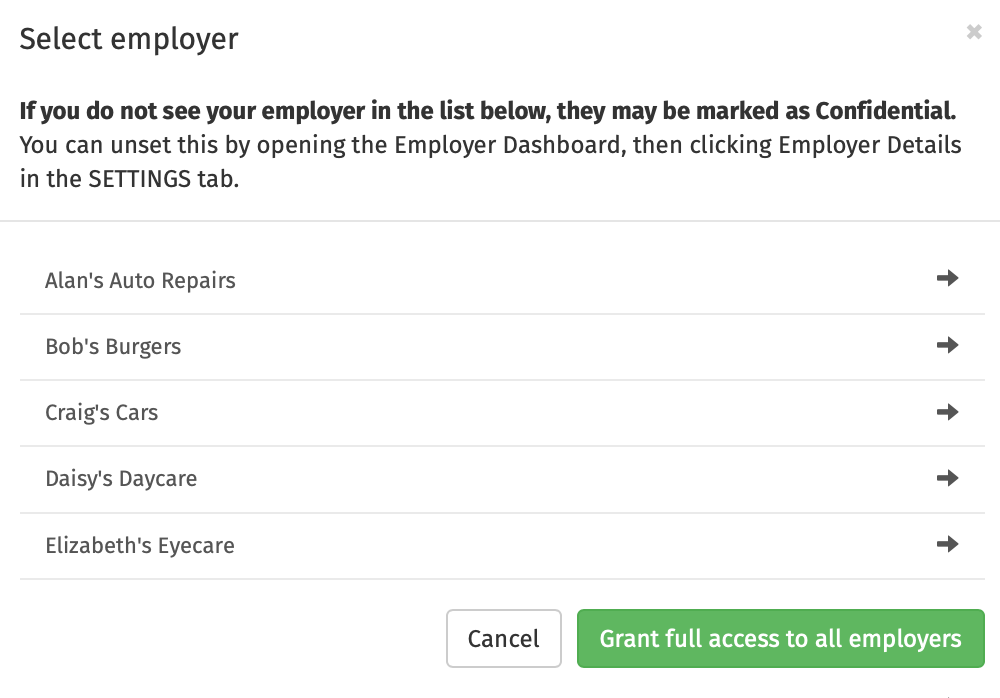

New User Management Interface for Connect

Our new User Management feature for BrightPay Connect makes it more seamless and quicker for users to be set up or amended. It offers the option to select permissions for multiple employers at one time for a standard user. There is also a new permission to allow standard users to connect and synchronise employers from BrightPay to Connect and a new feature to mark an employer as confidential.

Types of Users for Connect

- An administrator has full control over a BrightPay Connect account, with the ability to edit account settings, add other users, redeem purchase codes, connect employers and manage all employer and employee information and processes.

- A standard user typically has access to just one employer in your BrightPay Connect account, although they can be granted access to multiple employers if required. A standard user can view employer (and associated employees) information with various levels of restrictions and permissions.

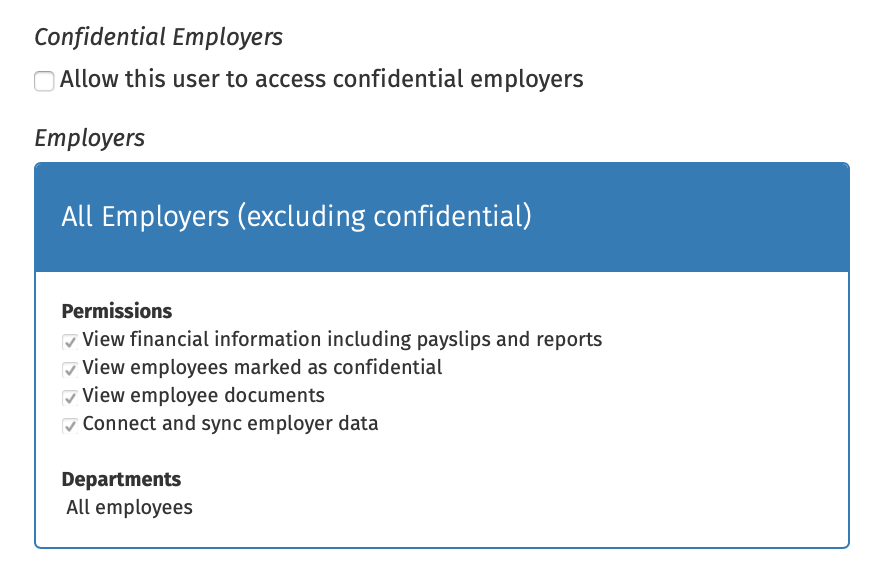

User Permissions & Confidential Employers

As before, standard users can be set up so that they are restricted by department, so that they can only see information pertaining to employees that are associated with a particular department. They can also be restricted from accessing certain information, such as the ability to:

- View financial information including payslips and reports

- View employees marked as confidential

- View employee documents

- NEW: Connect and synchronise employer data

- Approve employee self-service requests

You now also have the option to grant a standard user access to all current employers, along with any new employers linked to the Connect account. Simply select ‘Grant Full Access to all Employers’ and select the permissions you wish to be applied to the user, including the new permission to Connect and Sync employer data.

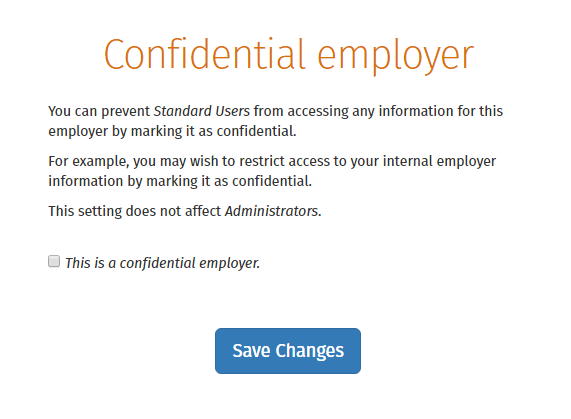

If required, an employer in Connect can be marked as confidential under the settings tab on the employer’s dashboard and only administrators on the Connect account will be able to view this employer. Standard users can only access confidential employers if they are given permission to do so.

Inviting your client as a user

If the employer details are entered in the ‘Client Details’ tab in the employer section in BrightPay, the employer can be added as a standard user by the bureau very quickly and easily. On the employer’s dashboard in Connect, you will see the option to ‘Invite your Client’. Selecting this populates the client’s information for a new standard user and you can then choose the permissions for the client.

May 2019

28

Digital trends that every employer should know

It’s predicted that by 2020, the global workforce would be dominated by millennials (35%) and generation X (35%). That means by next year, over 70% of the global workforce will be under the age of 40. A younger workforce presents knock-on effects for the entire business. As an employer, you need to adapt to meet the expectations of this new generation of employees; they’re very different from the workforce that preceded them. Having grown up using the internet as second nature, these young employees are true digital natives and have never known a world without it.

Take, for instance, payroll. With payment technologies evolving, millennials have become some of the fastest adopters of mobile and digital payments. Their influence on mobile payroll adoption cannot be ignored. The simple fact is these new generation employees don’t do paper forms. They are increasingly looking for digital options to access payslips and apply for annual leave.

In recent years, employees are using holiday time differently than previous generations, with the average leave duration reduced to just 2.34 days. This alone creates new challenges for payroll and HR managers. Shorter, more frequent bursts of annual leave tend to be requested last minute rather than planned in advance. It is important for employers and HR personnel to be able to quickly review and approve leave requests.

Mobile payroll solutions, such as BrightPay Connect, are an ideal way to improve the efficiency of your business, especially as new generation workers continue to integrate smartphones into every aspect of business operations.

BrightPay Connect benefits include:

- Request annual leave - An employee opens up their phone or tablet, logs in to the employee self-service app and applies for leave online. The HR manager or employer will be alerted of the leave request and can approve the leave instantly, with the leave automatically flowing back to the payroll software. On the self-service portal, both the employee and the employer can view their number of leave days taken and remaining, along with an employee leave calendar displaying all past and future leave.

- View payslips and payroll documents - The employee can login to their self-service account to view and download all current and historic payslips and payroll documents such as P60s. For the payroll processor, there is no more printing or emailing payslips. Payslips are automatically added to the employee’s online portal each pay period eliminating employee requests for copies of past payslips.

- Access everything in one central location - Keep everything in one central place. For employees, there is just one login to view employee documents and a company noticeboard. Employers can upload documents such as employment contracts, staff handbooks, privacy policies, training manuals. The employer can decide whether the employee should have access to view the document or not, using it as a central location for everything to do with each individual employee.

As an employer, adopting these few features favoured by younger workers, along with the additional employer benefits (such as an automatic cloud backup of payroll data and instant access to payroll reports), you are guaranteed to improve the efficiency of your business and payroll processing.

Book a demo today to find out how you can benefit from BrightPay Connect.

May 2019

24

Happy Birthday GDPR!

Guys, if you’re anything like me then you’ve been counting down the days, been kept awake with excitement thinking of what to wear and how hard you’ll party for what seems like forever. Yes, that’s right folks, on May 25th of this year our beloved GDPR turns 1 year old! *dries eyes* - they grow up so fast.

We all know that GDPR has been a resounding success but we also know that, like all 1 year olds, there's been some teething problems. So let’s take a look back through our photo album of the past year and see how our little trooper has fared over its first year.

Let’s start with the reason GDPR is in our lives - data breaches. How’s it been doing with those? Well, this is probably the most successful part of GDPR’s short life. Prior to GDPR, there was no single breach notification regulation for the EU. Instead, it was compiled of lots of different interpretations of the 1995 Data Protection Directive (which GDPR replaced) meaning it was a kind of Wild West of data and sensitive information. Then GDPR came sauntering in to bring law and order to a lawless wasteland and created a unified framework for all breach notifications.

A data breach is when personal data for which a company is responsible is accidentally or unlawfully disclosed. If this happens, under GDPR, companies are obliged to report the data breach to their national DPA within 72 hours. The number of these reported in the last year is a whopping 41,502. Crikey! Looks like GDPR is really whipping people into shape!

To add to that, there has been an eye-watering 95,180 complaints made since the introduction of GDPR - a complaint being from those who believe that their rights under GDPR had been violated. The most common types of complaints (no surprises) were concerning telemarketing and promotional emails.

So what’s been happening as a result of these complaints and breaches then? Well, this is where our golden child’s report card slips from an “A+” to a “B - could be better, gets distracted easily” because although the number of breaches reported has been incredible, the total penalties imposed under the statute added up to €55,955,871. Which sounds really impressive until you remember that a single €50 million fine levied against Google in January accounts for nearly 90% of that sum. The vast majority of companies are still not being penalised at all for data breaches or are being fined so insignificantly that frankly, my dear, they don't give a damn.

So as we dry our eyes and close the photo album of the first year of GDPR’s existence, we can let out a big sigh and know that GDPR is the little regulation that is doing its best and making us all proud as punch. Now let’s all join together in singing a big ol’ Happy Birthday - and don’t worry, I received consent from all present, purchased the rights to the song and accepted cookies on all our behalves so no chance of the feds swooping in mid-song.

Apr 2019

16

Customer Update: April 2019

Why employees love self-service apps (And you should too!)

As a concept, self-service is nothing new. From paying at the supermarket self-service checkouts to online banking, consumers don’t want to have to wait for assistance if they know they can get it themselves. It’s no different in the workplace. With a self-service system, employees can download payslips, request annual leave, look at policies and HR documents and update personal information - all without once contacting HR personnel.

Read more | BrightPay Self-Service App

NEW: Payroll Journal Direct API Integration with Accounting Packages

BrightPay now includes direct API integration with Sage One, Xero and Quickbooks Online. With this direct integration, users will be able to directly send the payroll journal to the accounting package from within BrightPay. This accounts software integration eliminates the need to export CSV files from the payroll software and import them into the accounting system, saving time and reducing the risk of errors.

Payroll Bureaus: The 7 Unmistakeable Benefits of Client Payroll Entry

BrightPay Connect is better than ever before. Bureau customers now have the ability to send requests to clients through BrightPay Connect’s secure portal. Requests can be sent to get client approval of the payroll summary before the payroll is finalised or to ask clients to upload their employees’ timesheets and payments, known as Client Payroll Entry.

BrightPay 2019/20 is now available to download - What’s new?

The release includes exciting new features to make your payroll journey easier and less time consuming, including:

- 2019/20 legislative changes

- Automatic Enrolment Updates

- Real Time Information

- More Flexible Journals

- Journal API Support

- Importing Pay Records from CSV

- Improved Support for Offset Annual Leave Year

- CIS Updates

- BrightPay Connect - Cloud Add-on

See what’s new | Buy now | Download BrightPay 2019/20

Looking for customer support? See if our website can help!

It's currently a busy time for our customer support and phone lines with the 2018/19 tax year coming to an end and the new tax year commencing. We have updated our FAQs to include the top 10 questions that we get asked. You can also search our online support documents before getting in touch. You may get the answer to your query so much more quickly!

Visit FAQs | Visit Online Docs

Payroll Bureaus: The big four: How payroll leapt into the future

In the six years since BrightPay was launched, a new wave of payroll innovation and cloud access has completely remoulded the sector, from onerous, manual input into a low effort, dynamic and automated service offering. Download our free guide for payroll bureaus where we look at four specific areas where cloud innovation is already impacting the future of payroll.

Payslips in the cloud is the future for payroll

When it comes to being GDPR compliant, you might think that you only need to password protect all the payroll reports and payslips. There is nothing in the GDPR legislation that states it is no longer permissible to email payslips, that doesn’t mean you can email payslips without protecting the information you send. There is a strict process that needs to be followed.

Accountex 2019 - will you be there?

It’s that time of year again where accountants, bookkeepers, practice managers and finance directors are preparing to travel from all over the UK to Accountex. Discover the latest technical tools from over 250 exhibitors that could help you run your practice more efficiently and productively. After winning Payroll Software of the Year 2018 at the Accounting Excellence awards, the BrightPay team are back with a bang this year, our fifth year in a row.

Auto Enrolment Phasing - Part Two

Minimum auto enrolment contribution rates faced further increases on 6th April 2019, with the total minimum contribution rate now at 8%. Employers are now required to contribute a minimum of 3%. Employees need to contribute the remaining 5%. Find out more about the various scenarios that can occur and how to handle them in BrightPay.

Apr 2019

11

Why employees love self-service apps (And you should too!)

As a concept, self-service is nothing new. From paying at the supermarket self-service checkouts to online banking, consumers don’t want to have to wait for something if they know they can get it themselves. It’s no different in the workplace.

An employee self-service is the ultimate tool whereby employees can login from anywhere to view their employment and pay related information. With a self-service system, employees can download payslips, request annual leave, look at policies and HR documents and update personal information - all without once contacting HR personnel.

Benefits for Employees

- Instant Payslips - The employee can login to the employee self-service portal to view and download their most recent payslip, along with all of their historic payslips. Gone are the days of emailing HR chasing lost or past payslips when needed, for example when applying for a mortgage.

- Annual Leave - Employees can submit leave requests instantly through the employee self-service portal. Once the leave is approved, employees will be notified and the approved leave will automatically appear on the employee’s calendar. Employees can also view their leave balance and leave history through their portal.

- HR Documents - Access everything in one central place - a single online login gives the employee instant online access to other employment related documents such as employment contracts or company handbooks and policies.

- Personal Data - With the self-service portal, the employee can view their personal payroll information that the employer has on file. The employee can also amend or update various personal data, including their postal address, contact number, emergency details etc.

- 24/7 Access - Employees can login to the employee self-service through any web browser at any time - meaning they don’t have to be at their desks to use it. They can login from home or anywhere else with an internet connection. Better yet, employees can access their employee self-service directly from their phones using the BrightPay employee app.

Knock-on Effect for Employers

Today’s employees are accustomed to having information readily available. An employee portal can help fulfil that expectation with the added benefit of creating workflow efficiencies. The employee self-service portal eliminates the burden of sending payslips, updating personal information, approving annual leave requests and answering leave balance enquiries for the payroll department.

Managers and HR personnel will save administrative hours and frustration on a daily basis when no longer faced with working through these monotonous and time-consuming tasks.

The former way of managing employee data is fast becoming outdated. What was once considered normal in the past is no longer considered normal anymore. Today, the new normal is to implement an employee self-service system whereby workflows are streamlined, with added benefits for both employees and employers.

Book a demo today to find out how BrightPay Connect can transform your business.

Read more: 10 surprising benefits of an employee self-service system

Apr 2019

2

Payslips in the cloud are the future for payroll services

When it comes to being GDPR-compliant in a payroll bureau, you might think that you only need to password protect all the payroll reports and payslips. There is nothing in the GDPR legislation that states it is no longer permissible to email payslips, that doesn’t mean you can email payslips without protecting the information you send. There is a strict process that needs to be followed.

If you choose to email payslips, you need to ensure that they are all password protected and sent directly to the employee’s chosen email address. It is very important that a unique password is used for each employee, as using the same password is for all employees could be considered a breach of GDPR. Once they are sent, then the payslips need to be deleted from the server of your payroll software provider.

But sharing the information securely is not the only thing that you need to do to make sure that you are GDPR compliant. Making sure you put all the necessary steps in place to avoid cyber attacks, keeping secure copies of the data in case of theft, fire or damage to the computers and providing employees with a way to easily update the information their employer holds about them are other important GDPR requirements.

Secure portals

Putting a system in place that takes into account all these requirements can be time consuming. Instead, secure portals can simplify the payroll process and offer the most secure environment to protect the employees’ information. Secure portals offer the maximum level of security and compliance with GDPR and make the payroll process much easier since they automate payslip distribution and eliminate the need to email payroll reports each pay period.

Besides the ability to securely send and store payslips and other sensitive payroll documents, self-service portals also have other advantages such as providing employers and employees with an easy way of remotely accessing information. Additionally, self-service portals make it easy for employees to request leave, keep track of their personal information and update it when necessary, and they also keep a secure backup of all the payroll records.

Avoiding cyber threats… and fines!

Self-service portals does not only make GDPR processes much easier, they also eliminate the risk of being fined up to €20 million or 4% of annual turnover of the previous year, whichever is higher. BrightPay Connect automatically backs up payroll data every 15 minutes when the payroll is open, and again when you close down the employer file and all the backups are available to be downloaded and restored if necessary.

This means that the portal always keeps a secure copy of the payroll files in the cloud, protecting the data in case of cyber attacks and making it possible to restore it should something happen to the physical equipment, such as any damage to the computers.

Accurate records

GDPR specifies that individuals have a right to have inaccurate personal data rectified, or completed if necessary. The BrightPay Connect portal makes all the personal data held by their employer visible to the employee, who can easily edit approve leave requests and update contact details for employees.

When the employee information is incomplete or inaccurate, for instance, should their phone number or postal address change, employees can easily update their details from the portal, which they can access 24/7 from any device, such as PCs, Macs, tablets or even their smartphone via the employee smartphone app.

Limited access to data

To be GDPR compliant, all the payslip information should only be available to payroll processors, only when it is strictly necessary for processing the payroll. With BrightPay Connect, users can be set up so that they only have access to the information needed to complete their assigned tasks.

Stay GDPR compliant with BrightPay Connect. Book a demo to find out more.

Mar 2019

28

10 surprising benefits of an employee self-service system

The ability for employees to view and edit their own data is one of the most important advancements of HR in recent years. Providing employees with remote access to view personal information held is also a best practice recommendation of the GDPR. It's obviously true that employees have a lot to gain from a self-service system, such as BrightPay Connect. The option to view and manage their data online provides a source of independence, power and control.

But what about HR personnel, managers and everyone else involved in the payroll and HR process? They benefit too! For administrators, it's a way of delegating the workload that would otherwise be handled solely by them. Implementing an employee self-service system is a way to re-distribute various tasks and bring it to the employee’s level.

The Benefits of an Employee Self-Service

- Printing & emailing payslips - With some employee self-service systems, such as BrightPay Connect, payroll administrators no longer need to manually print or email payslips to employees. Payslips are automatically available to employees through their self-service portal either on, before or after the payday, as selected by the employer.

- Responding to payslip requests - It can be very time consuming and monotonous for payroll administrators to respond to employee requests for past or lost payslips. With an employee self-service, the employee can now access their information directly by logging onto their portal where they can view and download historic payslips.

- Responding to leave balance enquiries - Similar to payslip requests, payroll administrators often get enquiries regarding an employee’s annual leave entitlement remaining. Again, the employee can login to their self-service portal to instantly view their leave balance along with their leave entitlement for the year.

- Managing annual leave requests - Managing annual leave could be considered a full-time job in itself with the amount of paperwork and administration required. An employee self-service portal will enable employees to request annual leave electronically, with an automatic notification sent to the supervisor or manager to approve or decline the leave request. Once approved, leave will be automatically added to the employee and employer calendars, and will also synchronise back to the payroll software on the payroll administrators desktop, streamlining the entire annual leave process.

- Updating employee contact information - No longer does the HR personnel need to collect or change employee details. Instead, the responsibility is fully with the employee to ensure that their personal details are updated and correct at all times.

On the surface, an employee self-service system seems designed simply to relieve a bit of pressure on your HR department. But the benefits to the business go much deeper than that. Some employee self-service systems also have the following benefits:

- Reduce errors - Entry errors and other mistakes may be avoided by allowing employees to enter their own personal information. By eliminating the need for double entry and allowing employees to evaluate their own information, the chances of inaccurate information may be greatly decreased.

- Reduce sick days - Some businesses have noticed a reduction in sick days since implementing employee self-service systems. As sick days are much more visible on screen to both employees and their managers, this likely acts as an incentive to keep sick days to a minimum.

- Cut costs - The administrative cost of processing leave or printing out payslips should not be underestimated.

- Reduce paper - The ability for employees to access payslips and other documents online can be a time and money saver. By replacing paper documents, you are also reducing your impact on the environment.

- Keep staff up-to-date - An employee self-service system can allow you to notify employees of policy changes or company-wide announcements. Employees don’t need to access their email to view changes - they can simply login to their self-service employee app wherever they are to stay abreast of any legislative or company-wide changes that may affect them. The employer can then track which employees have viewed the notice, resource or document.

If your HR and payroll administrators spend a lot of time printing payslips, managing annual leave or responding to employee requests, consider how an employee self-service system could help your business.

When implemented successfully, a company may see immediate increases in productivity and efficiency. Managers and HR personnel will save labour hours and frustration on a daily basis, and instead have more time to concentrate on more important tasks.

Book a demo today to find out how BrightPay Connect can transform your business.