Apr 2018

25

Auto Enrolment: The True Consequences of Non-Compliance

By law, all UK employers are required to complete a number of mandatory duties to comply with automatic enrolment. Some of these duties include enrolling staff who meet certain eligibility criteria into a workplace pension scheme, issuing letters to all employees and paying minimum employer pension contributions.

If an employer fails to comply with auto enrolment, the Pensions Regulator will take enforcement action. Although the rollout of auto enrolment began in 2012, it is now that the true consequences of non-compliance are coming to light.

Earlier this year, bus company Stotts Tours (Oldham) appeared at Brighton Magistrates' Court for sentencing, after pleading guilty to eight counts of wilfully failing to comply with the law on workplace pensions - the first such prosecution by The Pensions Regulator.

Stotts Tours (Oldham) should have put its staff into a workplace pension and begun paying pension contributions from June 2015. With 36 employees that should have been enrolled, the bus company and its Managing Director are now left with a bill of more than £60,000 after they admitted trying to deliberately avoid giving their staff workplace pensions.

District Judge Teresa Szagun said: "Initially Mr Stott's attitude was to bury his head in the sand. This later left him in a position where he was out of his depth."

The bus company was ordered to pay a £27,000 fine, £7,400 costs and a £120 victim surcharge. This is on top of the £14,400 in civil fines that the employer already owes for failing to comply with the law on automatic enrolment and an estimated £10,000 in backdated pension contributions for employees. Managing Director Alan Stott was also ordered to pay a £4,455 fine and a £120 victim surcharge.

Darren Ryder, TPR's Director of Automatic Enrolment, said: "Compliance with automatic enrolment remains very high and so it's extremely disappointing that a tiny minority of employers continue to flout the law by denying their staff the pensions they are entitled to.”

“This case shows the cost to employers that failing to comply with automatic enrolment can bring - a bill of tens of thousands of pounds, a criminal conviction and a damaged reputation."

Related Articles:

Apr 2018

18

GDPR: Everything you need to know!

Free GDPR Webinars for Employers & Payroll Bureaus

Employers process large amounts of personal data, not least in relation to their customers and their own employees. Consequently, the GDPR will impact most if not all areas of the business and the impact it will have cannot be overstated. Join us for our free webinar where we will discuss what GDPR is, why employers need to take it seriously and how you can prepare for the 25th May deadline.

Employer Webinar | Bureau Webinar

How can BrightPay Connect help with GDPR?

Under the GDPR legislation, where possible the controller should be able to provide self-service remote access to a secure system which would provide the data subject with direct access to his or her personal data. BrightPay Connect is a self-service option which will give employees online remote access to view their payroll information 24/7.

Free Guide: GDPR & The Future of Payroll

The guide will uncover the ins and outs of the impact of GDPR on your payroll processing, highlighting the biggest areas of concern including emailing payslips, employee consent and your legal obligation.

Data Processor Agreement - Free Template

Whenever a data controller (e.g. a payroll bureau client) uses a data processor (e.g. payroll bureau) there needs to be a written contract in place. The contract is important so that both parties understand their responsibilities and liabilities. To assist our customers, we have created a template Data Protection Agreement which can be used by data processors as an addendum to any existing agreements.

Download Data Protection Agreement

GDPR Employee Privacy Policies

GDPR requires employers to give information to their workforce, setting out in particular the personal data (employee information) the employer holds about them, how it is used, and with whom the information is shared. The information required is more detailed than is currently required under existing data protection laws. Employers need to ensure that their employee privacy notices accurately reflect how they process employee data and are in line with GDPR requirements. GDPR compliant employee policies are available through the Bright Contracts software.

BrightPay Newsletter - Are you missing out?

GDPR is changing how we communicate with you. After May 2018, we will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at any time. Don’t miss out - sign up to our newsletter today!

Still confused about GDPR? Here are some more useful links that can help:

Apr 2018

10

GDPR will affect your employee processing!

The General Data Protection Regulation (GDPR) will come into force on 25th May 2018 changing the way we process data forever. The aim of the GDPR is to put greater protection on the way personal data is being processed for all EU citizens. Personal data can be anything from a name, an email address, NI number, bank details etc so as you can imagine employers process a huge amount of personal data on a daily basis. So how will the GDPR affect employers in terms of processing employee data?

Consent

Data in the employment context, will include information obtained from an employee during the recruitment process (regardless of whether or not they eventually got the job), it will also include the information you hold on current employees and previous employees. All this information may be saved in hard copy personnel files, held on HR systems or it could be information contained in emails or information obtained through employee monitoring.

Under GDPR your employee’s will have increased rights around their data. These rights will include:

- The Right to Access. It’s not a new concept that employees will be able to request access to the data you hold on them. However, there is a new recommendation that where possible employers should provide their employees with access to a secure self-service login where they can view data stored on them. This backs-up the whole concept of transparency and ease of access to data, which underpins the new Regulations.

- The Right to Rectification. Individuals are entitled to have personal data rectified if it is inaccurate or incomplete. This is an existing right and the onus is on the employer to ensure that your employee records are kept up-to-date. To help ensure you maintain up-to-date records, employers should make it easier for employees to update their data.

- The Right to be informed. Employers must be very transparent with employees about what data you hold, why and how long it is held for. Up until now it has been the common practice for many employers to include a standard clause in the employment contract regarding the processing of HR Data, under GDPR that will no longer be sufficient. Employers need to be reviewing their Employee Data Protection Policies and possibly writing new Employee Privacy Policies that go into detail on the processing of employee data.

Employee Self-Service

Under the GDPR legislation, where possible employers should be able to provide self-service remote access to a secure system which would allow employees view and manage their personal data online 24/7. Furthermore, the cloud functionality will improve your payroll processing with simple email distribution, safe document upload, easy leave management and improved communication with your employees. By introducing a self-service option, you will be taking steps to be GDPR ready.

Book a demo today to find out how you can benefit from BrightPay Connect.

Related articles:

Apr 2018

9

Employers: Time to adapt to the needs of millennials

Experts predict that by 2020, millennials (now aged between 21 and 35) will make up 35% of the global workforce, with ‘Generation Z’ (aged 20 and younger) making up 24%. In just two years, more than half the entire workforce population will be made up by these younger workers.

A younger workforce presents knock-on effects for the entire business. As an employer, you need to adapt to meet the expectations of this new generation of employees. Millennials are very different from the workforce that preceded them. Having grown up using the internet as second nature, these young employees are true digital natives and have never known a world without it.

Take, for instance, payroll. With payment technologies evolving, millennials have become some of the fastest adopters of mobile and digital payments. Their influence on mobile payroll adoption cannot be ignored. The simple fact is these new generation employees don’t do paper forms. They are increasingly looking for digital options to access payslips and apply for annual leave.

In recent years, employees are using holiday time differently than previous generations, with the average leave duration reduced to just 2.34 days. This alone creates new challenges for payroll and HR managers. Shorter, more frequent bursts of annual leave tend to be requested last minute rather than planned in advance. It is important for employers and HR personnel to be able to quickly review and approve leave requests.

For HR managers, there is also the added strain due to the higher turnover of millennials, with research suggesting that they last just 8 months in a job! Fortunately, we live in a mobile world, whereby online platforms can enable HR staff to manage and approve time off instantly, with more time to focus on attracting and retaining top talent.

Mobile payroll solutions, such as BrightPay Connect, are an ideal way to improve the efficiency of your business, especially as new generation workers continue to integrate smartphones into every aspect of business operations.

BrightPay Connect benefits include:

- Request annual leave - An employee opens up their phone or tablet, logs in and applies for leave online. The HR manager or employer will be alerted of the leave request and can approve the leave instantly, with the leave automatically flowing back to the payroll software. On the self-service portal, both the employee and the employer can view their number of leave days taken and remaining, along with an employee leave calendar displaying all past and future leave.

- View payslips and payroll documents - The employee can log into their self-service account to view and download all current and historic payslips and payroll documents such as P60s. For the payroll processor, there is no more printing or emailing payslips. Payslips are automatically added to the employee’s online portal each pay period eliminating employee requests for copies of past payslips.

- Access everything in one central location - Keep everything in one central place. For employees, there is just one login to view employee documents and a company noticeboard. Employers can upload documents such as employment contracts, staff handbooks, privacy policies, training manuals. The employer can choose whether the employee can view the document or not, using it as a central location for everything to do with each individual employee.

As an employer, adopting these few features favoured by millennials, along with additional employer benefits (such as an automatic cloud backup of payroll data and instant access to payroll reports), you are guaranteed to improve the efficiency of your business and payroll processing.

Book a demo today to find out how you can benefit from BrightPay Connect.

Mar 2018

26

April Customer Newsletter - BrightPay 18/19 released

***** Please confirm whether you want to hear from us (GDPR related) - Important Update ****

From May 2018, we will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. This is due to the GDPR legislation. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

BrightPay 2018/19 is Now Available. What's New?

The release includes exciting new features to make your payroll and auto enrolment journey easier and less time consuming including:

- Auto enrolment minimum contribution increases (phasing) including letters

- Enhanced feature to email documents & reports

- Improved calendar features

- BrightPay Connect - Improved GDPR security and cloud functionality

- 2018/19 Scottish Rate of Income Tax (SRIT) codes, rates and thresholds

- Payroll journal export to Sage, Xero, Quickbooks, Exact & Kashflow

- API integration with Aviva

- April 2018 National Living Wage rates

See what’s new | Buy now | Download BrightPay 2018/19

You need to activate your BrightPay Connect licence to backup your data

After purchasing BrightPay Connect, you will need to activate your licence key code. If the licence is not activated, your payroll data will not backup automatically. Employees will not be able to access their payslips or request leave on the self-service portal. Activate your licence key code now to start availing of the many cloud benefits. Haven’t tried BrightPay Connect yet?

Book a demo today | Find out more

BrightPay Announces API Integration with Aviva

BrightPay are delighted to announce that we are the first payroll software on the market to offer direct integration with Aviva. An API is a fully integrated tool that directly links both the payroll and pension provider together. This integration allows customers to submit their pension data file to the Aviva online portal from within BrightPay.

Free Bright Contracts Webinar: UK Employment Law Overview

As busy employers it can be difficult to keep up-to-date with the constant changes in employment law. In this webinar our employment law experts discuss what is new in employment law, recent employment law cases and have a look at the most frequently asked questions that come through our support line.

Register for free webinar | Bright Contracts

For Payroll Bureaus / Accountants

Payroll Data and GDPR: What you need to know about consent, emailing payslips, and your legal obligation

In this guide, we will specifically look at the impact of GDPR on your payroll processing and address the biggest areas of concern. We will walk you through some important steps to achieve GDPR compliance.

Download here | Register for GDPR webinar

Understanding Minimum Contribution Increases (Phasing) and its Implications

Your clients will need to be ready to implement the increased minimum contribution rates for auto enrolment from April 2018 and April 2019. Our guide and free webinar look at what you must know about processing the increases in contribution rates in 2018 (and clients should thank you for it).

Download white paper | Register for free webinar

How BrightPay Connect can help with GDPR!

Under the GDPR legislation, where possible the controller should be able to offer self-service remote access to a secure system which would provide the individual with direct access to his or her personal data. BrightPay Connect is a self-service option which will give your payroll clients and their employees online remote access to view payslips and other payroll documents 24/7.

Mar 2018

23

Now Available: Template Data Processor Agreement

Those of you who were on any of our recent GDPR webinars will be aware that data controllers (e.g. a payroll bureau client) need to be amending their contracts with any data processors (e.g. the payroll bureau) to accommodate the new requirements under the GDPR.

For those of you who did not get to attend our webinars here is a brief overview.

The Legislation

Whenever a data controller uses a data processor there needs to be a written contract in place. The contract is important so that both parties understand their responsibilities and liabilities. The GDPR sets out certain information which needs to be included in the contract.

Controllers are liable for their compliance with the GDPR and must only appoint processors who can provide ‘sufficient guarantees’ that the requirements of the GDPR will be met and the rights of data subjects (an individual who is the subject of personal data) protected.

Processors must only act on the documented instructions of a controller. They will however have some direct responsibilities under the GDPR and may be subject to fines or other sanctions if they don’t comply.

What does this contract look like?

To comply with the new requirements under GDPR you could either:

- Draft new Terms of Service / EULAs / Engagement Letters for each client to include the new GDPR requirements.

- Where you have an existing contract in place you could issue an Addendum to this contract covering the new GDPR requirements, this is commonly known as a Data Protection Agreement (DPA).

Our Advice to Payroll Bureaus

Our advice to payroll bureaus is that when it comes to GDPR you should aim to take an active role in educating your clients about GDPR.

Although the onus is on data controllers to ensure contracts are in place, payroll bureaus looking to get ahead of the GDPR would be well advised to approach their clients and instigate putting the appropriate contracts in place.

Template Data Protection Agreement (DPA)

To assist our customers we have created a template Data Protection Agreement which can be used as an addendum to any existing agreements.

Mar 2018

20

BrightPay 2018/19 is Now Available. What's New?

BrightPay 2018/19 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2018/19 Tax Year Updates

- 2018/19 rates, thresholds and calculations for PAYE tax, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay, Automatic Enrolment earnings thresholds and triggers, company cars, vans and fuel.

- The emergency tax code has changed from 1150L to 1185L. When importing from BrightPay 2017/18, L codes are uplifted by 35, M codes are uplifted by 39 and N codes by 31.

- Full support for the 2018/19 Scottish Rate of Income Tax (SRIT) codes, rates and thresholds.

- April 2018 National Living Wage rates.

- Ability to process 2018/19 HMRC coding notices.

- Eligible employers can continue to claim the £3,000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30 and P32 forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EYU, EXB, CIS300, CISREQ).

Automatic Enrolment Updates

- From April 2018 onwards, the minimum required pension contribution level is 5%, at least 2% of which must be contributed by the employer. BrightPay 2018/19 now uses and validates against this increased level by default. Where pre-April 2018 minimum levels were being used in 2017/18, BrightPay 2018/19 will automatically uplift them on import.

- With all employers in the UK now having staged for Auto Enrolment, BrightPay no longer relies on a Staging Date for assessment – all un-actioned employees are automatically assessed and flagged for action as required.

- Where submissions are outstanding for a pension scheme, BrightPay now more clearly shows the numeric indicators on the Enrolment Summary and/or Contributions Summary buttons for that scheme, depending on the type of submission(s) outstanding.

- The salutation of Auto Enrolment letters can now be customised.

- Auto Enrolment letters can now be quickly printed via the new Letters menu in the PENSIONS section of BrightPay.

- New letter template to tell staff who are already a member of a scheme about the April 2018 minimum contribution increases.

- New Automatic Enrolment Journey Report replaces the previous Assessment Report.

- Automatic Re-enrolment date and Declaration of Compliance date can now be shown as columns on the BrightPay startup window.

- Improved handling of the situation in which Auto Enrolment duties are ignored for one or more pay periods.

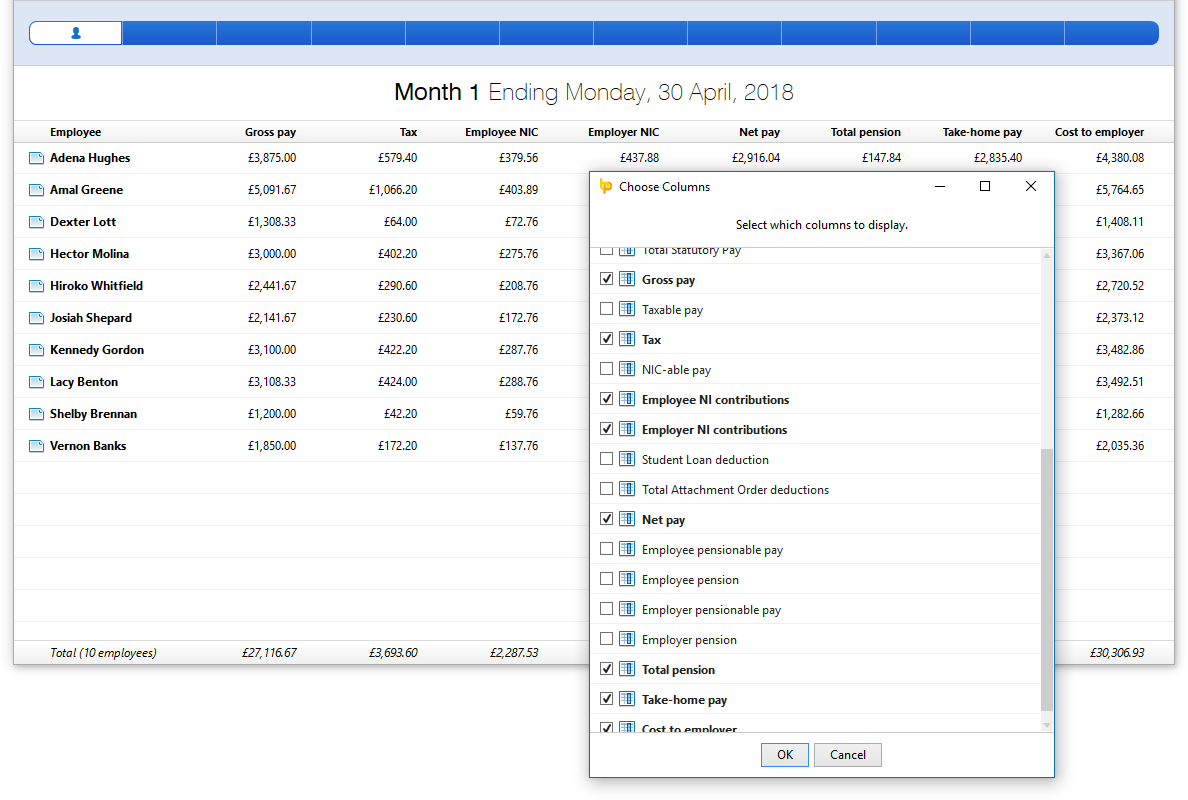

Ability to Edit the Columns of the Period Summary View

A popular customer request has been to show columns for number of hours worked and pension contributions on the BrightPay period summary view. In BrightPay 2018/19, you can now easily include these, as well as many more additional column options.

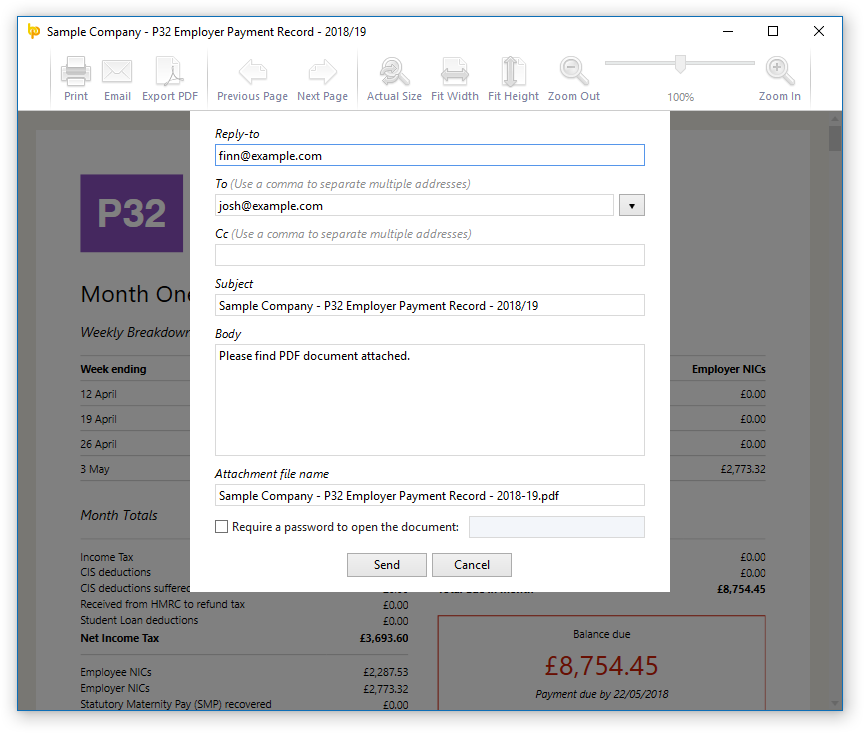

Ability to Quickly Email any Document/Report

There is a new Email button in the print preview of documents and reports in BrightPay which allows you to easily send it as a PDF attachment in an email. Where and when applicable, BrightPay makes it easy and quick to select the relevant employee, client or previously used recipient.

Note: In version 18.0, there are a few document types for which email support is not yet available (e.g. P45, SMP1, etc) – we will be adding support for these very soon.

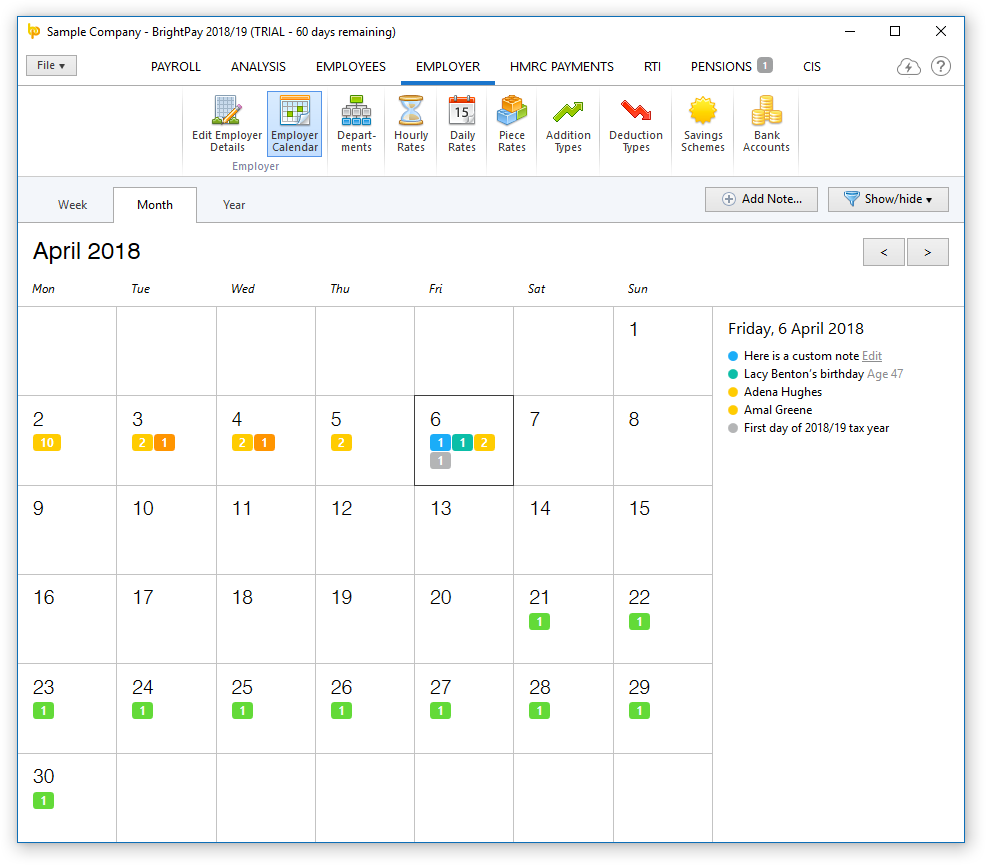

New Feature: Employer Calendar

There is a new employer-wide calendar in the EMPLOYER section of BrightPay which amalgamates all the employee events along with other key payroll dates into a single view:

- Switch between Year, Month or Week view.

- Shows combined events for all employees (i.e. those entered on the employee calendar, as well as birthdays)

- Includes general tax year events and deadlines.

- Ability to filter which kinds of events are displayed on calendar and in the day event list.

- Ability to add/edit/delete your own notes.

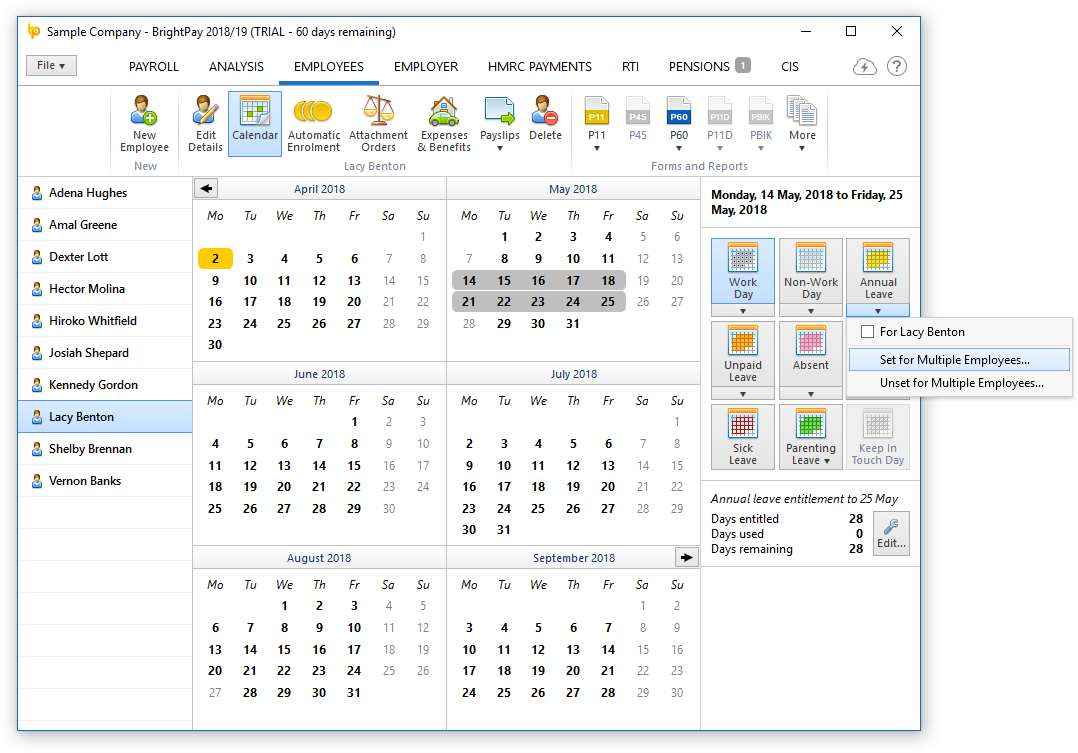

Employee Calendar Improvements

- Ability to batch set working days, non-working days and leave days for multiple employees at once.

- Holding the Ctrl key allows you to select (or unselect) multiple arbitrary days on the calendar.

Bureau Improvements

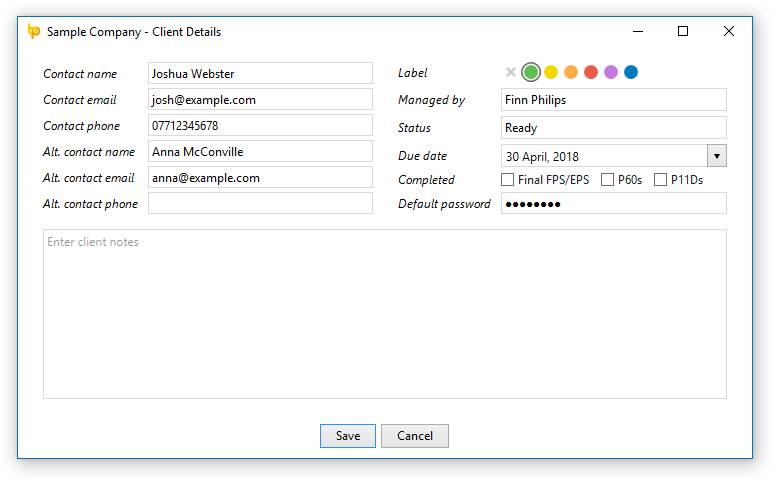

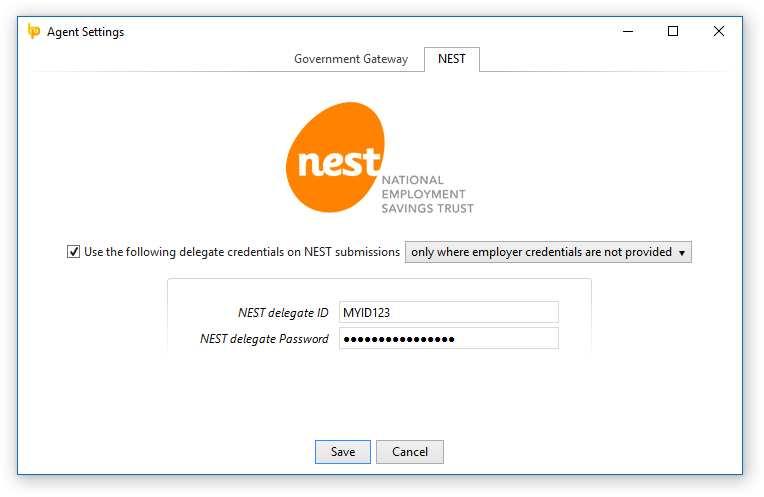

Several new Client Details fields have been added:

In BrightPay Agent Settings, you can now enter your own NEST delegate ID and password to use globally in NEST submissions:

Other 2018/19 Changes in BrightPay

- We've made several key architectural improvements for dealing with large employer files (e.g. those with hundreds or even thousands of employees) with regard to both speed of execution and computer memory usage. This will be something we continue to improve as time goes on.

- When a text input field receives focus via keyboard tabbing, its content is all selected automatically.

- Adds several more customisability options for payslip production.

- When zero-ising payslips, you can now choose to zero-ise only the overtime (or non-overtime)hourly/daily payments.

- Enables specific period payments, daily payments, hourly payments, piece payments, additions and deductions to be explicitly hidden on printed payslip.

- Enables specific period payments, daily payments, hourly payments, piece payments, additions and deductions to be given a custom description to appear on printed payslip.

- Enables specific period payments, daily payments, hourly payments, piece payments and additions to 'contribute to gross for minimum wage' or not.

- Ability to set whether or not an hourly rate/payment should accrue hour-based annual leave entitlement.

- For 'accrued' annual leave days/hours, ability to manually specify additional accrued days/hours not accounted for in payroll (i.e. an adjustment).

- Annual leave accrual is now calculated up to end of the currently open pay period (rather than up to the end of the last finalised pay period).

- Printing page setup is now centralised into the File menu of BrightPay.

- Ability to control whether or not the PDF export settings are remembered between usages.

- Enables traditional pension schemes to use employer AVCs.

- Includes Student Loan Plan on FPS

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

Includes all updates made to BrightPay during the 2017/18 tax year

While we have traditionally focused our announcements of new features and updates in each new tax year version of BrightPay, it doesn't mean we're not busy during the rest of the year. In 2017/18, we released many updates and enhancements throughout the tax year, all of which are of course included in BrightPay 2018/19. See our release notes for full details. Here's a quick reminder of some of the main areas of improvement:

- Additions or deductions can be set up to calculate as a percentage of the payslip’s basic, gross or net pay.

- Hourly and daily rates with the same 'description', whether set up at employer level or employee level, are all reported under a single column in analysis.

- Ability to make additions 'notional' i.e. only contributing towards taxable, NIC-able and/or pension-able pay, without actually giving the payment to the employee (also works for CIS-able pay and subcontractors).

- Ability to include declaration on FPS (or EYU) that an employee's payment is being made to a non-individual.

- Ability to easily switch one or multiple employees from one auto enrolment pension scheme to another.

- Any automatic enrolment pension scheme contribution can now include additional one-off amounts

- Any automatic enrolment pension scheme contribution (whether employee or employer, standard or one-off) can now be entered as a percentage amount or a fixed amount.

- Support for sending enrolment and contributions submissions directly to Aviva via API.

- New/updated documents and reports (e.g. Statutory Pay Calculation and Schedule, Attachment Orders Summary, SMP1, SPP1, SAP1, Employee Count, Employee Address Labels)

- Net to gross functionality can now do ‘Take-home pay to gross’ and ‘Cost-to-employer to gross’.

- Improvements to handling of 'no longer enrolled' employees in selection lists.

- TUPE support

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Here’s some of the new things coming in April/May 2018:

- Journal API support for Quickbooks, Xero and Sage

- API support for The People’s Pension

- Improved and more flexible CIS P&D statement

- Exciting new BrightPay Connect features.

Mar 2018

6

Auto Enrolment - Integration between payroll & pension providers

This year we will see an increasing number of key pension providers developing an API option that will allow payroll software to fully integrate with them. Certain pension providers such as NEST, have made real head way in terms of automation. Direct API integration allows payroll software and the pension scheme to communicate or talk directly to each other, which is a similar concept to RTI.

API integration means that users no longer need to export and save the data file to their PC and then log into the pension provider web portal to upload the data. Instead, data can be sent directly to the pension provider at the click of a button from within the payroll software.

This method of sending information between two systems will be of particular interest to payroll bureaus who could have a large number of payroll clients. The integration will enable bureaus to reduce errors and minimise the time spent submitting their clients’ files to the pension provider each pay period.

NEST have two other APIs to validate groups and payment sources, and to approve contribution payments from within the software. This integration further streamlines the setup and ongoing tasks involved when using NEST as your pension provider. Again any good payroll software will offer all three of these NEST API’s.

BrightPay offers csv support for 18 pension providers. We are now proud to say we offer API integration with NEST, Smart Pension and we’re the very first payroll provider to offer API integration with Aviva.

BrightPay Newsletter - Are you missing out?

GDPR is changing how we communicate with you. After May 2018, we will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Related articles:

Feb 2018

27

Next stop: Accountex Summit North! Find out why you should attend

Accountex Summit North is the NEW one-day conference dedicated to the accounting profession. This conference is all about learning, connecting and networking. It will take place at Manchester Central on 6th March 2018 and will attract over 1,000 people.

In today’s world it’s so easy to attend and watch a webinar from the comforts of your own bed or even while relaxing on holidays from practically anywhere in the world. But, there are many benefits and reasons why we choose to attend these conferences. Although, you can conduct meetings, watch online software demos, interviews and provide training without leaving your home/office, nothing can substitute for live, in peron business conferences.

Face-to-Face Networking

At BrightPay payroll, we believe that one of the most important aspects of a business conference is your ability to network and form relationships with other businesses and attendees. You become more than just an email address or a screen name by meeting face-to-face. When reaching out to people you met at a conference in the future, they will be more receptive if you left a good impression when you met in person.

Observe Visual Cues

These non-verbal communication elements such as body language and the overall atmosphere and environment allows you to remember knowledge from a previous experience. At Accountex Summit North, there is a range of high profile keynote speakers offering the latest insights, focusing around a main auditorium.

Direct Contact

Attending conferences such as Accountex Summit North puts you in direct contact with potential clients, software providers and customers in a setting where they will be receptive to hearing about your business ideas or recommendations.

Observe your Competitors

One of the reasons you attend a business conference is to learn the best ways to improve and grow your business. Your competitors are there for the exact same reason. Live events allow you to observe and learn what strengths and weaknesses your competitors may have. You can use this information to gain a competitive edge.

Promote Creativity & Innovation

Taking a break from your day-to-day activities to attend a live event helps you develop new ideas in a change of scenery, because being in business doesn’t mean all work no fun!

Visit BrightPay’s stand

Come visit us at stand number 33 at Accountex Summit North on the 6th March 2018 to see for yourself how our payroll software, BrightPay can benefit you and your business. BrightPay is incredibly flexible, letting you run your payroll with ease, no matter what type of employer you are or what your situation is.

We will run live demos at Accountex. Call over and speak to one of our experts to see just how useful BrightPay can be.

Alternatively Click here to book a demo of our software.

Related Articles:

Feb 2018

2

Auto enrolment to hit Ireland

Ireland looks to follow in the footsteps of the UK and introduce a workplace pension reform by 2021. The Irish prime minister, Leo Varadkar announced that Ireland is planning an auto enrolment pension system that would see all employees enrolled into a workplace pension scheme by their employers. While details are still being finalised it is likely that Ireland will replicate many of the processes that were rolled out by the UK.

Similar to the UK, Irish employees are not saving enough for their retirement. To combat this, the Irish government wants employers and employees to contribute towards a workplace pension scheme to prepare for retirement.

Varadkar states:

“This issue has been long-fingered for too long, and now that the economy is recovering strongly we must act decisively, and we will publish a five-year roadmap for pension reform before the end of the year. This will include the introduction of an auto-enrolment pension scheme for private sector workers, two-thirds of whom currently have no occupational pension to supplement their State pension.”

Certain Irish employer groups are opposing the move for auto enrolment citing the administrative and financial burdens it will create. The concept is being driven by the fact that the Irish government will not be able to support the growing aging Irish population into retirement. Auto enrolment is an effective retirement strategy that will increase employees savings towards a more financially secure retirement.

The auto enrolment concept has been hugely successful and proved in Australia, New Zealand, and the UK. The aim of a pension reform will allow every employee access to a workplace pension scheme that is provided by their employer by law.

Written by Karen Bennett | BrightPay Payroll Software

Related articles

- How is auto enrolment going to work?

- How will BrightPay handle auto enrolment?

- Will Ireland get auto enrolment right?