Apr 2017

24

Auto Enrolment - Increased workload or increased opportunity for Bureaus?

This year, accountants and payroll bureaus will see a large number of their clients approaching them to assist with auto enrolment (AE). The process of complying with AE requires payroll expertise to calculate pension contributions for employees who are eligible and for employees who choose to join or opt into the pension scheme. 2017 will see the largest number of employers reach their staging date. At the end of March, we saw a new record of over half a million employers who have complied and fulfilled their auto enrolment duties.

The sheer volume of small and micro employers going through the AE process represents an opportunity for payroll bureaus to add a new service to their existing payroll services. Many of these small employers will be using HMRC's Basic PAYE tools (BPT) which will not cater for the needs of automatic enrolment. Basic tools is just that, a basic tool. It will not carry out the employee assessment required, produce communications to send to all employees, cater for enrolment, produce payslips that show both employer and employee contributions or create the pension data file to submit to the pension provider. This lack of functionality with Basic Tools is another reason why your clients may look to you for help with their duties.

For employers who wish to carry out their payroll and auto enrolment tasks in house, they have the option to switch to payroll software that can support their employer auto enrolment duties. Check to see if your payroll provider can import from Basic PAYE Tools. BrightPay has a specially developed feature, where you can import your employer data into BrightPay from BPT instantly. There is no need for manual data entry. Some good providers even offer a free payroll software licence which includes auto enrolment to micro employers.

How much is auto enrolment software?

At this stage you should be aware that you should not have to pay an extra charge for auto enrolment functionality. Unjustifiably, some payroll providers are charging their customers for an auto enrolment module or add-on. Some are also charging per employee, per month which can be expensive. If you do the maths, you will soon see how this can add up over a yearly period. There are other payroll systems that can deal with auto enrolment but it can be a manual process of running reports every pay period with additional steps required to process your client through AE.

It is worth investing in payroll software that has automated auto enrolment technology. BrightPay has been developed specifically with payroll and auto enrolment automation in mind. Using an automated software will not only save you time but it can make you money. By improving efficiencies, bureaus will naturally increase productivity and profitability for each client. BrightPay can email payslips, send RTI returns, automate auto enrolment, manage holiday pay and a whole list of features.

An important thing to look out for is the ability to import your staff details into the payroll. BrightPay has the ability to import data via CSV file or FPS. You can also directly import each of your client's employer information into the program. At BrightPay, we have developed tailored import facilities from HMRC’s Basic Tools and Moneysoft where payroll bureaus can import multiple employer files at the same time. Read: Switching to BrightPay - Made Easier for you!

Increased opportunity?

With the right, automated payroll tools, the process of auto enrolment should be very straightforward, seamless and, above all, a profitable exercise. Without doubt, auto enrolment should be an additional service that your payroll clients should expect to pay for. For many accountants and bureaus, auto enrolment has been the perfect platform to increase revenue. The smaller employer is likely to be the least prepared for auto enrolment and are also likely to turn to a payroll professional to outsource their payroll and auto enrolment tasks. Additionally, clients will want to avoid being fined for non-compliance by the Pensions Regulator. This is another motivation to use a professional to get it right first time round.

Increased workload?

With the wrong tools, helping your clients through auto enrolment could end up being very costly and time consuming. Check how much your payroll provider is charging for auto enrolment. Your workload will be increase if you do not utilise an automated software. For example, your payroll software should automatically complete the employee assessment each pay period for you and then alert you of any new AE duties that need to be performed.

This assessment needs to take place on an on-going basis to monitor any changes to an employee's circumstance. If they turn 22 or if there is an increase in their earnings, they may become eligible. Auto enrolment does not just take place at staging, it is an ongoing process. As auto enrolment is an integral part of the payroll process, BrightPay believe that it should be an included feature as part of the price of your payroll package. Paying more money for auto enrolment software will eat into your profits and make for a poor bottom line.

BrightPay is the answer

BrightPay is a user friendly payroll package that makes your auto enrolment journey easy. BrightPay take the manual grunt work out of AE by automating employee assessment, enrolment, producing letters and is integrated with 18 pension providers. Book a BrightPay Demo where we will show how you can setup your clients in BrightPay and start the automated process once you reach your staging date. BrightPay will ensure that you can streamline your AE processing to maximise efficiencies and profits.

Related articles

Auto Enrolment - This is what you must know for 2017

Switching to BrightPay - Made Easier!

Payroll clients continue to ignore auto enrolment

Apr 2017

13

Over 500,000 Employers have completed Automatic Enrolment

At the 31st March over 500,000 employers have completed their automatic enrolment duties according to the most recent Declaration of Compliance reports from The Pensions Regulator. This report shows that over 7.6 million employees are now saving in a pension and for their retirement. In the first quarter of 2017 136,000 small and micro employers completed their declaration of compliance.

A Declaration of Compliance needs to be completed and submitted to the Pensions Regulator within five months of the staging date. A Declaration of Compliance is the employer informing The Pensions Regulator that they have met their automatic enrolment duties.

If you do not submit your declaration of compliance in time you may be fined. It is a legal duty that the declaration of compliance is fully completed with the correct information and submitted on time.

Should you be experiencing any issues regarding your automatic enrolment process or collecting the relevant information for your Declaration of Compliance contact The Pensions Regulator immediately. The Pensions Regulator's website has a help section: http://www.thepensionsregulator.gov.uk/automatic-enrolment-registration-questions.aspx

Feb 2017

6

Risk of County Court Judgement for Employers who ignore Automatic Enrolment Duties

Employers who are persistently ignoring their automatic enrolment duties are being warned by The Pensions Regulator that they could be issued a county court judgement. Employers that ignore penalty notices issued by the The Pension Regulator to them are more likely to be issued with a CCJ. And if an employer does not pay within the 30 day limit of when they received the CJJ, these details will be recorded on their credit record. This may affect their borrowing ability in the future.

According to information from The Pension Regulator nearly 3,000 penalty notices were issued to employers between October and December 2016. In this same timeframe 870 escalating penalty notices were issued to employers. The number of fines have risen in line with the higher amount of employers now reaching their compliance deadline. Due to a small number of employers failing to pay these fines a number of County Court Judgements have now been issued.

The Pension Regulator believe that the smaller employers are leaving things to the last minute for their automatic enrolment duties, but if a compliance notice is issued hurries the employer up to fulfill their duties.The executive director for auto-enrolment at The Pensions Regulator, Charles Counsell , said: “Burying your head in the sand and ignoring your legal duties means your staff are missing out on pensions they are entitled to and your credit rating and reputation could be hit.”

Andy Beswick, managing director of business solutions at insurance firm Aviva, said: “No one wants to see small businesses being penalised for not complying with auto-enrolment. “A workplace pension can be a great asset to an employer when it comes to retaining and attracting key staff. It’s also a legal requirement so ignoring it isn’t an option. “There are a number of pension providers who have worked hard to make auto-enrolment as simple as possible for companies and advisers. With a bit of planning, the process of setting up a workplace pension is not as complicated as most people think.”

Feb 2017

2

Nannies & Carers - How does Auto Enrolment affect me?

Auto Enrolment means that all employers must put certain staff into a workplace pension and pay into it. Employing someone in your home (such as a carer, nanny, or gardener) means that you are an employer and therefore you will have auto enrolment duties to complete. Your staging date is the date the law comes into effect for you. The Pensions Regulator will write to you to notify you of your staging date and tell you what duties need to be completed.

At staging, you must assess the age and earnings of your staff to see if they are an eligible jobholder. Eligible jobholders are those who are aged between 22 and state pension age and earn over £10,000 per year. You must automatically enrol these employees into a workplace pension scheme.

Auto Enrolment Tasks

- Your first step as an employer is to set up a pension scheme and this can be done in advance of your staging date. When you reach your staging date, you must assess staff, and if eligible, enrol them into the pension scheme. Along with being enrolled into the pension scheme, you must also deduct contributions from employees pay and add these contributions to the employees pension pot. By law, the employer must also contribute to the scheme. These contributions must meet minimum regulations, which is currently 1% employer and 1% employee. By April 2019, these minimum rates will rise to 3% employer and 5% employee.

- If an enrolled employee does not wish to be part of the pension scheme, they can decide to opt out of the pension scheme within 1 month of being enrolled. Employees who opt out are entitled to a full refund of any pension contributions made to date. All employees who are not eligible to be automatically enrolled are known as either non-eligible jobholders or entitled workers. Non-eligible jobholders may choose to opt in to the pension scheme, and if so, they must be enrolled and treated exactly the same as an eligible jobholder, i.e. must meet minimum employer and employee contributions. On the other hand, entitled workers may choose the join a scheme and this scheme does not have to meet these requirements.

- Along with the above duties, you must also communicate with all employees. You must write a letter to eligible jobholders to let them know that they have been enrolled into a pension, the contribution rates and their option to opt out. A letter must also be sent to non-eligible and entitled workers to let them know of their right to opt in or join the scheme.

- Another important auto enrolment task is to complete your declaration of compliance. This must be completed within 5 months after your staging date and notifies the Pensions Regulator that you have fully complied with AE. This must be completed regardless of whether or not you have automatically enrolled employees. If you have no eligible jobholders, be aware that you still have a number of auto enrolment responsibilities, including communicating with non eligible and entitled workers and completing the declaration of compliance. There are many other auto enrolment tasks that employers are responsible for, including keeping records for a minimum of 6 years and re-enrolling employees into a pension scheme every 3 years.

Software Solutions

Although software is not a legal requirement for auto enrolment, the Pensions Regulator recommends that you have software in place to simplify the process. Most payroll software enables employers to automate and simplify the employers auto enrolment tasks. It is important that HMRC Basic PAYE Tools users are aware that the software does not and will not cater for auto enrolment. This means that all the auto enrolment tasks must be completed manually, increasing the workload and the risk of errors.

If you have someone who manages your payroll or finances for you, it may be worth contacting them to see how they can help you with your duties. If you manage your own payroll, BrightPay is the perfect tool that will allow you to seamlessly and effortlessly process auto enrolment tasks. BrightPay automates most of an employers auto enrolment tasks, including employee assessment, auto enrolment communications and opt outs & refunds. The software is currently compatible with 17 different pension providers, including direct integration with both NEST and Smart Pension.

BrightPay’s standard employer licence for 2017/18 costs £99 + VAT per tax year. The 17/18 bureau licence is £229 + VAT per tax year. This includes full auto enrolment functionality, free support, and the ability to process payroll for an unlimited number of employees. BrightPay also has a free licence for employers with 3 or less employees. Book a demo today to see how easy it can be to process auto enrolment with BrightPay. The online demo lasts approx 30 minutes and will also include how you can easily process payroll on a day to day basis for employees. In the meantime, why not download a 60 day free trial to find out how your business can benefit from BrightPay.

Jan 2017

10

Payroll software should work with any Auto Enrolment pension scheme.

As part of automatic enrolment, employers need to have a qualifying workplace pension scheme in place. However, if you are an employer and have no eligible employees you do not need to set up a scheme. Non-eligible jobholders have the option to opt in to the scheme and entitled workers can choose to join the scheme, therefore it would be advisable to have a scheme in mind.

For an eligible jobholder, the employer and the employee must pay into the chosen scheme to help the employee save for their retirement. Eligible jobholders have the right to opt out of the scheme. Employers will need to find a scheme themselves or consult with an accountant or financial adviser to help them choose the best option.

The Pensions Regulator (TPR) advises employers to research a few different schemes before they make their decision. The following schemes have informed TPR that they are open to the small employer market.

- The People’s Pension

- Ascot Lloyd Benefit Solutions

- True Potential Investments

- Standard Life Workplace Pension

- Welplan Pensions

- AutoEnrolment.co.uk

- The BlueSky Pension Scheme (TBPS)

- NOW: Pensions

- NEST

- Aviva Workplace Pension

Employers will need to confirm that the pension scheme will accept all their staff, how much it will cost to implement and what the ongoing costs will be to both the employer and the employee. Importantly, you will need to make sure it works with your existing payroll software. BrightPay supports 17 different pension schemes listed below. We also offer direct API integration with both NEST and Smart Pension. This means users can submit their pension files directly from BrightPay to the pension provider, similar to RTI submissions. BrightPay can also accommodate any pension scheme that is not directly supported where users can export a csv file with the required information selected and upload to the pension portal.

Find out more here.

Related articles

- Auto Enrolment - Choosing a Pension Scheme

- A few things to consider when choosing a pension scheme for AE

- What’s involved with AE on an ongoing basis?

Dec 2016

21

The top 5 benefits of using BrightPay Connect for Automatic Enrolment

Auto Enrolment Overview

Auto enrolment has been introduced because people in the UK are living longer lives but not saving enough for retirement. The government estimates that as much as 7 million people do not have adequate savings to provide for them in retirement. The government will also be unable to cope with the increasing number of people retiring in the future.

By law, every employer in the UK has auto enrolment (AE) duties to complete. Employers must enrol all eligible jobholders into an AE workplace pensions scheme. The employer must also contribute to the employee’s pension pot. It is called automatic enrolment because it is automatic for employees but it’s not automatic for employers.

To comply with automatic enrolment, employers need to complete a number of AE duties, including employee assessment, communications, process employee requests, calculate contributions and deductions and submit files to the chosen pension provider. There will be additional duties to perform if the employer chooses to postpone AE. Employees will also have certain rights including being able to opt out, opt in or join the pension scheme.

BrightPay Connect & Auto Enrolment

Employers can reap huge benefits from cloud software. BrightPay Connect is the latest add-on that integrates directly with your BrightPay payroll. Cloud software provides flexibility and online access on the go where your payroll and certain auto enrolment data can be accessed on any device. Auto enrolment functionality should be included free of charge as part of your payroll software package. Payroll should allow you to automate and simplify your automatic enrolment duties. For efficient and successful AE compliance, BrightPay Connect offers significant online advantages for automatic enrolment including:

- Auto Enrolment Communications

Employees can be given access to their own online self-service portal where they can access and download their payroll documents. Communicating with employees about their AE rights is a compulsory part of complying with AE. You must notify all employees about their worker category, give information about how AE applies and let them know their rights. BrightPay Connect can help with the process of sending AE communications. You will have the option of sending and making the AE communications available on each employee's online portal where they can view, download or print the letter.

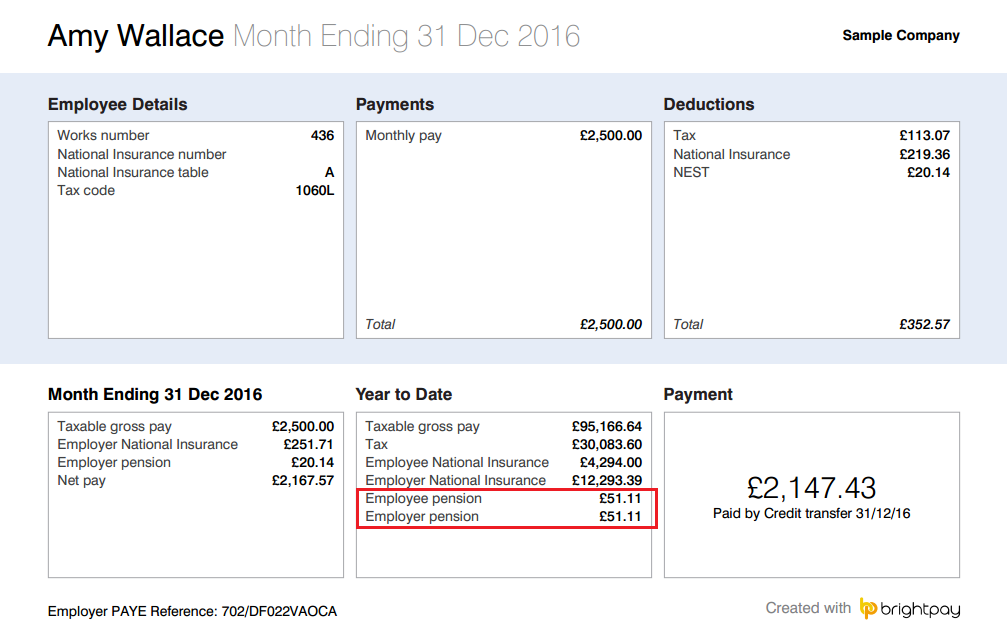

- Interactive Payslips

Part of an employer's duty is to calculate the correct contributions and deductions for each employee. This information should be visible on the employee's payslips displaying the employee and employer contribution amounts. BrightPay Connect allows employees to view and download all current and historical payslips. These interactive payslips will show these auto enrolment contributions for you. See a sample BrightPay payslip below.

- AE Compliance

To ensure compliance, it is essential that your staff records are correct, including employee dates of birth, salaries, National Insurance numbers, contact details and amounts being paid into the pension scheme each pay period. Having the correct information will ensure you have what is needed to run auto enrolment effectively. On the employee portal, employees can keep their contact details up to date and make any changes should their contact details need to be modified. As BrightPay Payroll and BrightPay Connect are fully integrated keeping up to date with your AE staff records is easy.

- AE Reporting

You are legally required to keep certain information and records for the purposes of AE. Poor record keeping could result in a fine being issued by the Pensions Regulator. All employers must provide certain information to the Pensions Regulator to let them know that they have complied with their AE duties. Auto enrolment reports can be set up and saved in your BrightPay payroll. Any saved reports will then be available to the payroll bureau and to the employer on BrightPay Connect.

- Mobile Access

People want their information on the go. Payroll bureaus, employers and employees can access their payroll data on any smartphone, desktop computer, tablet or laptop. Accessing your payroll and auto enrolment data on BrightPay Connect allows the processes to be easier and more flexible. Online access also allows for better communication regarding automatic enrolment between workers, employers and bureaus.

How BrightPay can help with Auto Enrolment

BrightPay payroll offers full auto enrolment functionality to take the hard work out of the employer duties for you. What’s more, there is NO additional charge for auto enrolment. Your payroll and auto enrolment duties must still be processed on the desktop BrightPay Payroll application.

The AE process in BrightPay Payroll

BrightPay can automate a lot of the administrative auto enrolment processes for you. Simply enter in the staging date and the rest is easy. When setting up your AE pension scheme, you will have the ability to set up your contribution rates too. Once you reach the staging date in BrightPay, the payroll will automatically assess all employees for you. From there, BrightPay will automatically produce the appropriate letters for each employee which can be printed, emailed directly to the employee, downloaded or uploaded to the BrightPay Connect self-service portal. Other AE tasks are seamlessly handled, including postponement, processing opt in, opt out or join requests, support for AE pension schemes and AE reporting.

Find out just how easy the entire process can be. Book a BrightPay Connect demo today.

Dec 2016

8

Auto Enrolment & the Small Employer Market

Auto enrolment is being rolled out in stages across all employers, and started with the larger employers in October 2012. By October 2018 all employers will be required to offer workplace pension schemes to eligible workers.

New employers (or new PAYE scheme users) will begin to reach their staging date depending on when PAYE income was first payable. These employers will have a staging date of between 1 May 2017 and 1 February 2018.

By the end of October this year, almost 300 thousand employers had completed their declaration of compliance, enrolling over 6.8 million eligible jobholders into a workplace pensions scheme. The Pensions Regulator estimates that, over the next three years, over 1 million small and micro employers will need to act as a result of auto enrolment.

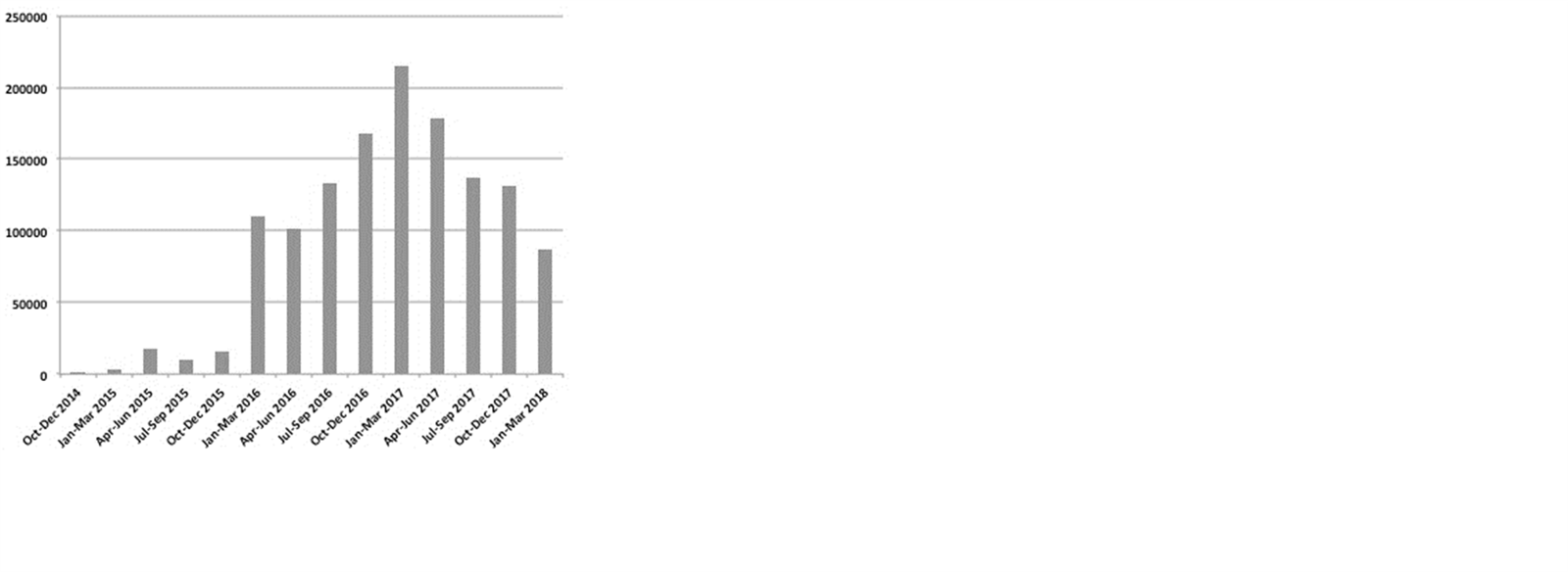

The so called tsunami is almost upon us and it keeps growing each quarter, with the largest number of employers reaching their staging date early next year. You can see from the image below that auto enrolment will affect 170 thousand employers within the next three months.

A lot of the companies staging before now will probably have had their own HR people or in- house accountant to help them through the enrolment process. The vast majority of those staging from now onwards will have no in-house expertise. These employers may not have the knowledge or experience to make informed decisions when it comes to their AE obligations.

With the vast quantity of information available, employers are fast becoming confused and overwhelmed. These clients will require help understanding the implications for them, their employees and their business.

So, payroll bureaus have a gift-wrapped business opportunity! And this is business you don’t have to go chasing. Read more about offering AE as a service with BrightPay’s free guides.

Nov 2016

16

Huge increase in The Pension Regulator's fines for Non-Compliance

The Pension Regulator's quarter figures for 1st July to 30th September 2016 have been released and there has been a huge rise in the number of notices and penalties issued to employers for non-compliance with auto-enrolment.

In this quarter The Pension Regulator issued 15,073 compliance notices, an increase of over 344% from the last quarter with 3,392 being issued. 3,728 fixed penalty notices carrying fines of £400 were also issued, an increase of 861 from the last quarter, up by 30%. Between July and September The Pension Regulator also issued 576 escalating penalty notices, up from 38 in the previous quarter. Depending on the size of the employer, these escalating penalty notices can carry a daily fine ranging between £50 and £10,000 per day.

The Pensions Regulator (TPR) says the rise is in line with the sharp increase in employers reaching their deadline to comply with auto-enrolment duties.

Since auto-enrolment was introduced in 2012 the following have been issued:

• 741 escalating penalty notices

• 26,040 compliance notices

• 6,779 fixed penalty notices.

A regulator spokesperson said: “Although the vast majority of employers are successful in meeting their duties, the minority of employers who fail to listen to warnings from us are subject to fines.”

The latest compliance and enforcement bulletin also emphasizes that explanations given by employers for non-compliance such as illness, being short staffed or confusion about their duties or miscommunication between employers and their advisers/agents are not a “reasonable excuse”.

Nov 2016

2

After Auto Enrolment Staging - What happens next??

Once you have completed the initial setup of auto enrolment you will need to complete a set of tasks on an ongoing basis. Clients will need to comply with their ongoing duties to avoid being fined by the Pensions Regulator.

Ongoing Assessment: All employees must be monitored on an ongoing basis to see if there are any changes to their worker category. For example, if an employee turns 22 or their qualifying earnings increase then they may become an eligible jobholder. Even if this occurs after staging, your client will still need to carry out new AE assessment duties for this individual employee.

Your payroll software should easily monitor the ages and earnings of any new and existing staff. Good payroll will automatically notify you of any changes to an employee's status therefore there should be no need to run a report every pay period. Any employees that become eligible will need to be enrolled and an AE communication letter issued to them.

Record Keeping: Clients must keep records of their auto enrolment activities for six years. They must also keep any employee opt-out notices for a period of four years. By law, there are two different types of records that an client must keep.

- Pension staff records- including employees names and addresses that have been enrolled, records of when the contributions were paid to the pension scheme, any opt-out notices and much more.

- Pension Scheme records - including the client pension scheme reference and scheme name and address.

These records or reports should be available in your payroll software

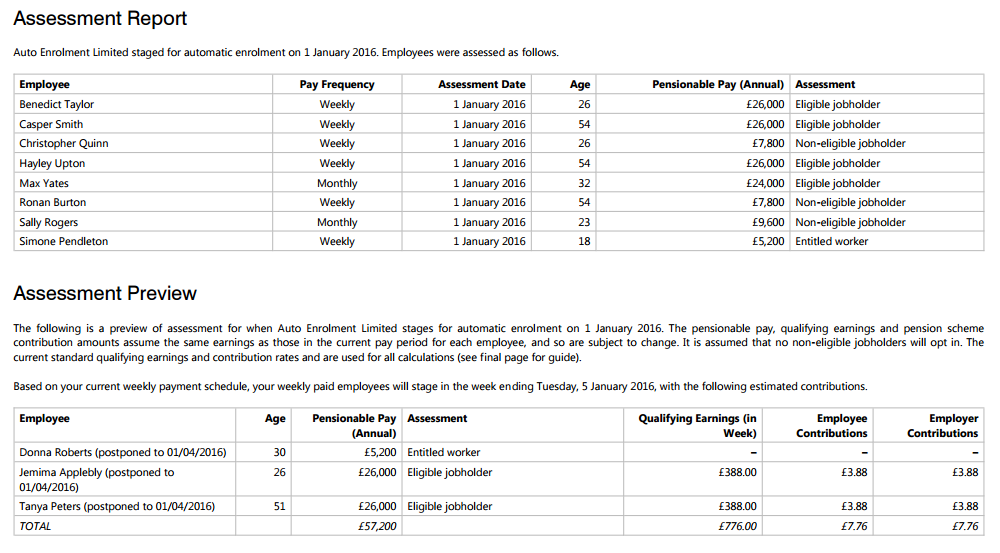

Post Assessment Report: A useful report to run is a post assessment report after your client has staged. The report will give your client a clear picture of what has taken place on the staging date for each employee. Your payroll software should easily produce this report to include each employee, pay frequency, assessment date, employee’s age, pensionable pay and assessment category. It would also be valuable to see employees who have been postponed. PDF Example post assessment report.

Pension Submission: Your payroll software should work and support your auto enrolment pension scheme. Each pension provider requires their data files in a certain format. Check to see if your payroll allows for the easy transfer of data files to the pension scheme. Some providers such as NEST and Smart Pension offer a direct integration or an API facility between payroll and pension provider which will save you time each pay period. Read: How useful will the NEST API tool be?

Paying Contributions: Your client will need to pay the correct level of employee and employer contributions to the AE pension scheme in a timely fashion. The contribution amounts will either be based on a fixed amount or a percentage of earnings. You payroll software should easily calculate both fixed or percentage amounts for you. One you have set up the contribution calculation basis then you payroll should deduct the correct amounts automatically for you.

To conclude..

The responsibility for meeting your automatic enrolment duties ultimately lies with your client. However if you are contracted to carry out AE on behalf of your client then you have an obligation to fulfill the terms of the contract. View a full list of Auto Enrolment Features in BrightPay.

25% BrightPay when you Switch!!

New bureau customers can now save 25% when they switch to BrightPay. To avail of the discount, you can purchase online or contact our sales team on 0845 3004 304 or [email protected] and quote '25% Discount Sale'.

*Offer applies to new bureau customers who switch from a different payroll software provider for the first year subscription only. Applies to BrightPay 16/17 bureau licences only.

Oct 2016

20

Cyclical Automatic Enrolment

Cyclical automatic re-enrolment occurs approximately every three years after an employer’s staging date. Essentially cyclical reenrolment is a repeat of the process the employer carried out on their staging date (or deferral date if they used postponement to postpone all their workers at staging).

However there are some key differences between automatic reenrolment and automatic enrolment:

• While both automatic re-enrolment and automatic enrolment apply to eligible jobholders, automatic re-enrolment will only apply to eligible jobholders who have already had an automatic enrolment date with that employer.

• Postponement cannot be used with automatic re-enrolment. If the eligible jobholder criteria are met by a worker on the automatic re-enrolment date, automatic re-enrolment must take place with effect from that date.

Crucially, the employer does not have to assess all their workers to identify if any meet the eligible jobholder criteria. Instead they must assess only the workers who have opted out or voluntarily ceased active membership of a qualifying scheme. The assessment of worker categories carried out on the cyclical automatic reenrolment date is separate to the employer’s usual assessment process, which they run each pay reference period to identify whether automatic enrolment or any information requirements are triggered.

Key points:

• Another declaration of compliance will need to be completed

• 1 date for all staff - if you are eligible you must be enrolled

• Postponement cannot be used

Source: pension regulator