Jan 2020

28

Employer obligations: Simple ways to comply using online payroll portals

There's been a lot of talk recently about online client platforms. They can bring many benefits to both employers and employees alike - from online payslip access to annual leave management to a HR document hub.

But can cloud payroll portals really help with employer obligations? Here we look at how BrightPay Connect can help with record-keeping requirements, employment law obligations and GDPR compliance.

Record-Keeping Requirements

By law, employers must retain certain documentation relating to their employees for specific minimum periods. Good cloud systems will record this information for you, meaning everything is stored securely online.

Not only is BrightPay Connect useful for keeping a record of payroll information, but employers can also use it to hold various employment and leave records. Sometimes record-keeping can be something that we let slip or are perhaps not as diligent as we might be with say, payroll files, where we tend to be very diligent.

If you have an inspection, the inspector will want to see all of the employee records, whether it’s pay records, annual leave, sick leave, maternity leave, and they’ll expect the records to be readily accessible. With BrightPay Connect, you can access the calendar and reporting features to see at a glance who has taken leave, and when, so should an inspector arrive, you can simply log into Connect to access the records, rather than getting into a panic about what is saved where.

Employment Legislation

For employers, there’s also compliance with employment legislation. This will be even more important over the coming months, as three new pieces of employment legislation come into force on 6th April 2020.

One of the changes being introduced is the introduction of a day-one right to receive a written statement of terms and conditions (more commonly known as a contract of employment). At the moment, this needs to be given to new employees, no later than two months after the beginning of their employment, so this new day-one timeframe requirement from this April of providing an employee with their contract on their first day of employment will be a big change for many employers. For employers who use Bright Contracts to create contracts of employment, the software will soon be updated in line with the new legislation.

Free Webinar: Employment Law Update - Register now

If you are on leave or not based at the same location as the new employee, meeting that day-one deadline could be challenging, and that’s where the online employer and employee portals can help. Being able to upload employment contracts and other employee documentation onto the cloud from any location, and share it with the employee, could be a lifesaver. With BrightPay Connect, the documents and resources hub also offers an activity log, which gives the date and time stamps in relation to when an employee accessed the document.

GDPR Compliance

In the new world of GDPR, non-compliance will be a continuous threat to all businesses. BrightPay Connect offers significant benefits to help your business or practice comply with GDPR legislation.

GDPR Remote Access for Employees

The GDPR legislation includes a best practice recommendation, whereby organisations should provide individuals with remote access to a secure system, which would give them direct access to their personal information. An online employee portal, such as BrightPay Connect, will store employee’s information online, giving the employee access to personal data that employer has on file for them. The employee can update their contact information easily, with changes instantly and seamlessly updated in the payroll software.

Data Security

Your data accuracy and compliance improve even further when you add in the ability to automatically backup payroll data in the cloud. If you only keep your payroll data on your desktop, you are at risk of losing the information. How prepared are you for a disaster recovery situation? Would employees still get paid if the information was lost? Without cloud backup, the consequences would be dire. But now, these problems can be solved quickly, and that’s because of cloud innovation.

Cloud integration introduces the ability to automatically and securely backup the payroll data to the cloud. BrightPay Connect maintains a chronological history of all your backups, and these backups can be restored at any time if required. It’s simply an added layer of data protection to safeguard your payroll data.

Book a demo today to discover more ways that BrightPay Connect can help you comply with your employer obligations.

Dec 2019

20

All I want for Christmas is the perfect cloud platform

What springs to mind when you hear the word ‘cloud’ will vary from person to person. Some will think of the weather as they look, grumbling, out their front window. But others will be thinking about all that extra storage on their iPhone. See, the meaning of the word has changed in recent times and most of us will now think the latter. But what about those who haven’t a notion what you’re on about? What is the cloud?

The cloud is a general term for any computing service that involves hosting over the internet to deliver computing services in lieu of a hard drive. Services such as storage, payroll and HR information. The other key feature is that you can access these services or information anytime, anywhere from any device that is connected to the internet. In fact, you’re already using cloud services if you use social media, Google Drive and Dropbox to name but a few. And now the cloud has become a must-have for any business who wishes to keep up with the times.

I can hear some of you now: “it sounds great but my employees would never use something like that”. Well, that’s where you’re wrong. A recent survey found that 48% of people believe technological advances will change the face of the workplace and a whopping 87% of those said they would be happy to adapt to technological changes if the right tools were given to them. Wow! So how do I know which cloud platform to choose for my business?

I’m glad you asked! Our experts got together for a brainstorming session and found that there are four key things to look out for when choosing the right cloud platform for your business - cost, compliance, simplicity and connection.

- Cost - Your upfront costs should be minimised - it shouldn’t be an expensive luxury reserved for big corporations. Make sure it provides the option of having multiple users so you can delegate and give access to various people to manage payroll tasks and HR requests on your behalf.

- Compliance - Make sure it takes into account your obligations as an employer with regards to things like the GDPR legislation, record keeping requirements and automatic enrolment duties. A good platform will have compliance built-in as standard and will manage it seamlessly.

- Simplicity - The most important thing to increase uptake of a cloud platform is to make sure it is user-friendly and reduces the chance of human error. Look out for simplistic interfaces and whether or not training and support is available. The best of the best will offer this for free. You should also be able to get set up and ready to go with minimal disruption to your business.

- Connection - Make sure it offers features that are attractive to employees such as a downloadable app, a self-service portal and company-wide messaging features. Because at the end of the day, your employees won’t give a damn about how excited you might be about it unless it works for them too. These features tie in with our ever-increasing digitally-minded workforce and will make them feel more in control and engaged.

So there you have it… off you go now! Good luck scouring through the internet trying to find the perfect cloud platform. But….., well, ...it is Christmas after all and I’m feeling generous. Ah what the heck, I’ll just let you in on a secret which is the best cloud platform for businesses out there: our very own BrightPay Connect.

BrightPay Connect is an add-on to BrightPay’s award-winning payroll software and ticks literally every single box I just mentioned over the course of this post. I’ve done enough talking so instead let me show you. Book a demo today to find out if BrightPay Connect is the perfect fit for your business.

Merry Christmas everyone! Don’t say I didn’t get you anything!

Nov 2019

27

How cloud payroll portals jack up your cybersecurity

Until the recent past, small businesses were unlikely targets for sophisticated cyber-attacks. But in the internet era, things have changed dramatically.

SMEs are doing more business online than ever and they are using cloud services that don’t use strong encryption technology. It’s turned your average SME into a likely, lucrative target. There’s a lot of sensitive data to be had, and if it’s behind a door with an easy lock to pick then all the better.

This new reality is on display in official statistics. Over four in ten businesses (43%) and two in ten charities (19%) experienced a cybersecurity breach or attack in 2018, according to the government’s cybersecurity breaches survey.

Three-quarters of businesses (74%) and over half of all charities (53%) surveyed also identified cybersecurity as a high priority for their organisation’s senior management. It’s likely GDPR and its stiffened sanctions for breaches and blunders has a lot to do with this heightened priority.

Payroll processing is a key innovation battleground in this new era of hacks and data regulation. Clients want the convenience of online access to their payroll information, but they also demand (and require) the very best in security.

For a bureau, offering best-in-class cybersecurity is a valuable way to add and demonstrate value, with very little actual effort on your part. A bureau using the most secure cloud payroll facility will offer data security as standard.

Meanwhile, the security itself is actually handled by the software supplier and the infrastructure they provide. All you need to do is make the right choice when it comes to picking a software partner.

When using BrightPay Connect in conjunction with your BrightPay desktop application, for instance, all communication between both systems is carried out on a safe channel with maximum security.

BrightPay utilises all manner of best practice to guard against nefarious tactics such as data injection, authentication hacking, cross-site scripting, exposure flaws, request forgery, and the many other types of vulnerabilities.

BrightPay Connect utilises the Microsoft Azure platform to give users reliability, scalability, data redundancy, geo-replication and timely security updates out of the box.

As a payroll bureau, cybersecurity is a critical commercial area. You must be able to promise security to both current and prospective clients. By investing in payroll software that offers cloud integration powered by the latest tech, that’s an easy promise to keep. Being at the bleeding edge of cybersecurity has never been simpler.

Book a demo today to discover more ways that BrightPay Connect can protect your business.

Nov 2019

19

How to use cloud technology to attract new staff

The Cloud is the current buzz-word in technology. Employers in the know are reaping the benefits from its capabilities, including helping them attract and retain new staff.

Why is this important? Becoming an employer of choice has never been more important, especially as we are at near full employment. A quick search of any of the main job boards will show an abundance of available jobs. It’s a jobseeker’s market. The challenge for employers therefore is to attract and retain the best candidates. One way to attract and retain employees is to offer them something new, something edgy… a strong, feature-rich, cloud employee self-service system could be it.

Today’s world has gone online, everyone has social media accounts, we are all familiar with buying many of our goods and services online. This is particularly true for millenials (generally defined as those born between 1984 and 1999) who are are fast becoming the largest sector of our workforce. Understanding how to tap into their fast-paced expectations is crucial for business success.

Businesses who do not compete in this space run risks of being overlooked by prospective employees, millennials in particular. This is where employers should consider a cloud, employee self-service system. Offering online access to their annual leave calendar, their personal details, their employers details, all their HR documents and all of their payslips on their smartphones via a dedicated employee app is the smartest, most cost effective way to show your employees you are in the same digital space that they are.

Book a demo today to find out how your business can benefit from cloud self-service systems.

Oct 2019

3

The life-changing magic of payroll cloud platforms: Free up time, work smarter and make more profits

The payroll landscape has changed significantly in recent years, not just because of RTI and auto enrolment, but also because of online client platforms. The relationship between the client and the payroll professional is no longer one-directional. Payroll services can - and should - be a team effort.

Join BrightPay’s Rachel Hynes and Ian Jenkinson as they take you through how cloud innovation can streamline, automate and delegate day-to-day tasks such as payslip distribution, entering the client's payroll data and backing up your payroll. That’s more time to focus on the essentials and provide better service.

Webinar Agenda

- Part 1: In this webinar, Rachel will examine six exciting ways that client cloud platforms have transformed payroll services. Not in the distant or even medium-term future: this is happening right now.

- Part 2: Ian will demonstrate how BrightPay Connect’s next-generation features can benefit your practice. Your payroll and HR processes can be more integrated into the cloud and streamlined with your payroll software than ever before.

Be ready to offer a new level of payroll and HR-related services by embracing automation and cloud flexibility for you, your clients and their employees. Register for this free CPD accredited webinar now to see how you can become more efficient by implementing new cloud technologies.

Can’t make it? Register for the webinar anyway and we will send you the on-demand recording when it’s ready.

More upcoming webinars

Join BrightPay for our series of free CPD accredited webinars where we look at how cloud innovation is transforming the future of payroll services. More upcoming webinars include:

Aug 2019

27

More capacity, more time, more flexibility: Payroll as a cloud service

Payroll processing has never exactly been the belle of the ball. Businesses disliked it because it’s onerous, while accountants loathe it because payroll has proven difficult to monetise. Not to mention, the work is complex and there are bountiful opportunities to mess it up.

But now, payroll is finally having a moment. Cloud portals have altered the landscape, unlocking new productivity and profits for businesses and accountants. Moving beyond the confines of the desktop and connecting payroll software to the cloud opens all sorts of new, exciting prospects.

The benefits of cloud allows constant and iterative improvements because software companies can offer added benefits and additional layers of access via the web, rather than through more traditional, unsecured methods like sending attachments via email. This formula for progress holds true for cloud payroll accessibility. Synching your payroll data to the cloud enables new features, fully supported by a remote access infrastructure for your clients that’s always improving the payroll process.

As for your clients and their employees, a cloud portal can act as an in-house HR system, streamlining many internal payroll administrative duties. For employees, there is just one login to view employee documents and a company noticeboard. Employers can upload documents such as employment contracts, staff handbooks, privacy policies, training manuals. The employer can decide whether the employee should have access to view the document or not, using it as a central location for everything to do with each individual employee.

Cloud integration updates your information in real time which is easily accessible at any time via any device with internet access. Whether it’s just checking something after hours, or enabling flexible online access to payroll information creates freedom. Cloud payroll portals are making it easier and cheaper to provide payroll services at scale for all of your clients. Drudge work is automated, it’s more collaborative, and a simple, intuitive online interface speeds up your work.

But the potential profits from online payroll platforms aren’t just about payroll itself. Time is money, as the old saying goes. Less work filling in boxes means more time spent on lucrative work such as advisory services, consulting and new business development. All throughout the accounting profession, we’ve seen that when firms cut the time spent on traditional services like bookkeeping, tax preparation and now payroll, they can then take on additional clients and projects, using the same number of staff.

More capacity, more time, more flexibility, more collaboration, more profits: the benefits of cloud automation and remote self-service portals will seep into every corner of your practice.

Book a BrightPay Connect Demo today to increase your profits from your payroll service.

Aug 2019

15

Payroll transformed: How client cloud platforms supercharge your bureau

Accounting and payroll processing is best left to the experts. That’s always been true - and it remains true. The steady hand of a seasoned accountant or payroll professional is a powerful commodity that can’t be replaced by software.

But as much as things have stayed the same, other things have changed, too. The relationship between client and professional is no longer one-directional. What software has created is a new collaborative framework in which the payroll professional can thrive.

Payroll services can - and should - be a team effort. Gone are the days of payroll bureaus continuously slogging through manual processes, and the frustration of clients who need to approach their payroll services provider with every minor tweak.

In its place is software with cloud integration that envelops the day-to-day tasks like annual leave management, payslip distribution and backing up your payroll. That’s more time to focus on the essentials and provide better service.

Software can never replace the core professionalism of a payroll professional, but it can supplement it in many ingenious ways. Through self-service, through apps, through cloud backup: payroll software is about making your life easier.

You do the hard work, you get the credit, while your software hums along quietly in the background, automating and simplifying the repetitive aspects of the job and keeping you compliant.

Download our free guide where we discuss six exciting ways client cloud platforms have transformed payroll services. Not in the distant or even medium-term future: now. Here’s how cloud integration can help you today.

Aug 2019

7

Save the trees: Instant access to payroll data without the paper trail

We don’t get paychecks anymore, do we? The concept has been banished to TV shows set in the 1960s, where we see a down-on-their-luck salesman contemplate their paper cheque with sad resignation.

Outside of these cultural portrayals, we’ve all moved along to bank transfers. And yet, there’s still one hangover from the era of manual, paper led payroll: the payslip. Many of us, despite receiving our pay electronically, will receive a paper payslip detailing precisely how much we’ve earned and the taxes we’ve paid. Often these slips will clutter on the employee’s desk, unsecured and aimless.

But how much can you innovate with the old fashioned payslip, anyhow? Quite a bit, actually. This resource heavy, old school process can be taken entirely online. All employee payslips can be securely stored and instantly accessible on BrightPay Connect.

From here, individual employees can also access their HR documents such as their contract of employment through a personal self-service portal as and when they need it. That’s less legwork for you and a simple, well-organised process for the employee.

This can completely replace the more labour intensive process you have now. Payslips can be set up by the user to be automatically available on BrightPay Connect with an email notification to employees, eliminating the need to email them or print it out to hand out, one-by-one manually.

But, of course, employers should still have the choice to do it their way. The business can always email, download or print payslips from BrightPay Payroll. Whichever way the client would prefer is fine, but it remains seamless for you, the accountant.

It’s all about what’s most comfortable. With 24/7 access to employee payslips and other payroll reports, missing payslips and confusion will be consigned to the past. No more manual processes, no more unnecessary legwork -- just the information when you need it, in one location, accessible from anywhere for the accountant, employer and employee.

And with BrightPay Connect, the self-service process empowers the employee beyond payslips. The self-service portal is a powerful, multi-purpose cloud tool.

Employees can access their own personal leave calendar, view remaining holiday days, view sick leave taken, request annual leave, view and change their contact information, access payslips and other payroll and employment-related documents. Clients can even give managers access to approve leave for their department and restrict access the other sensitive payroll information such as employee salaries. It’s payroll software with integrated cloud automation that’s about so much more than just pay.

Book a BrightPay Connect demo today to see just how much time cloud automation and integration can save you.

Jul 2019

23

Using intelligent automation to streamline your payroll

There’s a part in Joseph Heller’s classic novel Catch-22 where the character asks a military officer: “What do you do when it rains?" The captain answers the question frankly. "I get wet.” The captain’s resignation and simple acceptance echo the accountant’s attitude to admin. What else is there to do when processing payroll? Same as getting wet in the rain, payroll processing comes assigned with a burdensome bureaucracy.

Or does it? There are a lot of boxes to be ticked in the accounting profession. There are laws, statutes, regulations, each adding another bit of work to your already busy schedule. Indeed, the profession will never be without its share of bureaucracy and admin. But payroll doesn’t have to mean legwork and elbow grease. By using intelligent automation and the right system, you can cut out many of the repetitive (and plain tedious aspects) of payroll processing. Repetition becomes a thing of the past, too.

With BrightPay, you only need to set up payroll documentation and reports once. After that, you save them on the BrightPay desktop application for future use. It couldn’t be simpler. These documents and reports will also be automatically synced to BrightPay Connect and will be available to log in and view from anywhere. This includes payslips, periodic reporting, P60s, and P45s.

But perhaps for payroll bureaus the most critical way you can reduce the admin burden is by devolving it, so it’s not all on you. Using the password protected self-service portal, your clients and their employees can login online to view their payroll data. For routine tasks, clients can help themselves. The more mundane aspects of payroll processing hum along in the background while you focus on the important stuff. All while maintaining complete control over the entire process.

So what do you do when it rains? You don’t have to get wet - and if you’re a payroll bureau, there’s a more straightforward, smarter way ahead. Admin doesn’t need to be a by-word for payroll, with BrightPay it can be a profitable, low touch service.

Book a demo today to find out how BrightPay can streamline your payroll processing.

May 2019

31

New User Management Interface for Connect

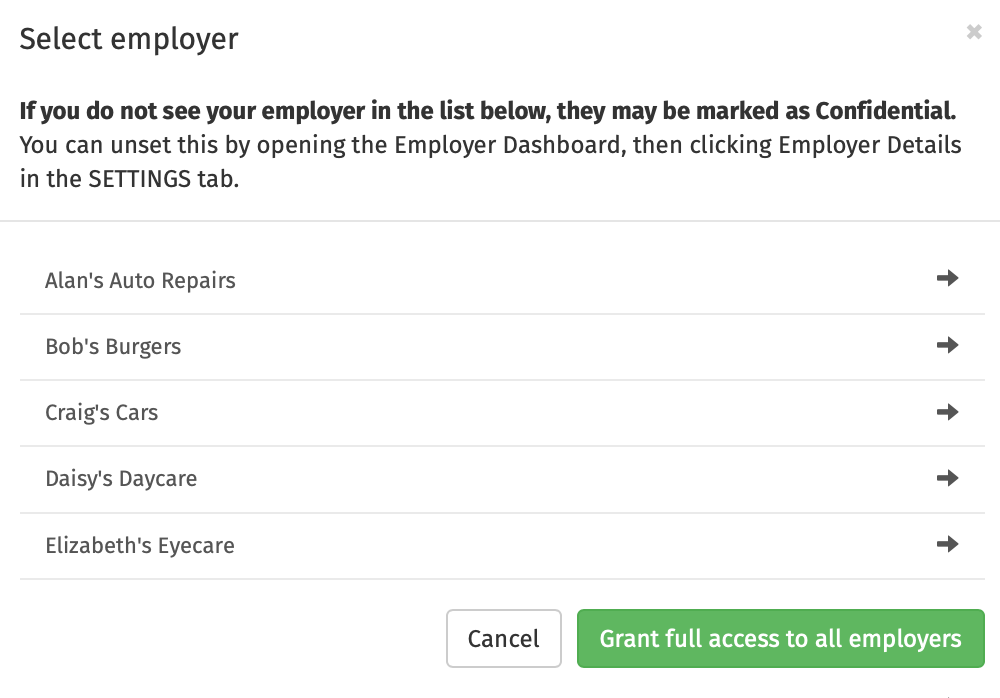

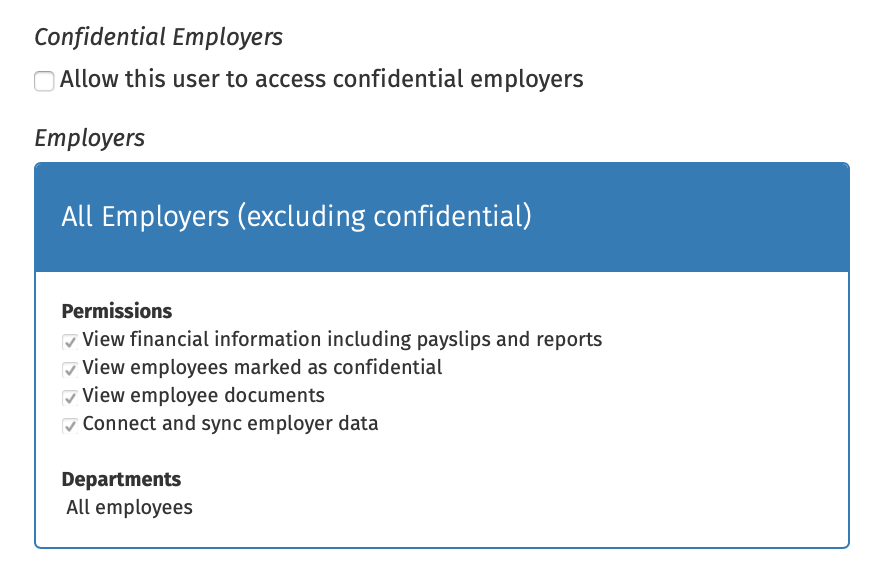

Our new User Management feature for BrightPay Connect makes it more seamless and quicker for users to be set up or amended. It offers the option to select permissions for multiple employers at one time for a standard user. There is also a new permission to allow standard users to connect and synchronise employers from BrightPay to Connect and a new feature to mark an employer as confidential.

Types of Users for Connect

- An administrator has full control over a BrightPay Connect account, with the ability to edit account settings, add other users, redeem purchase codes, connect employers and manage all employer and employee information and processes.

- A standard user typically has access to just one employer in your BrightPay Connect account, although they can be granted access to multiple employers if required. A standard user can view employer (and associated employees) information with various levels of restrictions and permissions.

User Permissions & Confidential Employers

As before, standard users can be set up so that they are restricted by department, so that they can only see information pertaining to employees that are associated with a particular department. They can also be restricted from accessing certain information, such as the ability to:

- View financial information including payslips and reports

- View employees marked as confidential

- View employee documents

- NEW: Connect and synchronise employer data

- Approve employee self-service requests

You now also have the option to grant a standard user access to all current employers, along with any new employers linked to the Connect account. Simply select ‘Grant Full Access to all Employers’ and select the permissions you wish to be applied to the user, including the new permission to Connect and Sync employer data.

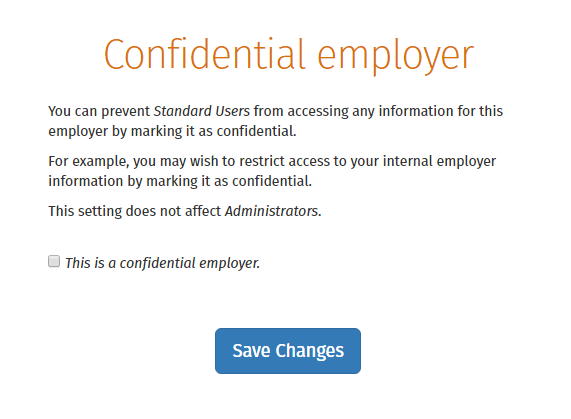

If required, an employer in Connect can be marked as confidential under the settings tab on the employer’s dashboard and only administrators on the Connect account will be able to view this employer. Standard users can only access confidential employers if they are given permission to do so.

Inviting your client as a user

If the employer details are entered in the ‘Client Details’ tab in the employer section in BrightPay, the employer can be added as a standard user by the bureau very quickly and easily. On the employer’s dashboard in Connect, you will see the option to ‘Invite your Client’. Selecting this populates the client’s information for a new standard user and you can then choose the permissions for the client.