Feb 2018

1

Customer Update - February 2018

Free Webinar: What does GDPR mean for your business?

The countdown is on!! The General Data Protection Regulation (GDPR) comes into effect on 25th May 2018, however this date is a deadline as opposed to a starting point. With hefty non-compliance fines, it is important to make sure you are prepared. Register now for our free webinars designed specifically for employers and bureaus.

Employer Webinar (13th March) | Bureau Webinar (6th February)

Increased minimum contribution rates from April 2018

The automatic enrolment minimum contribution rates are increasing on 6th April 2018. The minimum employer contribution rate will rise from 1% to 2% of the employee’s earnings, while the total minimum contribution will increase substantially from 2% to 5%. How will this ‘phasing’ process affect opt-out rates and the public perception of automatic enrolment?

Find out more | Register for free webinar

BrightPay Newsletter - Are you missing out?

GDPR is changing how we communicate with you. After May 2018, we will not be able to email you about webinar events, special offers or other news without you subscribing to our newsletter. Don’t miss out - sign up to the BrightPay newsletter today!

BrightPay & Aviva: Hello one-click pension submissions

BrightPay is delighted to announce that we now offer API pension integration with Aviva. This integration allows users to send enrolment and contribution files to Aviva at the click of a button, eliminating the need to manually save and upload files. Reduce your workload and the risk of error due to manual processing.

Pre-order BrightPay 2018/19

BrightPay and BrightPay Connect are now available to pre-order. We will send you an email closer to the 6th April once your new BrightPay is released and ready to download.

Keep your payroll data secure with BrightPay Connect

With BrightPay Connect, you don't need to worry about manually backing up your payroll data. The add-on will automatically and securely backup your payroll information each pay period ensuring that you never lose your payroll data. This also protects the payroll data against ransomware and similar threats.

Automatic Enrolment: Shaping the savings landscape

Since 1 October 2017, thousands of start-up businesses have instant pension duties, and more than half will have to enrol staff into a workplace pension. The Pensions Regulator highlights the success of auto enrolment to date in its fifth annual commentary and analysis report.

Jan 2018

31

BrightPay & Aviva: Hello one-click pension submissions.

Time-consuming pension file CSV uploads can now become a thing of the past as BrightPay have teamed up with Aviva to bring both employers and payroll bureaus a one-click pension submission. Using Aviva’s API technology, files can be directly sent from one system to another electronically. An API facility is a similar concept to RTI where one system (i.e. payroll software) can instantly communicate with another system (i.e. pension provider.

If Aviva is your chosen workplace pension scheme you can simply send your pension contributions to Aviva in an instant. There is no need to leave the BrightPay application to submit your pension contributions as the Aviva API accesses the pension file that BrightPay has created. This pension file can then be sent through to the Aviva portal with just a few clicks on BrightPay.

Whether you process payroll and automatic enrolment (AE) for your small business or for your payroll bureau’s multiple clients, you can easily comply with your legal duties without having to tirelessly toggle between tabs on your PC.

BrightPay are pleased to be the first payroll software to offer this API integration with Aviva. BrightPay and Aviva customers are saving invaluable time each pay period. If you’d like to see how BrightPay can streamline other tedious automatic enrolment tasks you can book an online demo today. Find out more on our Aviva API webpage.

Written by Cailín Reilly.

Jan 2018

19

Recognised Overseas Pension Schemes notification list

The list of Recognised Overseas Pension Schemes (ROPS) notifications has been updated. 17 schemes have been added and 1 scheme has been removed. This is a list of workplace pension schemes that have told HMRC they meet conditions to be a ROPS and have been asked to be included on the list.

The ROPS notifications list is updated and published on the 1st and 15th day of each month. The list will be published on the next working day if this date falls on a weekend or UK public holiday. From time to time, the list is updated at short notice to temporarily remove schemes while reviews are carried out. For example, this could be when there is suspected fraudulent activity.

The requirements for ROPS changes from 6th April 2017.

You need to meet the new requirements on or after the date you transfer from one scheme to another. HMRC can’t guarantee these are ROPS or that any transfers to them will be free of UK tax. The responsibility lies with you to find out if you have to pay tax on any transfer of pension savings.

HMRC will usually pursue any UK tax charges (and interest for late payment) arising from transfers to overseas entities that don’t meet the ROPS requirements even when they appear on this list. This includes where the ROPS requirements have changed and where taxpayers are overseas. HMRC will also charge penalties in appropriate cases.

Related Articles:

Jan 2018

12

2018-19 Rates and Thresholds for Employers

For 2018-19 the new personal allowance for an employee is £11,850.

The 20% PAYE tax threshold is for annual earnings up to £34,500.

The UK higher tax rate of 40% is on annual earnings from £34,501 to £150,000.

The UK additional tax rate is 45% on annual earnings over £150,001.

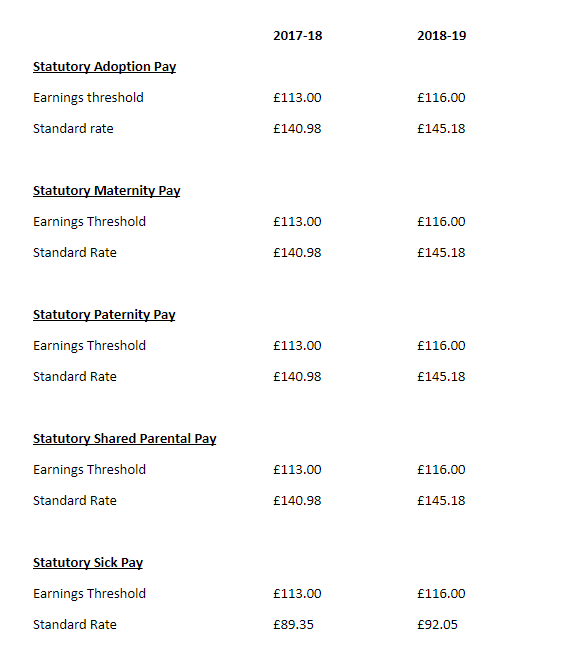

For the new tax year 2018-19, the Department for Work and Pensions have published the statutory payment rates for benefits and pensions.

Click here to see the full list published.

Please see some rates details below:

Jan 2018

5

The UK’s gender pay gap has risen. Here’s how you can help.

The Prime Minister has announced that she is taking action to close the pay gap between male and female employees and ultimately improve workplace equality.

This push being taken by the Prime Minister came after new figures were published. The figures showed that the UK’s overall gender pay gap has risen to 18.4%. Interestingly, the gap for full time workers has fallen from 9.4% in 2016 to 9.1% in 2017.

By law, businesses with 250 plus employees must report the pay gaps and bonus data as a mandatory requirement.

In a bid to seal the gender pay gap The Prime Minister is now asking all companies for their help.

“The gender pay gap isn’t going to close on its own – we all need to be taking sustained action to make sure we address this.”

Here are some of the recommended ways that all businesses can help:

- Ensure there are female representatives at senior level. This can be achieved by ensuring there are opportunities to progress for females within a company. This can also be achieved by introducing a return to work scheme for women.

- Publish gender pay gap information. This can prove helpful in closing the gender pay gap if all companies, even those with fewer than 250 employees, publish this information.

- Make flexible working a reality. This should be advertised with a new position from the start.

Related Articles:

Dec 2017

20

Employer NICs to be paid on Termination Payments from 6th April 2019

In the Spring Budget 2017, it was announced by the Chancellor of the Exchequer, Philip Hammond, that termination payments over £30,000 which are currently subject to income tax, would be subject to Employer National Insurance Contributions from April 2018. The government, however, has announced on 2nd November that the introduction of the National Insurance Contributions bill has been delayed.

From 6th April 2019 rather than 6th April 2018 Class 1A employer National Insurance contributions will be payable on termination payments over £30,000.

At the moment, generally the first £30,000 of a termination payment is free of tax and no National Insurance contributions will be due on any part of the payment to the extent that it would have qualified for tax exemption. In the Finance Bill 2017, the tax treatment of termination payments will be clarified and this will include all contractual and non-contractual payments in lieu of notice taxable as earnings and requiring employers to tax the equivalent of an employee’s basic pay if notice is not worked. The changes, including to Foreign Service Relief, will take effect from 6 April 2018.

For further information select here.

Related Articles

- Payroll for Bureaus: From loss leader to profit centre

- Autumn Budget 2017 - Employer Focus

- The Benefits of BrightPay Connect for Employers

Dec 2017

18

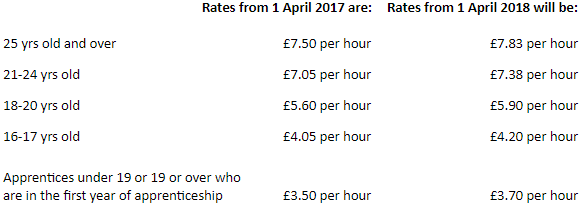

Minimum Wage Increase on 1st April 2018

The Low Pay Commission’s Autumn 2017 report has been published and on the 1st April 2018, the minimum wage will increase again.

The National Minimum Wage (NMW) is the minimum pay per hour most employees are entitled to by law. An employee's age and if they are an apprentice will determine the rate they will receive.

Dec 2017

6

Autumn Budget 2017 - Employer Focus

The main points to be noted by employers from Autumn Budget 2017, as announced by Chancellor of the Exchequer, Philip Hammond are:

- The personal tax allowance will increase by £350 from £11,500 to £11,850 from 6th April 2018. This is in line with the government's goal to have the personal tax allowance at £12,500 by 2020.

- The higher rate tax threshold will increase to £46,350 from £45,000.

- As previously announced, there has been a delay by one year on the series of changes for NICs to be implemented. These changes will now take effect from April 2019. They include the reforms to the NIC treatment of termination payments, abolition of Class 2 NICs and changes to NICs treatment of sporting testimonials.

- The planned increase in Class 4 NICs from 9% to 10% in April 2018 and to 11% in April 2019 by the government will no longer be happening.

- There is an increase in the Company Car Tax (CCT) diesel supplement to 4% from 3%. The supplement will apply to diesel cars registered on or after 1st January 1998 that are not certified to the Real Driving Emissions 2 standard. It will not apply to diesel hybrids or other vehicles except cars.

- From 6th April 2018 there will be no Benefit in Kind charge on electricity that employers provide to charge employees’ electric vehicles.

- The Government has announced its intention to consult on the extension to the private sector of the IR35 reforms, introduced in the public sector earlier this year.

- There is an increase of the lifetime allowance for pension savings, rising to £1,030,000 for 2018-19.

- The National Minimum Wage details for 1st April 2018 were published.

- HMRC's compliance team are monitoring employers that are claiming the Employment Allowance, as it has been reported that some employers are using avoidance schemes to avoid paying National Insurance amounts due.

Related Articles

Dec 2017

5

Customer Update - December 2017

5 simple scenarios to stop pension scams

A pension scam – when someone tries to con you out of your pension money – will often start by someone contacting you unexpectedly with one of many pension scenarios. If you find yourself in one of these scenarios make sure to act fast to prevent becoming a victim of a pension scam.

Sign up to BrightPay’s newsletter

Do you want to hear more about future CPD events, free ebooks, industry updates and special offers? Subscribe to BrightPay’s newsletter today. You will have the option to unsubscribe at anytime.

Does automatic enrolment apply to you?

It is essential that all employers understand that if they employ just one person, they have certain legal duties for automatic enrolment. After the 1st October 2017, new employers who employ their first member of staff will have to comply with auto enrolment from the day the new employee starts.

Free Webinar - What does GDPR mean for your business?

All businesses process large amounts of personal data, not least in relation to their customers and their own employees. Consequently, the GDPR will impact most if not all areas of businesses and the impact it will have cannot be overstated. Places are limited.

Bureau Webinar: 6th February | Employer Webinar: 13th March

How to avoid harassment in the workplace

The recent allegations against Harvey Weinstein in the US have created somewhat of a snowball effect worldwide with thousands of women and men speaking out about their accounts of sexual harassment and assault, many of them being work related.

Cut down on payroll processing time with BrightPay Connect

Employers across the UK are automating the process of providing payroll and HR documents to employees, such as payslips, P60s, employment contracts and company handbooks. Annual leave management can also be simplified and automated giving you more time to focus on pressing business matters.

Out with the staging date - in with the duties start date!

The ‘duties start date’ is the date that an employee first begins to work for a company. For those recruiting after October 1st 2017, it is important to be aware that as soon as their new hire begins working for them, their automatic enrolment duties will also begin straight away.

Did you know BrightPay offers a free licence to micro businesses?

BrightPay offers a free employer licence to businesses with up to three employees which includes payslip and auto enrolment functionality? Also, our standard employer licence is just £99 + VAT per tax year. BrightPay has a 99% customer satisfaction rate.

Download free 60-day trial | Book a demo

More for bureaus -

Payroll for bureaus: From loss leader to profit centre

New technologies can positively impact the way bureaus offer payroll services. There are several exciting developments that are happening right now in the cloud. Be ready to offer a new level of payroll and HR services by embracing new-world online technologies.

Free CPD Webinar - The Future of Auto Enrolment

Auto enrolment has well and truly evolved since the rollout began in 2012. There are a number of changes coming over the next 12 months that payroll bureaus need to be aware of, including instant duties for new employers, increases in minimum contribution rates and automatic re-enrolment.

Accountants are making the big switch to BrightPay

BrightPay has been operating in the UK since 2012. Year on year, more accountants are moving payroll providers to BrightPay for several reasons. You may ask yourself, why are so many accountants and payroll bureaus moving to BrightPay.

The benefits of offering cloud payroll services

The payroll landscape is changing and many payroll bureaus are offering clients a certain level of cloud functionality that automates otherwise time consuming tasks. Online access to payroll information for your clients and their employees offers significant benefits for today's bureau which can will streamline many workforce management tasks.

Nov 2017

28

The benefits of offering cloud payroll services

Accounting firms and payroll bureaus are increasingly moving into the cloud to offer clients a more flexible and streamlined payroll service. Many believe that payroll isn’t a profitable service due to the complexity of the work, the manual administrative time required and the increasing number of mistakes when it comes to recording employee leave.

The actual process of running payroll is straightforward enough due to easy to use features in payroll software. But what about the administrative payroll and HR related tasks such as processing & sending payslips, managing & recording employee leave, lost payslips, backing up your payroll data, sending payroll reports to clients and updating employee records? All of these tasks can take a considerable amount of managerial time to process and correct where errors have occurred.

The payroll landscape is changing and many payroll bureaus are offering clients a certain level of cloud functionality that automates otherwise time consuming tasks. Online access to payroll information for your clients and their employees offers significant benefits for today's bureau which can will streamline many workforce management tasks.

Cloud Backup

Storing payroll information and data protection continues to be a challenge for payroll bureaus. With an automated cloud backup tool you will never lose your payroll data again. You don’t need to worry about manually backing up your payroll data. Where you payroll software is integrated with the cloud, your payroll data will synchronised to the cloud as you run your payroll or make any changes whilst maintaining a chronological history of your backups. You can restore or download any of the backups to your PC or Mac at any time.

Eliminate Paper & Postage Processing

The concept of a paper payslips that need to be downloaded and emailed or printed, enveloped and then posted in an outdated process. More and more, employees want their payslips to be accessible and securely stored online. Payslips and other payslips related documents such as P60’s, P45’s and employment contracts can be easily accessible on an employee self service online portal. With the cloud, payroll bureaus can avoid spending time printing, emailing and resending lost documents to employees. An online employee self service option allows employees to view current and historic payslips and access all HR employee documents.

Online 24/7 Accessibility

A cloud client and employee dashboard provides 24/7 flexibility and control of payroll information. Clients can access all employees payslips, payroll reports, amounts due to HMRC, employee contact details and can even approve annual leave requests. Employees can access their self service portal on their computer or via a mobile app to view and download payslips, easily submit holiday requests and view leave taken and leave remaining.

Increased Bureau Productivity

Cloud functionality allows for many payroll related tasks to be synchronized with your payroll software. Payroll bureaus radically save time as they no longer need to send payslips to employees, send payroll reports to clients, re-send lost payslips or manually process employee leave on the payroll software.

Annual Leave Management Tool

Annual leave approvals can be approved in the cloud and automatically recorded on your payroll software reducing errors and ensuring leave data is up to date at all times. Clients can view a company wide online calendar where they can easily approve leave while managing staff availability for their business. Employees can benefit as a cloud portal will calculate accurate leave balances in real time. Senior managers and supervisors can be given a high level access to approve holiday requests.

Full integration with payroll software

Payroll software systems that offer a fully integration with the cloud is a must. Integrated payroll and cloud allows both tools in share and synchronise your payroll data in real time. An online payroll tool that links to clients data that is saved on your payroll software can directly communicate with each other ensuring all information is current and correct.

Embrace cloud payroll functionality

Using the cloud to automate many daily payroll and HR related tasks will improve efficiencies for payroll bureaus, employers/clients and their employees. BrightPay Connect is one such cloud solution that fully integrate with BrightPay Payroll offering:

- Automatic cloud backup

- Bureau / Client online dashboard

- Online payroll reporting

- Employee self service

- Online leave management

- Safely store HR documents online

- Update employee details

- Affordability with discounts for multiple purchases

- Easy of Use

Related guides / articles

BrightPay Connect - Guide to Profit for Accountants

Benefits of BrightPay Connect for Bureaus