May 2017

15

Employer fined £42k for Non-Compliance of Automatic Enrolment Duties

Employer Johnson Shoes Company’s automatic enrolment staging date was 1st May 2014 and they had to file their declaration of compliance within the 5 months after the staging date by 30th September 2014, but they failed to do so by the deadline.

Johnsons were contacted by The Pensions Regulator several times advising them of their automatic enrolment duties and how to fulfil these duties. But Johnsons’ lack of action regarding their duties made The Pensions Regulator to use their enforcement methods.

TPR issued a Fixed Penalty Notice of £400 to Johnsons but Johnsons refused to pay this fine and asked TPR to review the penalty as they stated the pressures of work were the reason they did not fulfil their duties. As TPR had sent Johnsons several reminders in the year leading up to their staging date, giving Johnsons plenty of time to prepare, this excuse was not deemed to be a reasonable excuse by the TPR so the fine remained.

An Escalating Penalty Notice was issued which in Johnsons case was £2,500 per day due to the number of employees they have. This escalated to £40,000 total fine. As Johnsons also refused to pay this EPN fine The Pensions Regulator lodged a money claim with the County Court in order to recover the amount owed. In the end Johnsons were ordered to pay the £40,000 plus £2,000 in legal fees that The Pensions Regulator had to pay at the beginning of their claim, so total cost of £42,000 for Johnsons.

Johnsons are now fully compliant for automatic enrolment and their employees that are in the automatic enrolment pension scheme are in the same position as they would have been if Johnsons had been compliant at their staging date.

In a regulatory intervention report produced by The Pension Regulator it states this case shows that early engagement with the employer where non-compliance is identified is necessary. This cost to Johnsons could have been prevented if Johnsons had of being prepared for automatic enrolment and not ignored the communication from The Pensions Regulator.

Apr 2017

24

Auto Enrolment - Increased workload or increased opportunity for Bureaus?

This year, accountants and payroll bureaus will see a large number of their clients approaching them to assist with auto enrolment (AE). The process of complying with AE requires payroll expertise to calculate pension contributions for employees who are eligible and for employees who choose to join or opt into the pension scheme. 2017 will see the largest number of employers reach their staging date. At the end of March, we saw a new record of over half a million employers who have complied and fulfilled their auto enrolment duties.

The sheer volume of small and micro employers going through the AE process represents an opportunity for payroll bureaus to add a new service to their existing payroll services. Many of these small employers will be using HMRC's Basic PAYE tools (BPT) which will not cater for the needs of automatic enrolment. Basic tools is just that, a basic tool. It will not carry out the employee assessment required, produce communications to send to all employees, cater for enrolment, produce payslips that show both employer and employee contributions or create the pension data file to submit to the pension provider. This lack of functionality with Basic Tools is another reason why your clients may look to you for help with their duties.

For employers who wish to carry out their payroll and auto enrolment tasks in house, they have the option to switch to payroll software that can support their employer auto enrolment duties. Check to see if your payroll provider can import from Basic PAYE Tools. BrightPay has a specially developed feature, where you can import your employer data into BrightPay from BPT instantly. There is no need for manual data entry. Some good providers even offer a free payroll software licence which includes auto enrolment to micro employers.

How much is auto enrolment software?

At this stage you should be aware that you should not have to pay an extra charge for auto enrolment functionality. Unjustifiably, some payroll providers are charging their customers for an auto enrolment module or add-on. Some are also charging per employee, per month which can be expensive. If you do the maths, you will soon see how this can add up over a yearly period. There are other payroll systems that can deal with auto enrolment but it can be a manual process of running reports every pay period with additional steps required to process your client through AE.

It is worth investing in payroll software that has automated auto enrolment technology. BrightPay has been developed specifically with payroll and auto enrolment automation in mind. Using an automated software will not only save you time but it can make you money. By improving efficiencies, bureaus will naturally increase productivity and profitability for each client. BrightPay can email payslips, send RTI returns, automate auto enrolment, manage holiday pay and a whole list of features.

An important thing to look out for is the ability to import your staff details into the payroll. BrightPay has the ability to import data via CSV file or FPS. You can also directly import each of your client's employer information into the program. At BrightPay, we have developed tailored import facilities from HMRC’s Basic Tools and Moneysoft where payroll bureaus can import multiple employer files at the same time. Read: Switching to BrightPay - Made Easier for you!

Increased opportunity?

With the right, automated payroll tools, the process of auto enrolment should be very straightforward, seamless and, above all, a profitable exercise. Without doubt, auto enrolment should be an additional service that your payroll clients should expect to pay for. For many accountants and bureaus, auto enrolment has been the perfect platform to increase revenue. The smaller employer is likely to be the least prepared for auto enrolment and are also likely to turn to a payroll professional to outsource their payroll and auto enrolment tasks. Additionally, clients will want to avoid being fined for non-compliance by the Pensions Regulator. This is another motivation to use a professional to get it right first time round.

Increased workload?

With the wrong tools, helping your clients through auto enrolment could end up being very costly and time consuming. Check how much your payroll provider is charging for auto enrolment. Your workload will be increase if you do not utilise an automated software. For example, your payroll software should automatically complete the employee assessment each pay period for you and then alert you of any new AE duties that need to be performed.

This assessment needs to take place on an on-going basis to monitor any changes to an employee's circumstance. If they turn 22 or if there is an increase in their earnings, they may become eligible. Auto enrolment does not just take place at staging, it is an ongoing process. As auto enrolment is an integral part of the payroll process, BrightPay believe that it should be an included feature as part of the price of your payroll package. Paying more money for auto enrolment software will eat into your profits and make for a poor bottom line.

BrightPay is the answer

BrightPay is a user friendly payroll package that makes your auto enrolment journey easy. BrightPay take the manual grunt work out of AE by automating employee assessment, enrolment, producing letters and is integrated with 18 pension providers. Book a BrightPay Demo where we will show how you can setup your clients in BrightPay and start the automated process once you reach your staging date. BrightPay will ensure that you can streamline your AE processing to maximise efficiencies and profits.

Related articles

Auto Enrolment - This is what you must know for 2017

Switching to BrightPay - Made Easier!

Payroll clients continue to ignore auto enrolment

Apr 2017

21

Switching to BrightPay - Made Easier for you

As we move into the new tax year, employers and payroll bureaus across the UK are reviewing their software packages to ensure their payroll processing is working at maximum efficiently. There are many things to compare between different packages, such as price, ease of use, automation and support.

BrightPay’s development team have been working hard this past year to add as many new features that benefit our customers into the 2017/18 version of BrightPay. The ease of switching to BrightPay was a key priority for us to simplify the transfer process from other software packages.

Importing from Moneysoft & HMRC Basic PAYE Tools

If you are switching from HMRC Basic PAYE Tools or Moneysoft, we now have a seamless import, bringing in both employer and employee information for multiple company files instantly. Watch this video to see how easily you can import from HMRC Basic PAYE Tools straight into BrightPay.

Importing from other software packages

When switching from other payroll software packages, the first step is to set up your employer information. For bureaus with multiple employers, you can access your database or csv file with a list of your clients along with their payroll information, then you can easily set up the employers using our new bulk employer import feature.

Once you have the ability to export the employer data from your payroll you can import a csv file or FPS file into BrightPay. This will allow you to instantly add all of your employee information into the payroll compared with manually typing in all of the information. If your current payroll software allows you to export your payroll information (such as Sage, IRIS, etc), the easiest way to import employees is via CSV file. This will import all employee information, including year-to-date figures if the transfer is mid-year.

If you cannot export such a file from your current payroll software, then you have the option to import using a Full Payment Submission (FPS) file. This will import all the information that is included on an FPS to HMRC, including NI letter, tax code and year to date figures. However, this method will not import information not included on the FPS, such as employee email addresses, bank details, annual leave entitlement, departmental allocation etc.

Along with an improved transfer process, we have also introduced a number of exciting new features this year, including the ability to batch send RTI submissions, export a payroll journal to accounting packages, automatically retrieve coding notices and much more.

BrightPay 2017/18 is Now Available

You can now purchase BrightPay 2017/18. The bureau licence is just £229 + VAT, per tax year including unlimited employers, unlimited employees, free auto enrolment and free phone and email support. The single employer licence is is £99 + VAT, per tax year and includes unlimited employees, free auto enrolment and free phone and email support.

Book a BrightPay demo and find out why our customers give us a 99% satisfaction rate. Alternatively, you can avail of our 60 day free trial and parallel run with your existing software.

Apr 2017

13

Over 500,000 Employers have completed Automatic Enrolment

At the 31st March over 500,000 employers have completed their automatic enrolment duties according to the most recent Declaration of Compliance reports from The Pensions Regulator. This report shows that over 7.6 million employees are now saving in a pension and for their retirement. In the first quarter of 2017 136,000 small and micro employers completed their declaration of compliance.

A Declaration of Compliance needs to be completed and submitted to the Pensions Regulator within five months of the staging date. A Declaration of Compliance is the employer informing The Pensions Regulator that they have met their automatic enrolment duties.

If you do not submit your declaration of compliance in time you may be fined. It is a legal duty that the declaration of compliance is fully completed with the correct information and submitted on time.

Should you be experiencing any issues regarding your automatic enrolment process or collecting the relevant information for your Declaration of Compliance contact The Pensions Regulator immediately. The Pensions Regulator's website has a help section: http://www.thepensionsregulator.gov.uk/automatic-enrolment-registration-questions.aspx

Apr 2017

12

Employers Must Publish Their Gender Pay Gap Differences

The Equality Act 2010 (Gender Pay Gap Information) Regulations 2017 for private and voluntary-sector employers comes into effect at the start of the new tax year. With that, large companies (i.e. those with over 250 employees) will legally have to reveal the gender pay gap in their workforce. Thousands of employers will begin recording their gender pay gap figures for the first time and must publish their results before the end of the tax year.

At 18.1%, the difference between the average pay for men and women is at an all time low. The new legislation hopes to drastically reduce the gap. Experts are suggesting that these reporting provisions will likely do more for pay equality than equal pay legislation has done in decades. The government are hoping that by exposing company’s pay disparities they will be forced to take action and eliminate gender pay gaps, arguing that it could increase annual GDP by £150 billion.

Unfortunately, the 18.1% pay gap does not show the differences in the rate of pay for comparable jobs. The Office for National Statistics has provided an interactive tool to discover the gender pay gap for your job. According to the government the reasons for gender inequality are complex and can include:

- more women work in lower paid jobs or sectors.

- women are more likely to work part-time, which can mean a lower rate of pay.

- Under representation of women in senior roles. This may be due to stereotypical attitudes about gender roles, lack of flexible working or women taking time to look after their family.

The Equality and Human Rights Commission will enforce the following rule where: Companies who employ more than 250 people must provide data about their pay gap, the proportion of male and female employees in different pay bands, a breakdown of how many women and men get a bonus and their gender bonus gap. This legislation applies to over 9,000 companies, with over 15 million employees.

Apr 2017

4

HMRC to update Tax Codes for Adjustments for PAYE throughout the tax year

Currently with HMRC if there is an underpayment of tax that is owed at the end of the tax year the process is that it can be coded out, by means of adjusting the tax code for the employee in the next tax year, or the tax is to be paid by the employee in full. From May 2017 onwards HMRC will make automatic adjustment to Pay As You Earn tax codes using real time information as they occur.

HMRC will be watching the data being submitted from Full Payment Submissions by employers and pension companies from April 2017 onwards. HMRC will then be assessing individuals and projecting whether an employee will be due to have an underpayment of tax by the end of the tax year. Where this occurs HMRC will amend the employee’s tax code in order for the collection of the tax be in the current tax year and not be left owed at the end of the tax year. This proactive approach from HMRC ensures that the majority of tax owed will be collected in the same tax year.

Apr 2017

3

Customer Update - April 2017

BrightPay 2017/18 is Now Available. What's New?

The release includes exciting new features to make your payroll and auto enrolment journey easier and less time consuming. Our development team have been working hard to bring you the best customer experience, improving BrightPay’s performance and responsiveness.

Payroll Benefits 2017-18 - Register before 6th April 2017

Employers who wish to payroll benefits in the tax year 2017-18 must register with HM Revenue and Customs (HMRC) using the online Payrolling Benefits in Kind (PBIK) service before 6th April 2017 (if you had not already registered last year).

Auto Enrolment employer duties - Employee Assessment

Read our blog published on UK Business forums as we explain the ins and outs of what you need to understand your employee assessment process.

Have tried our latest add on - BrightPay Connect?

BrightPay Connect (previously named BrightPay Cloud) is an optional add on online tool that gives your clients access to their own dashboard. It allows you to automatically backup your payroll data to the cloud. Employees can log onto an online self service portal to view payslips and request annual leave. Bureau discounts for bulk purchases.

BrightPay Payroll & Auto Enrolment Training

At the end of the training session, participants will know how they can best use BrightPay to suit their payroll requirements, including:

- how to set up employer and employee records

- how to create and process pay items

- how to complete a payroll run and submit data to HMRC

- how to generate customised reports to suit your business requirements

Payrolling Benefits: What do you need to know? - Free Webinar

This presentation explains how to calculate cash equivalents for all of the different benefits employers may wish to payroll. It also provides best practice advice on the systems that employers should have in place to improve their workflow if they are interested in payrolling benefits for the first time.

For Payroll Bureaus

Review BrightPay on Accounting Web

Accounting Web’s Practice Excellence Awards have just launched. Please share your views on BrightPay and you could win a prize. AccountingWEB are offering one lucky winner £500 in Amazon vouchers, and 2 runners up with Amazon vouchers worth £250. The survey takes less than 30 seconds.

Auto Enrolment Webinar with Guest Speaker NEST

Over 750,000 employers are due to reach their staging date this year. Many of whom will choose NEST as their AE pension scheme. Join BrightPay & NEST as we take you through creating an effective AE pricing plan and how to easily set up NEST.

For Employers

Rate BrightPay on Software Advice

Software Advice is a review platform that rates various software products. As a valued customer, your feedback is very important to us. Please share your views on BrightPay. The survey takes about 2 or 3 minutes to complete.

Mar 2017

21

Off-payroll working in the public sector

Current HMRC guidance can be found here.

The guidance concerns both the provider of the services (the personal services company) and the payer for the services (the public sector client)

Assume an invoice of £6,000 for services (excluding VAT) issued by Joe Bloggs of ABC Ltd and that the payment falls within the new rules.

If you are the personal services company

Using the example deductions in HMRC's article, as the public sector client has already deducted tax (£1,458) and NIC (£413), you receive £4,129 (excluding VAT).

If you are paying yourself this £4,129 from your company, you will have no further PAYE or NIC liability on it, so, in your payroll system, you should mark the gross payment (£4,129) as not being liable to tax or NIC.

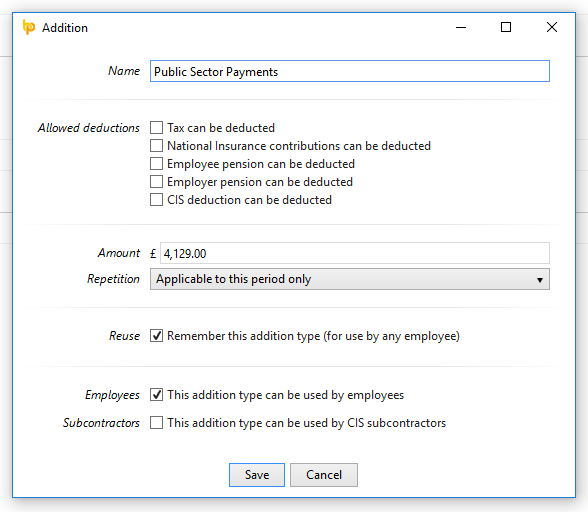

In BrightPay, simply set up a new addition type as per the following screen. Ensure that tax, NIC etc. are all unticked.

When the payroll is finalised, the non taxable pay will appear on the FPS.

![]()

If you are the public sector client

Pay Joe Bloggs through your payroll as if he were a normal employee.

When entering Joe Bloggs to your payroll, use starter declaration C - secondary employment. This will put him on basic rate tax. You should also tick that the employee is on an irregular payment pattern.

The payment frequency that you select for Joe Bloggs should match their contract as closely as possible e.g. if he is being paid for a month's work and you put him through the weekly payroll run, this will adversely impact on your NIC figures.

It may be useful to set up a department named “Personal Services Company” and assign Joe Bloggs to that department. This will enable specific reports for this category of employee.

When the contract ends, P45 Joe Bloggs as you would a normal employee.

Auto enrolment

The public sector client should treat Joe Bloggs as if he were a normal employee for AE purposes, if he falls within the definition of a personal services worker as per TPR's guidance (HMRC's guidance on this is contradictory - they state that Joe Bloggs should not be considered for auto enrolment in all cases). If the contract is a one off, then postponement would be appropriate. If Joe Bloggs is genuinely self employed and does not come within the scope of a personal services worker, then simply mark as exempt when BrightPay flags him for enrolment.

In the payroll of ABC Ltd, if Joe Bloggs is not deemed as a worker in the public sector company, he should be enrolled by ABC. However, in the majority of cases ABC Ltd will be a single director company, so is not deemed an employer for AE purposes.

Other:

This article does not cover the treatment of VAT.

Please note that the definition of public sector client, for the purposes of these rules, is quite broad and includes those bodies listed in the Freedom of Information Act 2000. Click here for list. e.g. a GP surgery may fall under the new rules although it is difficult to imagine Joe Bloggs in the above example not being genuinely self employed in this case (unless, for example, Joe Bloggs was a self employed locum who only provides his services to the one GP surgery).

It is also worth noting that the cost for the public sector client will have increased as a result of the employer NIC liability. This may lead to the re-negotiation of contracts in the majority of cases.

Mar 2017

20

BrightPay 2017/18 is Now Available. What's New?

BrightPay 2017/18 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2017/18 Tax Year Updates

- 2017/18 rates, thresholds and calculations for PAYE tax, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay, Automatic Enrolment earnings thresholds and triggers, company cars, vans and fuel.

- The emergency tax code has changed from 1100L to 1150L. When importing from BrightPay 2016/17, L codes are uplifted by 50, while M codes are uplifted by 55 and N codes by 45.

- Full support for Scottish Rate of Income Tax (SRIT) codes, including the new 2017/18 Scottish higher tax rate threshold.

- Support for an expanded range of National Insurance Number formats.

- April 2017 National Minimum/Living Wage.

- Ability to process 2017/18 coding notices.

- Eligible employers can continue to claim the £3,000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Full support for the new 2017/18 Apprenticeship Levy, including levy calculation, allowance and reporting amounts on an EPS submission.

- Updated P11, P45, P60, P30 and P32 forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all RTI, EXB and CIS submission types.

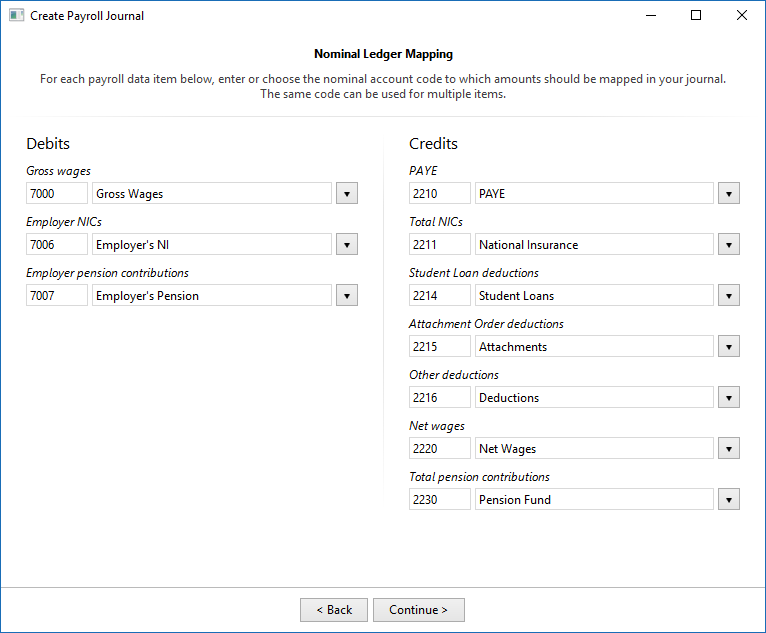

Payroll Journal

BrightPay 2017/18 enables you to produce a CSV payroll journal for import into your accounting software. This feature is accessed via the new Journal button on the payroll toolbar, and provides the following:

- The file formats and default nominal ledger code mappings are included for Exact, Kashflow, Quickbooks, Sage and Xero. These built-in mappings can be tailored to meet your own requirements, or you can create your own nominal ledger mapping from scratch if need be.

- Specify the journal date range – payslips finalised with a pay date in the range you select are included.

- Include individual journal records for each employee, or merge the employee records into rolled up records for each unique payment date.

- If required, you can use alternate nominal codes for payroll items relating to directors.

- Use a specific nominal code for any custom employer-wide item you have set up in BrightPay (i.e. addition/deduction types, hourly/daily/piece rates, pension schemes, savings schemes, etc.)

- Preview journal on screen, export preview to PDF, or print.

- Export journal CSV file for import into your accounting software.

Several accounting software providers can accept a direct upload of a payroll journal via an API, negating the need to export/import a CSV file. We plan to add this functionality for supporting providers soon.

Please get in touch if you'd like to see built-in support for any other accounting software providers.

Bureau Features

BrightPay 2017/18 includes several new features specifically targeted at accountants, bookkeepers, or other payroll bureau service providers. These bureau features are exclusive to the bureau version of BrightPay.

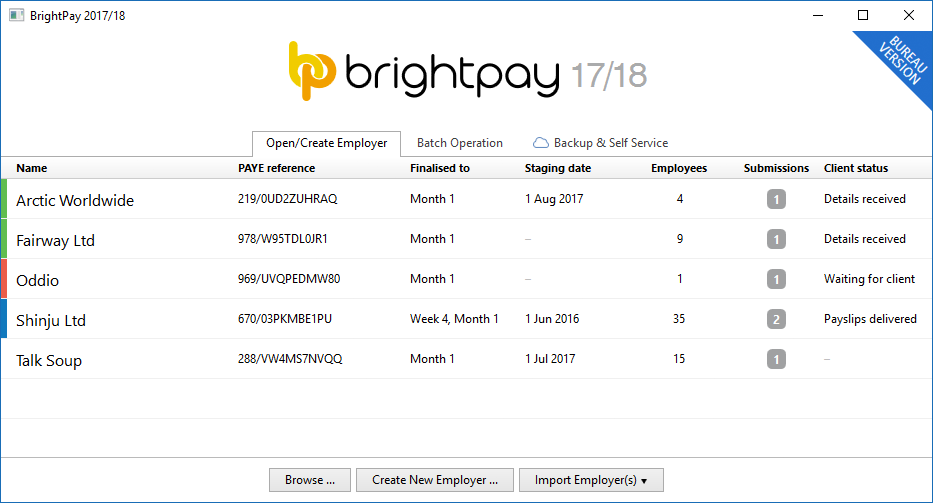

Improvements to BrightPay Startup Window

The columns on the BrightPay startup window can now be customised, and you can order the list of employers on the startup screen by any column. To help make this personalisation more useful, the size and position of the startup window will now be remembered between launches.

The data on the startup window now more reliably updates by itself - you no longer have to open a file to get it to do so.

Client Details

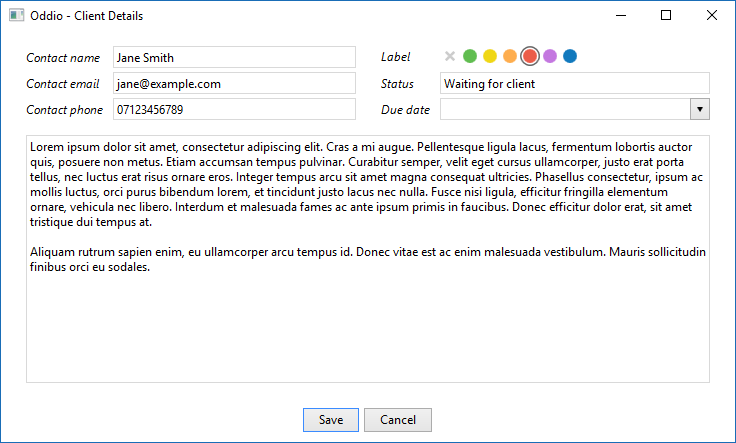

You can now record the following client information for each employer in BrightPay:

- Contact name, email address and phone number

- Status

- Due date

- Notes

- Label colour

This information can be edited directly from the startup window by right-clicking on an employer and selecting the new View/Edit Client Details menu option (this menu also includes a quick one-click link to set a label colour), or it can be entered via the new Client Details tab in Edit Employer Details when a file is opened in BrightPay.

Perhaps most usefully, these client details can be shown as columns on the BrightPay startup window, enabling you to more effectively manage your client workflows as an individual or across a team.

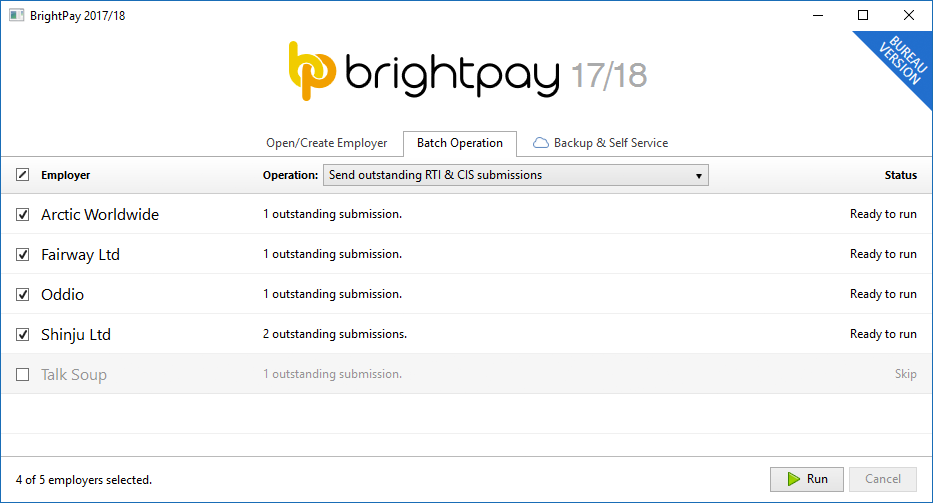

Batch Send RTI Submissions for Multiple Employers

A new Batch Operation tab on the BrightPay startup window enables you to process or perform a task on multiple employer files with a single click.

The first supported batch operation is to send all outstanding RTI and CIS submissions.

We have plans to add more batch operations in future.

Keep Your Client Documents and Files Organised

In BrightPay 2017/18, exported documents and files (e.g. payslips, P30s, reports, pension CSV files, journals, snapshots, etc.) are automatically organised into a separate folder structure for each of your clients by default. (If you don't want this, you can revert back to the previous functionality of exporting all files to a single location in BrightPay Preferences.)

BrightPay Connect

In case you missed it, we launched "BrightPay Cloud" in summer 2016. We have now rebranded this as BrightPay Connect. It works exactly as it has to date, including some further refinements and new features for 2017/18.

We have a detailed web page about BrightPay Connect here. Here's a quick overview of what it's all about:

- BrightPay Connect provides a secure, automated and user-friendly way to backup and restore your payroll data on your PC or Mac to and from the cloud.

- BrightPay Connect provides a web/mobile based self service dashboard for your employees, enabling them to:

- View/download their payslips and other payroll documents

- View their calendar, and make requests for annual leave.

- View and edit their personal details.

- BrightPay Connect provides a web/mobile based self service dashboard for employers and clients of payroll bureaux, enabling them to:

- Access the payroll documents and data for each of their employees.

- View an employer-wide payroll calendar.

- View payroll reports exactly as you have set them up in BrightPay.

- View the schedule of HMRC payments, outstanding amounts, and access the P30 for each tax period.

BrightPay Connect is built for security, reliability and stability, and costs just £49 per employer. Bulk pricing is available for bureaus.

Other 2017/18 Changes in BrightPay

- The foundational technology of BrightPay has been updated to the latest version, which immediately brings many performance, reliability and security improvements (and opens up new possibilities to our development team!). A side effect of this update, however, is that BrightPay 2017/18 cannot be run on Windows XP. We've attempted to make all customers aware of this change several times over the past six months, and our telemetry now shows that less than 1% of our customers still run on Windows XP. So while we do apologise for any inconvenience this causes, with the improvements gained it is unquestionably the best decision for our customers as whole.

- BrightPay 2017/18 will automatically offer to import your BrightPay 2016/17 files on first launch.

- New feature: Piece of Work rates – if you pay (or part pay) your employees by a unit other than salary, the hour or the day, BrightPay now caters for you.

- Additions and deductions can be calculated as a percentage of payslip basic, gross or net pay.

- BrightPay 2017/18 now allows you to adjust the 5.6 weeks statutory holiday weeks entitlement figure for annual leave calculation types.

- Support for Automatic Re-Enrolment.

- Real Time Information – more flexible workflow allows you to come back and check for a response from HMRC for an already sent submission, rather than having to start the submission process over from scratch.

- Expenses and Benefits:

- Company car information is now reported on the FPS submission.

- Vouchers and credit cards can now be payrolled.

- Support for new 'Serious Ill Health Lump Sum' indictor on FPS submission.

- Support for custom hourly/daily rate multipliers.

- Support for starters with no starter declaration.

- Improves how pay dates are entered when finalising payslips – you can now set a different pay date for individual employees if need be. When re-opening and re-finalising payslips, the previously used pay date is remembered.

- Import from Moneysoft 2016/17 (at the time of writing, this supports importing the basic details for employers, employees and subcontractors only).

- Royal London contributions now use a tax monthly based contribution schedule.

- Optimisations to data file size and installation package size.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

Includes all updates to BrightPay 2016/17 since March 2016

While we have traditionally focused our announcements of new features and updates in each new tax year version of BrightPay, it doesn't mean we're not busy during the rest of the year. In 2016/17, we released many updates and enhancements throughout the tax year, all of which are of course included in BrightPay 2017/18. See our release notes for full details. Here's a quick reminder of the main areas of improvement:

- Statutory Minimum Wage flagging and reporting.

- Retroactive Statutory Sick Pay.

- Centralised agent sender credentials and details.

- Support for several new Auto Enrolment scheme providers.

- Ability to disable carry-over of shortfall amount between HMRC pay periods.

- Ability to include employer logo and further customise the layout of Auto Enrolment letters.

- Batch P11 and P60.

- NEST – ability to override contributions schedule dates, validate groups and payment sources, and send payment approval requests

- CIS – ability to import pay records from a CSV file, zeroise payment records and print a tax period summary.

- Mid Year start summary report.

What's Next?

17.0, 17.1, 17.2, 17.X... we're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Mar 2017

9

Spring Budget 2017 - Employer Focus

The main points to be noted by employers from Spring Budget 2017 announced by Chancellor of the Exchequer, Philip Hammond are:

• The personal tax allowance will increase by £500 from £11,000 to £11,500 from 6th April 2017 as previously announced, this is in line with the government's goal to have the personal tax allowance at £12,500 by 2020.

• The Dividend Allowance will decrease by £3,000 from £5,000 to £2,000 from 6th April 2018. This means that there is no tax payable on dividend payments up to £2,000 from April 2018 onwards. Any dividends above this allowance will be taxed at 7.5% for basic-rate taxpayers, 32.5% for higher-rate taxpayers and 38.1% for additional-rate taxpayers.

• There were no changes regarding company car and van charges or fuel charges.

• In the Finance Bill 2017, legislation will be introduced by the government about dates where an employee can make a payment in return for a Benefit in Kind they receive, this can reduce the taxable value of the Benefit in Kind. The 6th of July after the end of that tax year has been decided by the government, so if employees make a payment for the BIK before that date, they can reduce the taxable value of the BIK or remove if payment in full is made. This will be for the 2017-18 tax year and following tax years.

• Termination payments over £30,000 which are subject to income tax currently from April 2018 will be subject to Employer National Insurance Contributions (NICs) The first £30,000 of a termination payment will remain exempt from Income Tax and NICs. In the Finance Bill 2017, the tax treatment of termination payments will be clarified and this will include all contractual and non-contractual payments in lieu of notice taxable as earnings and requiring employers to tax the equivalent of an employee’s basic pay if notice is not worked. The changes, including to Foreign Service Relief, will take effect from 6 April 2018.

• The Money Purchase Annual Allowance to £4,000 will be reduced from April 2017, down from £10,000. This restricts the amount of tax relieved contributions an individual can make in a year into a money purchase pension, if they have flexibly accessed their pension savings.

• The Government is carrying out the first statutory review of State Pension Age and the details will be published in their review by 7th May 2017.

• HMRC's compliance team are monitoring employers that are claiming the Employment Allowance, as it has been reported that some employers are using avoidance schemes to avoid paying National Insurance amounts due.