Feb 2017

15

Customer update from BrightPay

Have you tried our latest Cloud add-on?

BrightPay Connect is our newest add-on for BrightPay that offers powerful automatic backup features and annual leave features. Give your client and their employees online access to their payroll data. Significant discounts available for multiple bulk purchases.

Webinars for Bureaus

BrightPay have designed a number of webinars that are specifically tailored to meet the needs of payroll bureaus. Register for our next free webinar: Surviving Brexit for your Payroll Bureau. With Brexit uncertainty and 750k employers to stage in 2017, how will your bureau survive the fallout of Brexit to stay profitable?

BrightPay Payroll Training - 5th April & 11th April

We have designed training webinars to take you step-by-step through the payroll and auto enrolment process. At the end of the training session, participants will know how they can best use BrightPay to suit their payroll requirements.

BrightPay 2017/18 Release

BrightPay 2017/18 is packed with lots of new features, including a Payroll Journal export to accounts packages, the ability to batch send RTI and CIS submissions for multiple companies and much more.

Important Update for free BrightPay users

Please take time to read this important update for all free BrightPay users.

Risk of County Court Judgement for Employers who ignore Automatic Enrolment Duties

Employers who are persistently ignoring their automatic enrolment duties are being warned by The Pensions Regulator that they could be issued a county court judgement.

Have you tried our sister product, Bright Contracts?

Bright Contracts has everything you need to create and manage up-to-date staff policies and procedures and contracts of employment.

Feb 2017

14

2017-18 Notice of Coding - P9

Electronic Notification - HMRC will be sending out email notifications from 18th February up until the 5th March to notify employers that P9 coding notices for the tax year 2017-18 are available to view online. HMRC have advised employers to ensure when logging into their online account to ensure they have the correct tax year selected, 2017-18. And also if the notices are not available that day, to leave it 24 hours and log in the next day and the P9s should be available to be viewed.

HMRC have commenced to send out the P9 paper coding notices and employers should expect to receive them up until the 17th March, although some employers may receive this notifications up until 20th March. If for some reason the employer does not receive the paper coding notice before the 6th April 2017, the employer may contact HMRC Employer Helpline on 0300 200 3200 and request a duplicate. Just to note the duplicate will only be made for the full employer PAYE scheme and no individual tax codes will be sent for individual employees. HMRC have advised that the duplicate requests may take up to 14 working days.

Feb 2017

10

Higher rate Scottish Taxpayers to pay more

The new tax year will see thousands of Scots having to pay more in income tax compared to their British counterparts earning the same salary.

This follows the announcement that the wage at which Scots will start to pay the 40p income tax rate will remain frozen at £43,000 in tax year 2017-18. For the rest of the UK, this threshold will increase to £45,000 when the new tax year commences in April.

As a result, it is estimated that approximately 370,000 higher rate taxpayers in Scotland will pay up to £400 more than people earning the same in the rest of the UK.

Under devolved powers, Scotland is able to vary the rates of Scottish income tax (SRIT) by up to 10% from those set by the government in Whitehall.

Feb 2017

6

Risk of County Court Judgement for Employers who ignore Automatic Enrolment Duties

Employers who are persistently ignoring their automatic enrolment duties are being warned by The Pensions Regulator that they could be issued a county court judgement. Employers that ignore penalty notices issued by the The Pension Regulator to them are more likely to be issued with a CCJ. And if an employer does not pay within the 30 day limit of when they received the CJJ, these details will be recorded on their credit record. This may affect their borrowing ability in the future.

According to information from The Pension Regulator nearly 3,000 penalty notices were issued to employers between October and December 2016. In this same timeframe 870 escalating penalty notices were issued to employers. The number of fines have risen in line with the higher amount of employers now reaching their compliance deadline. Due to a small number of employers failing to pay these fines a number of County Court Judgements have now been issued.

The Pension Regulator believe that the smaller employers are leaving things to the last minute for their automatic enrolment duties, but if a compliance notice is issued hurries the employer up to fulfill their duties.The executive director for auto-enrolment at The Pensions Regulator, Charles Counsell , said: “Burying your head in the sand and ignoring your legal duties means your staff are missing out on pensions they are entitled to and your credit rating and reputation could be hit.”

Andy Beswick, managing director of business solutions at insurance firm Aviva, said: “No one wants to see small businesses being penalised for not complying with auto-enrolment. “A workplace pension can be a great asset to an employer when it comes to retaining and attracting key staff. It’s also a legal requirement so ignoring it isn’t an option. “There are a number of pension providers who have worked hard to make auto-enrolment as simple as possible for companies and advisers. With a bit of planning, the process of setting up a workplace pension is not as complicated as most people think.”

Feb 2017

2

Nannies & Carers - How does Auto Enrolment affect me?

Auto Enrolment means that all employers must put certain staff into a workplace pension and pay into it. Employing someone in your home (such as a carer, nanny, or gardener) means that you are an employer and therefore you will have auto enrolment duties to complete. Your staging date is the date the law comes into effect for you. The Pensions Regulator will write to you to notify you of your staging date and tell you what duties need to be completed.

At staging, you must assess the age and earnings of your staff to see if they are an eligible jobholder. Eligible jobholders are those who are aged between 22 and state pension age and earn over £10,000 per year. You must automatically enrol these employees into a workplace pension scheme.

Auto Enrolment Tasks

- Your first step as an employer is to set up a pension scheme and this can be done in advance of your staging date. When you reach your staging date, you must assess staff, and if eligible, enrol them into the pension scheme. Along with being enrolled into the pension scheme, you must also deduct contributions from employees pay and add these contributions to the employees pension pot. By law, the employer must also contribute to the scheme. These contributions must meet minimum regulations, which is currently 1% employer and 1% employee. By April 2019, these minimum rates will rise to 3% employer and 5% employee.

- If an enrolled employee does not wish to be part of the pension scheme, they can decide to opt out of the pension scheme within 1 month of being enrolled. Employees who opt out are entitled to a full refund of any pension contributions made to date. All employees who are not eligible to be automatically enrolled are known as either non-eligible jobholders or entitled workers. Non-eligible jobholders may choose to opt in to the pension scheme, and if so, they must be enrolled and treated exactly the same as an eligible jobholder, i.e. must meet minimum employer and employee contributions. On the other hand, entitled workers may choose the join a scheme and this scheme does not have to meet these requirements.

- Along with the above duties, you must also communicate with all employees. You must write a letter to eligible jobholders to let them know that they have been enrolled into a pension, the contribution rates and their option to opt out. A letter must also be sent to non-eligible and entitled workers to let them know of their right to opt in or join the scheme.

- Another important auto enrolment task is to complete your declaration of compliance. This must be completed within 5 months after your staging date and notifies the Pensions Regulator that you have fully complied with AE. This must be completed regardless of whether or not you have automatically enrolled employees. If you have no eligible jobholders, be aware that you still have a number of auto enrolment responsibilities, including communicating with non eligible and entitled workers and completing the declaration of compliance. There are many other auto enrolment tasks that employers are responsible for, including keeping records for a minimum of 6 years and re-enrolling employees into a pension scheme every 3 years.

Software Solutions

Although software is not a legal requirement for auto enrolment, the Pensions Regulator recommends that you have software in place to simplify the process. Most payroll software enables employers to automate and simplify the employers auto enrolment tasks. It is important that HMRC Basic PAYE Tools users are aware that the software does not and will not cater for auto enrolment. This means that all the auto enrolment tasks must be completed manually, increasing the workload and the risk of errors.

If you have someone who manages your payroll or finances for you, it may be worth contacting them to see how they can help you with your duties. If you manage your own payroll, BrightPay is the perfect tool that will allow you to seamlessly and effortlessly process auto enrolment tasks. BrightPay automates most of an employers auto enrolment tasks, including employee assessment, auto enrolment communications and opt outs & refunds. The software is currently compatible with 17 different pension providers, including direct integration with both NEST and Smart Pension.

BrightPay’s standard employer licence for 2017/18 costs £99 + VAT per tax year. The 17/18 bureau licence is £229 + VAT per tax year. This includes full auto enrolment functionality, free support, and the ability to process payroll for an unlimited number of employees. BrightPay also has a free licence for employers with 3 or less employees. Book a demo today to see how easy it can be to process auto enrolment with BrightPay. The online demo lasts approx 30 minutes and will also include how you can easily process payroll on a day to day basis for employees. In the meantime, why not download a 60 day free trial to find out how your business can benefit from BrightPay.

Feb 2017

1

Payroll Benefits 2017-18 - Register before 6th April 2017

Employers that wish to payroll benefits in the tax year 2017-18 must register with HM Revenue and Customs (HMRC) using the online Payrolling Benefits in Kind (PBIK) service before 6th April 2017 (if you had not already registered last year). You can register with HMRC using the PBIKs service Payrolling of benefits was introduced from the start of the tax year 2016/17 and will continue for the tax year 2017-18. Employers can account for the tax on benefits provided to employees through PAYE each pay day.

Registering with HMRC allows you to payroll tax on benefits without the need to submit a form P11D after the end of the tax year. P11D(b) returns will still have to be submitted and must include the total values of all payrolled and all non-payrolled benefits.

Using the online service, you can:

• Choose which benefits and expenses you want to include in the payroll for the following tax year

• Add or remove benefits and expenses

• Exclude employees who receive benefits or expenses but don’t want them payrolled. For these employees you must continue to report the benefit or expense on a P11D (you can exclude an employee at any time in a tax year but once you’ve done this you can’t reverse the decision, in year)

The only benefits you won’t be able to payroll are:

• Living accommodation

• Interest free and low interest (beneficial) loans

Tax is collected on benefits and expenses by adding a notional value to your employee’s taxable pay in payroll, tax is then deducted or repaid as usual as per the employee’s tax code. Payrolling Benefit In Kind functionality was incorporated into BrightPay 2016-17 and will continue in BrightPay 2017-18.

For more information about payrolling benefits, make sure to register for our free webinar here.

Jan 2017

23

Living and Minimum Wage Increases on 1st April 2017

On the 1st April 2017 the minimum and living wage will increase again. Going forward the rate will then change every April, starting in 2017.

The National Minimum Wage (NMW) is the minimum pay per hour most employees are entitled to by law. An employee's age and if they are an apprentice will determine the rate they will receive. The National Living Wage is the national rate set for people aged 25 and over.

| Rates from 1 October 2016 are: | Rates from 1 April 2017 will be: | |

| 25 yrs old and over | £7.20 per hour | £7.50 per hour |

| 21-24 yrs old | £6.95 per hour | £7.05 per hour |

| 18-20 yrs old | £5.55 per hour | £5.60 per hour |

| 16-17 yrs old | £4.00 per hour | £4.05 per hour |

| Apprentices under 19 or 19 or over who are in the first year of apprenticeship | £3.40 per hour | £3.50 per hour |

Jan 2017

10

Payroll software should work with any Auto Enrolment pension scheme.

As part of automatic enrolment, employers need to have a qualifying workplace pension scheme in place. However, if you are an employer and have no eligible employees you do not need to set up a scheme. Non-eligible jobholders have the option to opt in to the scheme and entitled workers can choose to join the scheme, therefore it would be advisable to have a scheme in mind.

For an eligible jobholder, the employer and the employee must pay into the chosen scheme to help the employee save for their retirement. Eligible jobholders have the right to opt out of the scheme. Employers will need to find a scheme themselves or consult with an accountant or financial adviser to help them choose the best option.

The Pensions Regulator (TPR) advises employers to research a few different schemes before they make their decision. The following schemes have informed TPR that they are open to the small employer market.

- The People’s Pension

- Ascot Lloyd Benefit Solutions

- True Potential Investments

- Standard Life Workplace Pension

- Welplan Pensions

- AutoEnrolment.co.uk

- The BlueSky Pension Scheme (TBPS)

- NOW: Pensions

- NEST

- Aviva Workplace Pension

Employers will need to confirm that the pension scheme will accept all their staff, how much it will cost to implement and what the ongoing costs will be to both the employer and the employee. Importantly, you will need to make sure it works with your existing payroll software. BrightPay supports 17 different pension schemes listed below. We also offer direct API integration with both NEST and Smart Pension. This means users can submit their pension files directly from BrightPay to the pension provider, similar to RTI submissions. BrightPay can also accommodate any pension scheme that is not directly supported where users can export a csv file with the required information selected and upload to the pension portal.

Find out more here.

Related articles

- Auto Enrolment - Choosing a Pension Scheme

- A few things to consider when choosing a pension scheme for AE

- What’s involved with AE on an ongoing basis?

Dec 2016

30

Wales handed powers to set income tax

Income tax rates in Wales could vary from April 2019 following a deal between the Welsh government and UK treasury.

In a milestone agreement between the UK and Welsh governments, Wales will take control of 10p in each band of the income tax collected within its borders.

The new fiscal framework was negotiated by chief secretary to the Treasury David Gauke and Welsh finance Minister Mark Drakeford.

The block grant that Wales gets from the Treasury annually will be reduced in a fair way, the governments claimed.

Dec 2016

21

The top 5 benefits of using BrightPay Connect for Automatic Enrolment

Auto Enrolment Overview

Auto enrolment has been introduced because people in the UK are living longer lives but not saving enough for retirement. The government estimates that as much as 7 million people do not have adequate savings to provide for them in retirement. The government will also be unable to cope with the increasing number of people retiring in the future.

By law, every employer in the UK has auto enrolment (AE) duties to complete. Employers must enrol all eligible jobholders into an AE workplace pensions scheme. The employer must also contribute to the employee’s pension pot. It is called automatic enrolment because it is automatic for employees but it’s not automatic for employers.

To comply with automatic enrolment, employers need to complete a number of AE duties, including employee assessment, communications, process employee requests, calculate contributions and deductions and submit files to the chosen pension provider. There will be additional duties to perform if the employer chooses to postpone AE. Employees will also have certain rights including being able to opt out, opt in or join the pension scheme.

BrightPay Connect & Auto Enrolment

Employers can reap huge benefits from cloud software. BrightPay Connect is the latest add-on that integrates directly with your BrightPay payroll. Cloud software provides flexibility and online access on the go where your payroll and certain auto enrolment data can be accessed on any device. Auto enrolment functionality should be included free of charge as part of your payroll software package. Payroll should allow you to automate and simplify your automatic enrolment duties. For efficient and successful AE compliance, BrightPay Connect offers significant online advantages for automatic enrolment including:

- Auto Enrolment Communications

Employees can be given access to their own online self-service portal where they can access and download their payroll documents. Communicating with employees about their AE rights is a compulsory part of complying with AE. You must notify all employees about their worker category, give information about how AE applies and let them know their rights. BrightPay Connect can help with the process of sending AE communications. You will have the option of sending and making the AE communications available on each employee's online portal where they can view, download or print the letter.

- Interactive Payslips

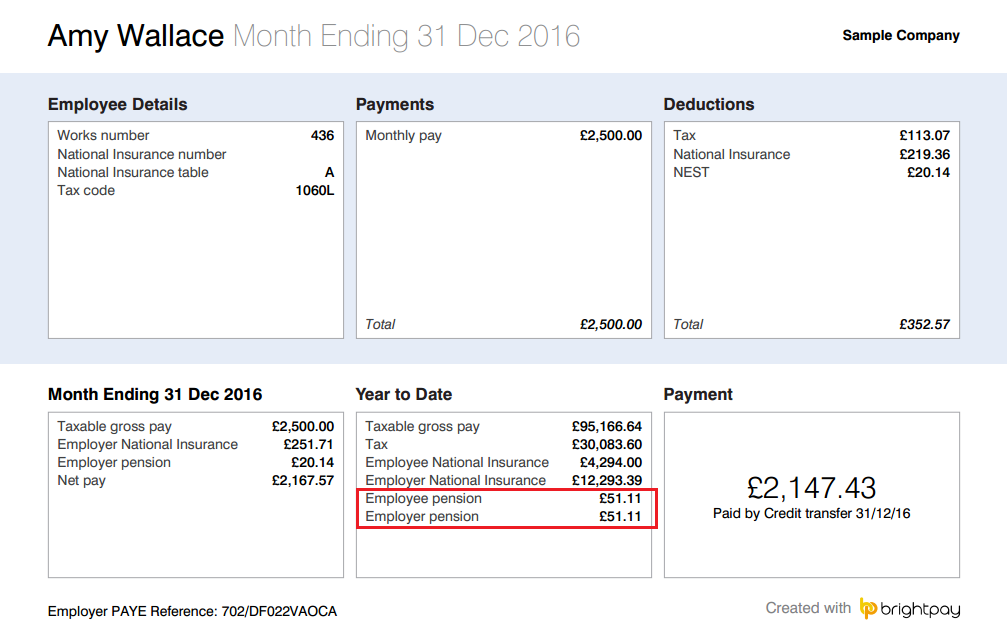

Part of an employer's duty is to calculate the correct contributions and deductions for each employee. This information should be visible on the employee's payslips displaying the employee and employer contribution amounts. BrightPay Connect allows employees to view and download all current and historical payslips. These interactive payslips will show these auto enrolment contributions for you. See a sample BrightPay payslip below.

- AE Compliance

To ensure compliance, it is essential that your staff records are correct, including employee dates of birth, salaries, National Insurance numbers, contact details and amounts being paid into the pension scheme each pay period. Having the correct information will ensure you have what is needed to run auto enrolment effectively. On the employee portal, employees can keep their contact details up to date and make any changes should their contact details need to be modified. As BrightPay Payroll and BrightPay Connect are fully integrated keeping up to date with your AE staff records is easy.

- AE Reporting

You are legally required to keep certain information and records for the purposes of AE. Poor record keeping could result in a fine being issued by the Pensions Regulator. All employers must provide certain information to the Pensions Regulator to let them know that they have complied with their AE duties. Auto enrolment reports can be set up and saved in your BrightPay payroll. Any saved reports will then be available to the payroll bureau and to the employer on BrightPay Connect.

- Mobile Access

People want their information on the go. Payroll bureaus, employers and employees can access their payroll data on any smartphone, desktop computer, tablet or laptop. Accessing your payroll and auto enrolment data on BrightPay Connect allows the processes to be easier and more flexible. Online access also allows for better communication regarding automatic enrolment between workers, employers and bureaus.

How BrightPay can help with Auto Enrolment

BrightPay payroll offers full auto enrolment functionality to take the hard work out of the employer duties for you. What’s more, there is NO additional charge for auto enrolment. Your payroll and auto enrolment duties must still be processed on the desktop BrightPay Payroll application.

The AE process in BrightPay Payroll

BrightPay can automate a lot of the administrative auto enrolment processes for you. Simply enter in the staging date and the rest is easy. When setting up your AE pension scheme, you will have the ability to set up your contribution rates too. Once you reach the staging date in BrightPay, the payroll will automatically assess all employees for you. From there, BrightPay will automatically produce the appropriate letters for each employee which can be printed, emailed directly to the employee, downloaded or uploaded to the BrightPay Connect self-service portal. Other AE tasks are seamlessly handled, including postponement, processing opt in, opt out or join requests, support for AE pension schemes and AE reporting.

Find out just how easy the entire process can be. Book a BrightPay Connect demo today.