Apr 2021

7

Pay Employees Directly through BrightPay

Collaboration is at the centre of BrightPay’s plan of continuously addressing the challenges our customers face by ensuring we can offer new and innovative solutions. Our partnership with Modulr, the UK payments platform, achieves exactly this. The API integration will significantly simplify the task of managing payroll payments for thousands of our customers across the UK. Through Modulr, BrightPay’s customers can eliminate the need to create bank files and the manual work associated with making payments to employees.

What does this integration mean for BrightPay customers and their clients?

The Modulr BrightPay integration enables accountants to provide their clients with a new service, the option of a seamless payroll workflow. Using Modulr, accountants and bureaus can offer accounts to individual clients, which allows payroll payments to be initiated within BrightPay payroll software without the need for payment files. Its functionality provides numerous benefits for accountants and their clients.

- Save time: With Modulr, you have access to the Faster Payments Service (FPS) scheme, which does not require you to upload any bank files. This eliminates the many frustrating steps traditionally associated with making Bacs payroll payments.

- Pay employees faster: Faster Payments Service, launched in 2008, is a payment scheme that is far faster than the traditional Bacs method. Instead of taking three days to process payments, FPS settles payments in 90 seconds. Conveniently, you can also make payments 24/7, 365 days a year, with the flexibility of instant emergency payments.

- Minimise error: An integrated payments solution can help cut down on costly data entry errors. By using an automated system, no manual input is required, which improves accuracy and reduces error. Moreover, payments must first be approved by clients on their individual Modulr dashboard before being sent.

- Increase security: Payments are made using a highly secure and compliant network. Modulr’s infrastructure is designed to ensure the highest level of data and system confidentiality and is compliant with the highest industry standards and regulations.??

Who is Modulr?

Modulr is the tech behind the tech. It’s likely you’ve been using their payments infrastructure without even knowing it. They are the award-winning payments partner behind Revolut, Sage, Iwoca and over 10,000 businesses (and millions of customers). The fintech company has established itself as a leading alternative to wholesale and commercial payments. It is FCA approved, has direct access to Faster Payments and is a partner of Visa, granting it direct access to the industry-leading global payments network.?

Pricing Structure

We want our customers to have the best experience possible and this collaboration with Modulr is an important step in this. We are confident that this partnership will improve the payroll workflow. We maintain that having a seamless payroll service should be available at an affordable price point and as our BrightPay customers know, we don’t believe in complicated pricing structures, opaque amounts or unfair selling tactics. That’s why BrightPay will not be receiving any referral fees for this service. This allows our customers who register with Modulr to avail of it at a highly competitive rate.

Schedule a personal demo:

Interested in learning more? Click here to learn more about BrightPay’s integration with Modulr and talk to a member of our team today to discover how BrightPay can improve your payroll processes.

Free webinar:

On Thursday, 22 April, join the BrightPay and Modulr teams for a free webinar, as we explore what you need to know about this Direct Payments functionality. Plus, we will demonstrate how quick and seamless the process is in both BrightPay and Modulr.

Related articles:

Mar 2021

22

BrightPay 2021/22 is Now Available. What's New?

BrightPay 2021/22 is now available (for new customers and existing customers).

2020 was challenging. Many of our development plans for the year had to be changed or postponed due to the need to cater for the Coronavirus Job Retention Scheme (CJRS) and the Coronavirus Statutory Sick Pay Rebate Scheme (CSSPRS) in BrightPay (not to mention the withdrawn-at-the-last-minute Job Support Scheme (JSS), which we invested many development hours on to no avail). We also have an Irish version of BrightPay, which likewise required additional time and attention on the equivalent schemes in the Republic of Ireland. And of course all of this had to be done in suboptimal conditions, with staff working remotely from home, often with young children. Demanding as it was, our team really stepped up, and as a company we were awarded with the COVID Hero Supplier Award at the Accounting Software Excellence Awards 2020.

At the same time, we have been working hard to bring a version of BrightPay to the cloud. While we have nothing to announce just yet, I can confirm it's going well, but it is still very much in development. We have a beta version planned, but cannot yet commit to a timeframe.

And so, given the time spent on COVID-19 features, along with that on cloud development, there hasn't been as much time as in previous years to spend on new features for BrightPay 2021/22. But we do have some new features, and we hope you'll find them useful. Rest assured that time-constraints have not caused any sacrifices to be made on quality – our goal to make the best payroll software continues as usual.

Here’s a quick overview of what’s new in 2021/22:

2021/22 Tax Year Updates

- 2021/22 tax bands. The emergency tax code has changed from 1250L to 1257L. When importing from the previous tax year, L codes are uplifted by 7, M codes are uplifted by 8 and N codes by 6.

- 2021/22 employee and employer National Insurance contribution rates, thresholds and calculations.

- 2021/22 Student Loan and Postgraduate Loan thresholds. Support for the new Student Loan Plan 4.

- 2021/22 rate of Statutory Sick Pay, including continued support for COVID-19 related periods of sick leave (in which SSP is paid from day one).

- 2021/22 rates and average weekly earnings thresholds for Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay and Statutory Parental Bereavement Pay.

- 2021/22 rates and calculations for company cars, vans and fuel.

- Support for off-payroll workers.

- Ability to process 2021/22 HMRC coding notices.

- April 2021 National Minimum/Living Wage rates. The top minimum wage age threshold has been reduced from 25 to 23.

- Eligible employers can continue to claim Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30, P32, P11D and PBIK forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all submission types (FPS, EPS, NVR, EXB, CIS300, CISREQ).

- Continued support for the Coronavirus Job Retention Scheme (CJRS) and the Coronavirus Statutory Sick Pay Rebate Scheme (CSSPRS).

Automatic Enrolment Updates

- 2021/22 qualifying earnings thresholds.

- For 2021/22, the minimum required pension contribution level continues to be 8%, at least 3% of which must be contributed by the employer.

- Various enrolment/contributions API submission and CSV formats have been updated to the latest versions to ensure continued compatibility with all pension scheme providers.

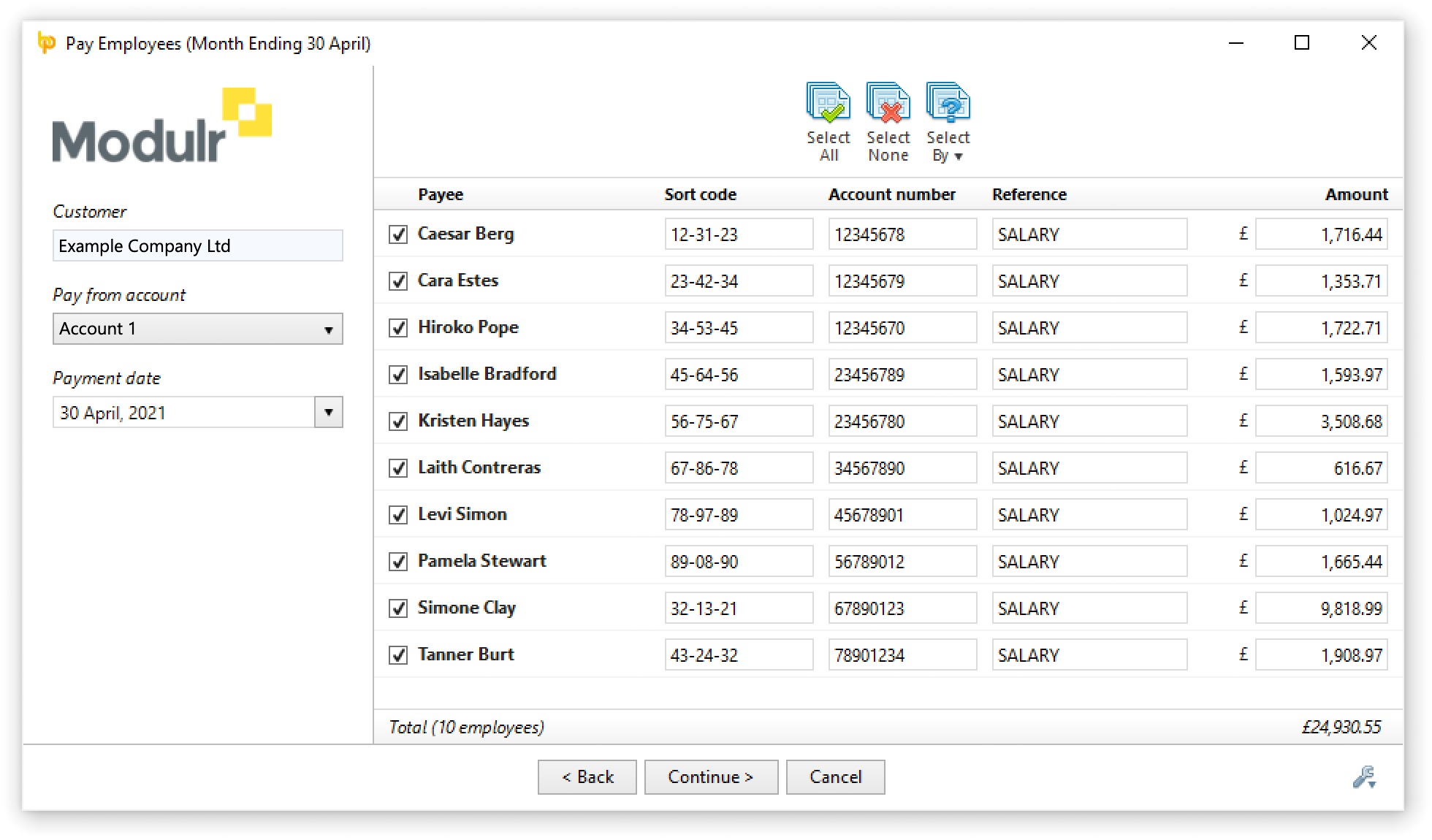

Pay Using Modulr

You can now create and send payment requests to Modulr directly from BrightPay, provided you have an active Modulr account that is set up for making payments. Payee information and amounts are automatically populated using the data from your payroll, making it a simple, fast and efficient way to pay your employees (or subcontractors).

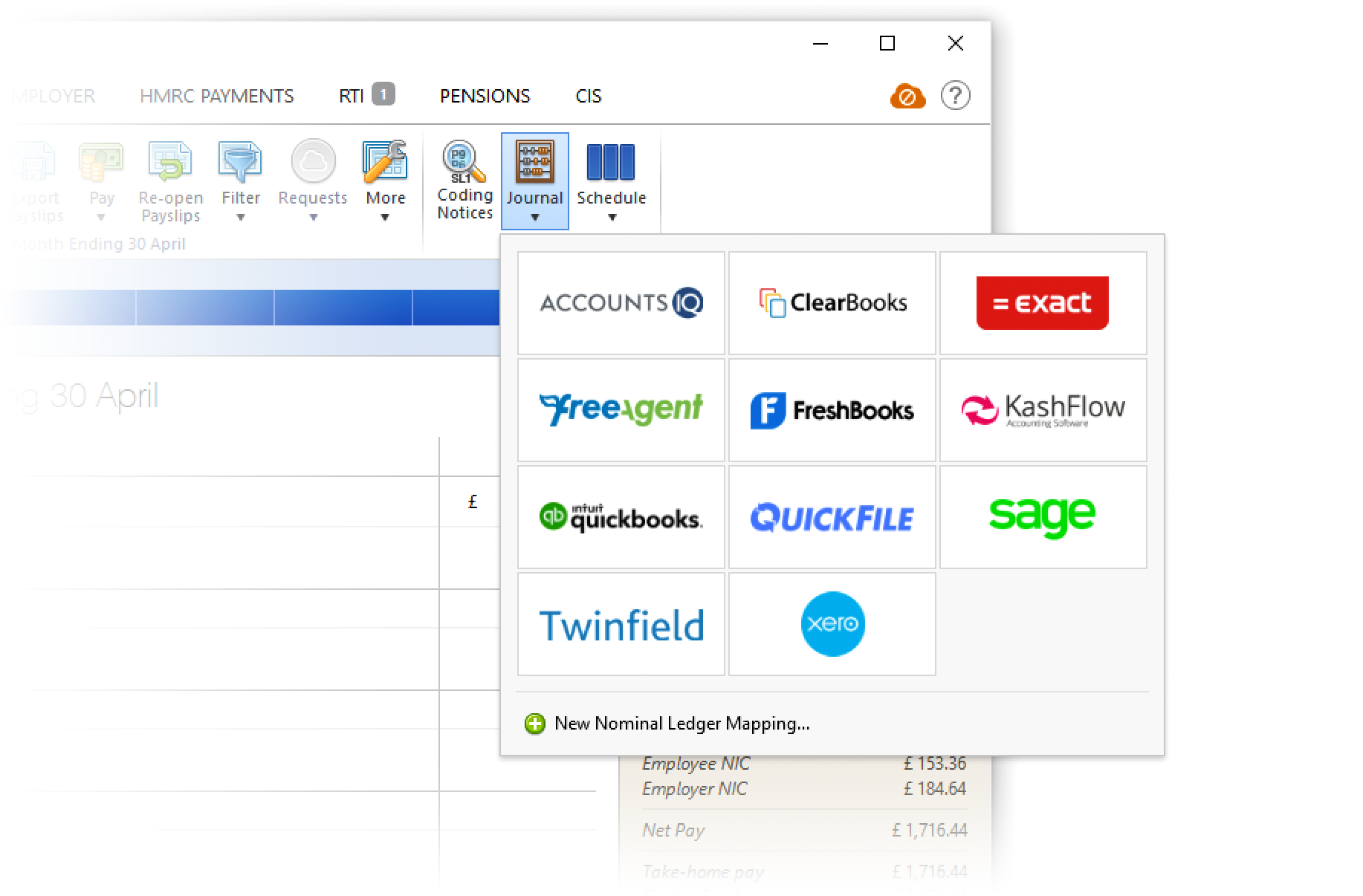

More Journal API Support

BrightPay 2021/22 now supports posting journals directly via API to FreshBooks, QuickFile and ClearBooks.

Other New Features and Updates in 2021/22

- The way of setting up a pay schedule for the tax year has been changed in response to customer feedback, making it easier and more flexible.

- Ability to auto-zeroise individual basic payments, additions and deductions for each pay period (i.e. repeat them into the next pay period as usual, but with a zero amount)

- Ability to auto-generate works numbers.

- BrightPay now shows the total "number of employees" in many more on-screen summaries and report documents.

- CIS – New custom P&D Statement template design that is able to contain much more information than the standard HMRC template (e.g. breakdown of hourly payments, addition subcontractor information, etc.)

- CIS – BrightPay is now smarter about automatically ticking/unticking and including/excluding subcontractors from various lists or reports by default depending on whether they received any pay in a tax period.

- More employee fields are importable from CSV, and a few column options have been added to Analysis.

- Several additional minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes and security improvements.

Includes all updates made to BrightPay during the 2020/21 tax year

Although 2020/21 updates were primarily focused on the CJRS, we did add a few other enhancements, all of which are of course included in BrightPay 2021/22. See our release notes for full details. Here's a quick reminder of some of the main areas of improvement:

- Supports the latest UK and London Living Wage rates, announced in November 2020.

- New message in HMRC Payments that lets you know when the equivalent annualised NIC-able pay would put you in excess of the Apprenticeship Levy threshold.

- New "Amount due to HMRC" column is available to be displayed on the BrightPay startup window.

- BrightPay now uses the Microsoft Edge WebView2 Runtime to display web-based content, ensuring technical compatibility with the requirements of modern web services.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Mar 2021

9

Making the move to BrightPay: The time is now!

As we approach the new 2021/22 tax year, many accountants are evaluating whether they are using the right payroll software to suit their client's needs. There are so many payroll software providers on the market that choosing the right one for your practice can become overwhelming. To make it easier for you, we have summarised the key reasons why hundreds of accountants are switching to BrightPay.

Multi-User Remote Access

All BrightPay licences can be installed on up to 10 PCs, and this means that payroll processing is possible by up to 10 users, or from 10 different locations. In conjunction with BrightPay Connect, BrightPay has a new ‘version checking’ feature when opening an employer, and an ‘other users check’ when opening an employer to prevent the risk of conflicting payroll copies.

Furlough Pay Calculator and Claim Report

BrightPay has a furlough pay calculator, including support for flexible furlough, to help users calculate an employee's furlough pay each pay period. BrightPay also has a CJRS claim report to make it easier for the user when making a claim via HMRC’s online claim portal.

Batch Payroll Processing Capabilities

With BrightPay’s batch payroll processing, you can finalise payslips, check for coding notices and send outstanding RTI and CIS submissions to HMRC for multiple clients at the same time. This will allow you to save time on manual, repetitive tasks, especially if you have a number of payrolls that don’t change from week to week or where a large number of single-director companies are on the payroll software.

Integration with Accounting and Pension Systems

BrightPay includes direct API integration with various accounting and pension systems. Send payroll journals directly to your general ledger from within BrightPay. Send auto enrolment files directly to the pension provider at the click of a button.

Online Client & Employee Portals

Invite clients to their own secure online dashboard. Clients can upload timesheets, approve the payroll, notify you of payroll changes, access employee payslips, run payroll reports and much more. Employees also have self-service access to payroll and HR information via an employee smartphone and tablet app.

Pay Employees Directly from BrightPay

BrightPay’s new functionality will give you a fast, secure and easy way to pay employees through BrightPay. Eliminate the need to create bank files and the manual workload associated with making payments to employees.

Free Webinar for Accountants & Payroll Bureaus

Don’t let the fear of switching payroll software hold you back. Register for this free webinar to discover top tips for making the transition to BrightPay as seamless as possible.

Book a demo today to discover more ways that you can automate your payroll processes. With payroll automation, simple furlough processing, and multi-user remote working capabilities, you can turn payroll into the quick and easy process it should be.

Related articles:

Feb 2021

8

10 Reasons why People are Switching to BrightPay

Payroll software has evolved a great deal in the past decade. Advances in digital technology and cloud computing have helped to create a new breed of payroll software, with platforms that offer streamlined and automated processes, integration with accounting software and links to other helpful third-party apps and business solutions.

So, if you’re a payroll bureau that’s looking to update its systems, or an accounting firm that wants to upgrade its outsourced payroll offering, how do you choose the best software? To make it easier for you, we have summarised the key reasons why you should switch to BrightPay today.

Book a demo to discover more about BrightPay or read on to find out more.

1. At the forefront for COVID-19

With the Coronavirus Job Retention Scheme being processed through payroll software, our development and support teams have been working hard to provide a quick response with ample payroll upgrades. We have been at the forefront for our customers both with product upgrades and expert guidance. We were awarded a COVID-19 Hero Award (Suppliers) at the Accounting Excellence Awards.

2. Furlough Pay Calculator

BrightPay provides a furlough pay calculator to assist users with calculating pay for furloughed employees, including support for flexible furlough. BrightPay also includes a CJRS Claim Report to help you work out how much to claim when making a claim through HMRC’s online claim portal.

3. Automatic enrolment at no extra cost

Auto enrolment is free with all BrightPay licences. BrightPay automates many tasks and ensures employers comply with their pension duties, for example, BrightPay automatically assesses employees each pay period and notifies you when you have auto enrolment duties to perform. BrightPay includes direct integration with a number of pension schemes including NEST, The People’s Pension, Smart Pension and Aviva.

4. Integration with accounting & bookkeeping software

Directly send the payroll journal to your accounting software from within BrightPay. You no longer need to export the journal via a CSV file and upload it manually through your accounting software. It’s secure and reduces the risk of errors making it more seamless. BrightPay includes integration with Sage One, Quickbooks Online, Xero, FreeAgent, AccountsIQ, Twinfield and Kashflow.

5. Batch Payroll Processing

Process payroll for multiple companies at the same time with BrightPay. Batch finalise open pay periods, batch send RTI & CIS submissions to HMRC and batch check for coding notices. This feature is available for accountants and payroll bureaus who process payroll for a number of clients. It enables you to save time on administrative tasks, especially if you have a large number of single-director companies on your payroll, or payrolls that don’t change from week to week.

6. Free CIS Module

BrightPay caters for all subcontractor types, including companies, trusts, sole traders and partnerships on a weekly and/or monthly basis. BrightPay also creates CIS300 monthly returns for submitting to HMRC. The CIS module is free with all BrightPay licences.

7. Payroll software you can trust

We have been developing payroll software for almost 30 years and our products are trusted by over 320,000 businesses across the UK and Ireland. With a 99% customer satisfaction rate, it’s no surprise that BrightPay won Payroll Software of the Year awards in both 2018 & 2019.

8. Free Friendly Customer Support

We're here to help you every step of the way with FREE phone and email support. We also have a whole range of step-by-step guides and video tutorials available on our website. Not only do our team of experts offer product advice, but we also run free online webinars and distribute free eBooks regarding legislative updates and changes. Whether it’s Auto Enrolment, GDPR, Employment Legislation or COVID-19 Furlough Schemes, you will always be kept one step ahead.

9. Online access anywhere, anytime

With the BrightPay Connect optional add-on, you can access a whole range of payroll and HR features anywhere anytime. As well as the peace of mind of having your payroll data automatically backed up to the cloud, you will also have access to a secure online employer dashboard and employee smartphone and tablet app. Access employee payslips, run payroll reports, view amounts due to HMRC, manage your employees’ leave, upload and distribute HR documents, send notifications to employees and much more.

10. Cost-effective solution with a 60-day free trial

BrightPay's 60 day free trial is a great way for you to discover just how easy BrightPay is to use without having to make any commitment. The trial version has full functionality with no limitations on any of the features, including auto enrolment, CIS, payrolling of benefits, integration with accounting systems and much more. There is no obligation to buy. We will not ask you for any credit card details or get you to sign any contract. Should you decide to purchase BrightPay, our pricing structure is simple and straightforward with no hidden charges, in-year upgrade charges or additional charges for customer support.

But don’t just take our word for it. Have a read of our customer testimonials to see why 99% of customers would recommend BrightPay.

Book a free online demo of BrightPay to avail of a free migration consultation with the BrightPay team. You will be assigned a dedicated account manager to help you through your decision making and setup process, ensuring a smooth transition to BrightPay.

Download Free Trial | Book a Demo

Related Articles:

Feb 2021

4

Five Challenges Businesses Face When Switching Payroll Software

Switching software for any business can be a confusing, challenging, and disagreeable process. When it comes to payroll software, this challenge can be even greater. If you are in the process of switching to a new payroll software you may have spent weeks, months even, searching for the best available solution. This likely involved speaking to various customer service and sales teams, watching online product demos, and comparing all the different options available to you. By now, you may have narrowed down your choices. Chances are, this will include BrightPay Payroll Software!

From your research, you fully understand all the additional features and advantages that this new software will bring, from automating tedious tasks to saving you money in the long run. Yet, many businesses who have spent months and months of their time analysing their options, who are fully aware that they are losing money and opportunities by staying with their current provider, are still hesitant to make the move. They feel that the challenges are greater than the benefits.

Let’s take a look at some of these very real challenges and examine how they can be minimised.

1. Business as usual:

Implementing any new software has teething problems. It’s not simply a matter of installing the software; it also means migrating the data over to a new system and ensuring that your team is properly trained to use and make the most of it. Accomplishing this while ensuring that it doesn’t interfere with your day-to-day operations can be quite challenging. You cannot afford to process your own or your client’s payroll incorrectly.

With BrightPay, we recommend that you initially run your new payroll software alongside your previous software. This is a good way to determine that everything has been set up correctly in BrightPay and there are no inaccuracies. It also provides the comfort of knowing you have a fail-safe. We offer a 60-day free trial, an ideal way to test out the software to see if it’s the right fit for your business.

2. Migrating data:

How much time will you have to spend entering data to get the new payroll system up and running? Arguably, migrating data from an old system to a new one, is the most time-consuming part of the job. Certainly, it’s the most tedious. However, it is an important part of the process and requires careful attention to reduce errors and minimise potential issues. Early preparation is key.

To speed up this process, BrightPay facilitates the importing of employee information. If your current payroll software allows it, you can export your data in a CSV file format (or to Excel, which can subsequently be converted to CSV format) and import it into BrightPay. If there is no option to export a CSV file, you also have the option to import the employee information using a FPS file. We also have a dedicated migration team that can assist you through this process.

3. Support for your Software:

Customer support is something that every business needs when switching to a different payroll software. Even if migration runs smoothly, chances are you’ll have a question or a tricky issue down the line that you will need help with. When considering your options, check whether the payroll software provider you choose has a dedicated customer support team, how you can get in touch with them, and if there are any additional costs to avail of support. What other forms of support do they offer? Are there webinars, online product documentation, step-by-step guides and video tutorials easily available?

A lack of support beyond the implementation phase is not acceptable and neither is a whole load of added costs. BrightPay support is completely free and has been for nearly 30 years! This includes payroll experts available via phone or email, free webinars, video tutorials, eBooks, and comprehensive online support documentation. All BrightPay licences include software updates in response to any changes to payroll legislation and government schemes.

We believe providing free support is what’s best for our customers and it motivates us to create easy to use, problem-free software. Don’t just take our word for it though. View our customer testimonials page and see for yourself!

4. Integrating with Internal Processes:

A different challenge but one that can be equally frustrating to buyers is ensuring that the new software they’re looking at will work with internal workplace policies. You may be convinced the software is right for you and your team, but it’s equally important the software meets your IT and Legal team’s requirements. Data protection and compliance with GDPR should be a priority for any company. Speak to the software provider about their privacy policy and how they handle your data or your client’s data. If you’re still unsure, ask your company’s Data Protection Officer to join in on the conversation.

Data Protection has always been a concern for BrightPay and we’ve always aimed to act with complete integrity in this regard. Like all companies, in preparation for GDPR we have had to complete a total review on how we gather, maintain and use data. Find out about BrightPay’s security measures.

5. Timing Differences

Knowing when to make the move can be difficult. On one hand, waiting for the new tax year may look appealing but on the other hand, staying with your current provider may have a negative impact on your business. We would recommend moving at a time that is most convenient to you. If this means waiting for the new tax year, then you will only have to import employee details into BrightPay. If you want to move mid-year, then both employee information and their mid-year pay information will need to be imported.

Book a demo to avail of a free migration consultation with the BrightPay team. You will be assigned a dedicated account manager to help you through your decision making and setup process, ensuring a smooth transition to BrightPay.

Related Articles:

Dec 2020

18

Add some sparkle to Christmas with the perfect cloud solution

What springs to mind when you hear the word ‘cloud’ will vary from person to person. Some will think of the weather as they look, grumbling, out their front window. But others will be thinking about all that extra storage on their iPhone. The meaning of the word has changed in recent times and most of us will now think the latter. But what about those who haven’t a notion what you’re on about? What is the cloud?

The cloud is a general term for any computing service that involves hosting over the internet to deliver computing services in lieu of a hard drive. Services such as storage, payroll and HR information. The other key feature is that you can access these services or information anytime, anywhere from any device that is connected to the internet. In fact, you’re already using cloud services if you use social media, Google Drive and Dropbox to name but a few. And now the cloud has become a must-have for any business who wishes to keep up with the times.

I can hear some of you now: “It sounds great, but my employees would never use something like that”. Well, that’s where you’re wrong. A recent survey found that 48% of people believe technological advances will change the face of the workplace and a massive 87% of those said they would be happy to adapt to technological changes if the right tools were given to them. Wow! So how do I know which cloud platform to choose for my business?

I’m glad you asked! Our experts got together for a brainstorming session and found that there are four key things to look out for when choosing the right cloud platform for your business - cost, compliance, simplicity and connection.

- Cost - Your upfront costs should be minimised – using the cloud shouldn’t be an expensive luxury reserved for big corporations. Make sure it provides the option of having multiple users so you can delegate and give access to various people to manage payroll tasks and HR requests on your behalf.

- Compliance - Make sure it takes into account your obligations as an employer with regards to things like the GDPR legislation, record keeping requirements and automatic enrolment duties. A good platform will have compliance built-in as standard and will manage it seamlessly.

- Simplicity - The most important thing to increase the uptake of a cloud platform is to make sure it is user-friendly and reduces the chance of human error. Look out for simplistic interfaces and whether or not training and support are available. The best of the best will offer this support for free. You should also be able to get set up and ready to go with minimal disruption to your business.

- Connection - Make sure it offers features that are attractive to employees such as a downloadable app, a self-service portal and company-wide communication features. Because at the end of the day, your employees won’t give a damn about how excited you might be about something unless it works for them too. These features tie in with our ever-increasing digitally-minded workforce and will make them feel more in control and engaged.

So, there you have it… off you go now! Good luck scouring through the internet trying to find the perfect cloud platform. But…., well, ....it is Christmas after all and I’m feeling generous. Ah, what the heck, I’ll just let you in on a secret which is the best cloud payroll platform for businesses out there: our very own BrightPay Connect.

BrightPay Connect is an add-on to BrightPay’s award-winning payroll software and ticks literally every single box I just mentioned over the course of this post. I’ve done enough talking so instead let me show you. Book a demo today to find out why BrightPay Connect is the perfect fit for your business.

Merry Christmas everyone! Don’t say I didn’t get you anything!

Dec 2020

11

Furlough and holiday during the Christmas period

Can you believe there are only two more Saturdays until Christmas?! I for one am in full on festive mode. My tree is up, the baubles strategically placed on top and out of my cat’s reach, and I’ve been blasting my ‘Xmas Hits’ playlist at full volume throughout my apartment, much to the chagrin of my long-suffering partner. It feels like a well deserved holiday at the end of a very crap year and even more well deserved time off.

But this Christmas has posed a new problem for the world of payroll - what happens with furloughed employees, especially as many would normally take Christmas and New Year’s as annual leave? Can they be furloughed for this period?

Where a bank holiday (namely Christmas Day, Boxing Day and New Year’s Day) falls inside an employee’s period of furlough and that employee would have normally worked this bank holiday anyway, then their furlough will be unaffected. However, if the employee would normally have taken these days as part of their annual leave then you, as the employer, have two options:

a) They can take the bank holiday as leave - If the employee does take the bank holiday as annual leave whilst on furlough then holiday pay must be paid instead.

b) They defer the bank holiday - if the employee doesn’t take the bank holiday as annual leave then this must be deferred as the employee will still be entitled to these days as leave. So they can take them at a later date.

So what happens with holiday leave during furlough then? Furloughed employees still continue to accrue annual leave entitlement as per employment law. Employees can agree to vary their holiday entitlement with their employers as part of their furlough agreement but workers are still entitled to a minimum of 5.6 weeks of statutory paid annual leave each year. This is non-negotiable.

Employees can still take holidays whilst on furlough though if they are being flexibly furloughed then any hours they take as holiday during the claim period should be counted as furloughed hours and not working hours. You should not place employees on furlough just because they’re going to be on paid leave or because you usually do less business over the festive period. (However, if you expect your business to be shut down completely or to be severely affected over the 2 week period due to the pandemic then you can of course still claim under the Coronavirus Job Retention Scheme).

A nice succinct summary of this I read online reads as follows:

“If you were going to furlough [employees] anyway then there is nothing to stop you doing it whilst they are on (pre-booked) holiday, or forcing them to take holiday (provided you give them adequate notice). If, however, you are 'furloughing' them because they've booked a couple of weeks off, then you are abusing the system and do not have a valid claim.”

This does mean that you will have to pay the employee’s holiday pay at the normal rate of pay and will be required to pay employees who are on holiday additional amounts over the grant to make up their usual holiday pay. If an employee usually works bank holidays then you can agree that this is included in the grant payment.

Whew! So a lot to digest but I hope that helps to clear things up a little bit. But as always, if in doubt please check the full guidance on the HMRC website. And once that’s all sorted, get your tinsel headdress on, pop open the mulled wine and start looking forward to the coming festivities!

Nov 2020

12

BrightPay Shortlisted For Two Top Payroll Awards

We are delighted to reveal that we have been shortlisted for both ICB LUCA Payroll Software of the Year 2020 and ICB LUCA Friendliest Software of the Year 2020. Having won the LUCA Award for Payroll Software of the Year last year, 2019, we are hoping to make it two years running.

The LUCA Awards are the ‘Oscars’ of the bookkeeping profession and are presented in recognition of the year’s outstanding bookkeepers and the many organisations and vendors that complement the valuable work that they do. It will be down to ICB students and members to vote and determine which payroll software provider is the best and friendliest.

Our recent BrightPay customer survey suggests some of the reasons why we have been shortlisted:

- We asked: How satisfied are you with BrightPay Payroll Software?

You said: 47% of our customers said they were extremely satisfied, 43% said they were very satisfied and 9% said they were satisfied with BrightPay. This comes together to a total of 99.6% customer satisfaction rate, which is fantastic news for everyone on the BrightPay team. - We asked: How satisfied are you with BrightPay Connect?

You said: An incredible 97.9% of our respondents said they were satisfied with BrightPay Connect, our optional add-on to the payroll software. The most highly rated BrightPay Connect features included automatic cloud backup (99.6%), online employer dashboard (99.5%) and employee self-service portal & app (99.4%). - We asked: How satisfied are you with BrightPay's Customer Support?

You said: The majority of customers rated BrightPay's telephone support (97.35%), email support (98.2%), online help documentation (98.1%) and online video tutorials (99.2%) as excellent, very good or good, giving our customer support team an overall satisfaction rate of 98.2%. - We asked: How would you rate BrightPay’s handling of COVID-19?

You said: 98.6% of customers answered that they found our handling of COVID-19 overall to be either excellent, very good or good - in particular, our free online COVID-19 webinars (99.4%), payroll upgrades (98.8%), online help and support (98.3%) and phone and email support (97.4%).

The winners will be announced as part of the 11th Annual Bookkeeping Summit, being held virtually at the awards evening on 17th November. Best of luck to all the finalists!

Related articles:

Nov 2020

2

Why are BrightPay the perfect payroll partner during challenging times?

Businesses are continuing to be massively impacted by COVID-19, and for many, their payroll solution may not be up to the challenge. At BrightPay, we believe that our COVID-19 response plan means that we are the perfect payroll partner to help you adapt to an ever-changing world.

How to find the right payroll partner for your business

Making simple changes and investing in payroll solutions with integrated cloud access can save money, improve productivity and increase profits. It is important to choose the right payroll software provider that will ensure COVID-19 does not slow down your bureau’s payroll processing.

Research different payroll software providers and compare them against what you are currently using. Choose the right payroll technology that not only streamlines your payroll processes but supports your business continuity needs.

Ask other providers what their customer satisfaction rating is, what are the hidden costs and how they are helping their customers through COVID-19.

How BrightPay are helping with payroll performance during unprecedented challenges

- Support payroll remote working: BrightPay customers can process their payroll from 10 different locations.

- Help you achieve business continuity: BrightPay Connect, the optional cloud add-on, will automatically backup your payroll data every 15 minutes, enabling you to restore your data should the unforeseen happen.

- Competitively priced payroll software: BrightPay includes unlimited employees, no additional charge for auto enrolment, CIS or customer support.

- Quality and speed of COVID-19 updates: In a recent survey, BrightPay achieved 98.6% rating for our overall handling of COVID-19 including customer support, payroll upgrades, COVID-19 webinars and online support.

- Automation of scheme calculations: We have released 15 software upgrades across three payroll products to assist users with calculations and make it easier for the user when making a claim via HMRC.

- No disruption to our customer support service: We transitioned 95% of staff to working remotely before the lockdown announcement in March 2020.

- Loyal customers say it all: In a recent survey, 97% of our customers said that they would renew with us next year and gave us an enviable Net Promoter Score of 69.3 for customer satisfaction.

- Management of mandatory COVID-19 employee documents: BrightPay Connect enables users to upload contracts of employment and COVID-19 HR documents and gives the employer or manager visibility as to when the employee views the document.

- Increased employee numbers by 40%: ensuring that we could help our customers with the new payroll demands (March to October 2020).

- Automation of your bureau’s payroll workflows: Using BrightPay Connect, you can not only give your client’s employees access to their own self-service payroll portal, but you can also give your clients access to their own employer dashboard.

- Streamlining of employee payroll and HR admin: BrightPay Connect gives your employees the ability to self-service, allowing them to browse and download historic payslips, request annual leave, view leave remaining and update their personal details.

- We’re prepared to put in the hours: An additional 122 hours of customer support overtime resulted in 97% of support emails being responded to within 24 hours.

- Excellent communication and education: The BrightPay COVID-19 help guides have been viewed over 136,600 times and the COVID-19 Resources Hub has been viewed over 32,000 times.

- We expertly answer your questions: We have hosted over 30 COVID-19 payroll webinars with live Q&A sessions joined by payroll experts and key government bodies (over 26,000 attendees and 15,500 views on-demand).

- Regular legislation updates: To date we have published 265 blogs detailing COVID-19 payroll legislative changes, with 540,125 users accessing our website, a 57% increase compared to last year.

What BrightPay customers have to say…

''Complex CJRS claims, 4 weekly pay periods crossing into July, the beginning of flexible furloughing. We could be in the middle of a logistical nightmare, but thanks to @BrightPayUK our lives have been made considerably easier.’’ Lucy Stupples @autumn_ cottage – Twitter

‘‘BrightPay have made it easy for us during this difficult time. They have kept us up to date on their information hub on all matter COVID-19 related, with free webinars on CJRS matters and other resources.’’ Linda Nicholls – Trustpilot

''We have worked around the clock since COVID disrupted life as we know it to support our clients. However, it would have been a lot harder to provide that support if we didn’t use BrightPay. Well done team @ BrightPayUK.” Investment Bookkeeping @InBookkeeping – Twitter

Download the guide now: ‘Safeguard your payroll against COVID-19 and the (hidden) cons of the Job Support Scheme’

Related articles:

BrightPay Covid-19 Resources Hub

Webinar: CJRS Changes & Flexible Furlough - What you need to know

Blog: The Results of our Customer Survey are in, and we want to say Thank You!

Nov 2020

2

The Original Furlough Scheme is back: Who can claim?

Originally introduced in March, the Coronavirus Job Retention Scheme & Furlough Leave has been extended beyond the original October deadline.

What has changed?

The Furlough scheme had been winding down over the last couple of months, with 70% government contribution to hours not worked in September and the employer paying 10%. In October the government paid 60% of the furloughed employees wages for their unworked hours, up to a maximum of £1,875, with employers contributing the remaining 20%.

The announcement made on 31st October in line with the second lockdown means that businesses can receive grants covering 80% of wages throughout November and the JSS implementation has been delayed to 1st December. The employer must pay for all the employer’s NIC and employer’s minimum workplace pension contributions on those wages and the grant will be for time not worked, up to £2,500 per month.

What is it?

The Coronavirus Job Retention Scheme allows all UK employers to access financial support to continue paying part of their employees' salary that would otherwise have been laid off due to the second lockdown. It prevents against layoffs and redundancies.

What organisations are eligible?

All UK companies are eligible: limited companies, sole traders who employee people, LLPs, partnerships and charities.

Which employees are eligible?

Employees who were on the employer’s payroll on 30 October 2020 will qualify to be included in CJRS claim for November; they don’t have to have been included in an earlier CJRS claim. The employee must have been paid by the employer, and that pay must have been reported on a RTI return before midnight on 30 October.

Furlough leave is available to all employees on a contract, including;

• full-time employees

• part-time employees

• employees on agency contracts

• employees on flexible or zero-hour contracts

Does Flexi Furlough still run?

Flexible furlough will still run alongside full-time furlough, so staff may be brought back part-time to say, prepare the premises for the lifting of national restrictions, or to prepare for Christmas.

The same rules for flexible furlough will continue to apply as they have done since 1 July, so the employee may be furloughed for a couple of days or hours per week. No minimum time set for furloughed hours or working hours has been communicated.

However, each furlough claim must be for a period of at least seven consecutive calendar days.

How does it work?

• The employer must designate affected employees as furloughed workers.

• They should notify the employee that they have been marked as Furlough. Agreement from the employee may be required.

• HMRC must be notified of the employee designated as furloughed workers as well as details of their earnings. This is done through an online portal (not currently set up).

• HMRC will reimburse 80% of furloughed workers wage costs, based on the February earnings of salaried workers, up to a cap of £2,500 per month.

• Wages for those on variable hours, can be calculated based on the higher of either:

o the same month's earning from the previous year

o average monthly earnings from the 2019-20 tax year

If the employee has been employed for less than a year, employers can claim for an average of their monthly earnings since they started work.

• Employees remain employed, their continuity of service is not impacted.

• Employer may choose to top-up the other 20% of salary. If they don’t top-up the 20% it will be a deduction in wages.

• Wages paid through the scheme are subject to the usual income tax and other deductions.

What are the employment issues?

Changing the status of employees to a furloughed worker remains subject to existing employment law. Generally, where an employee’s contract contains a layoff or short term clause employers should be able to place employees on furlough leave. Where there is no such clause, it is best advised to get agreement from the employee.

Additionally, a 20% reduction in salary will be a change in terms and conditions of employment. Where employers are not topping up the government payment, they should also seek agreement from the employee.

Given the current situation and the alternatives for those employees should they not agree, one can expect that most employees will agree. That said, prudent employers will seek to get their employees agreement as part of their furlough leave process.

BrightPay Software Update

A BrightPay UK (Windows) upgrade has just been released to cater for the extension to the Coronavirus Job Retention Scheme. This upgrade also removes previously released Job Support Scheme (JSS) functionality.

Get the details right

During COVID-19, BrightPay have been running regular webinars to keep businesses and accountants up-to-date with the latest changes and the impact on payroll processing don’t miss the latest webinar.

Free Webinar: New Job Support Scheme Explained and how to safeguard your payroll against COVID-19

18th November – 10.30am

In this webinar, we look at what you need to know about the re-instated Furlough scheme and new Job Support Scheme, including which employees are eligible, the level of government funding, and how the scheme is actioned through payroll. We will also share top tips to ensure COVID-19 does not slow down payroll processing. Plus, we will explore the rise in redundancies and the new changes regarding statutory redundancy and notice pay for furloughed employees.

What you'll learn:

• What the extended CJRS means for your business

• Everything you need to know about the Job Support Scheme

• Tips for safeguarding your payroll

• How BrightPay’s Job Support Scheme Calculator & Claim Report works

• How to calculate notice pay and redundancy pay for furloughed employees

• Top tips to ensure COVID-19 does not slow down payroll processing

Related articles:

BrightPay Covid-19 Resource Hub

On-demand webinar: Redundancies & Furloughed Employees

Guide: Safeguard your payroll against COVID-19 and the (hidden) cons of the Job Support Scheme