Apr 2015

19

Do you know your CIS obligations for HMRC ?

HMRC has published webinars, emails and videos on the Construction Industry Scheme which show how the scheme works, taking on and paying subcontractors and how to meet your tax obligations.

You can get business emails from HMRC on the Construction Industry Scheme (CIS).

The next live webinar is on 8th May 2015 from 9am to 10am where you can ask questions during the presentation and get answers from the HMRC host. You will need to register and log in at least 5 minutes before the webinar is due to start.

Apr 2015

16

UK - Employment Allowance now extended to Personal Carers

With effect from 6th April 2015, the Employment Allowance has now been extended to include individuals who employ personal carers and support workers. Such individuals who were previously excluded from claiming the allowance in tax year 2014-15, will now be entitled to deduct up to £2,000 per annum from their liability to pay secondary Class 1 Employer National Insurance contributions (NICs).

The new measure is intended to support individuals who need to purchase care for themselves or others.

To check eligibility and for further information about the Employment Allowance, simply go to Employment Allowance Eligibility.

Apr 2015

8

Shared Parental Leave comes into force

Shared parental leave has now officially come into effect, meaning parents whose babies are born, or whose children are adopted, on or after 5th April 2015 will now be able to share a 50-week pot of leave.

285,000 working couples a year are expected to be eligible for shared parental leave, according to the Department for Business Innovation and Skills.

How does it work?

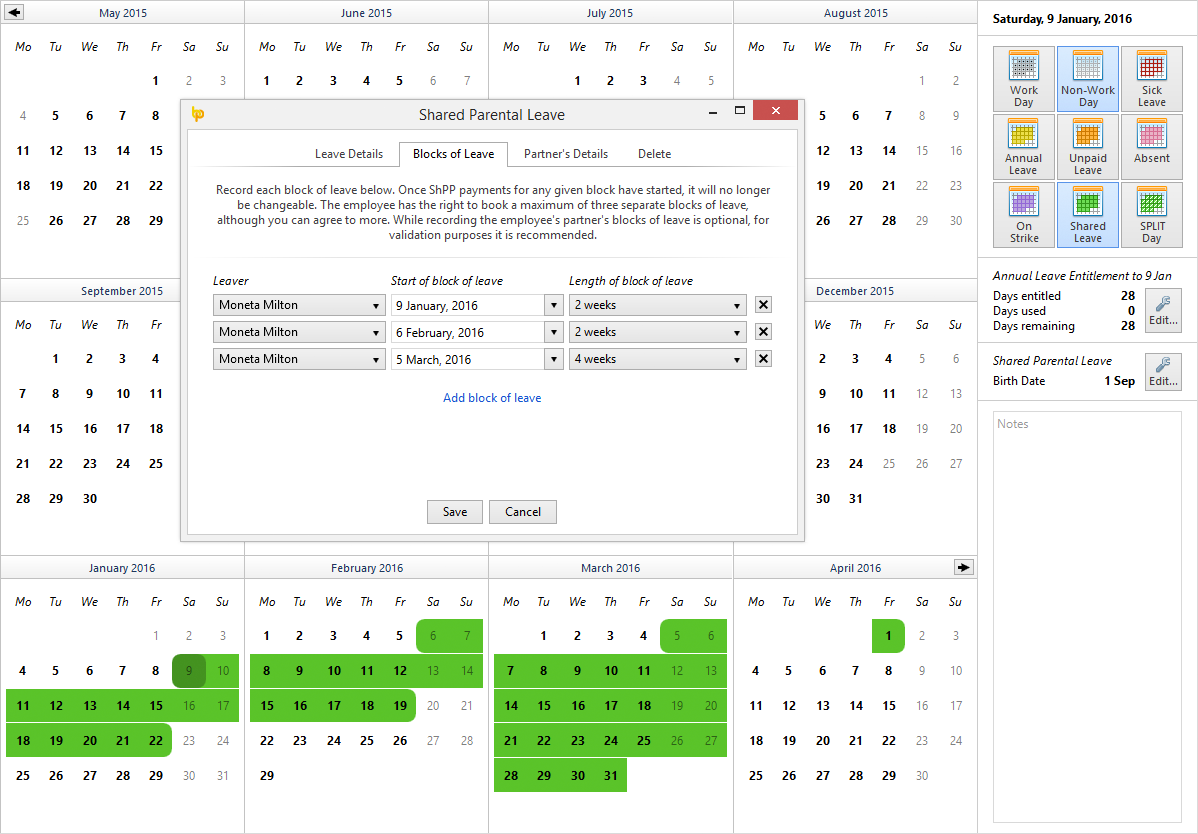

· Eligible couples will be able to share parental leave if the mother opts to end her maternity leave and pay early

· Both parents can be off work at the same time or can take turns to take time off to look after the child.

· The leave can be taken in discontinuous blocks if required and each parent is permitted to submit three separate notices to book this

Statutory shared parental pay will be paid at the rate of £139.58 a week or 90% of average weekly earnings, whichever is lower

Who is eligible?

To qualify for Statutory Shared Parental Pay, one parent must be an employee and must pass the continuity of employment test (they must have worked for the same employer for at least 26 weeks at the end of the 15th week before the week in which the child arrives), whilst the other must meet the employment and earnings test (must have worked for at least 26 weeks in the 66 weeks leading up to the due date and have earned above the maternity allowance threshold of £30 week in 13 of those weeks).

Eligibility can be checked using GOV.UK’s quick and easy online tool.

BrightPay 2015/16 has full support for Shared Parental Leave and Statutory Shared Parental Pay (ShPP). For assistance with recording shared parental leave and processing ShPP in BrightPay, please view our dedicated support topic on Statutory Shared Parental Pay.

Apr 2015

7

HMRC - No Late Payment fees for up to 3 days late

Employers are not to be issued automatic penalties for late submissions of up to 3 days .

HMRC have announced that they will not penalise employers for filing delays of up to 3 days. They have decided that late payment fees will continue to be risk assessed rather than automatic.

It is important to note that this does not mean that there is any change to the deadlines. FPS submissions must still be submitted on or before the payment date.

Any employer that was issued a late filing penalty between 6 October 2014 and 5 January 2015, and they were less than three days late can appeal online against the penalty.

Any employer with fewer than 50 employees are reminded that PAYE late filing penalties will apply to them from the 6th of March.

HMRC have advised that they will review the operation of the changes to the PAYE penalties by the 5th of April 2016.

Apr 2015

6

HMRC Scheduled Upgrade - Easter Monday

Monday 6 April 02:00 – 18:00

Due to a scheduled upgrade you will experience a delay in receiving your online acknowledgement to PAYE End of Year submissions made using HMRC and commercial software between 02:00 and 18:00 on Monday 6 April. Your acknowledgement will be sent once the service is restored. Please do not attempt to resubmit your submission. HMRC apologises for any inconvenience this may cause.

Apr 2015

3

Childcare Voucher Scheme Vs New Tax-Free Childcare Scheme

The Childcare Voucher Scheme is a UK government initiative aimed at helping working parents to benefit from tax efficiencies in order to save money on childcare. The scheme is offered by many employers as a salary sacrifice scheme and implemented through the employer’s payroll. This means that parents who are in the scheme are able to sacrifice part of their salary (Tax and National Insurance free) in order to obtain childcare vouchers of an equal amount up to specified limits.

The employer also saves money because the amount each parent sacrifices from their salary is exempt from employers’ National Insurance Contributions. Employers can offer the scheme themselves or by using one of the voucher companies to do the administration for them. The fees these companies charge should be less than the savings the employer makes on National Insurance. Employers may also benefit from having a happier workforce and seeing a reduction in staff turnover.

Basic rate taxpayers can pay for up to £243 of childcare with vouchers each month. This can lead to an annual Tax and NI saving of up to £930 per parent. Higher rate tax payers can pay up to £121 per month and top rate tax players can pay up to £108 per month. The higher and top rate restrictions only apply to those who joined the scheme on or after 6 April 2011.

These vouchers can be used for any nursery, playgroup, nanny, childcare or au pair who is an Ofsted registered provider. These vouchers can be saved up by parents but are non-refundable.

New Tax-Free Childcare Scheme from Autumn 2015

From Autumn 2015 Tax-Free childcare will be available to nearly 2 million households to help with the cost of childcare, enabling more parents to go out to work. Unlike the childcare voucher scheme the new Tax-Free childcare scheme will not be available to parents who have a stay at home partner. The new Tax-free childcare scheme will give a 20% tax break to cover annual childcare costs of up to £10,000, providing savings of up to £2,000 per child.

Parents will be able to register and open an online account for the new Tax-Free childcare scheme by going to the GOV.UK website. Parents and others can then pay money into their childcare account as and when they like. They will also be able to withdraw money if they want.

The scheme will be available for children up to age of 12 (or children with disabilities up to the age of 17). To qualify parents will have to be in work, earning just over an average of £50 a week and not more than £150,000 per year. Any eligible working family can use the Tax-Free childcare scheme as it does not rely on employers offering it. Unlike the current scheme, self-employed parents can use the Tax-Free childcare scheme.

Parents who sign up to the current childcare voucher scheme will be able to remain in the scheme and will not be disadvantaged by the proposed 2015 changes. However after Autumn 2015 the childcare voucher scheme will no longer be available for new entrants. The new arrangement will not provide any National Insurance savings for employers (currently worth up to 12% for basic-rate taxpayers).

Parents who sign up to the current childcare voucher scheme will be able to remain in the scheme. However, if they move to a new employer after Autumn 2015, they will be considered to have left the current scheme and be forced to switch to the new arrangements.

In general families with high childcare costs will be better off under the Tax-Free childcare scheme while families with low childcare costs will be better off remaining under the Childcare Voucher Scheme.

Mar 2015

23

BrightPay 2015/16 is Now Available. What's New?

BrightPay 15/16 is now available to download. Here’s a quick overview of what’s new:

2015/16 Tax Year Updates

- 2015/16 rates, thresholds and calculations for PAYE, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, and Statutory Shared Parental Pay.

- The emergency tax code has changed from 1000L to 1060L.

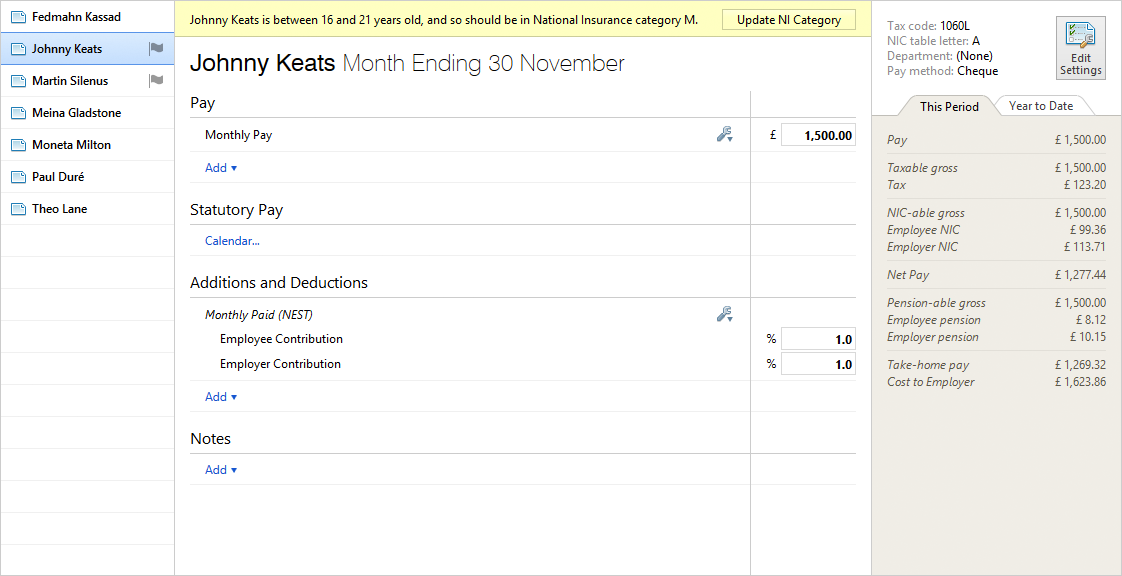

- Support for the newly introduced National Insurance category letters for employees under 21 years old:

- M – Standard rate contributions

- Z – Deferred rate contributions

- I – Contracted-out Salary Related standard rate contributions

- K – Contracted-out Salary Related deferred rate contributions

- Eligible employers can continue to claim the £2000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Updated P11, P45, P60, P30 and P32 forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all RTI submission types.

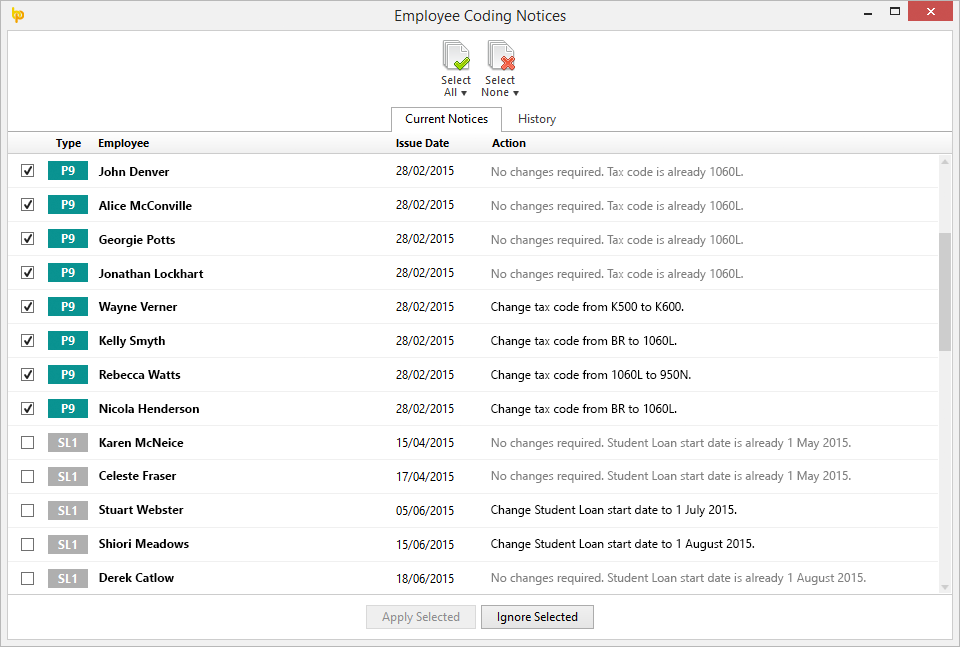

PAYE Coding Notices

BrightPay 2015/16 includes the ability to retrieve and process employee PAYE coding notices directly from HMRC (P9, PB, P6B, SL1, SL2).

To use this feature, ensure the notice options in your HMRC PAYE dashboard are all set to Yes. Only new coding notices issued after this instruction will be available for download.

Shared Parental Leave

Shared Parental Leave (SPL) is a new legal entitlement for eligible parents of babies due (or children placed for adoption) on or after 5 April 2015. SPL lets parents choose either to have one parent take the main child caring role, or to share the child caring responsibilities evenly, depending on their preferences and circumstances. Unlike maternity/adoption leave, eligible employees can stop and start their SPL and return to work between periods of leave.

BrightPay 2015/16 has full support for Shared Parental Leave and Statutory Shared Parental Pay (ShPP).

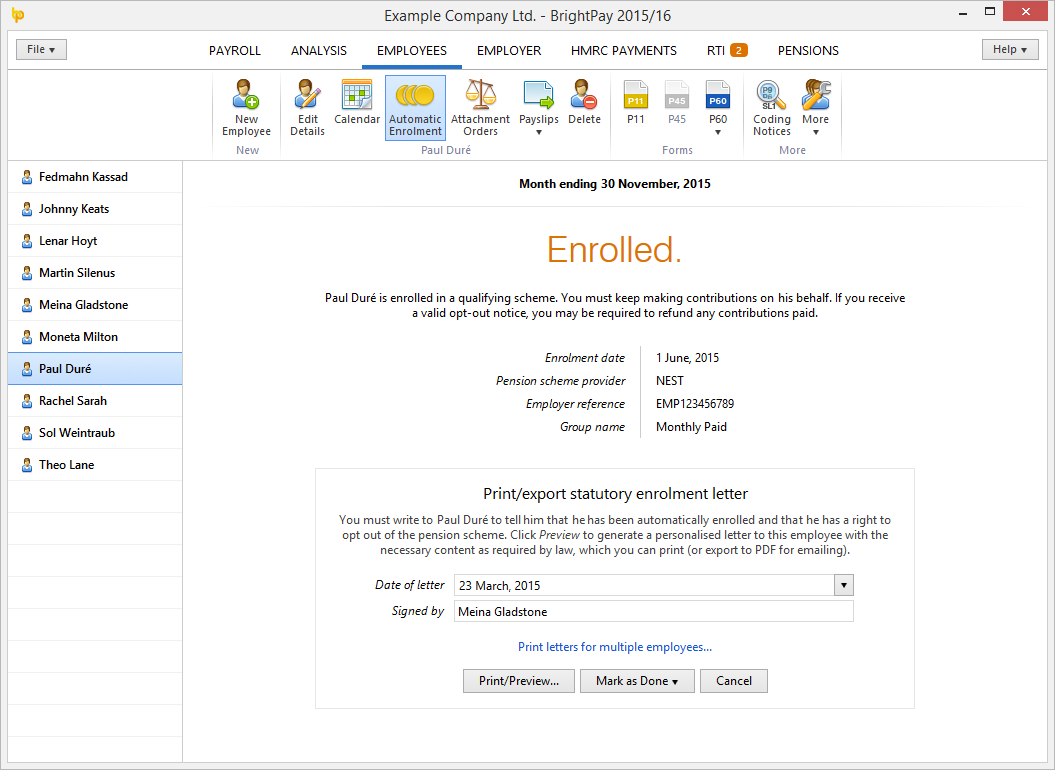

Pensions and Automatic Enrolment

With the first wave of small employers (i.e. those with less than 50 employees) set to stage for Automatic Enrolment in January 2016, this tax year will be busy.

We first introduced support for Automatic Enrolment in BrightPay 2014/15, providing the ability to set up qualifying pensions schemes, assessment, postponement, enrolment, opt-ins, opt-outs, employee communications, and more. We have dedicated support for NEST, NOW: Pensions, The People's Pension and Scottish Widows.

In BrightPay 2015/16 we have improved Automatic Enrolment support and added several new features:

- There is now a dedicated PENSIONS tab for setting up Automatic Enrolment in BrightPay, adding/editing pensions schemes, and exporting enrolment and contribution files.

- Batch processing – multiple employees can now be postponed or enrolled (and as well as other actions) together in a single click. Multiple communications can be printed together.

- Ability to override BrightPay's assessment of an entitled worker or non-eligible jobholder (e.g. if the employee's pay would normally put them in a different category).

- Ability to continue enrolment from a previous tax year or continue enrolment from other payroll software.

We'll be continuing to update Automatic Enrolment during the 2015/16 tax year and provide dedicated support for more pension scheme providers.

Improved Reminders

For years, BrightPay has given reminders of important actions and detected potential data errors as you process your payroll. In 2015/16, we've improved the system to handle even more reminders and give much improved visual feedback.

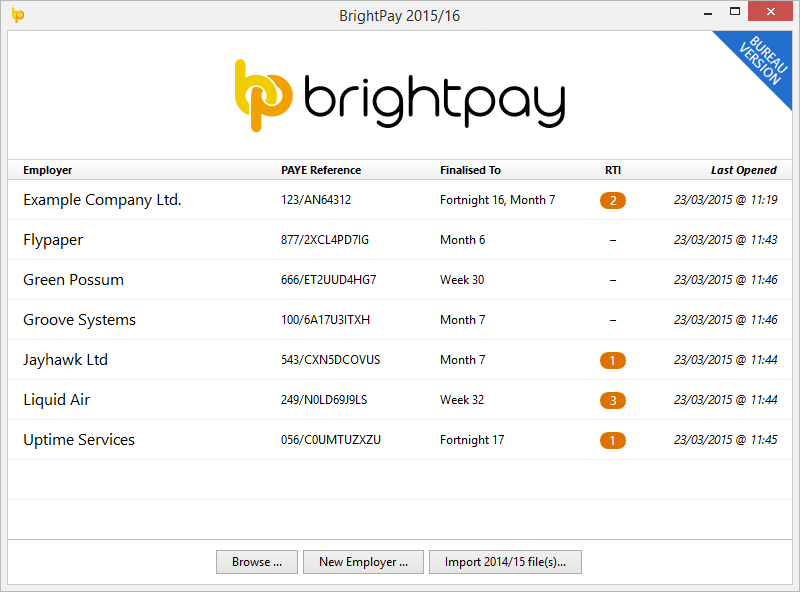

New Start-up Window

Standard and Bureau users alike will benefit from the extra employer information included in the new BrightPay start up window:

Other 2015/16 Changes in BrightPay

- Ability to batch print, email or export one or multiple payslips for a single employee.

- Automatic prompt to create an EPS when recoverable amounts are detected in an HMRC payment.

- A new summary of calendar events in the current period for the currently selected employee appears in the bottom right of main payroll screen.

- Support for Direct Earnings Attachment orders.

- New ability to set up an addition or deduction to repeat to a date beyond the current tax year.

- Improved Statutory pay descriptions.

- New ability to hide 'zero' payments, additions and deductions on printer (or emailed/exported) payslips.

- Employer's HMRC Sender password is now securely masked in the BrightPay user interface.

- Lots and lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

BrightPay 15/16 is the same price as BrightPay 14/15 (including FREE for small employers with up to three employees). Support will continue to be free of charge for all users.

Mar 2015

16

HMRC explains disputed charges

HMRC says payroll managers must appeal disputed charges as soon as they receive them and has outlined a common reason they may occur.

Addressing delegates at Ceridian’s annual conference last week, Phil Nilson, from HMRC’s customer and stakeholder engagement team, explained that disputed charges may occur due to a misunderstanding by payroll managers.

He said: “We used to reconcile annually and you used to send us money during the year. You didn’t send any information relating to that money until the end of the year when you submitted your P14s and P35. Only at that point could we start reconciling the money with the information.

“Now, thanks to RTI we are doing that on a monthly basis, we are doing it tax month by tax month.

“Using tax month one as an examples from 6th April to 5th May, HMRC looks at all the Full Payment Submissions (FPS) you have sent in month one on either the 6th, 7th or 8th of May, and then starts the reconciliation process to try to determine the charge that is due.

“Once you’ve sent your FPSs, in an ideal world, they will be visible to you from the 12th of the following month on your dashboard. So in the example used that would be from the 12th of May. So, theoretically, you would send in your FPSs and then by the 12th of May you could go online and could see what we think is due from you.

“But, sometimes things come in late and you may need to send information about payments beyond the end of the tax month, but which relate to the earlier tax month.

“This is vital. If an FPS comes in between the 6th and 19th of May you can put it back into tax month one, where it should be, and the charge will be adjusted accordingly. However, if that FPS comes in after the 19th of the following tax month it won’t go into the dashboard for that month, of tax month one in this case, because the 19th is the cut-off date – the date we want the payment in.

“That may affect your view of what you think is due and we think is due.

“By looking at FPSs it gives us the total amount that is due – but to be taken away from that is anything you want to claw back by way of the Employer Payment Summary (EPS), that should be submitted by the 19th of the following month. So, for tax month one, that will be the 19th of May. In terms of looking at your online account, if you sent that EPS before the 12th of May it will be reflected by the 14th – you will see it within two days.

“I hope that helps you get a better understanding of what we do.”

Article taken from www.payrollworld.com

Mar 2015

13

Auto Enrolment – Are you covered?

Every employer in the UK will have to enrol their employees into a pension scheme and they must contribute towards that pension. This process is called Auto Enrolment. Employers will need to prepare for their new Auto Enrolment duties and responsibilities or face hefty fines. There is a lot of uncertainty, ambiguity and doubt surrounding Auto Enrolment for employers.

However, there is a clear opportunity for bookkeepers, accountants and payroll bureaus to capitalise on these new obligations for their clients. Contrary to popular belief, confusion isn't a bad thing. In fact, confusion can work to your advantage. It can be a platform for payroll providers to demonstrate their automatic enrolment expertise and knowledge to their clients. This knowledge will position you as a credible and reliable authority on employer responsibilities.

Opportunity Knocking

Pension schemes will become a part of day to day life for each and every employer in the UK. Thousands of employers will begin to look to auto enrolment experts for advice, counsel and an easy solution. Employers that previously did their payroll in house may look to outsource this role to a payroll and auto enrolment expert. Payroll providers will be able to help them grasp the implications for their business and prepare them for their automatic enrolment responsibilities.

Payroll providers who offer auto enrolment services will naturally gain a competitive advantage, win new business and ultimately increase profits. According to The Pensions Regulator research 78% of small businesses will rely on their advisors for help, advice and support.

Win New Clients

Presumably you have worked hard to win and gain new clients. But now you've got those customers, how do you keep them? The downfall for many bureaus is that they don't know how to keep customers. Time and money goes into acquiring new customers and the last thing you want is to see them sneaking out the back door.

Keeping customers makes good business sense but it's not always easy. Being open for Auto enrolment business will play an important role in customer retention over the next few years. This will give payroll providers an edge over other bureaus who are shying away from AE and will provide the capacity to generate greater value for their clients.

There is a clear opportunity to financially benefit from AE by offering to handle all auto enrolment duties for your clients. Your services can lighten the load for employers. There is a pot of gold at the end of the rainbow and it’s up to you to grab it with both hands.

BrightPay has you covered!

To take advantage of this business opportunity, bureaus need to have a payroll solution that can automate the AE tasks. BrightPay is a payroll solution that has automatic enrolment process driven automation included for free. This simple solution handles the complex process of auto enrolment with ease. It's easy with BrightPay, simply enter your staging date and BrightPay will automatically let you know what you need to do to enrol the employees.

BrightPay automates the employee assessment for you by accessing each employees PAYE information and informing you what your duties are for each employee. It further can produce personalised employee communication based on the employee's work status which can be printed or emailed. Additionally, postponement, refunds, opt-out, opt-ins and required reporting come as standard. BrightPay is integrated with a number of AE pension providers.

What’s more is there are no additional costs for automatic enrolment functionality and support is completely free. Our 60 day trial will prove how easy it really is.

To arrange a demo click here

Feb 2015

28

Fit for Work- Initiative by Department of Work and Pensions (DWP) - tackling the problem of long-term sickness absence came into effect on January 1 2015

Fit for Work provides people on sick leave with help to return to work by providing an occupational health assessment when they have been, or are expected to be, off work for 4 weeks. After the assessment, which GPs have been told should be the default option after four weeks’ sickness; they will receive a return-to-work plan with recommendations to help them get back to work more quickly. a return to work plan (RtW) can be accepted as evidence for payment of SSP in the same way as a fit note.

Employers, even those without HR and occupational health teams in-house can also ask for an assessment if the GP has not done so. All referrals will be based on the informed consent of the employee. The government has set out the following deadlines for the referral service which has yet to go live:

- the first assessment will be within two working days of receipt of referral

- if the employee is not expected to return to work, a review date will be set as part of the case management

- further (phone) assessment will take place within two working days

- face to face assessment (either initial or further) will take place within five working days

- the return to work plan is sent to the employee and, subject to consent, to the employer and GP within two working days (the employer may be contacted to develop the plan)

- out of hours queries to the advice service are responded to within one working day of receipt

A tax exemption of up to £500 a year per employee on medical treatments recommended by Fit for Work or an employer-arranged occupational health service was also introduced from 1st January 2015