Oct 2021

18

The tools you need to make hybrid working a success

The evolution and growth of hybrid working has been a silver lining of the pandemic for many employees and employers. Despite the challenges of working from home, hybrid working can offer a better work-life balance, fewer distractions, time and money saved commuting, and greater flexibility. Employers have also been able to see that it works; tasks can still be completed on time and to a high standard, regardless of location.

As restrictions have eased in the UK, how employers have approached the adoption of hybrid working has been varied. Grappling with how they’ll implement it, employers have been testing out different models; from allowing a number of set day at home, or an entirely opt-in model, to a model where it's suited to only certain roles. In the accounting sector, we’ve seen major firms embrace the new workplace options. Most recently in the US, we’ve seen PwC announce that 40,000 of its employees can work remotely. If bigger businesses continue to implement hybrid working options, it is likely that it will impact smaller and mid-sized firms, with growing competitiveness among them to offer remote options to employees.

How can smaller firms adopt hybrid working and truly make it a success? It can be challenging, not only to productivity but also to the company culture. It’s made even more challenging when businesses don’t invest in the tools required to work from home. Research published in September 2021 by Ricoh Europe shows that that only a third (36%) of employers say their organisation has provided the tools and technology to maintain employee productivity while working from any location. This is despite over half of employers understanding that investing in automation boosts productivity.

To help you prepare for the realities of hybrid working and what accounting and payroll software tools are available to help you and your firm, we’ve teamed up with BTC Software to deliver a webinar. BTC Software provides feature-rich accounting and tax software. In the webinar we will examine the changes which have occurred at work due to COVID-19 and highlight what can be done to establish the best way of working. Register for the free webinar here.

Webinar agenda:

- Part 1: How COVID-19 has changed how we work

- Part 2: Restructure of how we work post-pandemic

- Part 3: What can accountants do to ensure they are digitally savvy to keep up with the new way of working?

- Part 4: Q&A session

Please note: This webinar is specifically designed for accountants, bookkeepers, and payroll bureaus.

Webinar Information:

The webinar takes place on 26th October at 1.00pm and is free to attend for accountants in practice and payroll bureaus. If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Related Articles:

Oct 2021

13

New guidance issued for those who receive Working Tax Credits or Tax Free Childcare

During the pandemic, those who received Working Tax Credits did not need to tell HMRC about any temporary short-term reductions in their working hours as a result of coronavirus i.e. if they were furloughed or simply had less hours (which would have previously rendered them ineligible.) Any reduction was treated as if they were working full time hours, which was a real nice move from the tax man.

Those who receive Tax-Free Childcare were not required to prove their income under the same relaxation of the eligibility criteria during the height of the pandemic. However, now that all coronavirus related benefits have ended and the country is “back open for business”, anyone who gets tax credits needs to inform HMRC if their working hours have not returned to pre-COVID levels. Likewise, those who get Tax-Free Childcare need to now prove their income.

You now must work a certain number of hours each week to qualify for Working Tax Credits. Those aged between 25 and 59 need to work 30 hours or more to qualify, while those over 60 need to work 16 hours a week in order to qualify. If you are a person with a disability or a single person with one or more children, you must also work 16 hours or more each week to qualify. For couples with one or more children, you must work at least 24 hours a week with one of you working at least 16 hours in order to qualify.

From the 25th of November 2021 if your hours have not returned to normal as shown in your Working Tax Credit claim and you haven’t notified HMRC then you may have to pay back any overpayments and face a penalty of £300 which, if you ask me, is like kicking a dog when it’s down - but anyway!

The good news is that if you’re no longer eligible for Working Tax Credits, you will remain entitled to Child Tax credits if you already receive it and have not yet made a claim for Universal Credit.

For Tax-Free Childcare, you need to earn an average of £142 per week to claim up to £2000 per year per child towards childcare costs. As previously mentioned, this was relaxed during the pandemic for those on furlough or claiming SEISS and for those whose earnings fell below the threshold. But now it is “back to business” again and you now must prove that you are eligible (as above) every three months when you wish to apply.

Furthermore, Child Benefit and Tax Credit customers who use Post Office card accounts need to be aware that from the 30th November 2021 these accounts will be closing and you will no longer be able to receive your payments into them. If you are affected by this, you must notify HMRC of your new account details, be it bank, credit union or building society. This should be done as soon as possible so as not to miss any payments.

For more information on tax credits you can use the following options:

- using the HMRC webchat service, by going to GOV.UK and searching ‘tax credits general enquiries’

- by tweeting @HMRCcustomers or posting on their Facebook page with general queries

- by calling the tax credits helpline: 0345 300 3900

- Ask your payroll or HR department who may be able to give you guidance.

Written by Aoibheann Byrne

Related articles:

Oct 2021

8

Easily Manage Attachment of Earnings Orders with BrightPay

What is an attachment of earnings order?

As an employer, you can be directed to deduct money from an employee’s pay. You will receive a formal notice, referred to as an attachment of earnings order, typically from a court, but can also be from the DWP Debt Management or from the Child Maintenance Group.

The order instructs an employer to divert money directly from an employee’s wages to pay back an outstanding debt. The order is issued because it is believed that the employee has failed or is likely to fail to pay the sums through other means. The money is sent to the court that made the order which is then forwarded to the employee’s creditor. Attachments can be issued for a number of reasons including unpaid fines and child support.

Deduct an attachment of earnings order using BrightPay

BrightPay Payroll has the facility to process a variety of attachment of earnings orders. This includes:

- Council Tax Attachment of Earnings Order

- Civil Judgment Debt Attachment of Earnings Order

- Child Support Deductions from Earnings Order

- View BrightPay’s full list of attachment of earning orders here

Fast and easy deductions:

BrightPay payroll software allows customers to easily add attachment of earnings to an employee’s payslip. In the employee’s profile, under ‘Additions and Deductions’, the user can choose from the different attachment orders available. Once selected, the description and relevant dates are added along with the amounts and status.

An AEO can either be a priority order or a non-priority order, which impacts the way deductions are calculated. If an employee has more than one order, priority orders will need to be deducted first. In BrightPay, tick the ‘priority’ box if the order is a priority order. The priority orders will be deducted in the order the employee received them.

Once it is set-up, BrightPay will continue to apply the Attachment Order on the employee’s payslip from the relevant period. To see how to apply an Attachment of Earnings Order click here.

What happens if you don’t comply?

Although attachment of earnings can be issued by different authorities, these authorities have the power to impose a fine. An employer that does not comply may be liable to a fine in the magistrate’s court, in the county court, or in the High Court. The employer must also notify the authority when the employee is no longer in its employment, or risk paying a fine.

Find out more about BrightPay Payroll:

BrightPay Payroll makes processing payroll quick and easy. Its comprehensive functionality, covering AEOs to auto-enrolment and CIS, provides a complete solution to your payroll needs. To learn more about BrightPay’s features and how they can benefit your business, book a free demo today.

Related Articles:

Oct 2021

1

Customer Update: October 2021

Welcome to BrightPay's October update. Our most important news this month include:

-

How is payroll impacted by the new national insurance levy?

-

What should employers do once furlough ends?

-

BrightPay & Relate Software join forces to create an accounting & payroll software champion

How is payroll impacted by the new national insurance levy?

A 1.25% health and social care levy on earned income will come into effect in April 2022. BrightPay payroll software will be updated to apply the new rates to employee’s earnings accordingly.

How to boost the efficiency of your payroll process (for employers)

Don’t let payroll be a task that you dread every pay period. Find out how the power of cloud technology allows employers to spend less time on payroll admin and more time on more important aspects of the business in our latest webinar.

Payroll success with increased profits (for bureaus)

Transform your payroll services and increase profits with BrightPay Connect. Discover six ways that cloud technology can integrate and streamline your payroll and HR processes in our latest webinar.

Set up BrightPay for multiple users

Each BrightPay licence key can be installed and activated on up to 10 PCs. If shared access is required, the data location can be set to your server or cloud environment.

How hybrid working has transformed payroll forever

In this guide, we discuss how COVID-19 has affected payroll and what long-term implications we should expect to see in the near future, including long-term hybrid working.

10 tips for successfully switching payroll software

In this guide, we discuss the challenges when switching payroll software providers and top tips to ensure you have a smooth transition.

A step closer to sustainability

Earlier this year at BrightPay we formed a ‘Green Team’ that will identify and implement opportunities that can improve the sustainability of our company. Follow us on our journey to keep up with our latest projects.

The roadmap out of lockdown

Join our sister product Bright Contracts for their free webinar on 13th October where they will be discussing SSP & isolation, hybrid working, redundancy and many more hot topics.

Sep 2021

29

BrightPay Connect - The New Norm In HR Management

Human resources is a dynamic field that is constantly changing. HR managers are required to keep up with the times as industries and employment law evolve. Whether that means updating a company policy to reflect legislative developments, finding ways to engage employees in order to create a vibrant work culture, or using innovative new technologies to affect positive change in the workplace, HR managers have a lot on their plate.

If you’re a HR manager, you’re probably nodding your head in enthusiastic agreement right now. But did you know that BrightPay Connect has been designed with you in mind? Not only can it streamline the payroll process, but it can have significant benefits for the HR department too.

BrightPay Connect provides much needed solutions to the challenges that HR managers face everyday. These vary from data storage and protection to internal communication and leave management, in other words - all of the things that take up your time and prevent you from working on the tasks that really need your attention. That’s why Connect is quickly becoming the new norm for forward-thinking HR professionals across Ireland and the United Kingdom.

What Is BrightPay Connect?

Connect is a cloud-based add-on to BrightPay’s payroll software. It offers a vast range of powerful new features, including an employee self-service smartphone and tablet app, automated cloud back-up, online employer dashboards and so much more. Connect combines payroll and HR functionality to create a holistic product that benefits bureaus, employers, HR and payroll administrators and employees alike.

Although BrightPay’s payroll software can only be accessed on a PC, BrightPay Connect can be used on any device, anywhere. The payroll is still processed on the desktop version of BrightPay, but the payroll information is stored online on a secure cloud server. This makes it particularly useful for the rapidly growing number of businesses who are offering remote working options to their employees. Remote working presents many challenges to HR managers, many of which are addressed by Connect.

However, this doesn’t mean that only businesses with remote working employees will benefit from BrightPay Connect. Keep reading to find out how Connect can transform your HR department.

Employee apps are a growing trend in human resource management. Self-service apps can allow employees to take control of their personal data, communicate with employers, and track their annual leave. Click the link to read more: https://t.co/FHMBkHCWEi pic.twitter.com/qvPhVr1Git

— BrightPay UK (@BrightPayUK) September 22, 2021

BrightPay Connect For HR Professionals

Although BrightPay Connect has many features that can have positive impacts on HR management, there are three in particular that HR managers love.

Annual Leave Management

Managing annual leave can be time-consuming and complicated, especially if your business has a large number of employees. However, it doesn’t have to be. BrightPay Connect includes an annual leave management feature that makes the process more straightforward for both employees and HR managers.

On their self-service app, employees can request annual or unpaid leave via the employee calendar. As soon as the request has been sent it will appear on their HR manager’s BrightPay Connect online dashboard. From here, the HR manager can check the company calendar to see if anyone else will be on leave on those dates, and either approve or deny the request accordingly.

Furthermore, a time-stamped record is kept of all requests, approvals and denials, along with which manager dealt with them. This is very useful if there are multiple managers managing leave requests from their own departments.

Document Sharing and Storage

BrightPay Connect makes document sharing more efficient and effective than ever before. From their employer dashboard, employers can upload documents to Connect. These documents are then available via employee dashboards or the employee self-service app.

This feature is fully customizable, meaning that the employer can choose which employees get access to the documents uploaded. They may choose to make them available to the entire company, to a specific team or department, or to just one individual employee. Similarly, they can choose to keep them private if they need to. For example, they may upload an employee file for a new employee. By uploading it, it’s automatically stored in the cloud but nobody who shouldn’t see it will have access to it.

Employee Personal Data

Finally, BrightPay Connect makes it easier for HR managers to comply with their data protection obligations under the GDPR. One such obligation relates to giving employees access to any personal data on them that you store.

In the employee app, employees can view this information and request to make edits. One example of this in practice would be if an employee moves house and needs to update their postal address, or changes phone number and needs to replace their old number with their new one.

Every HR manager knows how important it is to comply with GDPR so the fact that BrightPay Connect helps with this is a major advantage to the cloud-based add-on.

Book Your Free BrightPay Connect Demo

To find out more about how BrightPay Connect can help you to streamline your HR process and evolve with the times, book a free demo with our Connect team today. They’ll walk you through the benefits of our industry leading add-on and show you why BrightPay Connect is fast becoming the new norm in HR management.

Sep 2021

28

BrightPay & Relate Software join forces to create an accounting & payroll software champion

We are delighted to announce that BrightPay has joined forces with Relate Software, a leader in post-accounting, practice management, and bookkeeping software. The partnership will aim to create a software champion serving payroll and accounting bureau and SMEs across Ireland and the UK.

BrightPay is a modern payroll and HR software which takes care of every aspect of running your payroll, from entering employee and payment details to creating payslips and sending real-time payroll submissions. The software has been designed from the ground up to be clear and simple, and yet no compromise has been made on its payroll features.

Likewise, Relate is dedicated to building innovative and focused products designed specifically for the accounting profession. Its offering includes Surf products, a cloud native product suite of bookkeeping, post-accounting, and practice management software. Relate is an industry-leader in Ireland and has been building software for over 25 years.

By partnering with Relate and combining products and strengths from both businesses, we can provide a greater offering to our customers, with scope and backing for further innovation and development. This is an exciting moment in BrightPay’s journey to delivering a one stop solution for businesses and accountancy firms. Together we will aim to provide a best-in-class software suite with a clear value proposition to drive efficiency and reduce errors, all with increased flexibility from working with a cloud offering.

For more information, please see the press release and customer FAQs.

Sep 2021

24

Harness the power of phone notifications for employee communications

Push notifications are 7 times more likely to be opened than an email. This high ‘open rate’ has meant marketers have been utilising them as an important communication tool for a number of years. Now, employers and HR departments are examining how this marketing trend can be used to engage employees.

What are push notifications?

Recent research carried out in the UK has shown that 25% of smartphone users have between 11 and 20 apps on their phone, and 24% have 31 or more. With potentially dozens of apps on a user’s smartphone, it has become increasingly difficult to engage them.

Push notifications are short messages or alerts sent by an app or website to a user’s phone or desktop in real-time. They ‘pop-up’ on the screen, prompting the user to take some action. The messages can be personalised and can contain images, GIFs or video. They don’t deliver the primary message, but rather give an instruction to the user. The notifications are very effective; they engage users and encourage action.

How can employers use them?

Employers and HR departments can use push notifications to send important information to employees, anytime and anywhere. For example, BrightPay Connect customers commonly use the push notifications feature to notify employees of their latest payslip, Health & Safety updates, changes to the employee handbook, and even to direct them to the latest company newsletter.

How does BrightPay Connect harness the power of push notifications?

BrightPay Connect is an optional cloud add-on that works with BrightPay’s desktop payroll software. It is primarily focused on improving payroll workflows by automating tasks to save a business significant time, but its functionality also offers employers a ready-to-go, easy-to-use HR software solution.

With BrightPay Connect, employers and employees have their own self-service app which can be accessed by a web browser or by the app. Using the calendar feature on the app, employees can easily manage their annual leave, view how much they’ve already taken, how much is left, and can make leave requests, which are sent to their manager. The push notification then alerts employees of whether or not their request for leave has been approved.

Notifying employees of important changes:

The push notification is used to alert individuals, teams, or the whole company that a new document has been shared to their self-service portal. The HR team can share with an employee their contract of employment, their performance review, training records and other confidential information. To the wider company, they can share the company handbook and return-to-work procedures including the company’s social distancing and COVID-19 policies.

Additionally, the app’s activity log allows managers and HR to keep track of who has viewed documents and who has not. This can be significantly helpful to employers who are legally required to provide employees with certain documents.

Push notifications can be used to help ensure important messages are not missed. With overflowing inboxes, employees are more likely to click on these alerts and remain updated on any company news.

To learn more about BrightPay Connect and how it can help your business, book a demo to speak to a member of our team.

Related Articles:

Sep 2021

22

What to include on a hybrid working policy

Post lockdown, as restrictions lifted across the UK, many of us returned to the office for the first time in over a year. And while it was great to have the option of returning to the office, it didn't necessarily mean that everyone wanted to, not on a full-time basis at least. Experiencing the longer lie-ins, no commute, and an overall better work-life balance, employers and employees alike have enjoyed the benefits of remote working. However, each employee is different and working from home may not be as suitable for some as it is for others. A 2021 survey by Forbes found that 97% of employees surveyed would prefer flexibility between working remotely and working in the office. Because of this, many businesses have adopted a hybrid working model.

What is hybrid working and how can an employee request it?

In the UK, hybrid working falls under flexible working and is when an employee works part of their time in the workplace provided by their employer and part of their time from home or anywhere else other than the normal place of work. Employees have the right to request that they work this way once they have worked continuously for the same employer for at least the last 26 weeks. Employees can do so by making a statutory application to their employer. The employer must then make a decision on the matter within three months, or longer if this is agreed to by the employee.

If the employer agrees to allow one or more employees to work a hybrid working model, a Hybrid Working Policy document should be created so that all staff are aware of how the new arrangement will operate. Because many employers now have experience with employees working from home, they should already be aware of the challenges and advantages it can bring. This will be an advantage for employers and HR managers as they put together their Hybrid Working Policy.

What information should be included in a Hybrid Working Policy?

The rules and limitations surrounding the company’s hybrid working policy should be clearly outlined in the Hybrid Working Policy, including:

- Are there any roles within the company which may not be suitable for remote working

- Will employees need to follow a hybrid working schedule

- Are there certain tasks which you, as an employer, would prefer to be taken care of in the office rather than at home (or vice versa)

- While working remotely, is the employee allowed to work anywhere or are there limitations. Examples of this may be that the employee must stay in the country or cannot work in public settings due to cybersecurity concerns

- What hours should an employee be working. Are there set working hours, when should they take breaks and what is the maximum number of hours they should be working each day

The policy should include details of how staff will be managed and supported as they work from separate locations, including:

- How should employees communicate with managers and colleagues and what should be done to ensure effective and fair communication

- How should new staff be onboarded

- How will employees’ performance will be managed

- How will employees’ health, safety and wellbeing be maintained

Guidelines for remote working should be clearly defined, including:

- What equipment is suitable for remote working and how will the equipment be provided

- What are the insurance requirements for the employer and the employee

- Details of a home risk assessment

- How cyber security will be maintained

How should a Hybrid Working Policy be shared with employees?

Once you have put together a Hybrid Working Policy, what is the best way to share it with employees? When sharing the policy with employees, you may want to share it with all or multiple employees at the same time. As employees may be working from different locations, it’s likely not possible to physically hand out the document to each employee.

You could email the policy to employees. However, emails are not always an effective way of getting your employees' attention. In a 2019 survey, 34% of respondents said that they sometimes ignore HR emails from their employer, while 5.7% even said that they always ignore HR emails. The reason for this may be that employees are simply overwhelmed by the number of emails they receive at work.

A better way of getting employees to read your new Hybrid Working Policy is by sharing it with them through an app on their smartphones. BrightPay Connect is a cloud add-on to BrightPay payroll software which includes an employee app which can be used to take care of a number of HR tasks. With BrightPay Connect, employers will have access to their own employer dashboard from where they can upload employee documents to be shared with employees through the employee app. Employers can share documents with individual employees, multiple employees or all employees if they wish to do so. This means employees can easily access all their documents in one place, be it their individual contract of employment or company-wide documents. Since the documents are available on the employees' phones, it also means they can be accessed anytime, anywhere.

When a document is shared with employees this way, each employee will receive a push notification on their mobile to notify them that the document has become available for them to view. With push notifications, because users can instantly read the alert on their device, they are less likely to ignore it like they may do with an email. Furthermore, employers can track who has and who has not read each document and so you can give them a nudge if needs be.

Reviewing and updating your Hybrid Working Policy

As hybrid working is still a relatively new concept for many employers, the policy should be reviewed regularly. Employers may want to make changes to the policy as the needs of the business and employees change. The updated policy can be quickly reshared on BrightPay Connect and employees, are once again alerted to it by push notification.

As well as sharing documents, you can also easily share payslips with employees using BrightPay Connect. Other HR functions of BrightPay Connect which are done using the employee app are annual leave management and updating employee information. To learn more about the many benefits of BrightPay Connect and how they can improve your business and ease the transition to hybrid working, book a free online demo today.

Related articles:

Sep 2021

16

Coronavirus Statutory Sick Pay Rebate Scheme to end on 30th September 2021

The Coronavirus Statutory Sick Pay Rebate scheme was introduced to repay employers the current amount of Statutory Sick Pay paid to current or former employees on or after 13th March 2020 for periods of sickness related to Coronavirus. An employer can claim up to 2 weeks of COVID-related statutory sick pay for an employee that was paid, however this will end on 30th September 2021.

Employers will have up to the deadline on 31st December 2021 to reclaim back Coronavirus Statutory Sick Pay on this scheme for periods before and up to the end of September 2021. HMRC’s main guidance for claims under this scheme can be accessed here.

The employer must keep records for the statutory sick payments they wish to claim from HMRC such as:

- National insurance number for each employee being claimed for

- Start and end dates for the period of sick leave the employee could not work

- The reason why the employee could not work

- Details of the qualifying dates in the period the employee could not work

Hybrid working ????? is now seen as a permanent way of working by employers and employees alike. Key to its success is ensuring you have the right tools and know-how to deliver your services as usual. Download our guide to find out more: https://t.co/VkSUkbh8sT pic.twitter.com/MOGYT6BTr6

— BrightPay UK (@BrightPayUK) September 8, 2021

Related articles:

Sep 2021

14

BrightPay’s 2021 Customer Survey Results

Earlier this year, BrightPay conducted our annual Customer Satisfaction Survey. At BrightPay we are constantly trying to improve our products as well as our customer service. Our Customer Satisfaction Survey helps us identify in which areas we should make improvements. As it is an annual survey, it allows us to monitor customer satisfaction over time and evaluate the success of the changes we have made and the efforts we have put in throughout the year.

A total of 1169 customers took part in our survey. Just over half of those surveyed were employers on a standard BrightPay licence while the remaining were accountants or payroll bureaus who run payroll for multiple clients.

Below are some of the key stats from the survey:

For 2021 BrightPay received a 99.5% customer satisfaction rate. This means that our customer satisfaction rate has remained over 99% for the 7th year in a row.

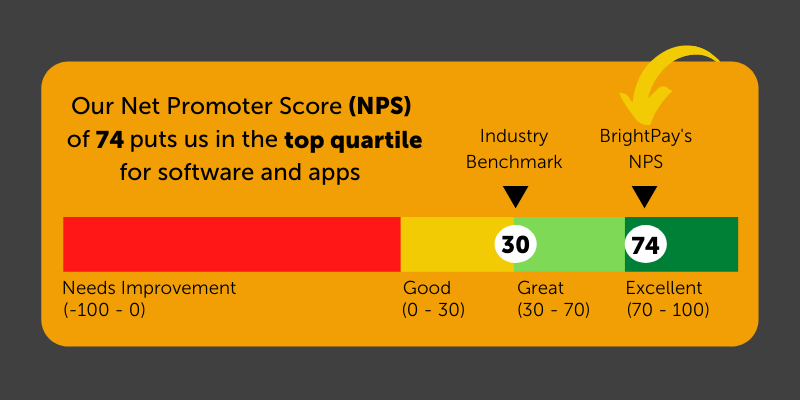

BrightPay’s 2021 Net Promoter Score (NPS) is 74. An NPS represents how likely customers are to recommend your product or service to others. With the industry average NPS score being 30, a score of 74 puts us in the top quartile for software and apps.

Of the 1169 customers surveyed, 166 had started using BrightPay within the last 12 months. 98.8% of our new users said that the software was easy to use. This score is thanks to our functionality and our user-friendly interface.

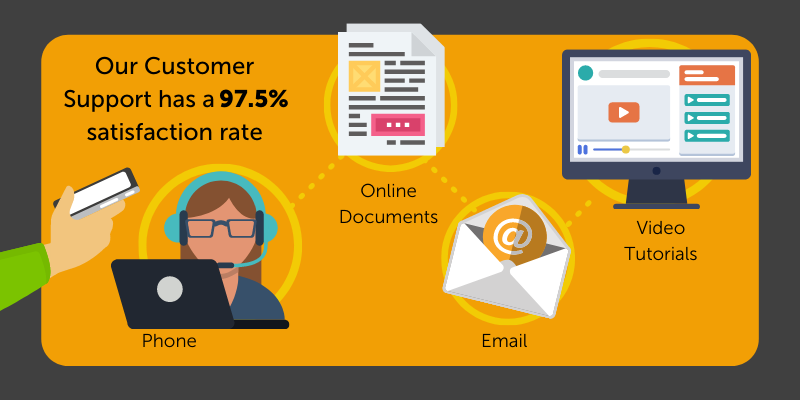

At BrightPay, unlike other payroll software providers, we do not charge for customer support. Because we do not profit from your need for help, this motivates us to make our software as user-friendly as possible. BrightPay customers can speak to one of our payroll experts by phone or email. If you need help switching from your old payroll software provider to BrightPay, we have a team of payroll migration experts on hand to help. As well as this, to help our customers, we hold free weekly webinars where we discuss current payroll topics and answer your payroll queries. We also have helpful videos, documents, guides and eBooks available on our website. It is because of this that our customer support has achieved a 97.5% satisfaction rate.

98.7% of customers surveyed said that they save both time and money by using BrightPay. This is through using our integrations with accounting packages, pension providers and a payments platform that allows you to pay employees, subcontractors, and HMRC, all in real-time.

Payroll bureaus and accountants can also save time by using our batch payroll processing feature which allows you to perform payroll tasks for multiple clients at the same time.

Another way you can save time and money is by using our optional cloud add-on BrightPay Connect, which 42% of BrightPay users surveyed said they also use. BrightPay Connect includes an employer dashboard which gives you a complete overview of the payroll information including managing employee leave, sharing payslips and other documents with employees. It also automatically backups the payroll data to the cloud every 15 minutes.

BrightPay Connect includes an employee self-service app which 99.1% of our customers surveyed said they love. From the app, employees can view current and historic payslips, request annual leave, view personal employment documents such as their contract of employment or companywide documents such as a monthly newsletter.

The 2020/2021 financial year was one like no other for BrightPay and for our customers. We all had to change the way we worked in order to adapt to the new world we found ourselves in. During the COVID-19 crisis, keeping up to date with the ever-changing furlough scheme and other wage support measures put in place by the UK government took centre stage for payroll processers. 99% of customers surveyed said they were satisfied with our handling of COVID-19 thanks to our software upgrades, free online webinars, online support documents and our phone and email support.

BrightPay would like to thank all those who took the time to take part in our Customer Satisfaction Survey. We believe that by listening to our customers' needs we can continue to grow and improve as a company. The full Customer Satisfaction Survey infographic can be viewed here. If you would like to find out more about BrightPay and BrightPay Connect, book a free online demo today.