Apr 2017

4

HMRC to update Tax Codes for Adjustments for PAYE throughout the tax year

Currently with HMRC if there is an underpayment of tax that is owed at the end of the tax year the process is that it can be coded out, by means of adjusting the tax code for the employee in the next tax year, or the tax is to be paid by the employee in full. From May 2017 onwards HMRC will make automatic adjustment to Pay As You Earn tax codes using real time information as they occur.

HMRC will be watching the data being submitted from Full Payment Submissions by employers and pension companies from April 2017 onwards. HMRC will then be assessing individuals and projecting whether an employee will be due to have an underpayment of tax by the end of the tax year. Where this occurs HMRC will amend the employee’s tax code in order for the collection of the tax be in the current tax year and not be left owed at the end of the tax year. This proactive approach from HMRC ensures that the majority of tax owed will be collected in the same tax year.

Mar 2017

21

Off-payroll working in the public sector

Current HMRC guidance can be found here.

The guidance concerns both the provider of the services (the personal services company) and the payer for the services (the public sector client)

Assume an invoice of £6,000 for services (excluding VAT) issued by Joe Bloggs of ABC Ltd and that the payment falls within the new rules.

If you are the personal services company

Using the example deductions in HMRC's article, as the public sector client has already deducted tax (£1,458) and NIC (£413), you receive £4,129 (excluding VAT).

If you are paying yourself this £4,129 from your company, you will have no further PAYE or NIC liability on it, so, in your payroll system, you should mark the gross payment (£4,129) as not being liable to tax or NIC.

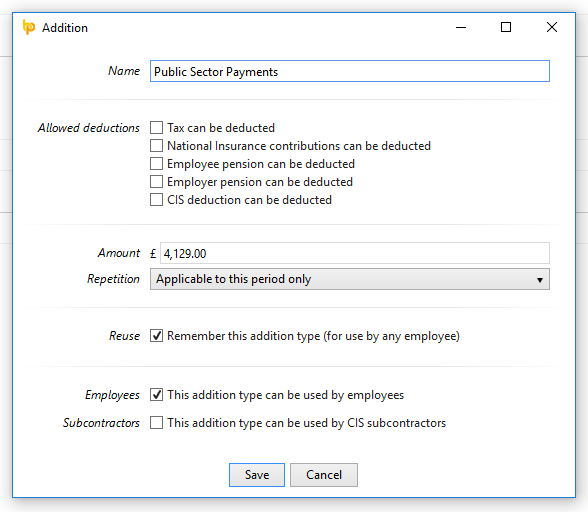

In BrightPay, simply set up a new addition type as per the following screen. Ensure that tax, NIC etc. are all unticked.

When the payroll is finalised, the non taxable pay will appear on the FPS.

![]()

If you are the public sector client

Pay Joe Bloggs through your payroll as if he were a normal employee.

When entering Joe Bloggs to your payroll, use starter declaration C - secondary employment. This will put him on basic rate tax. You should also tick that the employee is on an irregular payment pattern.

The payment frequency that you select for Joe Bloggs should match their contract as closely as possible e.g. if he is being paid for a month's work and you put him through the weekly payroll run, this will adversely impact on your NIC figures.

It may be useful to set up a department named “Personal Services Company” and assign Joe Bloggs to that department. This will enable specific reports for this category of employee.

When the contract ends, P45 Joe Bloggs as you would a normal employee.

Auto enrolment

The public sector client should treat Joe Bloggs as if he were a normal employee for AE purposes, if he falls within the definition of a personal services worker as per TPR's guidance (HMRC's guidance on this is contradictory - they state that Joe Bloggs should not be considered for auto enrolment in all cases). If the contract is a one off, then postponement would be appropriate. If Joe Bloggs is genuinely self employed and does not come within the scope of a personal services worker, then simply mark as exempt when BrightPay flags him for enrolment.

In the payroll of ABC Ltd, if Joe Bloggs is not deemed as a worker in the public sector company, he should be enrolled by ABC. However, in the majority of cases ABC Ltd will be a single director company, so is not deemed an employer for AE purposes.

Other:

This article does not cover the treatment of VAT.

Please note that the definition of public sector client, for the purposes of these rules, is quite broad and includes those bodies listed in the Freedom of Information Act 2000. Click here for list. e.g. a GP surgery may fall under the new rules although it is difficult to imagine Joe Bloggs in the above example not being genuinely self employed in this case (unless, for example, Joe Bloggs was a self employed locum who only provides his services to the one GP surgery).

It is also worth noting that the cost for the public sector client will have increased as a result of the employer NIC liability. This may lead to the re-negotiation of contracts in the majority of cases.

Mar 2017

20

BrightPay 2017/18 is Now Available. What's New?

BrightPay 2017/18 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2017/18 Tax Year Updates

- 2017/18 rates, thresholds and calculations for PAYE tax, National Insurance contributions, Student Loan deductions, Statutory Sick Pay, Statutory Maternity Pay, Statutory Adoption Pay, Statutory Paternity Pay, Statutory Shared Parental Pay, Automatic Enrolment earnings thresholds and triggers, company cars, vans and fuel.

- The emergency tax code has changed from 1100L to 1150L. When importing from BrightPay 2016/17, L codes are uplifted by 50, while M codes are uplifted by 55 and N codes by 45.

- Full support for Scottish Rate of Income Tax (SRIT) codes, including the new 2017/18 Scottish higher tax rate threshold.

- Support for an expanded range of National Insurance Number formats.

- April 2017 National Minimum/Living Wage.

- Ability to process 2017/18 coding notices.

- Eligible employers can continue to claim the £3,000 Employment Allowance which can be used to reduce Employer Class 1 Secondary NICs payments to HMRC.

- Full support for the new 2017/18 Apprenticeship Levy, including levy calculation, allowance and reporting amounts on an EPS submission.

- Updated P11, P45, P60, P30 and P32 forms.

- Updated RTI submissions in line with the latest HMRC specifications. BrightPay continues to be officially HMRC Recognised for all RTI, EXB and CIS submission types.

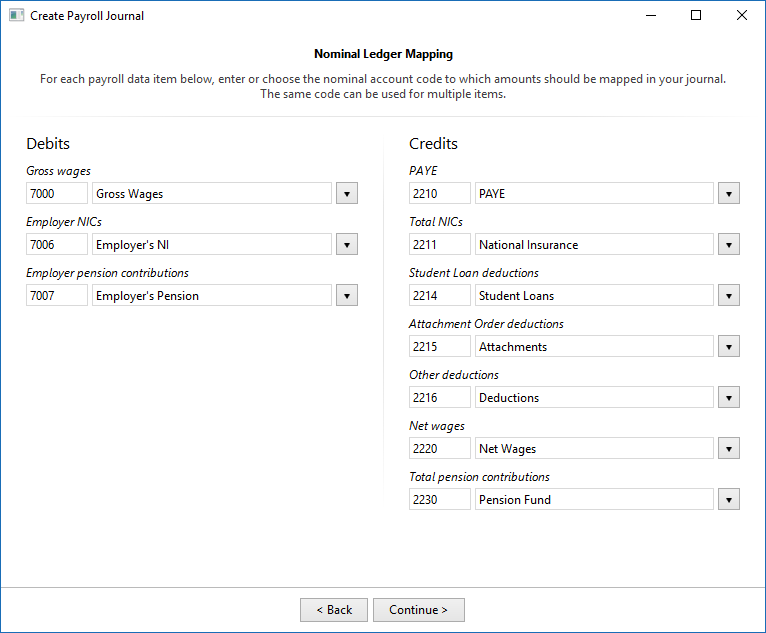

Payroll Journal

BrightPay 2017/18 enables you to produce a CSV payroll journal for import into your accounting software. This feature is accessed via the new Journal button on the payroll toolbar, and provides the following:

- The file formats and default nominal ledger code mappings are included for Exact, Kashflow, Quickbooks, Sage and Xero. These built-in mappings can be tailored to meet your own requirements, or you can create your own nominal ledger mapping from scratch if need be.

- Specify the journal date range – payslips finalised with a pay date in the range you select are included.

- Include individual journal records for each employee, or merge the employee records into rolled up records for each unique payment date.

- If required, you can use alternate nominal codes for payroll items relating to directors.

- Use a specific nominal code for any custom employer-wide item you have set up in BrightPay (i.e. addition/deduction types, hourly/daily/piece rates, pension schemes, savings schemes, etc.)

- Preview journal on screen, export preview to PDF, or print.

- Export journal CSV file for import into your accounting software.

Several accounting software providers can accept a direct upload of a payroll journal via an API, negating the need to export/import a CSV file. We plan to add this functionality for supporting providers soon.

Please get in touch if you'd like to see built-in support for any other accounting software providers.

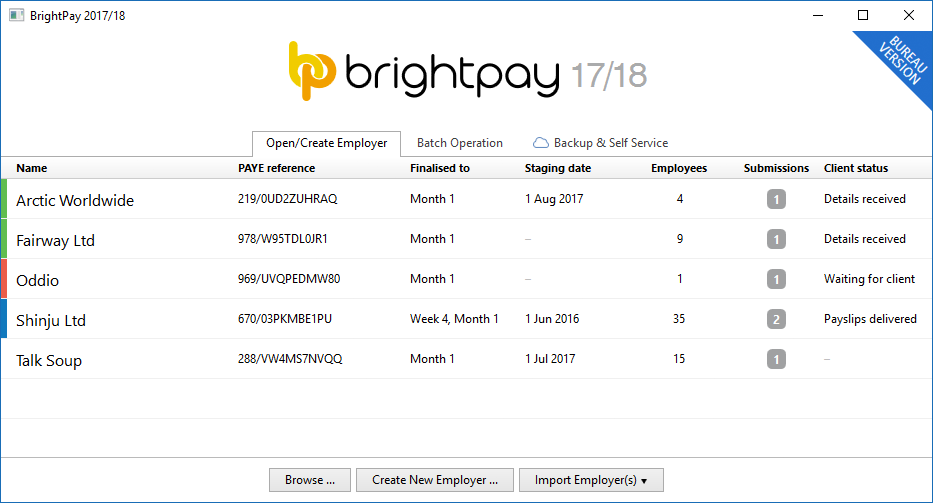

Bureau Features

BrightPay 2017/18 includes several new features specifically targeted at accountants, bookkeepers, or other payroll bureau service providers. These bureau features are exclusive to the bureau version of BrightPay.

Improvements to BrightPay Startup Window

The columns on the BrightPay startup window can now be customised, and you can order the list of employers on the startup screen by any column. To help make this personalisation more useful, the size and position of the startup window will now be remembered between launches.

The data on the startup window now more reliably updates by itself - you no longer have to open a file to get it to do so.

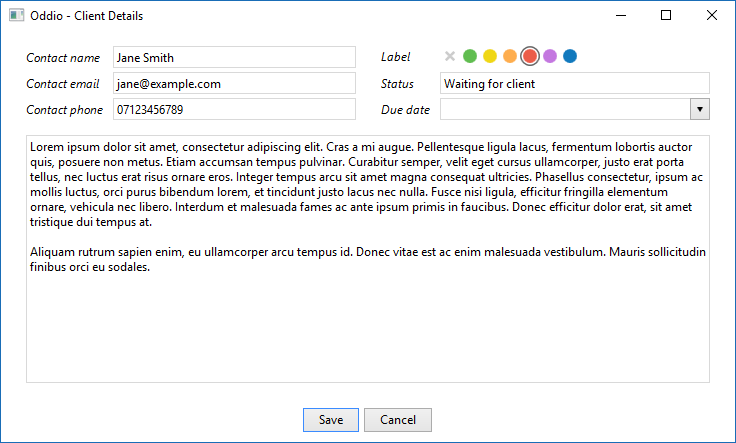

Client Details

You can now record the following client information for each employer in BrightPay:

- Contact name, email address and phone number

- Status

- Due date

- Notes

- Label colour

This information can be edited directly from the startup window by right-clicking on an employer and selecting the new View/Edit Client Details menu option (this menu also includes a quick one-click link to set a label colour), or it can be entered via the new Client Details tab in Edit Employer Details when a file is opened in BrightPay.

Perhaps most usefully, these client details can be shown as columns on the BrightPay startup window, enabling you to more effectively manage your client workflows as an individual or across a team.

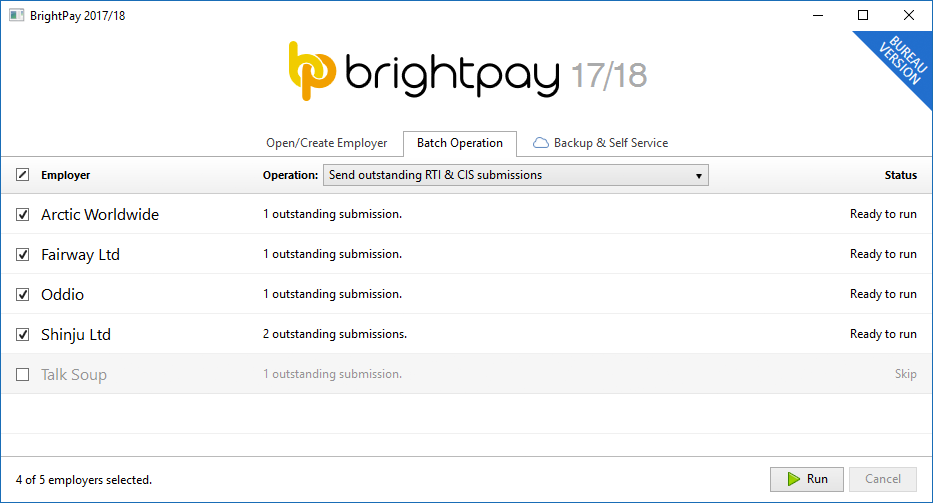

Batch Send RTI Submissions for Multiple Employers

A new Batch Operation tab on the BrightPay startup window enables you to process or perform a task on multiple employer files with a single click.

The first supported batch operation is to send all outstanding RTI and CIS submissions.

We have plans to add more batch operations in future.

Keep Your Client Documents and Files Organised

In BrightPay 2017/18, exported documents and files (e.g. payslips, P30s, reports, pension CSV files, journals, snapshots, etc.) are automatically organised into a separate folder structure for each of your clients by default. (If you don't want this, you can revert back to the previous functionality of exporting all files to a single location in BrightPay Preferences.)

BrightPay Connect

In case you missed it, we launched "BrightPay Cloud" in summer 2016. We have now rebranded this as BrightPay Connect. It works exactly as it has to date, including some further refinements and new features for 2017/18.

We have a detailed web page about BrightPay Connect here. Here's a quick overview of what it's all about:

- BrightPay Connect provides a secure, automated and user-friendly way to backup and restore your payroll data on your PC or Mac to and from the cloud.

- BrightPay Connect provides a web/mobile based self service dashboard for your employees, enabling them to:

- View/download their payslips and other payroll documents

- View their calendar, and make requests for annual leave.

- View and edit their personal details.

- BrightPay Connect provides a web/mobile based self service dashboard for employers and clients of payroll bureaux, enabling them to:

- Access the payroll documents and data for each of their employees.

- View an employer-wide payroll calendar.

- View payroll reports exactly as you have set them up in BrightPay.

- View the schedule of HMRC payments, outstanding amounts, and access the P30 for each tax period.

BrightPay Connect is built for security, reliability and stability, and costs just £49 per employer. Bulk pricing is available for bureaus.

Other 2017/18 Changes in BrightPay

- The foundational technology of BrightPay has been updated to the latest version, which immediately brings many performance, reliability and security improvements (and opens up new possibilities to our development team!). A side effect of this update, however, is that BrightPay 2017/18 cannot be run on Windows XP. We've attempted to make all customers aware of this change several times over the past six months, and our telemetry now shows that less than 1% of our customers still run on Windows XP. So while we do apologise for any inconvenience this causes, with the improvements gained it is unquestionably the best decision for our customers as whole.

- BrightPay 2017/18 will automatically offer to import your BrightPay 2016/17 files on first launch.

- New feature: Piece of Work rates – if you pay (or part pay) your employees by a unit other than salary, the hour or the day, BrightPay now caters for you.

- Additions and deductions can be calculated as a percentage of payslip basic, gross or net pay.

- BrightPay 2017/18 now allows you to adjust the 5.6 weeks statutory holiday weeks entitlement figure for annual leave calculation types.

- Support for Automatic Re-Enrolment.

- Real Time Information – more flexible workflow allows you to come back and check for a response from HMRC for an already sent submission, rather than having to start the submission process over from scratch.

- Expenses and Benefits:

- Company car information is now reported on the FPS submission.

- Vouchers and credit cards can now be payrolled.

- Support for new 'Serious Ill Health Lump Sum' indictor on FPS submission.

- Support for custom hourly/daily rate multipliers.

- Support for starters with no starter declaration.

- Improves how pay dates are entered when finalising payslips – you can now set a different pay date for individual employees if need be. When re-opening and re-finalising payslips, the previously used pay date is remembered.

- Import from Moneysoft 2016/17 (at the time of writing, this supports importing the basic details for employers, employees and subcontractors only).

- Royal London contributions now use a tax monthly based contribution schedule.

- Optimisations to data file size and installation package size.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

Includes all updates to BrightPay 2016/17 since March 2016

While we have traditionally focused our announcements of new features and updates in each new tax year version of BrightPay, it doesn't mean we're not busy during the rest of the year. In 2016/17, we released many updates and enhancements throughout the tax year, all of which are of course included in BrightPay 2017/18. See our release notes for full details. Here's a quick reminder of the main areas of improvement:

- Statutory Minimum Wage flagging and reporting.

- Retroactive Statutory Sick Pay.

- Centralised agent sender credentials and details.

- Support for several new Auto Enrolment scheme providers.

- Ability to disable carry-over of shortfall amount between HMRC pay periods.

- Ability to include employer logo and further customise the layout of Auto Enrolment letters.

- Batch P11 and P60.

- NEST – ability to override contributions schedule dates, validate groups and payment sources, and send payment approval requests

- CIS – ability to import pay records from a CSV file, zeroise payment records and print a tax period summary.

- Mid Year start summary report.

What's Next?

17.0, 17.1, 17.2, 17.X... we're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Mar 2017

9

Spring Budget 2017 - Employer Focus

The main points to be noted by employers from Spring Budget 2017 announced by Chancellor of the Exchequer, Philip Hammond are:

• The personal tax allowance will increase by £500 from £11,000 to £11,500 from 6th April 2017 as previously announced, this is in line with the government's goal to have the personal tax allowance at £12,500 by 2020.

• The Dividend Allowance will decrease by £3,000 from £5,000 to £2,000 from 6th April 2018. This means that there is no tax payable on dividend payments up to £2,000 from April 2018 onwards. Any dividends above this allowance will be taxed at 7.5% for basic-rate taxpayers, 32.5% for higher-rate taxpayers and 38.1% for additional-rate taxpayers.

• There were no changes regarding company car and van charges or fuel charges.

• In the Finance Bill 2017, legislation will be introduced by the government about dates where an employee can make a payment in return for a Benefit in Kind they receive, this can reduce the taxable value of the Benefit in Kind. The 6th of July after the end of that tax year has been decided by the government, so if employees make a payment for the BIK before that date, they can reduce the taxable value of the BIK or remove if payment in full is made. This will be for the 2017-18 tax year and following tax years.

• Termination payments over £30,000 which are subject to income tax currently from April 2018 will be subject to Employer National Insurance Contributions (NICs) The first £30,000 of a termination payment will remain exempt from Income Tax and NICs. In the Finance Bill 2017, the tax treatment of termination payments will be clarified and this will include all contractual and non-contractual payments in lieu of notice taxable as earnings and requiring employers to tax the equivalent of an employee’s basic pay if notice is not worked. The changes, including to Foreign Service Relief, will take effect from 6 April 2018.

• The Money Purchase Annual Allowance to £4,000 will be reduced from April 2017, down from £10,000. This restricts the amount of tax relieved contributions an individual can make in a year into a money purchase pension, if they have flexibly accessed their pension savings.

• The Government is carrying out the first statutory review of State Pension Age and the details will be published in their review by 7th May 2017.

• HMRC's compliance team are monitoring employers that are claiming the Employment Allowance, as it has been reported that some employers are using avoidance schemes to avoid paying National Insurance amounts due.

Feb 2017

14

2017-18 Notice of Coding - P9

Electronic Notification - HMRC will be sending out email notifications from 18th February up until the 5th March to notify employers that P9 coding notices for the tax year 2017-18 are available to view online. HMRC have advised employers to ensure when logging into their online account to ensure they have the correct tax year selected, 2017-18. And also if the notices are not available that day, to leave it 24 hours and log in the next day and the P9s should be available to be viewed.

HMRC have commenced to send out the P9 paper coding notices and employers should expect to receive them up until the 17th March, although some employers may receive this notifications up until 20th March. If for some reason the employer does not receive the paper coding notice before the 6th April 2017, the employer may contact HMRC Employer Helpline on 0300 200 3200 and request a duplicate. Just to note the duplicate will only be made for the full employer PAYE scheme and no individual tax codes will be sent for individual employees. HMRC have advised that the duplicate requests may take up to 14 working days.

Feb 2017

1

Payroll Benefits 2017-18 - Register before 6th April 2017

Employers that wish to payroll benefits in the tax year 2017-18 must register with HM Revenue and Customs (HMRC) using the online Payrolling Benefits in Kind (PBIK) service before 6th April 2017 (if you had not already registered last year). You can register with HMRC using the PBIKs service Payrolling of benefits was introduced from the start of the tax year 2016/17 and will continue for the tax year 2017-18. Employers can account for the tax on benefits provided to employees through PAYE each pay day.

Registering with HMRC allows you to payroll tax on benefits without the need to submit a form P11D after the end of the tax year. P11D(b) returns will still have to be submitted and must include the total values of all payrolled and all non-payrolled benefits.

Using the online service, you can:

• Choose which benefits and expenses you want to include in the payroll for the following tax year

• Add or remove benefits and expenses

• Exclude employees who receive benefits or expenses but don’t want them payrolled. For these employees you must continue to report the benefit or expense on a P11D (you can exclude an employee at any time in a tax year but once you’ve done this you can’t reverse the decision, in year)

The only benefits you won’t be able to payroll are:

• Living accommodation

• Interest free and low interest (beneficial) loans

Tax is collected on benefits and expenses by adding a notional value to your employee’s taxable pay in payroll, tax is then deducted or repaid as usual as per the employee’s tax code. Payrolling Benefit In Kind functionality was incorporated into BrightPay 2016-17 and will continue in BrightPay 2017-18.

For more information about payrolling benefits, make sure to register for our free webinar here.

Oct 2016

20

Cyclical Automatic Enrolment

Cyclical automatic re-enrolment occurs approximately every three years after an employer’s staging date. Essentially cyclical reenrolment is a repeat of the process the employer carried out on their staging date (or deferral date if they used postponement to postpone all their workers at staging).

However there are some key differences between automatic reenrolment and automatic enrolment:

• While both automatic re-enrolment and automatic enrolment apply to eligible jobholders, automatic re-enrolment will only apply to eligible jobholders who have already had an automatic enrolment date with that employer.

• Postponement cannot be used with automatic re-enrolment. If the eligible jobholder criteria are met by a worker on the automatic re-enrolment date, automatic re-enrolment must take place with effect from that date.

Crucially, the employer does not have to assess all their workers to identify if any meet the eligible jobholder criteria. Instead they must assess only the workers who have opted out or voluntarily ceased active membership of a qualifying scheme. The assessment of worker categories carried out on the cyclical automatic reenrolment date is separate to the employer’s usual assessment process, which they run each pay reference period to identify whether automatic enrolment or any information requirements are triggered.

Key points:

• Another declaration of compliance will need to be completed

• 1 date for all staff - if you are eligible you must be enrolled

• Postponement cannot be used

Source: pension regulator

Oct 2016

14

NINOs with prefix 'KC' will be accepted by HMRC from 15th November

National Insurance Numbers had been issued with the prefix of KC by Jobcentre Plus (on behalf of the Department for Work and Pensions). These National Insurance numbers are valid. HMRC had issues with these NINOs with the KC prefix as HMRC has not included the KC prefix as a valid prefix on their list of valid prefixes to software developers. So HMRC's systems did not recognise the prefix KC and most payroll software did not recognise it either. But from 15 November 2016, as advised by HMRC, employers will be able to submit RTI data to HMRC for employees using this NINO prefix.

Some software products, including HMRC’s Basic PAYE Tools, may not be updated before April 2017. If this applies to you then you should continue to follow this guidance when submitting your returns:

• Do not enter the NINO for the employee - this field should be left empty

• The employee's address has to be entered, the first two lines are the minimum requirement

• You do not need to request a new NINO as the NINO with the KC prefix is valid.

Sep 2016

11

Student Loans - which Plan type to use?

On 6th April 2016, a new plan type for student loans was introduced by HMRC. Employers should now be deducting student loan repayments from their employees using either Plan 1 or Plan 2.

A query that regularly comes into our BrightPay Helpdesk is 'How do I know which plan type to use?'

HMRC provide the following guidance on how you can determine an employee’s student loan plan type:

- check the Student Loan Start Notice (SL1)

- ask your new employee to fill in the starter declaration checklist

- ask your employee to go online to the Student Loan Company website at www.slc.co.uk/students/loan-repayment.aspx – if they do not know their plan type already.

HMRC also advise that if you receive an SL1 with a start date prior to 6 April 2016 and there is no plan type shown, you should make deductions under Plan 1.

Generic notifications have been sent by HMRC to those employers who haven’t reported any student loan deductions for a specific employee, but for whom deductions are expected. Where two generic notifications have been sent to an employer already, HMRC will begin contacting such employers to discuss the matter further.

Sep 2016

11

Payrolling Benefits in Kind 2017-18

HMRC requires an employer to register in order for them to process benefit in kind through the payroll. If you are planning on processing the benefit in kind through the payroll for 2017-18 you can register now and up to 5th April 2017. But HMRC are advising employers that it would be best to register before the 21st December, when the annual tax coding process normally starts, in order to avoid being sent several tax codes for employees with payrolled benefit in kinds.

Employers who wish to process benefits in kind through the payroll must ensure they are registered with HMRC for real time information. Employers can register for payrolling of benefits using their government gateway ID to login. Currently agents cannot use this registration service for payrolling of benefits but HMRC will develop this option at a later stage.

Employers must select the benefits that will be processed in the payroll for their employees for the whole tax year. If a benefit is not selected by the employer but is processed through the payroll the employer must report these benefits on a P11D. Benefits may be added or the original application can be changed by the employer if an error was made. Normally the selection of benefits, if no changes were made, would automatically be carried forward to the next tax year.