Jan 2022

5

Take the repetitiveness out of payroll

Each pay period, many busy payroll bureau managers find themselves having to input the same payroll data into both their accounting and payroll software. And while the repetitiveness of these tasks might not be in the same bracket as Greek mythological figure Sisyphus, the process can still be quite monotonous. If you haven’t heard of him, Sisyphus was a badly-behaved king who endured a unique punishment. Judged harshly by the gods, he was doomed to push a large rock up a steep hill, only to find it rolling back on nearing the top. Cruelly he was damned to repeat this task for all eternity.

Without integrated systems, you will find yourself entering payroll data repeatedly because the information needs to be in both the payroll and accountancy software. Having to repeat data entry tasks is a negative drain on time, and it also means the payroll will be more prone to human error. Luckily, the evolution of payroll software is not a myth, and technology now exists to reduce this type of endless payroll data entry.

Accounting software integrations rescuing your time

BrightPay Payroll Software’s Application Programming Interface (API) integration feature allows it to easily communicate with and directly send the payroll journal to eleven different accounting packages, including QuickBooks, Sage, Xero and FreeAgent. Because BrightPay’s payroll journals can match all the file formats used by the accounting packages, the need for double entry of information is eliminated. This means there is less chance of errors that can crop up during duplication, which also omits the need to log errors on the payroll diary.

What can you do to improve your #payroll services and how you deliver them?

— BrightPay UK (@BrightPayUK) December 14, 2021

1??Where can you save time?

2??How can you improve client communications?

3??How can you become more profitable?

Register for this upcoming webinar to find out more: https://t.co/DyS5MXDiGt pic.twitter.com/vEKoRPVskP

More BrightPay APIs equals better workflows

BrightPay also has APIs that cater for a quicker pension contribution process. Through BrightPay, you have the ability to send pension-related files in one simple click to the relevant pension systems, removing repetitive data entry and saving you valuable time. BrightPay has direct API integration with pension providers NEST, The People’s Pension, Smart Pension and Aviva.

One of our newest integrations is with payment platform, Modulr, allowing you to pay employees directly through the payroll software. This means you no longer need to create bank files as all the pay information is sent straight to Modulr. All you need to do is set up a Modulr accounts, go in and approve the payments, and employees can be paid in minutes.

Eternal workflow efficiency instead of endless graft

Payroll integration technology now exists that simplifies the potentially burdensome task of sharing payroll journals, pension files and bank files. Because BrightPay’s APIs ensure easy communication with those software solutions, payroll staff need no longer be subject to eternal repetition of routine tasks.

Book an online demo today to find out more about how BrightPay’s integrations can help you.

Nov 2021

26

The must-have integration for Xero customers

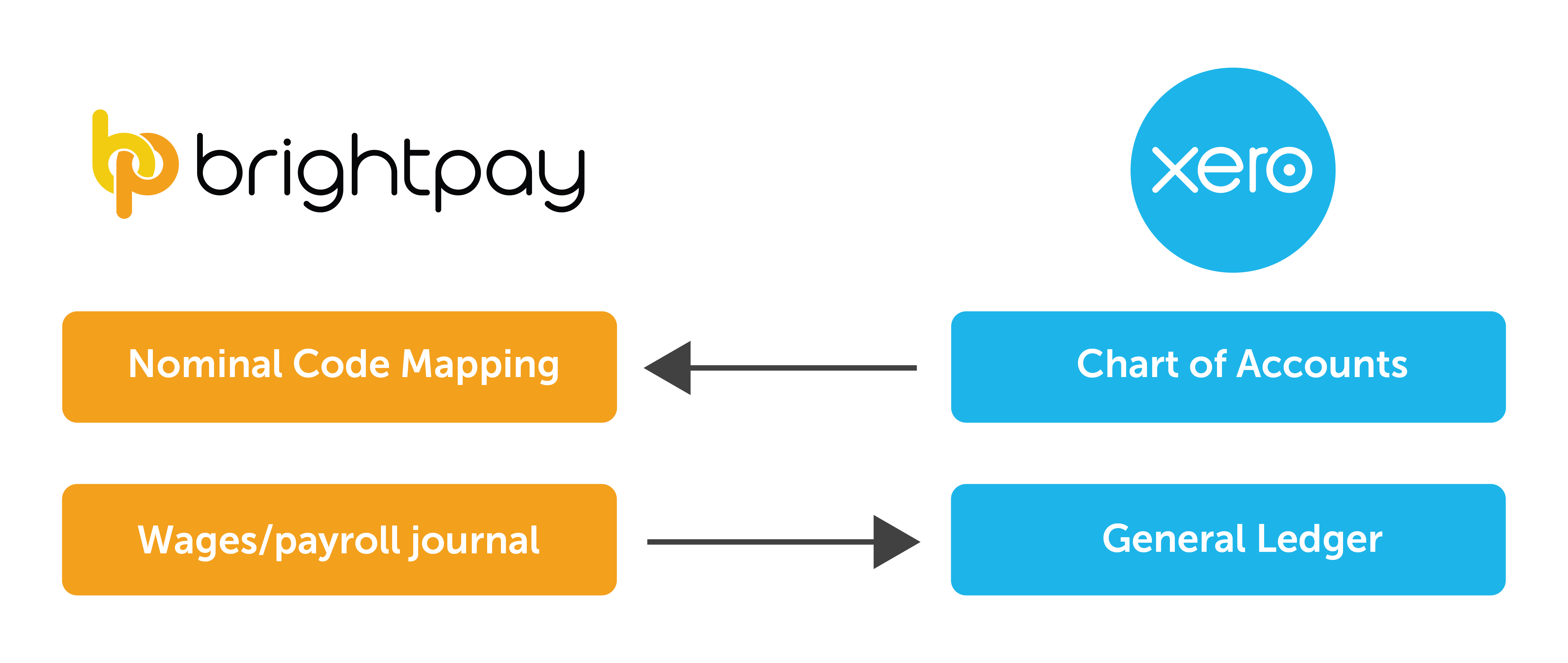

Customers of Xero accounting software now have the option of integrating their accounting package with their payroll software. With BrightPay payroll software, Xero customers can make use of an API (Application Programme Interface) to send their payroll journal directly from BrightPay to their general ledger in Xero. This straight-forward integration saves time, increases efficiency and make the payroll workflow that much smoother. A free trial of BrightPay is available to Xero customers through Xero’s marketplace.

The importance of integrating your accounting software:

As your business grows, so too do the number of financial tools you need to successfully manage your employees, operations, and customers. The amount of software you need, can at times, be overwhelming, confusing, and inadvertently result in time being wasted.

API integrations have become increasingly popular because, aside from their obvious benefit of saving you time, they also mitigate the risk of mistakes, reduce administrative tasks, and free you up, allowing you to focus on other responsibilities.

Save time:

With your payroll system communicating directly with your accounting software, you no longer need to spend time on the tedious task of manually exporting, importing, and entering figures multiple times. Instead, you can send payroll information to the correct account with just a click of a button.

Reduce data entry and errors:

Double entry of figures is well known for producing errors. By using the API, you will be able to send payroll information quickly and reliably, without the chance of human error. Nor will you have to spend time searching for errors and correcting them.

Improve efficiency:

With the API integration, you can benefit from a quicker and smoother workflow. Once the initial set-up is complete, you can begin sending your payroll information to the relevant ledgers. Where there are circumstances for which payroll figures should be mapped to an alternative nominal account, you can set these up as exceptions.

How does the BrightPay and Xero integration work?

An Application Programming Interface is a software intermediary that allows two applications to talk to each other. It helps to make communication between the two applications faster.

- When you sign into your Xero account in BrightPay, your nominal ledger accounts will be retrieved from Xero.

- Then, you map each payroll data item to the relevant nominal accounts.

- The payroll journal can include records for payslips across multiple pay frequencies and a nominal account can be used for multiple items.

- Learn more about how the integration works here.

What other integrations does BrightPay offer?

Along with Xero, BrightPay includes payroll journal API integration with several other accounting packages, such as Sage, QuickBooks Online, FreeAgent, and AccountsIQ. This is not the only integration BrightPay offers. The payroll software also includes integrations with various pension providers which helps make submitting pension files and carrying out auto-enrolment easier and quicker. Users of the software have direct API integration with NEST, The People’s Pension, Smart Pension, and Aviva.

Learn more:

If you’re interested in learning how BrightPay can improve your payroll services and save you time, schedule a 15-minute demo with a member of our team today. Or, to try the software for yourself, download your free 60 day trial today.

Related Articles:

Oct 2020

22

BrightPay announces API integration with AccountsIQ

Processing the payroll for your client’s employees and calculating payroll taxes accurately and on time are two of the most important tasks for payroll bureaus and accountants. That's why we have created this new webinar:

Payroll in the Connect Era: How integration has transformed the world of payroll

Thursday 5th November 11am

What you'll learn:

- The Importance of Automation

- What is Payroll Journal Integration?

- How BrightPay’s Accounts Software Integration can help

- The Benefits of Integrated Payroll & Accounting Systems

- API Integration in BrightPay

Tracking payroll figures in accounting systems is also equally important. In the past adding payroll journals was a manual process of exporting a CSV file from the payroll software, mapping the nominal codes and uploading them into AccountsIQ.

Without API integration between payroll and accounting systems, payroll journal information would need to be entered manually into the accounting system, which can result in errors and duplication of efforts. You may also need to make journal entries to fix mistakes. In order for this information to be included in financial statements efficiently, the payroll and accounting system should ideally be integrated through an API facility.

Payroll and accounting integration between BrightPay and AccountsIQ is a critical part of the payroll reporting process. BrightPay have now added an API payroll journal feature allowing users to create wage journals from finalised pay periods so that they can be added into AccountsIQ.

How the BrightPay & AccountsIQ integration works

BrightPay produces the payroll journal in a file format that is unique to AccountsIQ allowing users to easily upload their payroll figures into their general ledger in just a few clicks.

Once you have entered your AccountsIQ login credentials, BrightPay will automatically retrieve your nominal ledger accounts so that you can easily map each payroll data item to the relevant nominal account. The nominal ledger mapping is then saved for an even speedier process going forward. The payroll journal can include records for payslips across multiple pay frequencies. Users then have the option to include individual records for each employee or merge the records for each unique date. A nominal account can be used for multiple items.

What are the benefits of BrightPay’s API integration with AccountsIQ

Some accounting programs come with payroll modules that are fully integrated from the outset. However, the payroll module can be expensive, outdated or/and lack basic automation features. BrightPay and AccountsIQ are multi-award winning software systems that increase efficiency, avoid duplication of efforts and reduce the possibility of manual processing errors. The accuracy and automation of this wage journal API will help to ensure that your books and your payroll journal match up. This can be a critical part of both payroll and accounting. Click here for more information about AccountsIQ.

Webinar: Payroll in the Connect Era: How integration has transformed the world of payroll

To find out more about how you could benefit from the BrightPay and AccountsIQ integration register for the webinar now.

Thursday 5th November - 11am

In today’s technology-driven world, how well a business performs – whether it succeeds or fails – is increasingly dependent on how well it connects applications and integrates systems. That’s why BrightPay and AccountsIQ have teamed up, making it easier to keep your payroll and accounting systems aligned. Join BrightPay & AccountsIQ on Thursday 5th November to discover how you can streamline your payroll and accounting processes. Register today.

Related articles:

Step by step guide to BrightPay & AccountsIQ integration

Find out more about the BrightPay & AccountsIQ integration

Press Release: Accounts IQ partners with BrightPay

Sep 2020

4

What’s not to LOVE about BrightPay’s integration with FreeAgent

Together with FreeAgent, we’ve built a meaningful API integration to make payroll refreshingly easy while keeping your accounting simple. BrightPay produces the payroll journal in a file format that is unique to FreeAgent. Users can easily upload their payroll figures into their general ledger from within BrightPay using the FreeAgent API facility.

Connecting accounting and payroll means dead-simple reconciliation and consolidated journal entries, a much needed combination. This means each time you run payroll, a wage journal entry is created to send to your FreeAgent system. The BrightPay API facility eliminates the manual export and import process, automating tedious, repetitive and time-consuming tasks.

How does it work?

When you sign into your FreeAgent account in BrightPay, your nominal ledger accounts will be retrieved where users can simply map each payroll data item to the relevant nominal account. The payroll journal can include records for payslips across multiple pay frequencies. Users can include individual records for each employee or merge the records for each unique date.

Payroll Journal API integration with FreeAgent offers:

- Time Savings: Rather than manually inputting payroll data from one system to another, just import your wage journal straight into FreeAgent with a couple of clicks.

- Automation: Every bureau and accountant wants and needs an automated system these days. The automation of BrightPay’s API facility will easily input payroll journal files straight into FreeAgent streamlining the payroll process even further.

- Reduced Errors: BrightPay’s API facility will drastically reduce the chance of errors that could potentially be caused by manual data entry and time spent correcting those errors.

Step by step guide to BrightPay & FreeAgent integration

Find out more about the BrightPay & FreeAgent integration

Nov 2016

11

Making Tax Digital – How agents can prepare their business

Our good friends and tax software specialists, BTCSoftware, have been closely following the developments of HMRC’s Making Tax Digital programme. They have put together a handy overview which gives some background to the initiative, in particular Agent Services.

Agent Services encompasses the way accountants and tax advisers will be identified and authorised on HMRC’s systems to access client tax data and use other information facilities.

The guide is co-authored with accountingweb and also gives advice on how agents can prepare their practice and their clients for MTD’s arrival.

You can download a free copy here.