Saving Reports

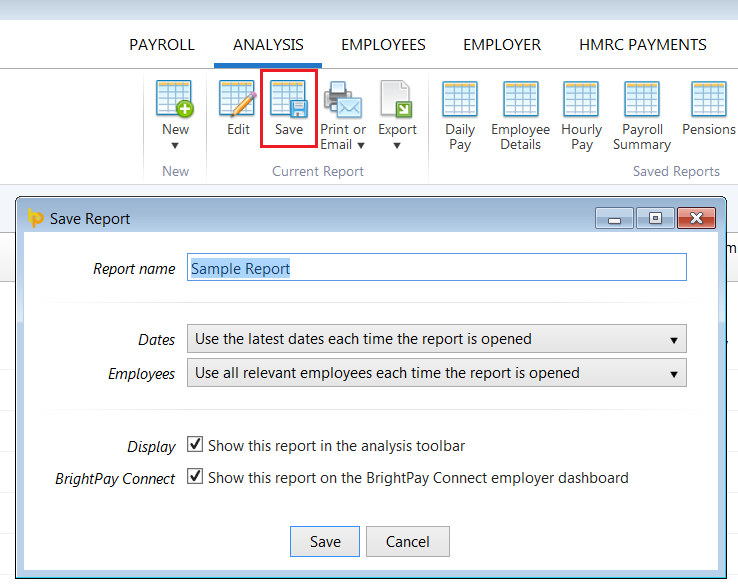

If you would like to save a report you have generated, simply select 'Save' on the menu toolbar:

1) Type in a 'Report Name' of your choice.

2) Select whether you wish the program to automatically use the latest dates each time the report is opened or to save and use the exact dates you have specified.

3) Likewise, select whether you wish the program to automatically select all relevant employees each time the report is opened or to save and use the exact employees you have selected yourself.

4) Should you wish to save the report to the analysis toolbar for future use, tick the box provided.

5) If you are using BrightPay Connect and wish to show the report on your BrightPay Connect employer dashboard, also tick the box provided.

6) Click 'Save' to save the report.

Please note: Once reports have been saved, these can be managed at any time using the ‘Manage Reports’ option on the menu toolbar. This facility provides the option to indicate where you would like the report to show and to delete any reports no longer needed.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.