Apprenticeship Levy

The Apprenticeship Levy is payable by employers with an annual pay bill in excess of £3,000,000 and is used to fund new apprenticeships.

NB: Please refer to HMRC's guidance (particularly if you are part of a group).

Your annual pay bill is all payments to employees that are subject to employer Class 1 secondary National Insurance contributions such as wages, bonuses and commissions.

This includes payments to:

- all employees earning below the Lower Earnings Limit and the Secondary Threshold

- employees under the age of 21

- apprentices under the age of 25

However, does not include earnings:

- of employees under the age of 16

- of employees who are not subject to UK National Insurance contributions legislation

- on which Class 1A National Insurance contributions are payable, such as benefits in kind

Employers are given an Apprenticeship Levy allowance of £15,000 each year.

This allowance reduces the amount of Apprenticeship Levy an employer has to pay by £15,000 across the year. This therefore means that only employers with an annual pay bill of more than £3 million will pay the levy.

Apprenticeship Levy is charged at 0.5% of your annual pay bill.

Other Key Points:

- Employers cannot carry over any unused allowance into the next tax year.

- Connected companies or charities have only one £15,000 allowance to share between them.

- If an employer starts or stops being an employer part-way through the tax year, they can use their full annual Apprenticeship Levy allowance against the amount of the levy they owe.

- Once you have started paying the Apprenticeship Levy, you’ll need to continue reporting it until the end of the tax year even if your annual pay bill turns out to be less than £3 million.

-

The Apprenticeship Levy is reported each month via your Employer Payment Summary (EPS). There is no requirement to report Apprenticeship Levy on your EPS if you have not had to pay it in the current tax year.

- The Apprenticeship Levy is payable each month in the same way you pay PAYE and National Insurance contributions. If you’ve overpaid Apprenticeship Levy during the year, you’ll receive a refund as a PAYE credit.

- Employers must keep records of any information used to calculate the levy for at least 3 years after tax year it relates to.

Enabling the Apprenticeship Levy in BrightPay

- Choose HMRC Payments

- Choose the agreed payment frequency between you and HMRC, monthly or quarterly, if not already done

- Under NIC, you will see the option for Apprenticeship Levy

- To enable the levy, select Enable

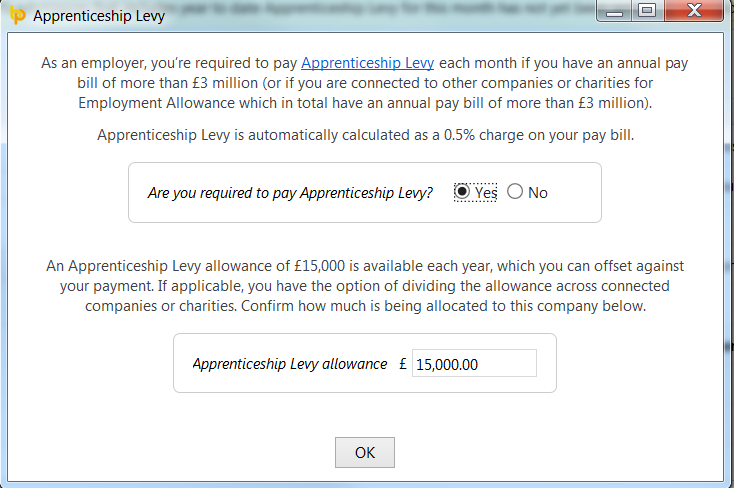

- Confirm you are required to pay the Apprenticeship Levy and the value of the Apprenticeship Levy allowance allocated to this company

- Click OK

Reporting your Apprenticeship Levy to HMRC

You must report the following each month to HMRC via an Employer Payment Summary (EPS):

- The amount of the annual Apprenticeship Levy allowance you’ve allocated to that PAYE scheme

- The amount of Apprenticeship Levy you owe to date in the current tax year

BrightPay will automatically calculate the amount of Apprenticeship Levy due each tax period by calculating 0.5% of the pay bill less the year to date Apprenticeship Levy Allowance. This amount will be reflected in the HMRC Payments utility and will be reported on the Employer Payment Summary (EPS).

Please note: you don’t need to report Apprenticeship Levy on your EPS if you haven’t had to pay it in the current tax year.

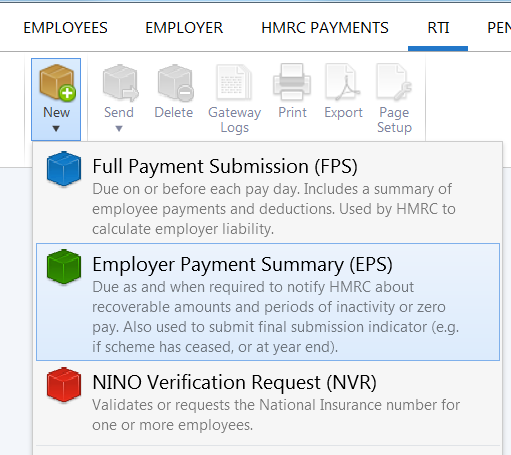

1) Select 'RTI' on the menu bar

2) Click New on the menu toolbar and select Employer Payment Summary (EPS):

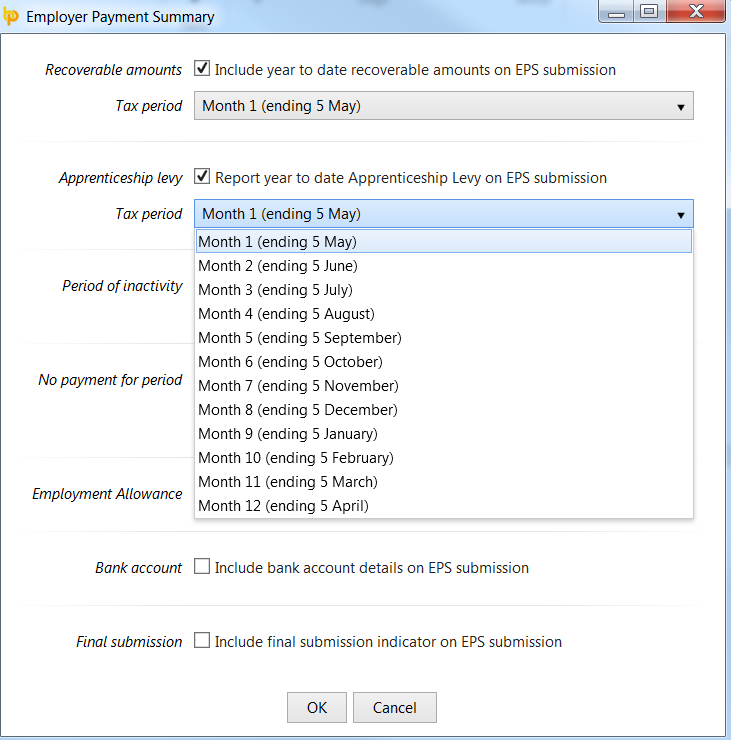

3) Ensure the 'Apprenticeship Levy' marker is ticked

4) Select the applicable Tax period from the drop down menu

5) Click 'OK' and submit to HMRC, when ready.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.