Directors' NIC

There are two possible methods of calculating Director's NIC:

- Annual Basis

- Pro-Rata Basis (Alternate Basis)

BrightPay facilitates both of these calculation methods. The user desired method of calculating NIC must be indicated at the first pay period for the Director and cannot be changed thereafter.

Annual Basis

HMRC guidelines advise that the Annual Basis is the preferred method for calculating Directors' NIC.

The Annual Basis assigns the NIC thresholds of LEL, PT, ST and UEL on an annual/ cumulative basis. This means that in week one, for example, the thresholds assigned to the calculation of the NIC for that week will be:

- LEL: £6,136

- PT: £8,632

- ST: £8,632

- UEL: £50,000

Thus, the annual thresholds are assigned in total and the NIC is calculated on a constant cumulative basis:

- calculate NIC's on the total earnings paid to the director each time a payment is made

- deduct the NIC's already paid, if any, to arrive at the amount of NIC's now due

This method differs to the normal calculation of NIC for a non-director employee which, in week one, would only assign the weekly thresholds of:

- LEL: £118

- PT: £166

- ST: £166

- UEL: £962

Pro-Rata Basis (Alternate Basis)

Since 6 April 1999, HMRC have operated alternative arrangements for the assessment and payment of NICs for company directors.

Under Regulation 8 of the Social Security (Contributions) Regulations 2001, the earnings period for the assessment of directors’ NICs remains an annual one. However, subject to the qualifying conditions below, you can, if you wish, make payments on account of directors’ NICs during the tax year based on the actual intervals of payment – usually weekly or monthly – in the same way as for other employees.

Qualifying Conditions

You will be able to take advantage of this arrangement if:

- the director agrees to NICs being assessed in this way

- the director normally receives his earnings in a payment pattern for which a regular earnings period can be established for the assessment of NICs,

- and those payments normally exceed the LEL for the pay period concerned

Under the Pro-Rata Basis (Alternate Basis), when the final payment of the director’s earnings in the tax year (or directorship) is being made, you must then:

- reassess the NICs due on the director’s total earnings for the tax year on the basis of an annual (or pro rata annual) earnings period, as appropriate.

Please note: HMRC guidelines state that this method can lead to disproportionate amounts of NIC being payable at year end.

This method differs to the Annual Basis in that it assigns the periodic LEL, PT, ST and UEL to each periodic wage/ salary in the same manner as the NIC calculation for a non-Director employee. Therefore on a weekly basis, the following NI thresholds are assigned:

- LEL: £118

- ST: £166

- PT: £166

- UEL: £962

Please refer to the HMRC guideline booklet 'CA44: National Insurance for Directors' for further information

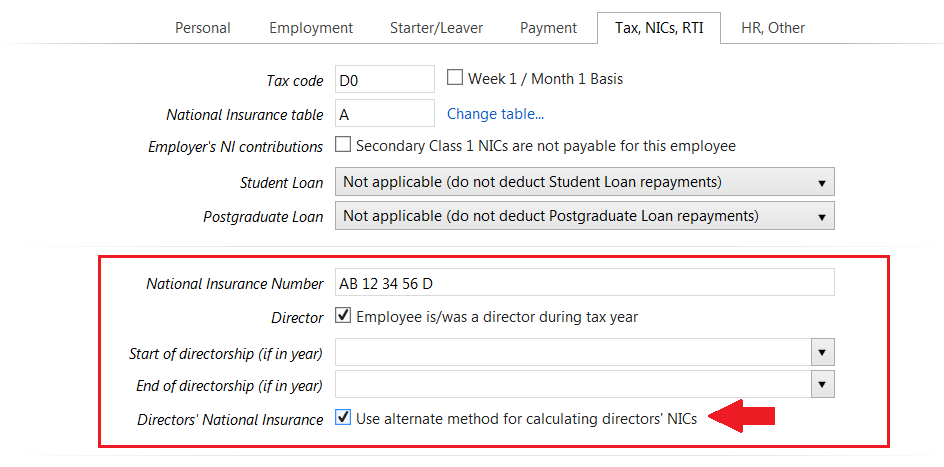

Applying the Pro-Rata Basis in BrightPay

By default, the payroll system will automatically apply the Annual Basis for NIC calculation for Directors, as this is the preferred method of calculation by HMRC.

To apply the pro-rata basis, click Employee:

1) Select the Director from the employee listing

2) Within their record, select the Tax/NICs/RTI section

3) Under the National Insurance Number, tick to indicate that the employee is a director

4) For Director's National Insurance, tick to 'Use alternate method for calculating directors' NICs'

5) Click Save Changes

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.