Setting Up a Director

Director's NIC

By default, BrightPay will automatically apply the Annual Basis for NIC calculation for Directors, as this is the preferred method of collection by HMRC.

This means the Director will not start to pay employee NIC until they reach the PT (primary threshold) of £12,570. For more information on Directors' NICs and the alternate way to calculate NICs for directors, please see the help section on Directors' NIC which you can access here.

Setting Up A Director in BrightPay

To set up an employee as a director, click 'Employees':

1) Select the Employee from the employee listing, or if it is a new employee choose 'New employee'

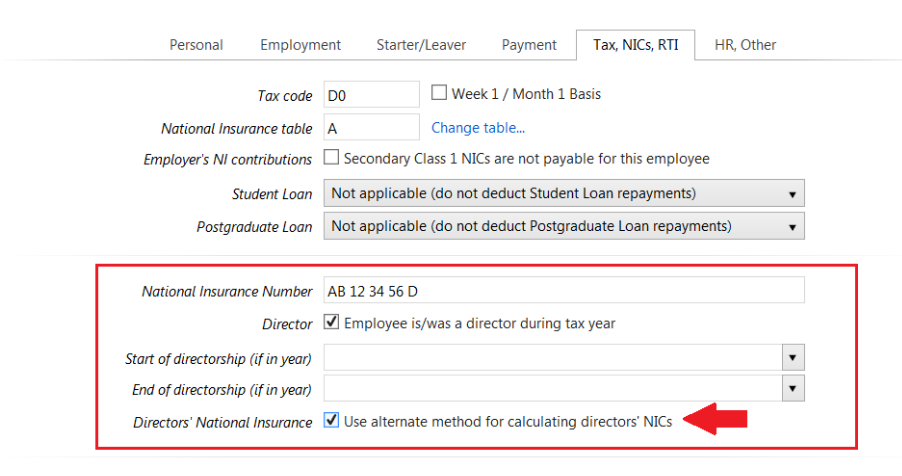

2) Within the employee record, select their 'Tax/NICs/RTI' section

3) Tick to indicate that the employee is a director

4) Start/End of Directorship - If the director starts/ends their directorship during the tax year, enter these dates accordingly

5) Should you wish to apply the Pro-Rata basis for calculation of the Director's NIC as opposed to Annual Basis, tick 'Use alternate method for calculating directors' NICs'

6) Click 'Save Changes'

Need help? Support is available at 0345 9390019 or [email protected].