Printing Payslips

After finalising the pay period, simply click the ‘Print Payslips’ button within the 'Payroll' function.

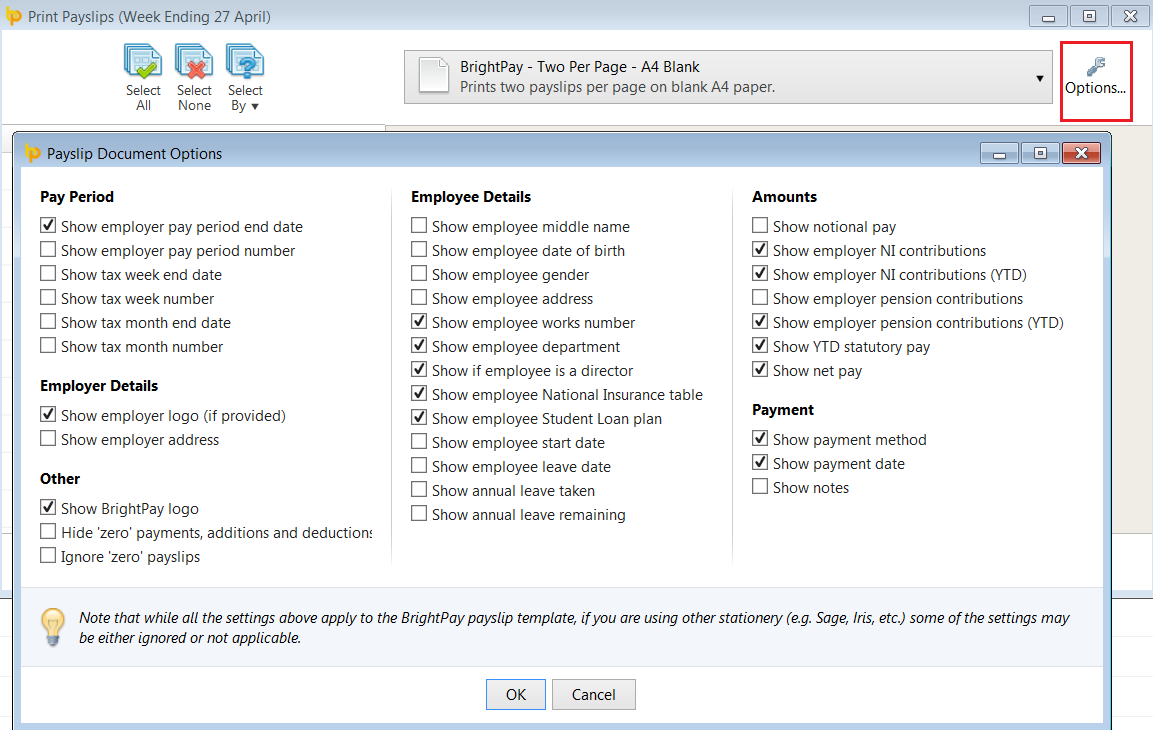

1) On the left hand side select the employees for whom you wish to print payslips. Several options for selecting which payslips to print are available by clicking the ‘Select By’ button.

2) Next, select your payslip design from the drop down menu.

3) To further customise your payslips before printing, click the ‘Options’ button on the right hand side. This facility allows you to add or remove certain information on the payslip, for example to add a company logo or an employer address.

4) To preview the payslips before printing, simply select ‘Print Preview’.

5) Select ‘Print’ when ready.

6) Once printed, you will see the date and time they were printed automatically populated under "Last Printed".

7) Payslips can be reprinted at any time.

Additional Information

BrightPay allows for specific period payments, daily payments, hourly payments, piece payments, additions and deductions to be given a custom description to appear on a printed payslip, if required.

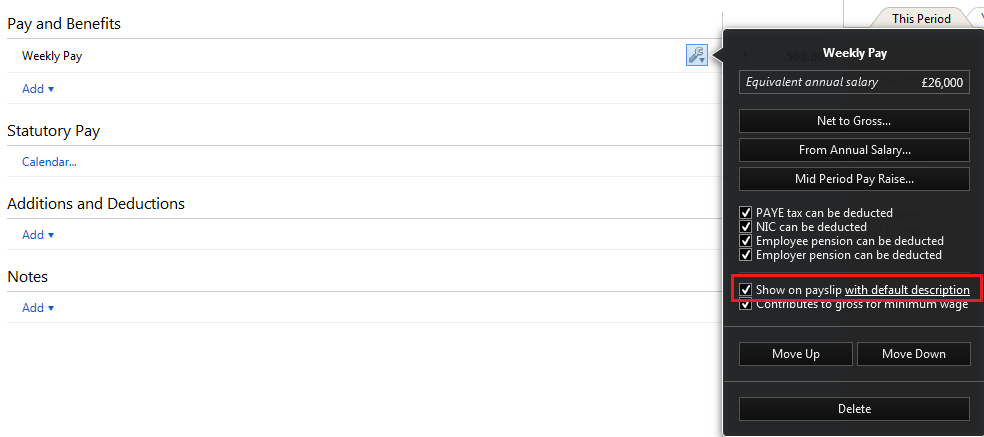

- To set a customised description, before finalising a payslip, click the spanner symbol for the pay item in question, followed by 'show on payslip with default description':

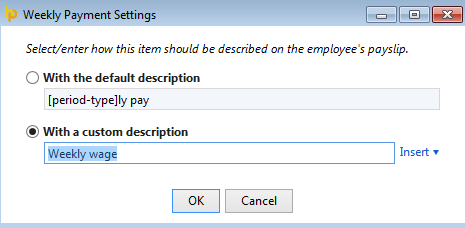

- Enter the desired description and click 'OK':

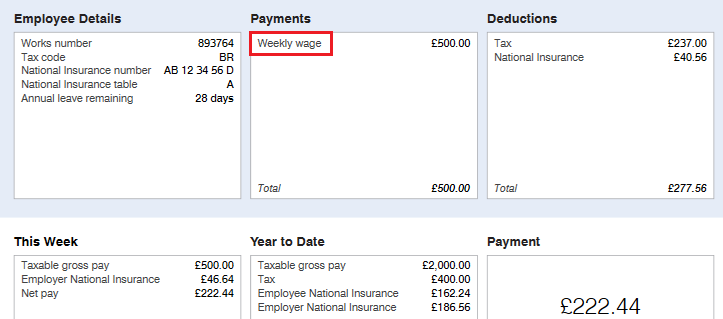

- On finalising the pay period, the employee's printed payslip will now reflect the customised description:

Please note: the customised payslip description will hold going forward until such time the user removes it.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.