Employment Allowance

Since 6 April 2020, Employment Allowance operates as de minimis state aid.

It is available to all employers who meet the secondary Class 1 NICs’ eligibility criteria (see below), provided they have space in their relevant de minimis state aid limit(s) to accommodate the annual amount of the employment allowance, regardless of whether they would have that level of secondary Class 1 NIC liability.

NB: Please ensure that you meet the eligibility criteria (particularly if you are part of a group). See HMRC's guidance.

The key eligibility rules which employers must check to establish if they are eligible to claim the employment allowance are:

- An employer can only claim the Employment Allowance for the tax year if their total (secondary) Class 1 National Insurance contributions is below the threshold of £100,000 in the previous tax year

- An employer cannot claim the allowance for deemed payments of employment income, as they are not included in the total cost of up to £100,000 for employers’ (secondary) Class 1 National Insurance contributions.

- In the tax year before you claim, if there is more than one payroll or connected companies, the employer will need to add the total liabilities for employers’ (secondary) Class 1 National Insurance contributions for all payrolls or companies and only if the total liability is under £100,000 can one payroll or company claim the Employment Allowance

- An employer must check that they will not exceed the de minimis state aid threshold, if applicable, as the Employment Allowance will be included as this type of aid. De minimis state aid rules apply to an employer if their business engages in providing goods or services to the market.

For further and more comprehensive information on the eligibility criteria, please consult HMRC's guidance which can be accessed here

The Employment Allowance for tax year 2021-22 is £4,000.

Important Information

Since tax year 2020-21, employers are required to re-check their eligibility for Employment Allowance and submit a new claim to HMRC each tax year.

The method of claiming through the Employer Payment Summary however remains the same (see instructions below).

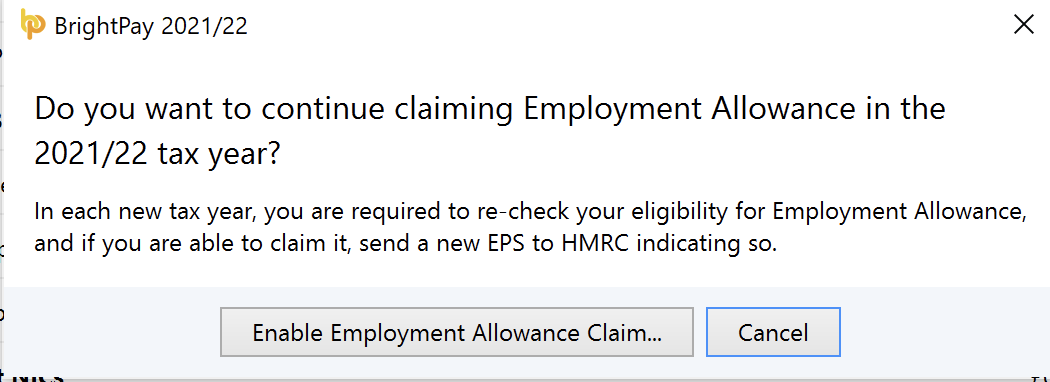

Where an employer is imported from 20-21 BrightPay in which employment allowance was enabled, 21-22 BrightPay will bring the above to your attention when you first access the 'HMRC Payments' utility:

Claiming the Employment Allowance in BrightPay

If you establish that you are eligible to claim the employment allowance in tax year 21-22, you will need to submit an Employer Payment Summary (EPS) submission via RTI, to notify HMRC that you are claiming the employment allowance.

To prepare an EPS for submission you must first set up your HMRC Payments schedule.

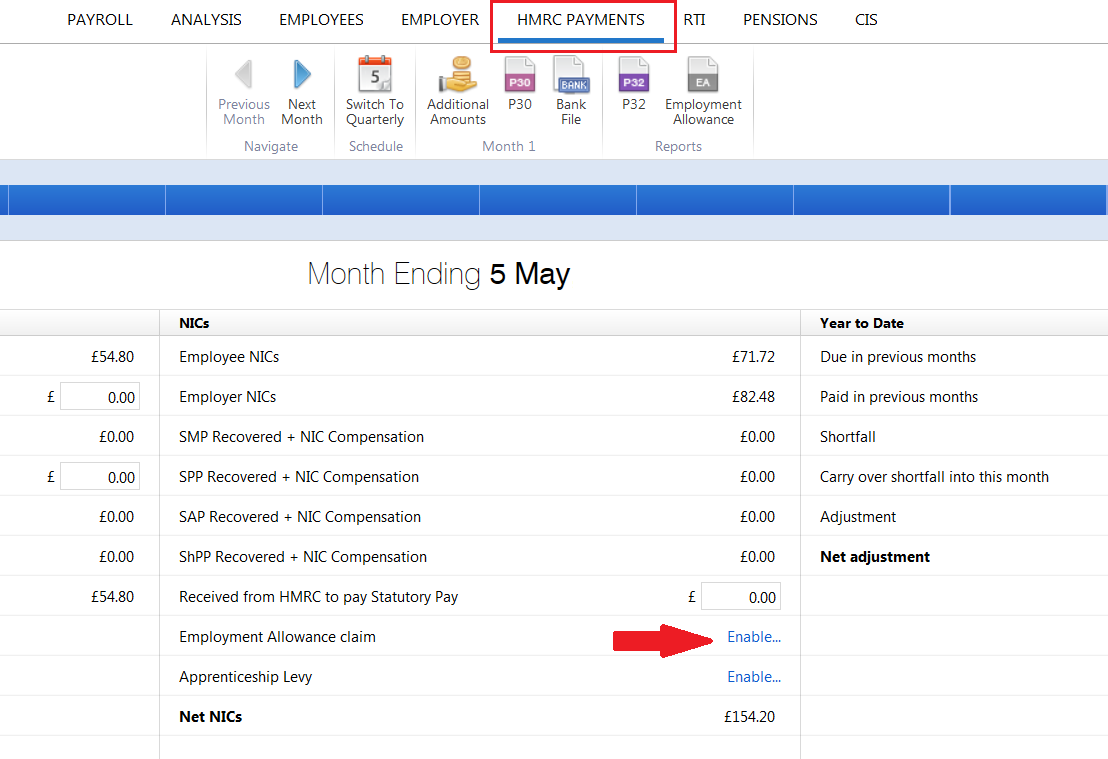

- Choose HMRC Payments

- Choose the agreed payment frequency between you and HMRC, monthly or quarterly

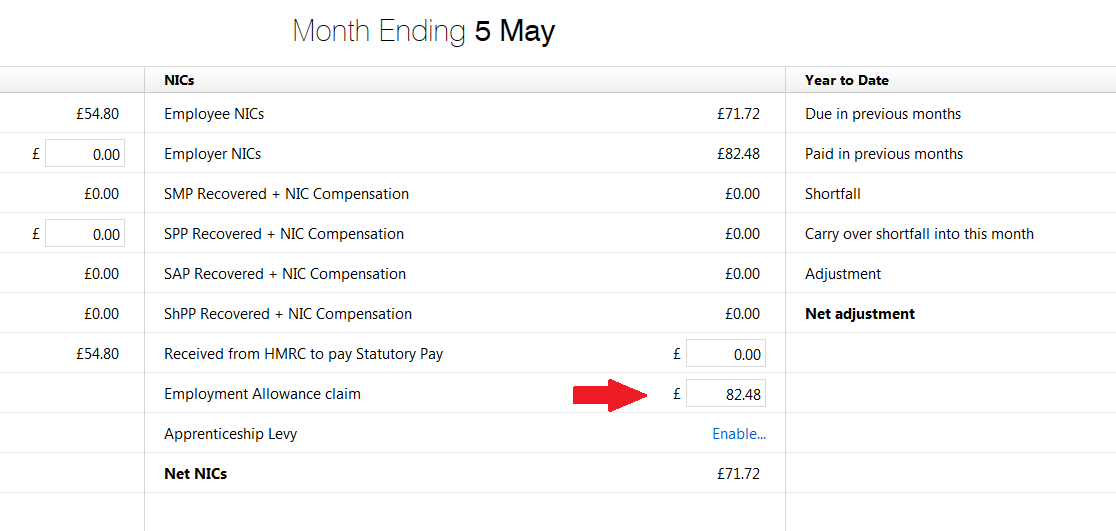

- Under NIC, you will find the option for Employment Allowance Claim

- To claim the Employment Allowance, select Enable

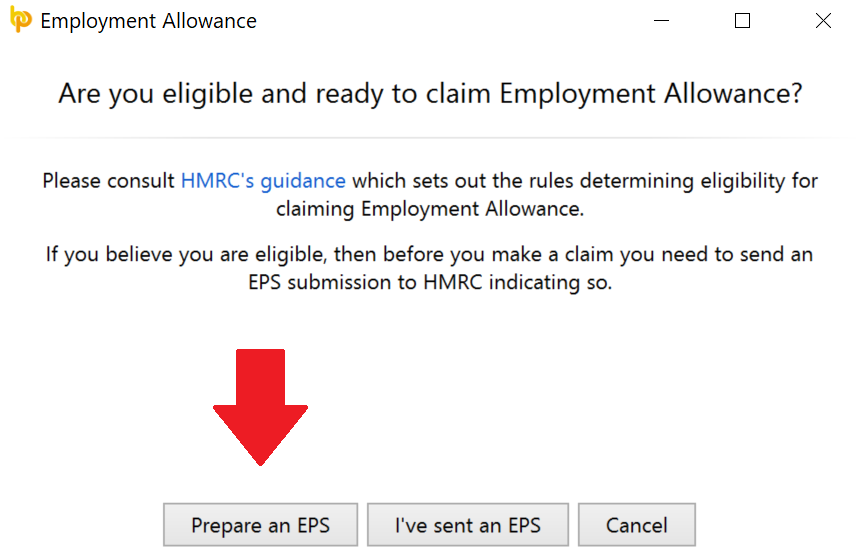

- The claim for the Employment Allowance is made via an EPS. Simply click Prepare an EPS:

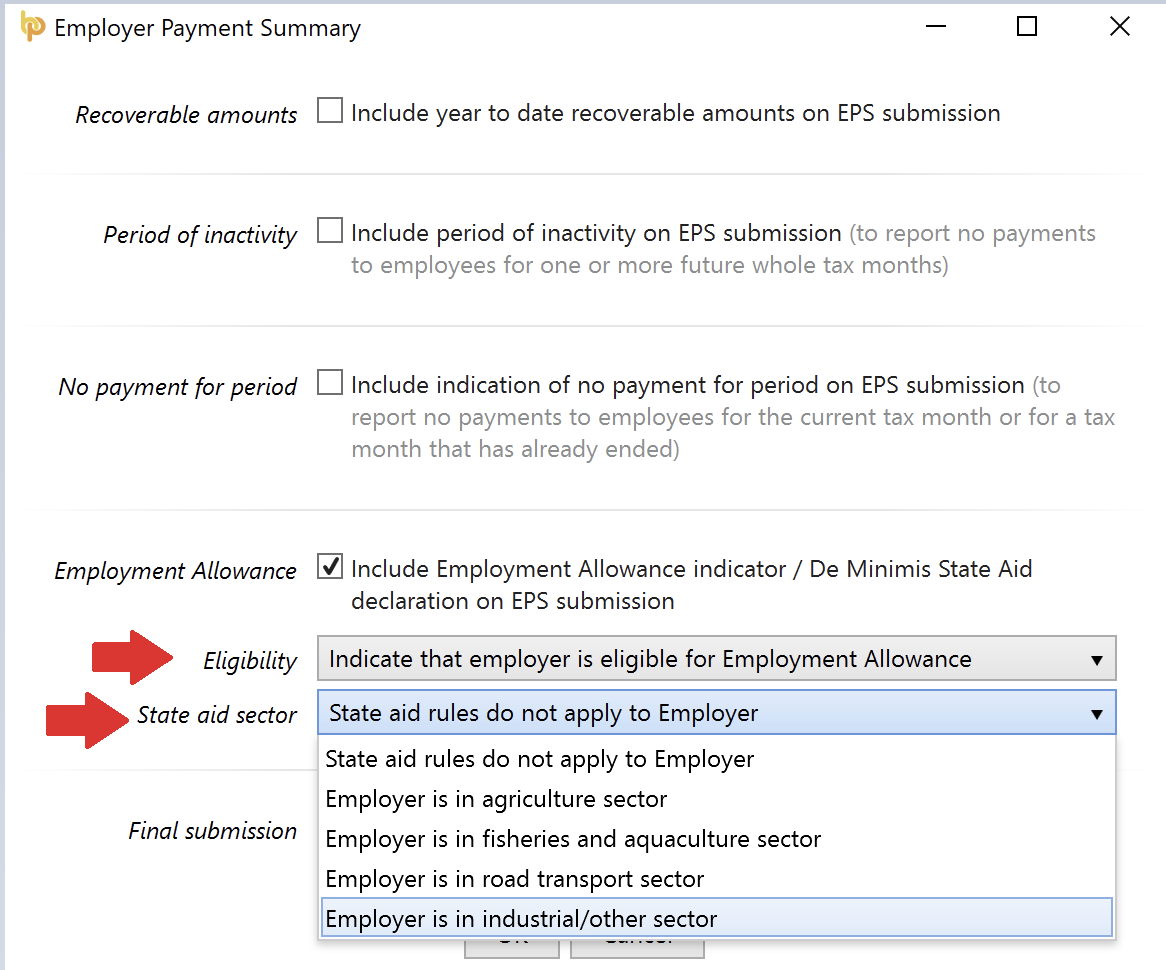

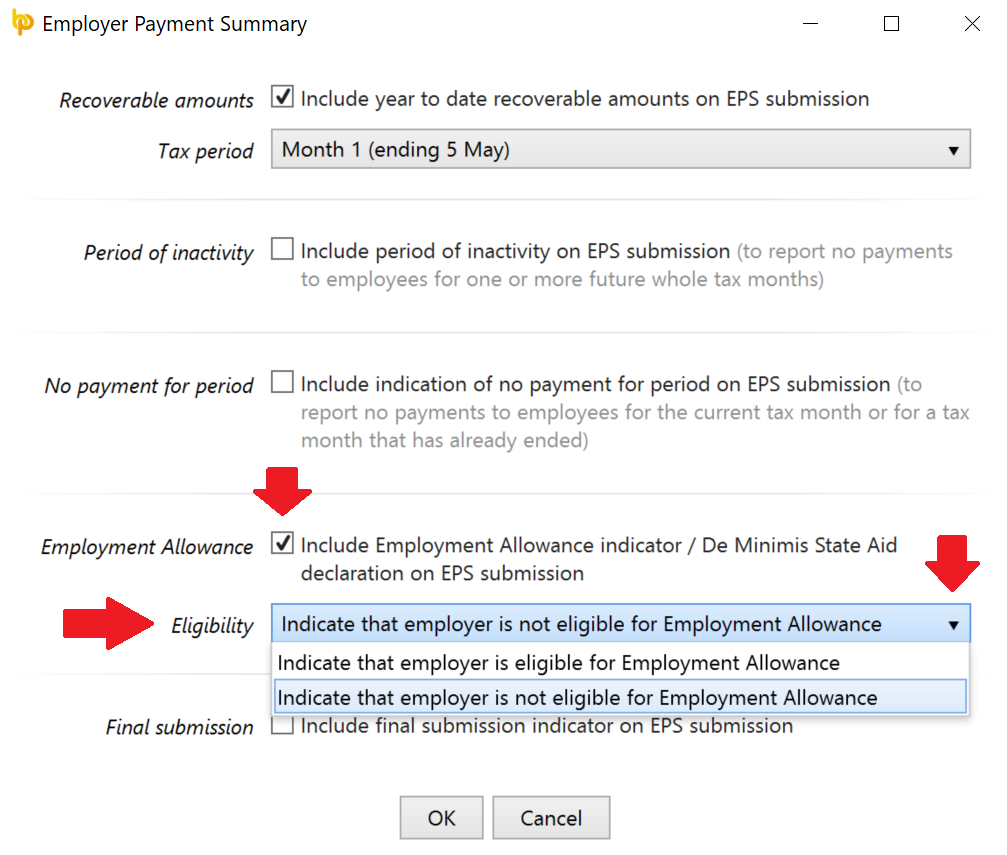

- The Employment Allowance section on the Employer Payment Summary will now be available for you to complete.

a) Under Eligibility, indicate that the employer is eligible for Employment Allowance

b) Under State aid sector, choose the sector that applies to you, noting the following HMRC guidance:

When claiming Employment Allowance, you must provide your business sector on your EPS if your business is undertaking ‘economic activity’ – this will apply to most businesses.

The business sectors to choose from are: - Agriculture

- Aquaculture & Fisheries

- Road Transport

- Industrial / Other (this sector should be selected if the business is undertaking economic activity and is not within 1-3 above)

- Only choose ‘State aid rules do not apply’ on your EPS when your business does not undertake any economic activity.

- Click OK to submit to HMRC.

- Once the EPS has been submitted and accepted by HMRC, click back into HMRC Payments and click the Enable button again

- Answer the question accordingly and click 'OK'.

- The Employment Allowance will now be automatically calculated in line with the employer's Class 1 National Insurance liability each tax period, up to the maximum total of £4,000 in the tax year.

If you are not eligible for the Employment Allowance

HMRC can be notified of your ineligibility for the employment allowance via the Employment Payment Summary (EPS).

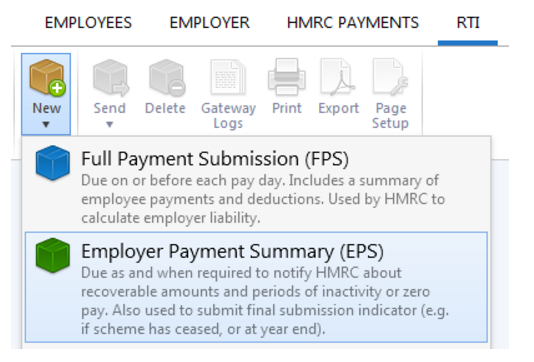

- Select RTI on the menu bar

- Click 'New' on the menu toolbar and select 'Employer Payment Summary (EPS)'

- Tick the 'Employment Allowance' marker

- Select 'Indicate that employer is not eligible for Employment Allowance':

- Click 'OK' to submit to HMRC when ready.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.