Printing/Emailing/Exporting a P45

Since 6th April 2013 and in line with the introduction of RTI, employers are no longer required to submit a P45 to HMRC when an employee leaves their employment. Instead, HMRC will be notified of an employee leaving in the last Full Payment Submission you send for that employee.

However as soon as an employee leaves your employment and their leave date has been processed through BrightPay (for assistance with this click here), a P45 should still be given to them for their own records.

Printing/Emailing/Exporting the Employee's P45

1) Within Employees, select the employee from the listing.

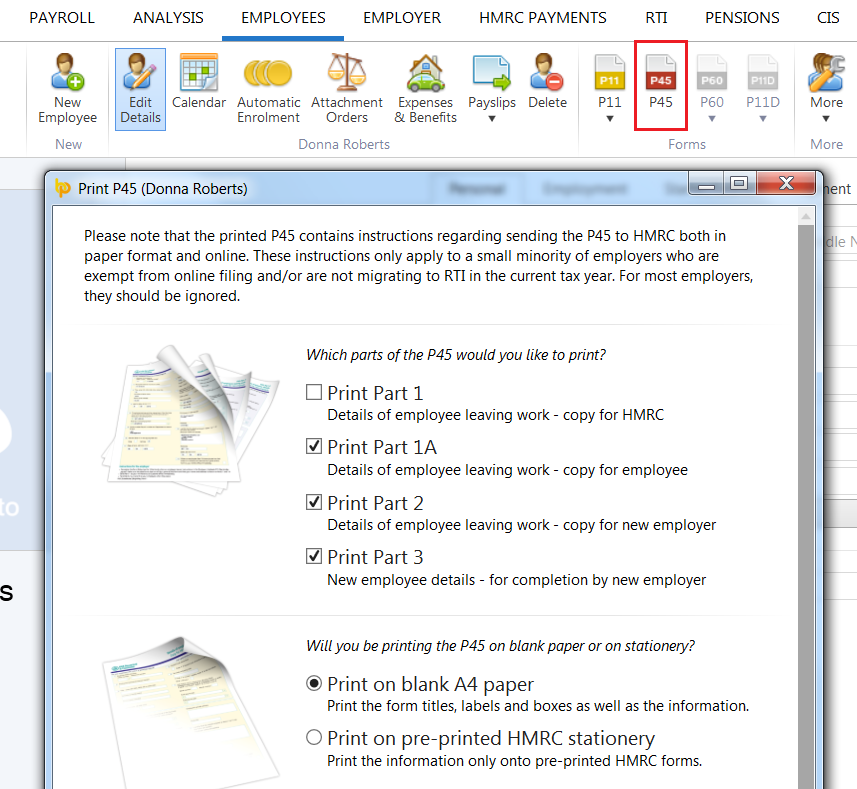

2) Select P45 on their menu toolbar.

3) Select which parts of the P45 you wish to print/email/export and click Print Preview

4) Select Print/Email/Export on the menu bar, as desired

No P45 available for the employee?

If there is no P45 available for viewing/printing within the employee's record after entering their leave date, this usually means that the pay period in which the leave date is falling is still 'open' and has yet to be finalised within the Payroll utility.

Simply check the leave date, and then within the Payroll utility, establish the pay period in which this leave date falls.

Is the payslip in which the leave date falls still open for the employee? If so, simply finalise this payslip accordingly and the employee's P45 will become available within the employee's record.

Need help? Support is available at 0345 9390019 or [email protected].