Mileage Allowance Payments (MAPs)

Mileage Allowance Payments (MAPs) are what you pay your employees for using their own vehicle for business journeys.

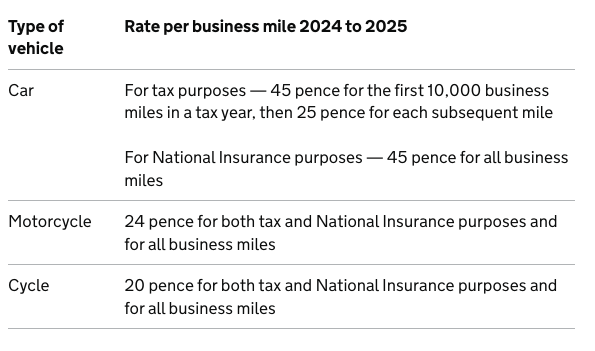

You can pay your employees an ‘approved amount’ of MAPs each year without having to report them to HMRC. To work out the ‘approved amount’, multiply your employee’s business travel miles for the year by the rate per mile for their vehicle.

Current MAP rates as per HMRC:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.

24-25 BrightPay - System Requirements24-25 BrightPay - DownloadIntroduction to BrightPayImportant Information for Mac UsersStarting the New Tax Year

Ordering for the new Tax YearHow do I start processing 2024-25 payroll?Importing From 23-24 BrightPayStarting the new tax year - FAQs

Importing From The Previous Tax YearInstalling BrightPayInstalling the software on to your PCSetting Up BrightPay for Multiple UsersDownload Sample Employer FilesTransferring BrightPay from one PC to another

Moving to BrightPay from another payroll softwarePreparing for your move to BrightPay - Useful GuidanceMethodology used in BrightPayImporting Employers - List of Employer Data that can be Imported into BrightPayImporting Employees - List of Employee Data that can be Imported into BrightPayMoving to BrightPay mid-year - Recoverable Amounts to DateMoving to BrightPay mid-year - Employment AllowanceMoving to BrightPay - Continuing Auto Enrolment from a previous softwareMoving to BrightPay mid-year - DirectorsImporting from 12PayImporting from Access PayrollImporting from CapiumImporting from HMRC Basic PAYE ToolsImporting from IRIS

Bureau Enhancements - Useful Functionality for Bureau Licence HoldersImporting from IRIS (excluding PAYE-Master) - using an FPS FileImporting from IRIS PAYE-MasterImporting from IRIS Bureau - using a CSV FileImporting from IRIS Professional or Earnie - using a CSV File

Importing from KashflowImporting from KeytimeImporting from MoneysoftImporting from Moneysoft - using a CSV File (start of year)Importing from Moneysoft - direct import (start of year)Importing from Moneysoft - direct import (mid year)Importing from Moneysoft - using a CSV File (mid year)Importing from Moneysoft - using an FPS File

Importing from MyPAYEImporting from OperaImporting from PayrooImporting from PegasusImporting from QtacImporting from QuickbooksImporting from SAGEImporting from SAGE 50 Payroll - using a CSV File (start of year)Importing from SAGE 50 Payroll - using a CSV File (mid year)

Importing from StarImporting from XeroImporting using a CSV File - Other softwareImporting using an FPS File - Other SoftwareBrightPay Startup WindowClient DetailsAgent SettingsExporting Client DocumentsBatch Processing Payroll

Employer DetailsBatch finalise currently open pay periodBatch send outstanding RTI and CIS submissionsBatch check for coding notices

Bureau Statistics ReportImporting Multiple Employers from CSV FileUpdating Existing Employee Details from a CSV FileImporting Saved Reports from another BrightPay Data FileAdding a New EmployerAdding/ Amending Employer DetailsAdding/ Amending DepartmentsAdding/ Amending Hourly RatesAdding/ Amending Daily RatesAdding/ Amending Piece RatesAdding/ Amending Addition TypesAdding/ Amending Deduction TypesAdding/ Amending Savings SchemesAdding/ Amending Bank AccountsEmployer Calendar

Employee DetailsPersonalEmploymentStarter/LeaverPaymentTax, NICs, RTIHR, OtherGenerating Employee Works NumbersEmployee Count ReportEmployee Address LabelsAdding New Employees from a CSV FileUpdating Existing Employee Details from a CSV File

Coding NoticesPayroll CalendarProcessing PayrollSetting your Payment ScheduleWeekly PayrollFortnightly Payroll4-weekly PayrollMonthly PayrollQuarterly PayrollAnnual/Yearly PayrollPeriod Summary View (Payroll Preview)Net to Gross PaymentsAllocating An Employee's Pay across more than one DepartmentAdditions and DeductionsProcessing Pension Deductions (outside of AE)Setting a Pension AVC to repeatAdding a Note to Employee PayslipsPre-paying an EmployeeZeroising Payslips (Batch Operation)Setting pay items to auto-zeroiseFinalising PayslipsChildcare Vouchers

Importing Pay Data using CSV FileImporting Periodic Payments using CSV fileImporting Daily Payments using CSV fileImporting Hourly Payments using CSV fileImporting Additions using CSV fileImporting Deductions using CSV fileImporting Notes using CSV fileImporting Payments, Additions & Deductions in a single CSV File

Distributing PayslipsPaying EmployeesPaying Employees by CashPaying Employees by ChequePaying Employees by Credit Transfer & Creating a Bank FilePaying Employees using Modulr

RTIReporting Contracted Hours - Hourly Bands for FPSFull Payment Submission (FPS)Additional Full Payment SubmissionEmployer Payment Summary (EPS)

Common HMRC Error MessagesAnalysisEmployer Payment Summary - OverviewRecovering Statutory PaymentsRecovering CIS deductions sufferedReporting Apprentice LevyDeclaring a future period of inactivityDeclaring no payment for periodClaiming & Stopping Employment AllowanceNotifying HMRC of Bank DetailsNotifying HMRC of your final submission of yearNotifying HMRC that your PAYE scheme has ceasedDeleting an EPS

NINO Verification Request (NVR)RTI - Additional FunctionalityMarking RTI Submissions as already sent to HMRCExcluding a submission from the 'Unsent Submissions 'Count'Excluding zero paid employees from an FPS submissionForce including an employee's starter declaration on an FPS submissionHMRC Submission Receipt

New RTI Requirement from April 2022 - CIS Deductions SufferedSaved ReportsCreating a New ReportViewing ReportsEditing ReportsSaving ReportsPrinting/Emailing ReportsExporting ReportsImporting Saved Reports from another BrightPay Data File

Payroll JournalsPayroll Journals - OverviewAccountsIQClearBooksExactFreeAgentFreshbooksKashflowQuickbooksQuickFileSageTwinfieldXero

HMRC PaymentsMaking Corrections to PayrollScheduling Future PaymentsSwitching an Employee's Pay FrequencyDirectorsOff-Payroll Working (IR35)StartersXero - Introduction to using the APIXero - Submitting your journal using APIXero - API FAQsXero - CSV upload

Zoho BooksCreating a Generic Payroll JournalNominal Ledger Mapping - Custom Items (e.g employment allowance)Setting up a new employee mid-yearNew Starter ChecklistTax Codes to use for New EmployeesNew Starters and Recruitment Templates

LeaversStudent Loan DeductionsPostgraduate Loan DeductionsStatutory PaymentsStatutory Payment Rates for 2024-25Statutory Sick PayStatutory Maternity PayStatutory Adoption PayStatutory Paternity Pay (Birth)Statutory Paternity Pay (Adoption)Statutory Shared Parental Pay (Birth)Statutory Shared Parental Pay (Adoption)Statutory Parental Bereavement PayStatutory Pay Calculation & Schedule Report

Attachment of EarningsAttachment of Earnings (Northern Ireland)Child Support Deductions from Earnings Order (DEO)Civil Judgment Debt Attachment of Earnings Order (County Court)Council Tax Attachment of Earnings Order (CTAEO) - EnglandCouncil Tax Attachment of Earnings Order (CTAEO) - WalesCurrent Maintenance Arrestment (CMA)Direct Earnings AttachmentEarnings Arrestment (EA) (Scotland)Magistrates Court Attachment of Earnings OrderMaintenance Attachment of Earnings OrderOther Attachment of Earnings OrdersAttachment Order Summary Report

Expenses & BenefitsExpenses & Benefits - OverviewExpenses & Benefits - Setting the Tax Accounting MethodApplying an Expense or Benefit in BrightPayExpenses & Benefits - P11D & P11D(b) End of Year Return

Pensions (outside of Automatic Enrolment)Payroll GivingYear EndYear End - Frequently Asked QuestionsYear-End Procedure for Tax Year 2024-25 - 5 Step GuideYear-End Checklist for Tax Year 2024-25Year End - Support Hub

Rates & Thresholds at a GlanceTaxTax Codes - OverviewTax Rates and Thresholds for 2024-25Scottish Rate of Income Tax (SRIT)Welsh Rate of Income Tax50% Overriding Regulatory Limit

National InsuranceNational Minimum/Living WageMileage Allowance Payments (MAPs)Employment AllowanceApprenticeship LevyTermination Awards & Sporting TestimonialsGender Pay Gap ReportingLeave Reporting & Employee CalendarEmployee Calendar - OverviewDefining and Setting Custom Leave Types on Employee CalendarRecording Employee Leave on the CalendarBatch Processing of Employee Leave on the CalendarAdding Notes to Calendar EntriesViewing/Printing Employees' Annual Leave EntitlementCalendar Report

Annual LeaveAnnual Leave Entitlement Methods in BrightPayAdjusting an Employee's Leave EntitlementRecording an Employee's Annual LeaveBatch Processing of Employee Annual Leave on the CalendarViewing/Printing Employees' Annual Leave EntitlementProcessing Holiday PayAnnual Leave Request FormHoliday Entitlements - Useful Information

Payslip TranslationsBacking Up/Restoring Your PayrollConstruction Industry Scheme (CIS)CIS OverviewContractor DetailsAdding SubcontractorsSubcontractor Registered DetailsSubcontractor Additional DetailsSubcontractor Payment DetailsSubcontractor NotesSubcontractor Verification RequestImporting Subcontractors from a CSV FileUpdating Existing Subcontractor Details from a CSV FileProcessing Subcontractor PaymentsFinalising Subcontractor PaymentsMonthly ReturnRe-opening Subcontractor Payments (Corrections)Payment & Deduction StatementsPaying Subcontractors

Automatic EnrolmentPaying Subcontractors by CashPaying Subcontractors by ChequePaying Subcontractors by Credit Transfer & Creating a Bank FilePaying Subcontractors using Modulr

Zeroising PaymentsImporting Subcontractor Pay Data using CSV FileImporting Periodic Payments using CSV fileImporting Daily Payments using CSV fileImporting Hourly Payments using CSV fileImporting Additions using CSV fileImporting Deductions using CSV file

Year End StatementCIS - VAT Domestic Reverse ChargeNew RTI Requirement from April 2022 - CIS Deductions Suffered24-25 Automatic Enrolment Assessment GuideInstructing BrightPay of your Duties Start DateEntering your Pension Scheme in BrightPayProcessing Eligible Jobholders in BrightPayProcessing Non-Eligible Jobholders in BrightPayProcessing Entitled Workers in BrightPayPostponing Employees in BrightPayBatch Processing of Employees in BrightPayProcessing Opt-out Notices in BrightPaySending your Pension Information to the Pension ProviderAutomatic Enrolment Journey ReportGenerating an Automatic Enrolment Report in BrightPaySwitching Pension Schemes/Groups in BrightPayApplying a Salary Sacrifice Arrangement in BrightPayAutomatic Re-enrolment in BrightPayDedicated Pension Providers in BrightPay - Guidance

BrightPay ConnectNESTNEST - Error MessagesThe People's PensionSmart PensionAvivaCreative Pension TrustLegal & GeneralNOW PensionsRoyal LondonSalvusScottish WidowsSimply Auto Enrolment SolutionsStandard LifeTrue PotentialWorkers Pension TrustOptionsCushonAegonCollegia

Salary Sacrifice for Auto EnrolmentBrightPay Connect - OverviewRegistering for BrightPay ConnectLinking an Employer to BrightPay ConnectCustomising your BrightPay Connect AccountAssigning a New User in BrightPay ConnectEditing/Deleting a User from BrightPay ConnectStandard Users - Invite and Manage UsersEnabling Employee Access to Self ServiceConfiguring Employee Self Service OptionsDisabling/Editing Employee Access to Self ServiceInviting Employees to use Self ServiceAutomated Cloud BackupRestoring from a Cloud BackupTwo Factor Authentication

GDPRBright Terms and Conditions and BrightPay End User Licence AgreementBright IDTwo Factor Authentication - Enabling for UsersSigning In - UserTwo Factor Authentication - Enabling for EmployeesEmployee Self Service App - Security

Employer Self Service PortalEmployer Portal - DashboardEmployer Portal - EmployeesEmployer Portal - ReportsEmployer Portal - CalendarEmployer Portal - HMRC PaymentsEmployer Portal - DocumentsEmployer Portal - SettingsEmployer Portal - Processing Leave RequestsEmployer Portal - Subcontractors

Employee Self Service PortalEmployee Portal - Cancelling LeaveEmployee Portal - DashboardEmployee Portal - DocumentsEmployee Portal - CalendarEmployee Portal - My DetailsEmployee Portal - Requesting Leave

Connect for Bureaus - New featuresPayroll Approval Requests - Bureau GuidancePayroll Approval Requests - Employer GuidancePayroll Entry Requests - Bureau GuidancePayroll Entry Requests - Employer GuidanceEmployer NotificationsEnter HMRC Payments Amount

BrightPay Connect - Terms of ServiceConnect - MultiUser EnhancementsConnect - New Tax Year FAQsDeleting a Company in BrightPay Connect