State Pension Age

State Pension Age

Currently, the State Pension age is 65 for men.

For women born before 6 April 1950 the State Pension age was 60.

From April 2010 the State Pension age for women born on or after 6 April 1950 and before 6 April 1953 is gradually increasing from 60 to 63 between 2010 and March 2016.

Therefore the validation around pension age for women within BrightPay 2014/15 should validate around the following key dates;

- A woman born before 6th April 1952 should be on Class C from the start of 2014/15 payroll

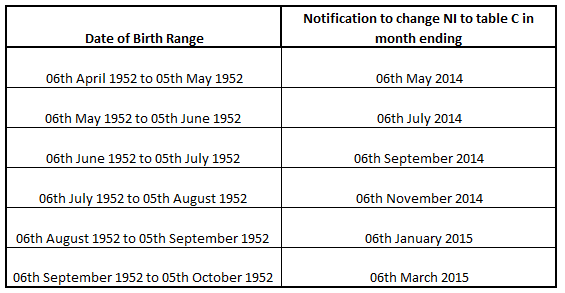

- Thereafter birthdays falling between 06th April 1952 and 05th October 1952 should be prompted to change NI category to C in the following payroll months;

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.