Kashflow - using API

BrightPay's payroll journal feature allows users to create wages journals from the finalised payslips and upload into the Kashflow accounts package using API.

Please note: before using this API, you must ensure that API is enabled within your Kashflow account. Instructions on how to enable API access within Kashflow are available here

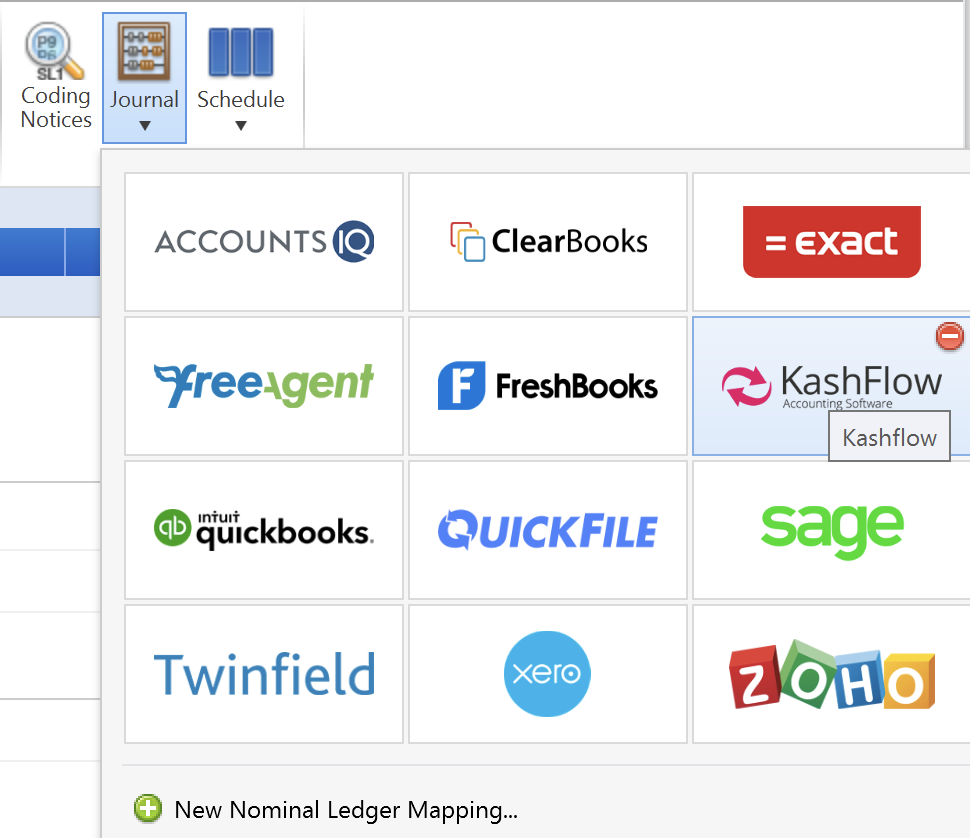

1) Within Payroll, select Journal on the menu toolbar, followed by Kashflow:

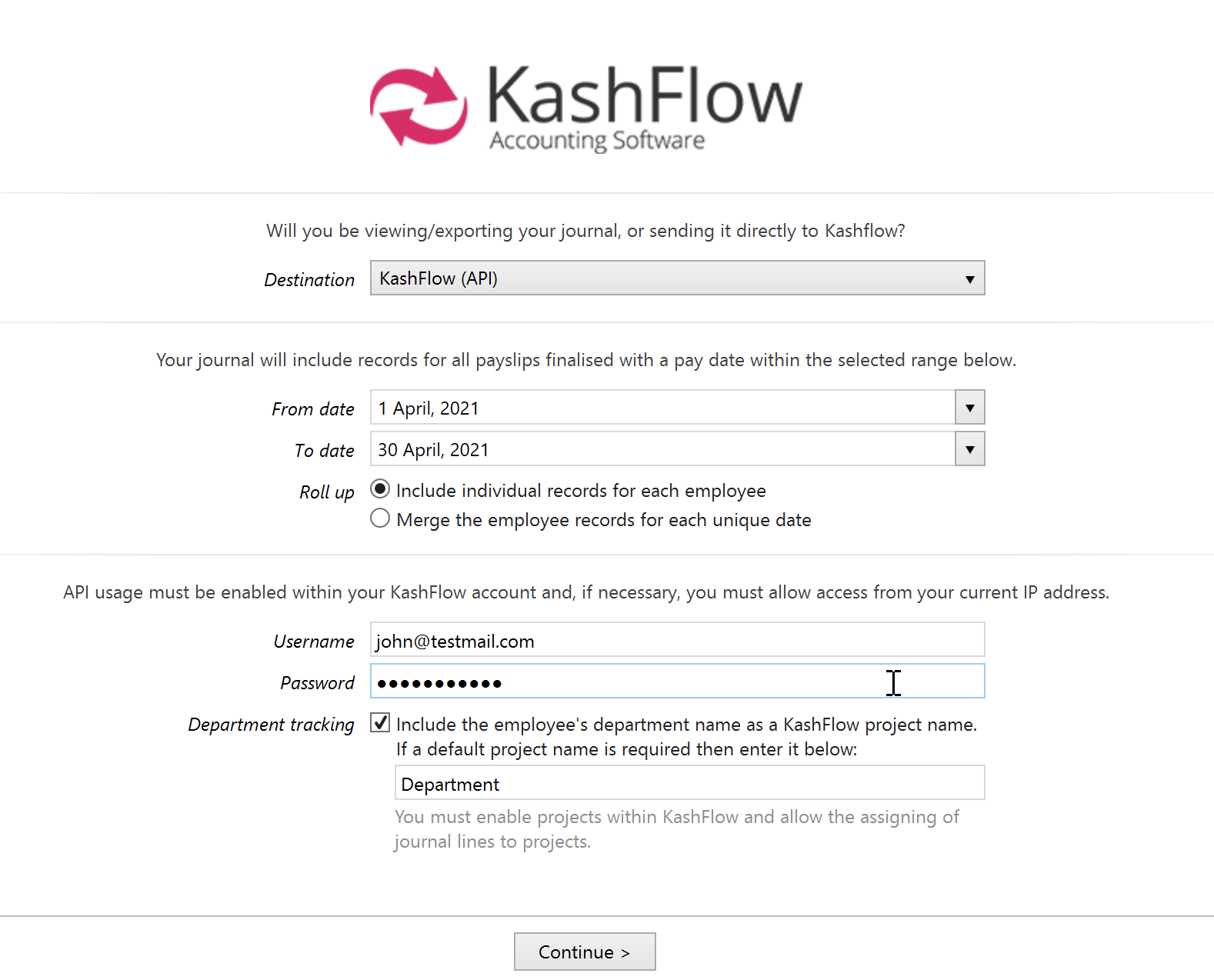

2a) On the next screen, choose Kashflow (API) as your destination.

b) set your Date Range - the journal will include records for all payslips (across all pay frequencies) with a pay date within the selected range.

c) Roll up - select whether you would like the journal to include individual records for each employee or whether to merge the records for each unique date.

d) Enter your username and password that you use to log into your Kashflow account.

e) Department tracking - Should you wish to include the employee's department name as a Kashflow project name, tick the box provided. If a default project name is required, enter accordingly in the field provided.

Please note: for this option, you must have projects enabled within your Kashflow account and have allowed the assigning of journal lines to projects.

f) Click Continue. Your nominal ledger codes will now be retrieved from Kashflow.

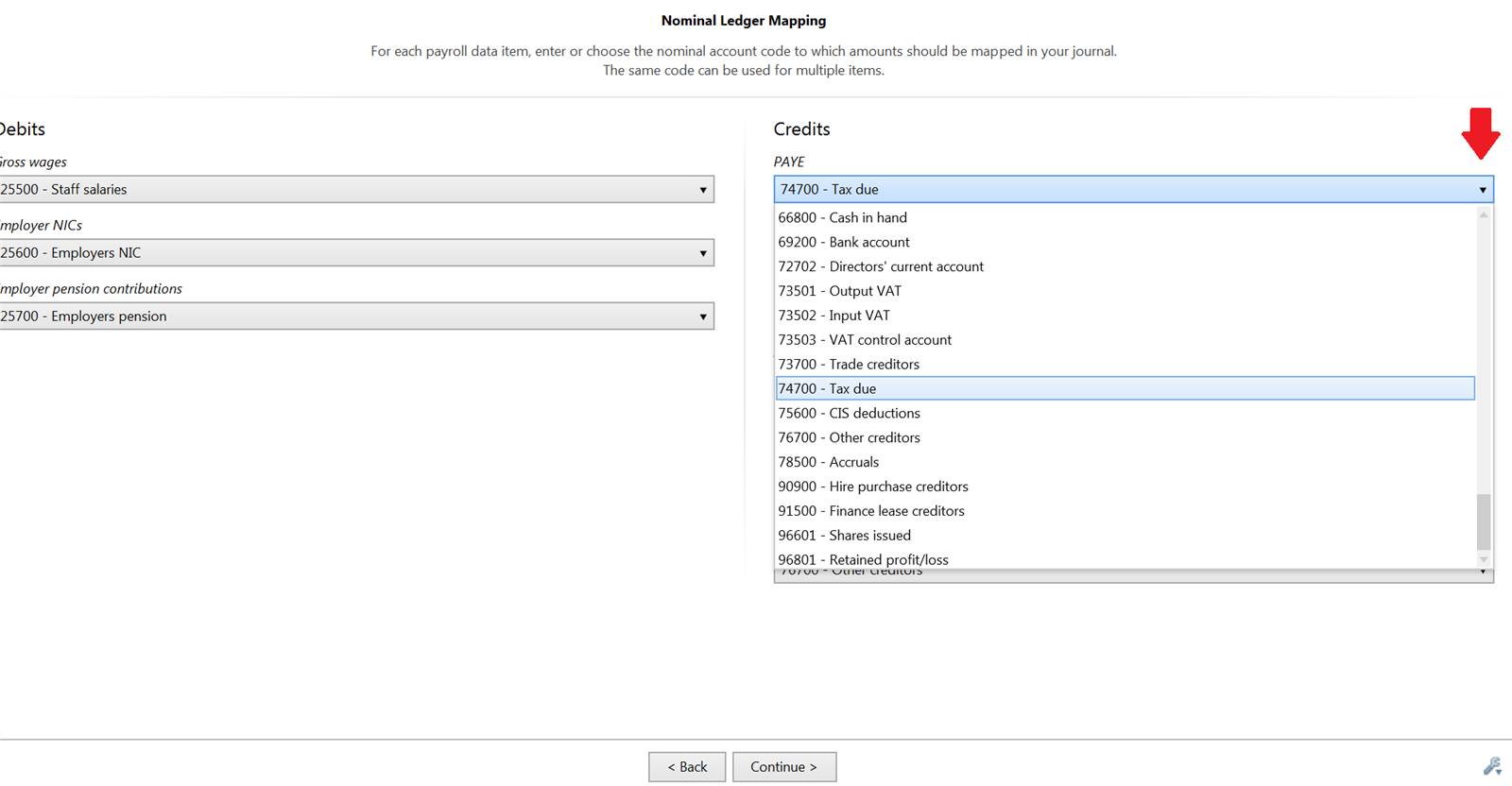

3a) Nominal Ledger Mapping - simply map each payroll data item to the relevant nominal account code. A nominal account code can be used for multiple items.

b) When ready to proceed, click 'Continue'.

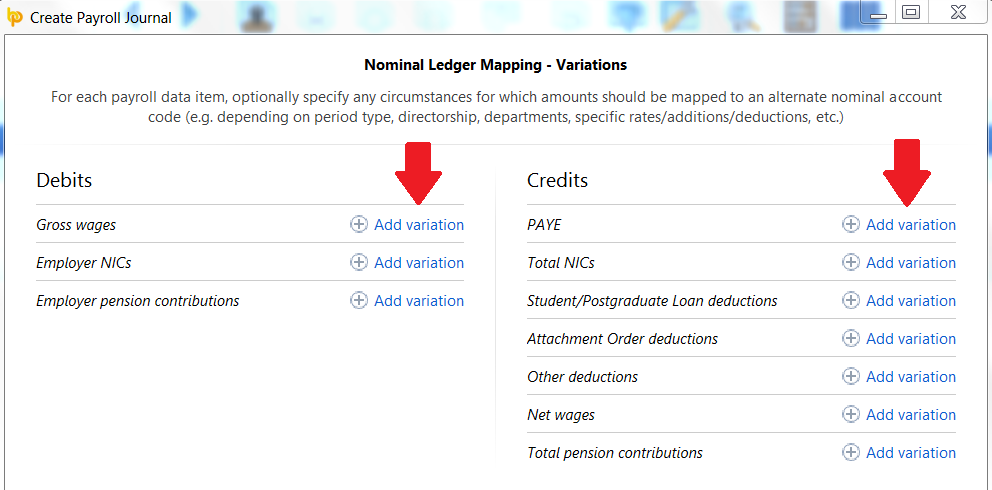

4) Nominal Ledger Mapping - Variations - this screen allows you to specify any circumstances for which amounts should be mapped to an alternate nominal account code (e.g. depending on period type, directorship, departments, specific rates/additions/deductions, etc.)

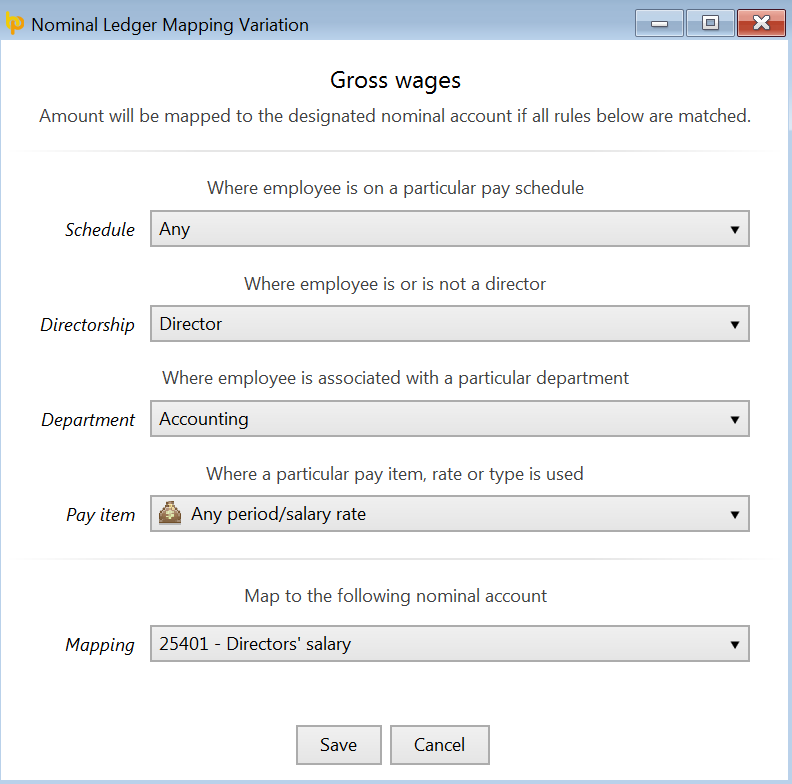

a) For each payroll data item you wish to add a variation for, click Add Variation:

b) For the payroll data item selected, set the rules to apply in order for the amount to be mapped to the designated nominal account you enter on this screen.

Rules can be set according to period type, directorship, department and specific pay items.

Example

You wish the salaries of all directors within the Accounting department to be mapped to the Directors' Salary nominal account within your accounting software. Your rules may thus be set as follows:

c) Click Save when complete.

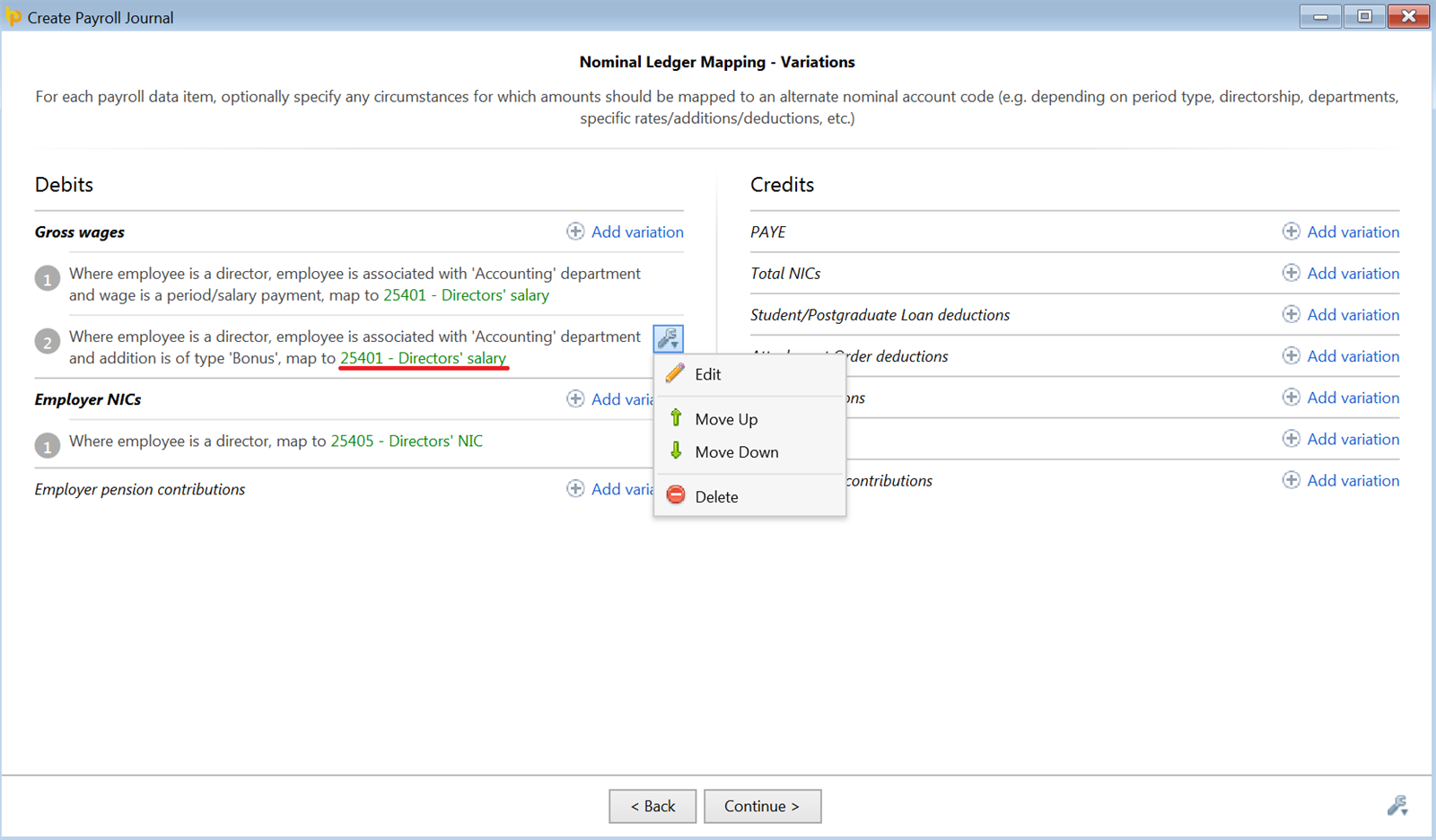

Your rule will now be displayed on screen under the payroll data item it is associated with.

d) Further variations can be added for different pay items or for the same payroll data item by simply clicking Add Variation again and setting the rules to apply.

e) Once variations have been set, these can be edited, deleted or re-ordered by clicking the spanner symbol next to it. In addition, clicking the nominal account information displayed in green provides quick access to the rules that have been set for it.

f) On completion of this screen (where required), click 'Continue'.

Your journal will now be displayed on screen for review. Simply click the 'Back' button to make any amendments.

5a) When ready to upload your journal, click 'Send to Kashflow...'

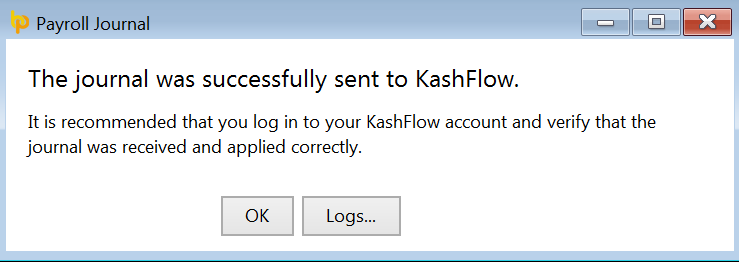

b) Confirmation will be displayed on screen to confirm successful upload into your Kashflow account.

c) Press 'Print' to print, email or export a copy of your journal to PDF.

d) To close the journal screen, simply click the cross at the top right of this screen. If you have made any changes to the journal, you will be asked if you wish to save your changes. Click 'Yes' or 'No' as required.

Additional Note

Please note: Employment Allowance and Recoverable Amounts are not catered for in the journal API.

Therefore a manual journal within your accounts software will be required, where applicable.

Need help? Support is available at 0345 9390019 or [email protected].