Childcare Vouchers

Childcare Vouchers are a cost-saving employee benefit, implemented through an employer's payroll.

Childcare Vouchers work through a salary sacrifice scheme which means parents swap part of their salary, tax and National Insurance free, to contribute towards their childcare costs. The amount each parent swaps is also exempt from employers' National Insurance Contributions.

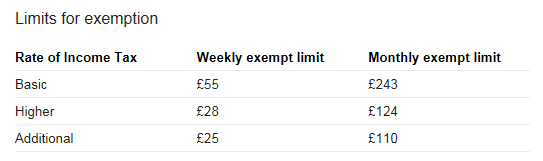

The amount that can be put through as a salary sacrifice depends on the marginal tax rate of the employee. The table below demonstrates the limits for exemption:

The employer pays into the scheme the amounts deducted from employee. The employee can then instruct the scheme to pay the approved childcare provider. Childcare Vouchers are accepted by day nurseries, childminders, holiday schemes, afterschool clubs and breakfast clubs.

Further details can be found at http://vouchers.employersforchildcare.org

To process childcare vouchers in BrightPay go to Payroll:

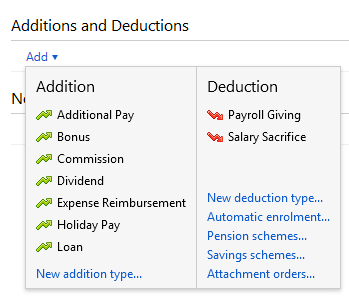

Click add under additions and deductins click add

Next select New Deduction Type

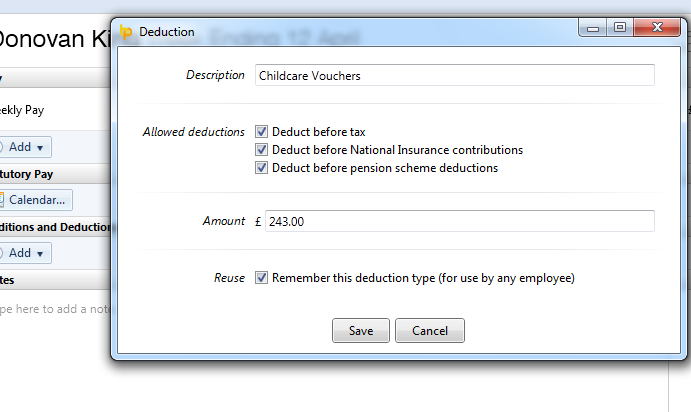

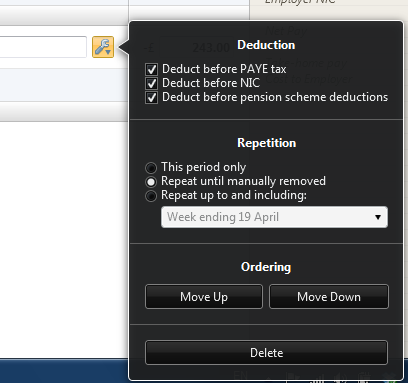

Then enter the description, tick the relevant boxes (note: you may need to check with the scheme provider that the salary sacrifice can be deducted)

Click Save and the deduction has now been set up.

To instruct the software to keep making the deduction until further notice, click the spanner icon beside the deduction and select the option button below:

Need help? Support is available at 0345 9390019 or [email protected].