Additional FPS

If an error is discovered in any FPS for 2016/17, then an Additional Full Payment Submission (FPS) can be submitted to HMRC at any time up to and including 19th April 2017.

To prepare an Additional Full Payment Submission (FPS)

- Re-open the payslips, make your amendments and finalise accordingly.

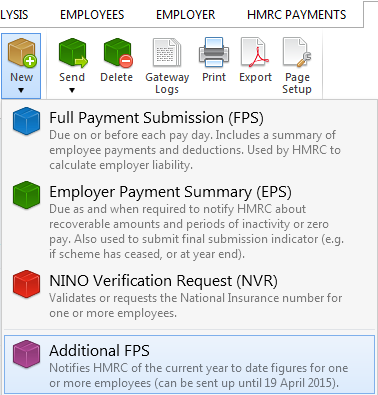

- In the RTI menu, select Additional FPS from the New menu:

- Select the employee(s) for whom you have made adjustments and select an appropriate late reporting reason from the drop down menu.

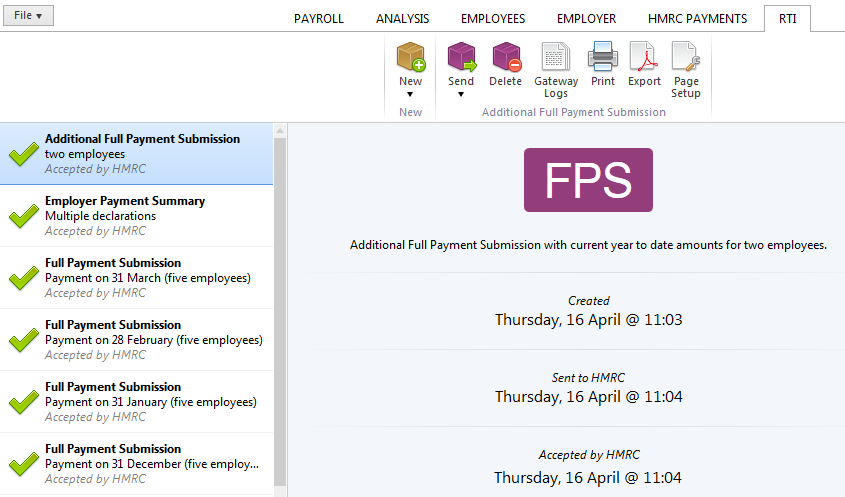

- Submit the Additional FPS to HMRC:

Need help? Support is available at 0345 9390019 or [email protected].