Additional Full Payment Submission

If you need to make a correction to employee(s) data and the corresponding Full Payment Submission has already been submitted to HMRC, you can inform HMRC of the amendment(s) to that pay period by submitting an Additional Full Payment Submission.

An Additional Full Payment Submission (FPS) can be submitted to HMRC at any time during or after the tax year.

To prepare an Additional Full Payment Submission (FPS) in BrightPay:

- Re-open the payslips, make your amendments and finalise accordingly.

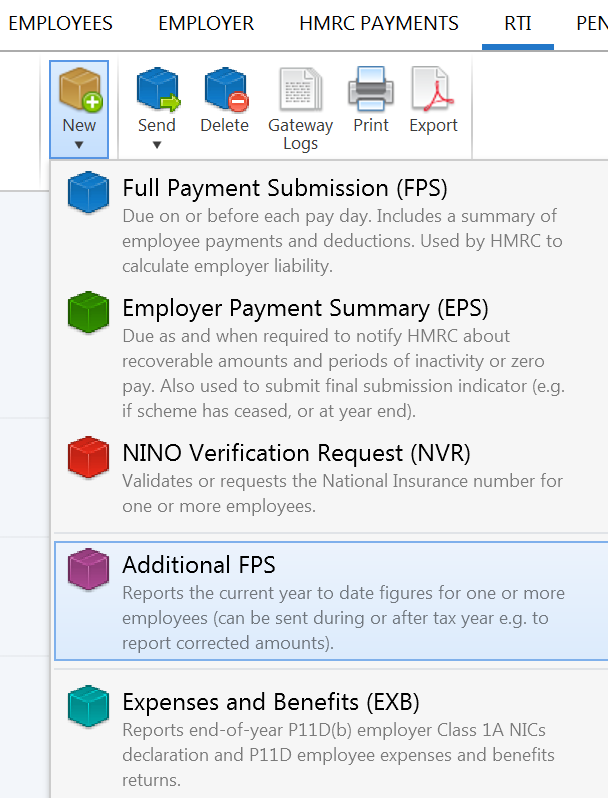

- In the RTI menu, select 'Additional FPS' from the 'New' menu:

- Select the employee(s) for whom you have made adjustments and select an appropriate late reporting reason from the drop down menu.

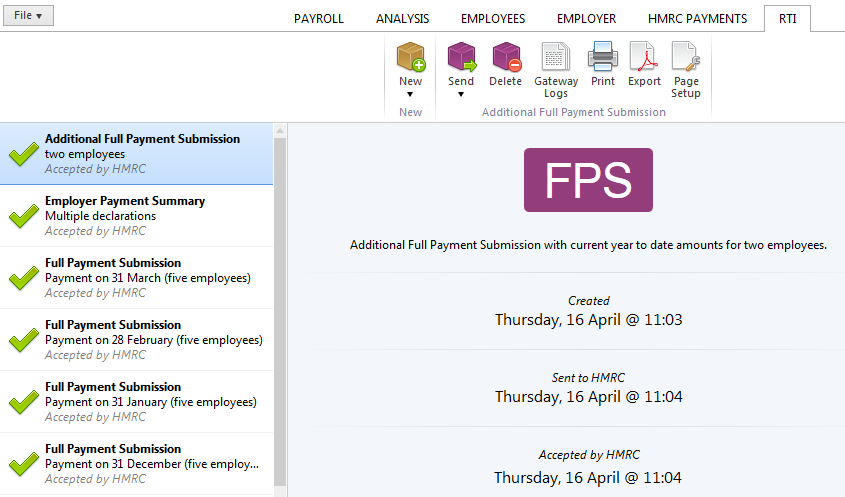

- Submit the Additional FPS to HMRC:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.