Employer Payment Summary (EPS)

You report your payroll information to HMRC by submitting Full Payment Submissions (FPS) and Employer Payment Summaries (EPS).

When to complete the EPS

There are certain situations when an EPS must be created and submitted - these situations all focus around claiming refunds/recoverable amounts from HMRC or making declarations to HMRC.

You should submit an EPS in the following circumstances:

- If no payments to employees are made within the current or past pay period (No Payment period), i.e. no FPS submission has been or is being submitted

- To declare a future period of inactivity, i.e. no FPS submission will be made

- To recover statutory payments

- To recover Construction Industry Scheme (CIS) deductions suffered

- To indicate that you have made your final submission for the year

- To claim the Employment Allowance, if entitled.

An EPS, if required, must be submitted by the 19th of the following tax month for HM Revenue and Customs (HMRC) to apply any reduction (e.g. statutory pay) on what you’ll owe from your FPS.

Submitting an EPS to HMRC

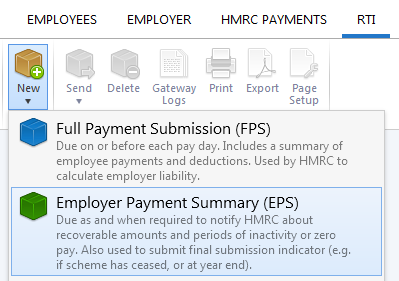

To send an EPS to HMRC using BrightPay, simply select 'RTI' on the menu bar:

Click New on the menu toolbar and select Employer Payment Summary (EPS):

Recoverable Amounts

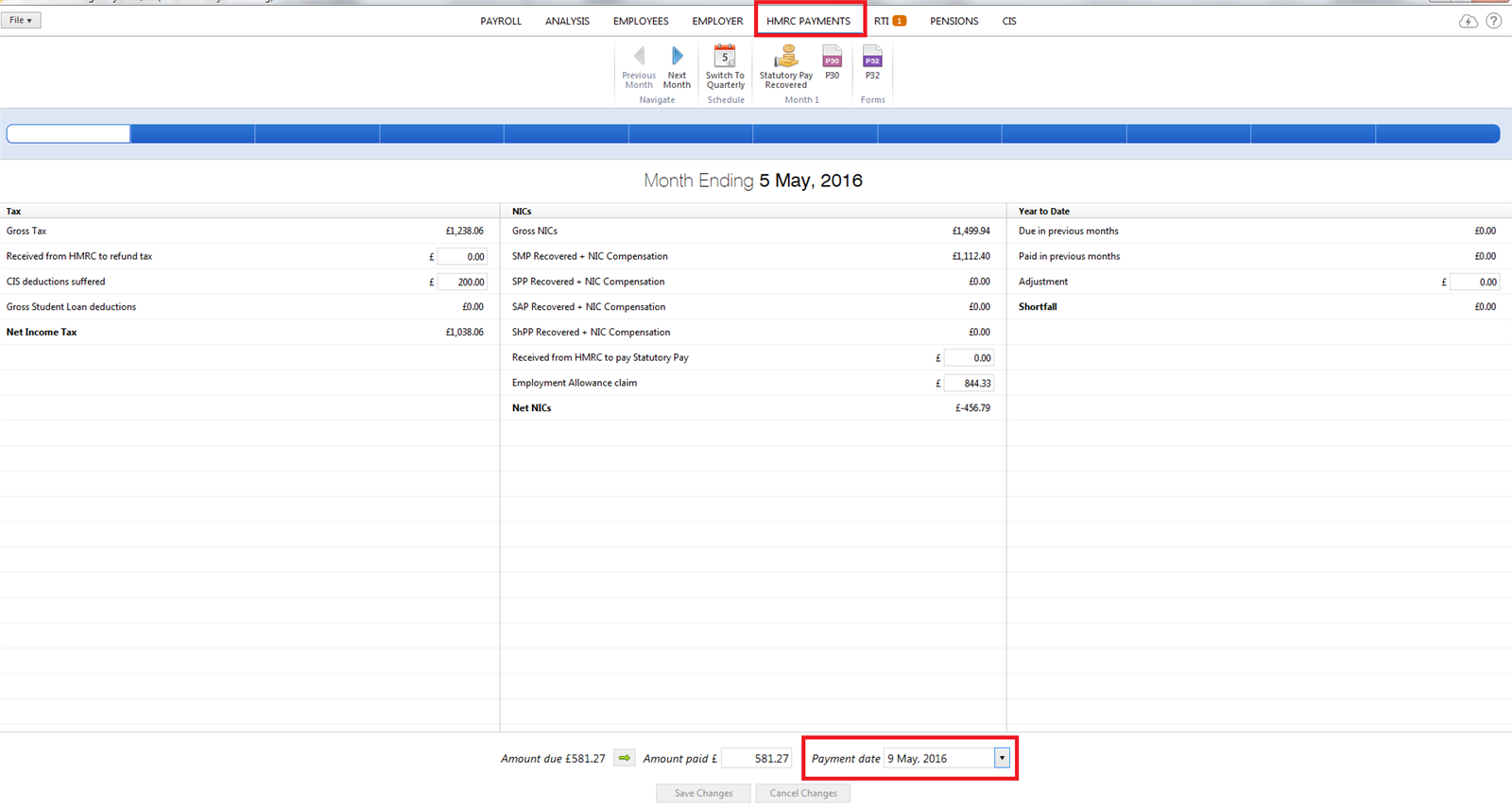

If you wish to claim recoverable amounts for statutory payments made to employees or CIS deductions suffered, then you must first choose the HMRC Payments menu and complete the relevant monthly/quarterly payment schedule for the relevant period for which there are recoverable amounts.

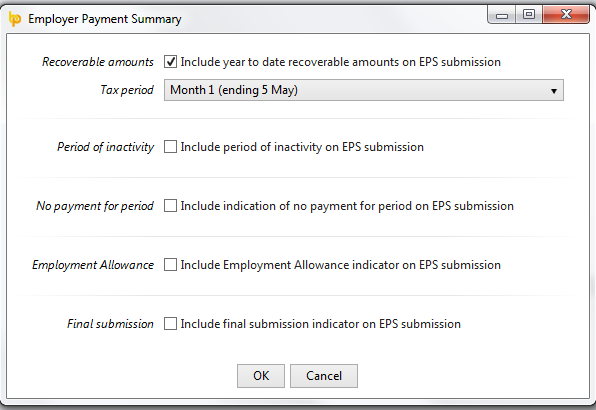

If there are recoverable amounts due, as per the HRMC Payments schedule, then this will automatically be indicated on the EPS:

Simply select the Tax Period from the drop down listing.

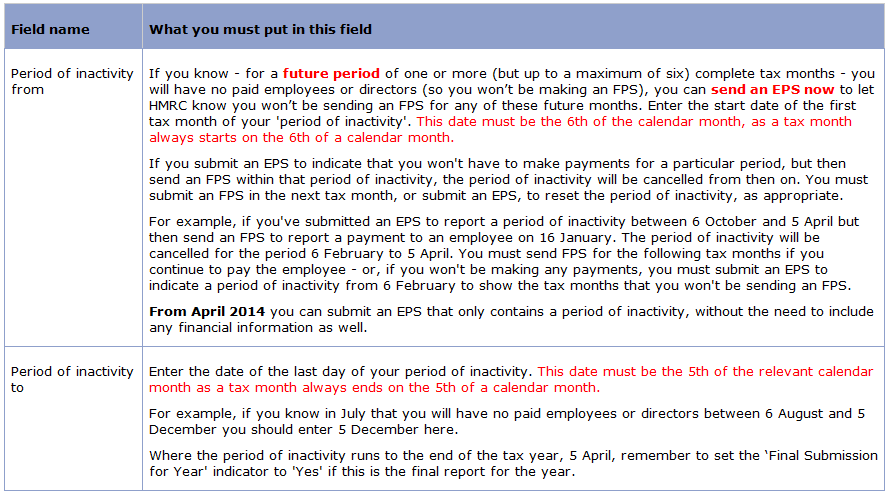

Periods of Inactivity – Future Periods

If there is a future period of inactivity, for which there will be no FPS submitted (i.e. there will be no payslips for the tax period in question) then this must be communicated to HMRC via the EPS.

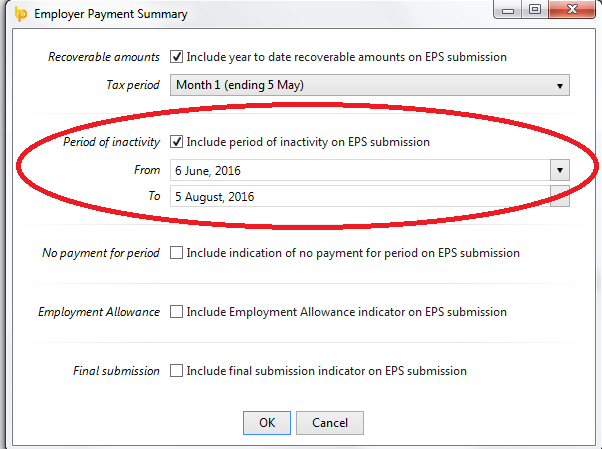

This is indicated using the Period of Inactivity indicator on the EPS

Tick Period of Inactivity and enter the future date range required:

No Payment for Period – Current or Earlier (historical) periods

If there has been no pay processed for all employees in the current tax period or earlier tax periods, and no FPS's are due to be submitted, then this must be communicated to HMRC via the EPS.

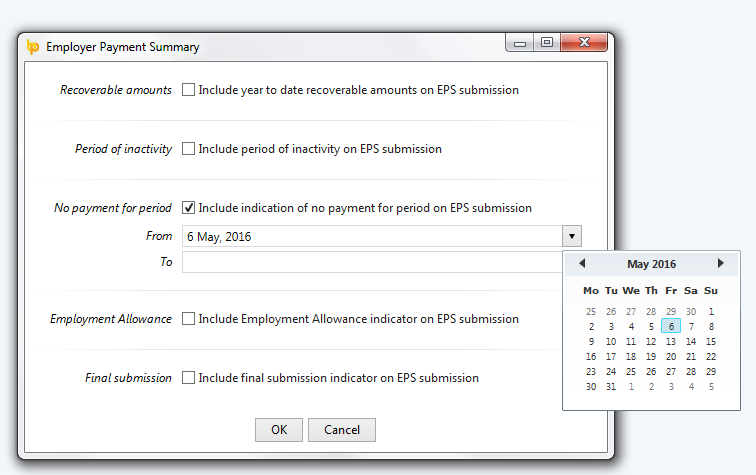

This is indicated using the No Payment For Period indicator on the EPS

Tick No Payment for Period and enter the current / earlier date range required - BrightPay will not allow you to use this option for a future date range:

Employment Allowance

For support on how to claim the Employment Allowance click here

When ready to submit the EPS to HMRC, click Send Now.

Confirmation details will subsequently appear on screen to indicate that your submission has been accepted by HMRC.

Should your submission fail, simply click on the 'Details' button for more information on why your submission has been rejected by HMRC and correct your payroll information where required.

Year End

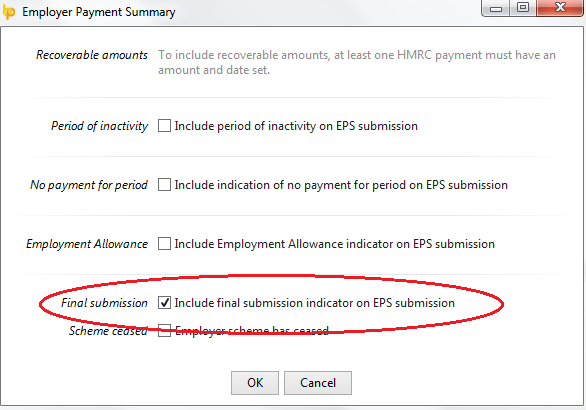

At the end of the tax year, a final Employer Payment Summary submission will be required in addition to your final FPS for the year.

Within the RTI utility, simply indicate on the EPS that this is to be the final submission of the year and submit accordingly:

See our comprehensive Year End guide in the Year End menu.

Deleting an EPS:

If an EPS has not been sent to HMRC and you wish to delete it, select 'RTI' on the menu bar:

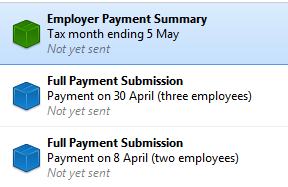

1) Select the EPS submission from the listing on the left

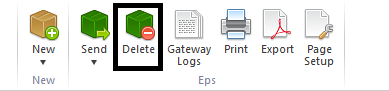

2) Click "Delete" on the menu bar

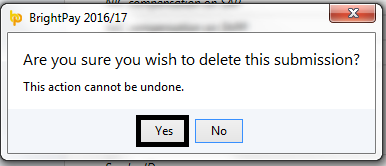

3) Click "Yes" to confirm that you wish to delete the submission

Need help? Support is available at 0345 9390019 or [email protected].