Employer Payment Summary (EPS)

The Employer Payment Summary (EPS) is due as and when required to notify HMRC of the following:

- statutory payment reclaims

- no payment for period

- periods of inactivity

- final submission declarations at year end

Submitting an EPS to HMRC

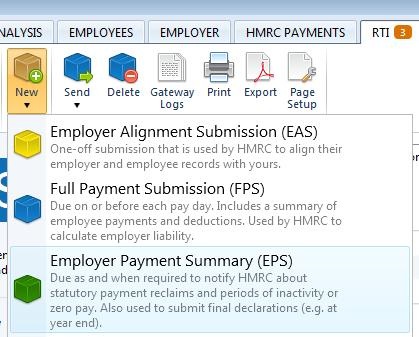

To send an EPS to HMRC using BrightPay, simply select 'RTI' on the menu bar:

1) Click New on the menu toolbar and select Employer Payment Summary (EPS):

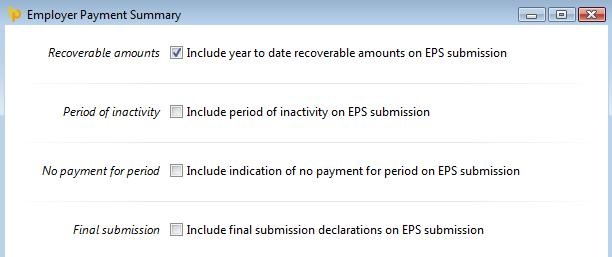

2) If you would like to recover statutory payments, CIS deductions suffered or any NIC holiday at the end of a tax month or quarter, tick the 'Recoverable Amounts' field. Such an EPS will inform HMRC of the reductions you are entitled to make to the totals already submitted on your Full Payment Submissions:

3) If you wish to notify HMRC of 'No Payment for Period' tick the box provided and enter the dates accordingly.

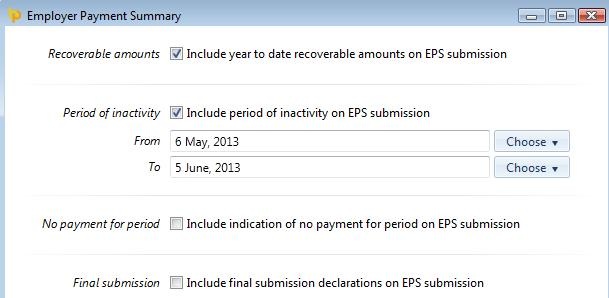

4) Likewise, if you wish to notify HMRC of a 'Period of Inactivity' tick the box provided and enter your period date range:

5) Click OK. The contents of the EPS will be displayed on screen. The EPS can be printed or exported at any time before or after its submission to HMRC by clicking 'Print' or 'Export'.

6) When ready to submit the EPS to HMRC, click Send Now.

7) Confirmation details will subsequently appear on screen to indicate that your submission has been accepted by HMRC.

8) Should your submission fail, simply click on the 'Details' button for more information on why your submission has been rejected by HMRC and correct your payroll information where required.

Year End

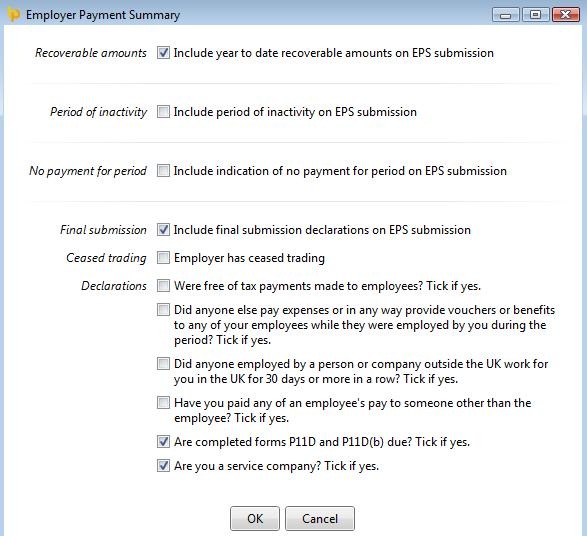

At the end of the tax year, a final Employer Payment Summary submission will be required in addition to your final FPS for the year. Within the RTI utility, simply indicate on the EPS that this is to be the final submission of the year and complete the declaration section accordingly. Submit your EPS in the normal manner by clicking ‘Send Now’.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.