Statutory Adoption Pay

Your employee may be entitled to Statutory Adoption Pay (SAP) if they adopt a child. It replaces their normal earnings to help them take time off around the time that the child is placed with them.

Whether you will have to pay them SAP depends on how long they have worked for you, how much they earn and when the child was matched for adoption. They will also have to provide you with evidence of matching and give you notice of when they want you to start paying their SAP.

Payments of SAP count as earnings. You must deduct tax and National Insurance Contributions (NICs) from them in the usual way.

You will normally be able to recover some or all of the amounts you have to pay out as SAP.

Entitlements

Adoption Leave is available to:

- individuals adopting a child on their own, or

- one member of a couple adopting a child together.

The Adopter is entitled to 52 weeks of statutory adoption leave. SAP is payable for 39 weeks.

SAP only becomes payable if the employee meets certain conditions. They must have:

- worked for you continuously - full or part-time - for at least 26 weeks up to and including the Matching Week

- average earnings at least equal to the lower earnings limit for NICs, £118.00 a week for 2019/20, in the relevant period up to the matching Week

- given you documentary evidence that they are adopting a child and sufficient notice of when they wish the SAP payments to start.

Average Weekly Earnings

The calculation of the average weekly earnings is very important because it not only determines if the adopter qualifies for SAP but also how much they qualify for. To qualify for SAP, an employee must have average weekly earnings of at least the NIC LEL amount, £118.00 for 2019/20, in the relevant period up to the Matching Week.

How Much Do You Need To Pay

90% of average weekly earnings for the first six weeks of the adoption pay period, followed by the lower of 90% of average weekly earnings or £148.68 for the remaining weeks.

Recovery of SAP

All employers are entitled to recover 92% of SAP they pay, however if the employer qualifies for Small Employers Relief, where the total NIC in the qualifying tax year was under £45,000, they can recover 100% of SAP paid plus an additional 3% in compensation for the employer’s share of NIC due on these payments.

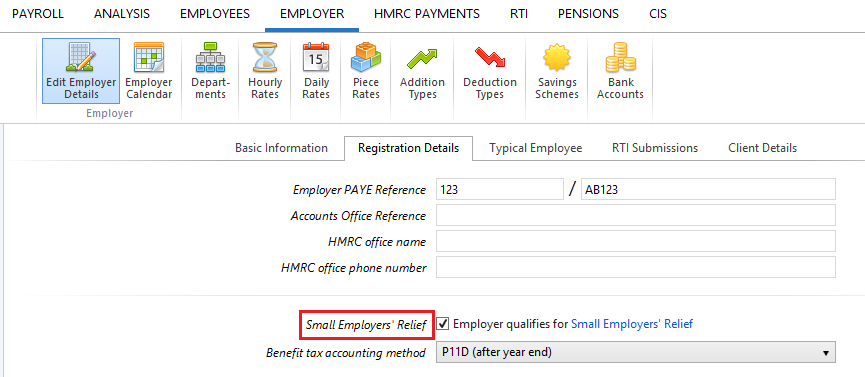

Should you qualify for Small Employer's Relief, ensure the box is ticked within Employer > Edit Employer Details > Registration Details:

Calculating SAP in BrightPay

To access this utility, simply click 'Payroll' and select the employee’s name on the left:

- Under Statutory Pay, click Calendar

- On the Calendar, click on the date that the baby is due

- Select Adoption Leave from the Parenting Leave section at the top right of the screen

- Enter all relevant dates and select the employee's Length of Leave from the drop down menu

- Average Weekly Earnings (AWE) - the program will automatically calculate the employee’s average weekly earnings for the purpose of calculating SAP due.

The user can at their own discretion override the automatic calculation and manually enter an employee’s average weekly earnings. However it is recommended to seek advice from an accountant before doing so. To override the automatic calculation, simply untick the box and enter the amount. - Click Save when completed. The program will automatically update the calendar accordingly and apply the SAP due.

Overriding the 'Average Weekly Earnings' Calculation

If existing payment records have not been recorded in BrightPay, the automatic calculation performed by the program after completing the above may be inaccurate. In the event of this occurring, the user may override the AWE by doing the following:

- On the main Payroll screen, click the Edit icon in the employee’s Statutory Payments section

- In Adoption Leave, select the option ‘Override average weekly earnings’

- Enter the average weekly earnings amount for the employee, then click out of this box

- The program will calculate SAP based on the AWE manually entered by the user

Editing the Length of Adoption Leave

Should an employee wish to extend or reduce the length of their adoption leave, the length of leave already entered for the employee can be edited as follows:

- In Payroll, select the employee’s name on the left

- Under Statutory Pay, click on Calendar

- On the Calendar, select any date in advance of the current payroll date and which is currently marked as Adoption Leave

- Within the Adoption Leave section that will appear to the right of the calendar, click the Edit icon

- Amend the employee’s Length of Leave by selecting the number of weeks now applicable from the drop down menu

- Click Save

- Close the Calendar to return to the main Payroll screen

Keeping in Touch Days (KIT)

During the Adoption period, an employee can work 10 days without losing any SAP. These KIT days can be taken separately, consecutively or in a block. The employee may be paid for KIT days. If the employee exceeds 10 KIT days, this will result in the loss of SAP for the week in which the work is done.

To record Keeping In Touch Days in BrightPay:

1. Under Employees, select the employee from the listing and click their Calendar tab.

2. On the Calendar, select the date of the Keeping In Touch day and click 'Keep In Touch Day' on the right hand side

3. Repeat if further Keeping In Touch Days are taken

As soon as the number of Keeping In Touch Days recorded in the employee's calendar exceeds 10 days, BrightPay will notify you in the relevant pay period that the employee is not entitled to any SAP due to having taken their 11th (or higher) Keep In Touch day.

How BrightPay calculates SAP

BrightPay uses the full statutory week method when calculating & applying SAP.

Monthly Payroll Example:

Adoption Leave begins on a Wednesday. Therefore the last day of the SAP week will be a Tuesday.

SAP will thus begin in the pay period in which the first Tuesday of the adoption leave falls

BrightPay will then establish how many Tuesdays fall in the pay period and apply the weekly SAP rate to the number of Tuesdays there are.

Weekly Payroll Example:

Adoption Leave begins on a Wednesday. Therefore the last day of the SAP week will be a Tuesday.

SAP will thus begin in the weekly pay period in which the first Tuesday of the adoption leave falls.

SAP1 Form

In the event that an employee is not entitled to SAP, employers are to complete form SAP1 to tell the employee the reason why.

Form SAP1 can be completed in BrightPay and subsequently printed or exported to PDF for emailing.

To complete form SAP1:

a) Within Employees, select the employee in question from the left hand listing

b) Click 'More' on the employee's menu bar, followed by 'SAP1...'

c) Complete the SAP1 form accordingly

d) Click Print/ Preview to view the completed form

e) Click Print, Email or Export PDF, as required.

Need help? Support is available at 0345 9390019 or [email protected].