Statutory Parental Bereavement Pay

Jack's Law

From 6th April 2020, parents who suffer the loss of a child will be entitled to two weeks’ statutory leave that may be paid. This has commonly been referred to as 'Jack’s law', after a campaign led by Jack Herd’s mother who highlighted in a government statement the issues grieving parents must cope with alongside their own loss.

Under Jack’s law, working parents who lose a child under the age of 18 or suffer a stillbirth from 24 weeks of pregnancy, from day one of employment will be entitled to:

- two weeks’ statutory parental bereavement leave (SPBL) within 56 weeks of the death of the child

- statutory parental bereavement pay (SPBP) where the employee has 26 weeks’ continuous employment and meets all qualifying conditions.

Statutory Parental Bereavement Pay (SPBP)

SPBP operates in the same manner as other statutory parental entitlements, such as SMP, SPP, ShPP, etc.

In tax year 2021/22, SPBP will be paid at £151.97 per week (or 90% of average weekly earnings where this is lower), provided the employee has earned at least the lower earnings limit for the past eight weeks. If the employee does not meet these requirements, SPBL will be unpaid.

Employers can recover 92% paid, or where eligible for Small Employers Relief, they can reclaim 103%.

Records should be kept for three years after the end of the tax year.

Blocks of Leave

SPBL may be taken as a block of one week, two consecutive weeks or two separate weeks at different times, however it cannot be taken as individual days.

The blocks of leave must be taken within 56 weeks of the death of the child.

Calculating Statutory Parental Bereavement Pay in BrightPay

To access this utility, simply click 'Payroll' and select the employee’s name on the left:

- Under Statutory Pay, click Calendar

- On the Calendar, click on the date on which the leave is to start

- Select Parental Bereavement Leave from the Parenting Leave section at the top right of the screen

Leave Details

- Within the 'Leave Details' section, enter the date of the child's death.

Blocks of Leave

- Within the 'Blocks of Leave' section, record each block of leave accordingly. Once SPBP payments for any given block have started, they will no longer be changeable.

The employee has the right to book up to two weeks of leave (either together or separate) in the 56 week period from the child's death date.

Average Weekly Earnings

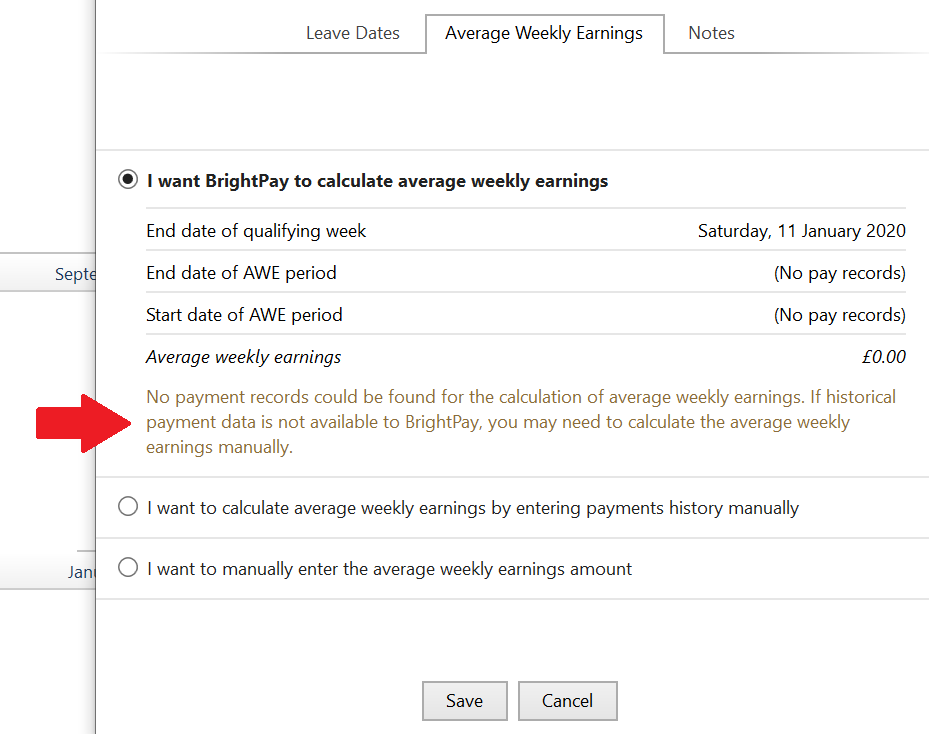

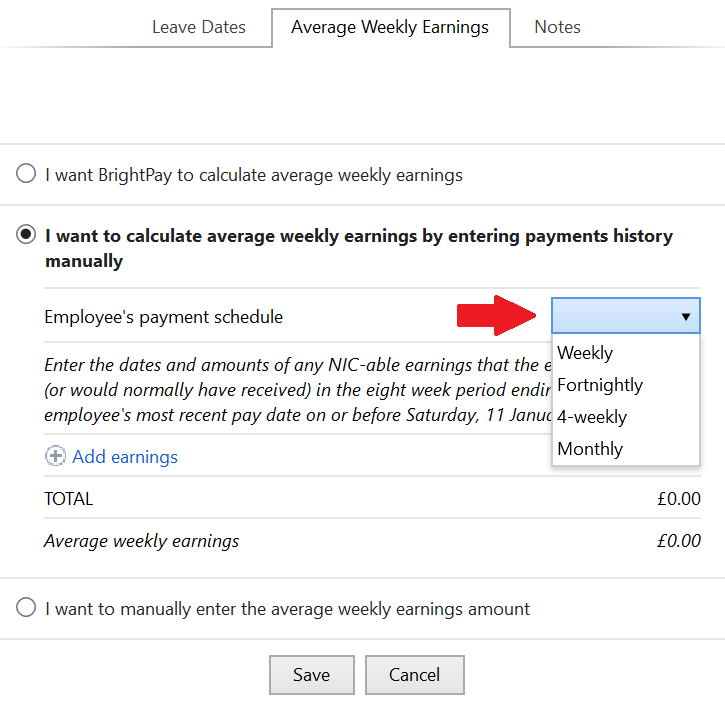

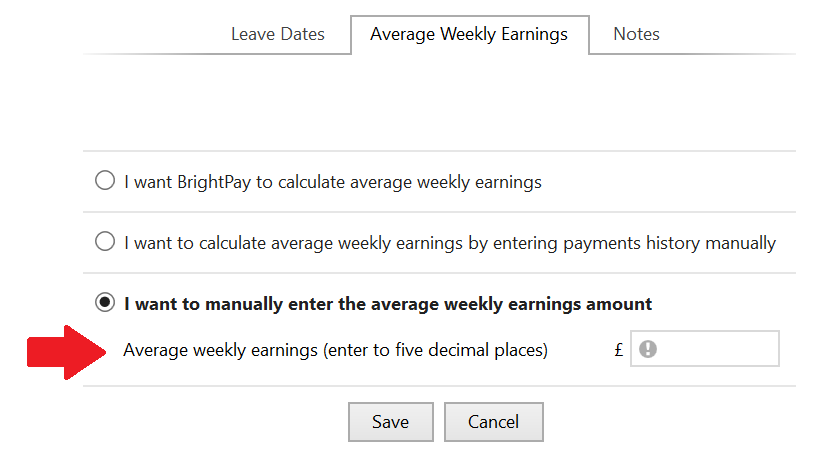

Within the Average Weekly Earnings section, BrightPay will now offer you three ways of establishing the employee’s average weekly earnings for the purpose of calculating SPBP due.

- I want BrightPay to calculate the average weekly earnings (AWE) - with this option, BrightPay will attempt to automatically calculate the employee's AWE. Where a calculation is possible, full details of the calculation will be displayed. Where the software detects any potential issues with the calculation (e.g. no payment history, more/fewer earnings than expected, unsupported pay schedule) a warning will be given to the user:

- I want to calculate average weekly earnings by entering payments history manually - where BrightPay is unable to calculate the employee's AWE automatically (e.g. where a different software was used previously and historical pay data is not available to BrightPay), this option allows users to enter the dates and amounts of the employee's earnings history manually, which BrightPay will then use to calculate the employee's AWE.

- I want to manually enter the average weekly earnings amount - the user can at their discretion use this option instead to enter the employee’s average weekly earnings figure, where this is known.

Notes

Use the Notes section to enter any relevant notes relating to the employee's parenting leave.

Click 'Save' when the parenting leave details are completed. The program will automatically update the calendar accordingly and apply the SPBP due.

How BrightPay calculates SPBP

BrightPay uses the full statutory week method when calculating & applying SPBP.

Monthly Payroll Example:

Parental Bereavement Leave begins on a Wednesday. Therefore the last day of the SPBP week will be a Tuesday.

SPBP will thus begin in the pay period in which the first Tuesday of the shared parental leave falls.

BrightPay will then establish how many Tuesdays fall in the pay period and apply the weekly SPBP rate to the number of Tuesdays there are.

Weekly Payroll Example:

Parental Bereavement Leave begins on a Wednesday. Therefore the last day of the SPBP week will be a Tuesday.

SPBP will thus begin in the weekly pay period in which the first Tuesday of the shared parental leave falls.

Employer Considerations

Parental bereavement is a very sensitive subject and the death of an employee’s child must be handled with care.

To help you, we’ve put together a few considerations for you to keep in mind:

- employers will not be entitled to request a copy of the child’s death certificate as evidence

- employees have the right to keep details of their child’s death confidential. It is vital for HR and line managers to be clear on how much detail employees would like their colleagues to know, and ensure that their wishes are respected

- Be aware of bereaved mothers’ maternity leave rights. Mothers who lose a child after 24 weeks of pregnancy, or during maternity leave, will not lose their entitlement to maternity leave and pay. Rights to paternity leave and shared parental leave (where notice of leave has been given) will generally also be maintained in these circumstances.

- Employers should be aware that different religions have their own bereavement traditions and funeral rites that must be followed. Refusing to allow an employee to observe their beliefs and customs could amount to religious discrimination

- Employees who suffer a loss may experience mental health issues such as depression, anxiety or post-traumatic stress disorder (PTSD), which could constitute a disability under the Equality Act 2010. In these cases, you should seek medical advice and make any reasonable adjustments that you can to support your employee. Offering counselling could also help bereaved parents on their road to recovery

- While introducing a legal entitlement to two weeks’ parental bereavement leave is undoubtedly a positive step, it is important for you to be aware that people recover at different rates. So you will want to be flexible, supportive and sensitive to your employee’s needs during this difficult time. You may also want to consider offering additional paid leave.

- As an employer, you should consider getting a written policy on Parental Bereavement Leave in place, as this can provide certainty and security at a difficult time - for both you and the employee.

Need help? Support is available at 0345 9390019 or [email protected].